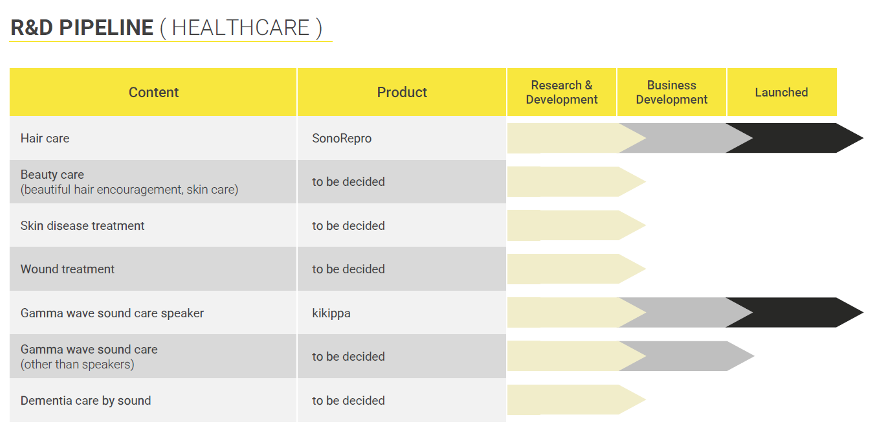

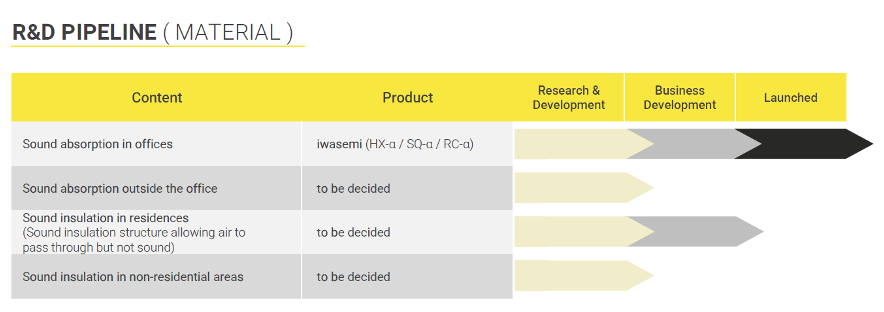

- Pixie has six commercialized products (all launched in the past one/two years), and several others in R&D stages. One of its flagship products promotes hair growth and mitigates hair loss. The company also offers products for individuals who are deaf or hard of hearing, and those interested in improving their cognitive abilities.

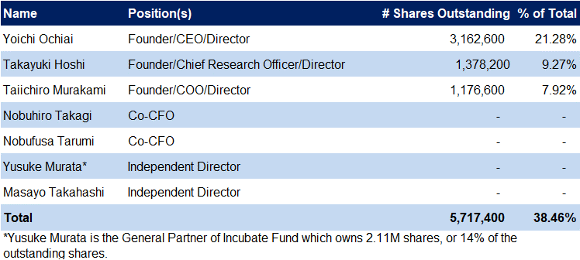

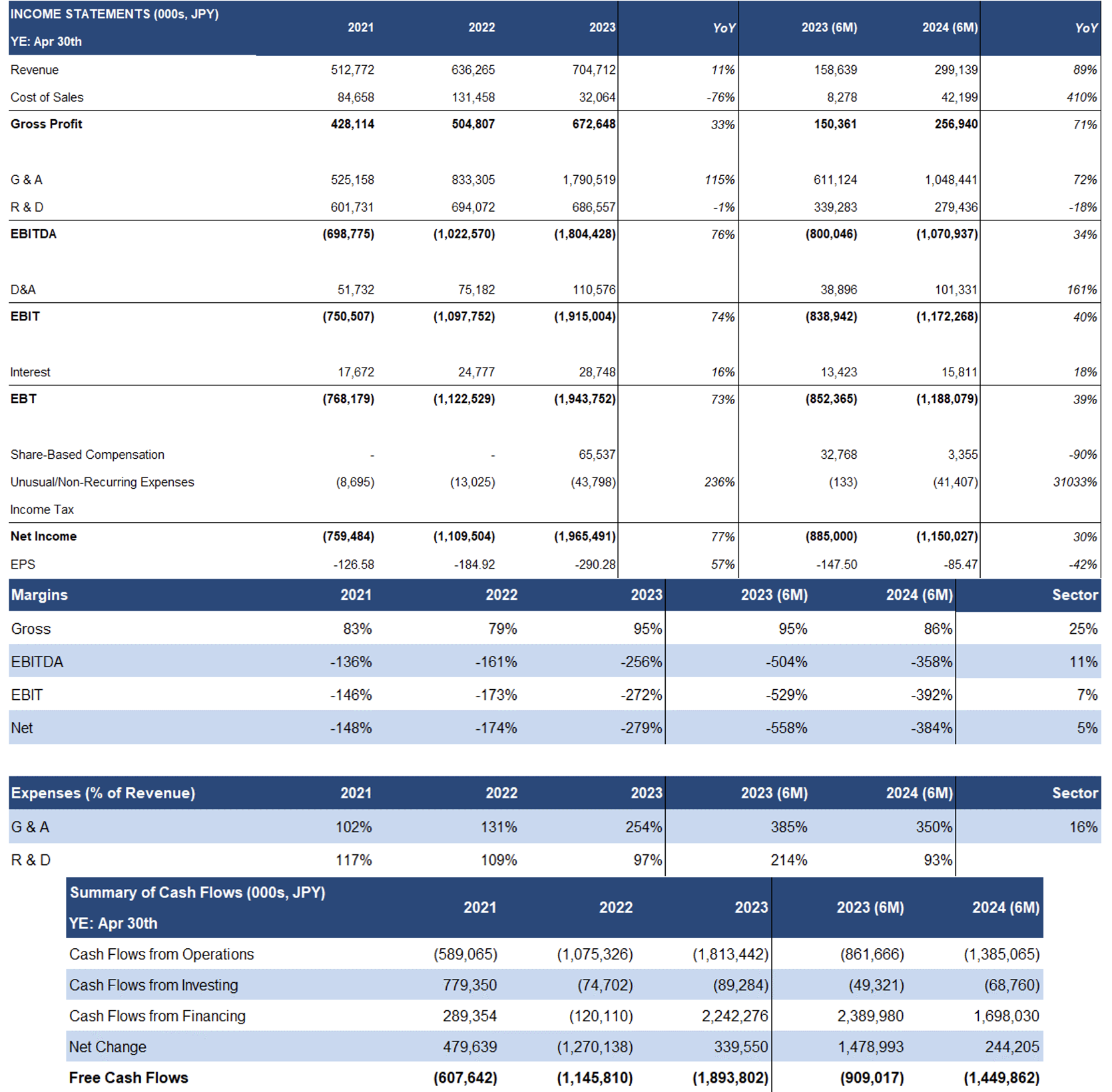

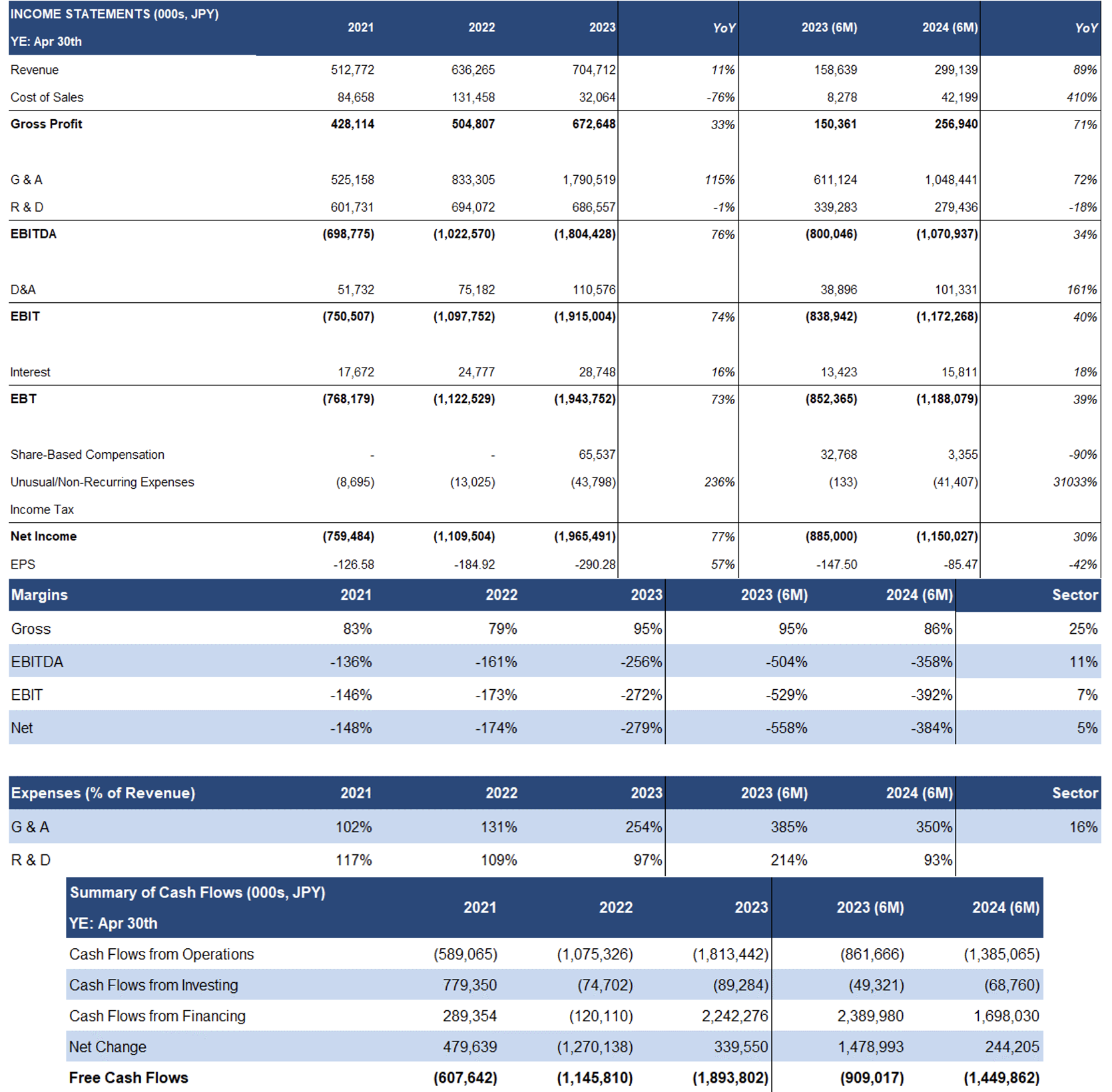

- The company is in the early stages of revenue generation. In H1-FY2024 (ended October 2023), revenue increased by 89% YoY to 299M yen (US$2M), indicating that its products are gaining traction quickly. EBITDA has yet to turn positive.

- The company follows an asset-light business model, relying on third-party manufacturers. We believe Pixie's strategic partnerships with established players across various sectors enhance its success potential compared to typical startups.

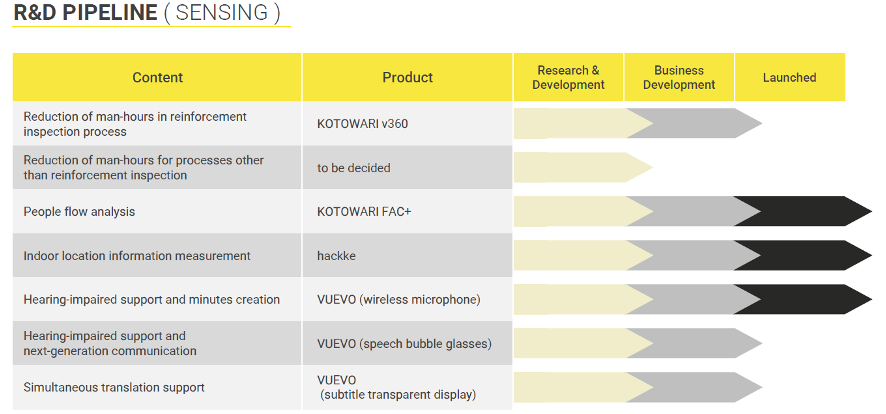

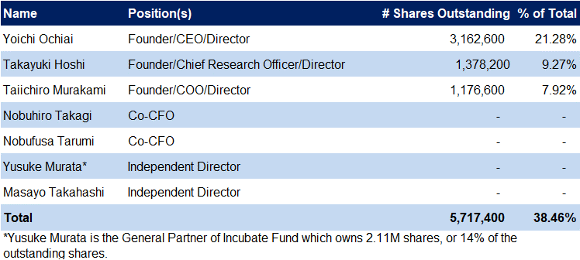

- Founders own 38% of the outstanding shares, reflecting their conviction in the company’s prospects.

