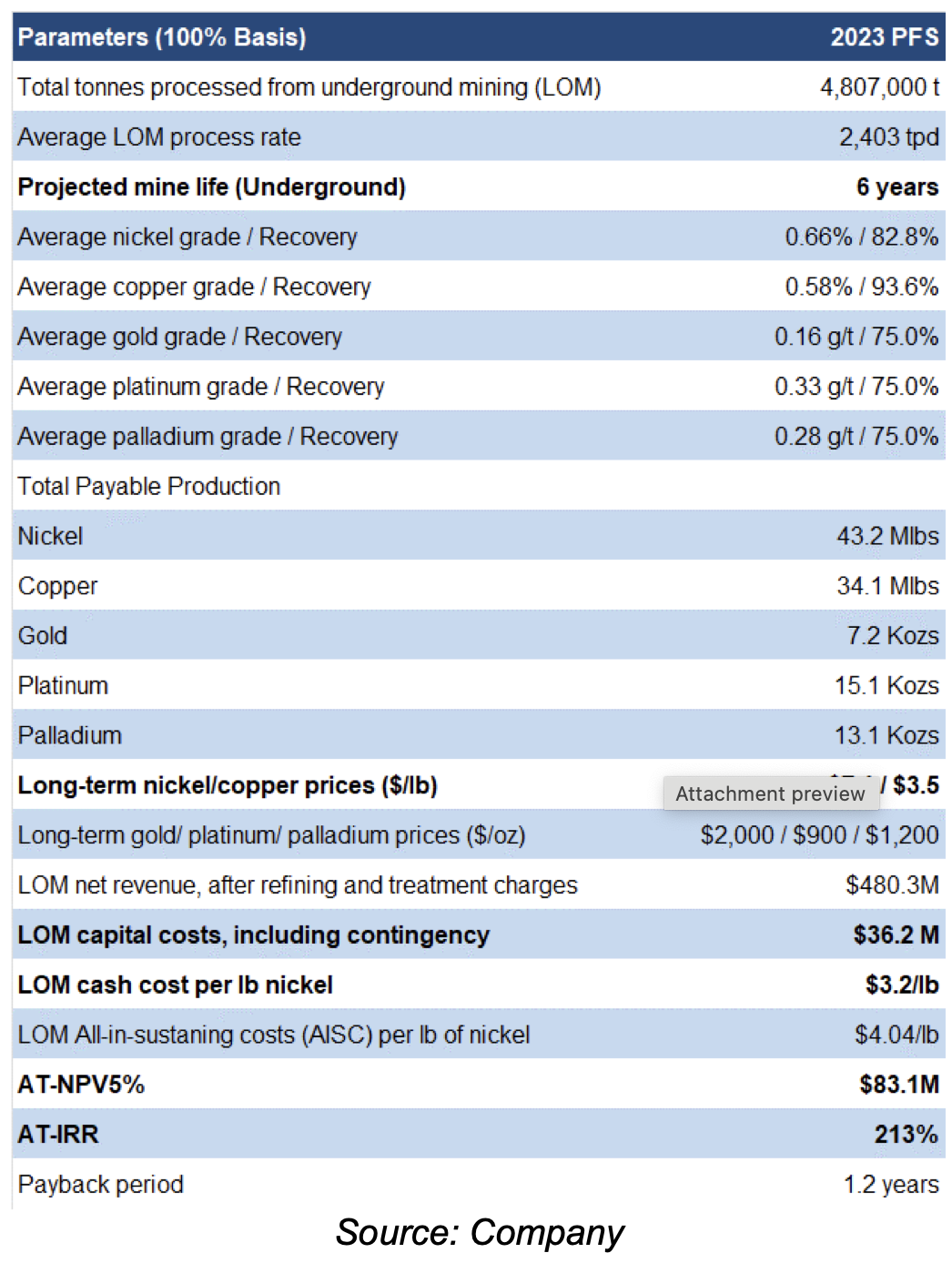

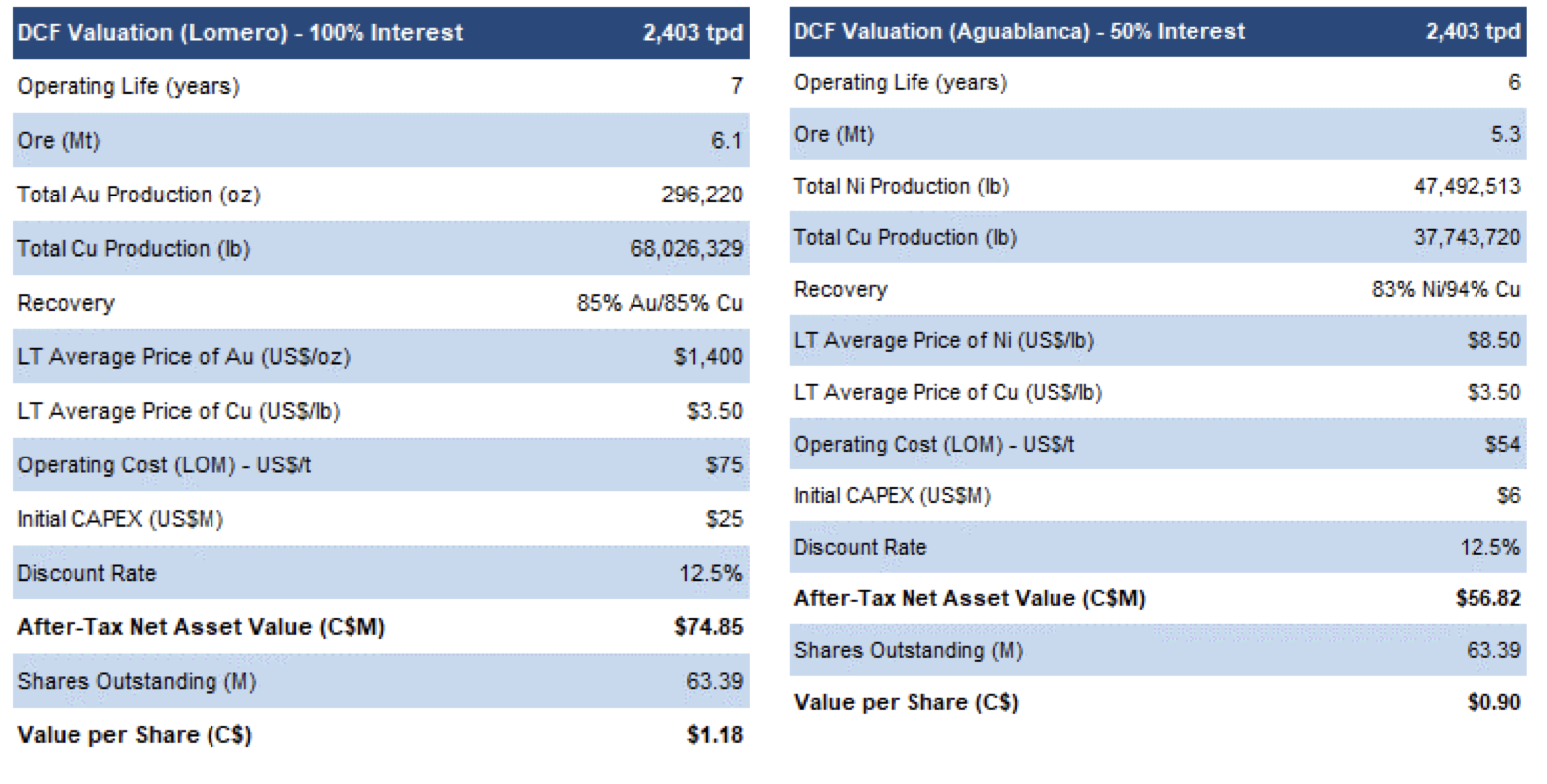

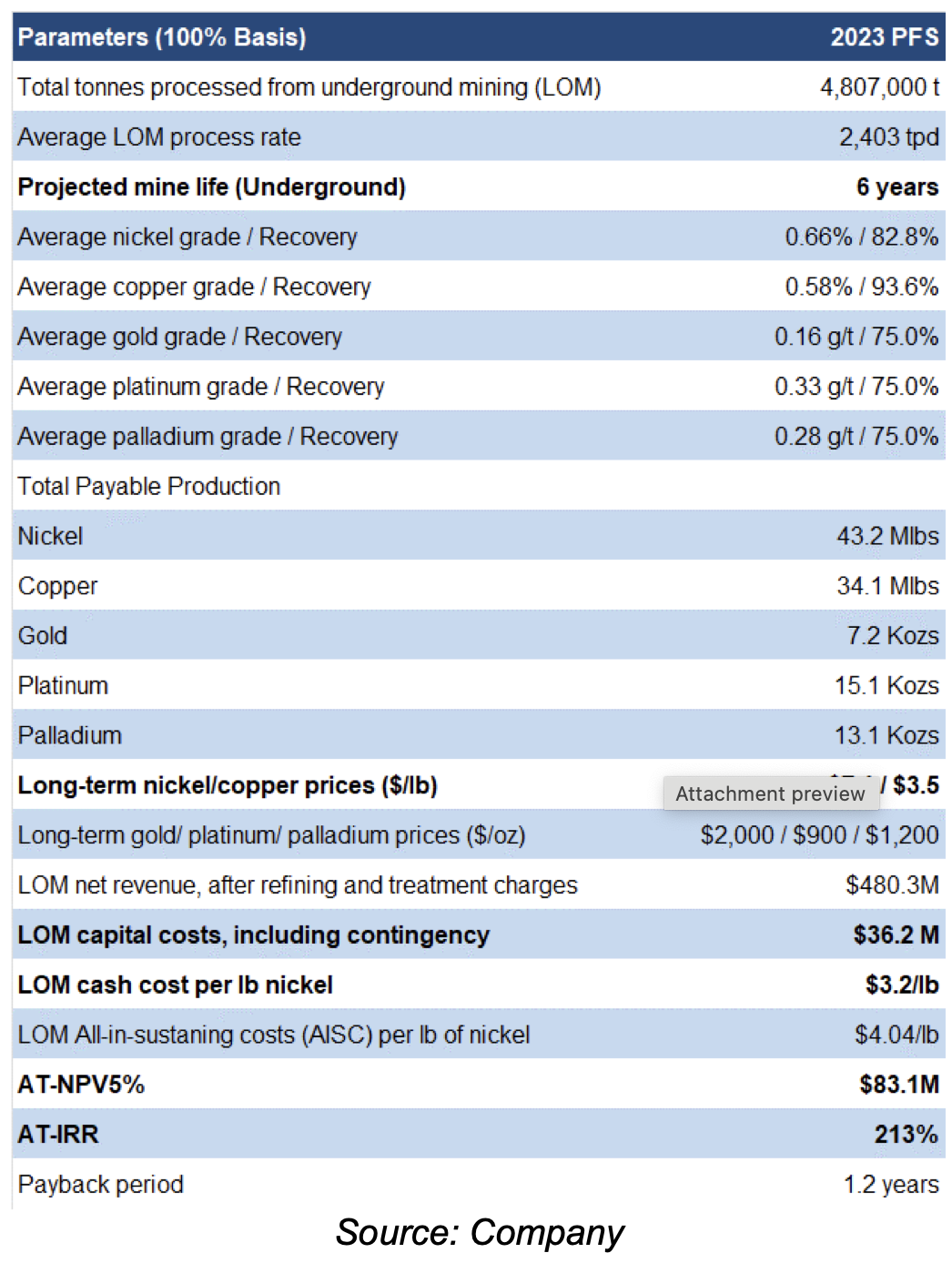

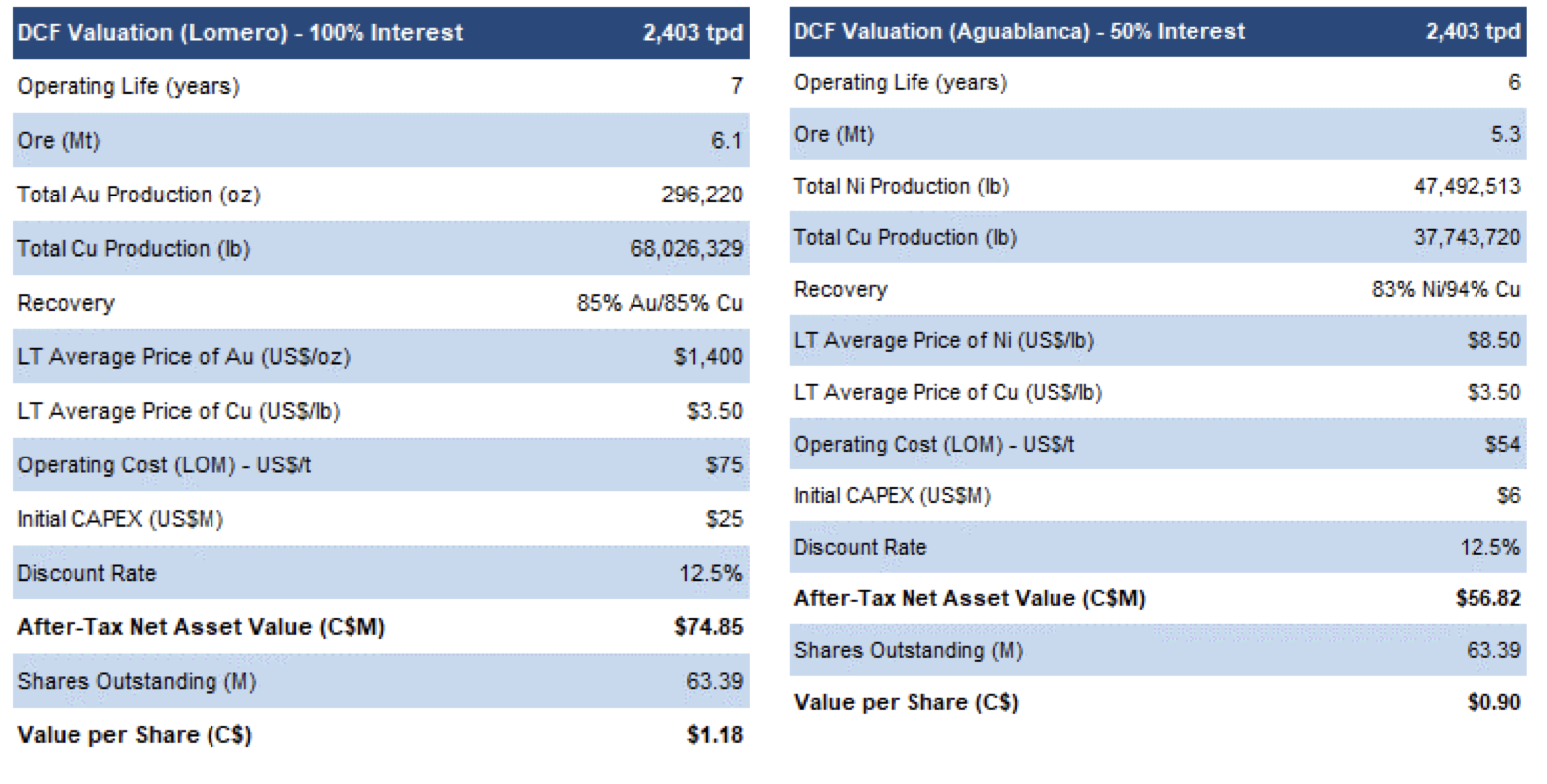

- Last month, DMET completed a Pre-Feasibility study (PFS) on the Aguablanca project, which returned an AT-NPV5% of $83M, and a very high AT-IRR of 213%, using $7.3/lb nickel, and $3.5/lb copper vs spot prices of $8.6/lb nickel, and $4.6/lb copper. The project’s initial CAPEX is just $6.1M, attributed to existing underground mine development, and a 5,000 tpd processing facility. Management intends to start production using 50% of the processing plant's capacity in early 2025. The remaining capacity will process materials from DMET's Lomero