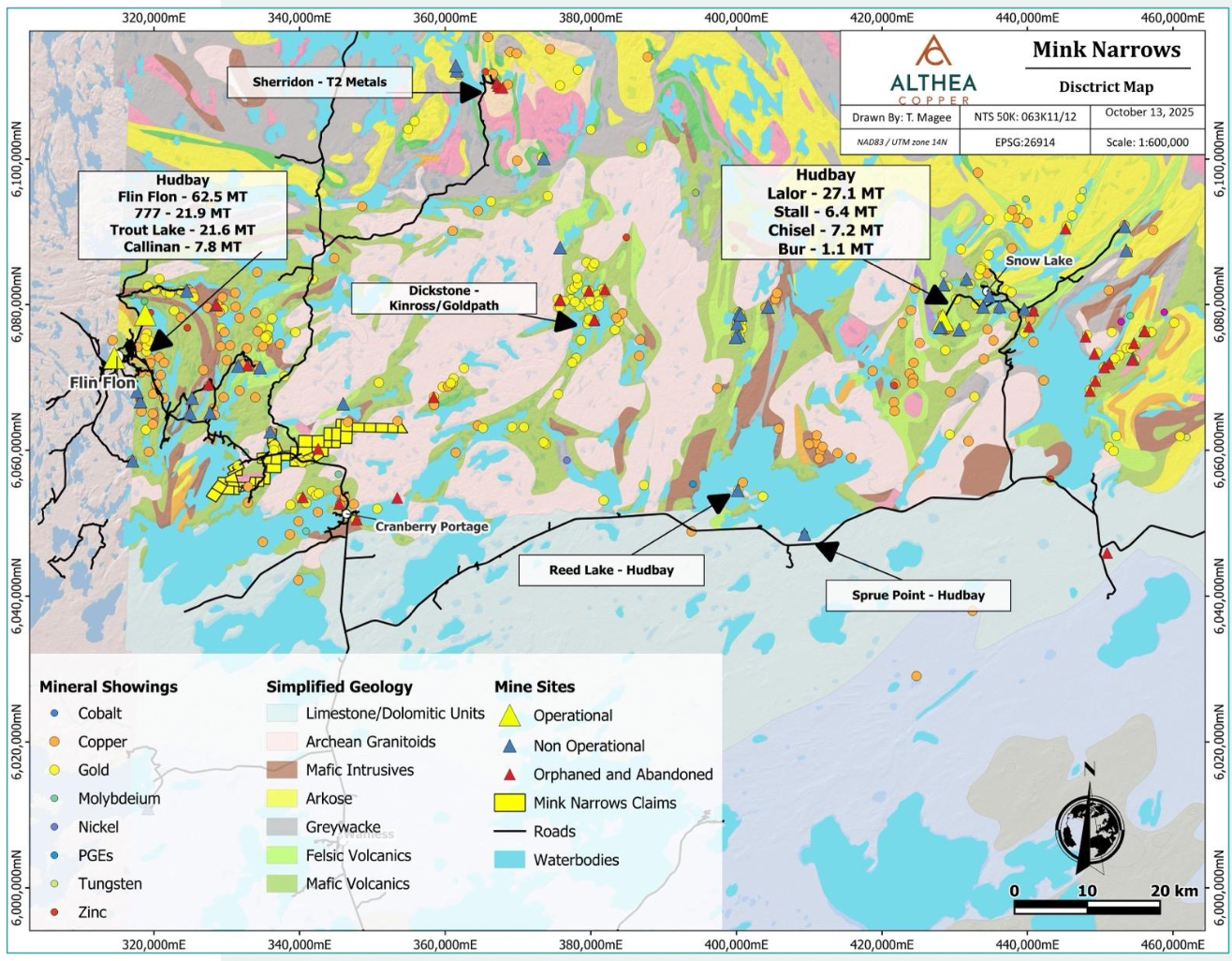

- The company is focused on delineating a maiden resource estimate for its Mink Narrows copper-polymetallic project in Manitoba, located in the Flin Flon–Snow Lake mining district, a prolific Canadian greenstone belt dominated by Hudbay.

- The project is near several well-known projects. We were among the first analysts to cover Foran Mining (TSX: FOM) back in 2017, which has become one of the region’s most successful stories, with its MCAP rising from $43M to $2B. Another regional copper junior we covered, Rockcliff Metals, was acquired by Hudbay in 2023.

- Mink Narrows is prospective for multiple types of mineralization, including copper-zinc, gold, and nickel-copper, with the primary focus the Copper Reef VMS copper-zinc target, which hosts a non-compliant high-grade historic resource. VMS deposits often occur in clusters (1–20 Mt), and collectively they can form major mining districts or camps.

- We believe there is significant upside potential beyond the historic resource, as mineralization remains open in multiple directions, and several geophysical anomalies are untested.

- Management is planning an initial nine-hole, 3,400 m drill program across four high-priority targets, aiming to complete a maiden resource estimate by Q4-2026.