- While Pixie's technology is a recent innovation, we believe that product distribution by major Japanese retail chains and electronic stores, coupled with strong sales growth, suggests promising market acceptance. In the next 12 months, as more consumers test Pixie products, we will be able to assess their efficacy through product reviews and sales traction.

Risks

- Limited operational history

- EBITDA has not yet turned positive

- Competition

- Need to pursue equity financings to fund working capital/R&D until EBITDA turns positive

- No guarantee that the company will be able to expand its products internationally

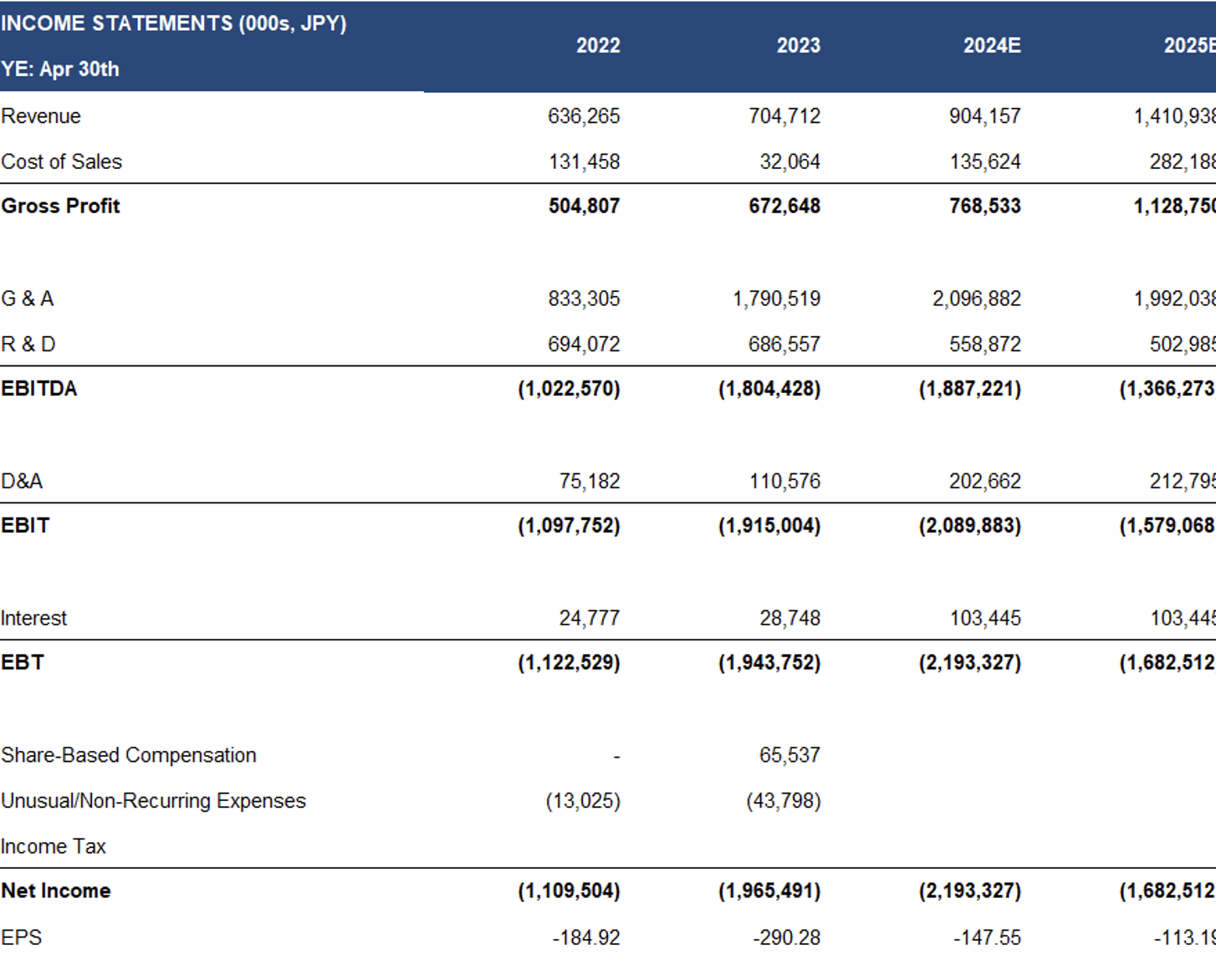

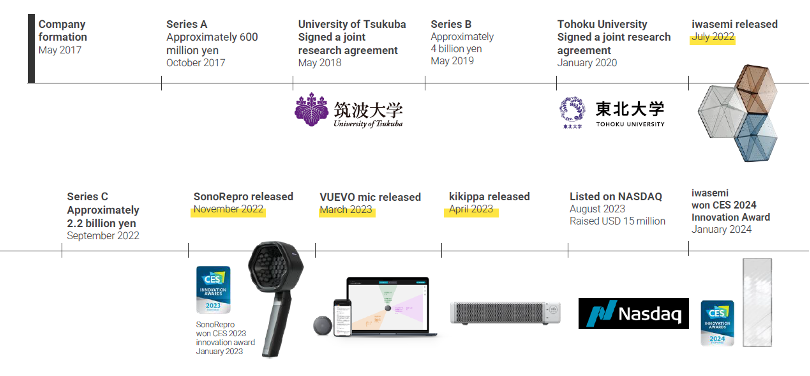

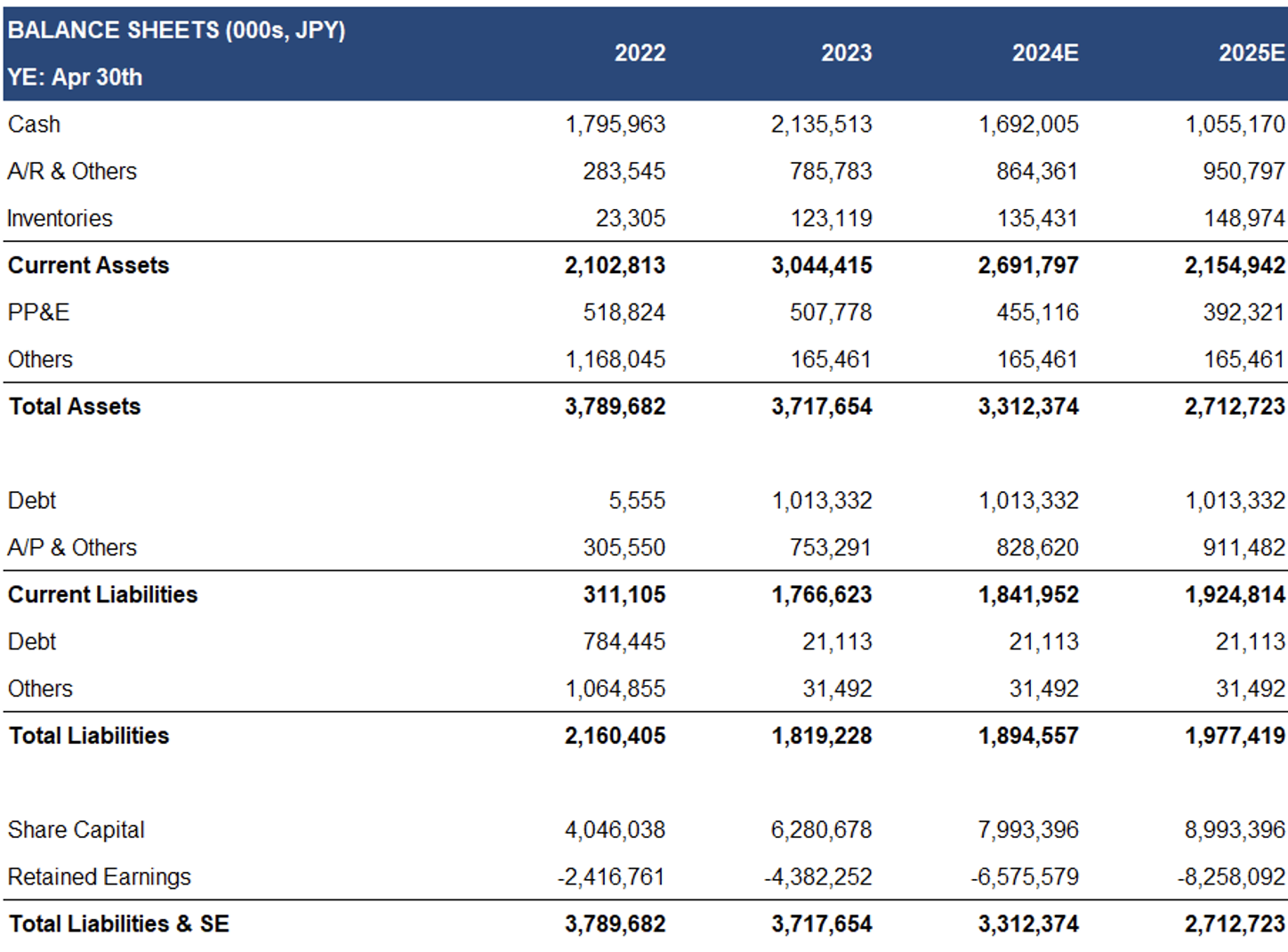

| Key Financial Data (000s, JPY) YE: Apr 30th |

2023 |

2024E |

2025E |

| Cash |

2,135,513 |

1,692,005 |

1,055,170 |

| Working Capital |

1,277,792 |

849,845 |

230,127 |

| LT-Debt |

21,113 |

21,113 |

21,113 |

| Total Assets |

3,717,654 |

3,312,374 |

2,712,723 |

| Revenue |

704,712 |

904,157 |

1,410,938 |

| EBITDA |

-1,804,428 |

-1,887,221 |

-1,366,273 |

| Net Income |

-1,965,491 |

-2,193,327 |

-1,682,512 |

| EPS |

-290.28 |

-147.55 |

-113.19 |

*See important disclosures at the bottom of this report, including rating and risk definitions. All figures in JPY unless otherwise specified.

