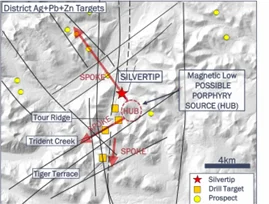

The company has completed a geophysical survey, and a drill program, at its Silverknife project in B.C. This property is just 1.1 km from Coeur Mining’s (NYSE: CDE/MCAP: $1.4B) Silvertip mine; one of the highest-grade silverzinc-lead mines in the world. Silverknife has historic resources totaling 17 Moz AgEq within high-grade veins.

CMB is planning a multi-phase study to identify new exploration targets at the Silver Hart project (located 55 km north of Silverknife), which hosts high-grade inferred resources totaling 7.5 Moz AgEq, grading 584 g/t.

We maintain a positive outlook on silver/gold prices, in light of the anticipated rate cuts by the Fed, and as we anticipate inflation to remain above its historic average in 2024.

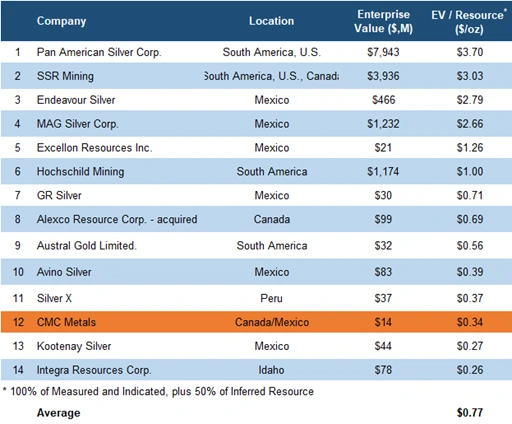

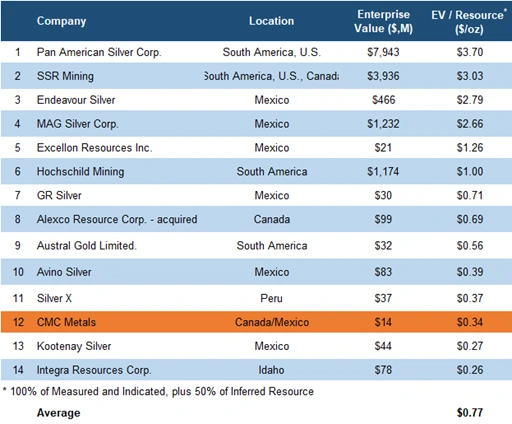

CMB is trading at $0.34/oz AgEq vs the sector average of $0.77/oz, implying a 56% discount.

Upcoming catalysts include drilling at Gavilanes, as well as positive sentiment towards gold/silver juniors.

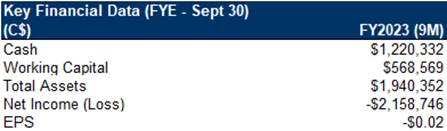

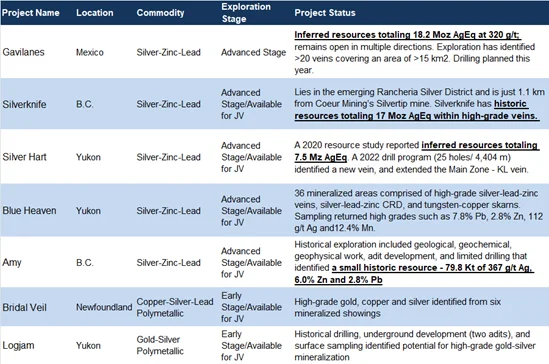

Portfolio Summary

Targeting silver-focused polymetallic projects in Canada, and Mexico

Four properties with resource estimates

Although Gavilanes is the company’s new flagship project, management remains committed to advancing the Rancheria silver district projects in B.C. and Yukon, while seeking JV partners

