Metalert, Inc.

A Tracking Tech for Health Monitoring and Gun Safety

Published: 3/16/2024

Author: Sid Rajeev, B.Tech, CFA, MBA

Sector: Technology | Industry: Communication Equipment

| Metrics | Value |

|---|---|

| Current Price | US $0.02 |

| Fair Value | US $0.14 |

| Risk | 4 |

| 52 Week Range | US $0.02-0.15 |

| Shares O/S (M) | 34 |

| Market Cap. (M) | US $1 |

| Current Yield (%) | n/a |

| P/E (forward) | n/a |

| P/B | n/a |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

Highlights

• MLRT has developed a suite of products/solutions, powered by a proprietary real time tracking technology, allowing remote monitoring, tracking, and data collection.

• Its products have a wide range of applications, with MLRT currently focusing on addressing two pressing issues prevalent in the U.S.: health monitoring and gun safety.

• One of its flagship products is the GPS SmartSoles, which is a GPS device embedded within shoe insoles, ideal for tracking and monitoring elderly individuals, and those prone to wandering due to cognitive disorders like Alzheimer’s, dementia, and autism.

• Another flagship product is GunAlert, a smart device designed to enhance gun safety, by alerting owners of unauthorized movement or use. MLRT is planning an aggressive marketing campaign targeting law enforcement/government agencies seeking their endorsement of GunAlert for consumer gun safety.

• The company generates revenue through upfront hardware sales, and recurring revenue from subscriptions, and licensing fees.

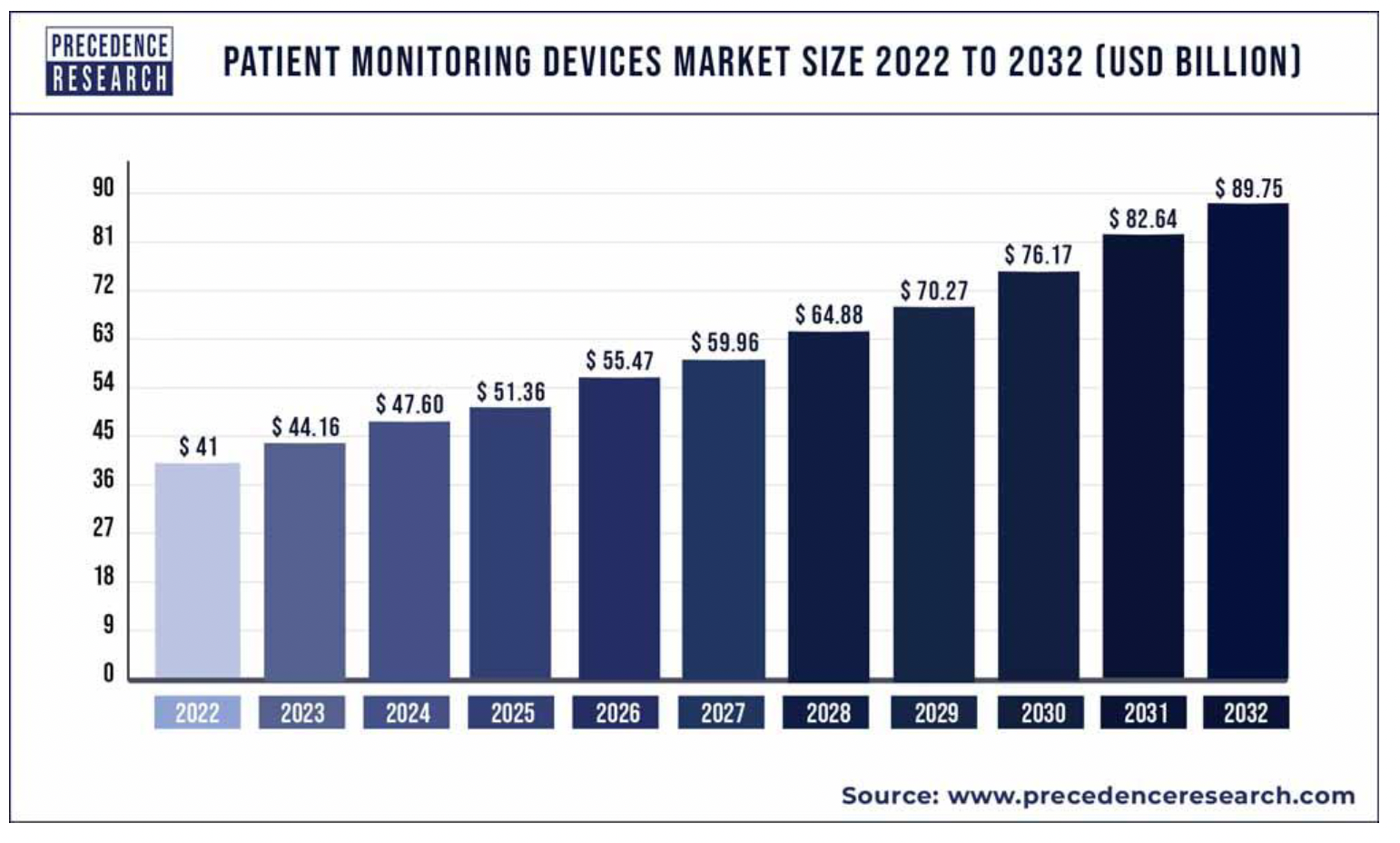

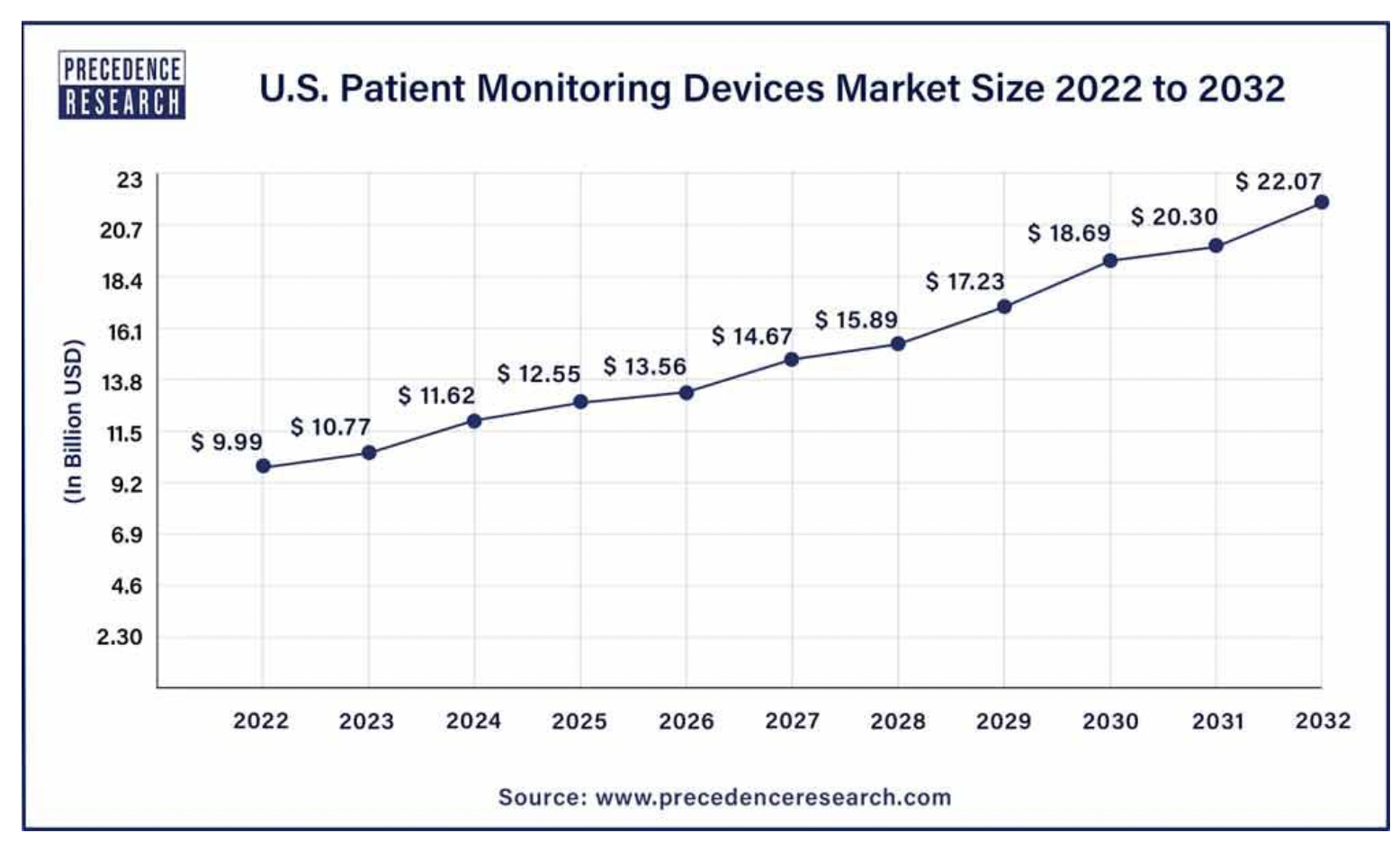

• In the U.S., 11M+ people, or 3% of the population, are diagnosed with Alzheimer’s, Dementia, and Autism (ADA). Precedence Research estimates that the global patient monitoring devices market will grow from US$41B in 2022, to US$90B by 2032, reflecting a CAGR of 8%.

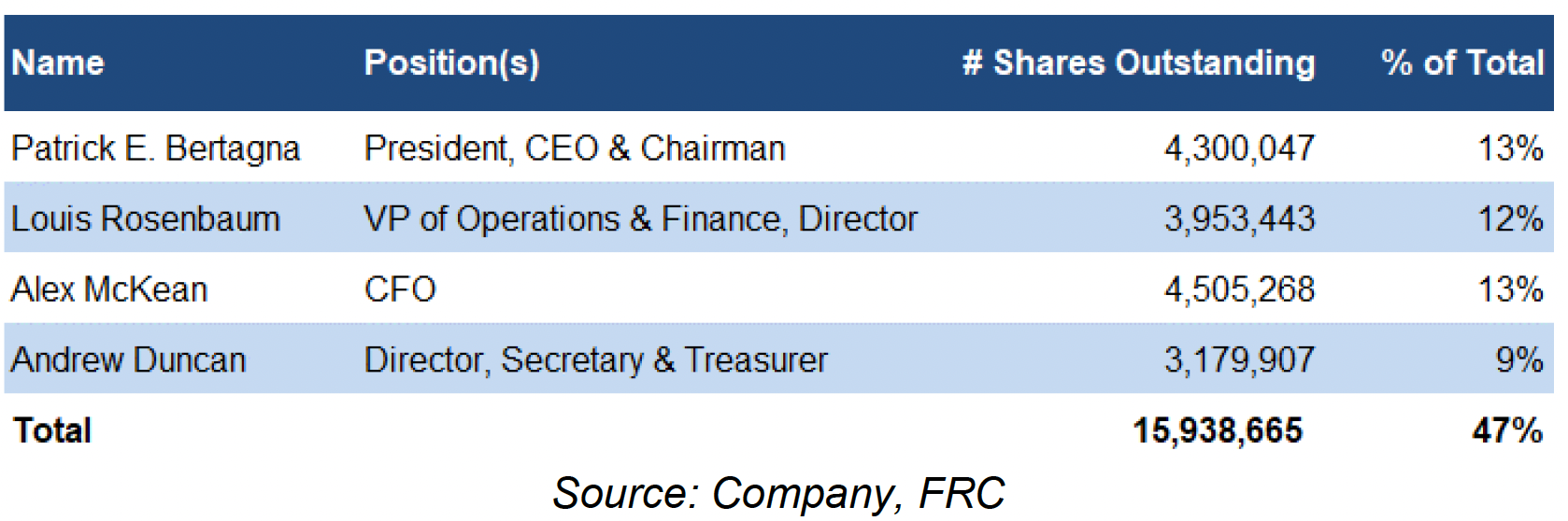

• Management owns 47% of outstanding shares, reflecting their conviction in MLRT’s growth prospects.