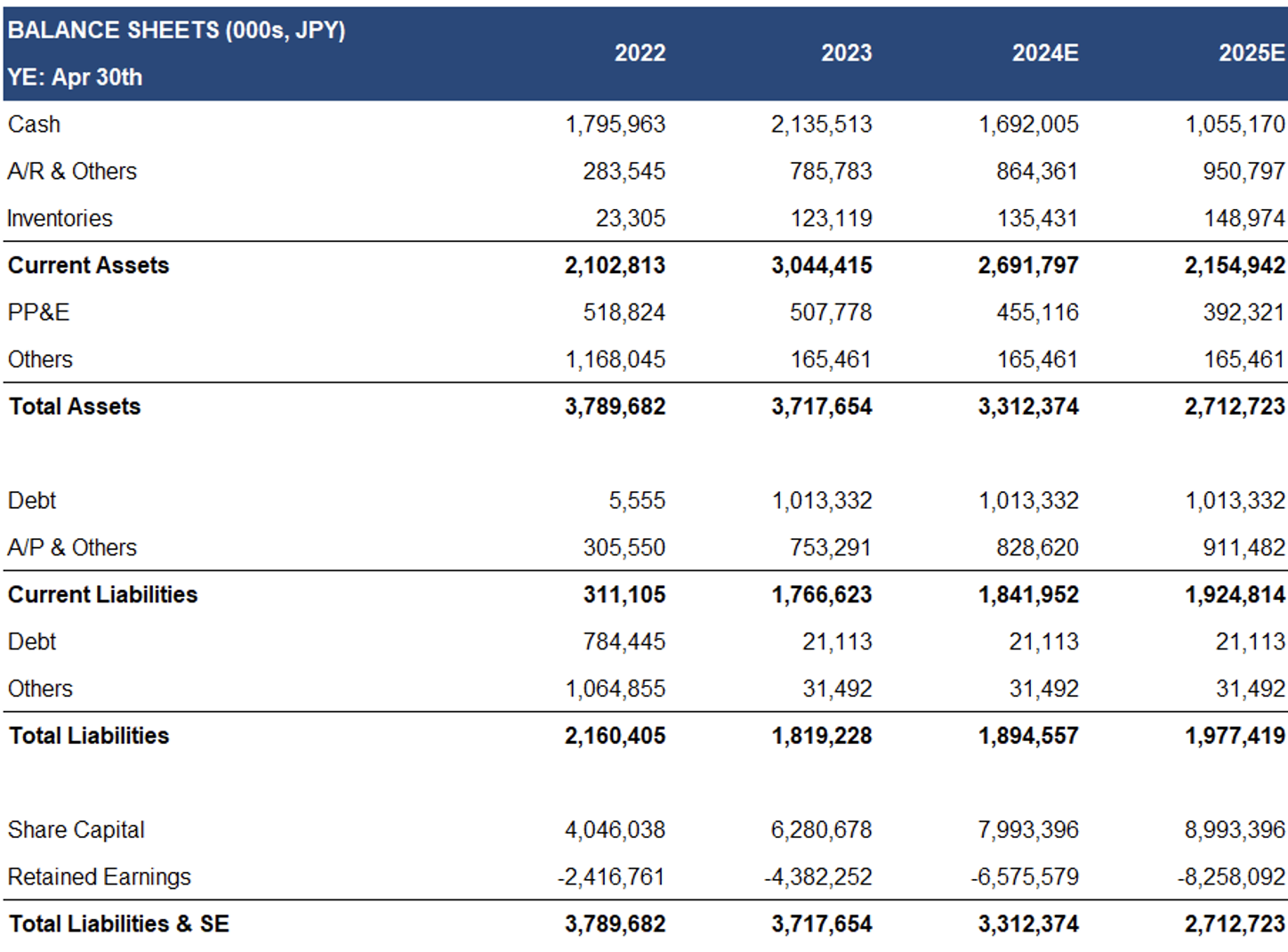

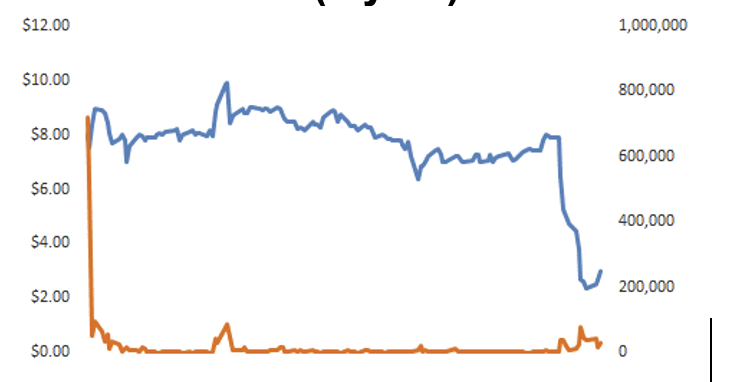

Price Performance (1-year)

| |

YTD |

12M |

| PXDT |

-65% |

N/A |

| NASDAQ |

11% |

38% |

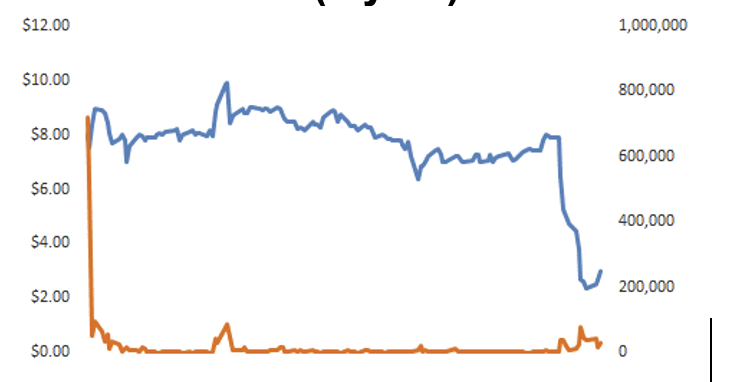

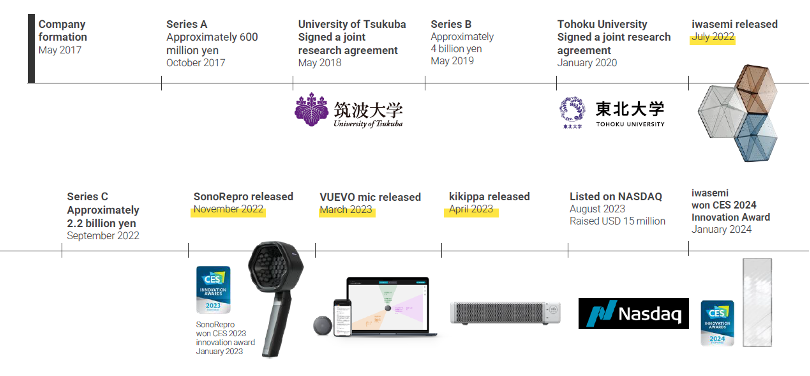

Company Overview

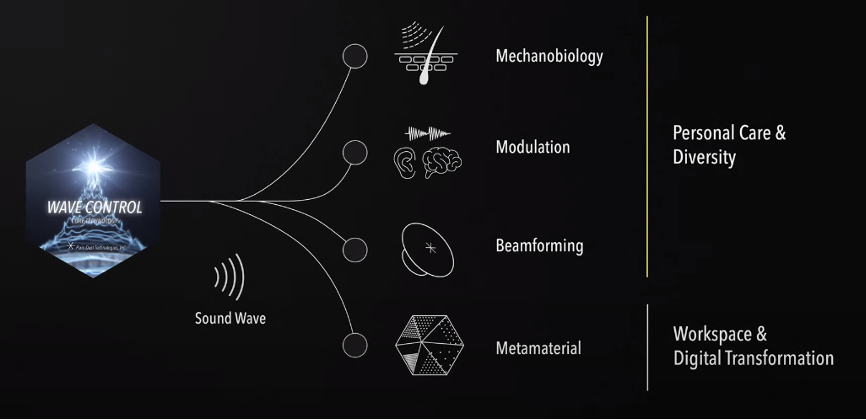

Headquartered in Tokyo, Pixie is focused on applying its proprietary wave control technology across a wide range of applications for consumers and businesses.

Source: Company

Formed in 2017

In 2023, Pixie completed a US$11M IPO, and listed its shares on the NASDAQ

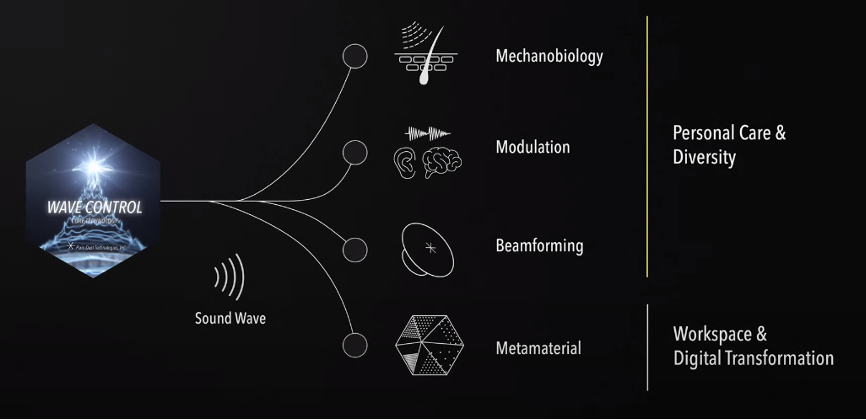

Wave control technology is a proprietary innovation capable of manipulating sound and light waves to influence objects, gather and analyze their information, and manipulate their features to achieve desired effects.

85 employees

The technology was developed in 2014 by Pixie's founders as part of an academic research project

Source: Company

43 registered patents, with an additional 236 pending approval

Six commercialized products, and several others in various stages of R&D

Follows an asset-light business model by relying on third-party manufacturers

Customers, R&D Partners, and Shareholders

Source: Company

- A subsidiary of Toyota (TSE:7203) has installed iwasemi at one of their locations

- Dentsu Group (TSE:4324) is a shareholder, and provides marketing services for Pixie

Commercializing applications through partnerships with industry players, and research entities

Flagship Products

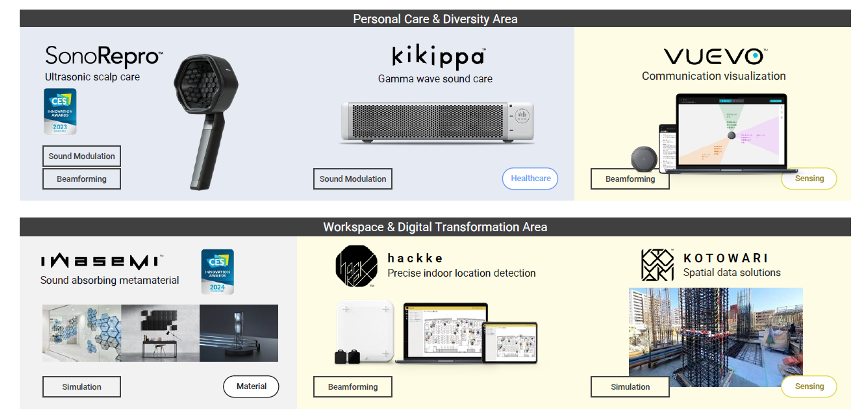

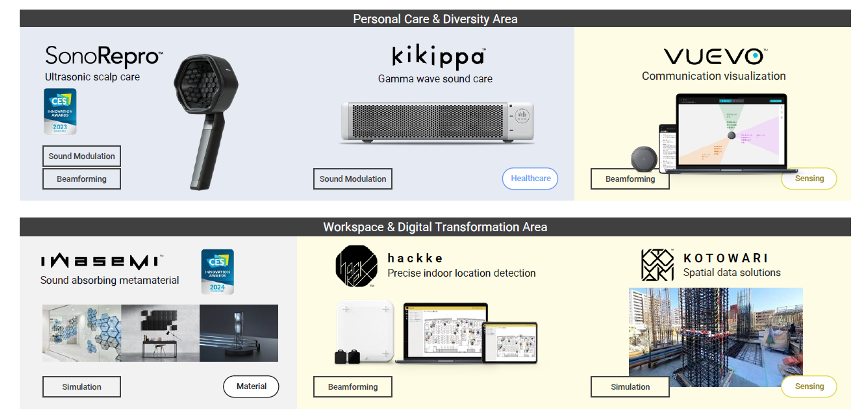

The company currently focuses on two areas of product development:

- Personal Care & Diversity: Harnessing wave control technology for healthcare applications including assistance in vision, hearing, and touch.

- Workspace & Digital Transformation: Harnessing wave control technology for designing workplaces, offices, and/or construction sites.

Product Portfolio

Source: Company

Three commercialized personal care products, all marketed in Japan currently

Source: Company

Three commercialized products for businesses, all available in Japan, with one also marketed in the U.S

The following sections summarize Pixie’s flagship products

Personal Care & Diversity

SonoRepro

(Launched in 2022) Pixies has a non-exclusive distribution agreement with Angfa, a Japanese preventive medicine company; financial terms undisclosed

Source: Company

A non-contact scalp care device utilizing ultrasonic waves to stimulate the scalp, promoting hair growth and overall hair health; Intended for daily use, with each section requiring one minute of treatment.

Tests conducted by Pixie and its partner revealed significant improvements in hair diameter, scalp condition, and scalp water content.

Number of devices sold to date – 2,600+

Distribution - 95+ retail and online stores/salons in Japan, including major consumer electronics retail chains, and Amazon Japan (NASDAQ: AMZN)

Product Reviews - <10 reviews on Amazon, and other online stores

Device Price - 125,000 yen (US$815)

Estimated product life – three years

Competition – Directly competes with hair scalp massagers offered by large brands; SonoRepro's advantages lie in its ability to stimulate the scalp without direct contact, ensuring cleanliness, and scalp protection. The price range of comparable devices is 85,000 (US$550) to 200,000 yen (US$1,300).

Pixie does not disclose segmented results, but management has indicated to us that their two best selling products are SonoRepro and kikippa

kikippa

(Launched in 2023) Developed in collaboration with Shionogi Healthcare (TSE: 4507/MCAP: US$14B), a Japanese pharmaceutical company; financial terms undisclosed

Source: Company

An acoustic stimulation device/speaker primarily designed for seniors to enhance cognitive abilities and prevent dementia. This device uses a proprietary algorithm to transform everyday sounds (like those from TVs or computers) into frequencies associated with gamma brainwaves. Gamma waves are the fastest signals produced by the brain. Third-party studies indicate a link between gamma waves and improved cognitive functions. kikippa connects directly to audio devices.

