TNR Gold Corp.

Near-Term Royalty Potential from Ganfeng’s Lithium Project

Published: 5/29/2024

Author: Sid Rajeev, B.Tech, CFA, MBA

Sector: Basic Materials | Industry: Other Industrial Metals & Mining

| Metrics | Value |

|---|---|

| Current Price | CAD $0.07 |

| Fair Value | CAD $0.24 |

| Risk | 5 |

| 52 Week Range | CAD $0.045-0.075 |

| Shares O/S (M) | 185 |

| Market Cap. (M) | CAD $12 |

| Current Yield (%) | n/a |

| P/E (forward) | n/a |

| P/B | 2.7 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

- Since our initiating report in September 2023, TNR’s royalty projects have made significant progress. TNR is up 40% since September 2023.

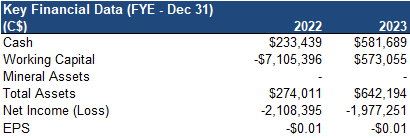

- The company’s portfolio primarily consists of a gold project in Alaska (Shotgun), and royalties in two advanced-stage projects in Argentina, including the Mariana lithium project owned by Ganfeng Lithium (SZSE: 002460/MCAP: $12B), and the Los Azules copper-gold project owned by McEwen Copper.

- Ganfeng is on track to start commercial production at its Mariana lithium project later this year. We are projecting annual royalty revenue of $1.4M for TNR at current spot lithium prices. Royalty payments for TNR could commence as early as 2025.

- McEwen Copper’s Los Azules copper-gold project hosts a large, open-pittable copper deposit (38 Blbs copper + 4.7 Moz gold + 159 Moz silver). An updated resource estimate and feasibility study (FS) are expected in early 2025. Recent metallurgical tests returned copper recoveries of up to 76% vs 73% used in a Preliminary Economic Assessment in 2023. As a result, the project’s AT-NPV8% increased 10% to US$2.9B, using US$3.75/lb copper vs the current spot price of US$4.54/lb. We are projecting annual royalty revenue of $6M from this project, using conservative copper prices.

- TNR is seeking a JV partner to advance the Shotgun project to a PEA. Shotgun hosts a small to medium sized gold deposit, with inferred resources totaling 706 Koz, at a relatively high grade of 1.1 gpt.

- TNR offers exposure to gold (41%), copper (38%), and lithium (21%). While gold and copper are trading near record highs, lithium prices are down 64% YoY to US$15k/t vs the five-year average of US$21k/t. We are more bullish on gold stocks than the metal itself, with gold producer valuations averaging 17% lower compared to the past three instances when gold surpassed US$2k/oz. In addition, we maintain a positive outlook on lithium stocks as we believe lithium prices have stabilized, and battery/EV manufacturers/miners are actively seeking stable/long-term supply sources.

- Upcoming catalysts include the commencement of production at Mariana, and the possibility of a JV partner for Shotgun.

*See last page for important disclosures, rating and risk definitions. All figures in C$ unless otherwise specified.

Portfolio Summary

Source: Company

90% interest in the Shotgun gold project in Alaska

Royalties in two advanced-stage projects in Argentina, including a lithium project owned by Ganfeng Lithium, and a copper-gold project owned by McEwen Copper

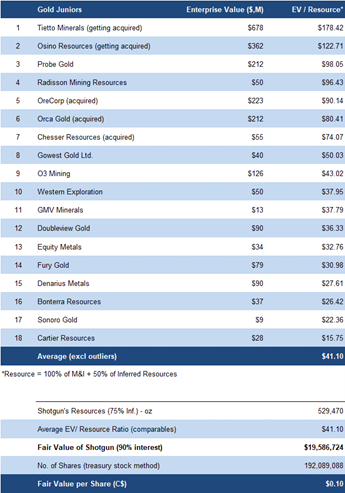

Mariana Lithium-Potassium Brine Project, Argentina (1.35% NSR)

This advanced stage lithium project is 100% owned by Ganfeng Lithium.