• Over the next 12 months, MLRT's marketing campaigns will play a crucial role in gauging the acceptance of its products.

Company Overview - Initiating Coverage

Headquartered in Los Angeles, MLRT has developed a suite of products/solutions, powered by proprietary real time tracking technology, allowing remote monitoring, tracking, and data collection. Its products have a wide range of applications, with MLRT currently focusing on addressing two pressing issues prevalent in the U.S.: health monitoring and gun safety.

MLRT’s predecessor company was formed in 2002; shares started trading on the OTC in 2008

Wide Range of Products/Solutions

In 2022, MLRT underwent rebranding, and relaunched its products.

18 patents in the U.S.

| The GPS SmartSole is an insole embedded with GPS technology, enabling remote monitoring, data collection, and encrypted transmission of data to the cloud. | GunAlert is a firearm recovery device equipped with motion sensitivity, and lockable features. | RoomMate is a wall-mounted alert system designed to detect and notify caregivers of patient behaviors that may result in falls and injuries. |

| If It Moves is a smart security device used to monitor valuable assets. | The Mini GPS Tracker is versatile, wearable, or attachable to any surface. | Track My Work Force offers an efficient and cost-effective solution for business owners and managers supervising a mobile workforce. |

Seven full-time and six part-time employees.

MLRT’s health monitoring devices aid caregivers in managing patients' locations, health status, and biometric data.

MLRT is an approved U.S. military contractor.

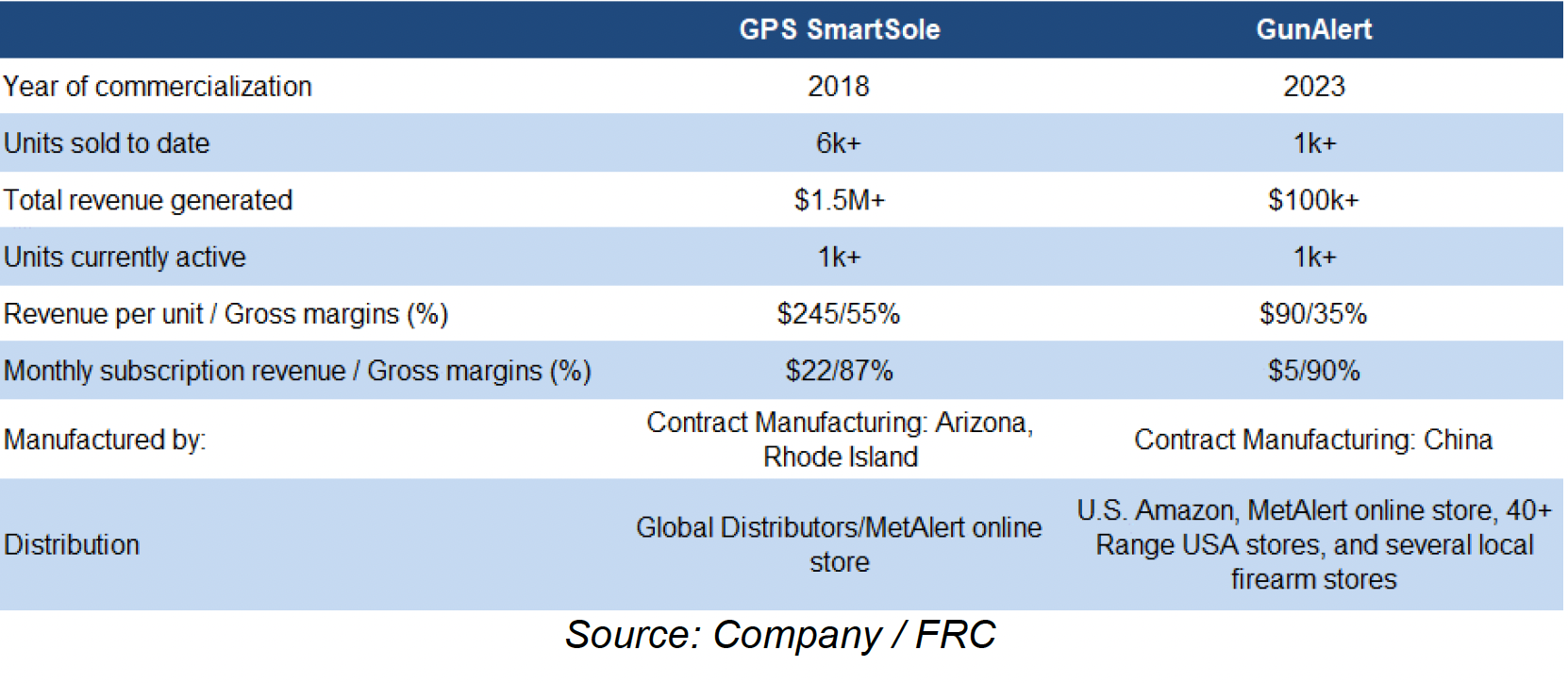

Two Flagship Products & Solutions

Management is prioritizing an aggressive marketing campaign for their two flagship products.

Distributors across 35 countries.

The company generates revenue through upfront hardware sales, and recurring revenue from subscriptions. Service plan subscriptions are a must for operating MLRT's devices, much like cell phone plans are essential for connectivity and functionality.

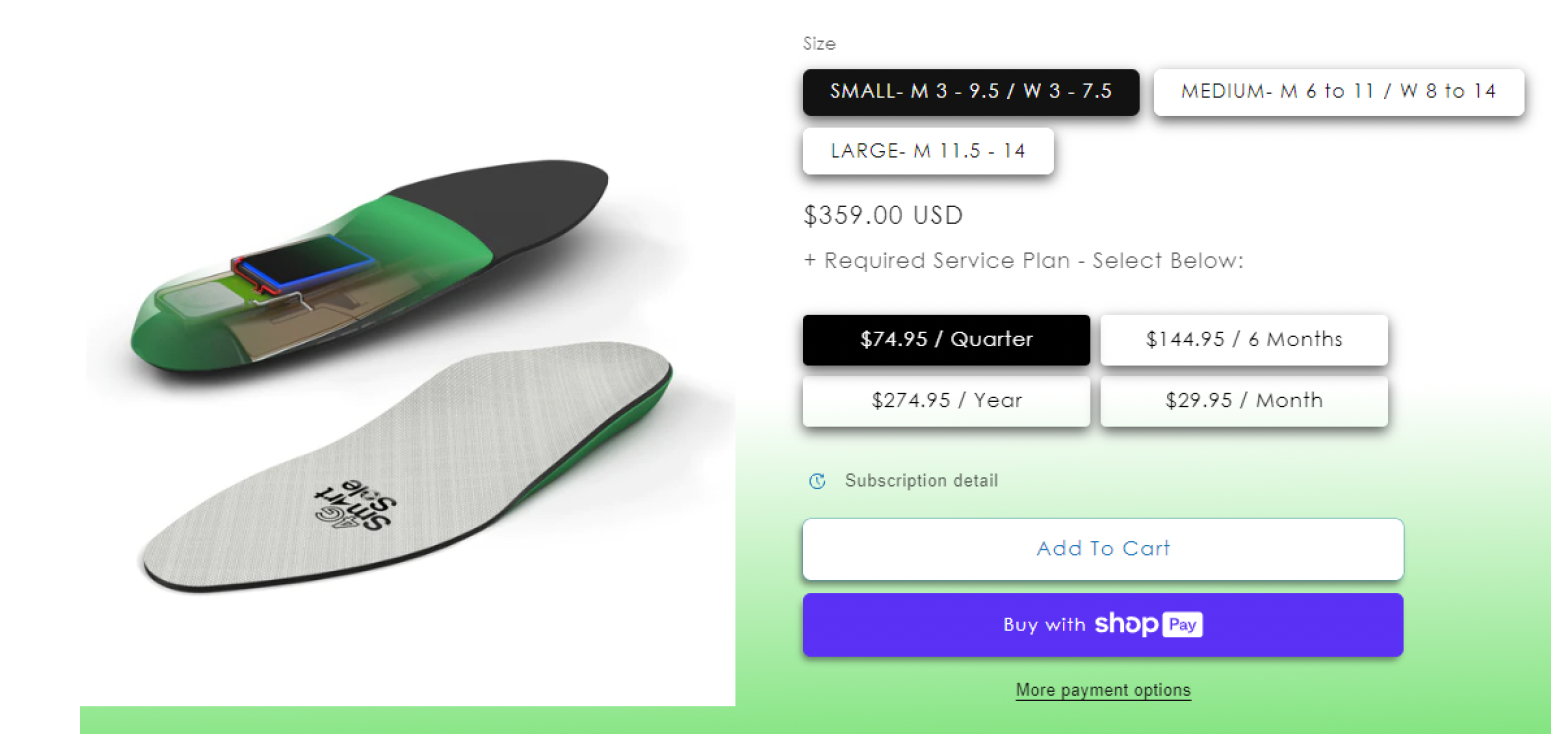

GPS SmartSoles

The GPS SmartSoles is a GPS device embedded within shoe insoles, ideal for tracking and monitoring elderly individuals, and those prone to wandering due to cognitive disorders like Alzheimer’s, dementia, and autism.

Features

- Sends alerts via email & text when a user enters or exits specified areas

- View location history on a map using any computer, tablet, or smartphone

- Requires a data plan for connectivity

- Charges fully in 2-4 hours, and lasts 2-4 days per charge

- Water-resistant

- Operates across all 50 states

The company has initiated collaborations with strategic partners to incorporate artificial intelligence into its products.