Number of devices sold to date – undisclosed

Distribution - Sold on partner Shionogi Healthcare's online platform, consumer electronics stores, and other online stores

Product Reviews - <10 reviews on Amazon, and other online stores

Device Price - 90,000 yen (US$590)

Estimated product life – five years

Competition – We are not aware of any direct competitors. However, the device competes with medical products/solutions designed for dementia prevention

The company avoids regulatory implications by refraining from marketing its products as medical devices

VUEVO

(Launched in 2023) Developed in collaboration with Sumitomo Pharma (TSE: 4506/MCAP: US$1B), a Japanese pharmaceutical company; financial terms undisclosed

Source: Company

A tabletop microphone transcription service designed for the deaf and hard of hearing; it displays the direction and content of a speaker's voice in real-time. Compatible with computers and tablets, it enhances conversations in group settings like meetings or lectures. Pixie is currently developing smart glasses equipped with same technology.

Number of devices sold to date – in early stages of commercialization

Distribution – Direct sales to businesses

Product Reviews – N/A

Device Price – 145,000 yen (US$945), and monthly usage fees of 30,000 yen (US$195) for connectivity

Estimated product life – five years

Competition - Pixie competes with hearing aids and speech-to-text apps. Its advantages include distinguishing speakers in meetings, and value-added features such as summarized minutes. Pixie is in the process of incorporating translation services.

Consequently, Pixie cannot claim that its products promote hair growth, or enhance cognitive abilities

SonoRepro is marketed as a scalp care device, while kikippa is marketed for its ability to stimulate users’s auditory experience

Workspace & Digital Transformation

In January 2024, iwasemi won an innovation award at the coveted Consumer Electronics Show/CES held in Las Vegas

iwasemi

(Launched in 2022 in Japan, followed by a soft launch in the U.S. in 2023, targeting architecture and interior design firms)

Pixie has developed a sound-absorbing material designed to enhance indoor sound environments by reducing room over-reflection, and sound transmission between areas. Key advantages include:

- Unlike common sound-absorbing materials such as glass and wool, which are porous and limited in design and strength, iwasemi can be applied to a wide range of surfaces.

- iwasemi absorbs a broad spectrum of sound frequencies, including those that glass and wool cannot. It can also target specific frequency ranges for absorption.

- iwasemi is easily installable and relocatable compared to other soundproofing materials, which usually require permanent installation. Users can easily move it from one wall to another.

Distribution – Offered by large Japanese interior design providers to their clients; In addition, Pixie has signed a distributorship agreement with Energy Spot, an interior design and construction company based in Seoul

Number of devices sold to date – 23k+ pieces (3,220 sqm)

Device Price - 300k to 500 k yen (US$2k to US$3k) per room

Competition – Directly completes with other sound proofing materials and office acoustic panel manufacturers. While the upfront cost for a client is comparable to other options, management believes the lifetime cost is lower due to advantages such as relocation capabilities, and wider sound absorption.

Pixie offers two more products for businesses: one for spatial analysis for architects and interior designers, and another for high-precision indoor location tracking; both products are in early stages of commercialization

Source: Company

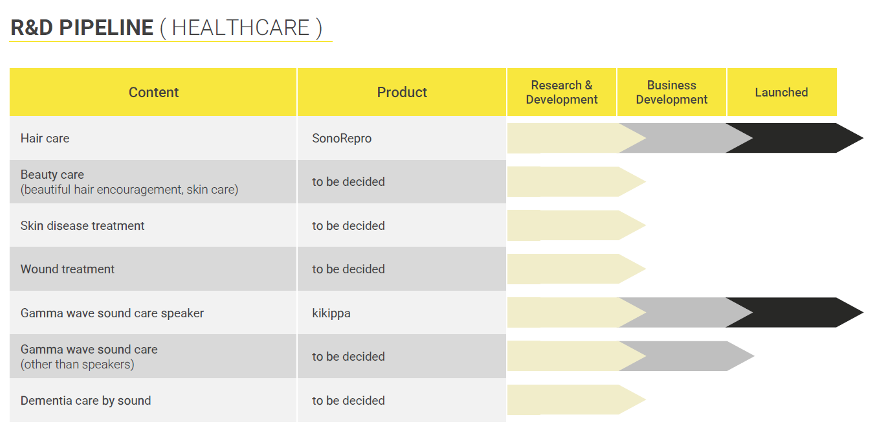

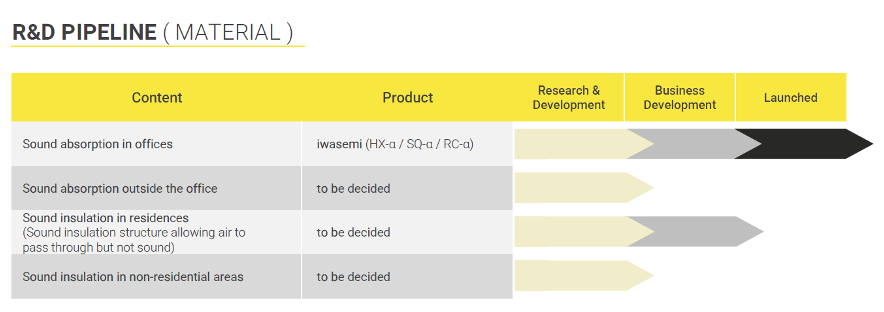

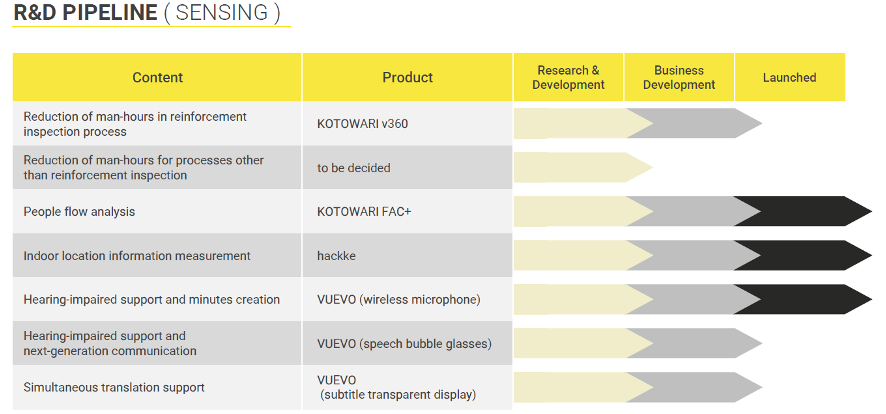

10+ products in pipeline in various stages of R&D, all driven by Pixie’s wave control technology

Source: Company

Management and Board

Founders own 38% of the outstanding shares

Source: Company/FRC

Brief biographies of the founders, as provided by the company, follow:

Yoichi Ochiai – Founder/CEO/Director

Dr. Ochiai has been an assistant professor of library, information and media studies at the University of Tsukuba since 2015. Dr. Ochiai has received numerous awards and accolades, including the 2015 World Technology Award (IT Hardware) from the World Technology Network, the 2020 Innovators Under 35 Japan by MIT Technology Review and the Future 50 by Project Management Institute. Dr. Ochiai is the youngest ever keynote speaker in the 40-year history of SEMICON Japan and was also invited as a speaker at South by Southwest in 2022. Dr. Ochiai received a master’s degree in Applied Computer Science from the University of Tokyo in 2013, and a Ph.D. in Applied Computer Science at the University of Tokyo in 2015.

Taiichiro Murakami - Founder/COO/Director

Mr. Murakami served as a management consultant for Accenture Japan from April 2010 to December 2016 where he focused on assisting companies with the development of business strategies, operating models, digital strategies and large-scale business transformation and organizational change. In addition, Mr. Murakami has served as an executive advisor for Mitou Foundation since January 2017 and as a director of Ippan Shadan Houjin xDiversity since November 2018. Mr. Murakami received a Bachelor of Engineering degree from University of Tokyo in 2008, and a Master of Engineering degree from University of Tokyo in 2010.

Takayuki Hoshi - Founder/Chief Research Officer/Director

Dr. Hoshi served as an assistant professor at the University of Tokyo in its Research Center for Advanced Science and Technology from June 2016 to September 2017 and in the department of information physics and computing from April 2016 to May 2016. Prior to his tenure at the University of Tokyo, Dr. Hoshi served as an assistant professor at Nagoya Institute of Technology’s Center for Innovative Young Researchers, and as an assistant professor in the department of intelligent mechanical systems at the Graduate School of Science and Technology at Kumamoto University. Dr. Hoshi is considered a world-renowned expert on wave control technologies. Dr. Hoshi received a Bachelor of Engineering degree in 2003, a Master of Engineering degree in 2005 and a Ph.D. in Information Science and Technology in 2008 from the University of Tokyo.