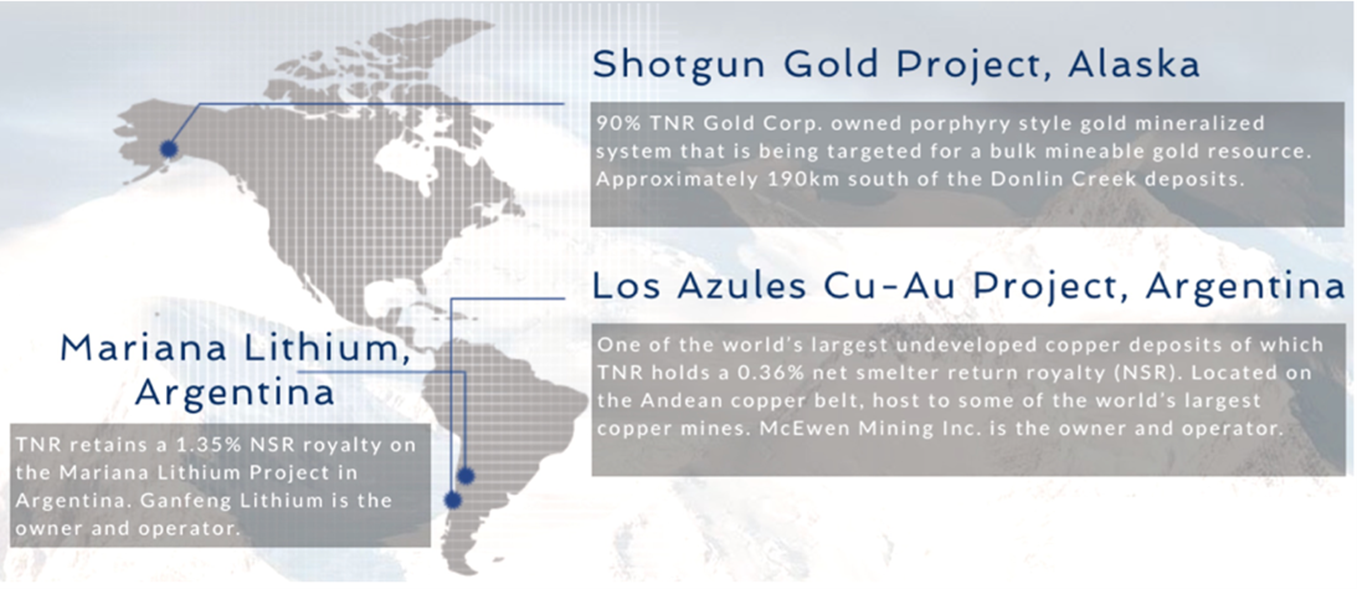

2021 Resource

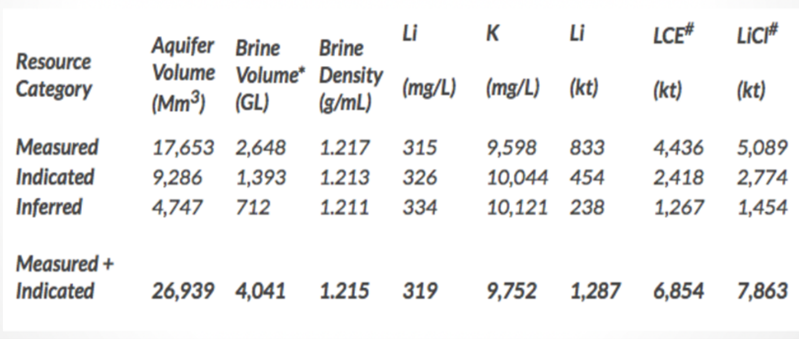

2018 PEA Highlights

Source: Ganfend Lithium

Source: Ganfend Lithium

Located in Salta province, Argentina

Argentina is the fourth largest lithium producer in the world

The project hosts a large lithium-potassium brine resource

A 2018 PEA based on a 10,000 tpa operation, and a 25-year mine life, returned an AT-NPV10% of US$192M, and an AT-IRR of 20%, using US$9.7k/t LCE vs the current spot price of US$15k/t

Ganfeng started construction work in 2022, and anticipates producing 20,000 tpa of lithium chloride. TNR owns a 1.35% NSR in the project, of which, Ganfeng has an option to purchase 0.90% for $0.9M. We believe Ganfeng will exercise its option, thereby reducing TNR’s interest to 0.45%. We are projecting annual royalty revenue of $1.4M for TNR at current spot lithium prices.

Los Azules Copper-Gold-Silver Project, Argentina (0.36% NSR)

This advanced stage porphyry copper project is 100% owned by McEwen Copper. McEwen Copper is owned by a group led by McEwen Mining (NYSE: MUX), Stellantis (NYSE: STLA/the owner of auto brands such as Fiat, Maserati, and Chrysler), Rio Tinto (LSE: RIO), and Rob McEwen.

