Aton Resources Inc.

Targeting Gold Production in Egypt by 2026

Published: 5/17/2024

Author: FRC Analysts

Sector: Basic Materials | Industry: Other Industrial Metals & Mining

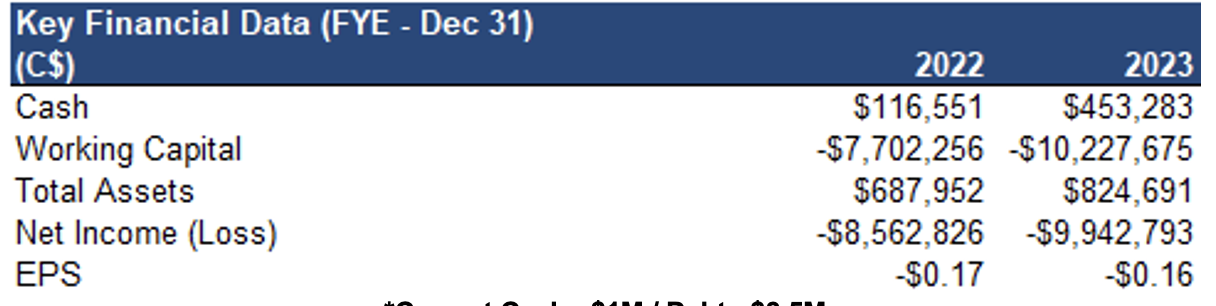

| Metrics | Value |

|---|---|

| Current Price | 0.32 |

| Fair Value | 0.63 |

| Risk | 5 |

| 52 Week Range | 0.15-0.35 |

| Shares O/S (M) | 127 |

| Market Cap. (M) | 41 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | N/A |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

- We are resuming coverage on Aton Resources. Aton is advancing multiple gold projects in Egypt’s Arabian Nubian Shield (ANS). Egypt is a vastly underexplored geologically rich country.

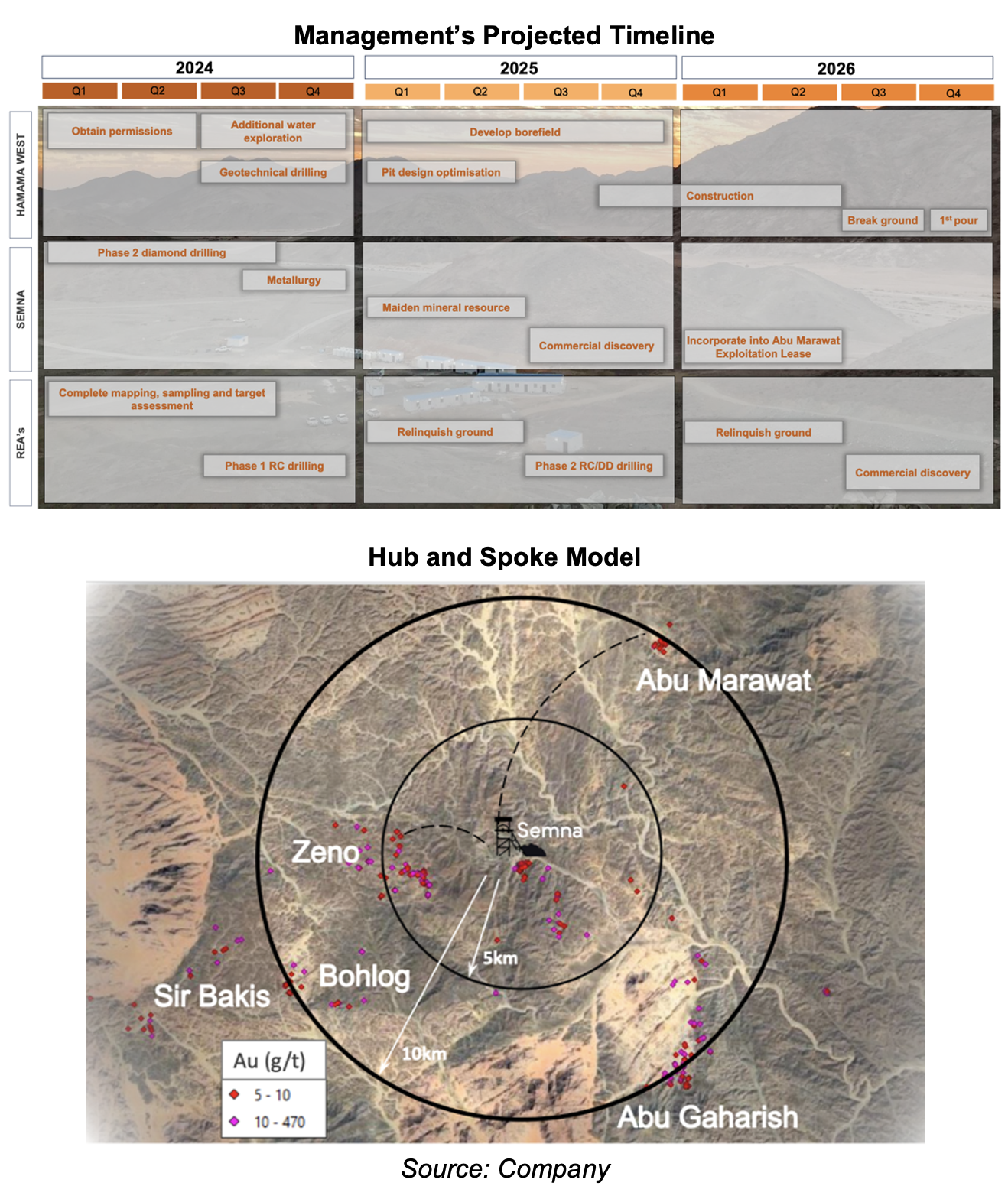

- Management’s strategy involves implementing a hub-and-spoke approach, supported by a central processing plant, managing ore from multiple projects.

