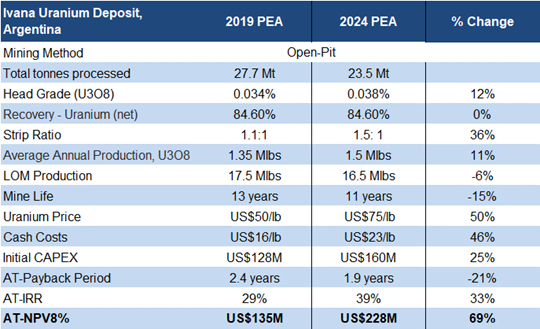

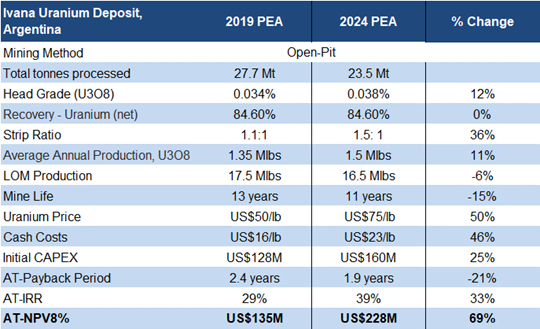

➢ Compared to the 2019 PEA, NPV increased by 68%, and IRR by 10 pp (percentage points), due to higher uranium prices, partially offset by the impact of higher CAPEX/OPEX.

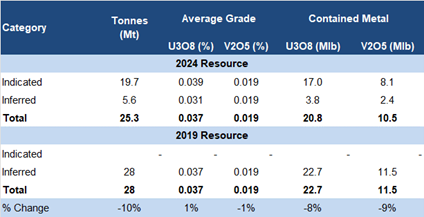

➢ BSK has also upgraded the project’s resource estimate. Indicated resources now account for 80% of total resources (previously nil), implying a higher level of confidence.

➢ We note that the project has potential for a low-cost mine, with relatively low cash costs of US$23/lb, and significant resource expansion potential as multiple prospects remain untested. Management is planning to conduct infill drilling, and engineering studies, prior to completing a prefeasibility study.

➢ Uranium prices are up 86% YoY to US$91/lb. The Sprott Physical Uranium Trust (TSX: U-UN), the world’s largest physical uranium investment fund, has increased its holdings by 3% in the past six months to 64 Mbls. Given that Russia contributes to 35% of global enriched uranium production, we believe the uranium supply chain remains highly vulnerable. According to the World Nuclear Association, uranium demand for nuclear reactors is projected to rise by 28% by 2030, and nearly double by 2040. Consequently, we believe majors will likely pursue M&A to secure longterm supply.

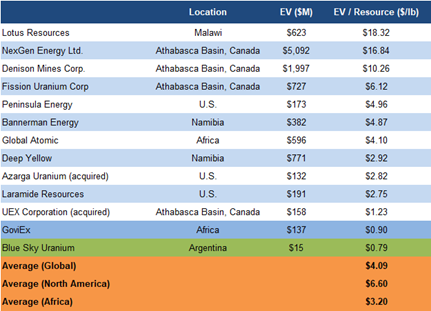

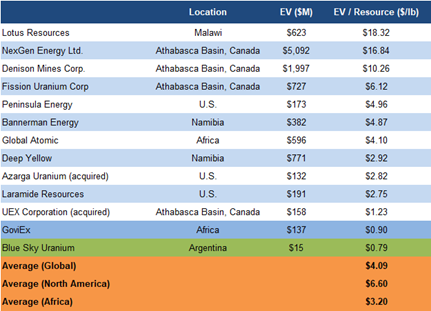

➢ BSK is trading at just $0.79/lb vs the sector average of $4.09/lb. Key near-term catalysts include drilling, and a PFS.

➢ Argentina has three operating nuclear reactors, but no domestic uranium production. Given the robust PEA, and Argentina’s reliance on imports, we believe BSK is an attractive acquisition target.