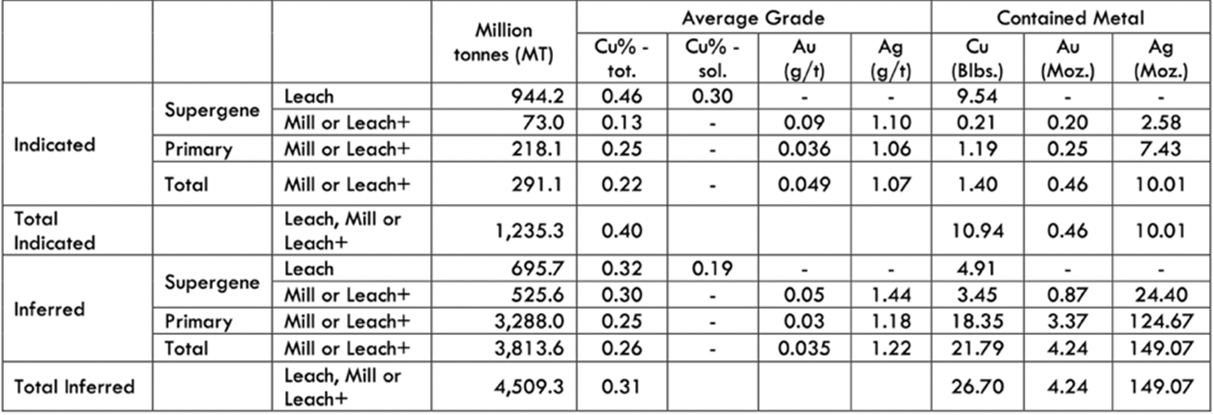

2023 Resource Estimate

Source: McEwen Mining

Source: McEwen Mining

Ganfend is on track to start commercial production in Q4-2024

Located in the prolific Andes copper belt, 90 km north of Glencore’s (LSE: GLEN) El Pachon project

Los Azules is one of the largest undeveloped copper projects in the world, with resources totaling 38 Blbs copper, 4.7 Moz gold, and 159 Moz silver, suitable for open-pit mining

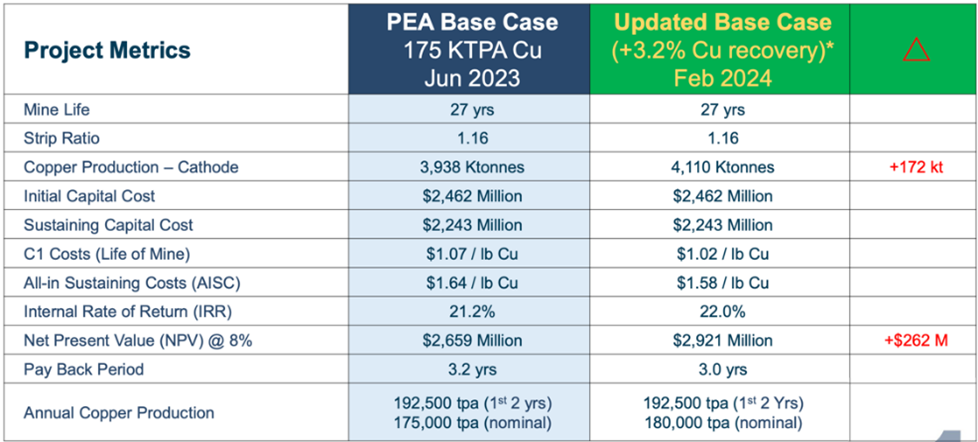

Recent metallurgical test results returned copper recoveries of up to 76% vs 73% used in a Preliminary Economic Assessment in 2023.

PEA Comparison

Source: McEwen Mining

Source: McEwen Mining

As a result, the project’s AT-NPV8% increased 10% to US$2.9B, using US$3.75/lb copper vs the current spot price of US$4.54/lb