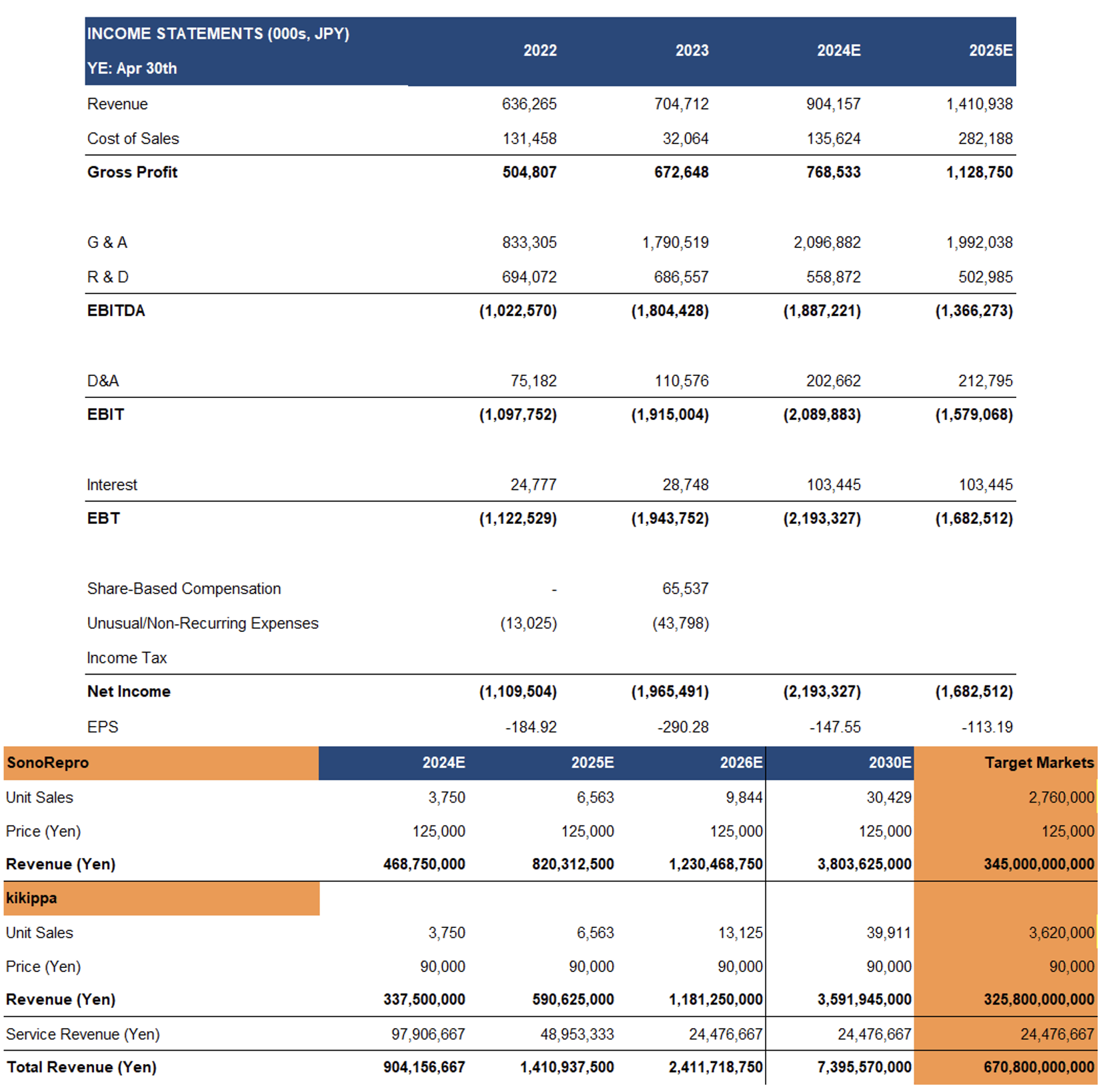

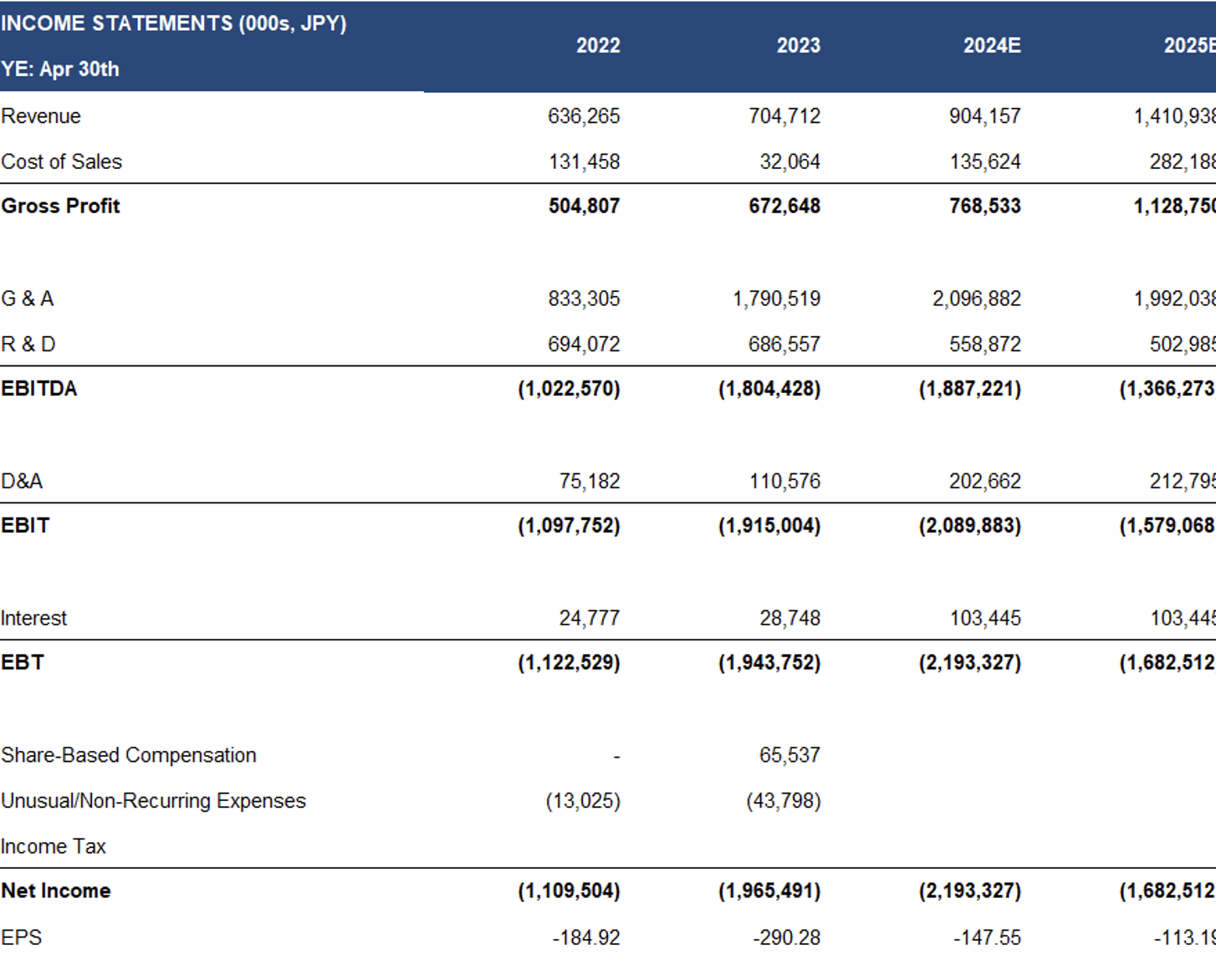

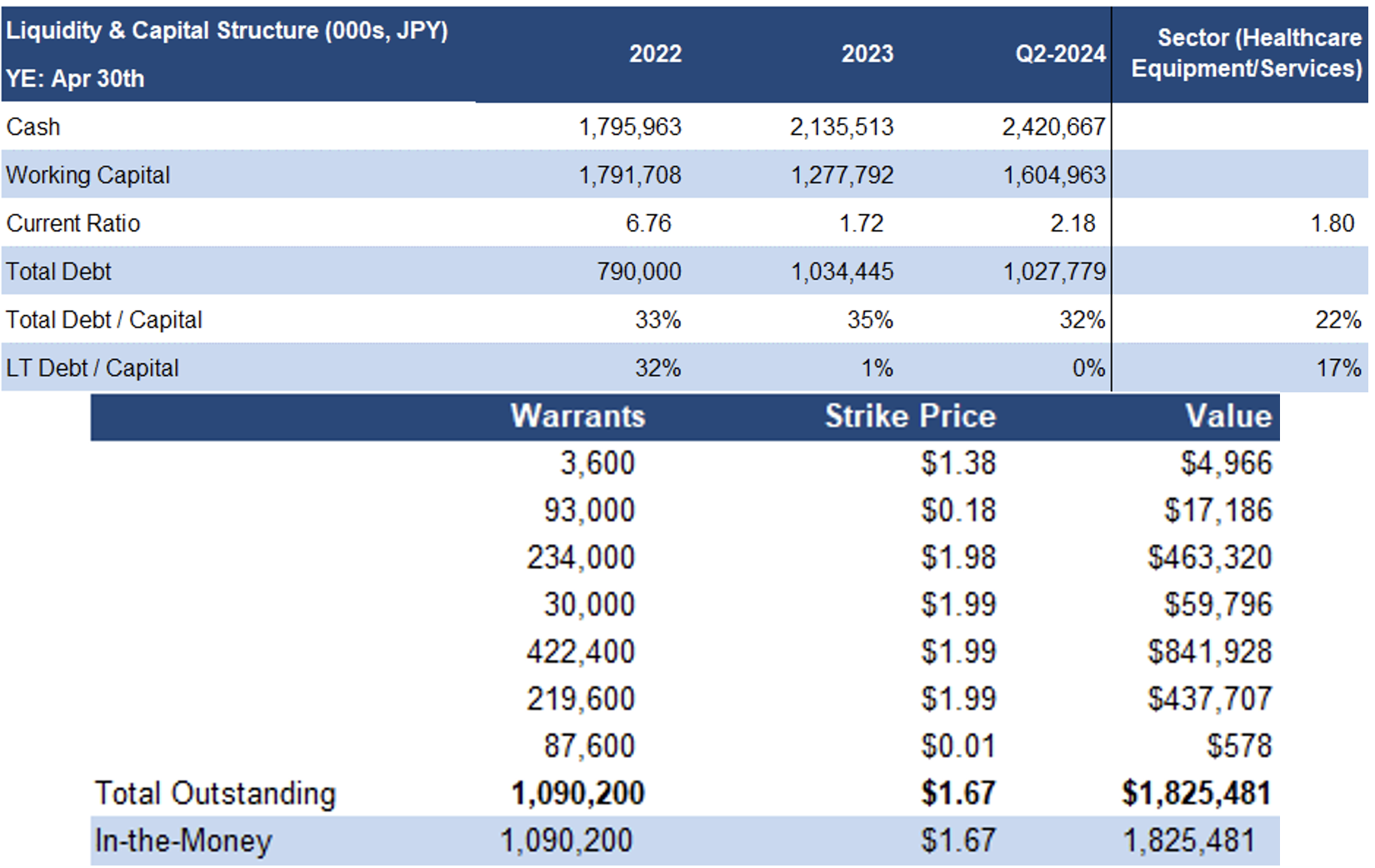

Financials (Year-End: Apr 30th)

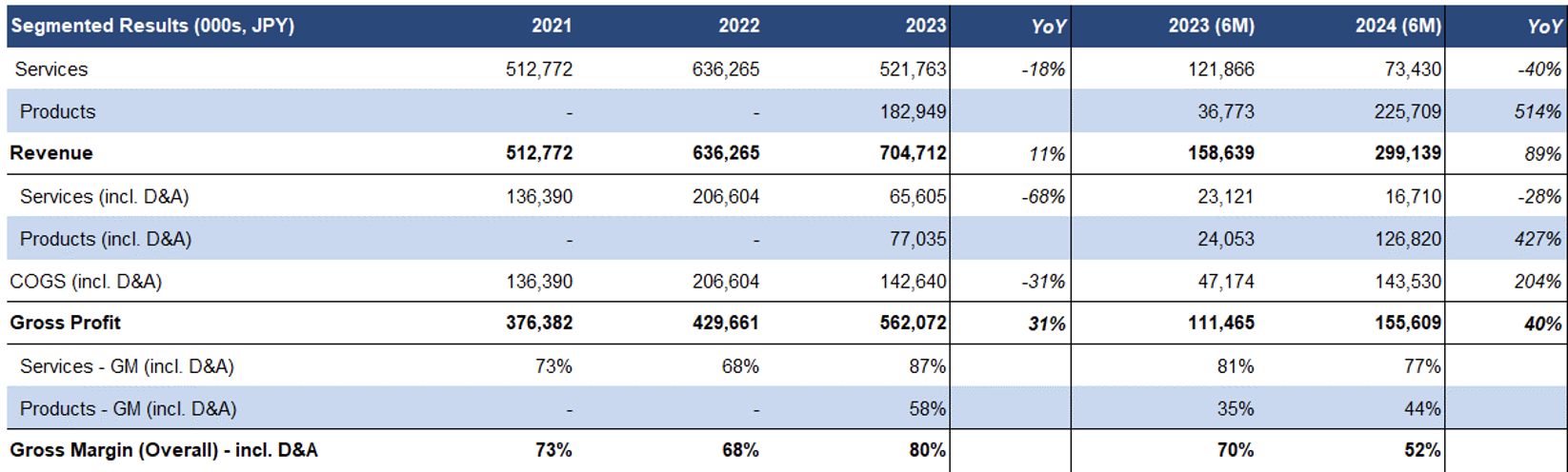

The company does not provide segmented results

Until FY2023, revenue mainly came from providing R&D services to partners; however, this revenue stream will diminish moving forward

Source: Company Filings, FRC

As a result of new product launches in FY2023, product revenue was up 514% YoY in H1-FY2024

Yet to be profitable

Gross margins are higher than the sector average

The company does not disclose its marketing expenses; In H1-FY2024, G&A expenses (which also includes marketing expenses) were 350% of revenue

Established companies in the Healthcare Equipment/Services sector typically allocate 5%-10% of revenue to marketing expenses

Healthy balance sheet. The company maintains low CAPEX budgets due to its asset-light model

