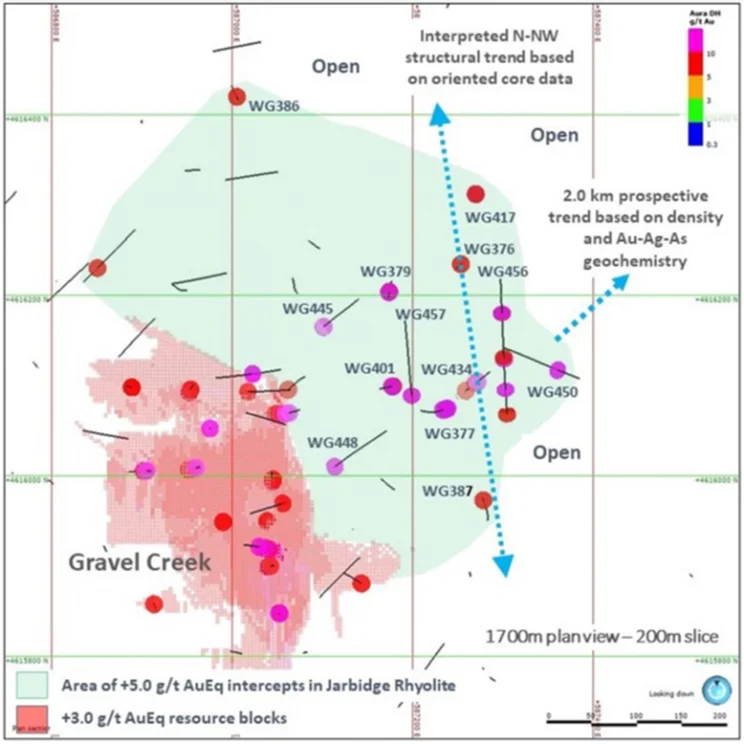

Assay from two holes, located 140 m to 250 m east of the known Gravel Creek resource, returned bonanza gold-silver grades of up to 257 g/t Au, and 2,800 g/t Ag.