project, situated 88 km away, expediting its advancement to production. The company anticipates a PEA on Lomero in the coming weeks.

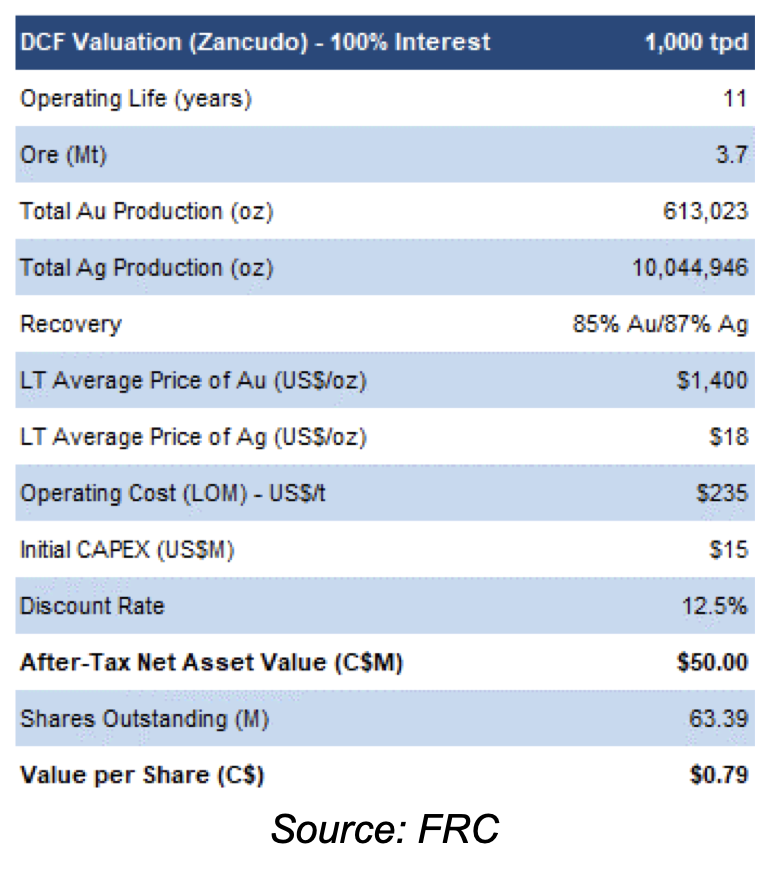

- The combined AT-NPV5% of Aguablanca and Zancudo is $248M. DMET is trading at just 24% of this.

- Although DMET is a polymetallic play, gold is the most dominant metal in its portfolio. We maintain a bullish outlook on gold, anticipating inflation to stay above historic averages in 2024, and expecting the Fed to commence rate cuts in Q4-2024. That said, we are more bullish on gold stocks than the metal itself, with gold producer valuations averaging 17% lower compared to the past three instances when gold surpassed $2k/oz.