Portfolio Summary

BSK's Portfolio

Source: Company

Four uranium-vanadium properties spanning 400,000 hectares

The flagship Amarillo Grande project, located in Rio Negro province, hosts the largest NI 43-101 compliant uranium resource in Argentina

Amarillo Grande consists of three properties – Ivana, Anit, and Santa Barbara, spread along a 145 km long trend

Source: Company/FRC

NPV increased by 68%, and IRR by 10 pp, due to higher uranium prices, partially offset by the impact of higher CAPEX/OPEX

The study used a long-term uranium price of US$75/lb, which is in line with our forecast, vs the spot price of US$91/lb

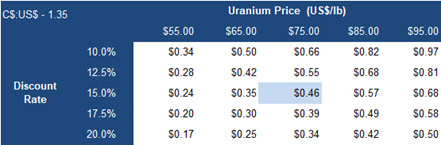

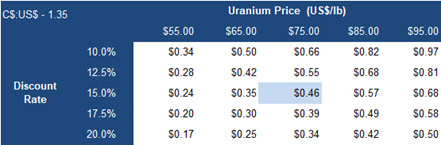

NPV and IRR are highly sensitive to uranium prices

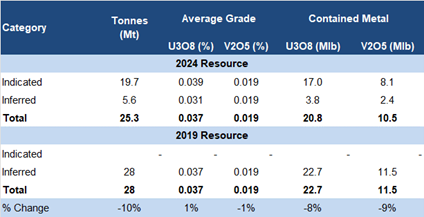

Updated Resource Estimate - Ivana

Ivana hosts a medium-sized/low-grade resource

Currently, indicated resources account for 80% of total resources vs nil in the previous estimate, indicating a higher level of confidence