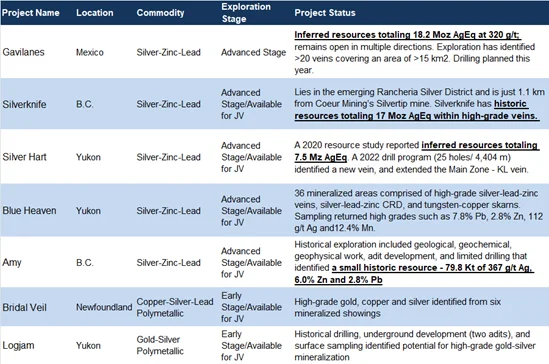

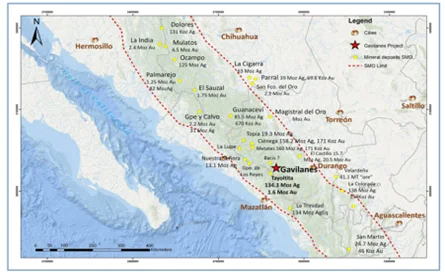

Gavilanes Project, Mexico

Last month, CMB entered into an option to acquire this project through back-ended weighted staged payments through 2026, totaling $10M in cash, shares and exploration expenditures. Gavilanes is located in the San Dimas district, known for producing 11+ Moz gold, and 580+ Moz silver.

Location Map

Source: Company

Located in the prolific Sierra Madre Occidental province in southwestern Durango

23 km northeast of First Majestic Silver’s San Dimas/Tayoltita mine, which hosts 134 Moz Ag, and 1.6 Moz Au

The property hosts an intermediate to low sulphidation epithermal deposit, with inferred resources totaling 18.2 Moz AgEq at 320 g/t.

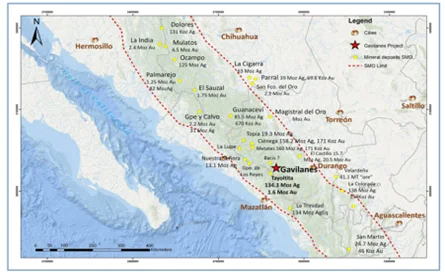

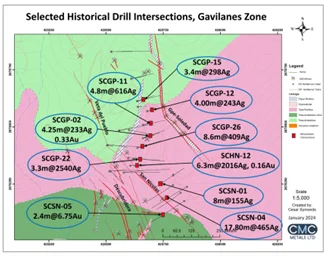

Historical Drill Highlights

Gavilanes hosts a small tonnage, epithermal deposit; epithermal deposits typically host high grades

61 holes (13,011 m) drilled to date

Three mineralized zones including the Gavilanes, Central, and Western zones

18.2 Moz in inferred resources spread across <2% of the Gavilanes zone

Source: Company

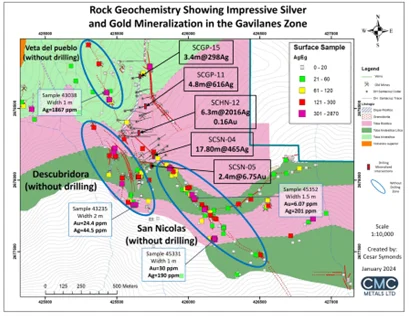

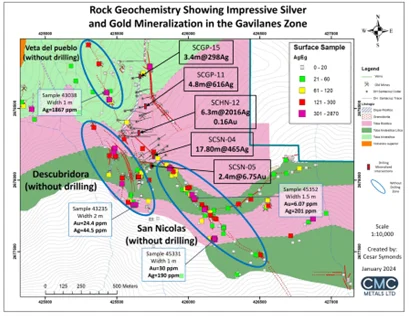

Recent mapping and sampling have identified 20+ veins, and several breccia zones, in the Gavilanes zone

The project is currently permitted for 4,650 m of drilling; CMB aims to drill 35,000-50,000 m during 2024-2026

Ejido Los Gavilanes (a communal agrarian cooperative), which owns surface rights in the core area, have had exploration agreements with the previous operators of Gavilanes. CMB has initiated negotiations for a new agreement, aiming to conclude within the next few months.