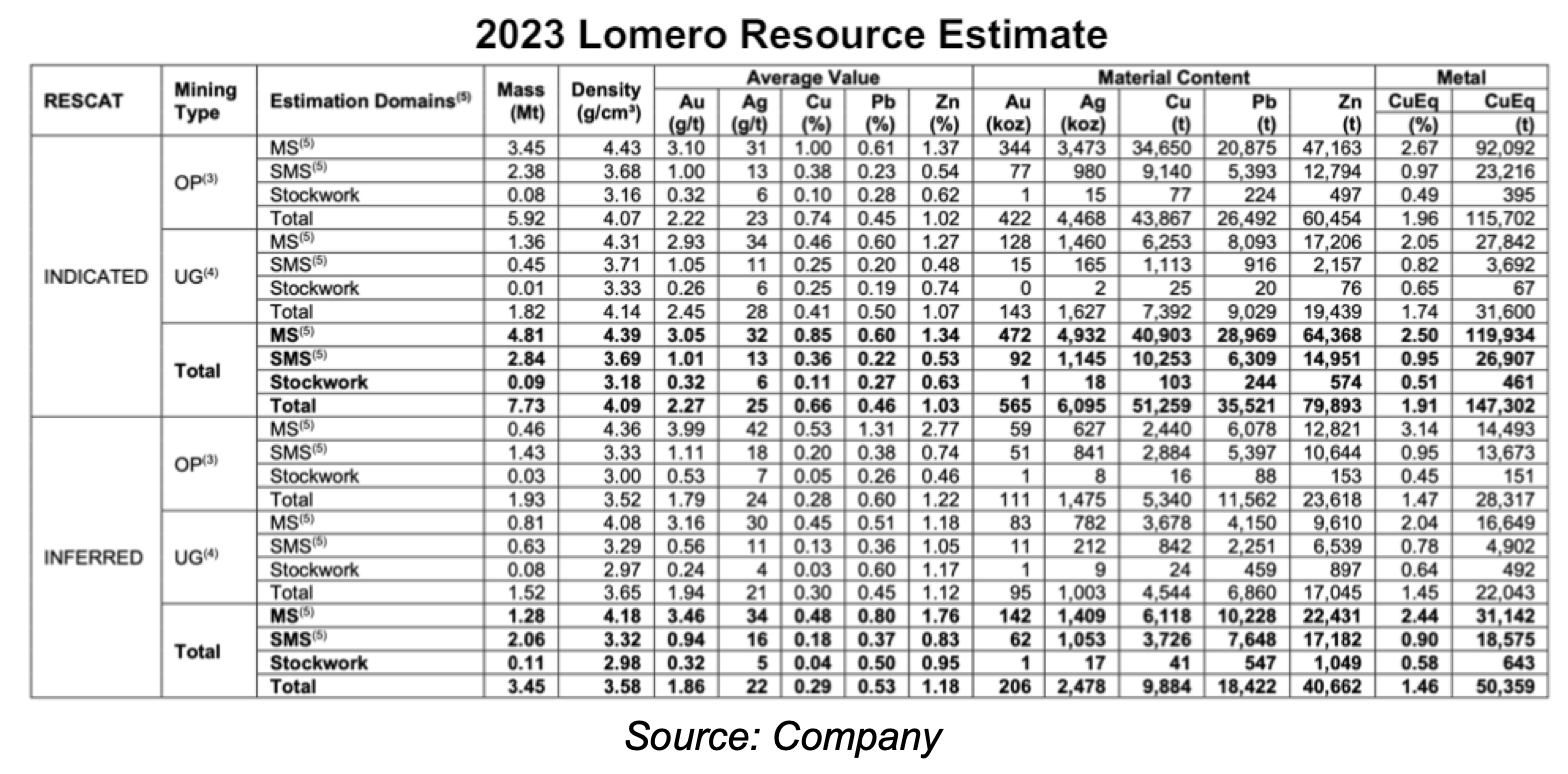

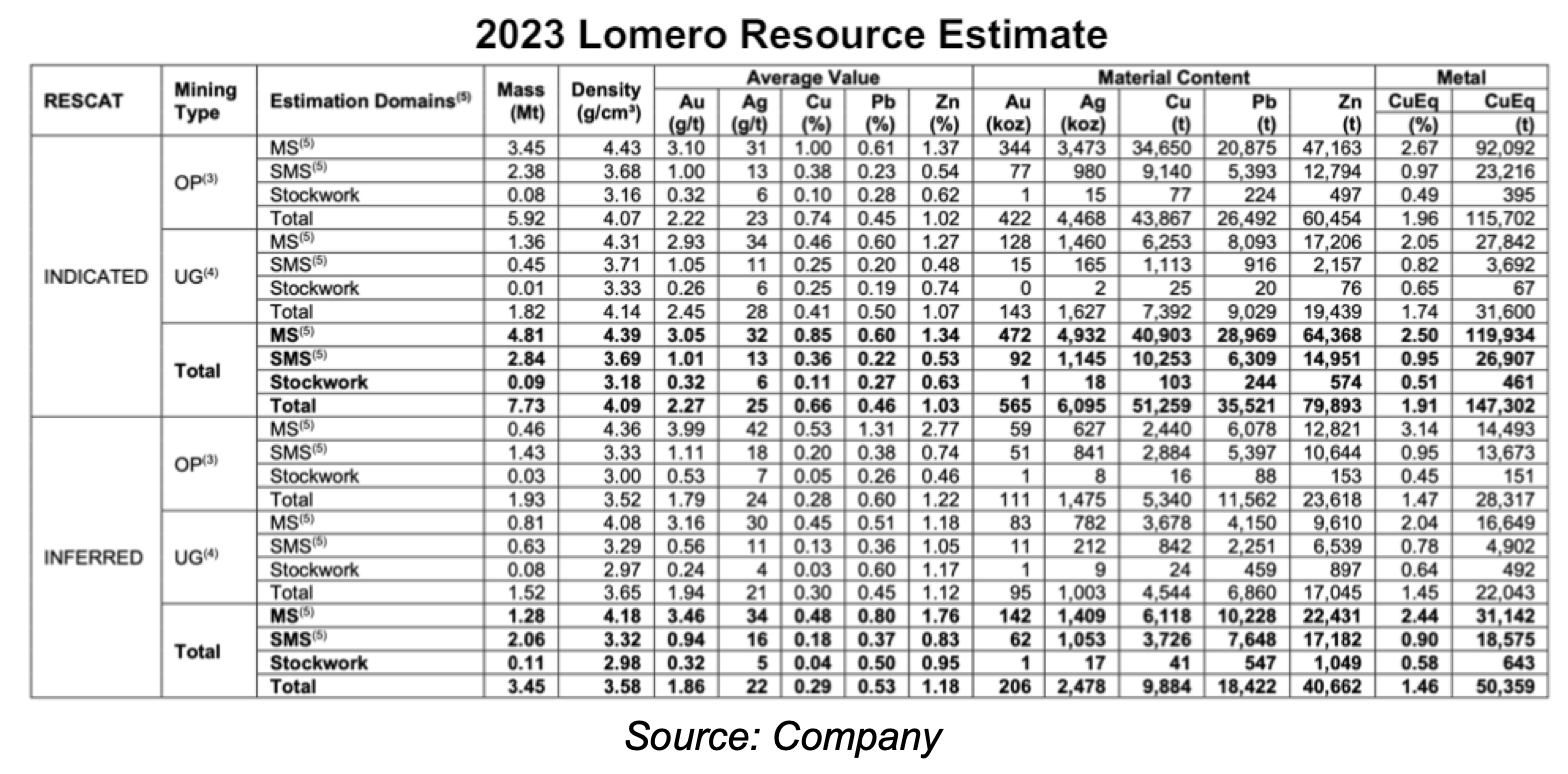

- We anticipate a series of upcoming catalysts, including a PEA on Lomero, and the commencement of production at Aguablanca and Zancudo.

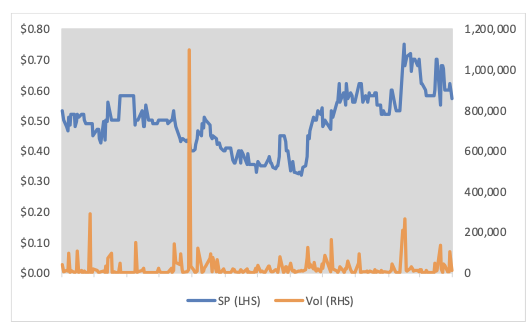

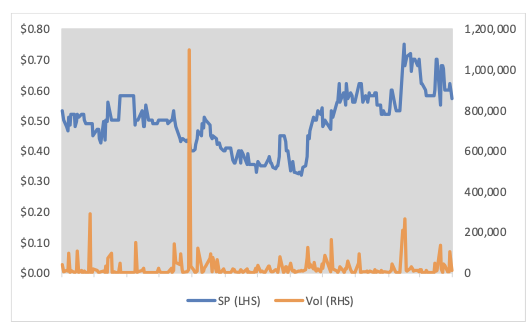

Price Performance (1-year)

| |

YTD |

12M |

| DSLV |

-10% |

9% |

| TSXV |

5% |

-4% |

*Subsequent to 2023, DMET has raised/secured $15M, and is currently pursuing a C$20M financing.

**See important disclosures at the bottom of this report rating and risk definitions. All figures in US$ unless otherwise specified.