- Copper prices are up 19% YoY to US$4.97/lb. We maintain a positive outlook, anticipating continued US$ weakness, slow production growth, and recent supply disruptions. Per consensus estimates, the market is expected to shift from a surplus in 2025, to a deficit in 2026.

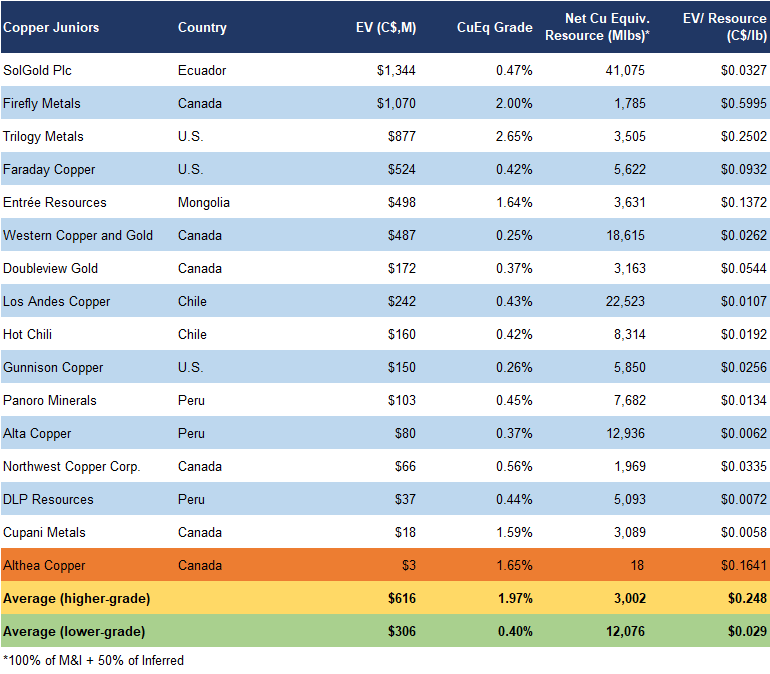

- At the IPO financing price of $0.30/share, Althea’s historic resources are valued at $0.16/lb vs. the sector average of $0.25/lb for high-grade copper juniors, a 34% discount.

- Upcoming catalysts include the IPO, a geophysical survey, and drilling.

| |

YTD |

12M |

| KIDZ |

50% |

25% |

| TSXV |

13% |

15% |

* Qualified Person: Ty Magee, M.Sc., P.Geo., Axiom Exploration

* Althea Copper has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions.