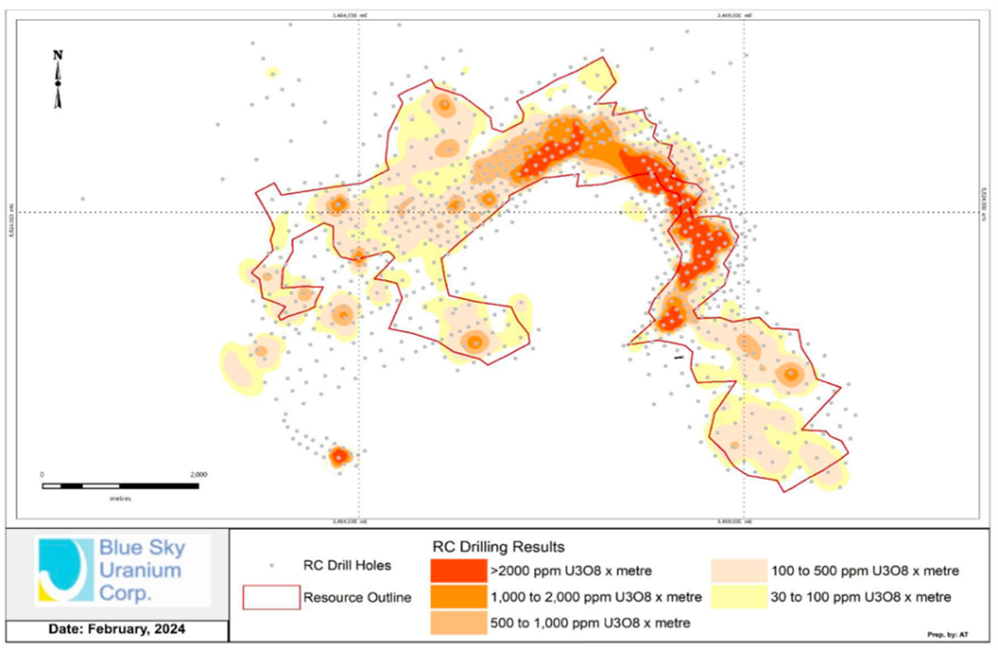

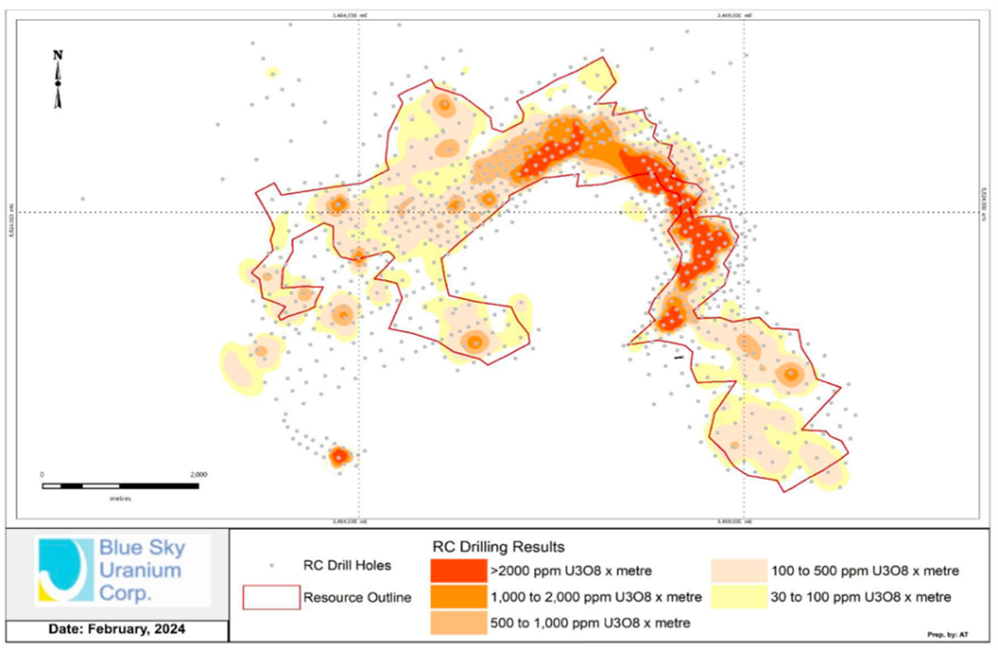

Ivana Deposit

Source: Company

Total resources decreased by 10% due to pit optimization, and the exclusion of resources outside the pit envelope