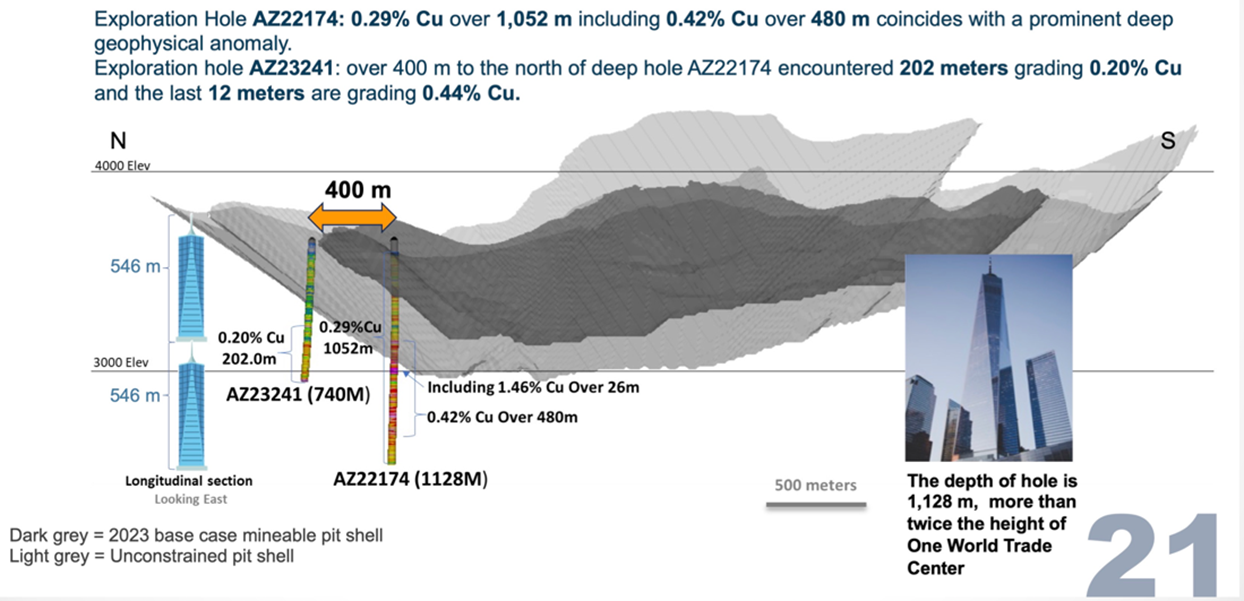

A recently completed resource expansion/upgrade drill program (totaling 70,000 m) returned promising results.

Resource Upside

Source: McEwen Mining

Source: McEwen Mining

We note that the deposit has significant resource expansion potential as mineralization is open along strike, and at depth

McEwen Copper is aiming to complete a resource update and a feasibility study next year. Management anticipates commercial production by 2029. Using our long-term average copper price forecast of US$3.5/lb, we anticipate TNR could generate $6M in annual royalty revenue from this project.

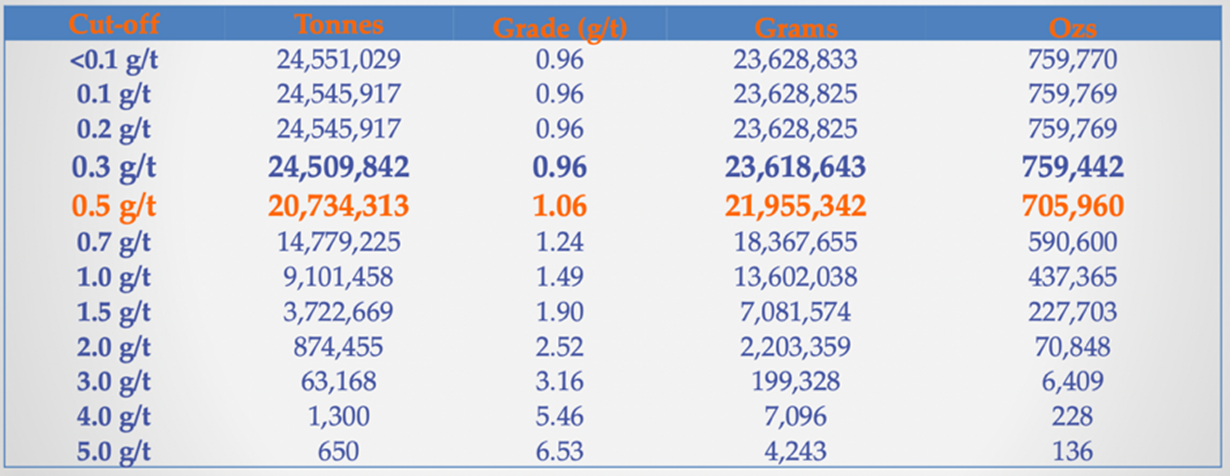

Shotgun Gold Project, Alaska (90% interest)

The property hosts a medium-sized/relatively high-grade/shallow deposit, with inferred resources totaling 0.71 Moz (1.06 gpt) on one of five identified targets.

2013 Resource Estimate

Source: Company

Source: Company

Located 190 km from NovaGold and Barrick’s Donlin gold project (45 Moz in resources at 2+ gpt) – one of the largest undeveloped gold deposits in the world; Donlin has experienced delays due to strong opposition from local groups

As Shotgun is much smaller, we anticipate a smoother permitting process

Management is seeking an option/JV partner to advance the project to a PEA

We believe the project has resource expansion potential as the Shotgun Ridge deposit remains open along strike and at depth; in addition, four targets remain untested.