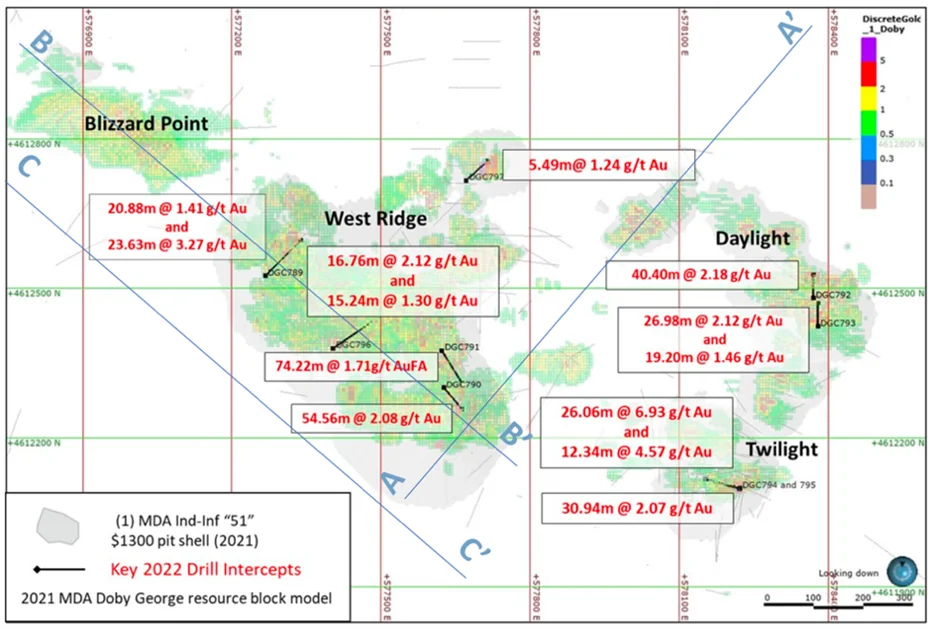

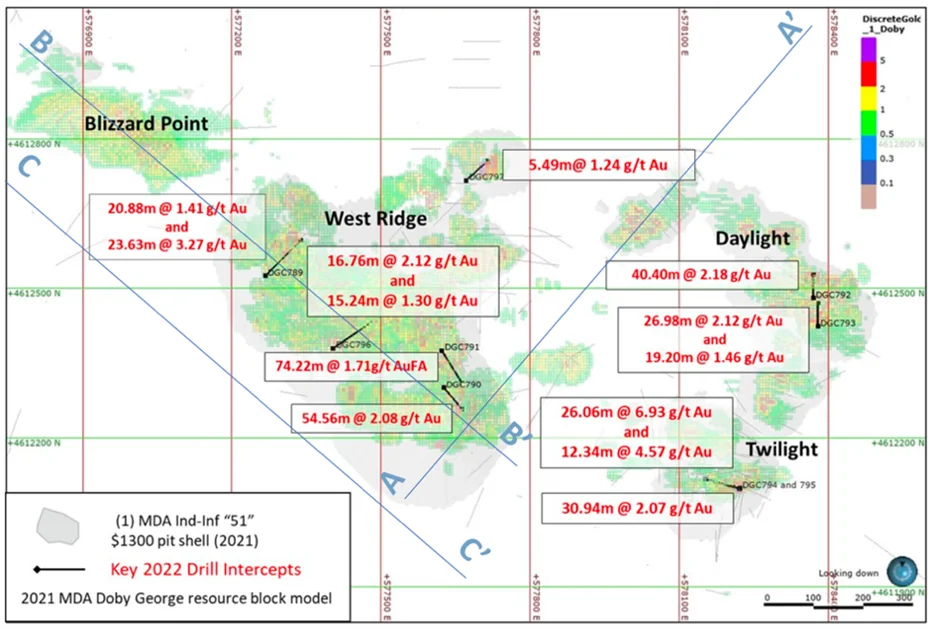

At Doby George, preliminary metallurgical heap leach tests confirmed high-grade oxide mineralization, and an average recovery of 69.3%, supporting our previous estimate of 70%.