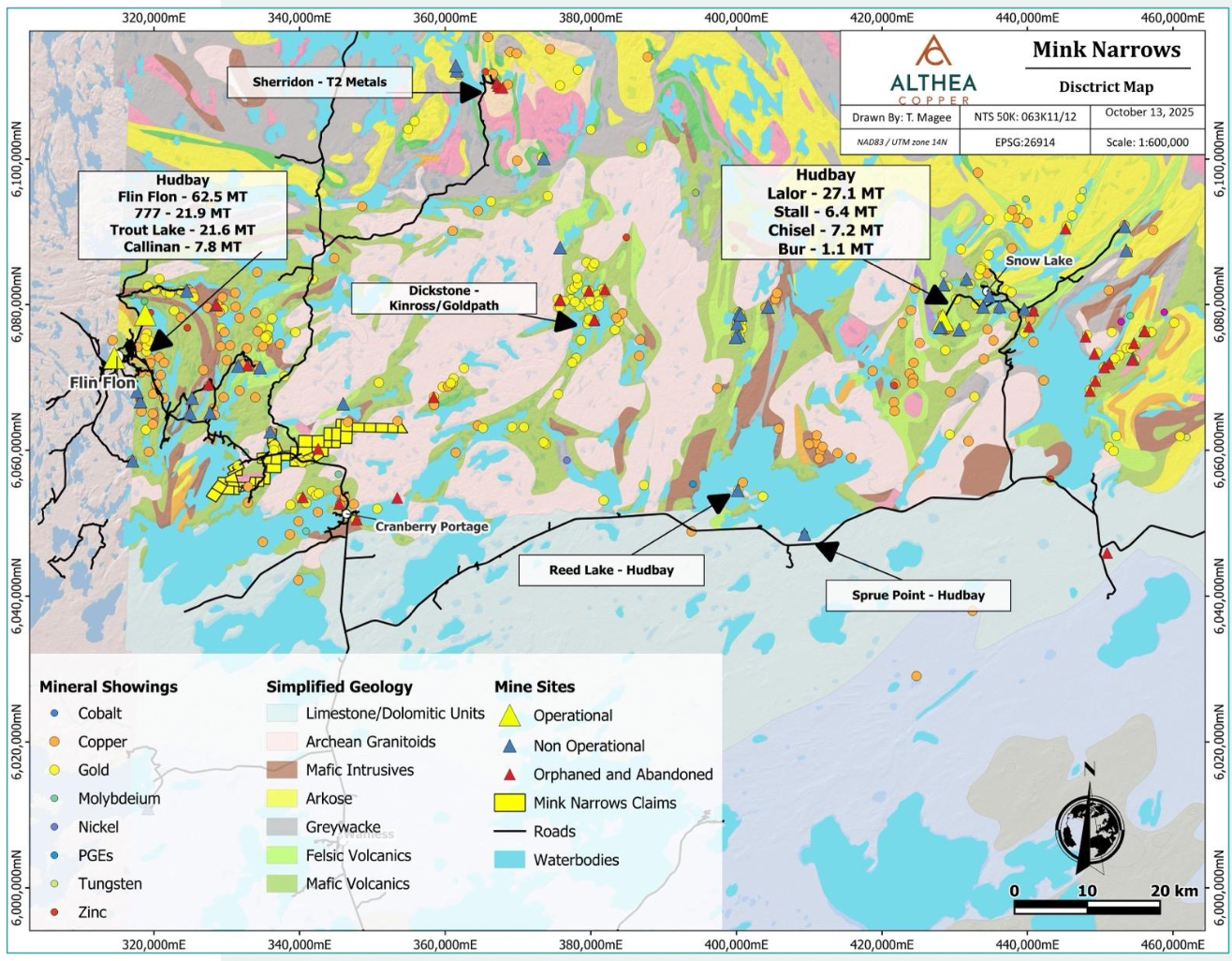

Mink N arrows Polymetallic Project , Manitoba - O ption to earn a 100% interest

Althea’s flagship 6,984-hectare project is located in the Flin Flon–Snow Lake mining district, a prolific greenstone belt in Canada.

District-scale land package

Project Location Map

Source: Company

Located 24 km southeast of Flin Flon, Manitoba, near several well-known projects held by majors

~150 Mt mined from 30+ deposits in Flin Flon–Snow Lake, with 100+ deposits identified

Hudbay dominates the region

Excellent infrastructure in place, including access to roads, rail, water, power, and a skilled workforce

History, Mineralization and Historic Resource

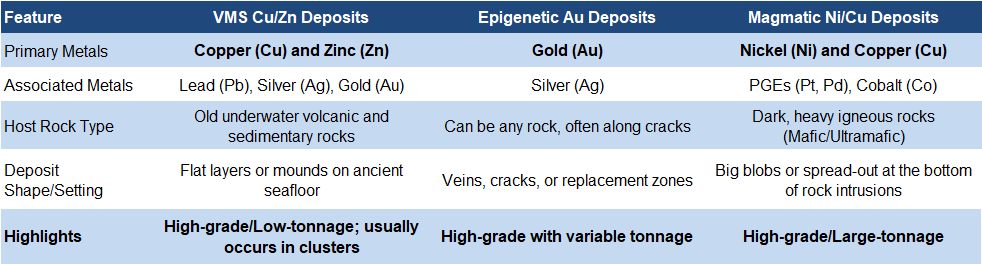

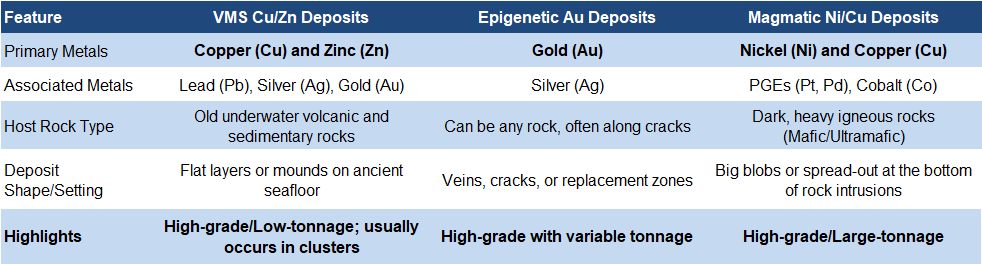

With exploration dating back to the 1920s, Mink Narrows hosts multiple mineralization types—VMS copper-zinc, epigenetic gold, and magmatic nickel-copper.

Deposit Types

Source: FRC / Various

Althea is primarily focused on the Copper Reef VMS target

A brief overview of VMS deposits: Copper sulfides form in the hotter, central parts of VMS systems, while zinc sulfides occur farther out. VMS deposits often occur in clusters (1–20 Mt) , and collectively they can form major mining districts or camps. Canada hosts three major VMS camps: Flin Flon–Snow Lake (Saskatchewan–Manitoba), Bathurst (New Brunswick), and Noranda (Quebec). Smaller deposits (<4 Mt) are usually found from surface to ~300 m depth, whereas larger deposits (>10 Mt) commonly extend to depths of 1,000–2,000 m.