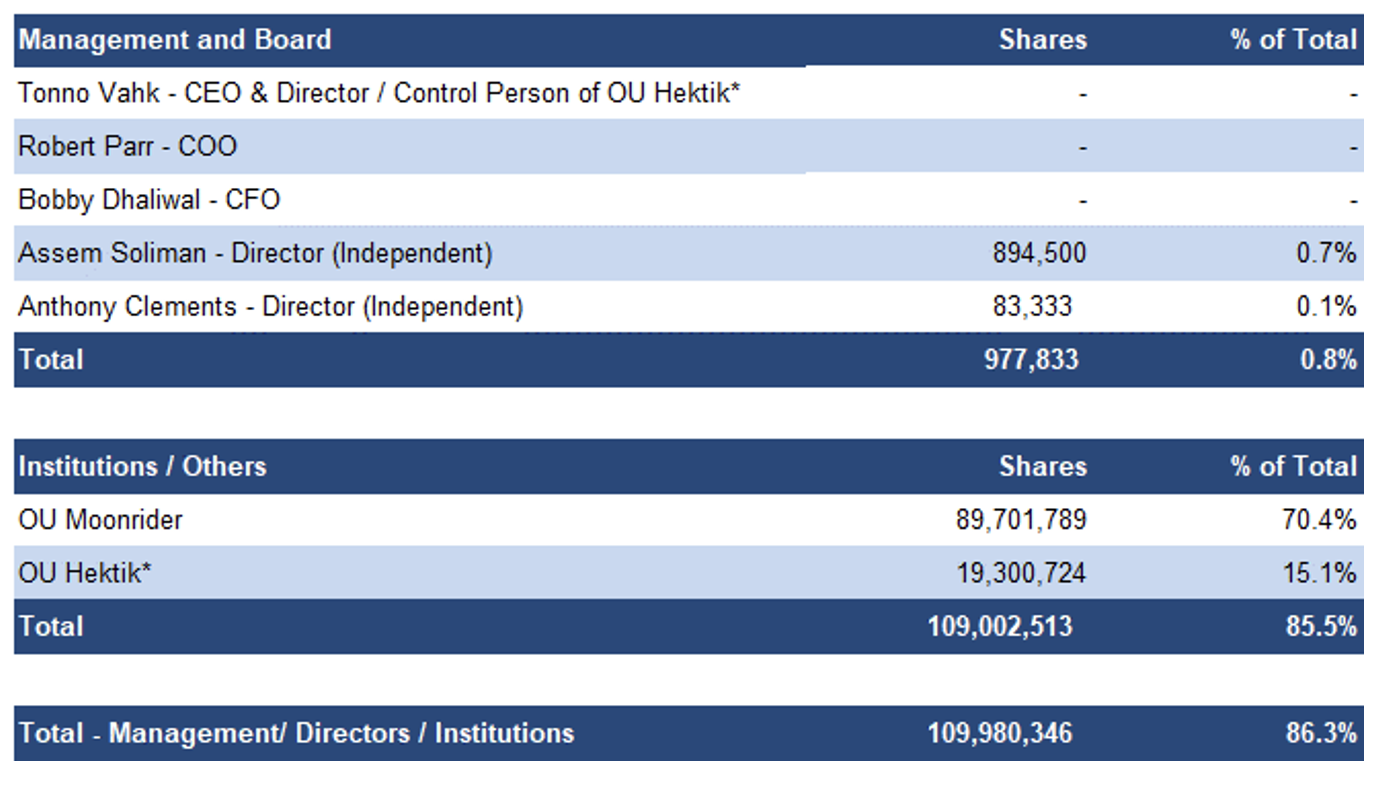

- Two institutional investors own 86% of Aton’s equity, which we believe signifies a strong vote of confidence in Aton’s portfolio.

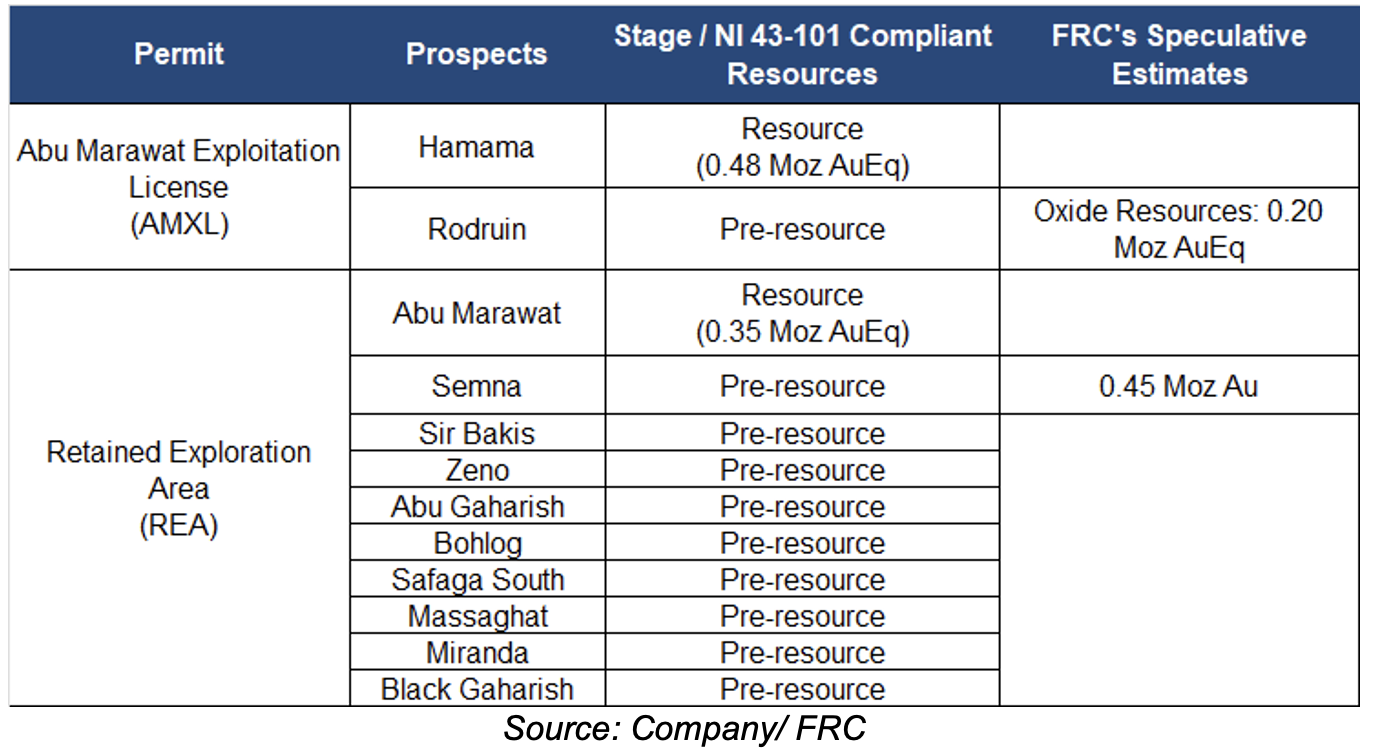

- Aton’s portfolio consists of 12 projects at various stages, with NI 43-101 compliant resources totaling 0.83 Moz AuEq across two projects (Hamama and Abu Marawat), In addition, we are assigning speculative estimates totaling 0.65 Moz AuEq for two additional projects (Semna and Rodruin).

- Aton’s projects host Volcanogenic Massive Sulfide (VMS)-epithermal hybrid mineralization. VMS deposits commonly occur in clusters (1-20 Mt), and individual deposits, when combined, have potential to form mining districts/camps.

- In early 2024, the company received a 20-year mining permit for Hamama and Rodruin. Management’s near-term goal is advancing Hamama West to production by 2026. We anticipate a relatively small 15 Koz - 20 Koz per year operation.

- The company is also aiming to complete maiden resource estimates for Rodruin, and Semna, in 2025.

- Gold has surpassed US$2,400/oz for the first time, and is currently trading at record highs. We are more bullish on gold stocks than the metal itself, with gold producer valuations averaging 17% lower compared to the past three instances when gold surpassed $2k/oz.

- M&A activities in the junior gold sector are on the rise. Recent transactions in the African gold sector involved Yintai Gold’s (SZSE: 000975) acquisition of Osino Resources (TSXV: OSI/gold in Namibia) for $368M, Silvercorp Metals’s (TSX: SVM) acquisition of Orecorp (gold in Tanzania) for $186M, and Zhaojin Mining’s (SEHK: 1818) acquisition of Tietto Minerals (ASX: TIE/a brand new gold producer in Côte d’Ivoire) for $422M. We estimate an average price of $82/oz for these deals. AAN is currently trading at $29/oz.

- Upcoming catalysts include drilling, and economic studies on Hamama West.