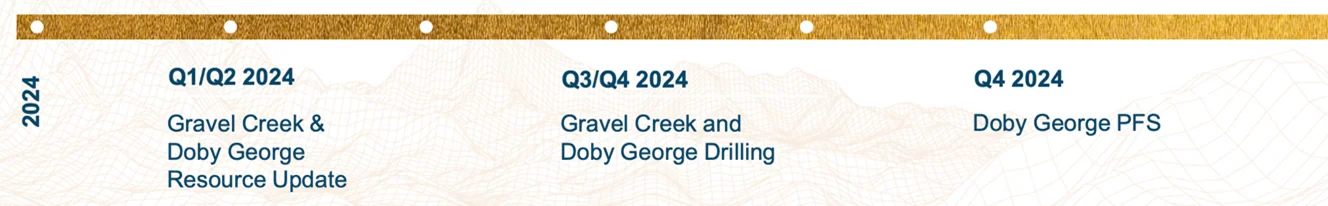

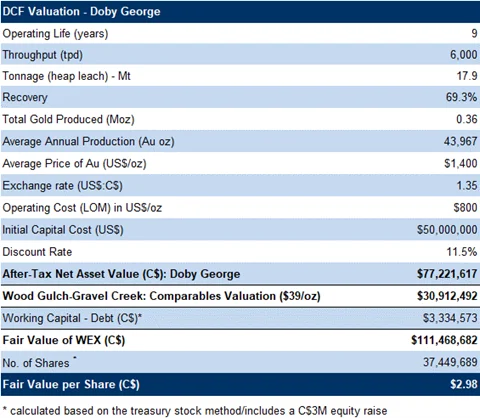

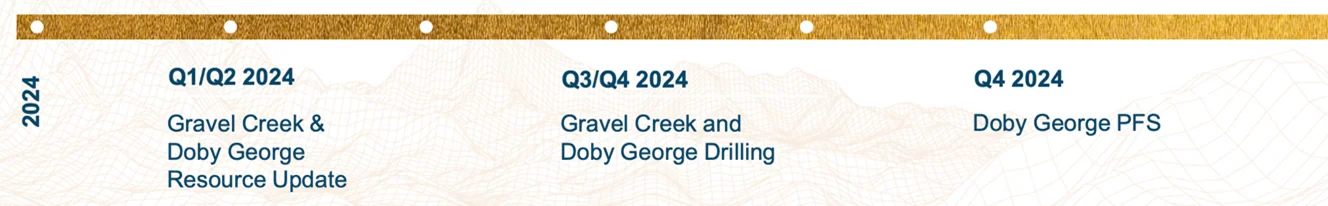

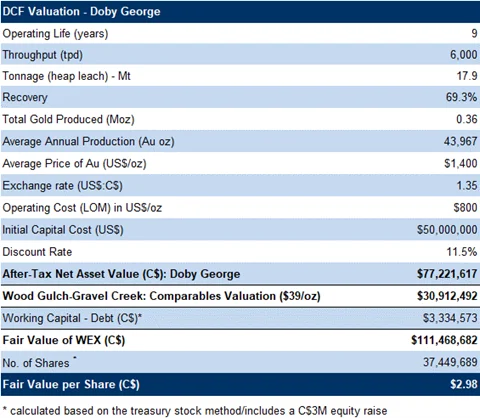

Management is planning resource updates for Gravel Creek, and Doby George, followed by a Preliminary Feasibility Study (PFS) for Doby George by Q4-2024/Q1- 2025. We believe Doby George can be advanced to production quickly, with a low initial CAPEX (<$50M). Based on its existing resource, we envision the project operating for nine years (40-50 Koz/year), with a relatively low OPEX ($800/oz).

We maintain a positive outlook on gold in light of the anticipated rate cuts by the Fed, and as we anticipate inflation will remain above its historic average in 2024.

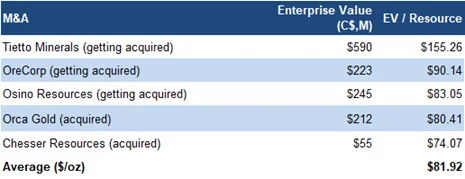

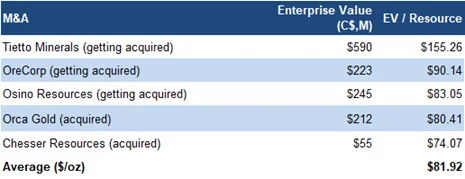

M&A activities in the junior gold sector are on the rise. Recent transactions involved Dundee Precious Metals’s (TSX:DPM) acquisition of Osino Resources (TSXV: OSI) for C$215M, Silvercorp Metals’s (TSX: SVM) acquisition of Orecorp (ASX: ORR) for C$186M, and Zhaojin Mining’s (SEHK: 1818) acquisition of Tietto Minerals (ASX: TIE) for C$422M. We estimate an average price of C$82/oz for these deals. WEX is trading at just C$28/oz, reflecting a 66% discount.

Upcoming catalysts include metallurgical test results, resource expansion drilling, and resource updates.

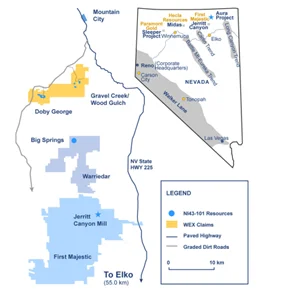

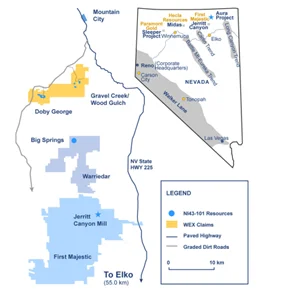

Aura Gold-Silver Project, Nevada

Location Map

Nevada is the fifth largest gold producer in the world

Aura is located 32 km north of First Majestic Silver’s (NYSE: AG) Jerritt Canyon mine

Excellent infrastructure in place including access to highways, water, and electricity