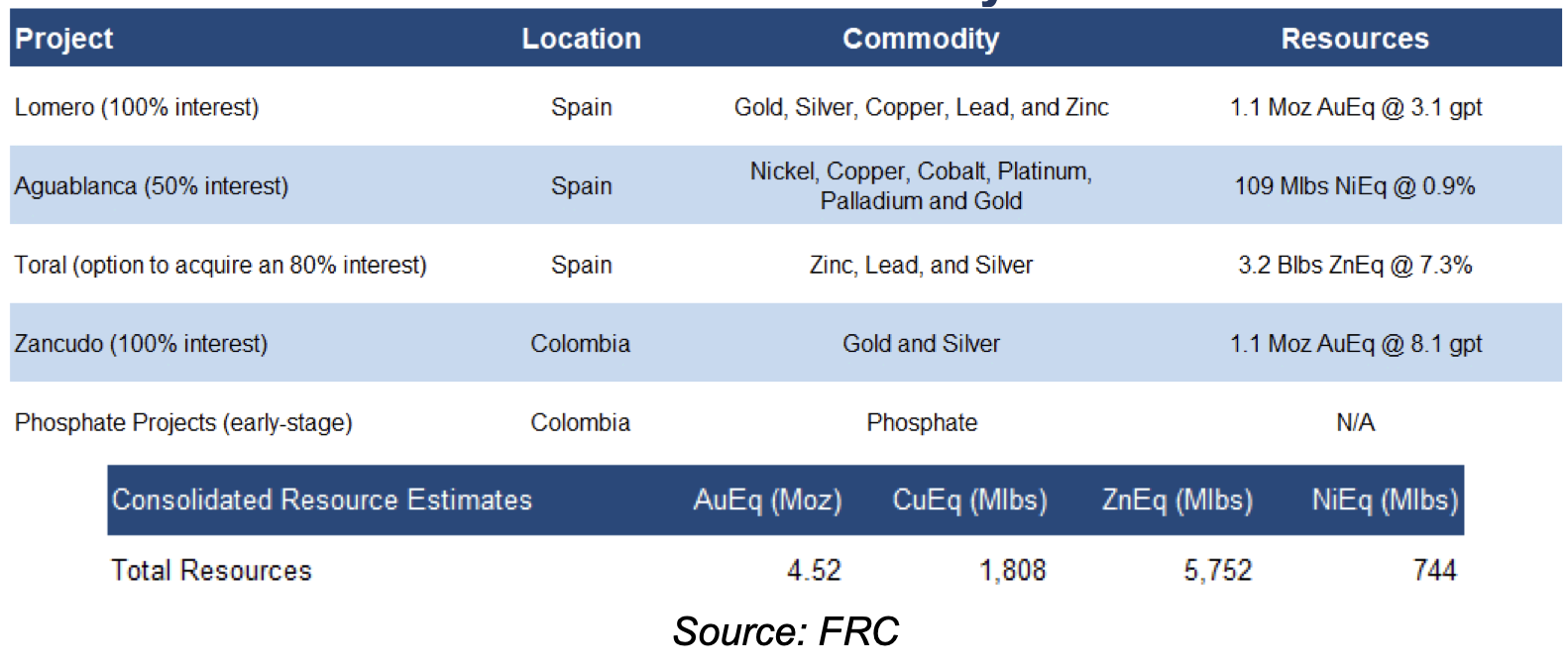

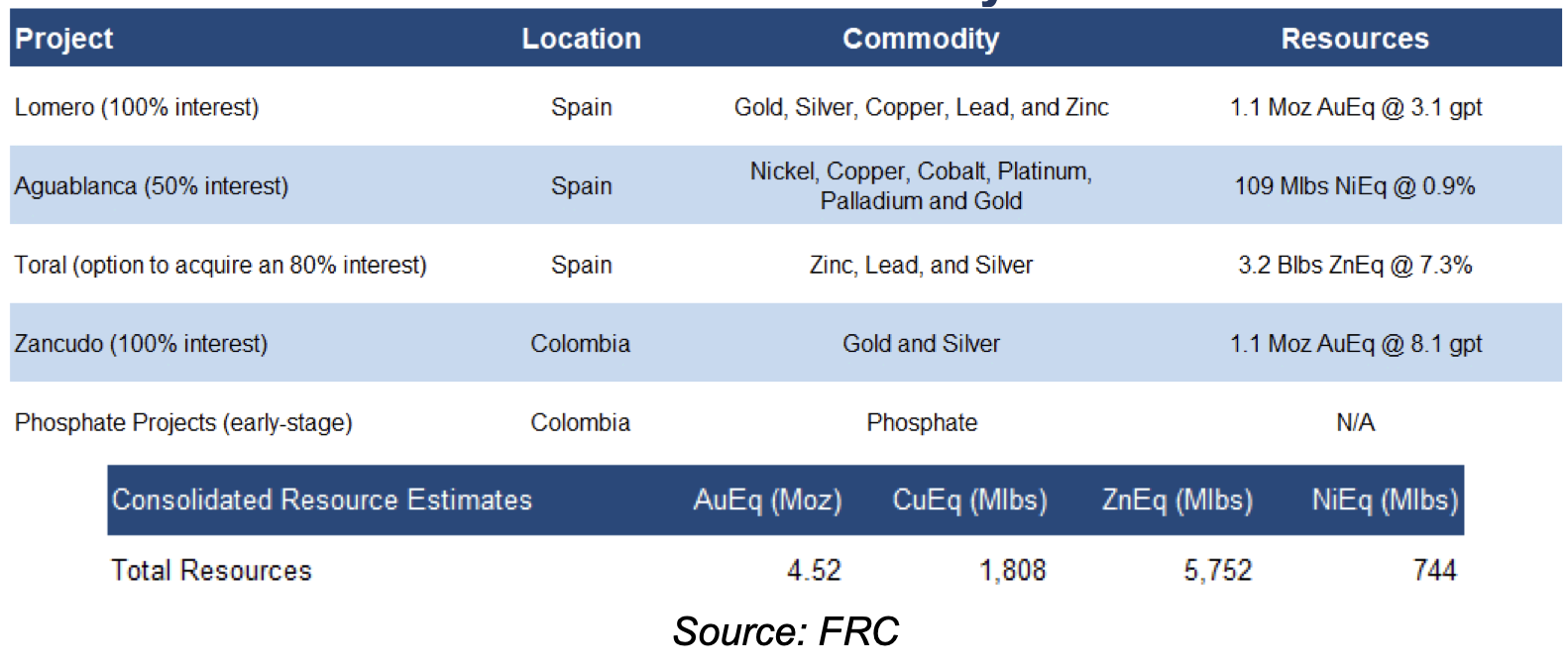

Portfolio Summary

Four polymetallic projects, including two near-term producers (Aguablanca and Zancudo)