*Current Cash - $1M / Debt - $3.5M

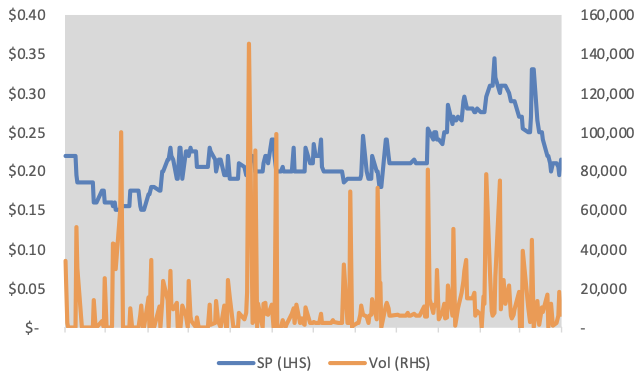

Price Performance (1-year)

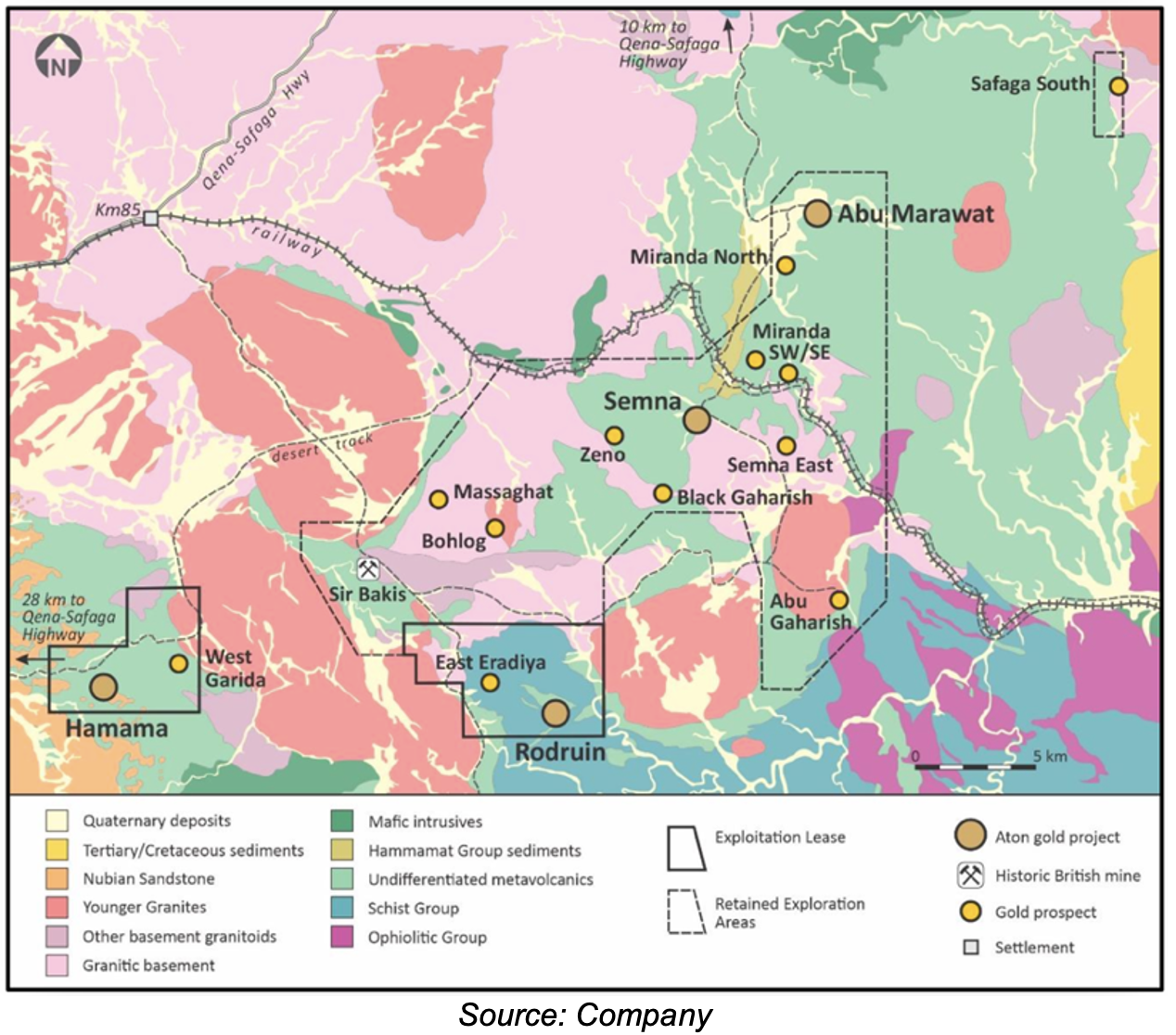

Portfolio Summary

Located 200 km north of Centamin’s (LSE: CEY) Sukari gold mine – Egypt’s first and only large-scale gold mine. Established infrastructure with access to power, water, highways, and a seaport

12 projects at various stages. NI 43-101 compliant resources totaling 0.83 Moz AuEq across two projects (Hamama and Abu Marawat

In addition, we are assigning speculative estimates totaling 0.65 Moz AuEq for two additional projects (Semna and Rodruin)

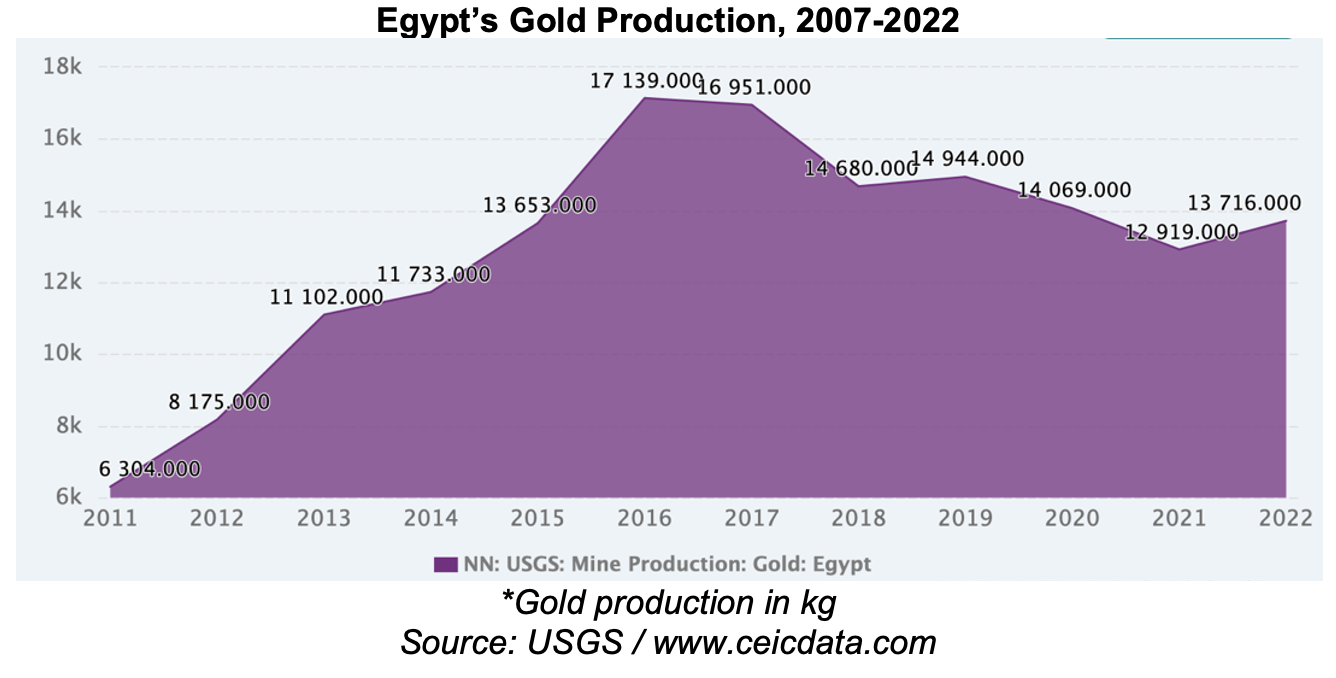

Gold in Egypt

Egypt hosts mineral resources such as gold, copper, silver, zinc, phosphate, iron ore, kaolin, and coal. Aton’s projects are located in the Arabian Nubian Shield (ANS), which hosts several gold deposits, including Centamin’s Sukari gold mine. Operational since 2009, Sukari is a low-cost, open-pit, high-grade operation. Sukari has produced 5+ Moz, and has 11+ Moz in remaining resources.