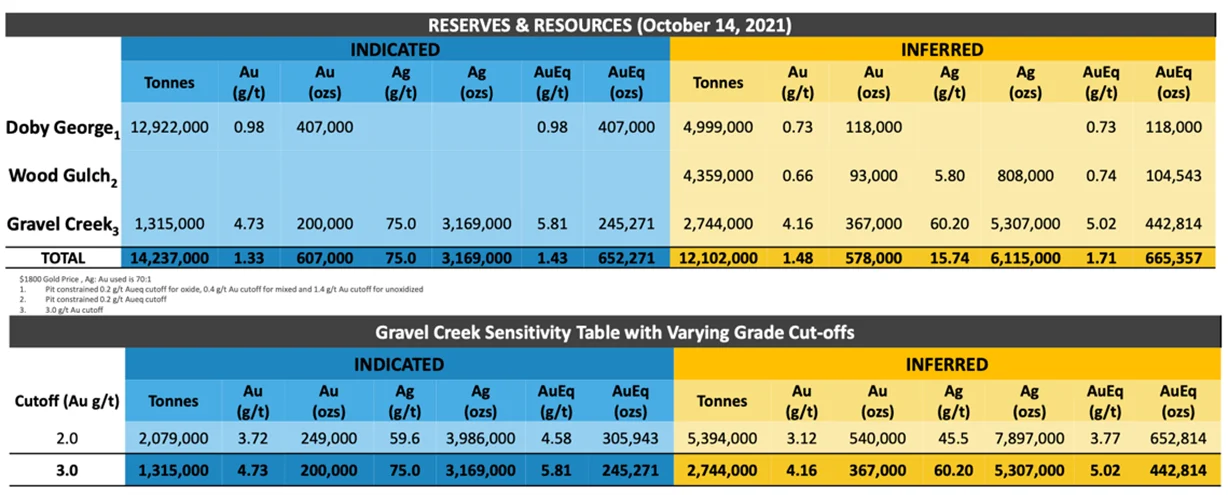

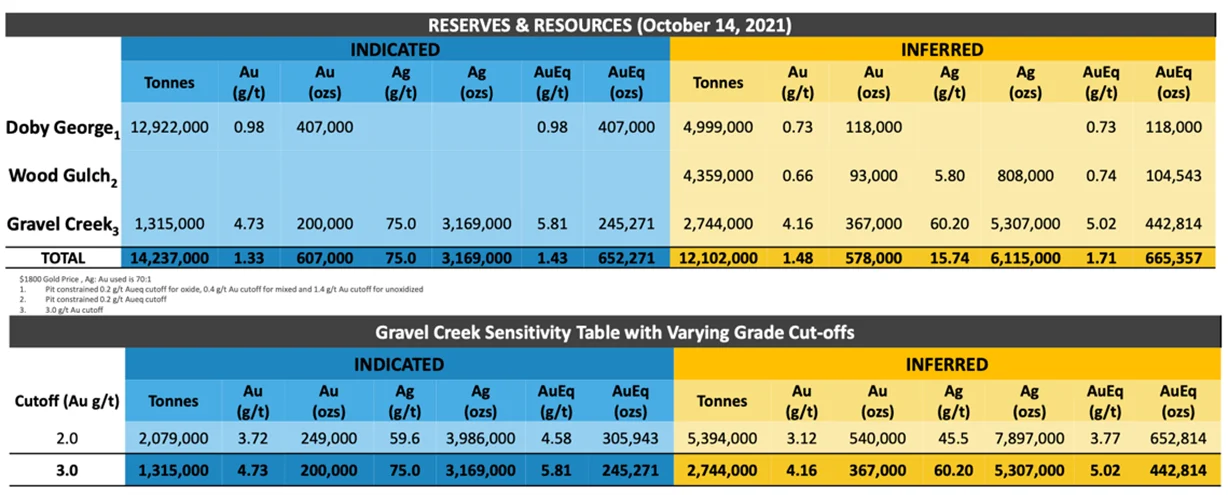

Resources are spread across three high-grade gold deposits, with indicated resources totaling 652 Koz AuEq, and inferred resources totaling 665 Koz

Gravel Creek and Wood Gulch are located 8 km from Doby George

Source: Company

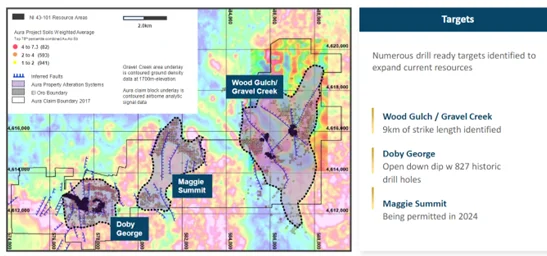

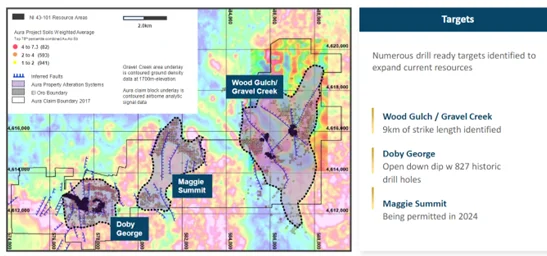

Doby George and Wood Gulch have potential for open-pit operations, while Gravel Creek has potential for underground operations

At Doby George, preliminary metallurgical heap leach tests confirmed high-grade oxide mineralization, and an average recovery of 69.3%, supporting our previous estimate of 70%.