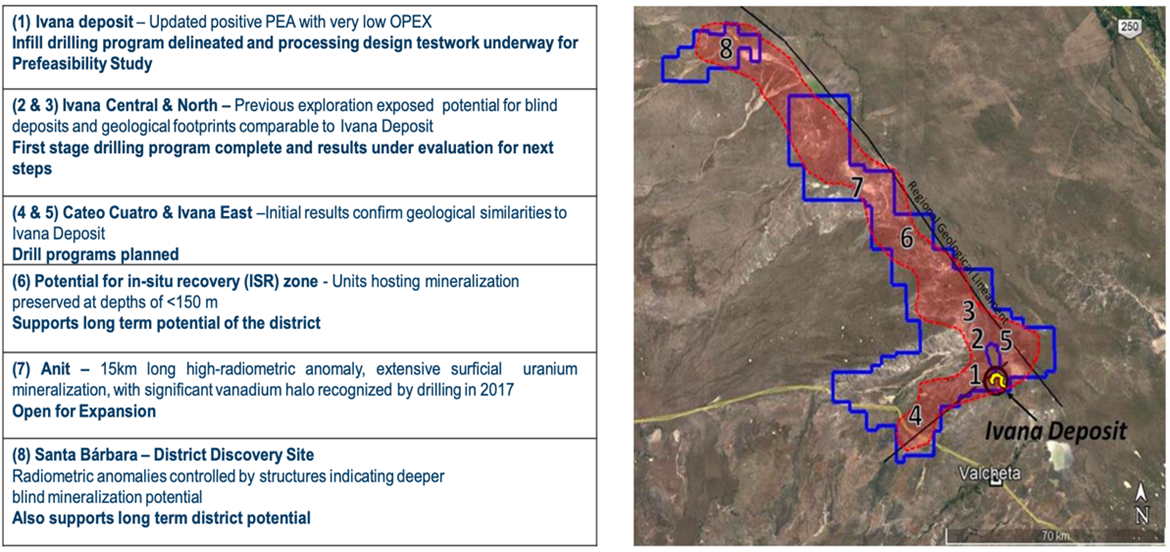

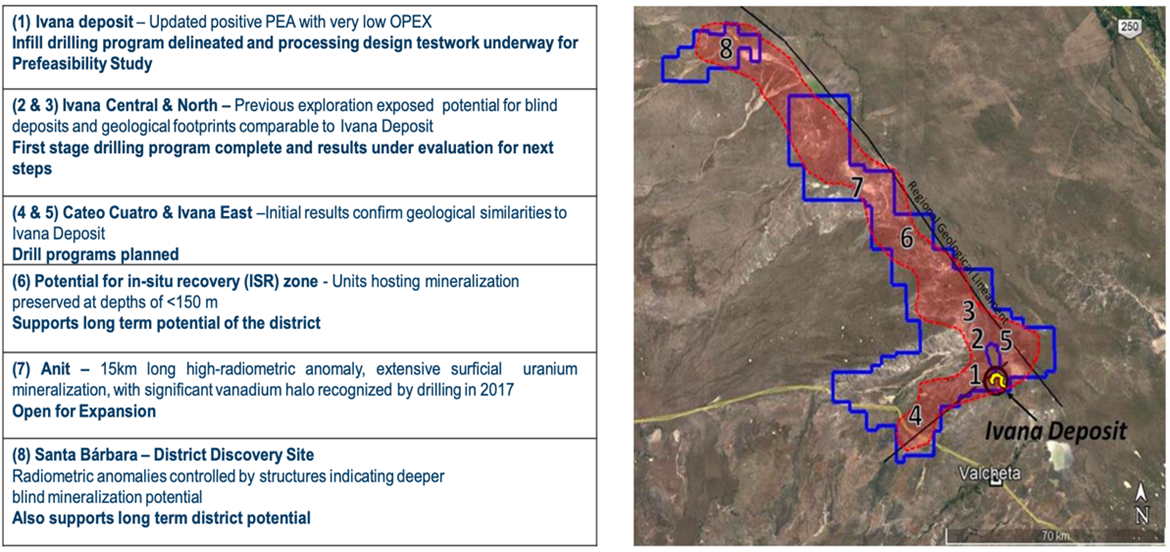

Resource Expansion Potential

Source: Company

We believe there is potential for resource expansion as multiple targets remain untested

Management plans to continue resource expansion and upgrade drilling, along with engineering studies, before completing a prefeasibility study.

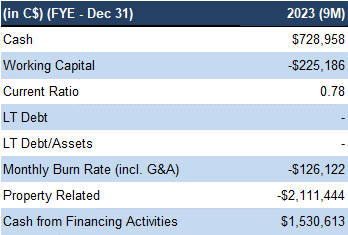

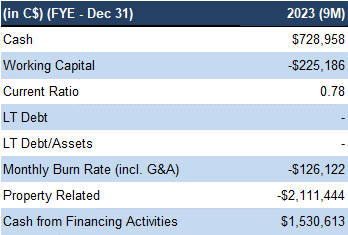

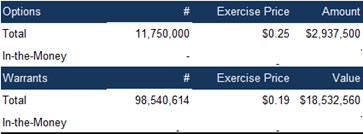

Financials

Source: FRC/Company

Subsequent to Q3-2023), BSK raised $1.5M through an equity financing

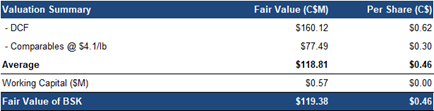

FRC Valuation

Source: FRC/S&P Capital IQ/Various

Source: FRC/S&P Capital IQ/Various

BSK is trading at $0.79/lb (previously $1.53/lb) vs the sector average of $4.09/lb (previously $3.74/lb)

Source: FRC

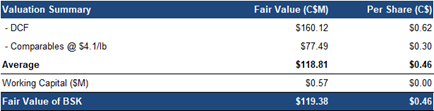

We are reiterating our BUY rating, and adjusting our fair value estimate from $0.38 to $0.46/share (the average of our DCF and comparables valuations). We believe the uranium sector is primed for consolidation, given the highly vulnerable supply chain. AI advancements, being highly energy-intensive, are poised to escalate energy consumption growth. Therefore, we anticipate majors will likely pursue M&A to secure long-term supply of energy sources, such as uranium.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- Uranium prices

- Exploration and development

- Geopolitical and FOREX

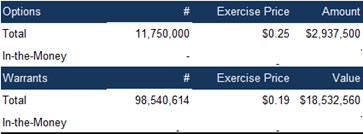

- Access to capital and share dilution

Source: FRC/S&P Capital IQ/Various

Source: FRC/S&P Capital IQ/Various