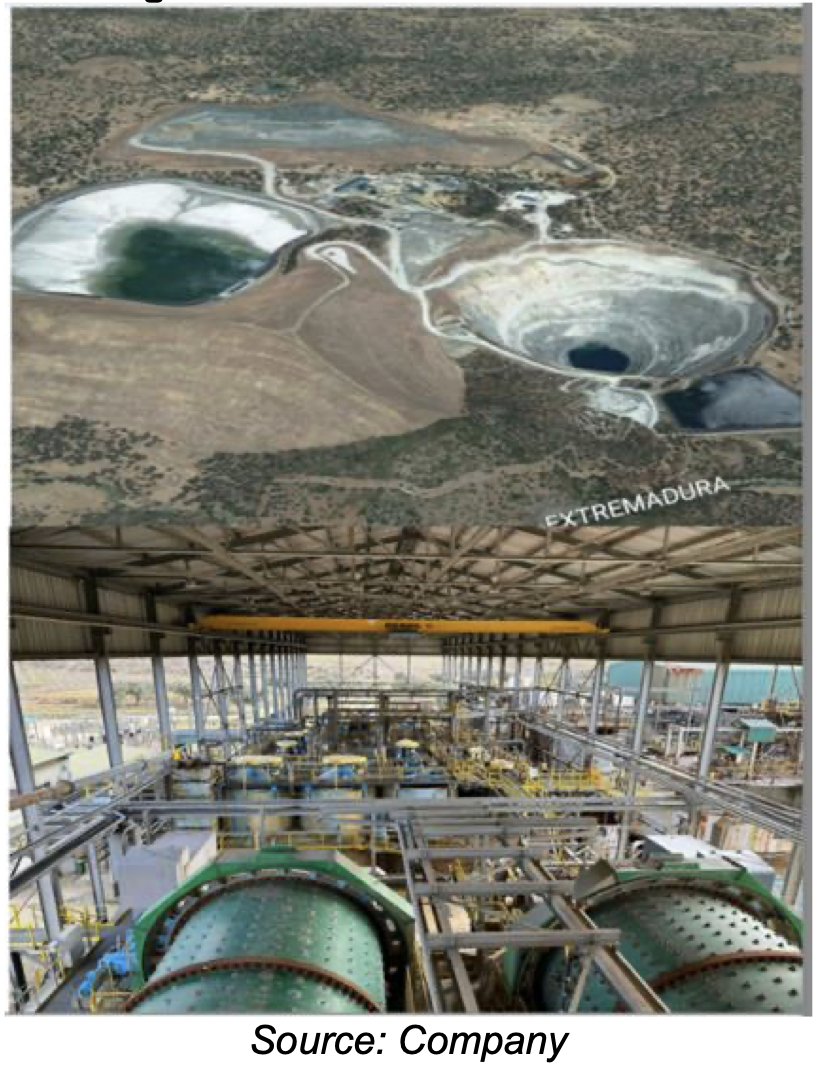

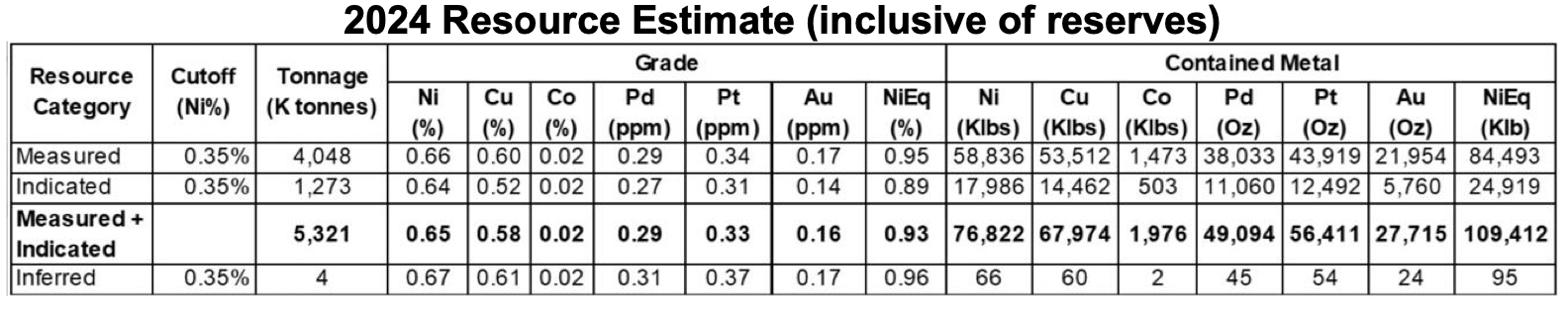

Aguablanca Polymetallic Project (Spain) – 50% Interest

Located 88 km from DMET’s Lomero project

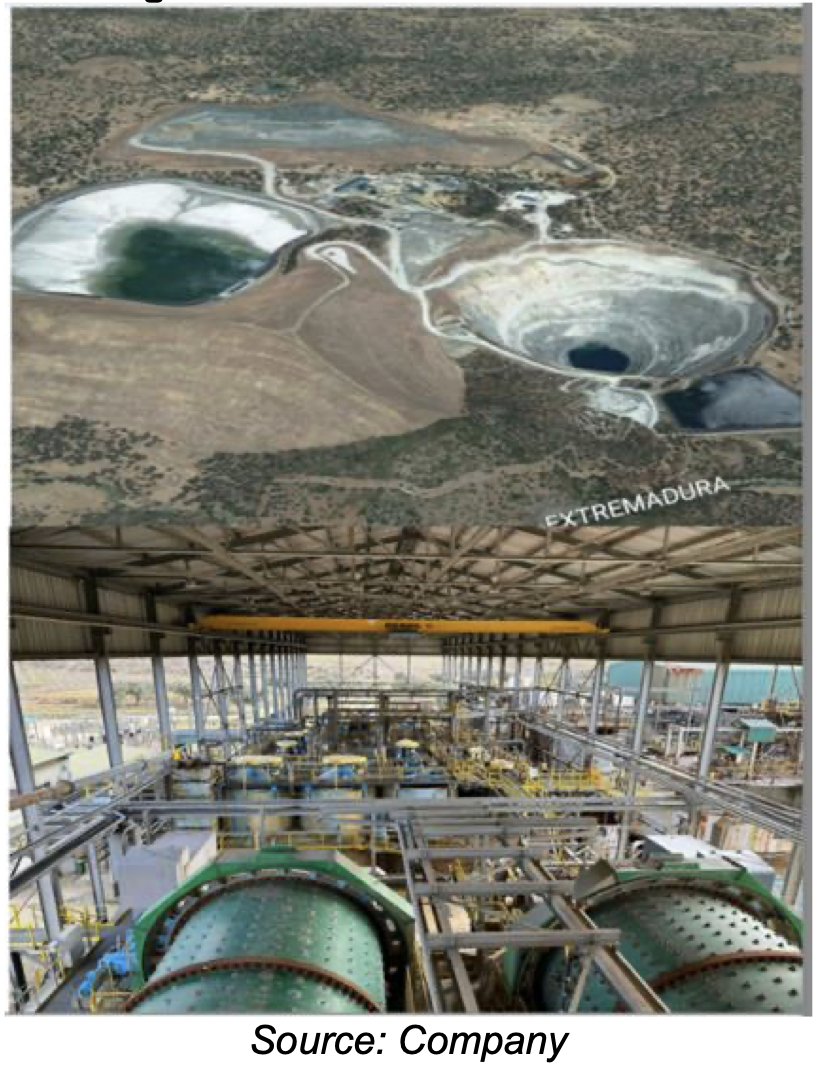

Excellent infrastructure, including access to an underground mine, and paved highways

As the project has a well-maintained 5,000 tpd processing plant, the PFS estimated a low initial CAPEX of $6.1M

The study returned an AT-NPV5% of $83M, and a very high AT-IRR of 213%, using $7.3/lb Ni, and $3.5/lb Cu, vs spot prices of US$8.6/lb Ni, and $4.6/lb Cu

Aguablanca Mine and Facilities

This project hosts the only known nickel-copper deposit in Spain

Lundin Mining (TSX: LUN) had operated the mine from 2007 to 2015, utilizing open-pit operations

An Environmental Impact Statement/EIS, and a mining license are in place

Awaiting a water use permit to begin dewatering the open-pit for underground access

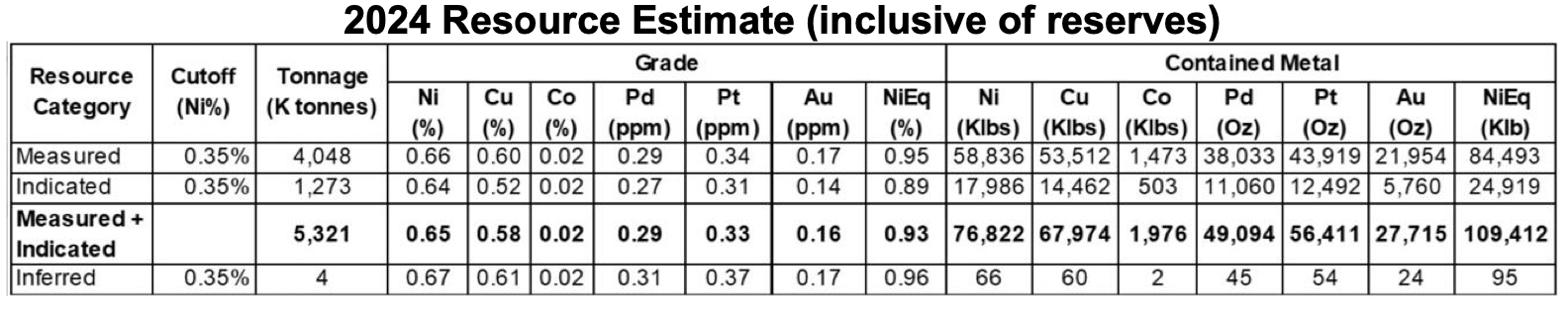

The PFS was based on 89% of the project’s resources

A PEA on Lomero is expected in the coming weeks

Management is aiming to start commercial production by early 2025. The study was predicated on the project utilizing just 50% of the processing plant’s capacity. The remaining capacity is allocated for processing materials from Lomero, thereby expediting and reducing the cost of bringing Lomero into production.

Upcoming Catalysts

- Lomero: Finalize a PEA in the upcoming weeks, followed by a resource expansion drilling program in H2-2024.

- Aguablanca: Initiate dewatering, and prepare the underground mine for commencing production in Q1-2025.

- Zancudo: Conclude a 10,000 m infill/resource upgrade drilling program, and commence commercial production by Q4-2024. DMET has secured an offtake agreement with Trafigura for concentrate sales. Additionally, Trafigura has offered a prepayment financing facility of up to $10M. DMET has also divested a 3% NSR royalty in the project for $5M. Approval for an EIS is pending.

- Toral: Complete an updated resource estimate this year, followed by a PEA.