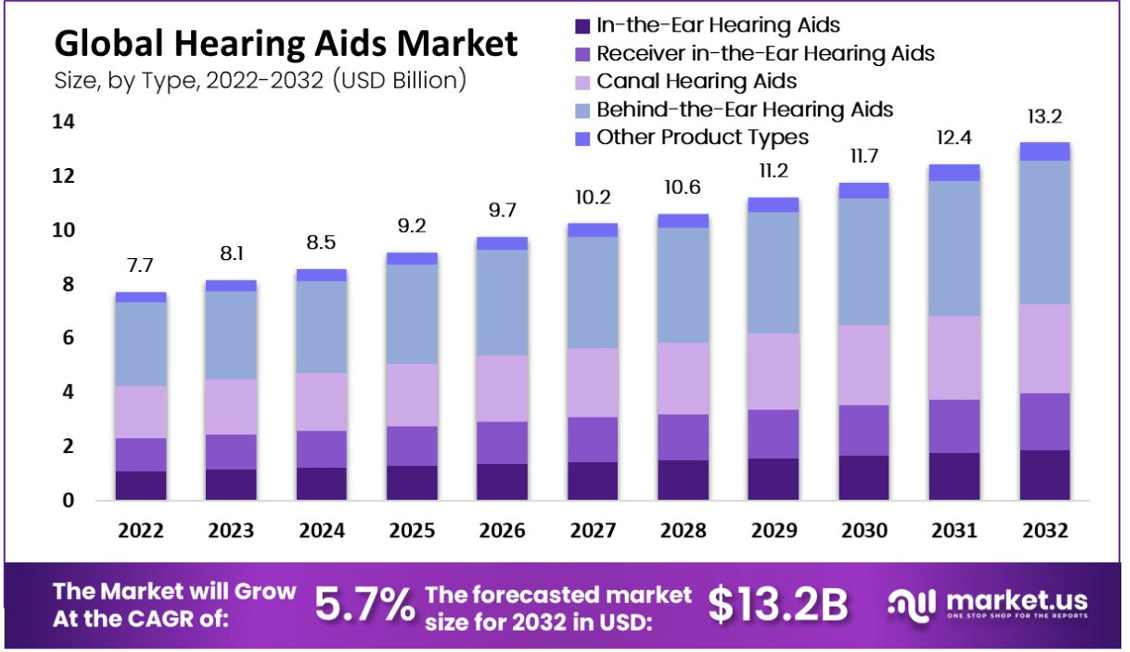

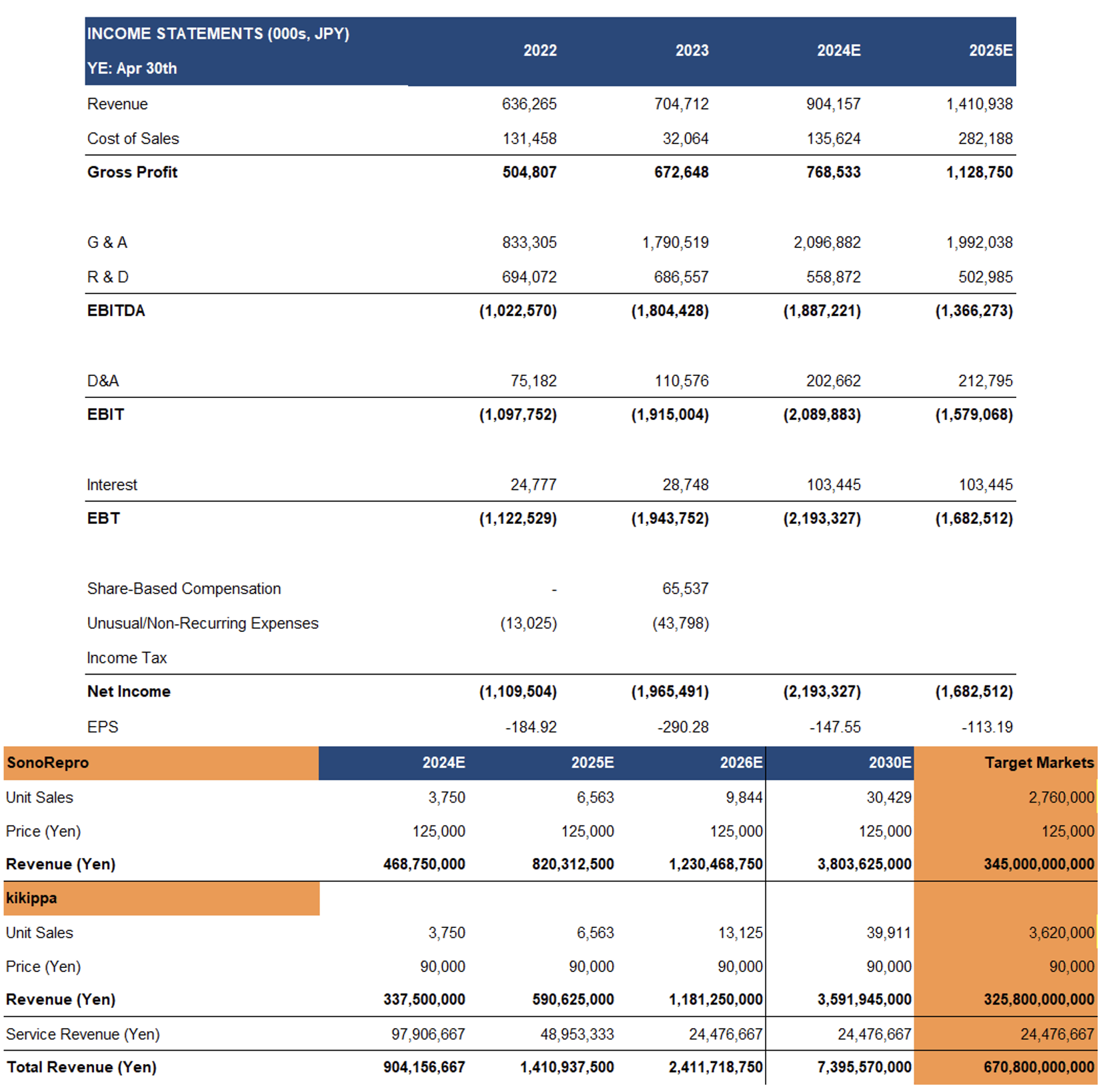

FRC Projections and Valuation

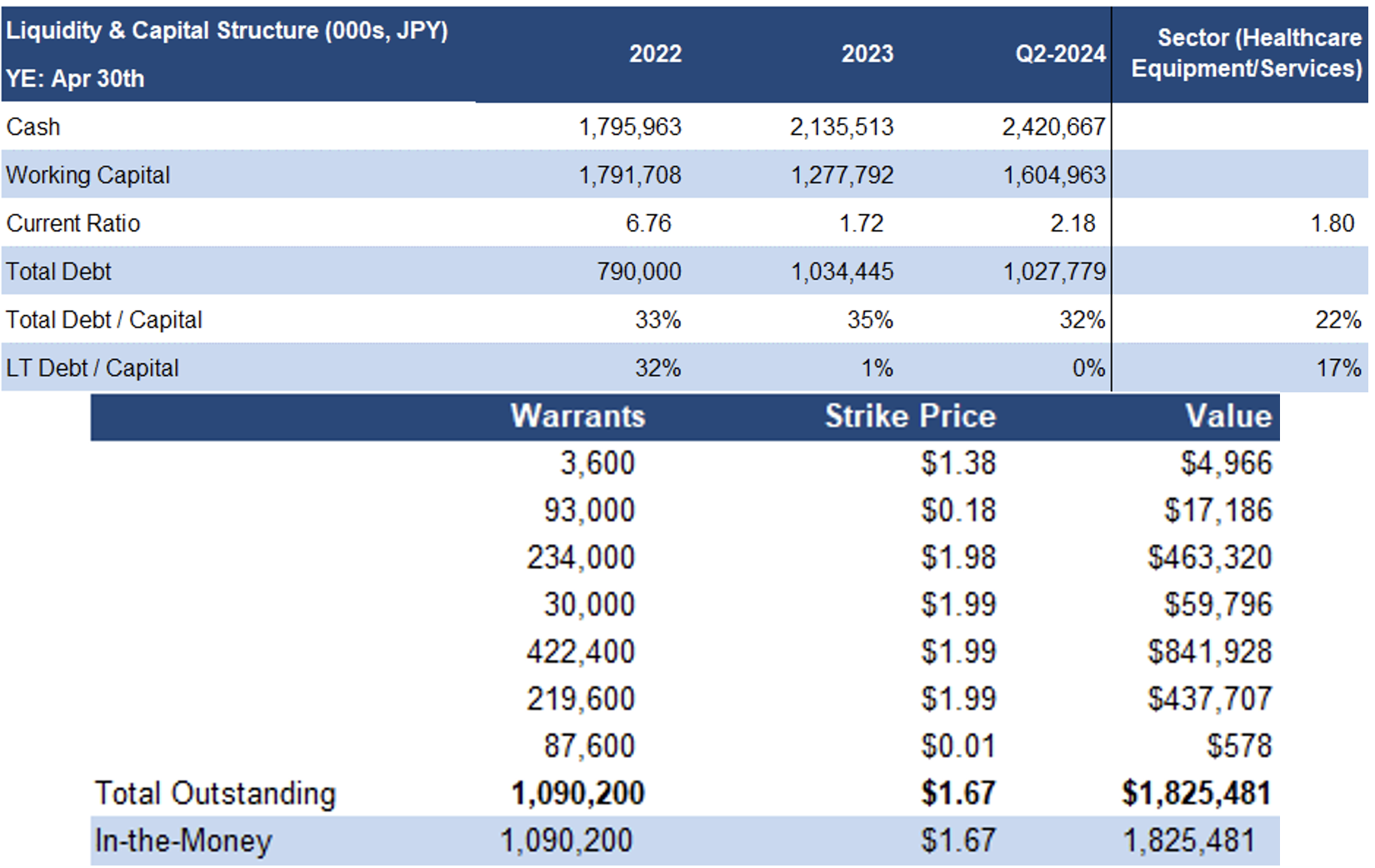

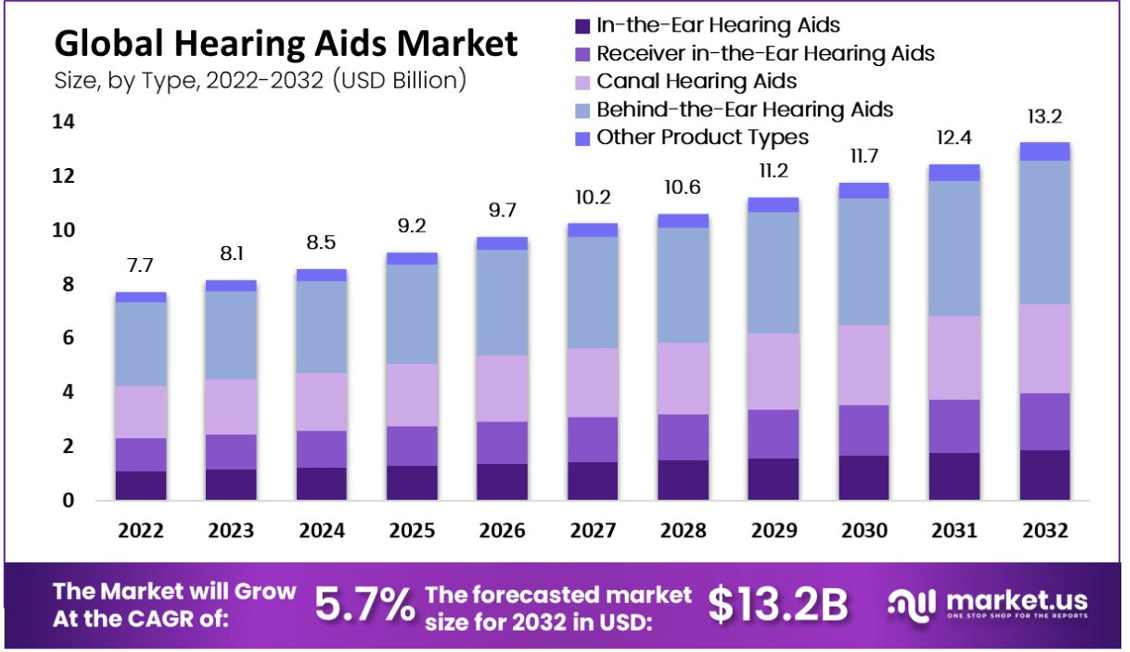

The global hearing aids market is anticipated to grow from US$8.5B in 2024, to US$13.2B by 2032, reflecting a CAGR of 5.7%

The global hearing aids market is primarily driven by an expanding elderly population, and increasing demand for high-quality hearing aids.

Though not a hearing aid, Pixie's VUEVO targets the deaf and hard of hearing, aligning with the hearing aid market.

The Japanese hearing aids market is anticipated to grow from US$138M in 2024, to US$260M by 2033, reflecting a CAGR of 6.8% (Source: Spherical Insights)

The US$4.24B global hair loss treatment market is anticipated to grow at a rate of 6.2% p.a. from 2023 to 2030 (Source: Coherent Market Insights), driven by rising incidences of alopecia and related diseases, along with increasing R&D initiatives.

Target Markets:

- SonoRepro: In Japan, there are approximately 55M adult males. Studies suggest that by the age of 50, 30%-50% of men experience visible hair loss. Based on these findings, we believe Pixie is targeting a 345B yen market (US$2.2B) in Japan.

- Kikippa: With 36M adults in Japan aged over 65, we believe Pixie is targeting a 325B yen (US$2B) market.