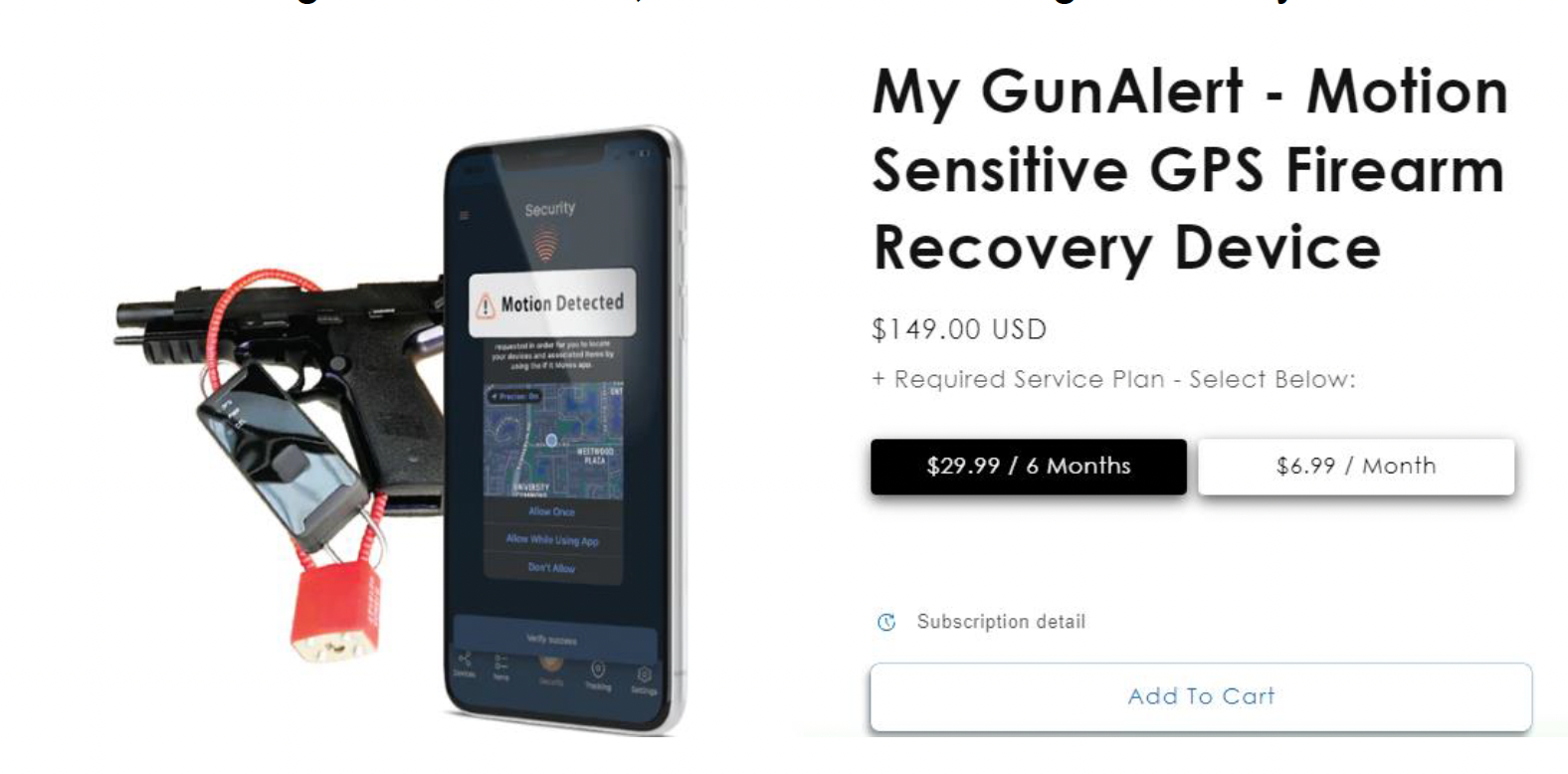

GunAlert

GunAlert is a smart device designed to enhance gun safety by alerting owners of unauthorized movement or use. It aims to deter theft, prevent accidental shootings, aid in recovering stolen firearms, and elevate overall gun security.

We note that gun safety is gaining recognition at both federal and state levels in the U.S.

Several states have implemented policies mandating prompt reporting of lost or stolen firearms to law enforcement agencies.

Features

- Detect unauthorized movement, and send alerts immediately.

- Uses cellular technology for location tracking, unlike WiFi competitors.

- Updates location every 5 minutes until gun recovery.

- Location data is never stored on servers.

- Easy setup and use via a mobile app.

Product reviews: We were unable to obtain credible consumer reviews as GunAlert has fewer than 10 reviews on Amazon (NASDAQ: AMZN).

Started receiving orders from a leading firearm retailer

In October 2023, MLRT received its first order from Range USA - a leading firearm retailer with 40+ stores across the U.S. Our discussions with management indicated that they are anticipating an undisclosed large retailer to start distributing its products shortly.

Competition

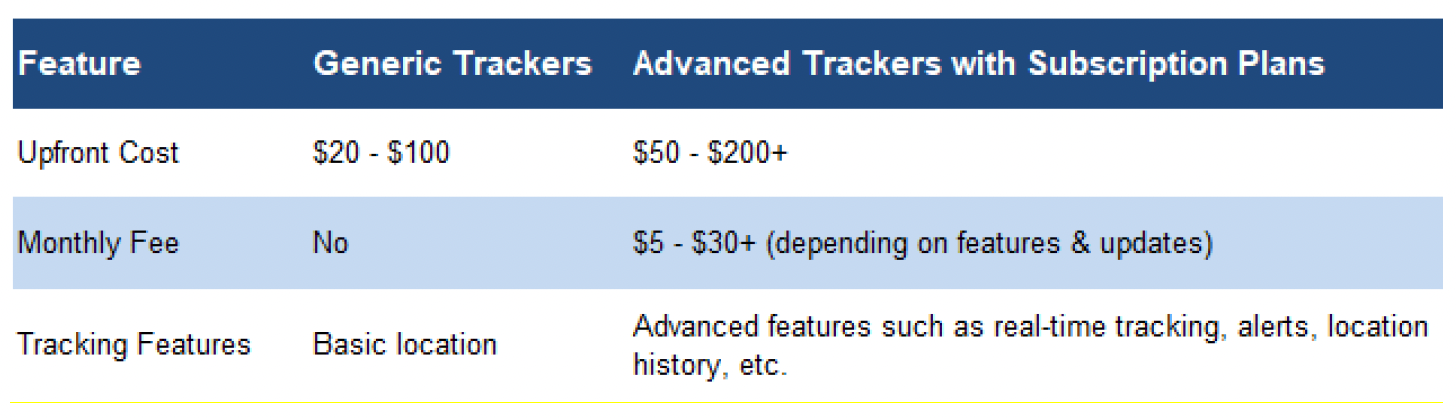

There are several generic and advanced GPS trackers available in various forms such as watches, ankle bracelets, and necklaces. Notable examples of generic trackers for personal items include Apple's AirTag (NASDAQ: AAPL) and Samsung’s Galaxy SmartTag (KOSDAQ: A005930), providing basic tracking functionalities. Advanced trackers like those sold by MLRT offer enhanced features such as real-time geofencing alerts, and detailed location history access. These advanced trackers typically operate on monthly subscription plans to provide continuous connectivity, and enhanced functionality.

MLRT’s products are competitively priced.

Key Differentiators of MLRT's Trackers:

- MLRT's trackers are tailored for specific uses, setting them apart from generic and advanced trackers.

- MLRT's SmartSoles stand out as the only invisible tracker designed for footwear, protected by U.S. patents, which we believe is a more effective form factor for monitoring elderly individuals, and those prone to wandering.

- According to management, GunAlert’s motion sensors offer superior sensitivity, ensuring instant alerts are triggered by any unauthorized movement. In addition, GunAlert integrates a combination lock directly into the device, offering an additional layer of protection against unauthorized access. We are not aware of any other tracker that has a built-in lock, and a highly sensitive motion sensor.

Market Outlook

In the U.S., 11M+ people, or 3% of the population, are diagnosed with Alzheimer’s, Dementia, and Autism (ADA).

MLRT’s products/solutions target large markets.

Based on MLRT’s subscription fee of $22/month, and the target market of 11M consumers in the U.S., we note that MLRT is targeting a market with revenue potential of $2.9B/year.

It is estimated that the global patient monitoring devices market will grow from US$41B in 2022, to US$90B by 2032, reflecting a CAGR of 8%.

Based on MLRT’s subscription fee of $22/month, and the target market of 11M consumers in the U.S., we note that MLRT is targeting a market with revenue potential of $2.9B/year.

Key growth drivers:

a) Aging population,

b) Escalating prevalence of chronic conditions,

c) Increasing awareness of the importance of continuous patient care and healthcare monitoring, and

d) Advancements in patient monitoring technologies

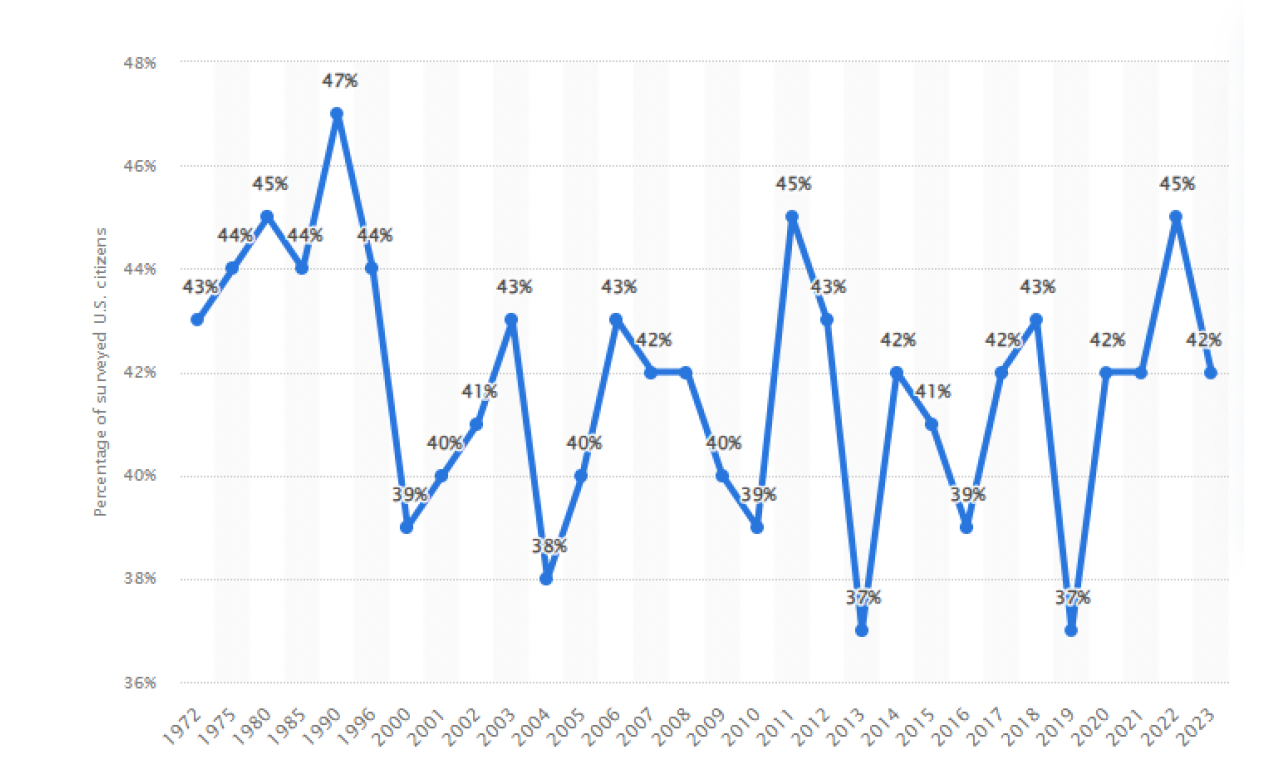

Percentage of households in the U.S. owning one or more firearms

In 2023, 42% of U.S. households had at least one gun in their possession

32% of adults, or 83M consumers, own firearms in the U.S. (Source: Ammo.com)

Based on MLRT’s subscription fee of $5/month, and a target market of 83M consumers in the U.S., we note that MLRT is targeting a market with revenue potential of $5B/year.

