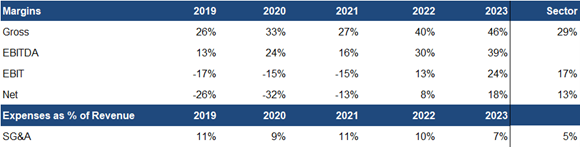

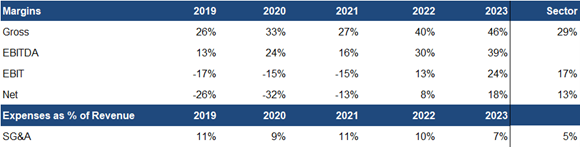

Gross and EBITDA margins exceeded our estimates by 1 pp, and 3 pp, respectively.

Revenue growth came from new contracts with tier-one clients. Per consensus estimates, growth in North American oil and gas CAPEX will ease to 2.2% in 2024, down from 19% in 2023.

Recently closed a $7M bought-deal equity financing to expand its rental equipment fleet, signaling management's expectation of continued revenue growth in 2024.

Upcoming catalysts include Q1 results, and revenue growth stemming from the deployment of newly acquired equipment. Note that Q1 and Q4 are historically stronger quarters due to seasonality.

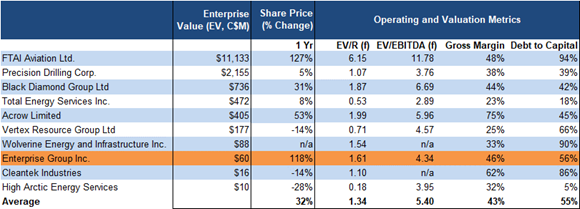

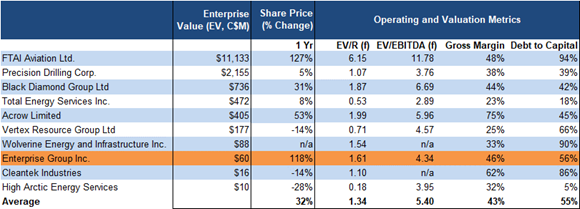

Enterprise vs Larger Players

Source: FRC/S&P Capital IQ

E is up 118% YoY, and is one of the best performing stocks on our list of oilfield services companies