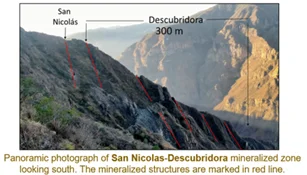

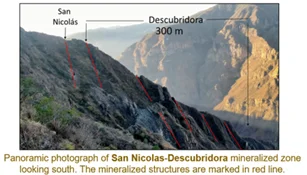

The company intends to conduct resource expansion drilling on the San Nicolas, Descubridora, Guadalupe-Soledad, and Pueblo de Veta veins. Recent sampling of outcrops produced numerous anomalous results. Management believes that Gavilanes shares similarities with the San Dimas/Tayoltita mine, and has potential to host 100M+ oz AgEq.

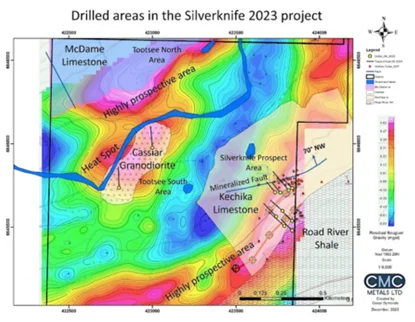

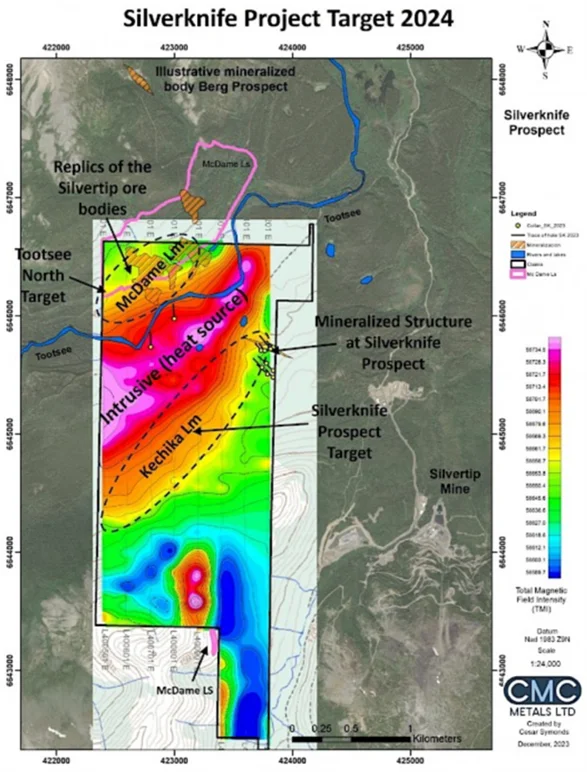

Silverknife Project, B.C.

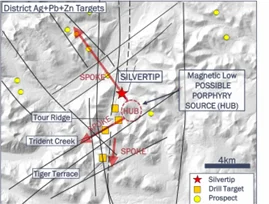

This property is 1.1 km northwest of Coeur’s Silvertip silver-zinc-lead mine, one of the highest-grade silver-zinc-lead mines in the world.