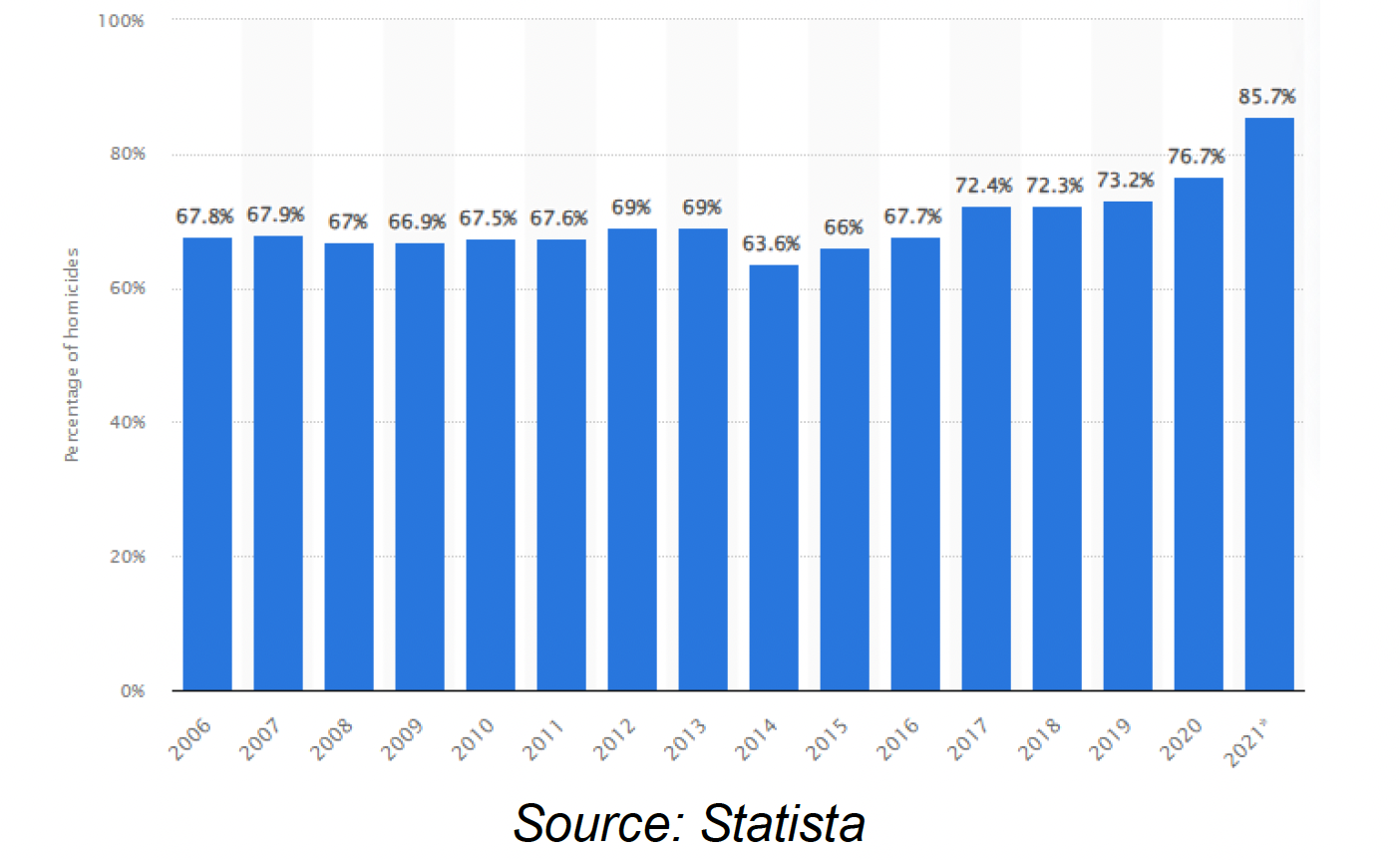

Percentage of homicides by firearm in the U.S.

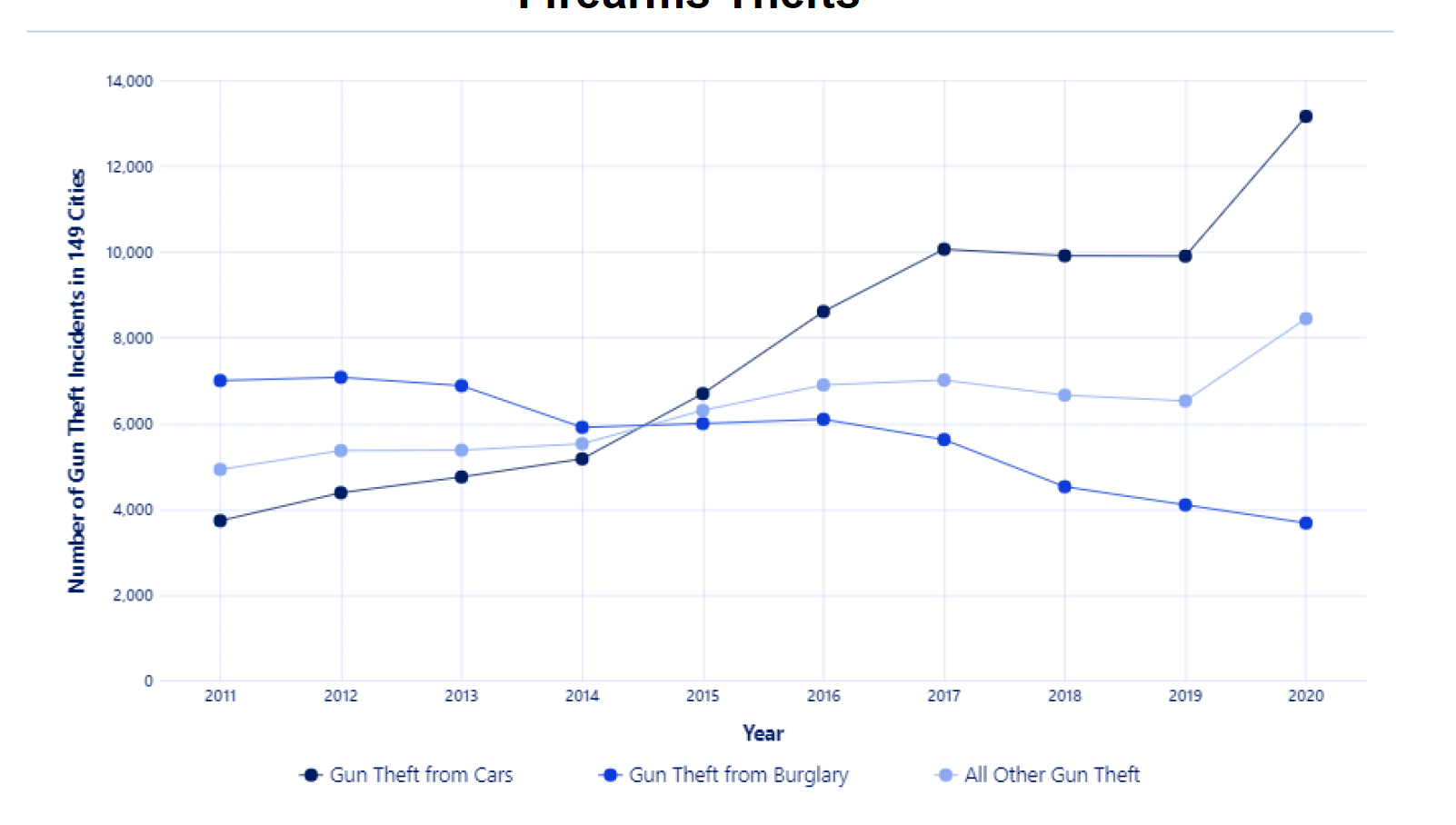

Gun theft in the U.S. is a significant issue, with a large number of firearms being stolen each year.

In 2021, 86% of homicides were committed by firearms in the U.S.; 77k guns were reported stolen in 2020.

Firearms Thefts

Source: Everytown for Gun Safety analysis of FBI NIBRS data, 2011–2020

From 2003 to 2021, 1,262 children (0-17 years of age) were killed by unintentional firearm injury (Source: NVDRS).

The Gun Crime Prevention Strategic Fund, a newly launched initiative, proposes to provide states with up to $884M annually for law enforcement, and crime prevention, to reduce gun violence.

Marketing Strategy

MLRT plans to implement the following strategies to garner interest in its flagship products/solutions:

- Expand its global distribution network

- Recruit retired law enforcement officers

- Engage with local, state, and federal politicians, to align products with legislative initiatives

- Collaborate with gun safety organizations

- Explore private label options

In 2024, MLRT has allocated $0.3-$0.5M for marketing, earmarked for initiatives such as social media advertising, trade shows, outreach programs to law enforcement, insurance companies, and government agencies.

Management and Board

Management owns 47% of MLRT’s outstanding shares No independent directors.

Brief biographies of the management team/board are provided below:

Patrick E. Bertagna – President, CEO, and Chairman of the Board Mr. Bertagna co-founded Metalert, Inc. (formerly known as GTX Corp) in 2002 and has been its Chairman, President and Chief Executive Officer since 2008. His career spans for more than 35 years in building companies in both technology and consumer branded products. He began his career in consumer products importing apparel from Europe and later went on to import and manufacture apparel, accessories and footwear in over 20 countries. He has formed alliances with Fortune 500 companies such as IBM, AT&T, Sports Authority, Federated Stores, Netscape and GE. He is a co-inventor of the patented GPS footwear technology.

Louis Rosenbaum – VP of Operations and Finance, Director Mr. Rosenbaum is a founder of Metalert, and serves as its Vice President of Operations & Finance since 2015. He has been a serial entrepreneur. He founded GTX California and served as its President of Advanced Environmental Services since July 1997. He has been working in the environmental and waste disposal industry for the past eighteen years. He started with Allied Waste Services, a division of Eastern Environmental in 1990.

Alex McKean – Chief Financial Officer Mr. McKean serves as the Chief Financial Officer of Metalert since 2015 and served as Interim Chief Financial Officer since 2011. He has acted as an independent management consultant as well as an independent contractor at Robert Half International and Ajilon Finance. He has held positions as a Controller and Vice President of Finance at 24:7 Film from 2002 to 2004, Vice President of Finance at InternetStudios.com from 2000 to 2002, Director of FP&A/Senior Vice President at Franchise Mortgage Acceptance Company from 1998 to 2000, as Corporate Accounting Manager/Treasurer of Polygram Filmed Entertainment from 1996 to 1998 and Assistant Treasurer/Controller for State Street Bank from 1989 to 1996.

Andrew Duncan – Director, Corporate Secretary, and Treasurer Mr. Duncan has been working in the consumer electronics and technology licensing business for over 20 years. Since 2006 he has been the CEO of ClearPlay International, a software licensing company. Prior thereto, he founded Global TechLink Consultants Inc., a technology consultancy company, specializing in technology licensing, multimedia, communication and application technology. From 1994 to 2001, Mr. Duncan worked as Vice President Consumer Electronics for Gemstar TV Guide International (Los Angeles USA).