The Arabian Nubian Shield (ANS), spanning Egypt, Sudan, Israel, Saudi Arabia, Eritrea, Jordan, Ethiopia, Somali, and Yemen, is an under-explored prospective gold region

Sukari is the only large-scale operating mine in Egypt, accounting for 90%+ of the country’s gold production. In 2023, Sukari produced 450 Koz gold, with US$895/oz in cash costs

Despite its rich mining history, the country has had limited foreign investments in gold exploration/development. This can primarily be attributed to the Egyptian government's use of a production sharing agreement (PSA) model, which mandates mining companies provide a 50% carried-free interest to the Egyptian General Authority for Mineral Resources (EMRA). However, in 2020, the EMRA launched an international gold bid round for exploration blocks promising more attractive royalties (still pending finalization). This led to major players like Barrick (TSX: ABX) gaining ground near Aton’s Abu Marawat Concession.

Operates under a 50:50 PSA model with the EMRA. Aton covers 100% of project advancement costs; initial cash flows from the projects will be used to recoup invested capital, with the remainder split equally

Abu Marawat Exploitation Lease (AMXL)

The Abu Marawat Exploitation Lease (AMXL), covering 57.7 km2, is comprised of the Hamama and Rodruin projects.

Hamama Gold-Silver-Polymetallic Project

This property exhibits potential for Volcanogenic Massive Sulfide (VMS)-epithermal hybrid mineralization, a deposit type sharing characteristics with well-known deposits within the ANS. Examples include Zijin's (SZE: 601899) Bisha mine in Eritrea, and Ariab Mining Company’s Hassai mine in Sudan. We note that VMS deposits commonly occur in clusters, and individual deposits, when combined, have potential to form mining districts/camps.

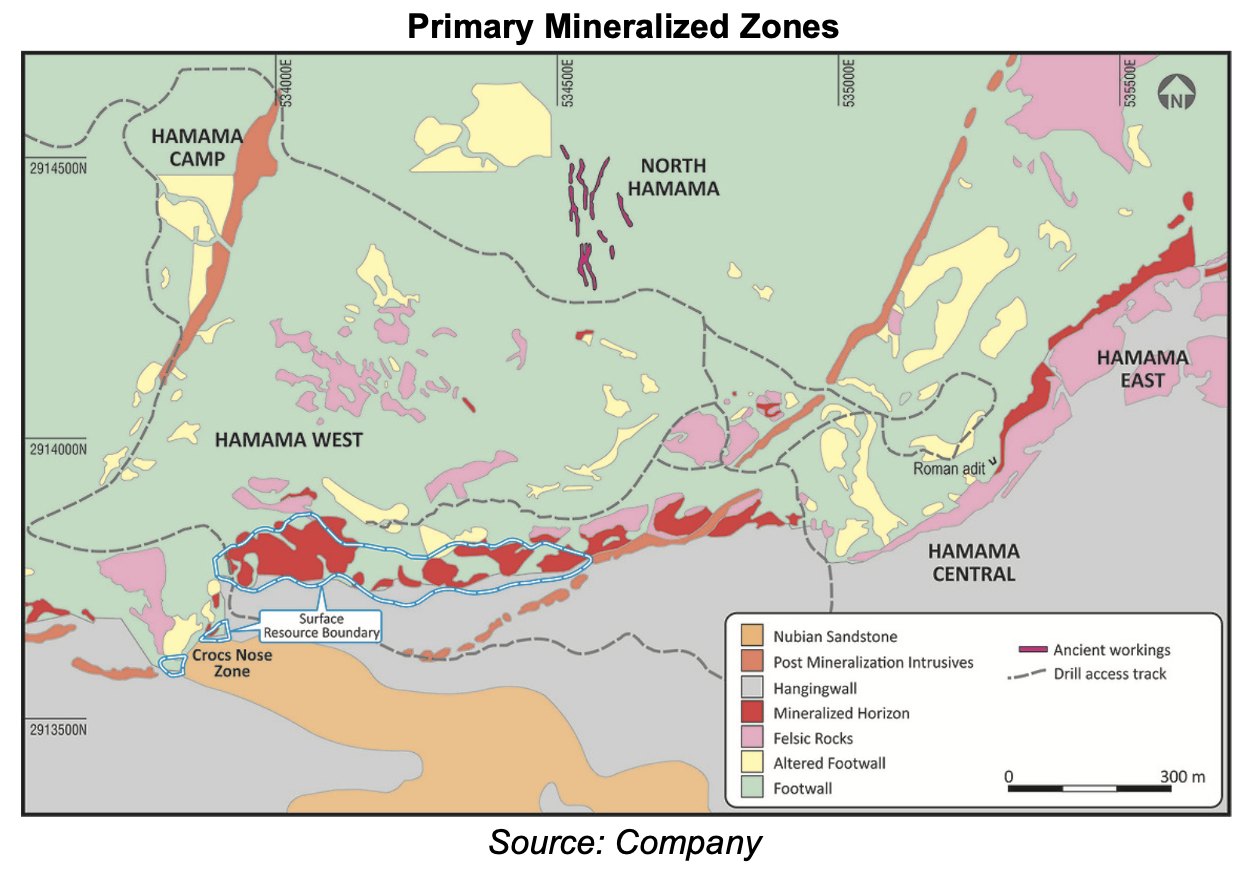

Aton has identified three primary zones of mineralization (Hamama West, Hamama Central, and Hamama East), extending 3 km along strike.

In January 2024, Aton received a 20-year mining permit, potentially renewable for an additional 10 years. Aton is obligated to commence production within four years - a timeline we consider reasonable; if this deadline is not met, Aton will need to either request an extension, or apply for a new permit

