Skyharbour Resources Ltd.

Launches Largest-Ever Annual Drill Program Amid Bullish Uranium Backdrop

Published: 7/2/2025

Author: FRC Analysts

Sector: Basic Materials | Industry: Other Industrial Metals & Mining

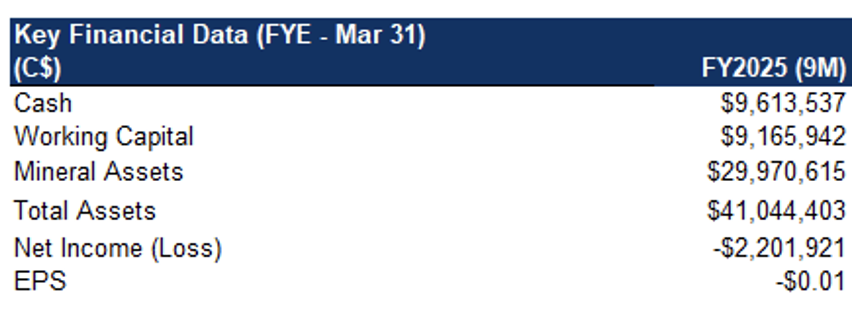

| Metrics | Value |

|---|---|

| Current Price | CAD $0.33 |

| Fair Value | CAD $1.01 |

| Risk | 5 |

| 52 Week Range | CAD $0.28-0.51 |

| Shares O/S (M) | 204 |

| Market Cap. (M) | CAD $67 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | 1.6 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

- Uranium prices are up 22% in the past three months to US$78/lb. The Sprott Physical Uranium Trust (TSX: U-UN), the world’s largest physical uranium investment fund, recently closed a US$200M financing to acquire more physical uranium, signaling strong demand and bullish sentiment for prices.

- Meanwhile, the Trump administration is pushing to revive the U.S. nuclear sector by fast-tracking domestic uranium projects.

- Meta (NASDAQ: META) just announced a 20-year deal to secure nuclear power for its AI and data centers. It joins tech giants like Google (GOOGL), Microsoft (MSFT), and Amazon (AMZN), who have already signed similar agreements to ensure a sustainable energy supply for their expanding operations. We believe rising uranium demand, and supply chain risks, especially with Russia producing 35% of global enriched uranium, are driving renewed investor optimism in the industry.

- SYH has commenced its largest-ever annual drill campaign, with fully funded, multi-phase programs underway at its two flagship projects: Russell Lake and Moore. The campaign includes 35 to 45 holes totaling 16,000 to 18,000 m.

- At Russell Lake, the company is currently pursuing a phase one program (5,000 m/10-12 holes), which is part of a larger 10,000 to 11,000 m campaign to build on recent promising exploration results.