Doby George - Metallurgical Holes

Source: Company

The resource at Doby George is amenable to heap leach processing, indicating potential for relatively low OPEX/CAPEX

Oxidized mineralization extends 150 to 200 m below surface

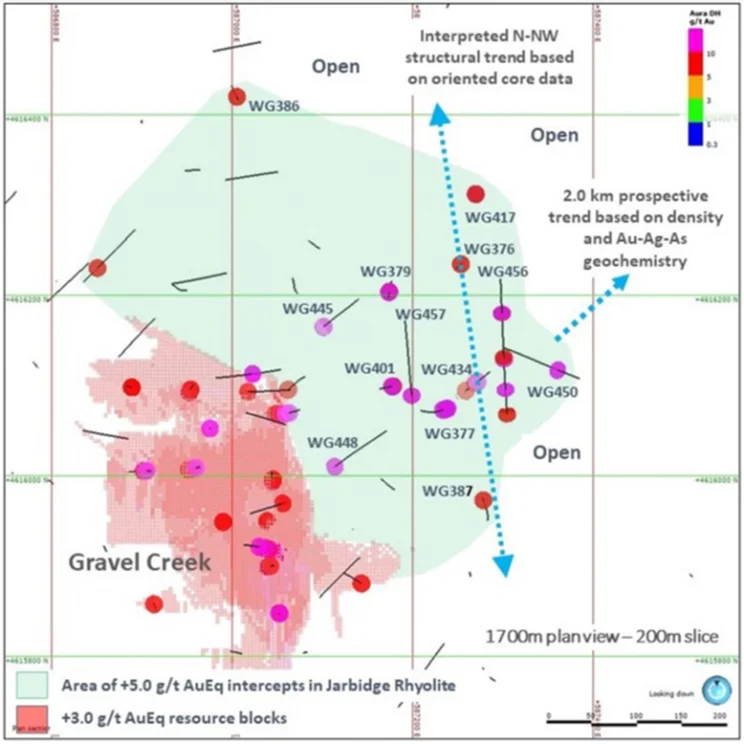

Two step-out holes, drilled 140 m to 250 m northeast of the Gravel Creek resource area, returned bonanza gold-silver grades including 257 g/t Au, and 1,655 g/t Ag (Hole: WG457), and 35 g/t Au, and 2,800 g/t Ag (Hole: WG456).

2023 Drilling Highlights (Gravel Creek)

Source: Company

Drilling returned bonanza gold-silver grades, delineating a 0.55 km x 0.35 km area of epithermal mineralization adjacent to the Gravel Creek resource area, implying resource expansion potential

Gravel Creek (600 m along strike and >400 m in depth) hosts 52% of the project’s resource estimate