Hosts VMS-epithermal mineralization dominated by precious metals

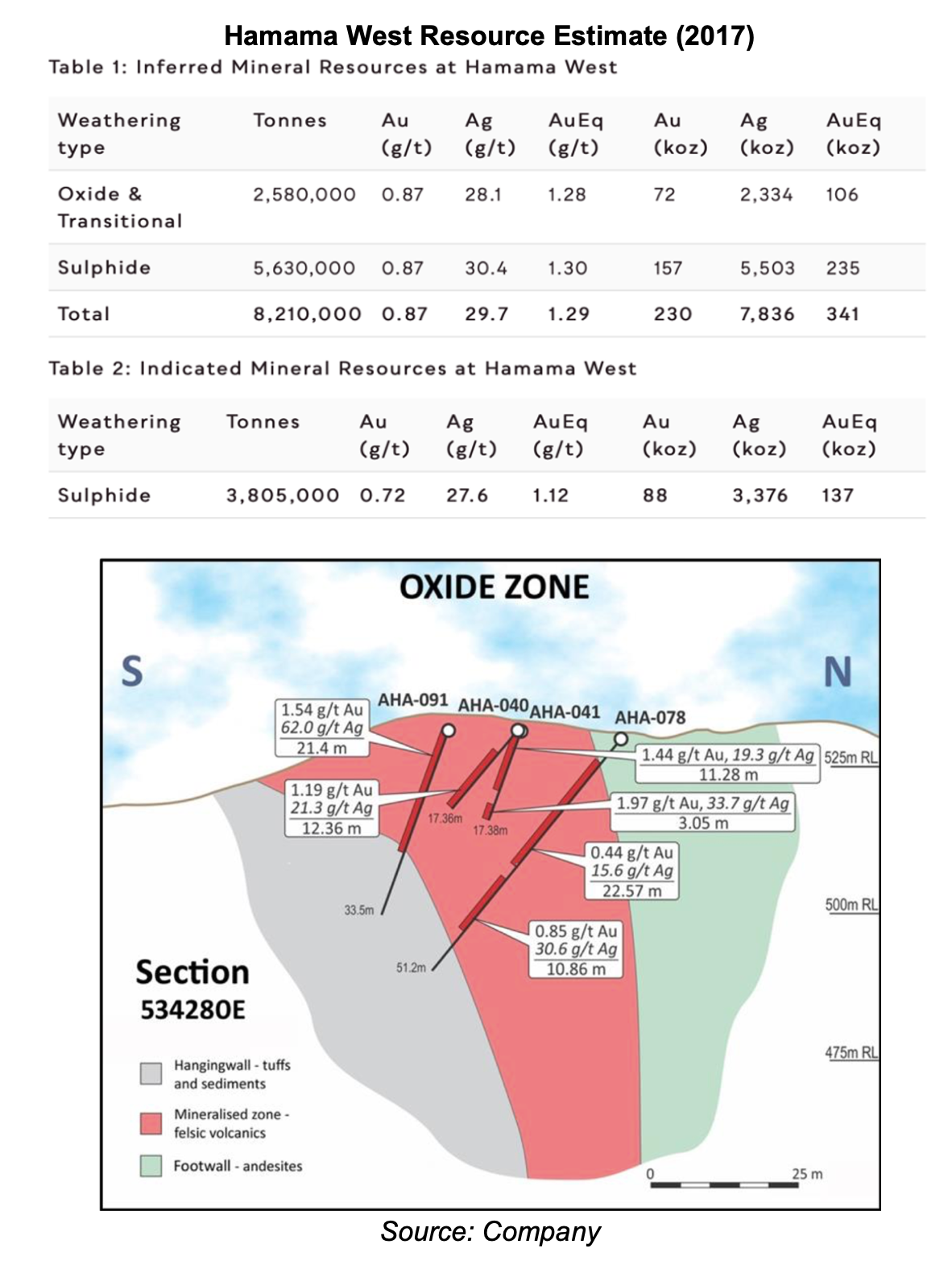

In 2017, Aton completed a maiden resource estimate on the Hamama West deposit based on 74 drillholes. Metallurgical tests showed that the oxide component is suitable for heap leach treatment, achieving about 72% gold recovery, typical for such operations.

A small to medium sized resource totaling 0.48 Moz AuEq. The Hamama West deposit measures 675 m long x up to 60 m wide x up to 275 m deep

Oxide mineralization is amenable to heap leach processing, implying relatively low OPEX/CAPEX

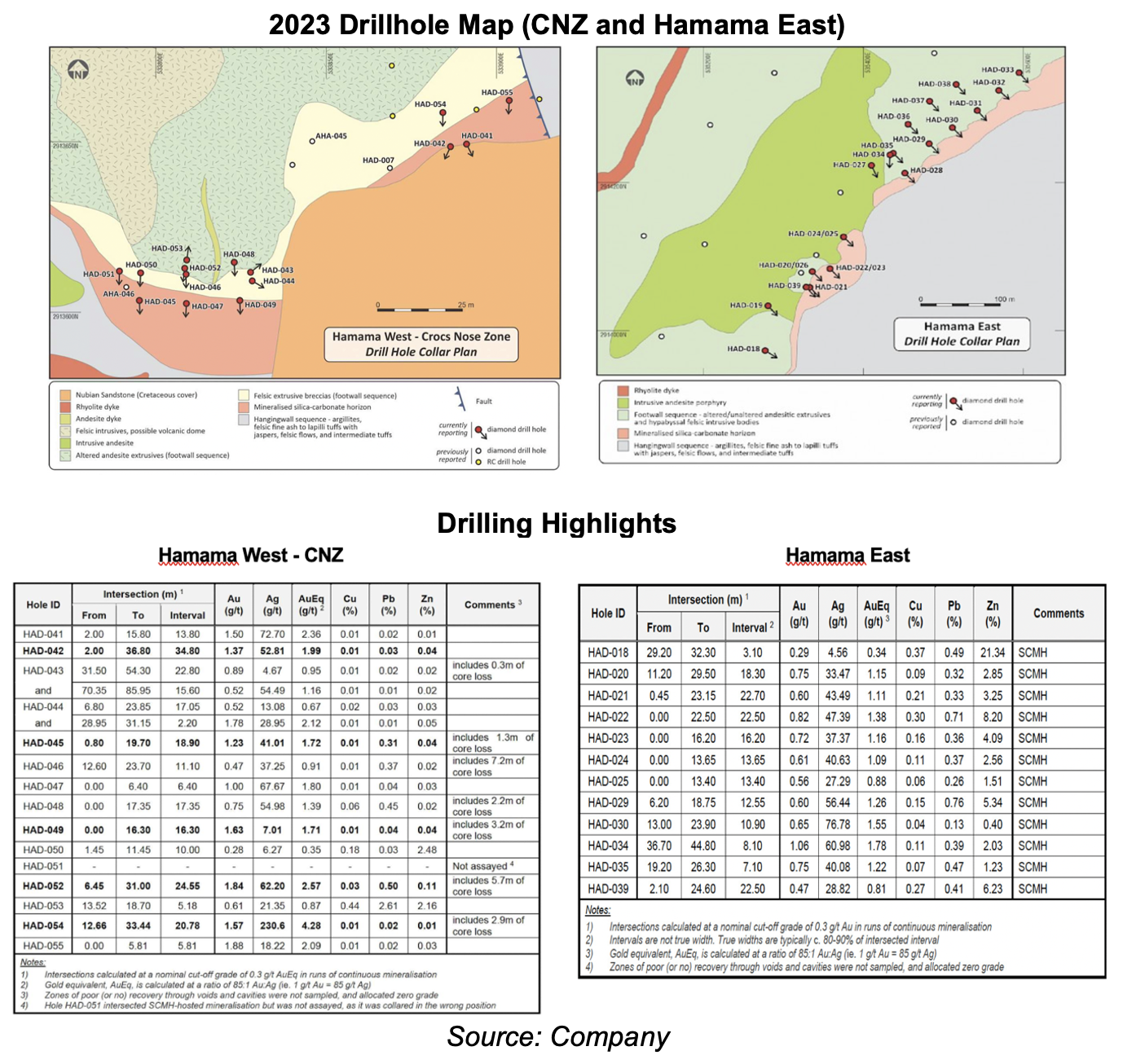

In 2023, Aton completed a drill program (42 holes/ 1,613 m) to explore oxide mineralization at the Hamama West – Crocs Nose Zone (CNZ), Hamama East, and Hamama Central.

Assay intercepts from the CNZ, and Hamama East, returned high gold grades. At Hamama Central, two out of five holes intersected mineralization

We believe there is significant resource expansion potential, with only one of three targets delineated, and multiple prospects yet to be drilled

Management is planning a Pre-Feasibility Study (PFS) to mine the upper oxide gold component of the Hamama West deposit. They are targeting production in 2026, with a low strip ratio, open-pit mining, and heap leach processing. We anticipate a relatively small 15 Koz – 20 Koz per year operation. The current oxide resource estimate will last five years.