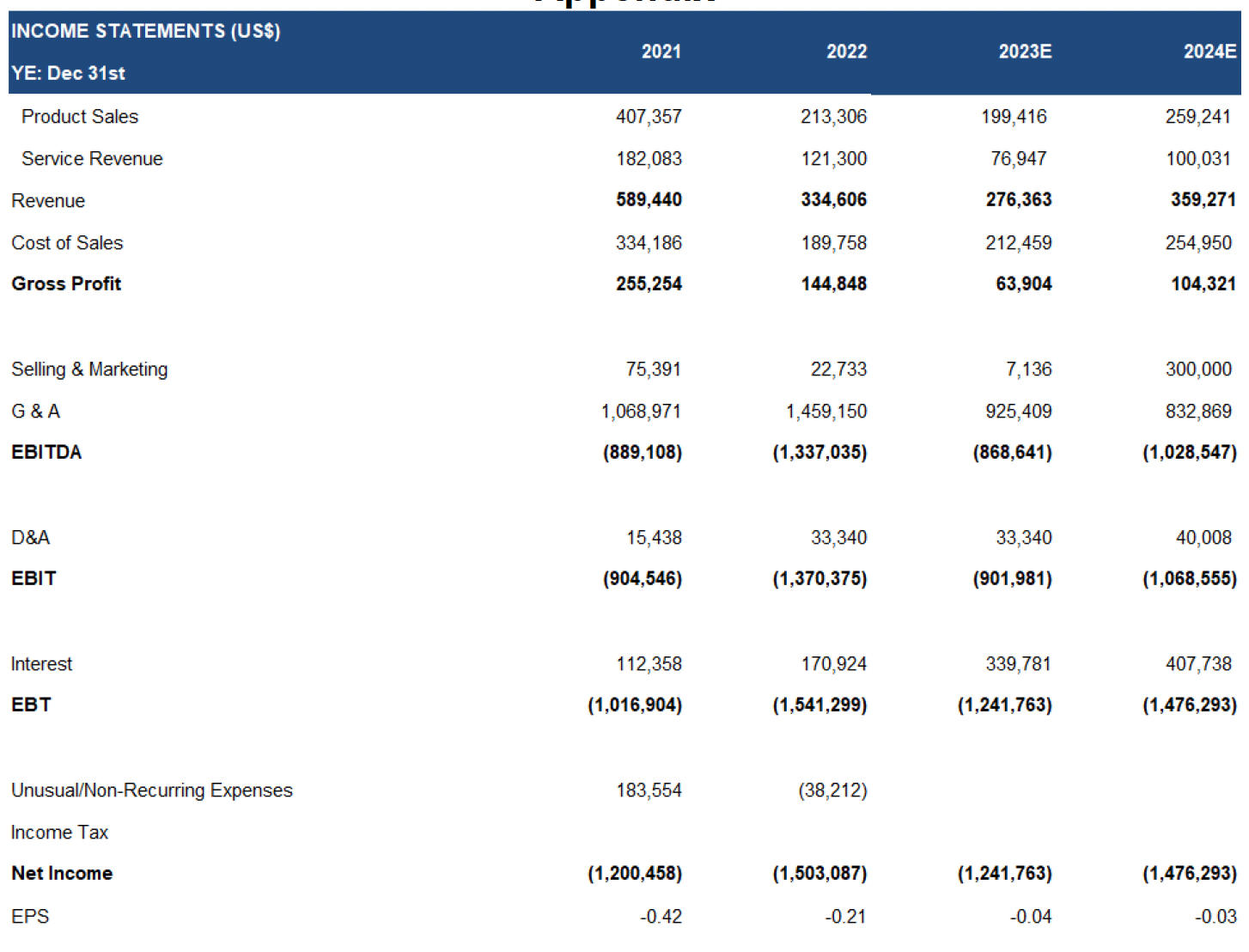

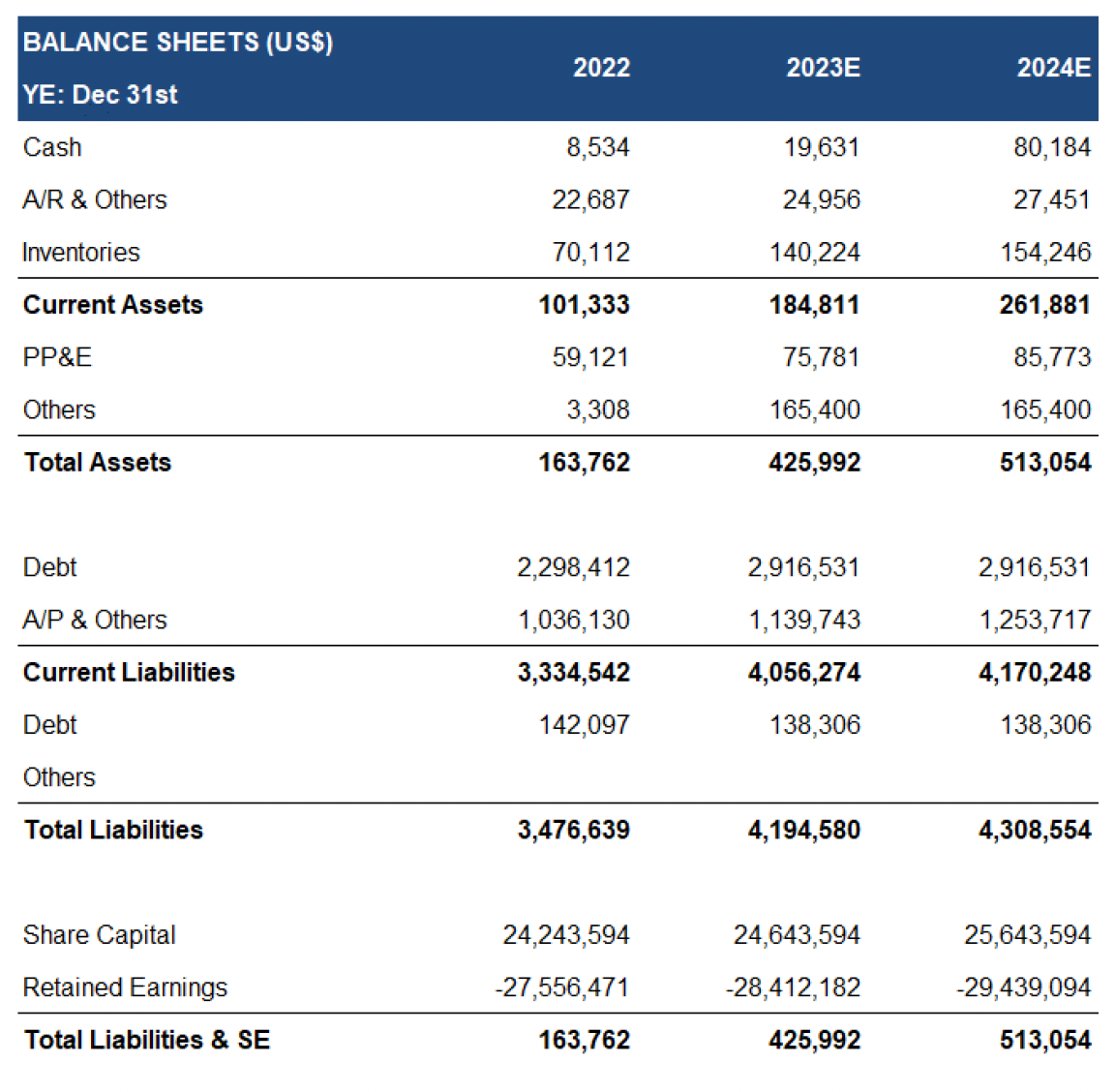

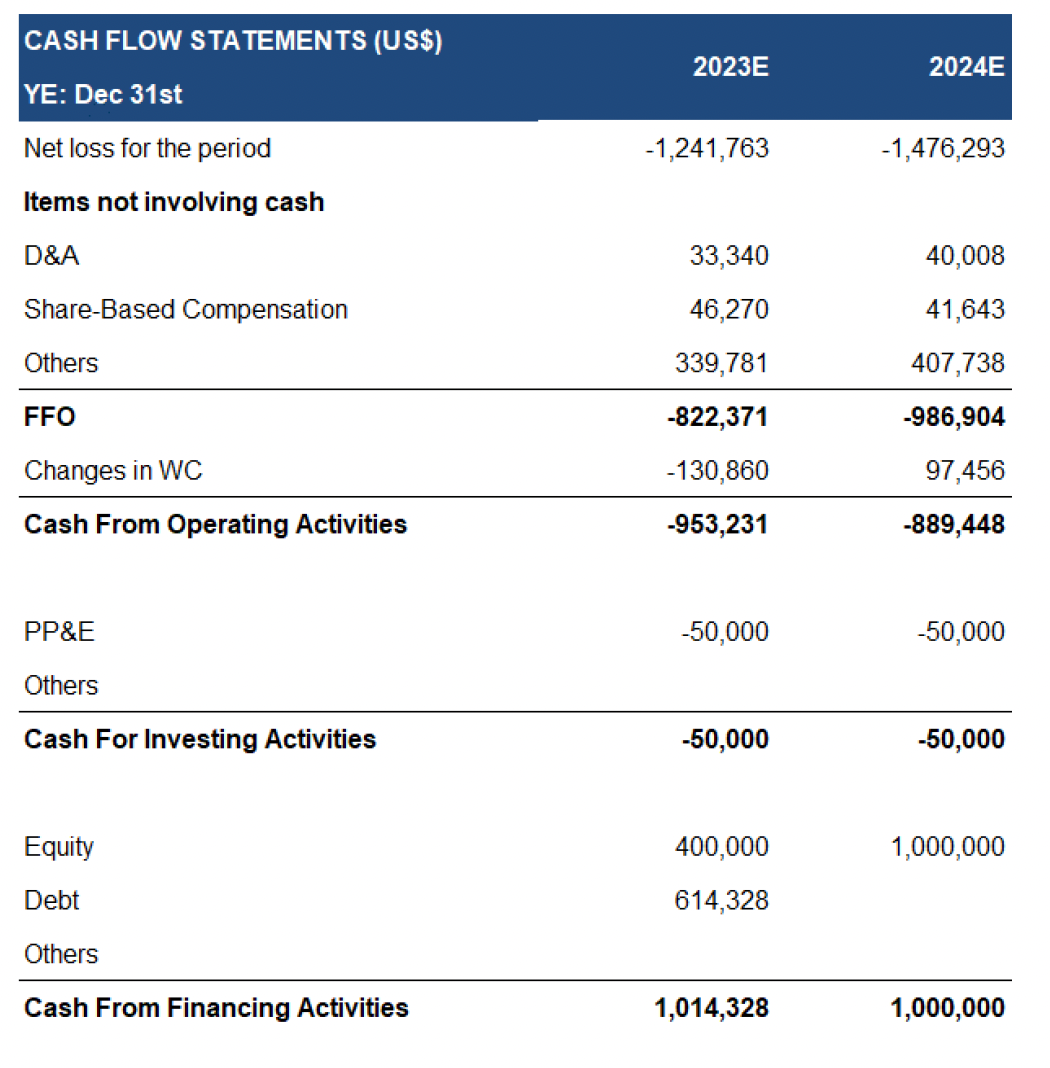

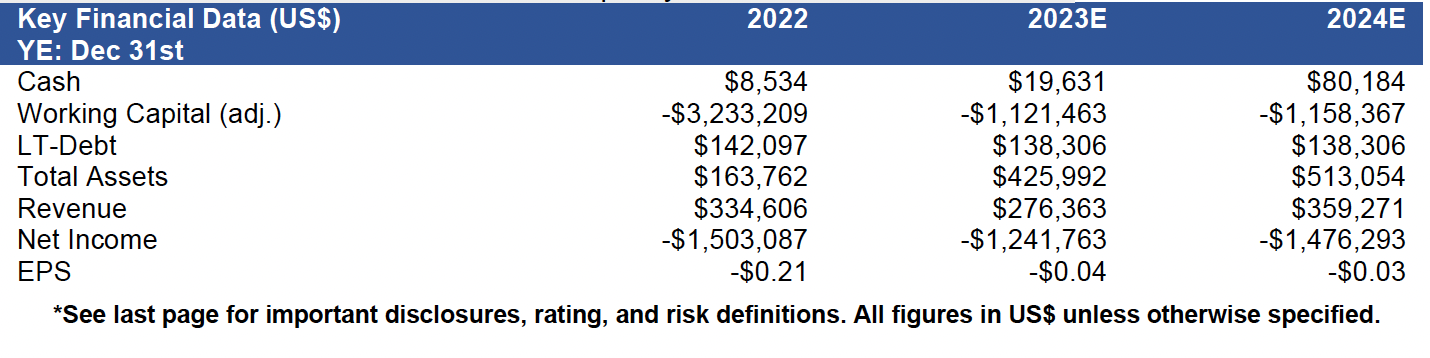

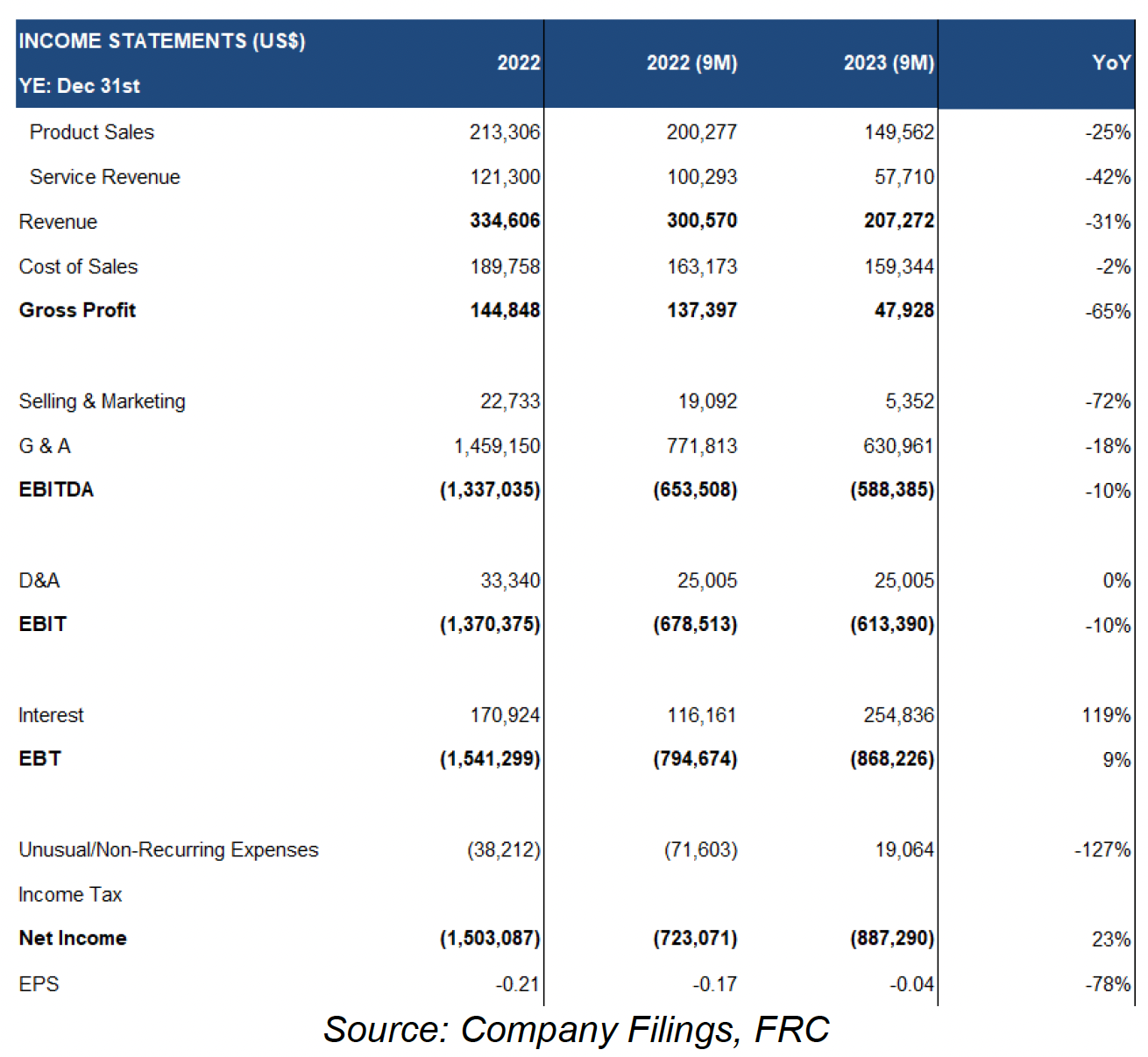

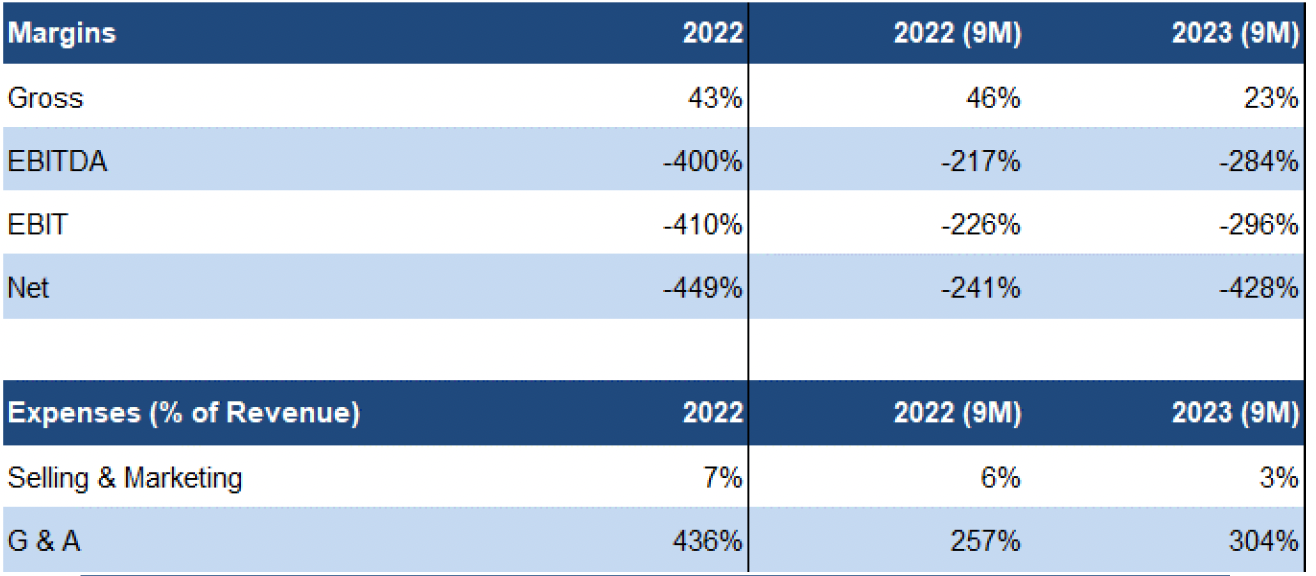

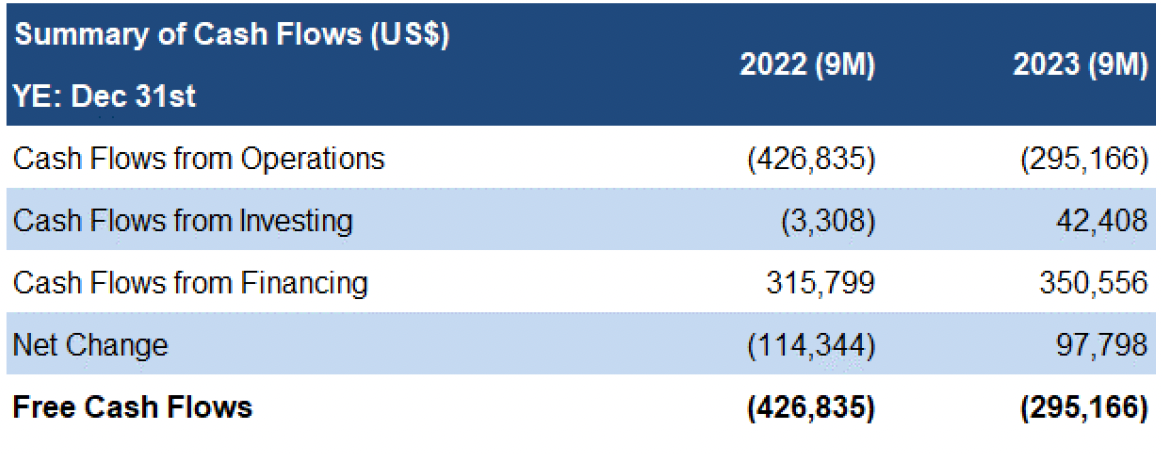

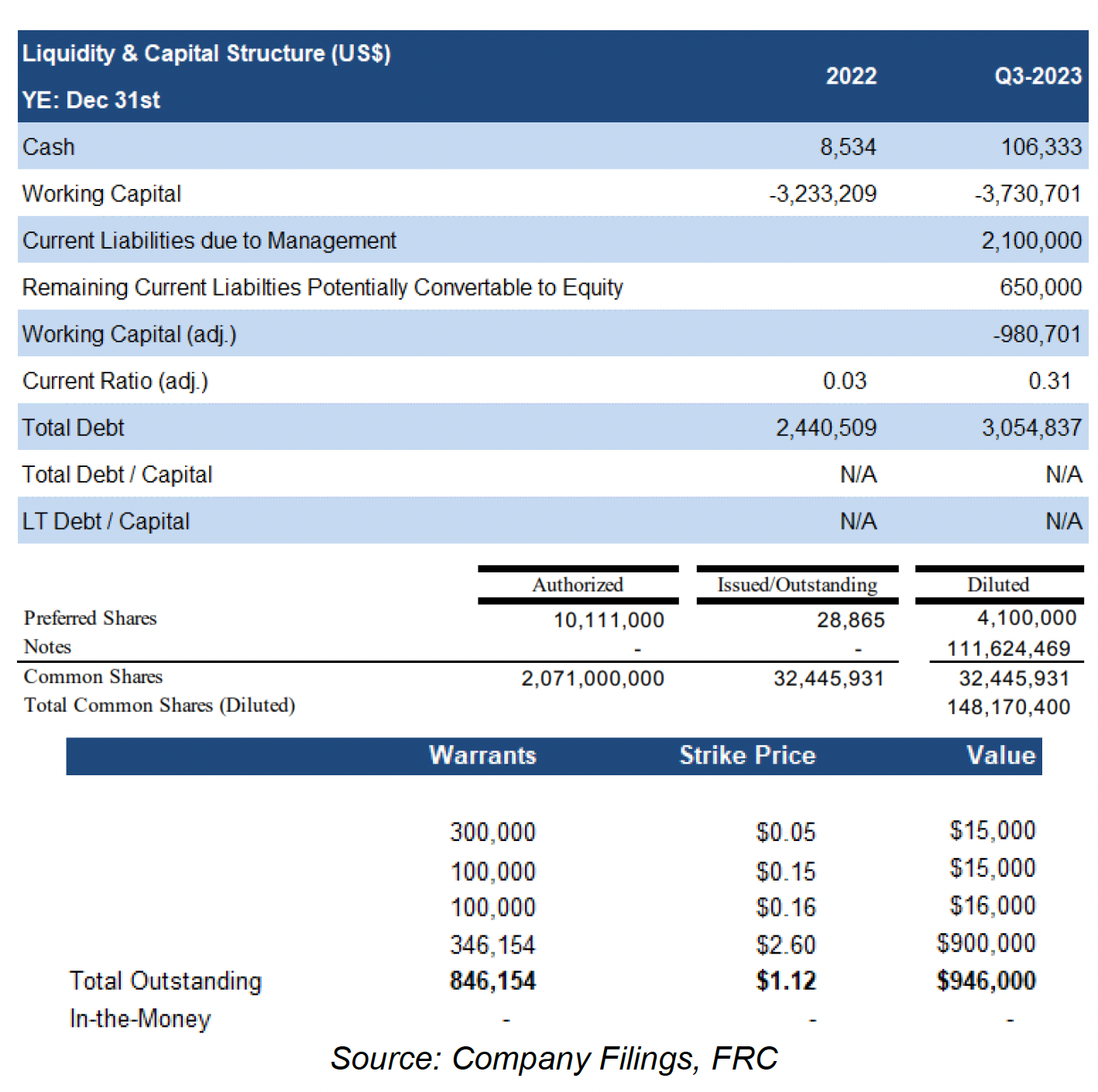

Financials (Year-End: December 31st)

MLRT is in the early stages of commercialization

Funding operations through equity financings.

At the end of Q3-2023, the company had a $1M working capital deficit

MLRT is pursuing a $2M equity/strategic financing priced at $0.10/share vs the current share price of $0.028/share; due to the significant premium, we believe MLRT will likely face challenges in attracting interest.

None of the outstanding warrants are in-the-money.