E has higher margins than sector averages

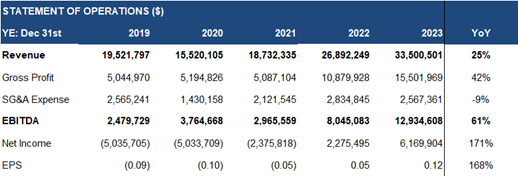

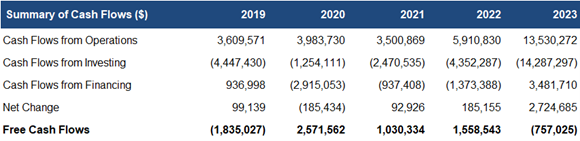

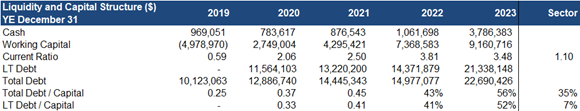

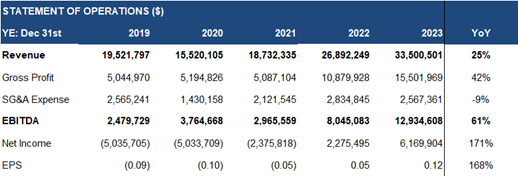

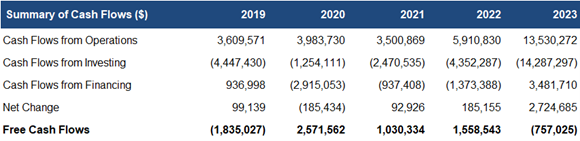

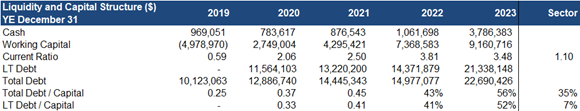

Financials

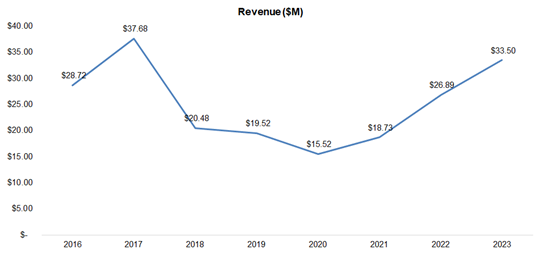

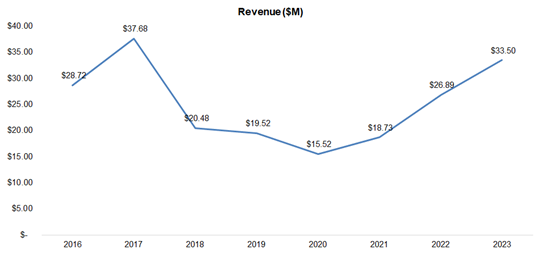

2023 revenue was up 25% YoY, missing our estimate by 7% due to forest fires in Alberta and B.C., as well as project delays caused by warm weather in Q4

EBITDA margins exceeded our estimate by 3 pp, primarily driven by lower G&A expenses

Source: FRC/Company

EBITDA was up 61%, missing our estimate by 1%

EPS (adjusted) was up 140% YoY, missing our estimate by 5%

E’s margins remained well above sector averages

CAPEX increased 171% YoY to $15M, driven by heightened client demand necessitating new equipment purchases

Source: FRC/Company

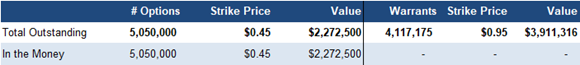

As a result, FCF declined, and debt to capital increased 4 pp to 47%

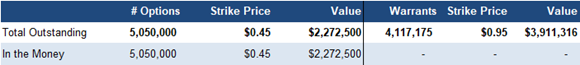

Can raise up to $2.27M from in-the-money options

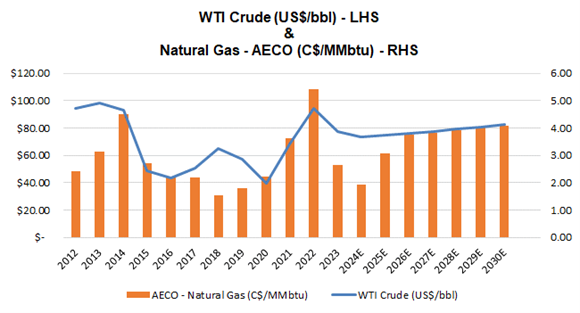

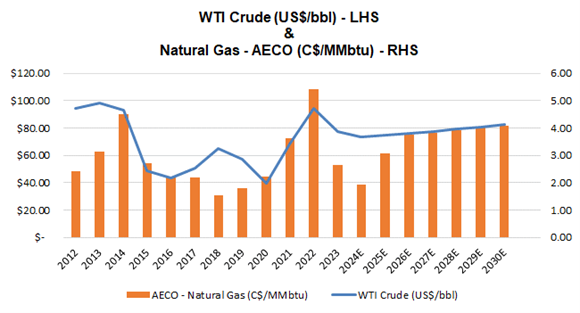

Oil & Gas Price Outlook

Source: FRC/Sproule/GLJ

Consensus price forecasts (near and long-term) are well above historic averages, implying a positive outlook for the oilfield services sector

E's revenue generally tracks changes in oil and gas prices, and sector CAPEX spending

Source: FRC/Various

Historically, a 1% increase in oil and gas prices, and CAPEX spending, has led to a 2.5% increase in E's revenue

Conversely, a 1% decrease in these factors has resulted in a 1.3% decline in E’s revenue

Based on consensus CAPEX spending, and oil/gas prices forecasts, we anticipate 5% organic revenue growth in 2024