Rodruin Gold-Silver-Polymetallic Project

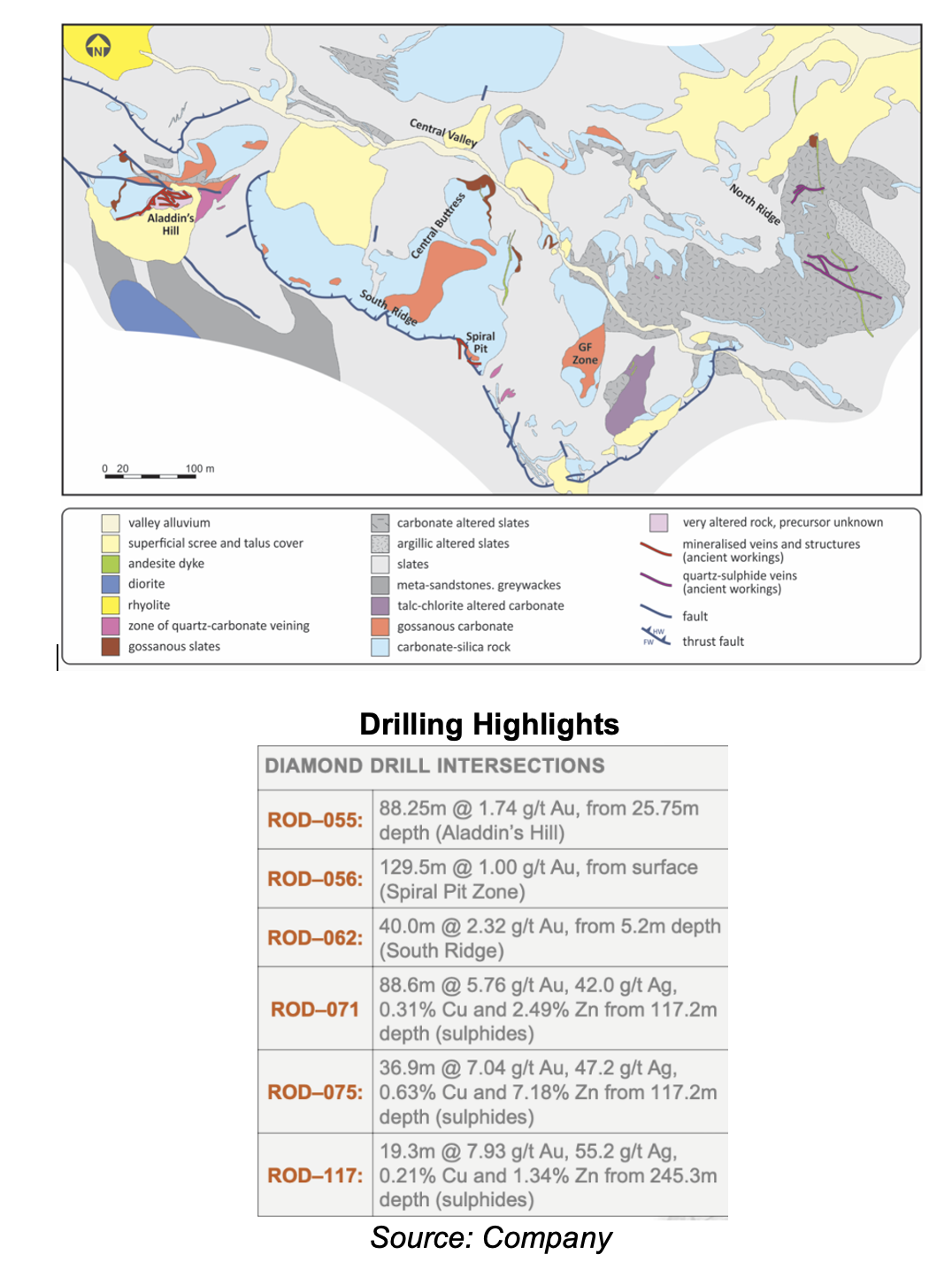

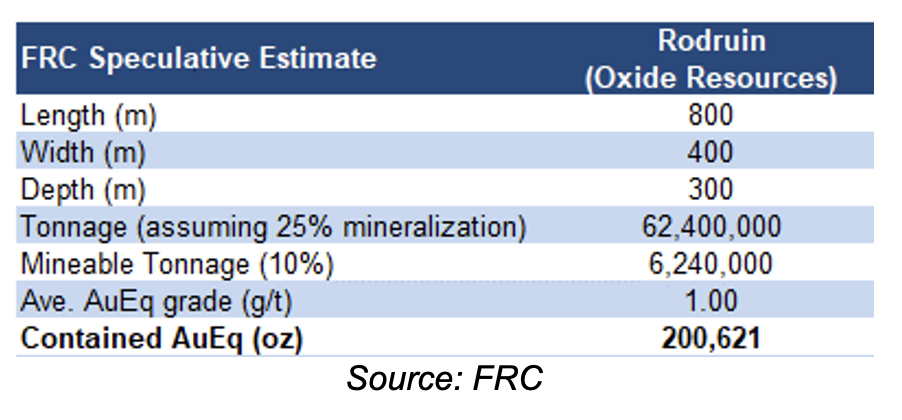

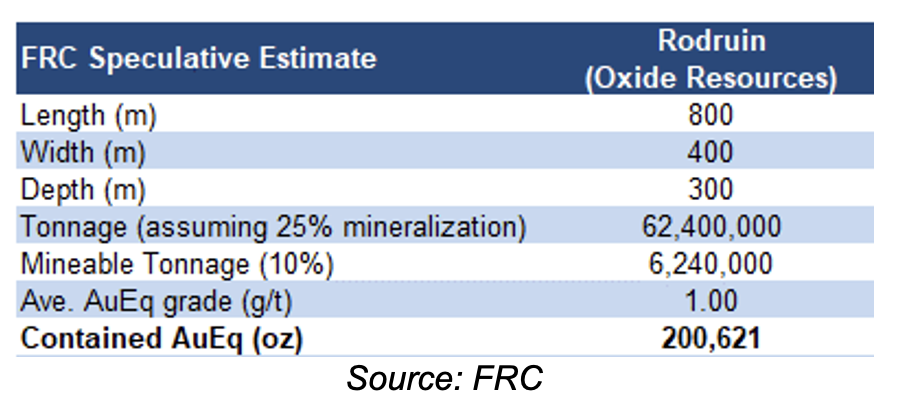

Surface sampling, and drilling, have identified an area spanning 800 m x 400 m x 200+ m in depth across multiple zones. A total of 135 drill holes, totaling 13,198 meters, have been completed to date.

The Rodruin target was discovered in 2017. Located 18 km east of the Hamama project

Rodruin Mineralized Zones

Hosts carbonate-hosted VMS-epithermal mineralization similar to the Hamama West deposit. Multiple zones of outcropping surface mineralization

Management is targeting a maiden resource estimate in 2025.

Drilling intersected thick deeper sulphide intercepts of high gold grades of up to 7.93 g/t. Based on available data, we estimate that Rodruin hosts 0.20 Moz AuEq in oxide resources

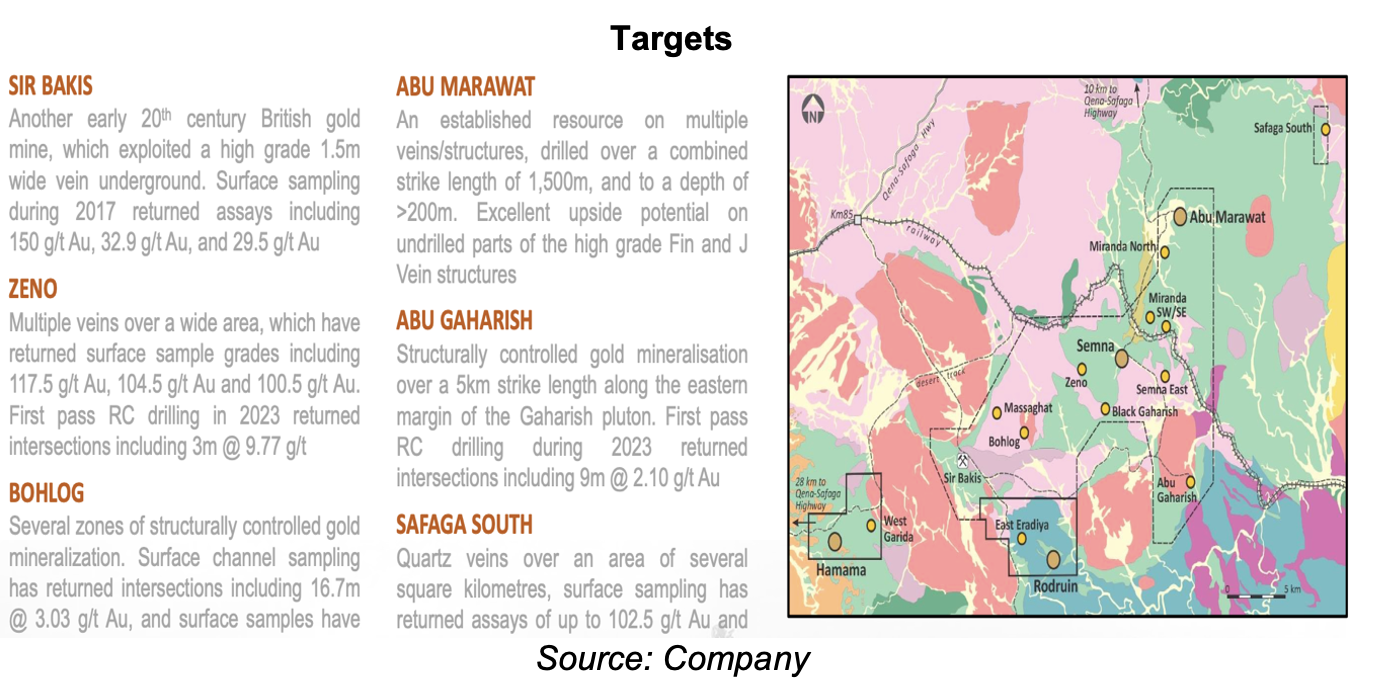

Retained Exploration Areas (REA)

Aton controls an additional 255 km2 of exploration area, which hosts the Abu Marawat polymetallic deposit, the high-grade Semna discovery, and several other targets

Aton has identified 15+ zones/targets.

