Tudor Gold Corp.

Expands & Upgrades Resources Amid Rising M&A Activity

Published: 3/14/2024

Author: Sid Rajeev, B.Tech, CFA, MBA

Sector: Basic Materials | Industry: Gold

| Metrics | Value |

|---|---|

| Current Price | US $0.9 |

| Fair Value | US $2.48 |

| Risk | 5 |

| 52 Week Range | US $0.80-1.83 |

| Shares O/S (M) | 229 |

| Market Cap. (M) | US $206 |

| Current Yield (%) | n/a |

| P/E (forward) | n/a |

| P/B | 1.8 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

Highlights

TUD has completed an updated resource estimate for its 60% owned Treaty Creek project, located in the Golden Triangle, B.C.

Resources increased by 10% to 34 Moz AuEq (78% gold + 22% copper/silver). Eighty-two percent of resources are in the indicated category vs just 76% for the previous estimate, implying a higher level of confidence.

The weighted average grade was up 10% to 1.20 g/t AuEq, implying potential for lower OPEX/CAPEX.

We believe there is resource expansion potential as the Goldstorm deposit remains open in multiple directions. In addition, multiple high potential targets remain untested.

Management intends to continue resource expansion drilling prior to completing a maiden Preliminary Economic Assessment (PEA), possibly by 2025.

Gold has surpassed its previous high, and is currently trading at US$2,170/oz. We maintain a positive outlook on gold given the potential weakness in the US$, fueled by the Fed's relatively dovish stance compared to other central banks.

Upcoming catalysts include resource expansion drilling, and a PEA. We believe TUD is a promising M&A candidate as Treaty Creek is one of the largest undeveloped gold projects in the world.

M&A activities in the junior gold sector are on the rise. Notable transactions include Calibre Mining’s (TSX: CXB) acquisition of Marathon Gold for $345M, Yintai Gold’s (SZSE: 000975) acquisition of Osino Resources (TSXV: OSI) for $368M, and Silvercorp Metals’s (TSX: SVM) acquisition of Orecorp (ASX: ORR) for $186M.