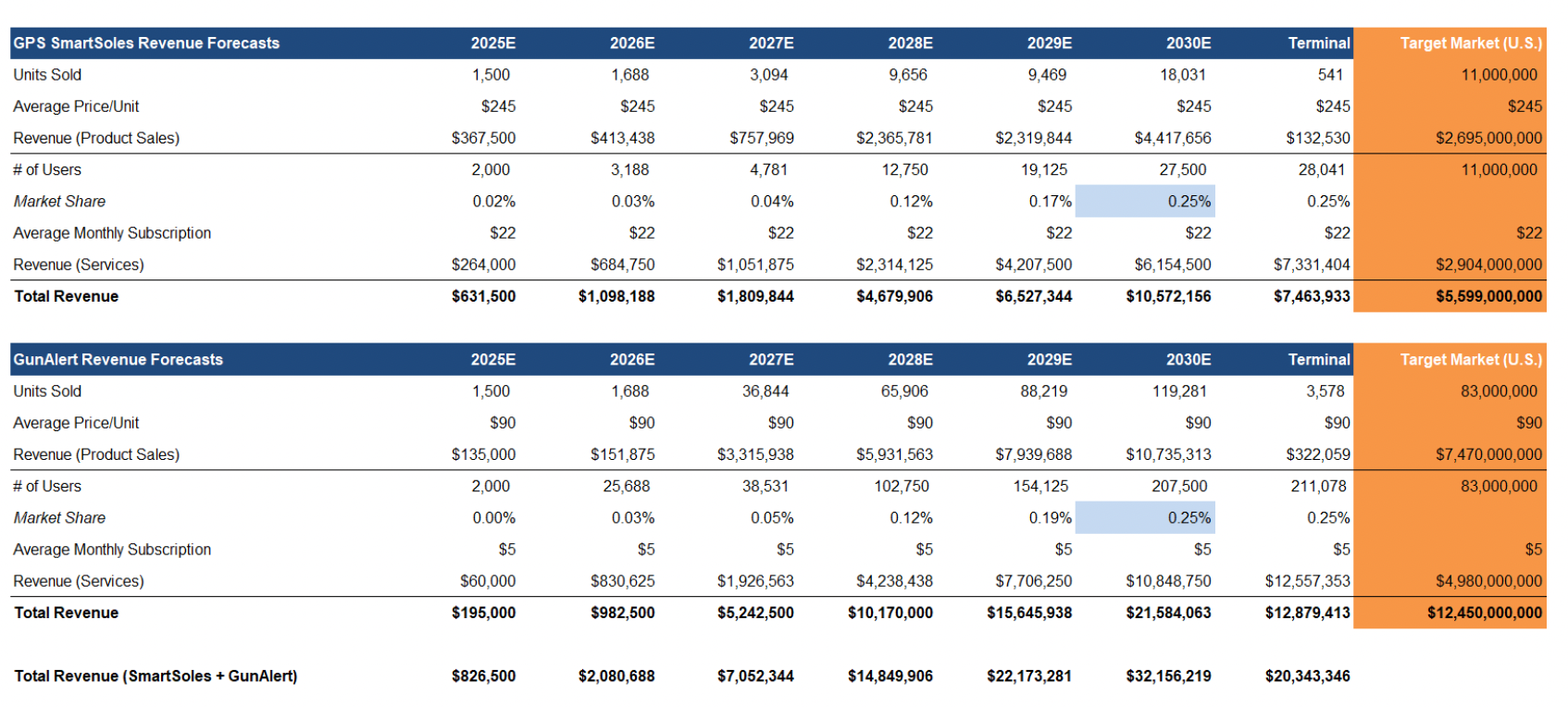

FRC Projections and Valuation

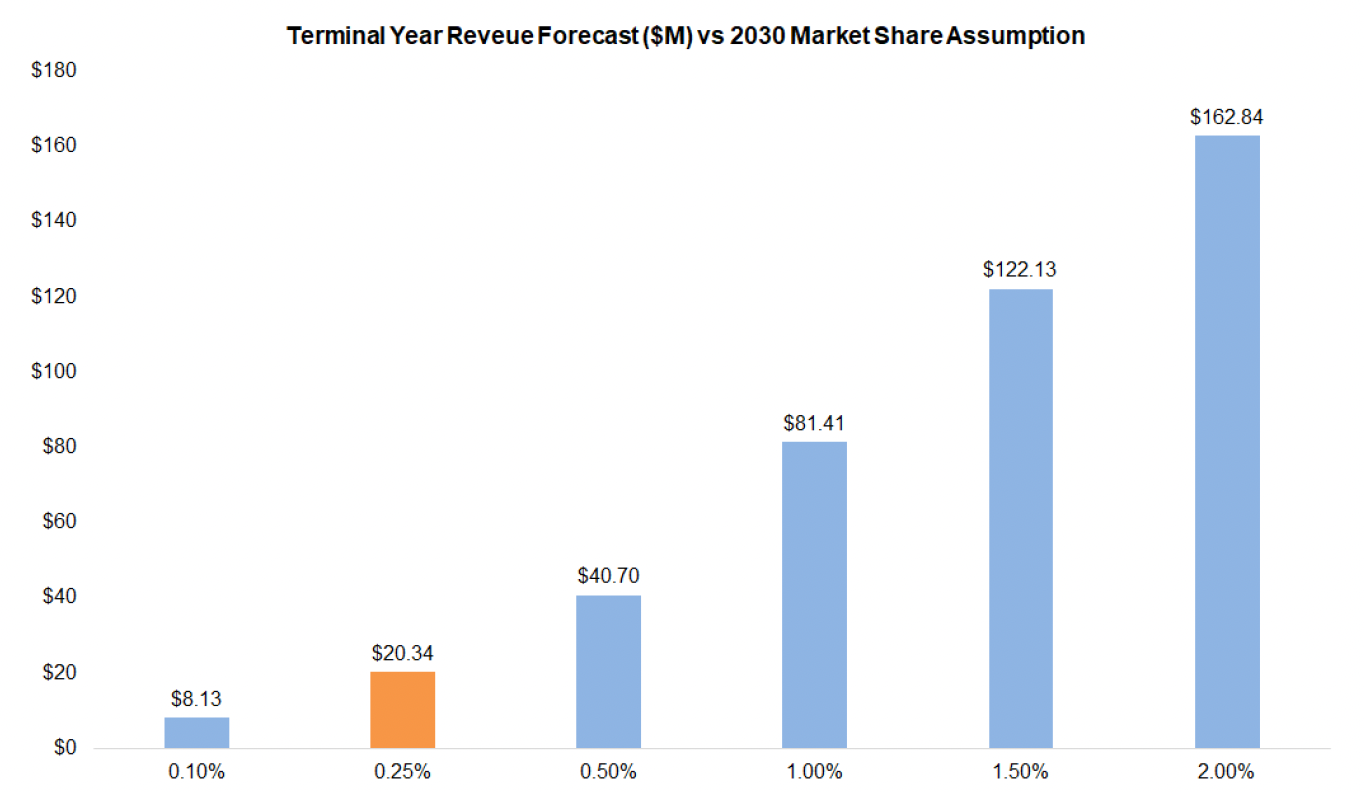

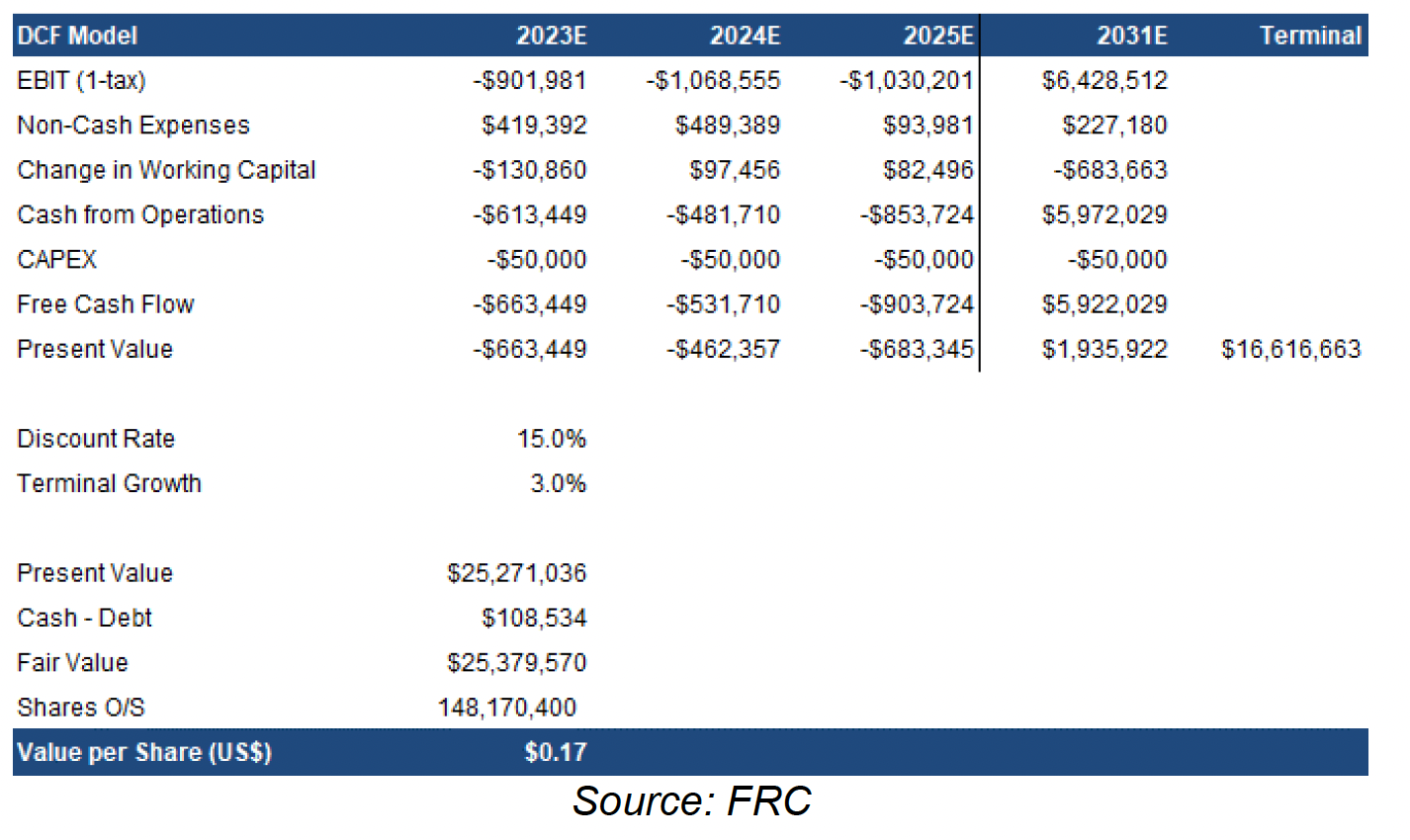

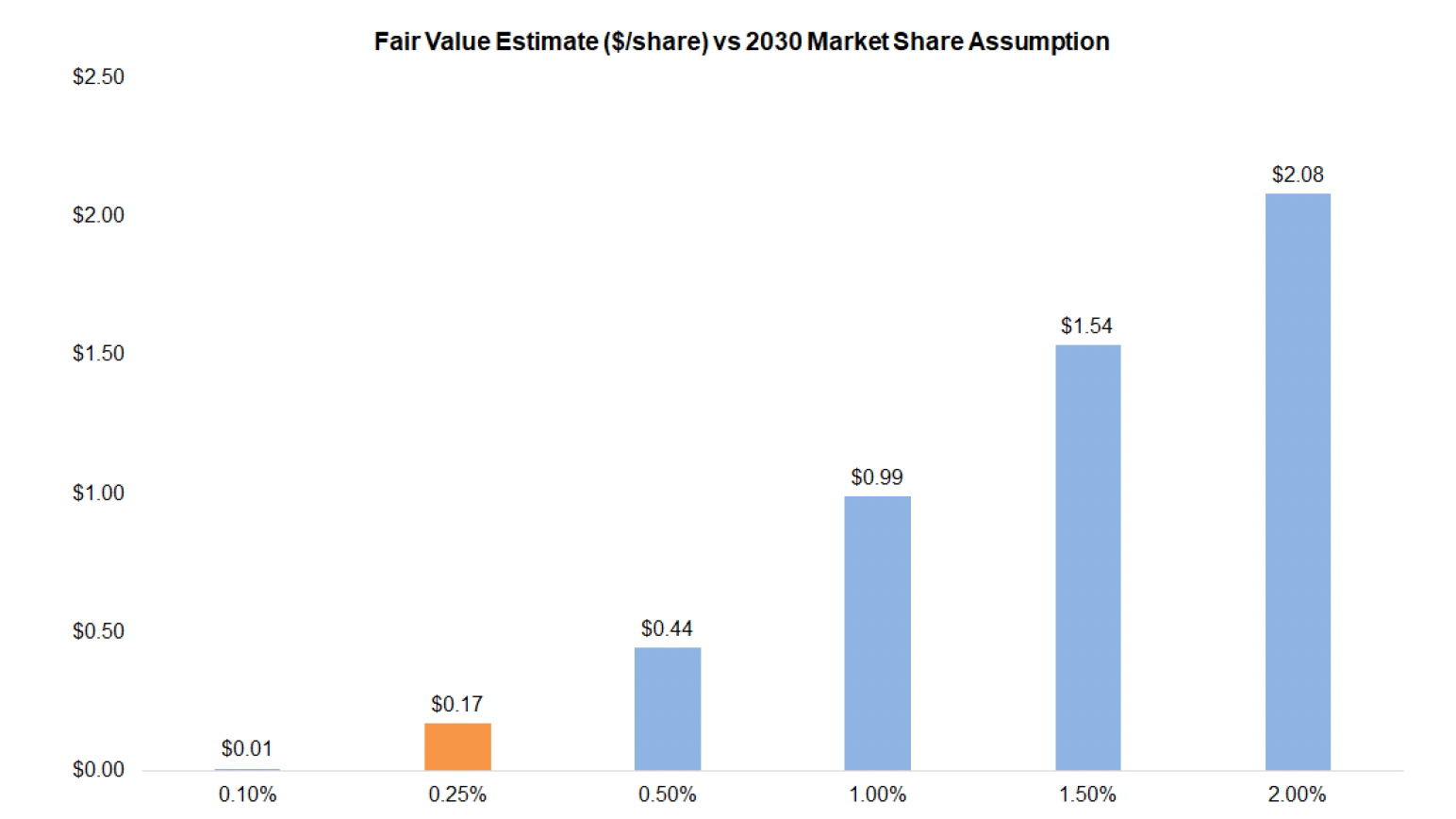

Our models are based on the assumption that MLRT’s products capture 0.25% of their target markets in the U.S. by 2030

We anticipate marketing expenses will average 40% of revenue in the next three years, declining to a long-term average of 15%, aligning with the sector average.

Our base-case DCF model returned a fair value estimate of $0.17/share.

Our valuation is highly sensitive to our market share assumptions

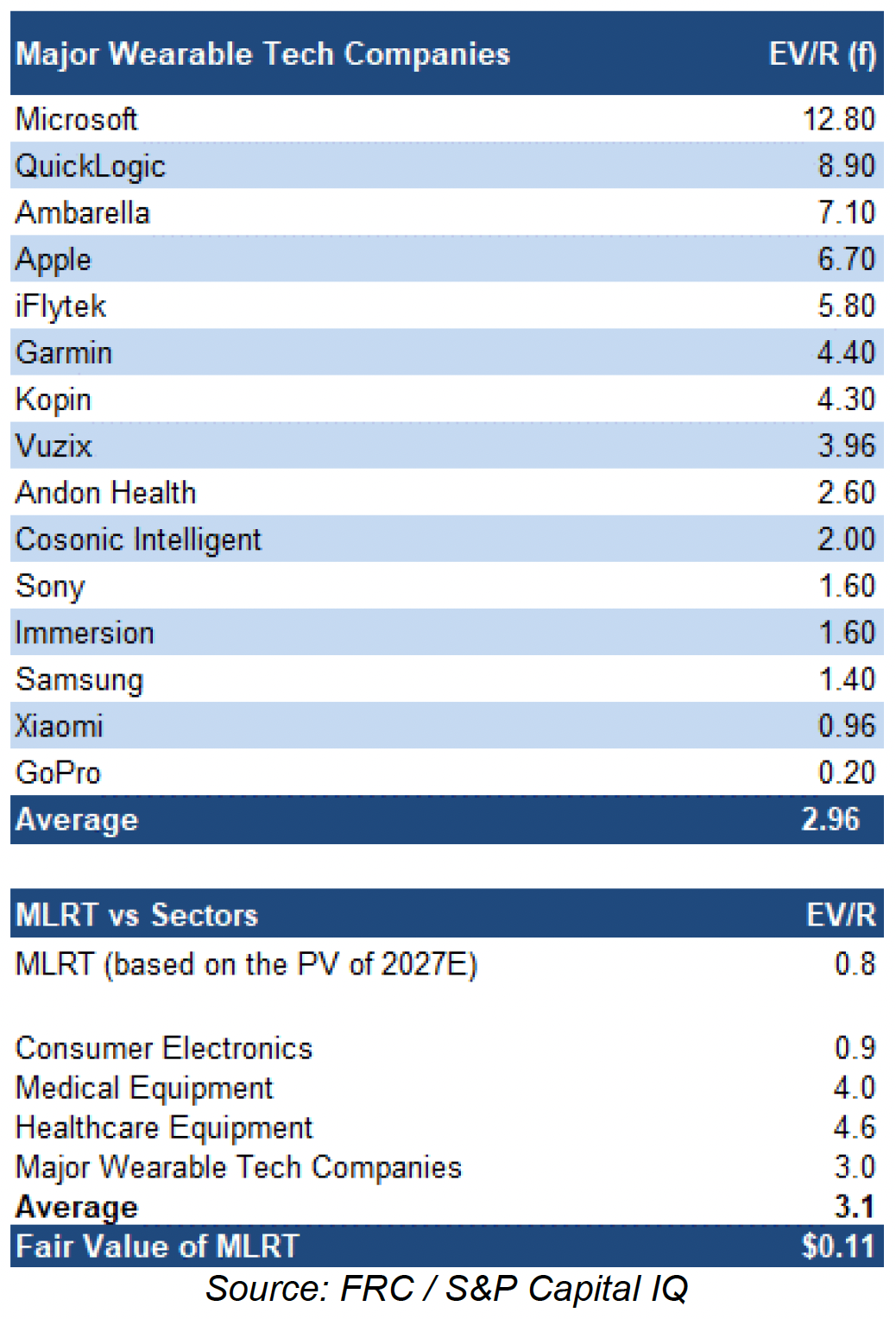

MLRT is trading at 0.8x revenue (based on the present value of our 2027 revenue forecast) vs the sector average of 3.1x.

Applying 3.1x to the present value of our 2027 revenue forecast for MLRT, we arrived at a comparables valuation of $0.11/share.

We are initiating coverage with a BUY rating, and a fair value estimate of $0.14/share (the average of our DCF and comparables valuations). Over the next 12 months, MLRT's marketing campaigns will play a crucial role in gauging the acceptance of its products. Our valuation hinges heavily on the success of its two flagship products. That said, we have applied a relatively high discount rate of 15% in our valuation models to account for the risks associated with our assumptions. A major highlight of the company is its focus on addressing two pressing issues in the U.S.: health monitoring and gun safety. If successful, MLRT stands to generate high-quality revenue through recurring subscriptions

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- MLRT is in early stages of revenue generation•

- Need to pursue equity financings, implying potential for share dilution

- Leveraged balance sheet

- Competition

- No guarantee that any of its product/solutions will achieve widespread adoption

- Companies listed on the OTC Pink have fewer reporting and disclosure requirements, while their shares exhibit lower liquidity

- Like any business involved in consumer product sales, hefty marketing budgets are critical for growth

Appendix