The resource envelope, spanning 1500 m long x 200+ m deep, is based on 98 drillholes/19,573 m

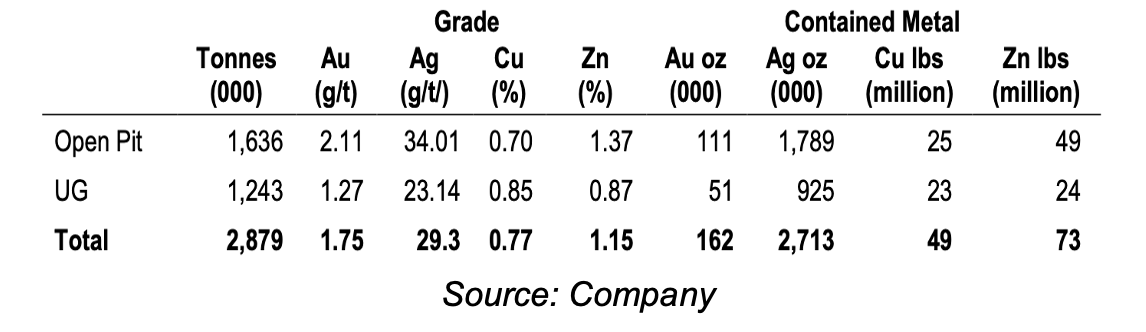

Abu Marawat Gold-Silver-Copper-Zinc Deposit

This deposit hosts a small, polymetallic epithermal vein deposit, potentially accessible through both open-pit, and underground mining methods.

Abu Marawat Inferred Resources (2012)

Resources totaling 353 Koz AuEq. Located 27 km northeast of the Hamama West deposit, and 13 km northeast of the Rodruin project

Semna High-grade Gold Project

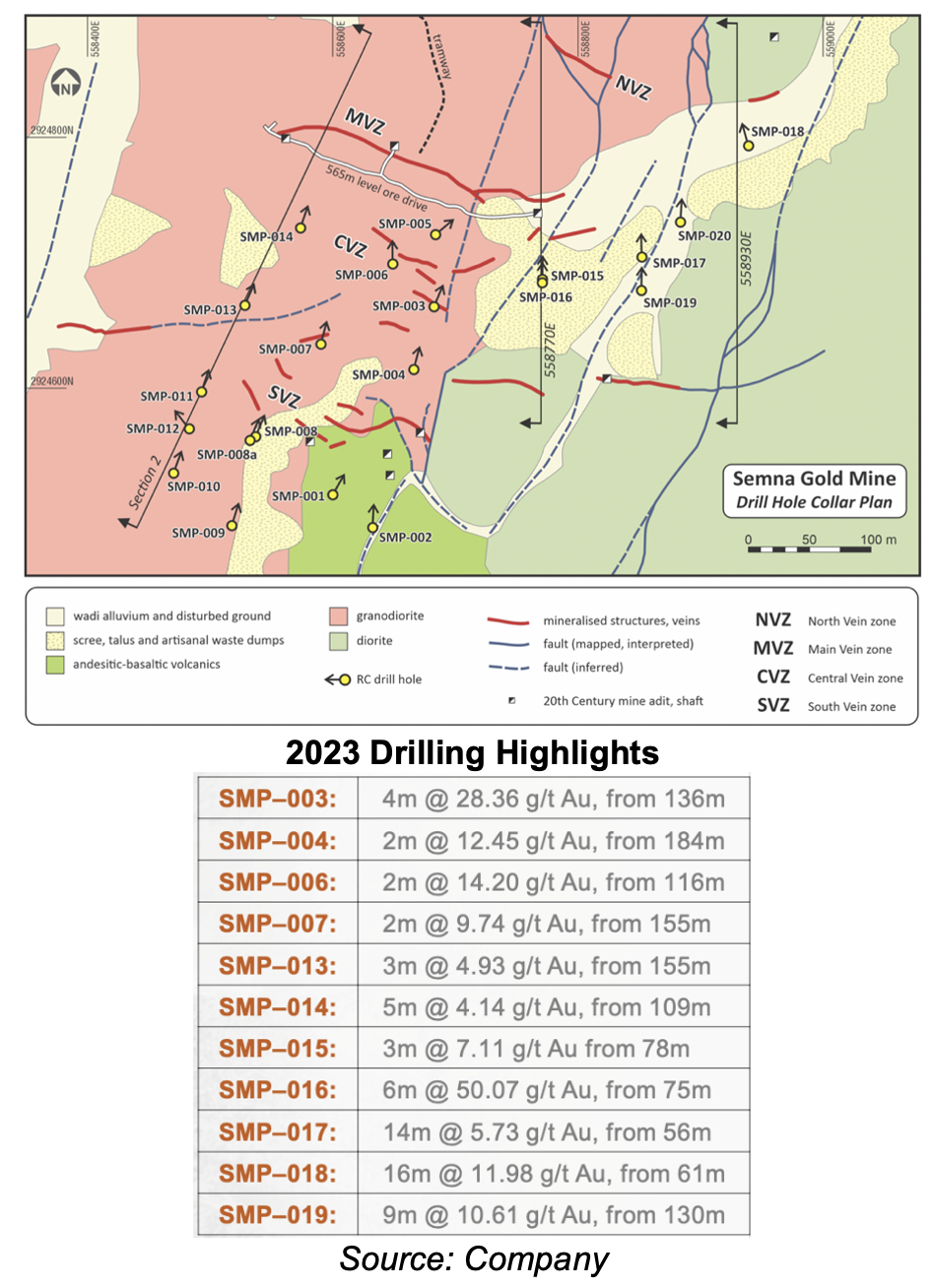

This property hosts the historic Semna gold mine, and several ancient mining sites. Last year, a regional RC drilling campaign (11,600 m) intersected bonanza gold grades of up to 50.07 g/t.

Semna Gold Mine: Vein Zones

Prospective for orogenic gold deposits, characterized by large tonnage, and high grades. Four major vein zones tested over an area covering 600 m long x 300 m wide x 200+ m deep

Drilling encountered high gold grades in in several holes. Based on our review of all published data, we estimate that Semna hosts 0.45 Moz Au in resources

Metallurgical tests show the deposit can be processed via heap leach and gravity concentration, yielding 97% gold recovery. Aton is planning a maiden resource estimate in 2025.