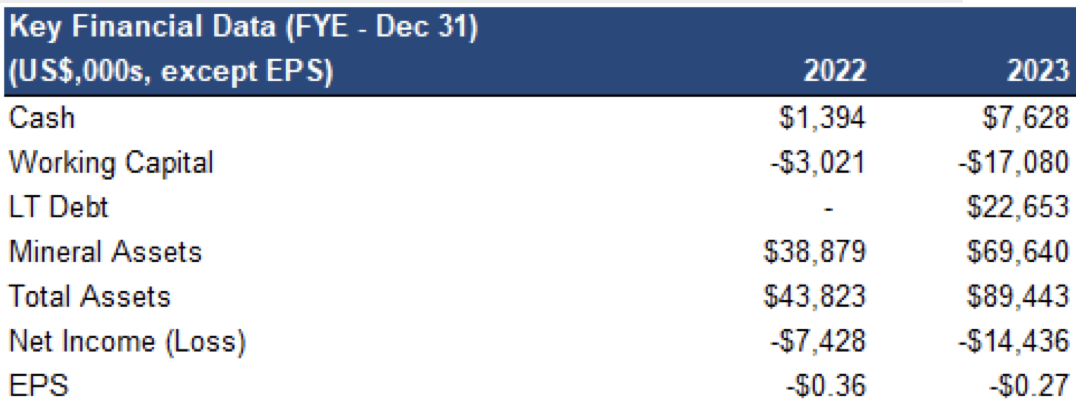

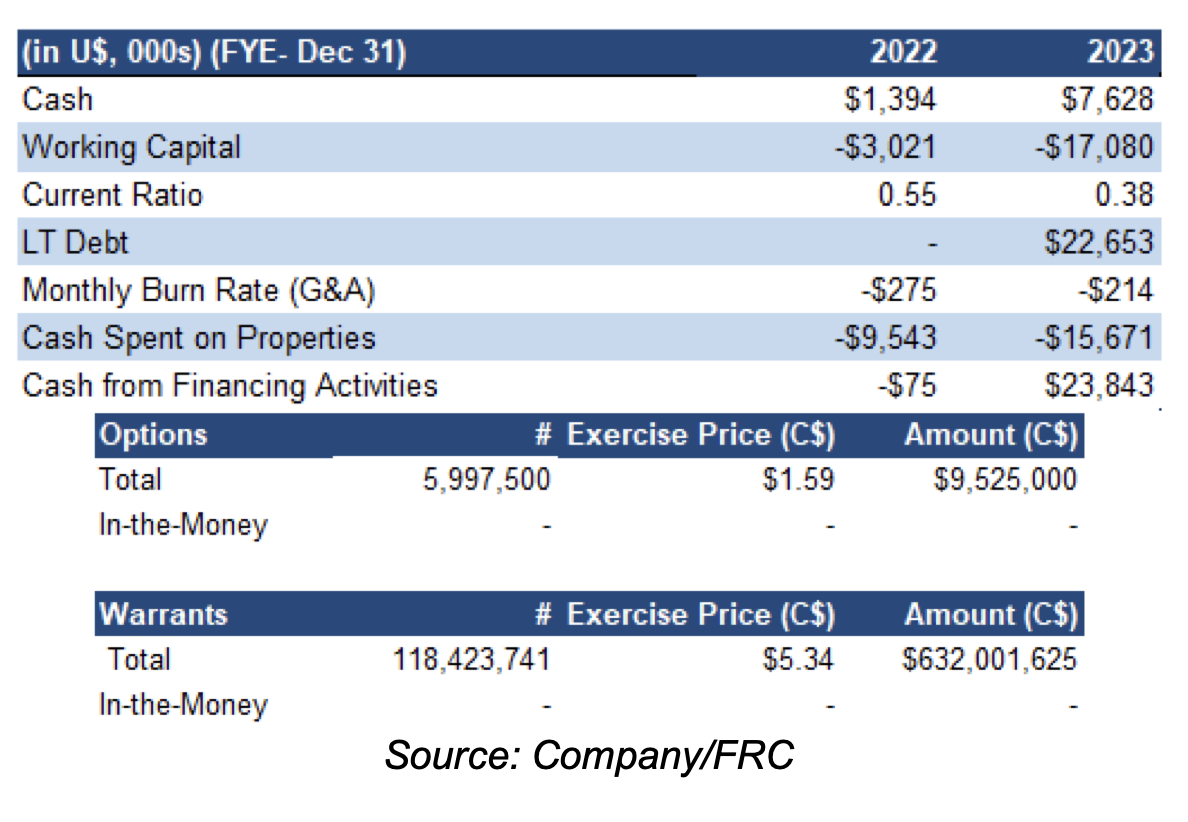

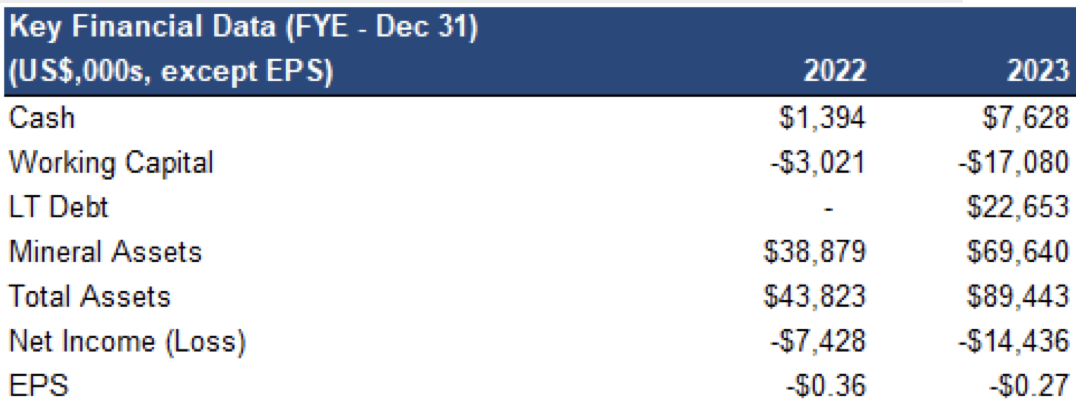

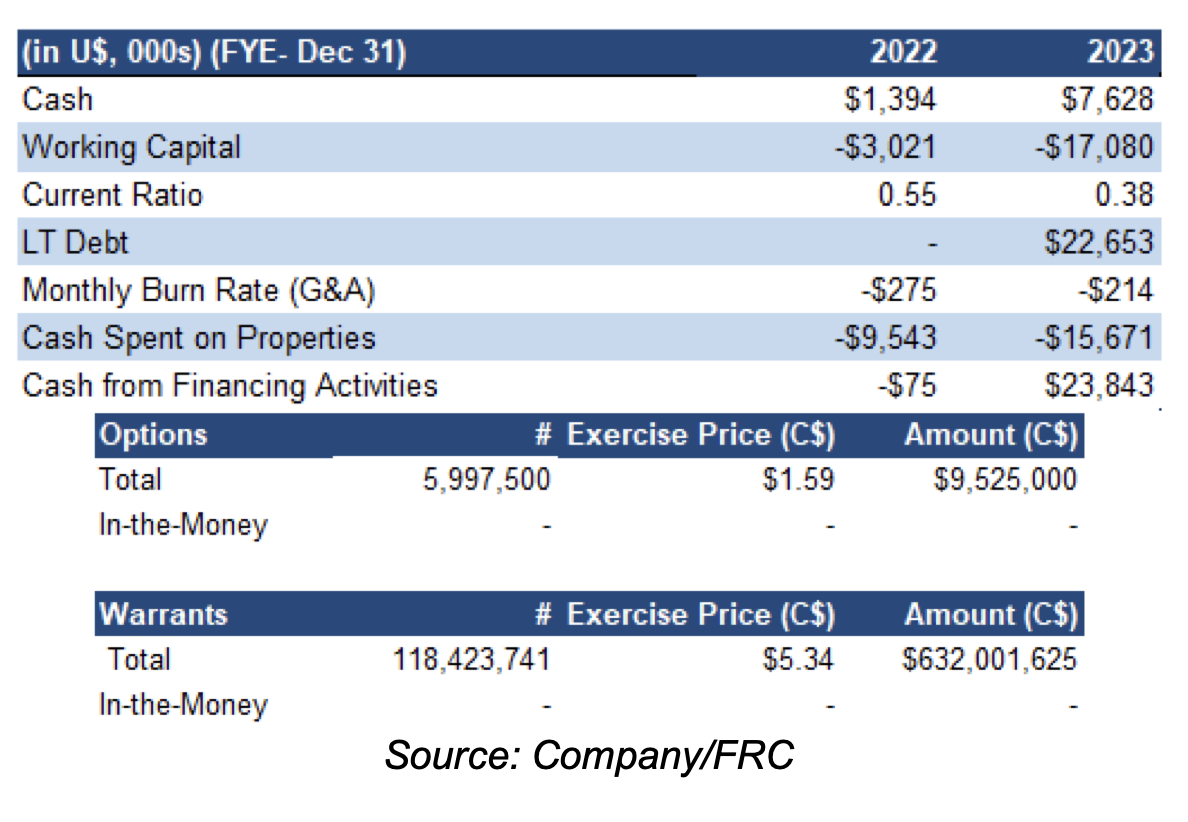

Financials

Subsequent to 2023, the company raised $5M through the above-mentioned NSR sale

DMET is currently finalizing a $10M financing facility with Trafigura, while pursuing a C$20M convertible debenture financing