Resource Update

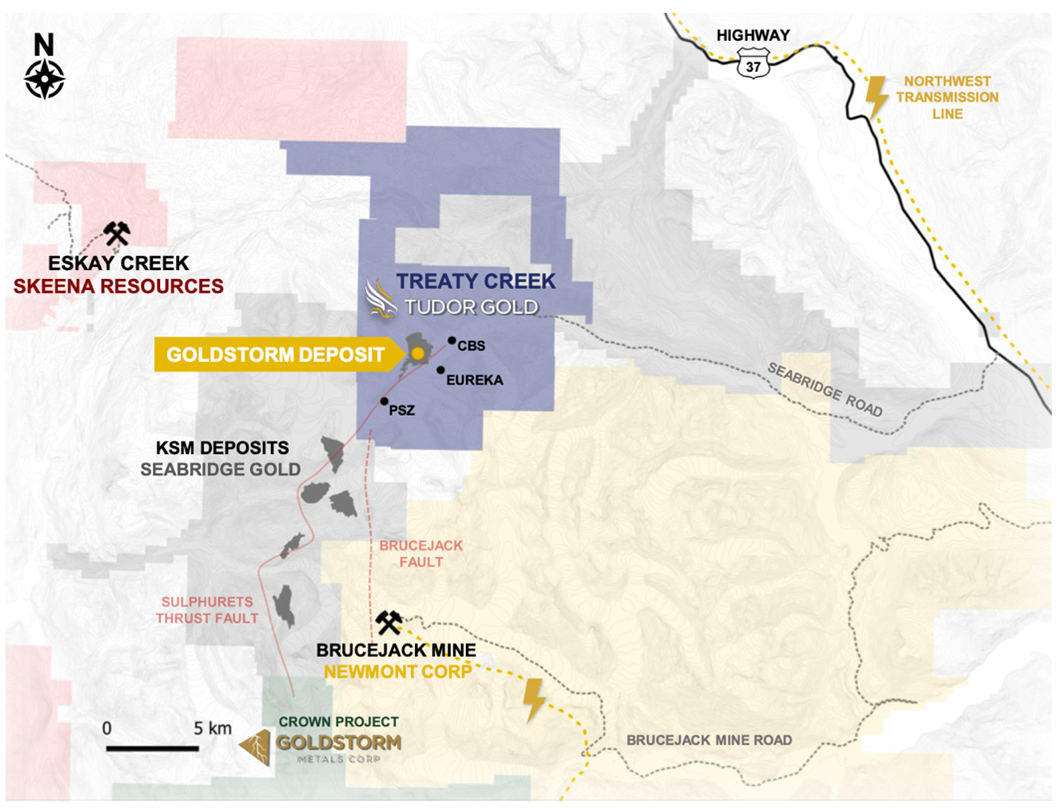

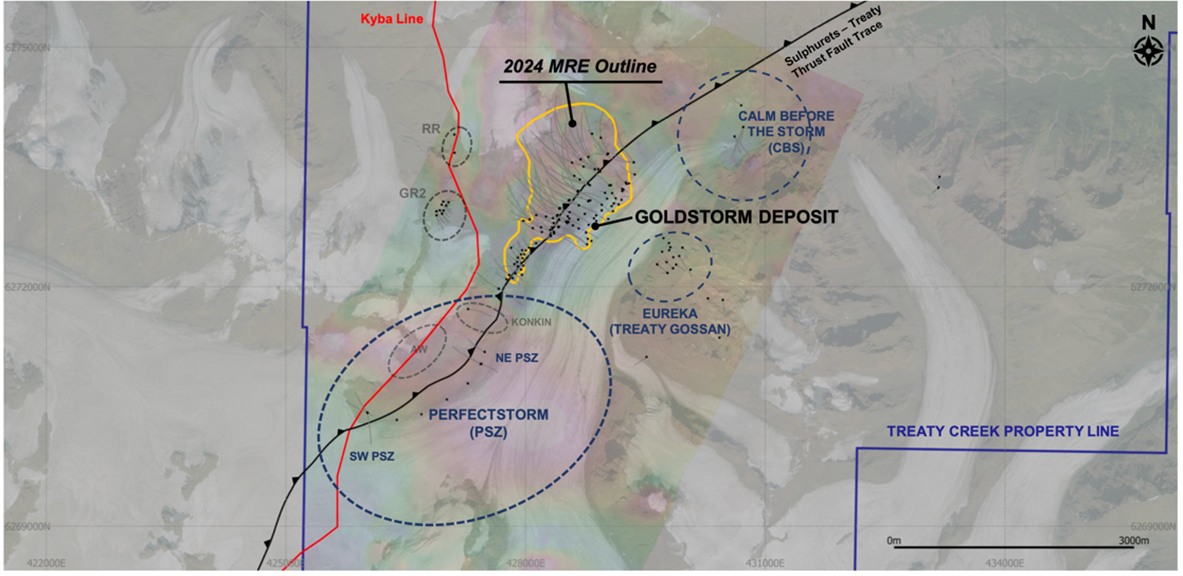

Project Location

Source: Company

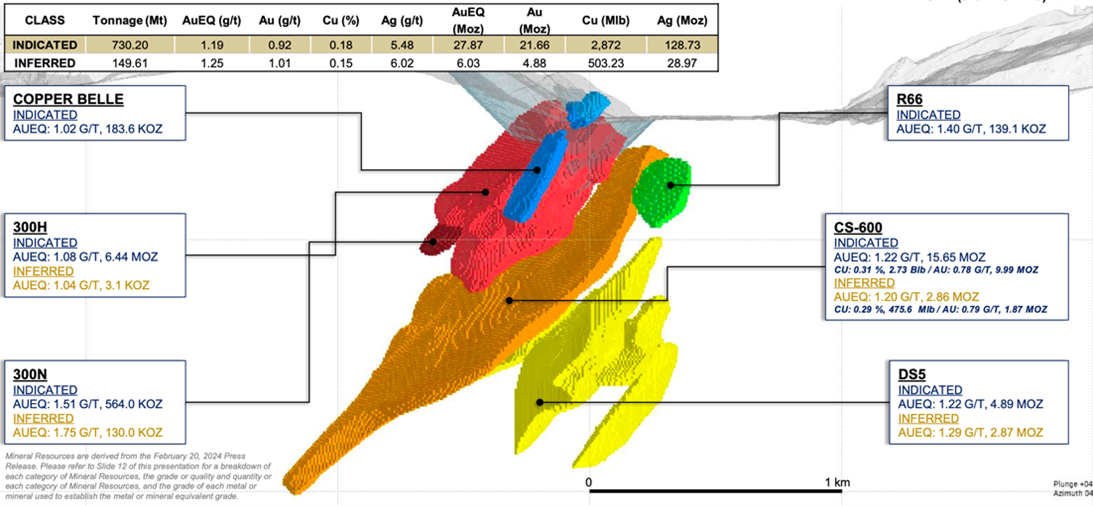

The updated resource was based on 175,719 m/225 drill holes. Resources are located within a porphyry system, measuring 2.5 km long x 1.5 km wide x 1.5 km deep.

The Treaty Creek project is owned by TUD (60%), American Creek Resources Ltd. (TSXV: AMK/MCAP: $71M/20%), and Teuton Resources (TSXV: TUO/MCAP $82M/20%)

Near Seabridge Gold’s (TSX: SEA/MCAP: $1.6B) KSM property, and Newmont’s (NYSE: NEM) Brucejack mine