Source: Company

Located in northern B.C., south of the Yukon border

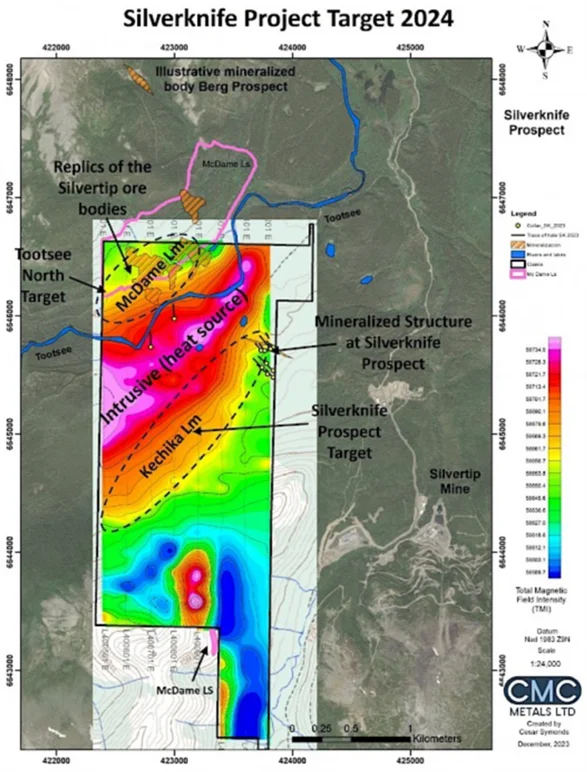

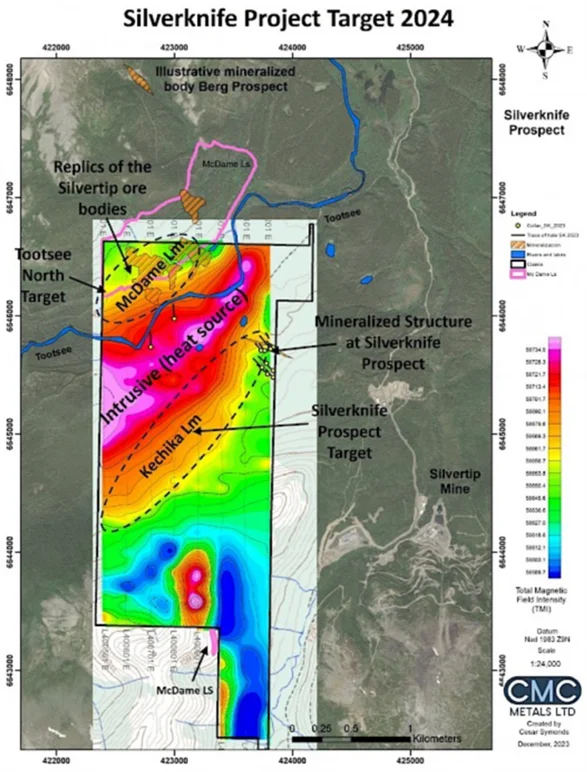

Mineralization at Silverknife is similar to other Carbonate-Replacement Deposits (CRD) in the Rancheria silver district, such as Silvertip

CRDs are typically found in clusters of large ore bodies

Coeur's Exploration Focus

Source: Coeur/FRC

The project has historic resources totaling 17 Moz AgEq. Historic drilling (in the 1980s) returned high weighted average grades of 511 g/t silver, 3.7 gpt gold, 12.5% lead, and 4.8% zinc.