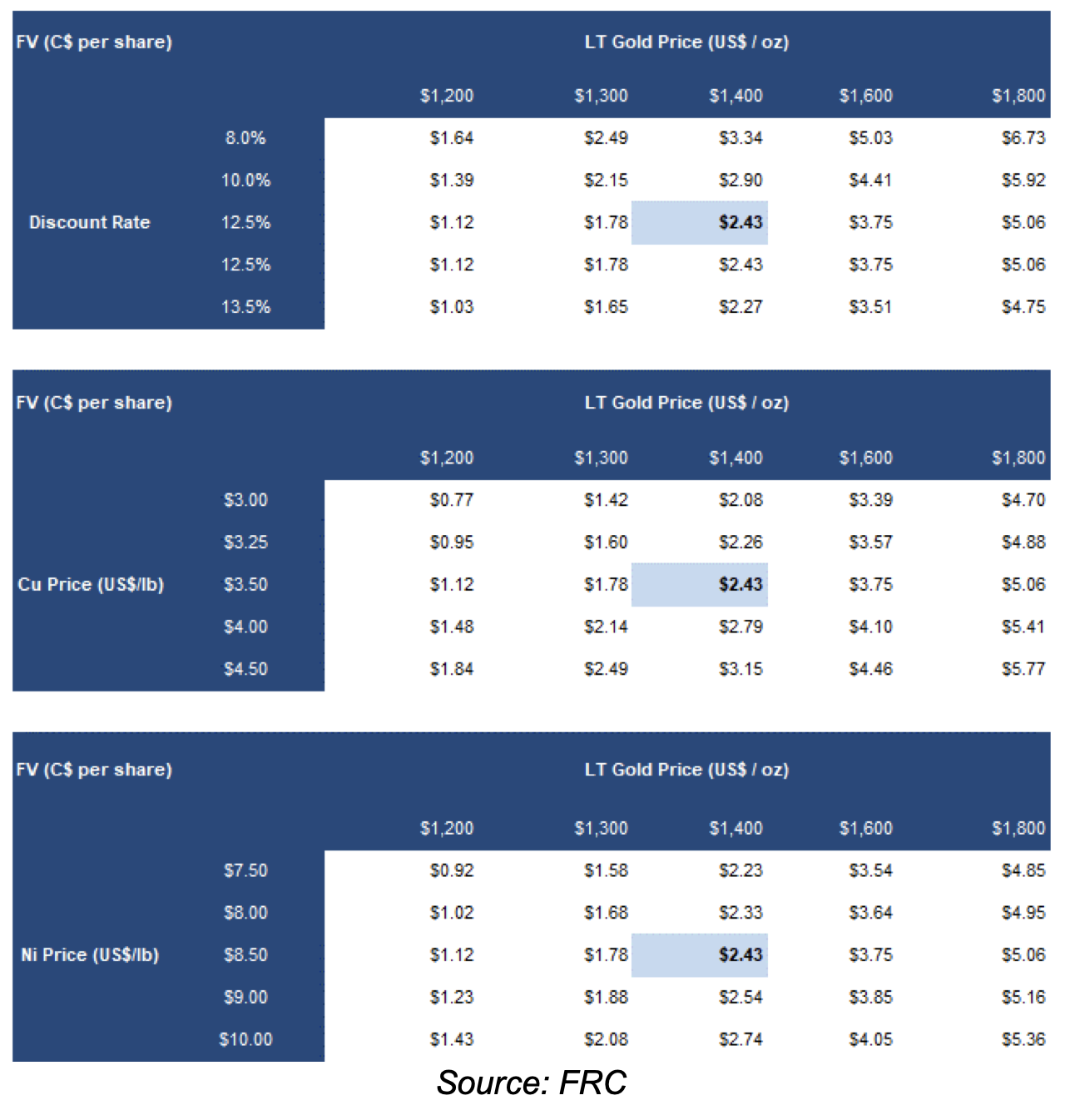

FRC Valuation

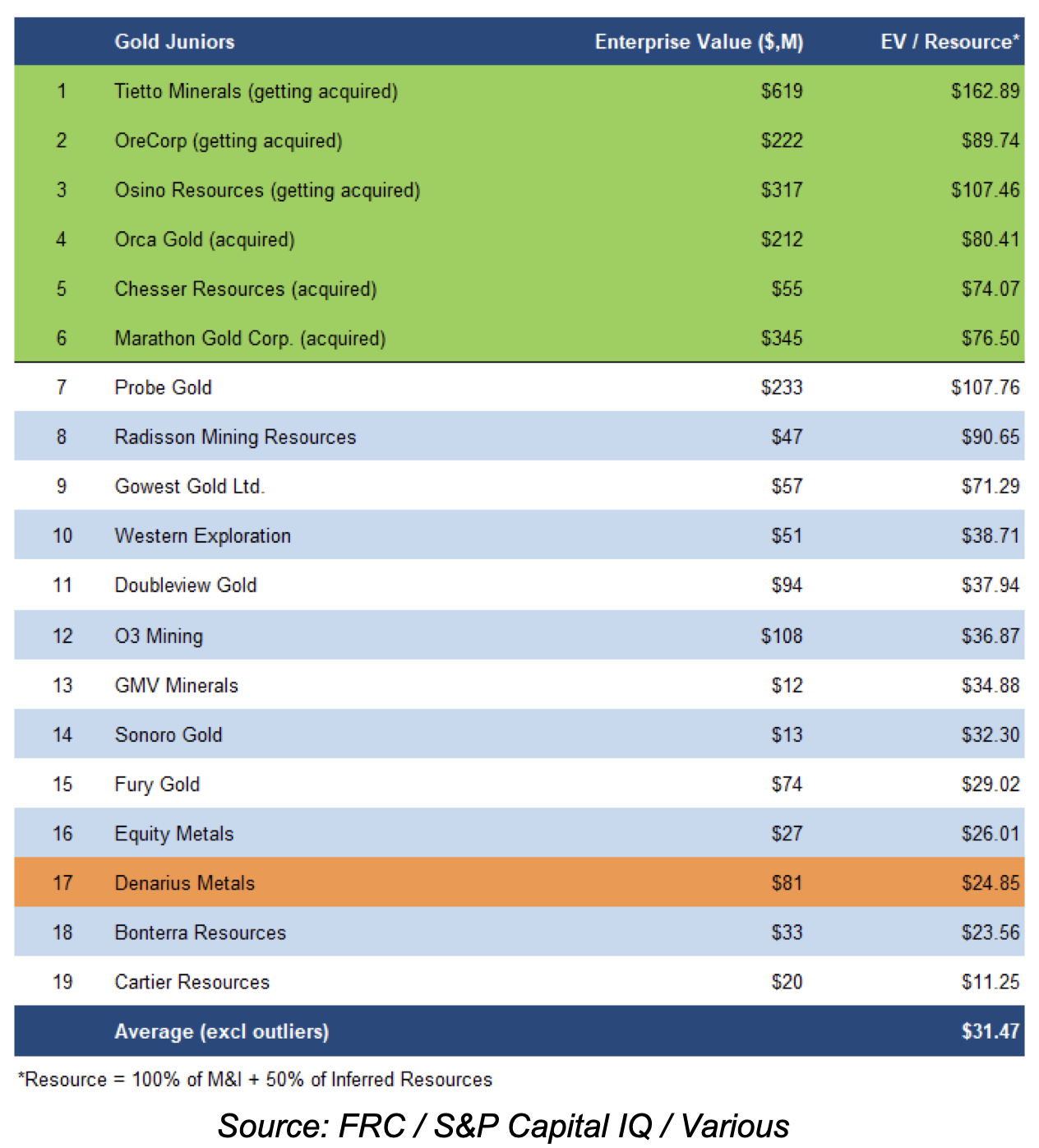

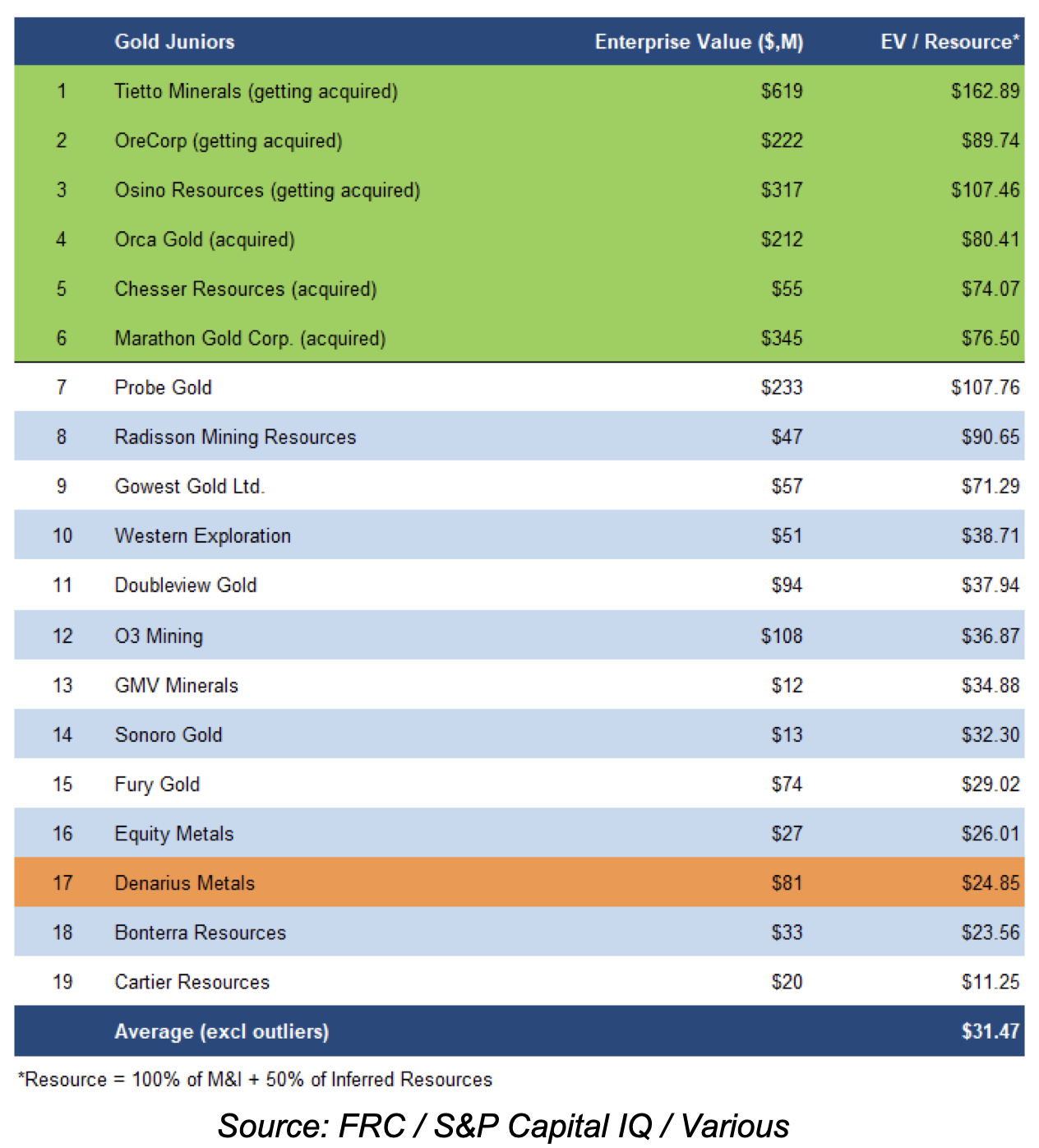

DMET is trading at $25/oz (previously $20/oz) vs the sector average of $31/oz (previously $34/oz)

Our comparables valuation decreased from C$1.21 to C$0.86/share due to lower sector valuations