Upcoming Catalysts

Source: Company

Multiple Catalysts

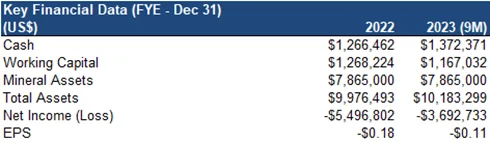

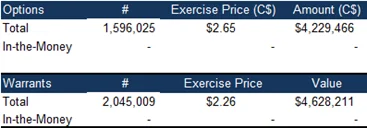

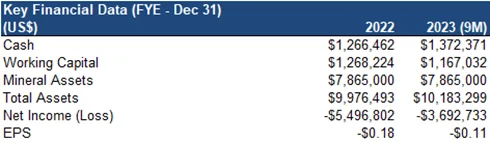

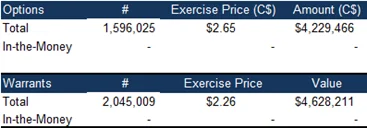

Financials

$1.2M in working capital

We anticipate a C$3M+ equity raise this year

Source: FRC/Company

FRC Valuation and Rating

Recent M&A transactions were priced at an average of C$82/oz

Source: FRC/ S&P Capital IQ/ Various

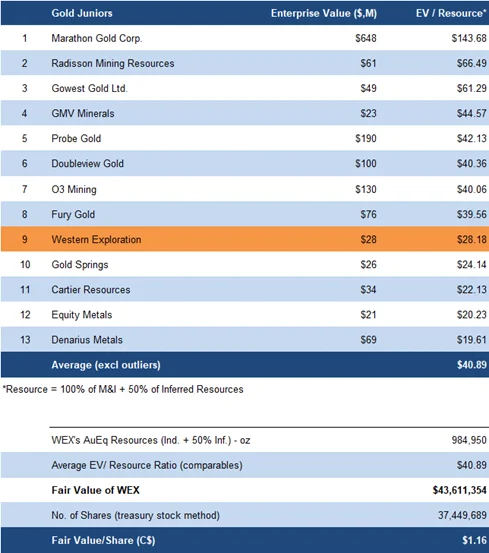

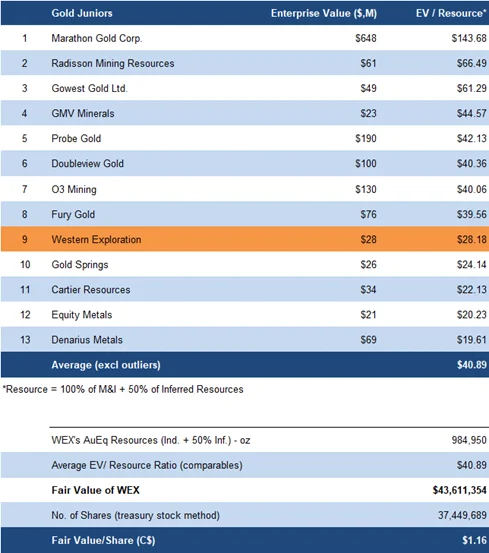

Gold juniors are trading at C$41/oz, based on 100% of M&I + 50% of inferred resources

WEX is trading at C$28/oz, reflecting a 31% discount

Applying the sector average EV/oz of C$41/oz (previously C$60/oz) to WEX’s resources, we arrived at a comparables valuation of C$1.16/share (previously C$1.50/share)

DCF Valuation

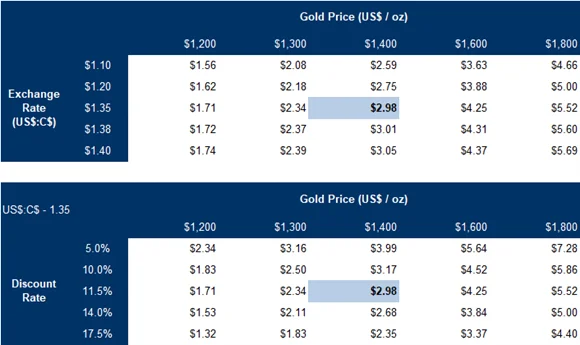

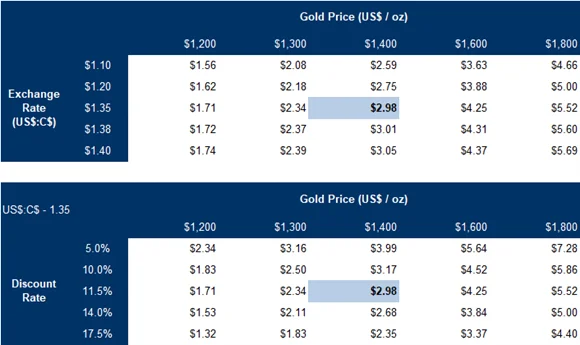

Our DCF valuation declined from C$3.48 to C$2.98/share primarily due to share dilution since our previous report

Our models are highly sensitive to gold prices and discount rates

We are reiterating our BUY rating, and adjusting our fair value estimate from C$3.48 to C$2.07/share (the average of our DCF and comparables valuation). Upcoming catalysts include metallurgical test results, resource expansion drilling, and resource updates. We believe WEX stands out with high-grade projects, a strong management/board, and the backing of Agnico Eagle.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- The value of the company is dependent on gold prices

- Exploration and development

- Access to capital and potential for share dilution

- Yet to complete a NI 43-101 compliant economic study