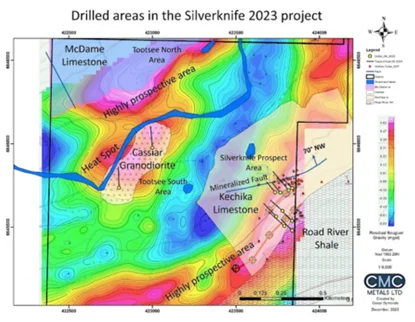

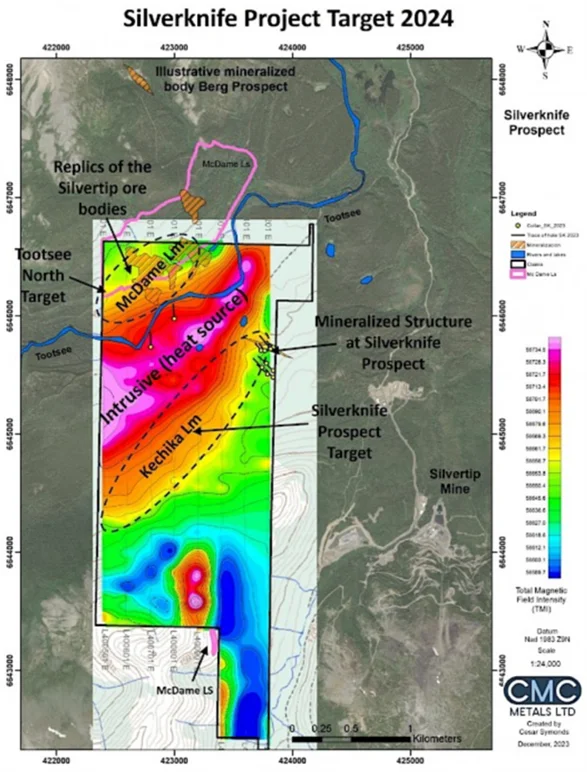

A recent drill program targeting Tootsee South, and the Silverknife prospect, did not return any promising values

The Tootsee North area is underlain by the limestone McDame formation, which hosts the Silvertip mine

Source: Company

In 2024, management intends to assess major structural faults at Tootsee North, and the Silverknife prospect area, to pinpoint potential drill targets

Upcoming Catalysts

• Gavilanes – Enter into an exploration agreement with the Ejido de Los Gavilanes (Q1-2024), drilling (Q2-Q4,2024), followed by an updated resource estimate (Q4-2024/Q1-2025)

• Resume exploration in Rancheria silver district projects (Silver Hart, Blue Heaven, and Silverknife): Q3-2024

• Baseline environmental studies for constructing a route to Amy: Q3-2024

• Secure a new exploration permit for Silver Hart (in progress)

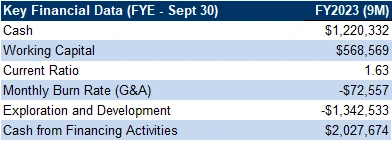

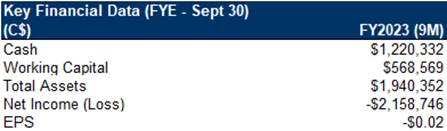

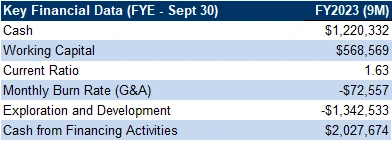

Financials

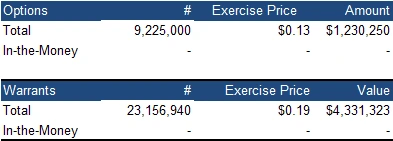

Source: FRC/Company

Healthy balance sheet

Subsequent to Q3-FY2023, CMB raised $0.6M through equity financings, and sold certain non-core assets in California for $1M in cash and shares

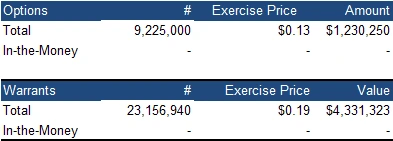

FRC Valuation

Source: FRC/ S&P Capital IQ / Various

Silver juniors are trading at $0.77/oz (previously $1.70/oz)

CMB is trading at $0.34/oz, implying a 56% discount

Applying the sector average multiple of $0.77/oz, we arrived at a fair value estimate of $0.17/share (previously $0.31/share)

For the comparables listed above, we used 100% of M&I resources, and 50% of inferred resources. However, we did not apply any discounts to CMC, and instead used 100% of its inferred and historic resources, given the resource expansion potential of its projects. We are reiterating our BUY rating, and adjusting our fair value estimate from $0.31 to $0.17/share. Upcoming catalysts include drilling, and positive sentiment towards gold/silver juniors.

Risks

We believe the company is exposed to the following risks:

- The value of the company is dependent on commodity prices

- Exploration and development

- Access to capital and potential for share dilution

- No guarantee that the company will be able to advance all its projects simultaneously