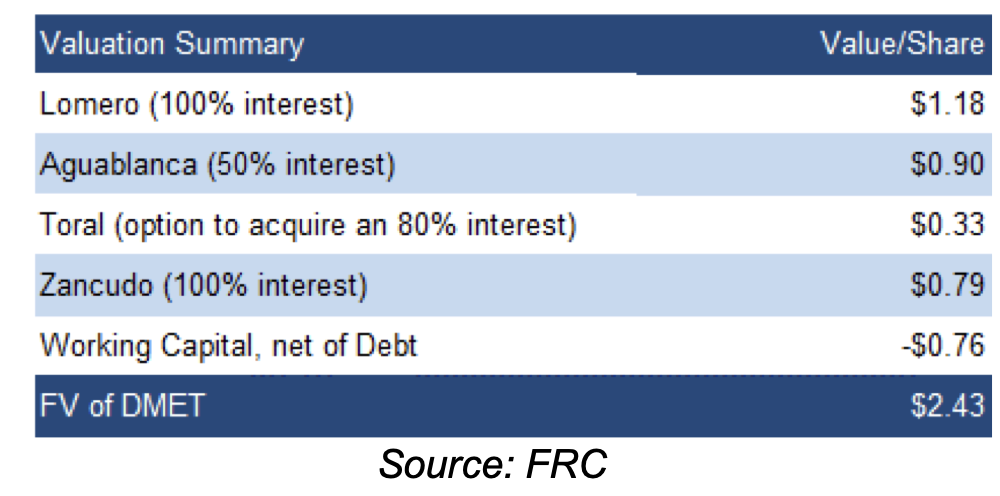

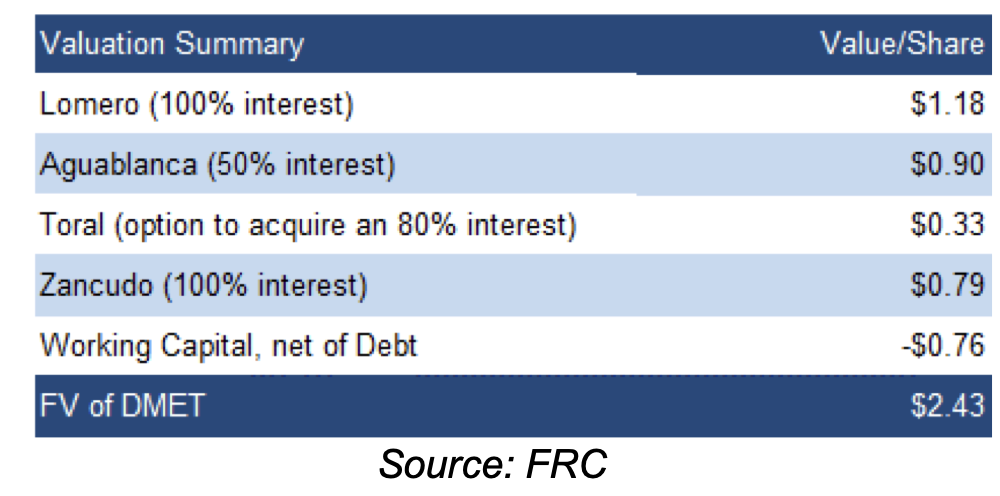

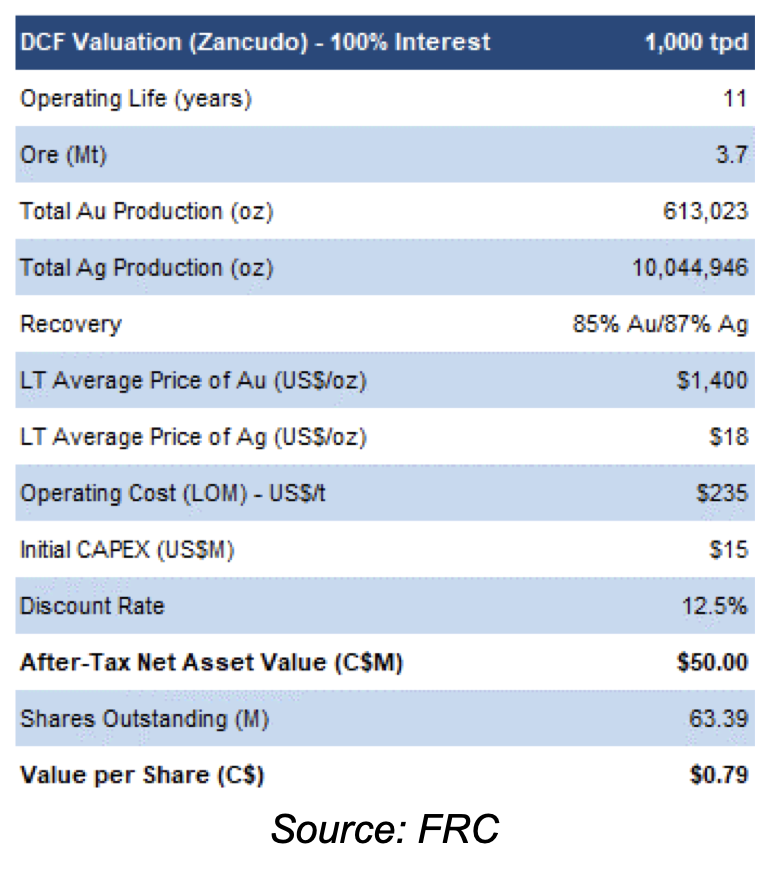

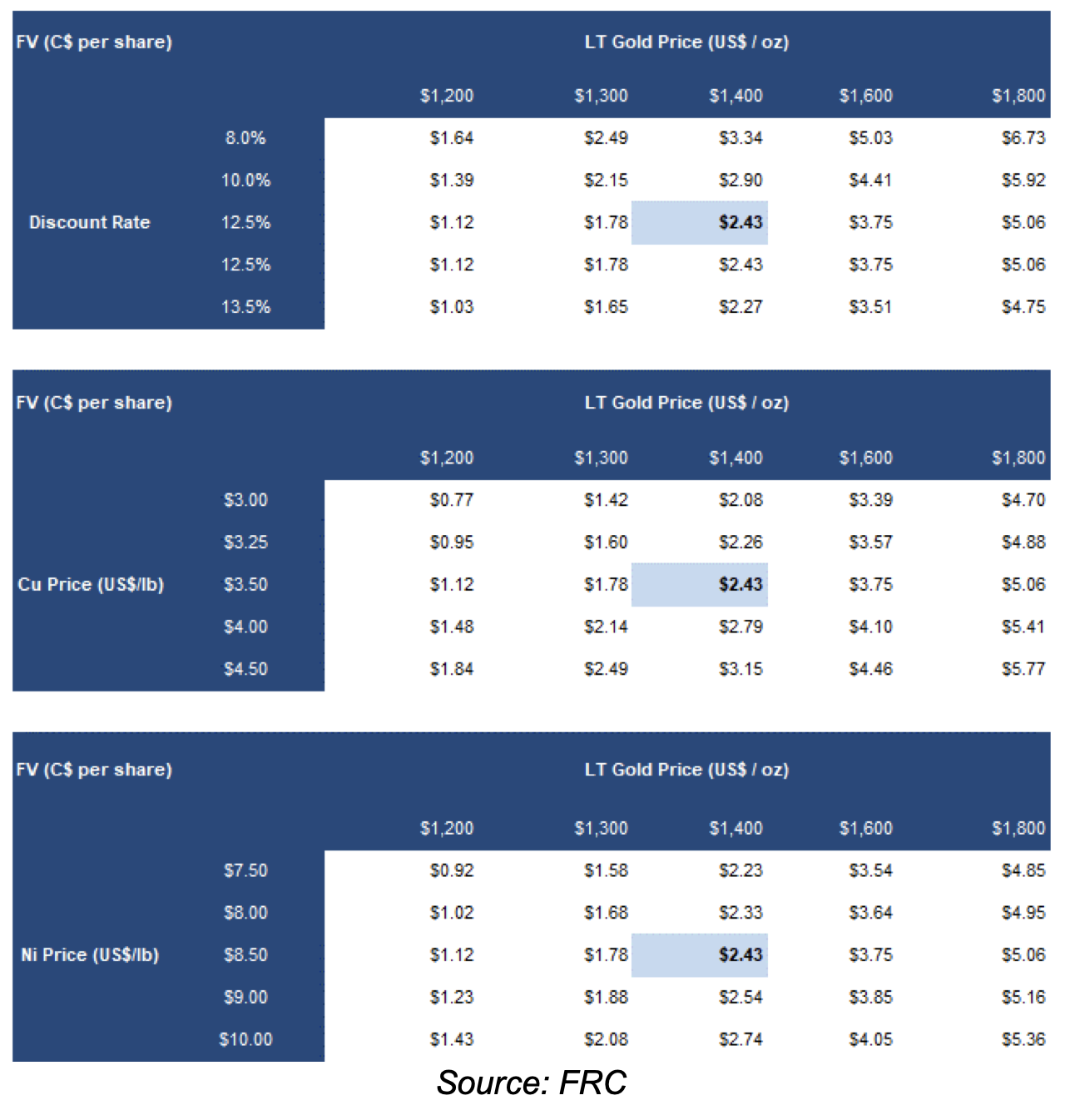

We are introducing our DCF/NAV valuation of C$2.43/share in this report, given the recently completed economic studies on Aguablanca and Zancudo.

We used a sum-of- parts valuation model; the tables presented here summarize our valuation on each project.

Our valuation is highly sensitive to metal prices

We are reiterating our BUY rating, and adjusting our fair value estimate from C$0.99/share to C$1.65/share (the average of our DCF and comparables valuations). Valuation increased as we introduced our DCF valuation models in this report. As the company is advancing multiple projects simultaneously, we believe the market has yet to fully comprehend the true intrinsic value of DMET. We anticipate a series of upcoming catalysts, including a PEA on Lomero, a resource update on Toral, and the commencement of production at Zancudo, and Aguablanca.

Risks

- Commodity prices

- Exploration, development, and permitting

- FOREX

- No guarantee that the company will be able to advance all of its projects simultaneously

- Access to capital and potential for share dilution