VMS deposits often cluster, forming mining camps

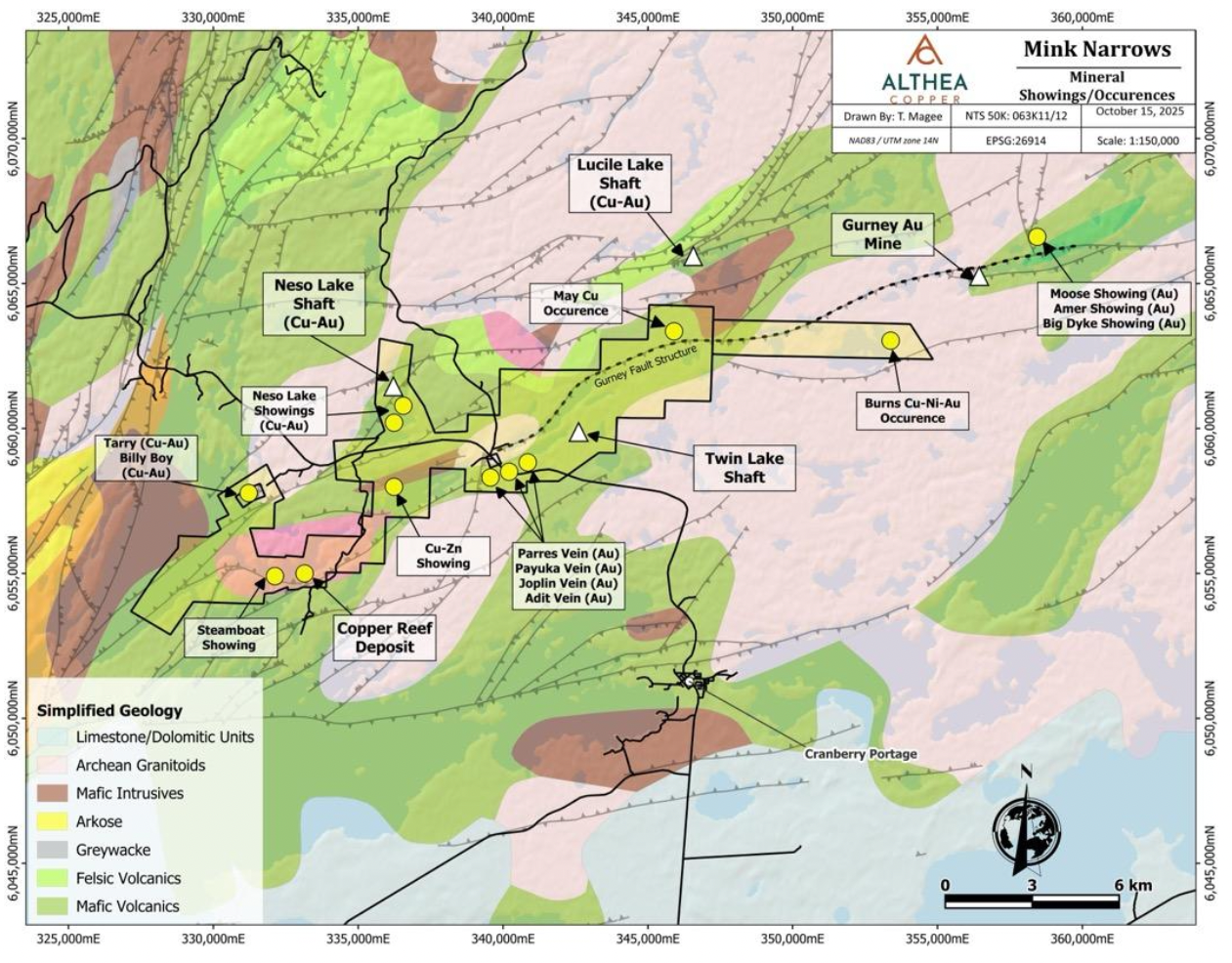

Targets

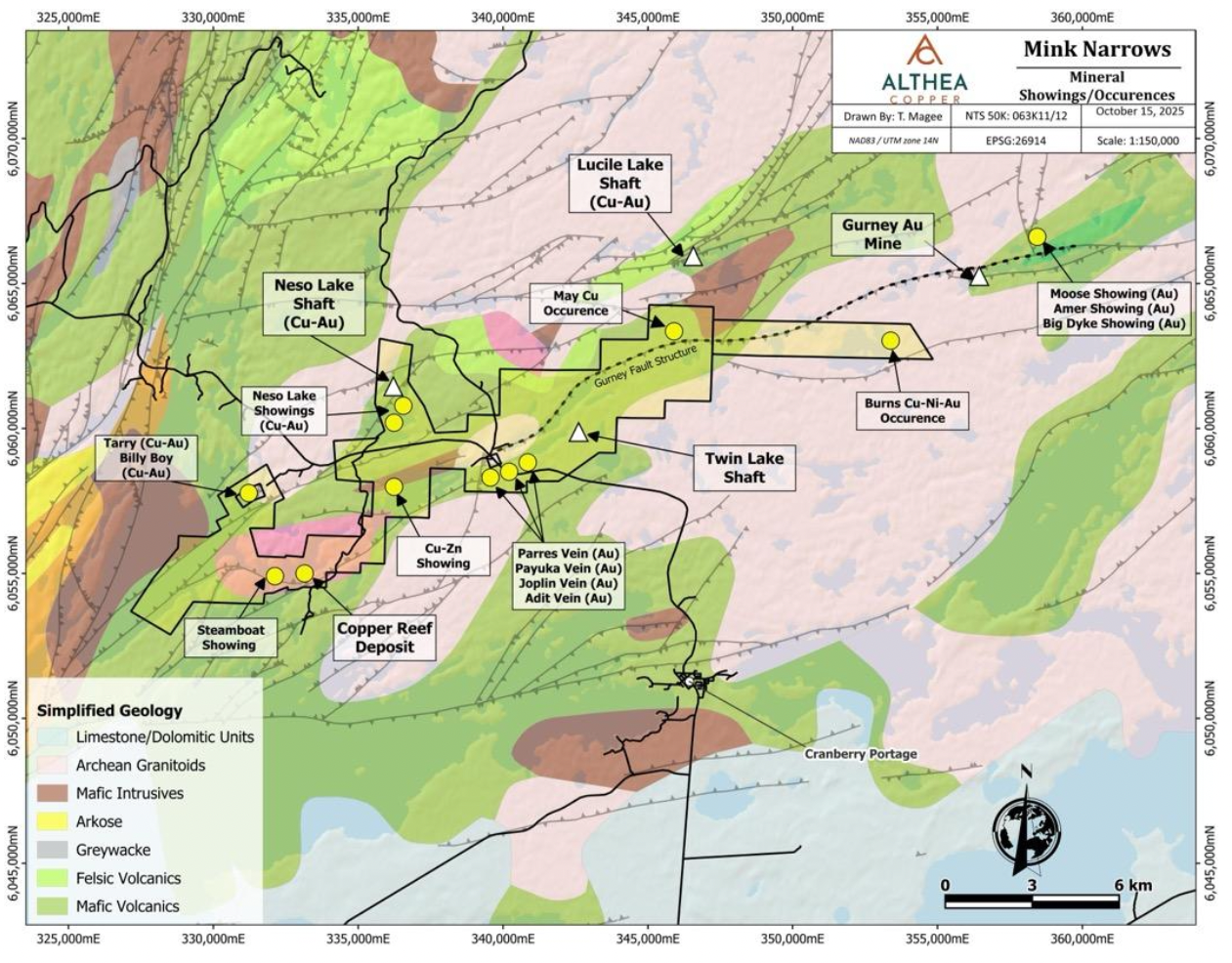

The flagship Copper Reef target accounts for 5-10% of the project area

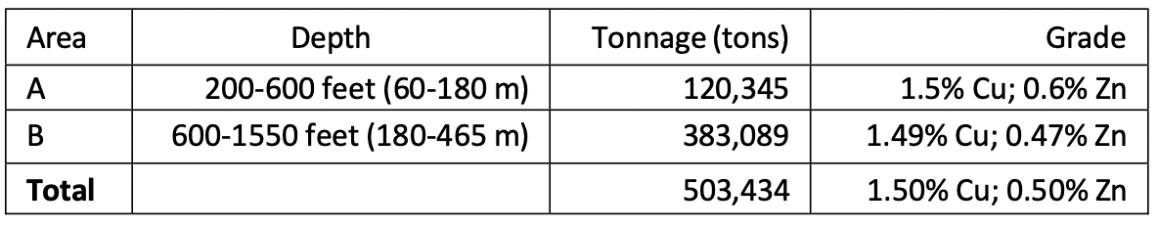

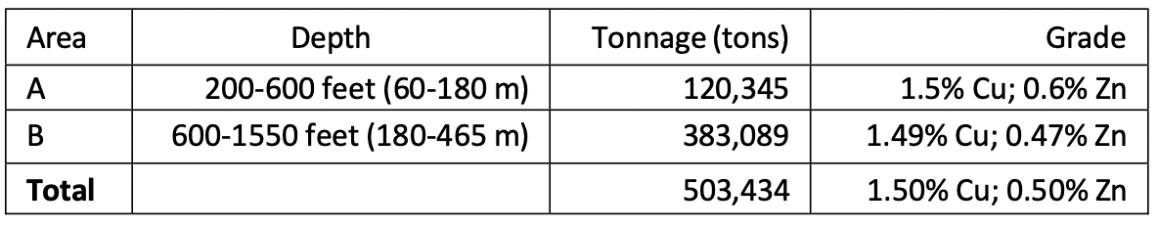

Copper Reef : Historic Resources (1969)

Source: Company

A 1969 study delineated a high-grade, small-tonnage VMS deposit, containing 16.5 Mlbs of copper, and 5.5 Mlbs of zinc