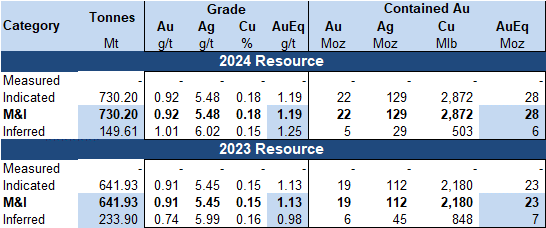

Treaty Creek Resource Estimate

Source: Company

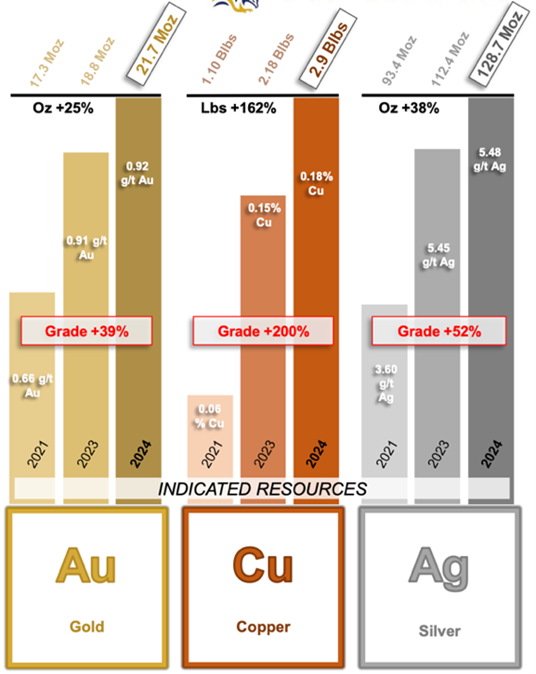

Resources increased by 10% to 34 Moz AuEq, driven by higher grades

The weighted average grade increased by 10% to 1.20 gpt AuEq

82% of resources are in the indicated category vs 76% for the previous estimate, implying increased confidence

Resource Estimate by Metal

Gold accounts for 78% of gold equivalent resources (previously 75%), while silver and copper account for the remaning 22% (previously 25%)

Resource Estimate (Goldstorm) by Domain

Resources are spread across five gold-dominant domains (Copper Belle, 300H, R66, 300-N, and DS-5) and a gold-copper rich zone (CS-600)

We believe there is potential for resource expansion as the Goldstrom deposit remains open in multiple directions

Resource Upside Potential

Source: Company

In addition, drilling has identified several high potential targets, such as the Perfect Storm (PFS), Eureka, and Calm Before the Storm (CBS)

We anticipate a maiden PEA in 2025

Management is planning additional resource expansion drilling, and metallurgical studies, prior to completing a PEA.

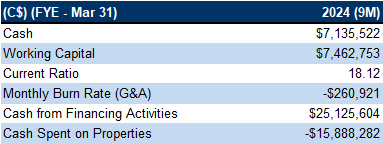

Financials

Source: FRC/Company

Strong balance sheet

In-the-money options can bring in up to $6M

Source: FRC/Company

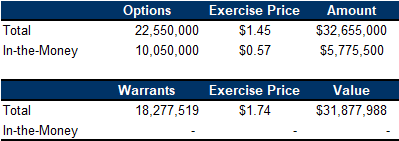

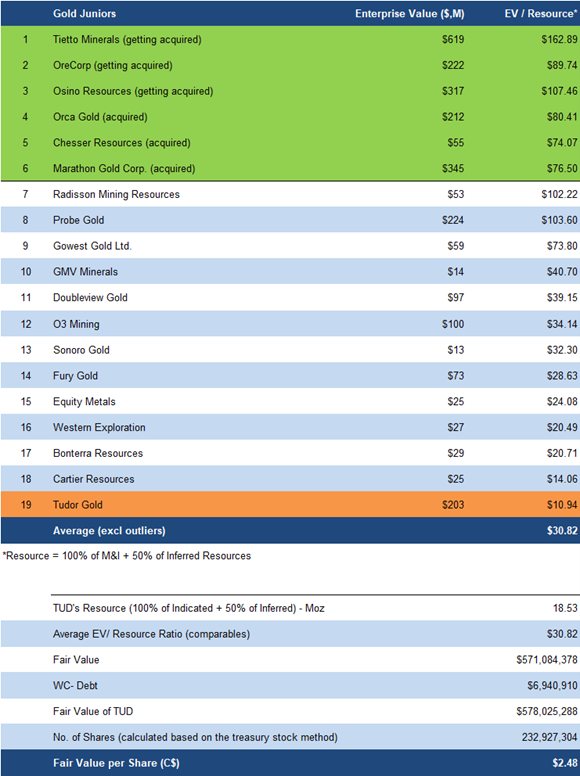

FRC Valuation

Source: FRC/Various/S&P Capital IQ

TUD is trading at $11/oz (previously $9/oz) vs the sector average of $31/oz (previously $28/oz)

Our comparables valuation increased from $2.14 to $2.48/ share, primarily due to higher resources

Risks

The following, we believe, are the key risks of the company:

- The value of the company is dependent on gold prices

- No NI 43-101 compliant economic studies

- Exploration and development

- Access to capital and potential for share dilution

- Permitting

- Tudor has agreements in place with First Nation groups in the region. That said, we believe long-term local support is key for project development.

- Ongoing dispute with Seabridge Gold’s proposed tunnel route, which overlaps Tudor’s mineral claims; we believe both parties stand to benefit from reaching a mutually favorable pathway to advance their projects to production, avoiding delays.