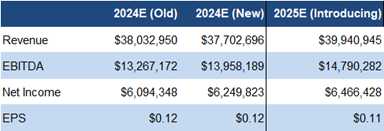

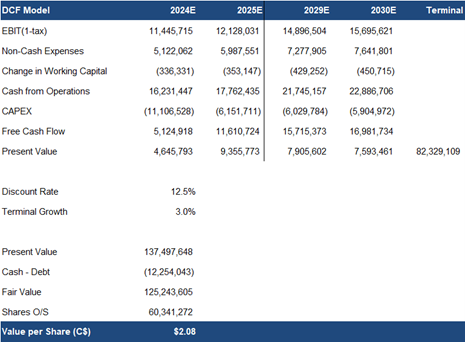

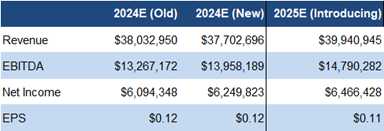

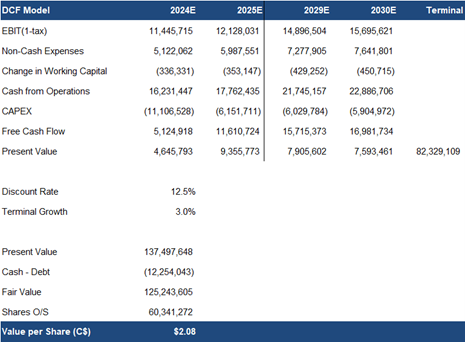

FRC Projections and Valuation

We are not making any material changes to our near-term forecasts

Source: FRC

However, we are raising our long-term revenue/EPS forecasts to account for growth attributed to increased CAPEX

As a result, our DCF valuation increased from $1.98 to $2.08/share

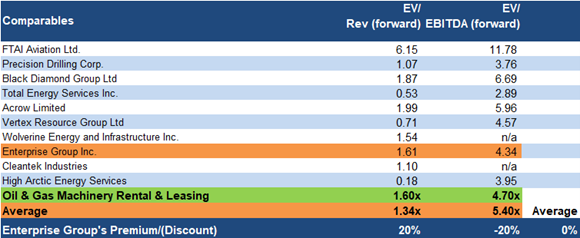

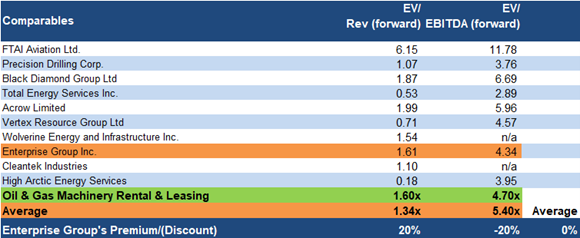

Source: FRC/S&P Capital IQ

E’s EV/EBITDA (forward) is 4.3x vs the sector average of 5.4x, reflecting a 20% discount

E’s EV/revenue (forward) is 1.6x vs the sector average of 1.3x, reflecting a 20% premium

Given E's higher margins compared to sector averages, we believe E warrants a premium

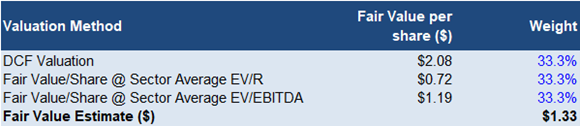

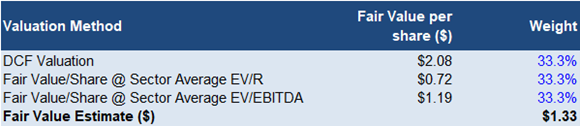

Source: FRC

Our weighted average valuation increased from $1.26 to $1.33/share

We are maintaining our BUY rating, and raising our fair value estimate from $1.26 to $1.33/share. Upcoming catalysts include Q1 results, and revenue growth stemming from the deployment of newly acquired equipment.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- The oil/gas field services market is highly dependent on oil and gas prices

- Operates in a competitive space

- As the company uses leverage, a downturn in business activities can negatively impact its balance sheet