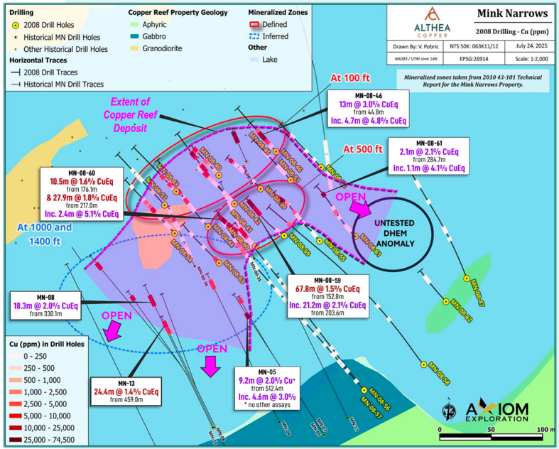

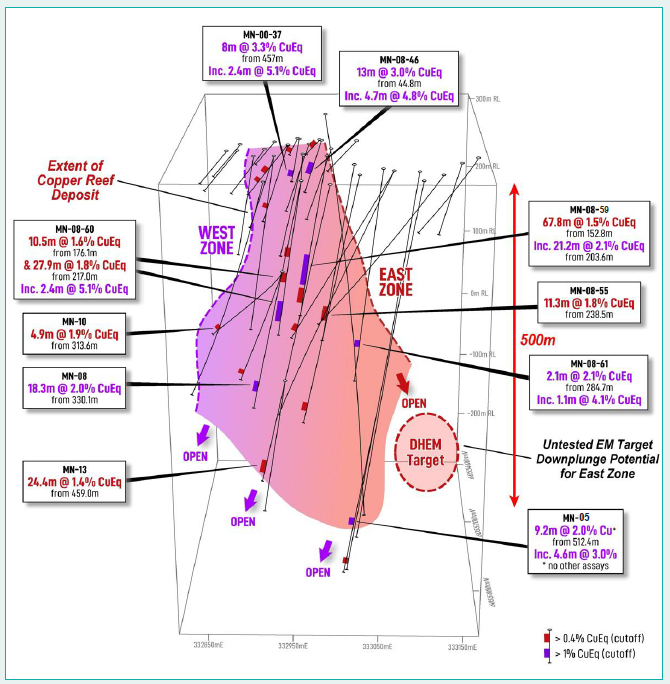

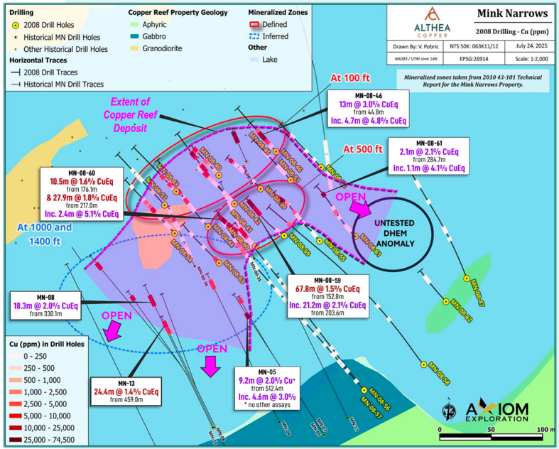

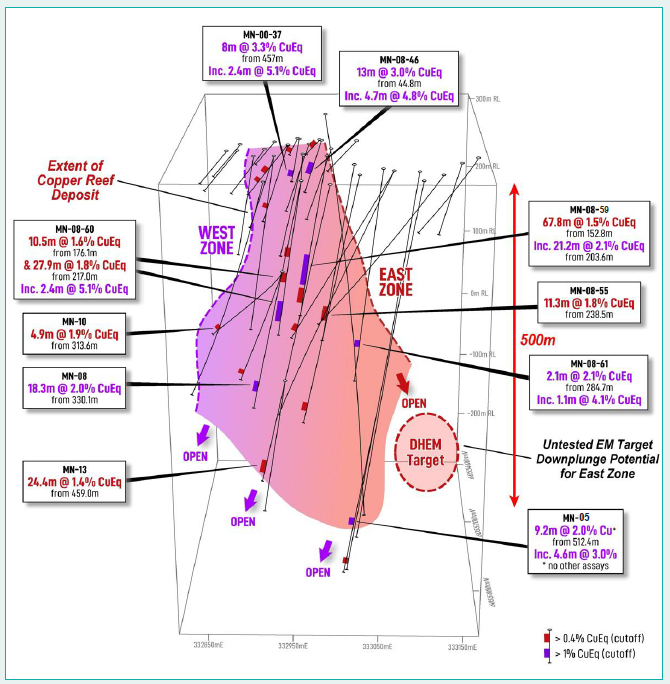

Post-2000 drill programs reported large bulk-tonnage style intercepts, including up to 67.8 m grading 1.5% CuEq, and several high-grade intercepts such as: 4.0 m at 4.95% Cu , 19.7 g/t Ag, 0.32 g/t Au, and 3.1 m at 13.9 g/t Au , 1.7% Cu, 2.0% Zn.