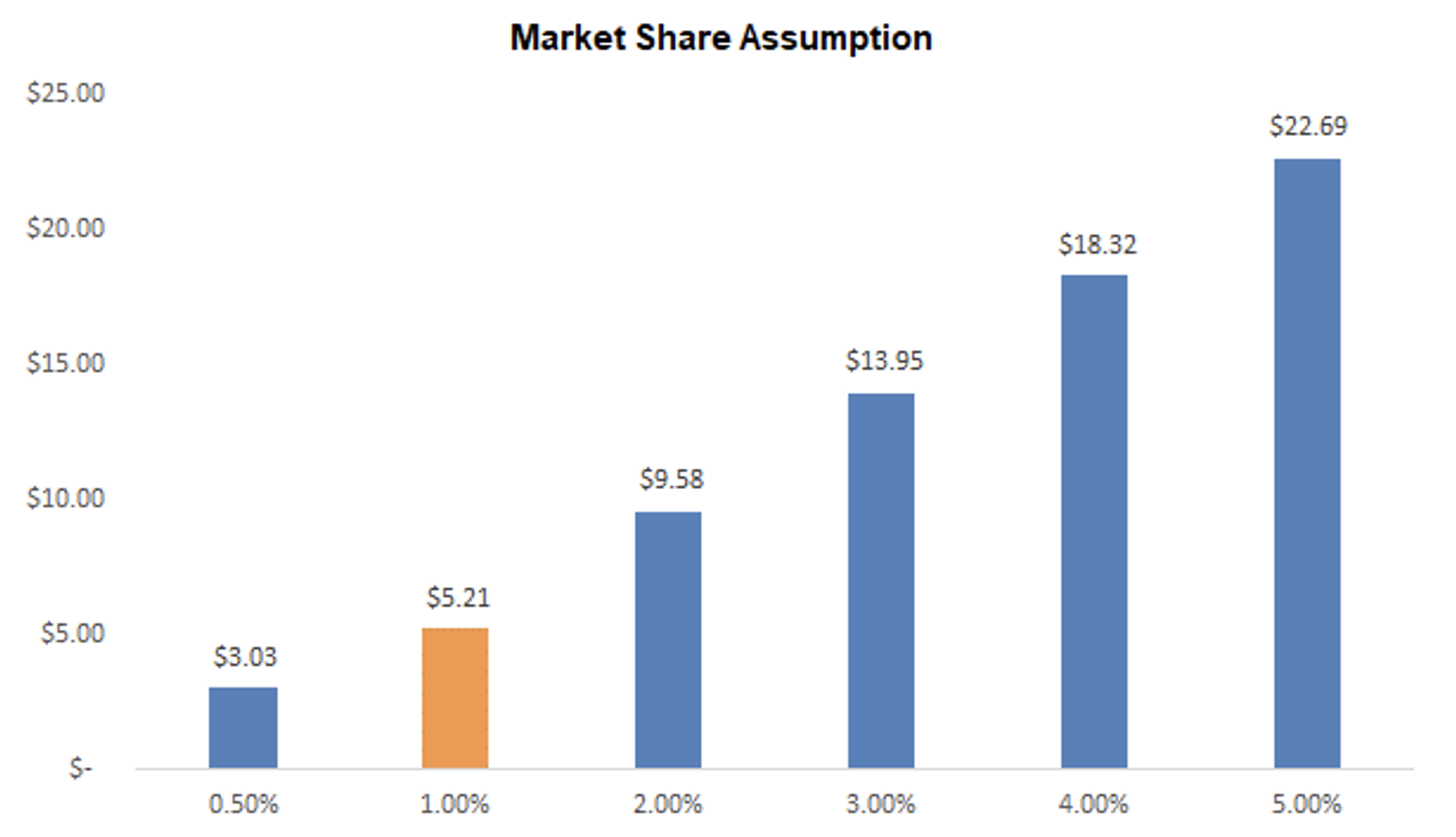

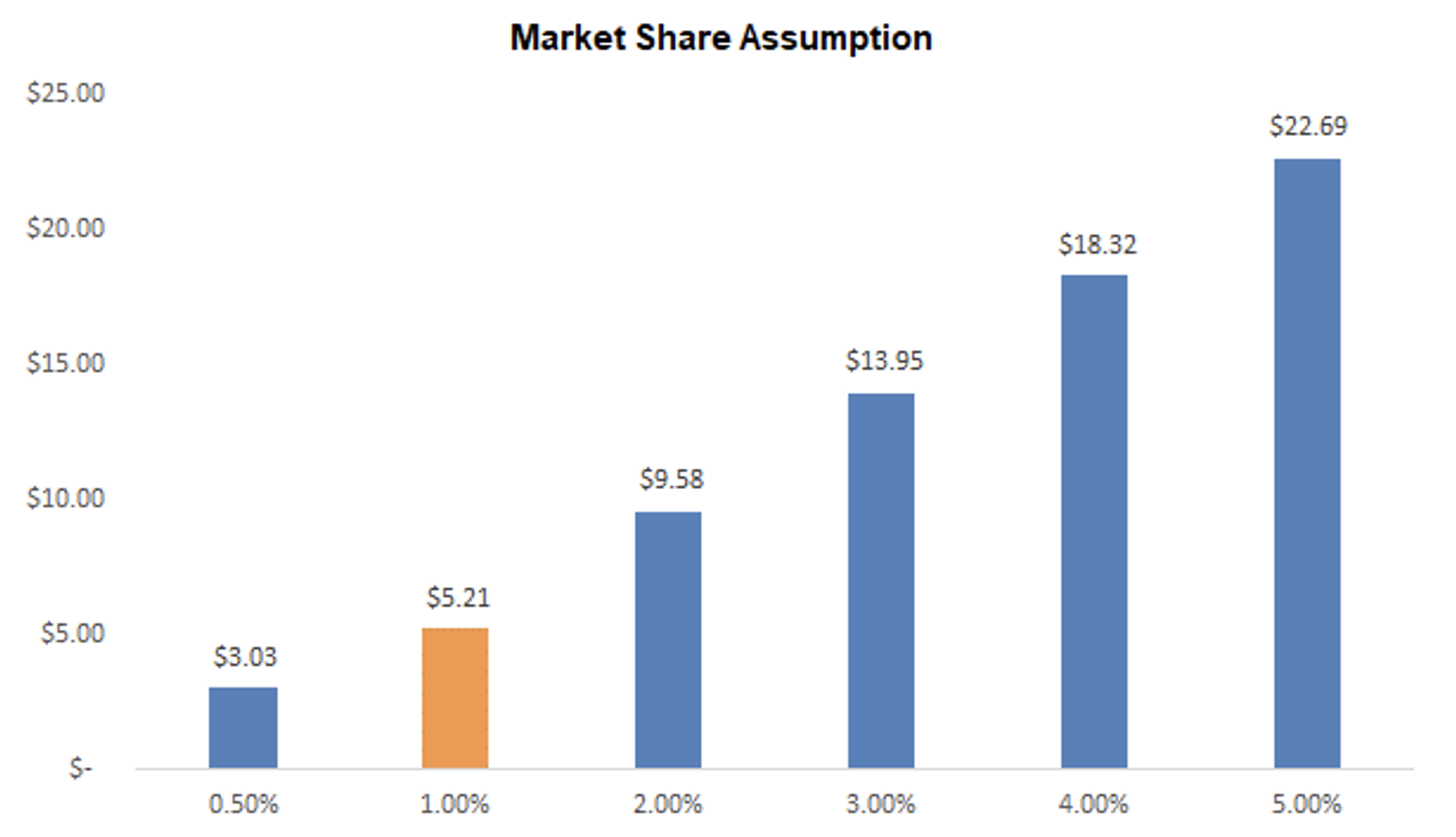

Our models are based on the assumption that Pixie’s two flagship products will capture 1% of their target markets in Japan by 2030, without factoring in any international expansion

Source: Company / FRC

For conservatism, we are not assigning any upside from the company’s other products

We anticipate marketing expenses will range between 50%-100% of revenue in the next three years, declining to a long-term average of 10%, aligning with the sector average