Multiple upcoming catalysts. Management's long-term strategy involves establishing a hub-and-spoke operation, centered around a processing plant located at Semna. Their near-term goal is advancing Hamama West to production by 2026

Management and Directors

Two institutions own 86% of Aton’s equity. The CEO is a control person of one of the institutional investors

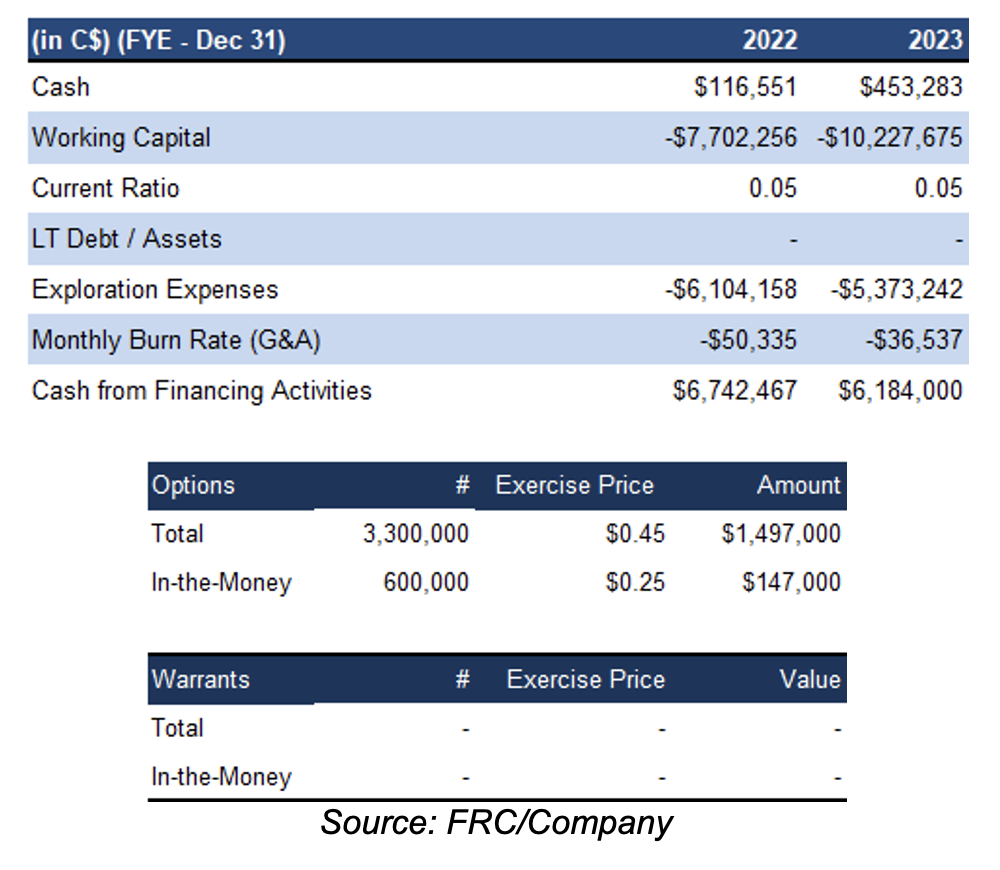

Financials

At the end of 2023, Aton had $10.21M in debt due to major shareholders. Subsequent to 2023, Aton converted $6.31M in debt to equity by issuing 28.70M shares, and raised $4M through the exercise of warrants

The company currently has $1M in cash, and $3.5M in debt

FRC Valuation and Rating

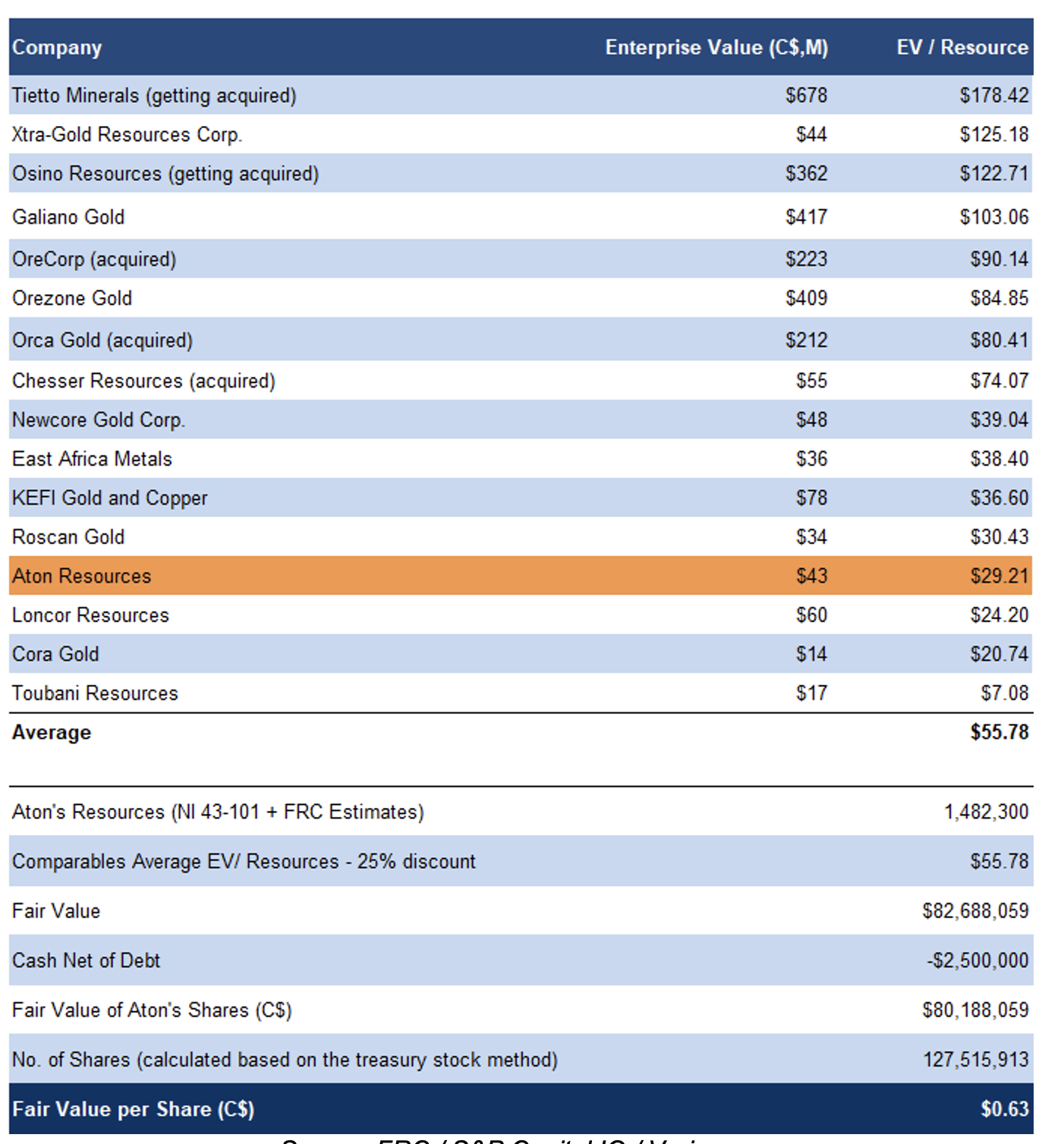

African gold juniors are trading at $56/oz, based on 100% of M&I + 50% of inferred resources. AAN is trading at $29/oz, reflecting a 48% discount

Recent acquisitions of African juniors were priced at an average of $82/oz. Applying the sector average EV/oz of $56/oz to AAN’s NI 43-101 compliant resources, and our speculative estimates, we arrived at a comparables valuation of $0.63/share

We are resuming coverage with a BUY rating, and a fair value estimate of $0.63 per share. Due to the projects' proximity to each other, and the feasibility of a hub-and-spoke operation with one centralized processing plant, we believe the company's resources should trade at a premium, given that CAPEX can be shared among multiple projects. We are more bullish on gold stocks than the metal itself, with gold producer valuations averaging 17% lower compared to the past three instances when gold surpassed $2k/oz.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- The value of the company is dependent on gold prices

- Access to capital and share dilution

- Exploration and development

- Geopolitical and FOREX

- No assurance that the company will be able to advance all of its projects simultaneously

We are assigning a risk rating of 5 (Highly Speculative