Copper Reef Resource Upside

The Copper Reef target hosts multiple high-grade VMS-style shoots

Mineralization has been traced to over 500 m depth and remains open in several directions

Source: Company

We believe there is significant expansion potential beyond the historic resource, as mineralization is open along multiple directions, and several geophysical anomalies remain untested

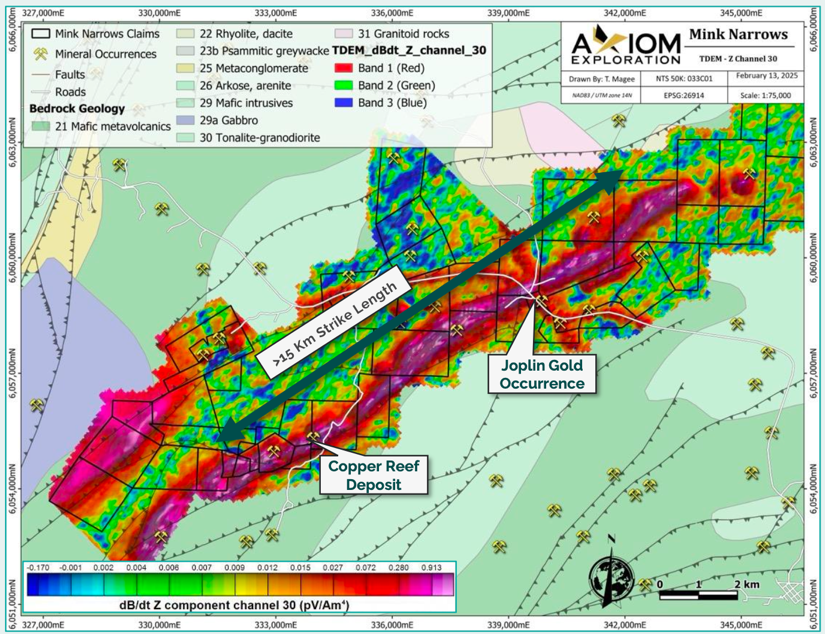

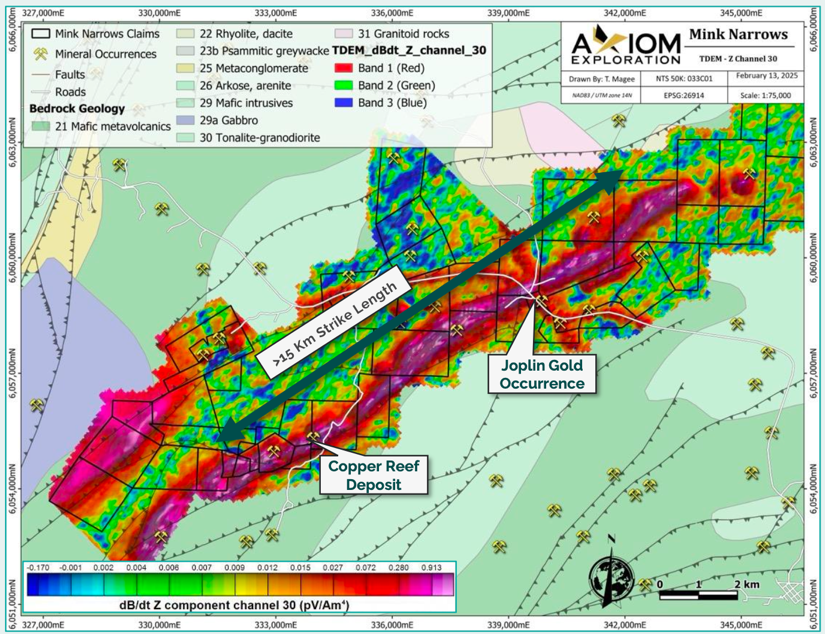

Last year, Althea completed a property-wide geophysical survey, delineating a major conductive body over 15 km long and open at depth, along with several new targets.

Geophysical Anomalies

Source: Company

Four drill-ready targets along a >15 km trend

Exploration Strategy

According to the property’s technical report completed earlier this year, approximately 25 drill holes (4,129 m) have been completed since the historical resource estimate, confirming and expanding the non-compliant historical resource .

Copper Reef Exploration Strategy

Source: Company

Total budget over 24 months: $3.6M

Management aims to complete a maiden NI 43-101 compliant resource estimate by Q4-2026

Management is focused on confirming the Copper Reef mineralization , and exploring opportunities to expand the existing mineralized envelope. Upcoming work will include further geophysical surveys , and an initial nine hole/3,400 m drill program ( pending permits ) at four high-priority targets along the Copper Reef trend .