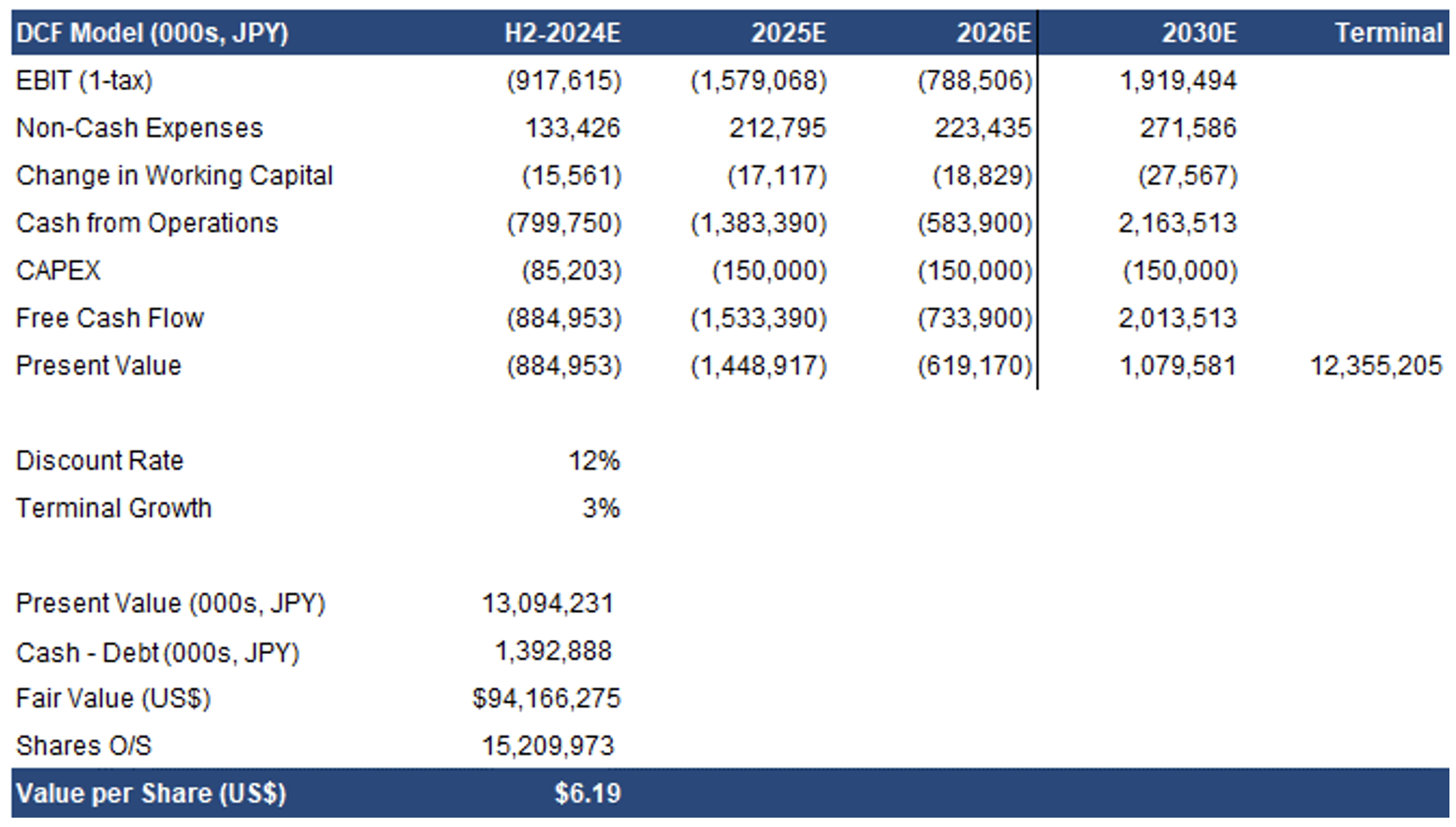

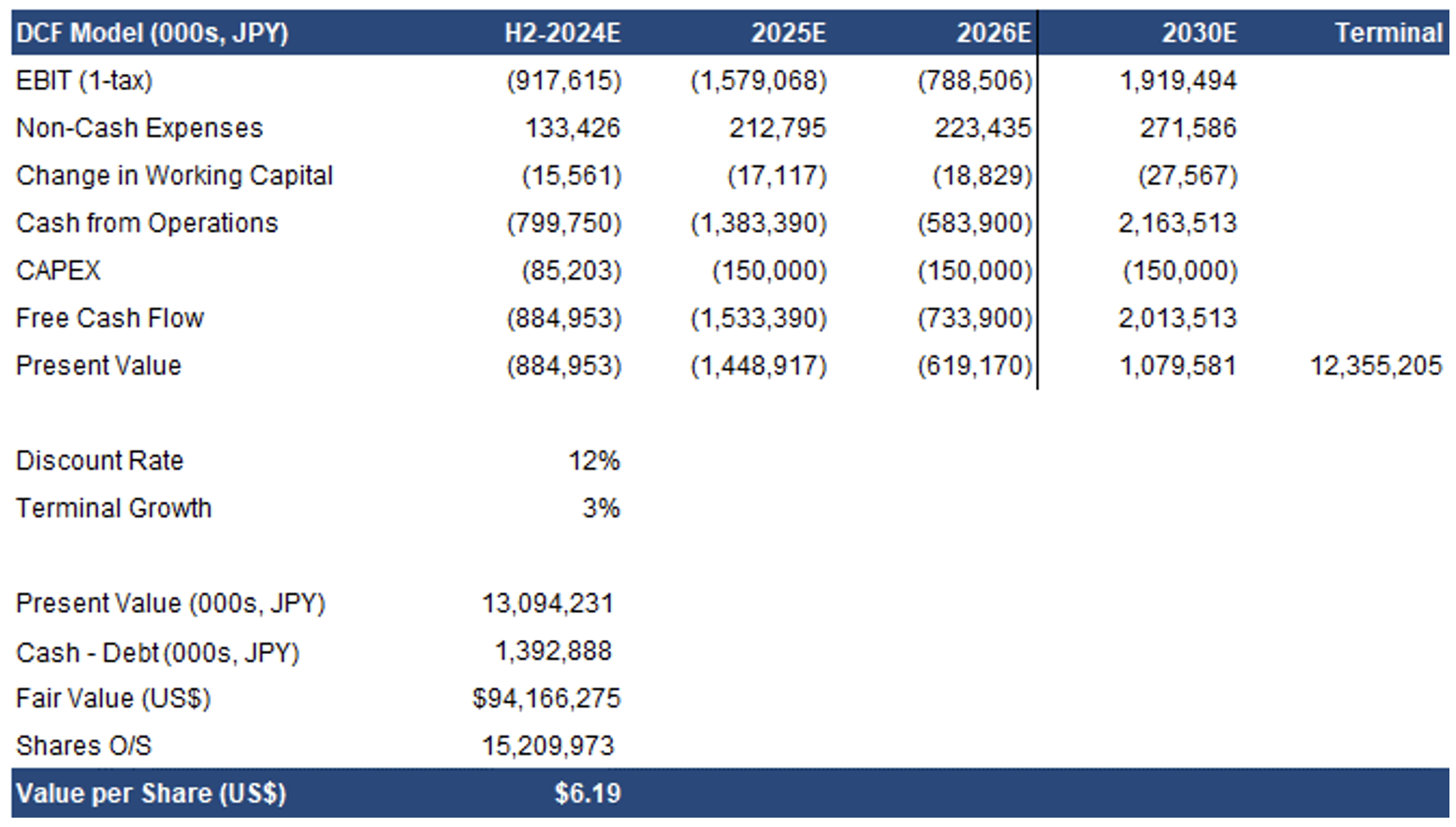

Our base-case DCF model returned a fair value estimate of US$6.19/share

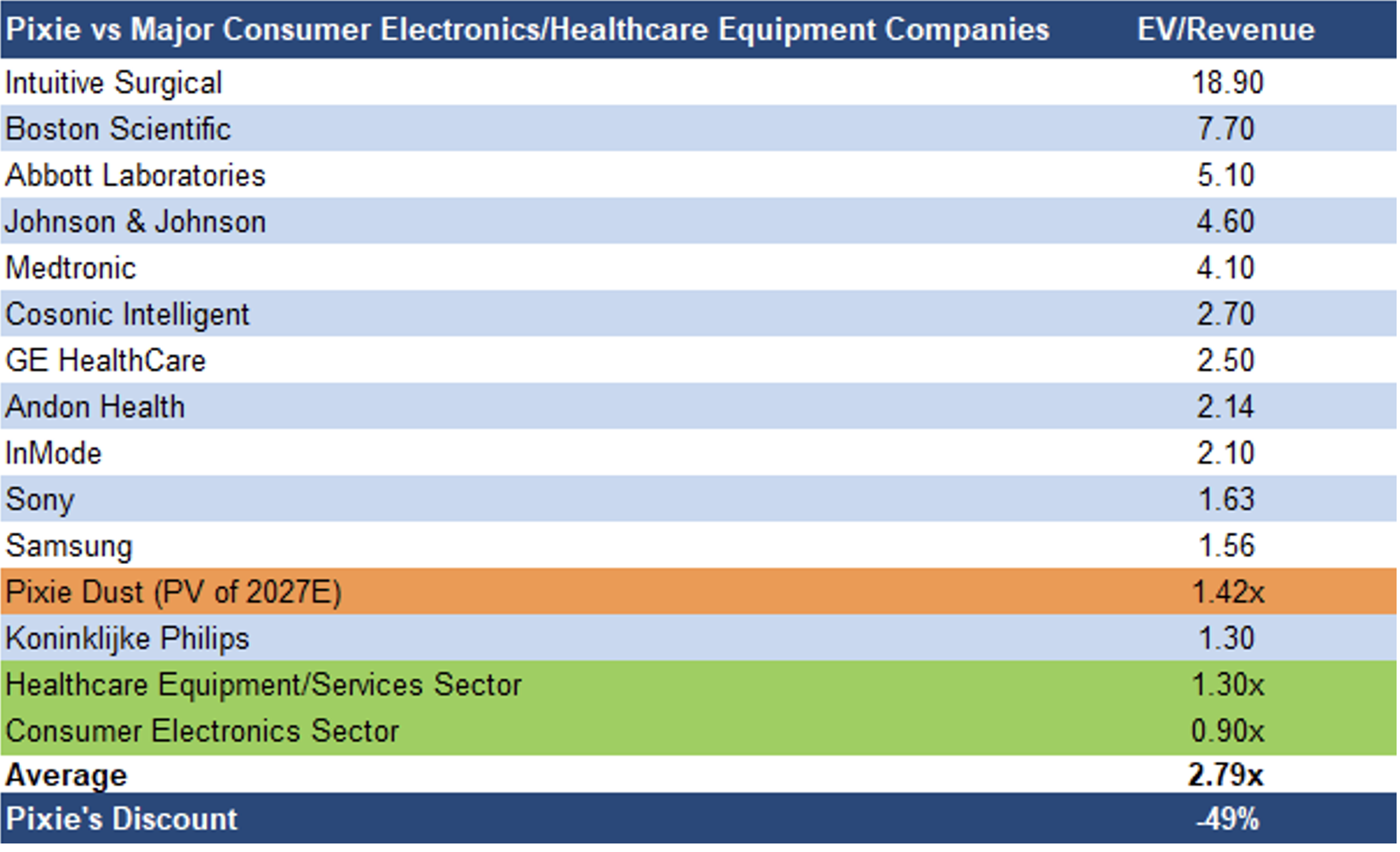

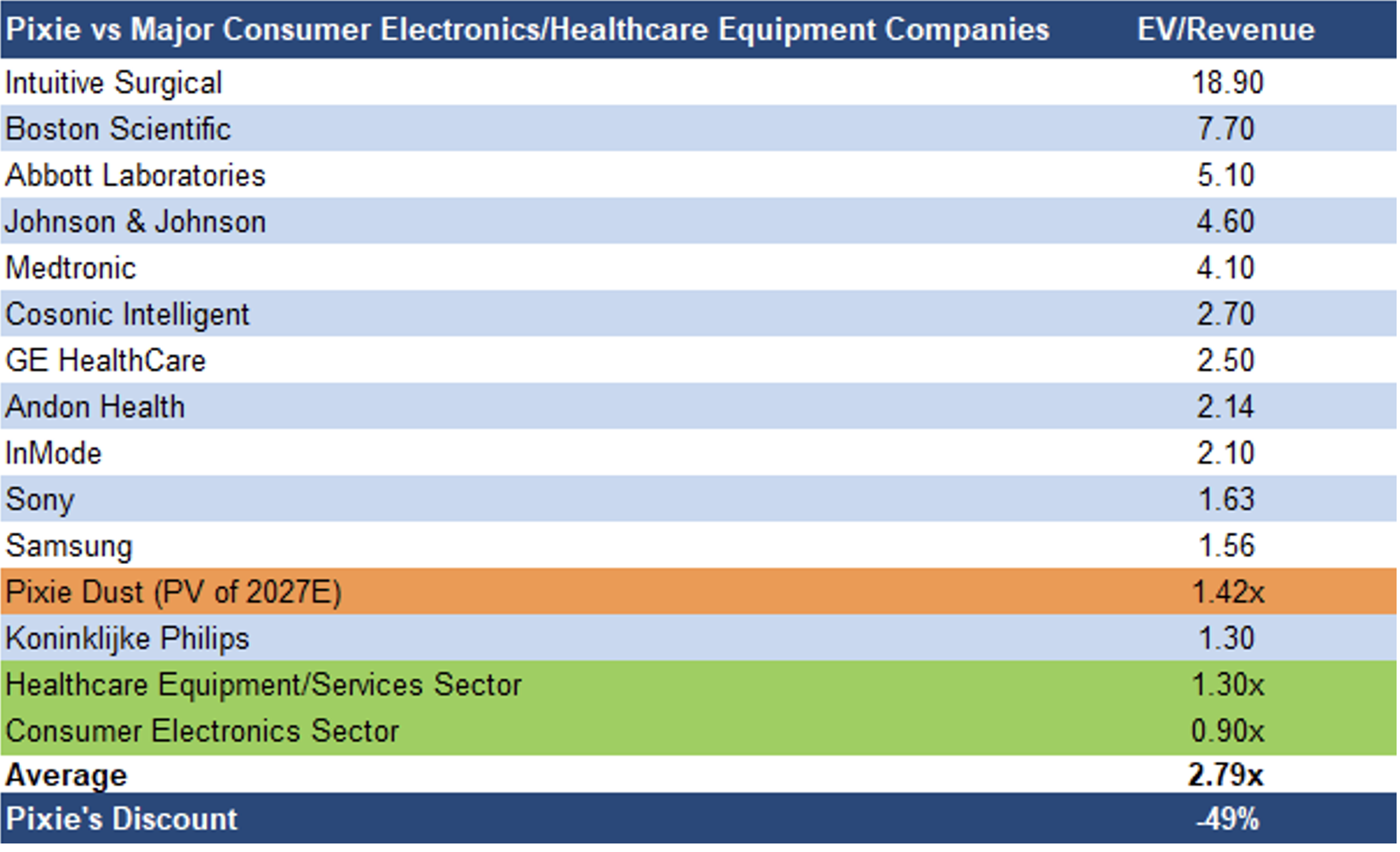

Comparables Valuation

Source: FRC/S&P Capital IQ

Pixie is trading at 1.4x forward revenue vs the sector average of 2.8x, implying a 49% discount

Applying 2.8x to the present value of our 2027 revenue forecast for Pixie, we arrived at a comparables valuation of US$4.23/share

We are initiating coverage with a BUY rating, and a fair value estimate of US$5.21/share (the average of our DCF and comparables valuations). Our valuation hinges heavily on the success of Pixie’s two flagship products

Source: FRC

Our valuation is highly sensitive to our market share assumptions

While ongoing research explores the utilization of sound waves in healthcare, including applications for dementia, Pixie’s wave control technology is a relatively new innovation in its early stages. Currently, there are insufficient customer reviews to gauge the effectiveness of Pixie’s products. However, we consider the distribution of Pixie products by major Japanese retail chains and electronic stores as a vote of confidence. Additionally, a positive indicator is that Pixie has already sold 2,600+ units of SonoRepro in a relatively short span of time. In the next 12 months, as more consumers test Pixie products, we will be able to assess their efficacy through product reviews and sales traction

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- Limited operational history

- EBITDA has not yet turned positive

- Competition

- Need to pursue equity financings to fund working capital, and R&D, until EBITDA turns positive

- No guarantee that the company will be able to expand its products internationally

We are assigning a risk rating of 4 (Speculative)

Appendix