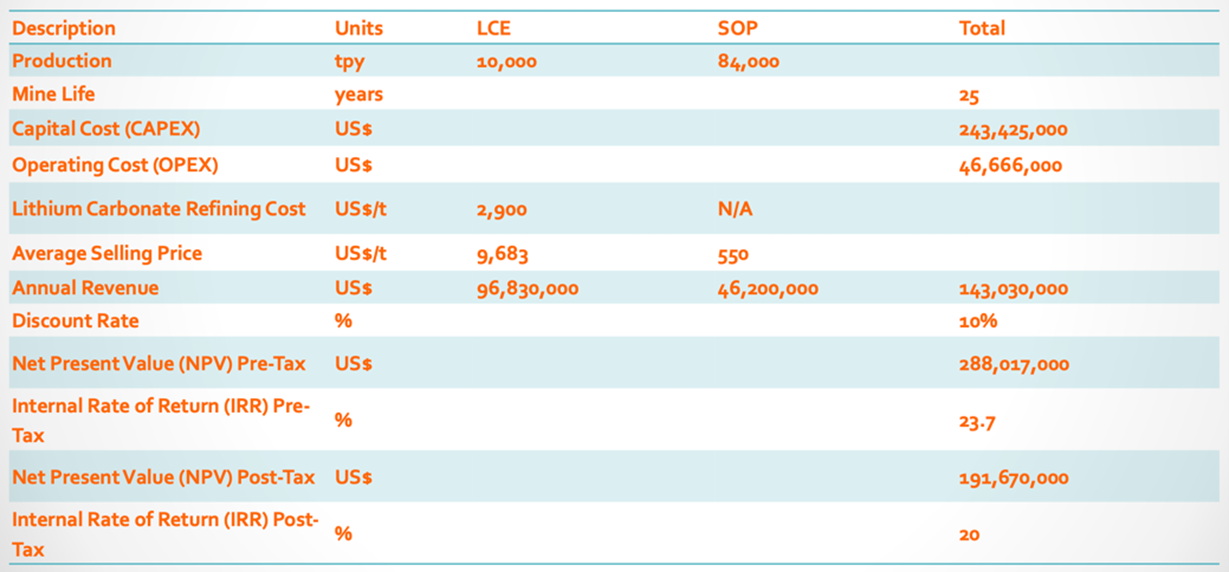

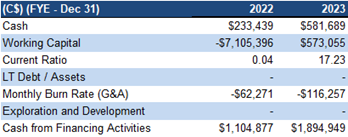

Financials

Source: FRC/Company

Source: FRC/Company

$573K in working capital at the end of 2023, with no debt In-the-money options and warrant can bring in $1.56M

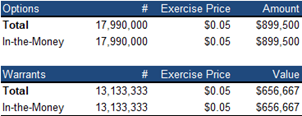

FRC Valuation and Rating

Source: FRC/S&P Capital IQ/Various

Source: FRC/S&P Capital IQ/Various

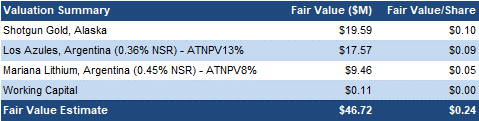

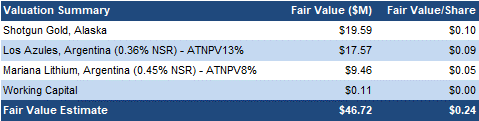

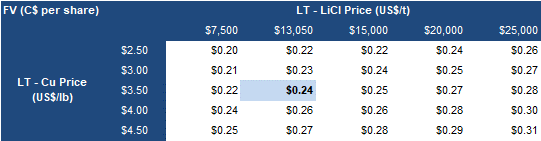

Based on an average EV/Resource of $41/oz (previously $38/oz) for gold juniors, we arrived at a fair value estimate of $0.10/share (previously $0.09/share) for the Shotgun project

As a result of the higher recovery estimate, we are raising our fair value estimate on TNR’s royalty in Los Azules from $0.07 to $0.09/share, while maintaining our valuation for the royalty in Mariana at $0.05/share

Using a sum-of-parts model, we arrived at a revised fair value estimate of $0.24/share (previously $0.22/share)

We are reiterating our BUY rating, and adjusting our fair value estimate from $0.22 to $0.24/share. Upcoming catalysts include the commencement of production at Mariana, and the possibility of a JV partner for Shotgun. We believe TNR's share price of $0.07 indicates that the market is not only undervaluing the Shotgun project, but also completely overlooking TNR's royalty interests.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- Commodity prices

- Potential for delays in attracting a partner for Shotgun

- Exploration and development

- No assurance that its partners will advance their projects within expected timelines

- Access to capital and share dilution