Management and Board

Brief biographies of the management team, as provided by the company, follow:

Lowell Kamin , CEO , Chairman & Founder

- Founded Althea Copper Corp in 2022

- 30+ years of capital markets experience (Scotia Capital, BofA Merrill Lynch)

- Worked with Kinross, Hudbay; supported Kinross–Red Back Mining transaction

Management, Board members, and advisors hold more than 70% of the shares, maintaining a tightly held structure

Randene Seeman, President & Director

- 25+ years in land, regulatory, compliance, and project execution

- Formerly with Shell Canada and other industry leaders

- Deep expertise in government relations, vendor management, cost optimization

Leo Horn, Technical Advisor

- 25+ years global exploration & mining experience in precious, base and critical metals as well as uranium and diamonds

- Led high-grade uranium discoveries in Athabasca Basin

- Also Technical Director at Lodestar Metals (TSX-V) and Cosmos Exploration (ASX) and technical advisor for several other companies

The IPO will broaden the public float

Doug Engdahl, Advisor

- President & CEO of Axiom Exploration

- Professional Geologist with applied geostatistics background

The team brings experience from major companies including Hudbay, Kinross, and Shell

Richard Masson , Advisor

- 20+ years across Manitoba/Saskatchewan

- President & CEO of Boreal Gold

- Formerly with M’Ore Exploration and Voyageur Minerals

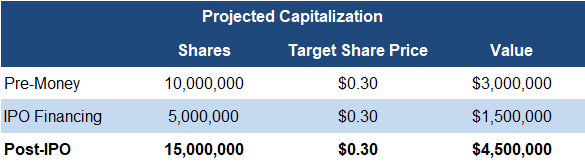

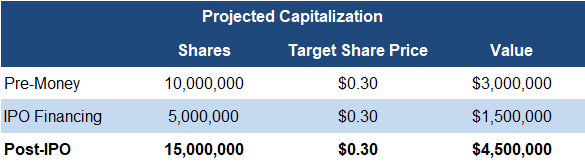

Capital Structure

Source: Company /FRC

Management intends to raise $1.5–$2.0M through the IPO in Q4-2025, with a subsequent larger raise of $3–$5M planned in 2026

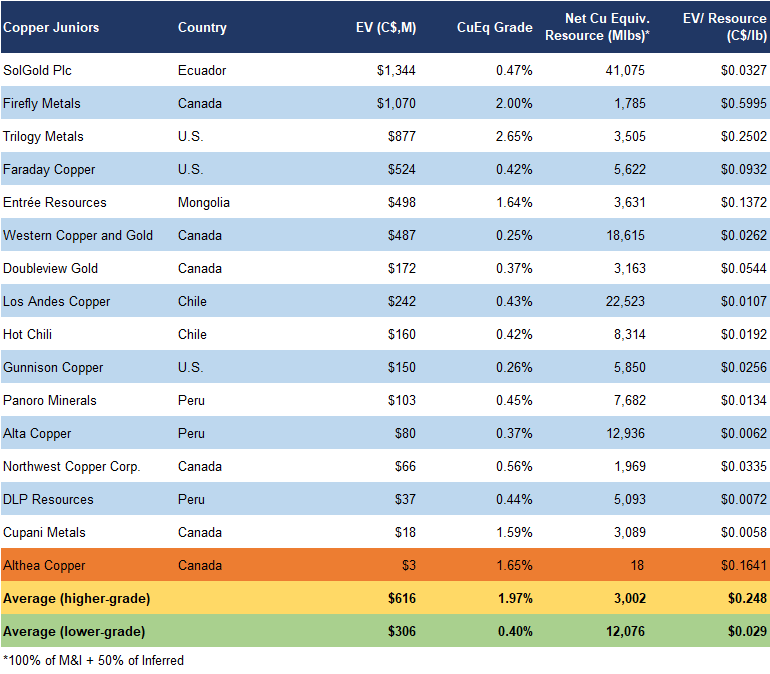

Comparables Valuation

Source: FRC / S&P Capital IQ / Various

At the IPO financing price of $0.30/share, Althea’s historic resources are valued at $0.16/lb, compared with a sector average of $0.25/lb for high-grade copper juniors, a 34% discount

Applying the sector average, we estimate a pre-IPO valuation of $0.45/share, and a post-IPO valuation of $0.40/share, assuming IPO financing at $0.30/share

This valuation is based solely on Althea’s historic resources and excludes any potential upside

Conclusion

Althea Copper presents a pre-IPO opportunity in a relatively under-the-radar junior. It offers exposure to an early-stage, high-grade project in a region dominated by Hudbay, which has a strong track record of acquiring promising juniors. Based on our comparable valuation, we believe the IPO is priced at a discount. Multiple catalysts lie ahead, including the IPO, geophysical surveys, and a maiden drill program

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- Commodity prices

- Access to capital and potential share dilution

- Exploration and development

- No NI 43-101 compliant resource

- Permitting

We are assigning a risk rating of 5 (Highly Speculative)