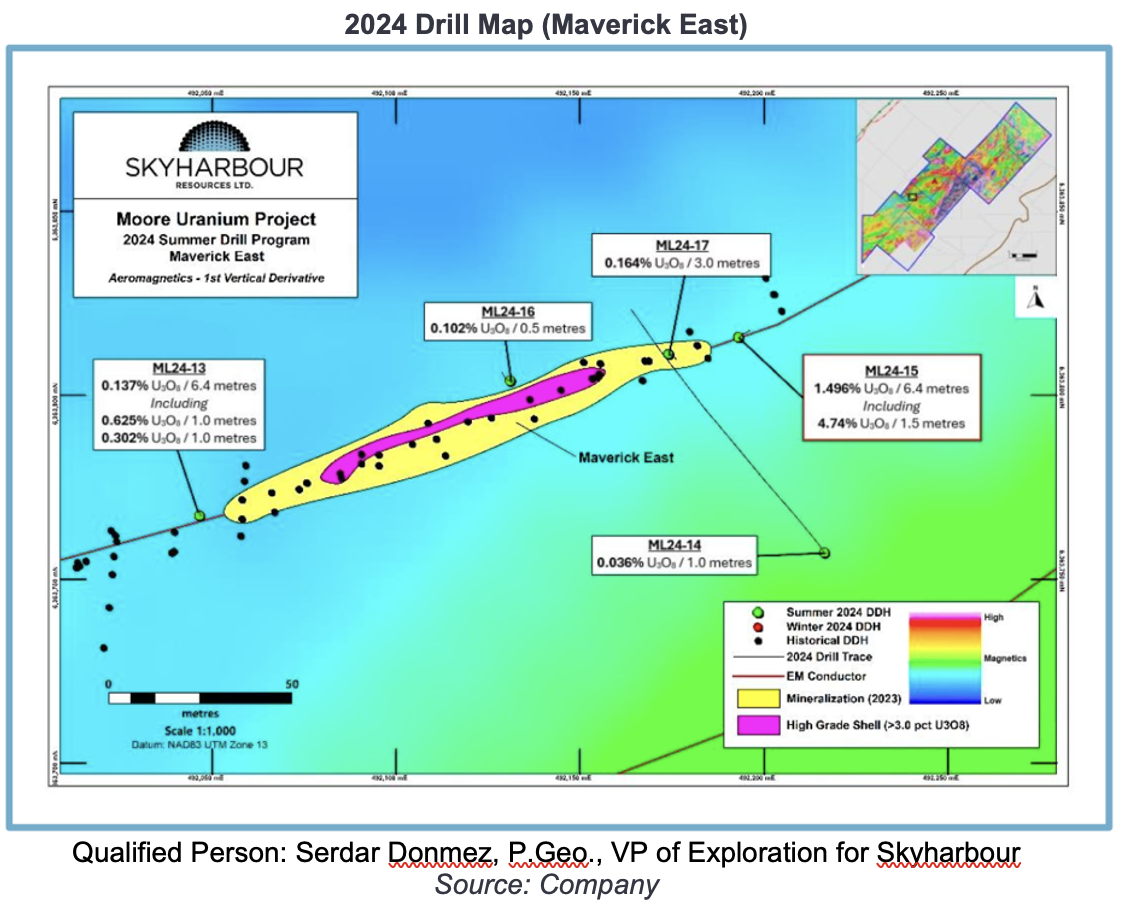

- At Moore Lake, eight of nine holes in SYH’s 2024 summer drill program intersected mineralization. A step-out hole returned high-grade intercepts at shallow depths - 6.4 m grading 1.50% U₃O₈, including 1.5 m grading 4.74% - expanding the high-grade mineralized zone in the Maverick East area. A follow-up drill program will begin shortly. (Qualified Person: Serdar Donmez, P.Geo., VP of Exploration for SYH)

- Though unconfirmed by management, it is our view that SYH may complete a NI 43-101 resource estimate at Moore next year.

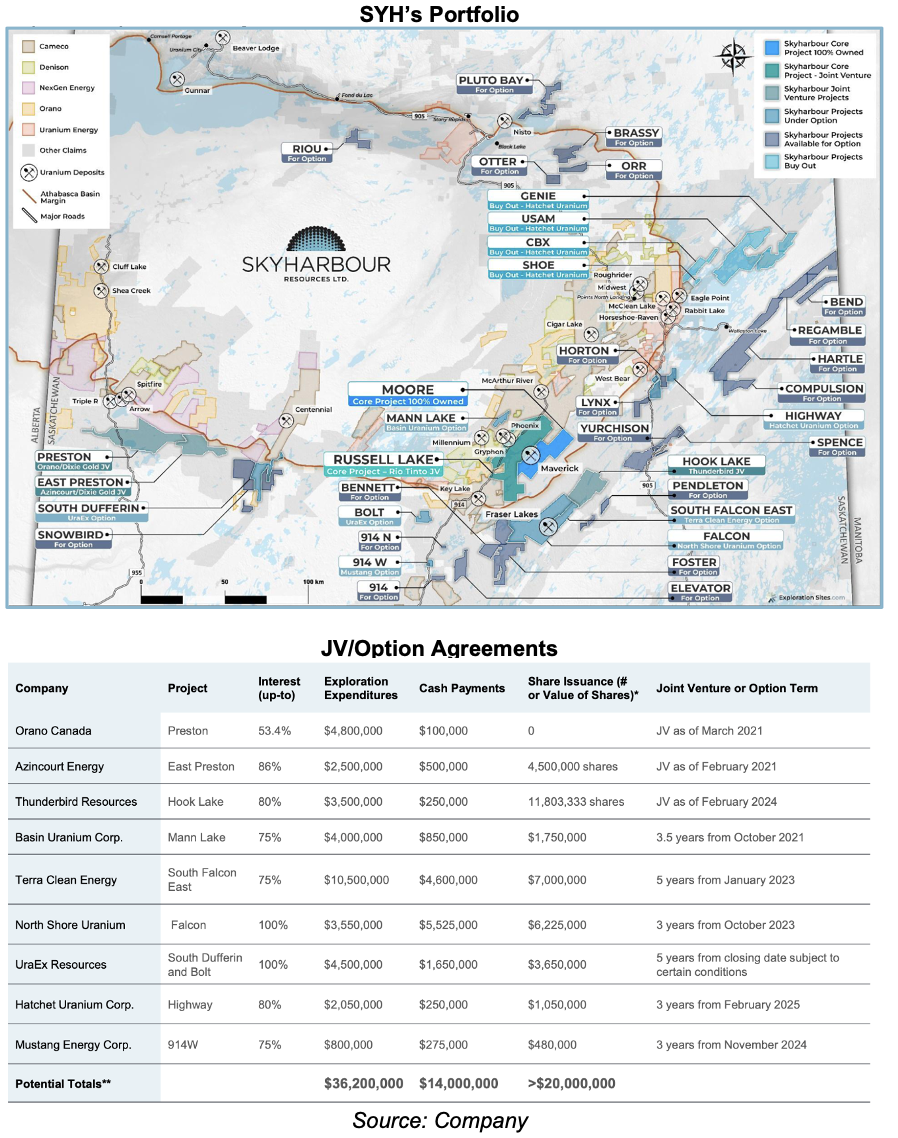

- Option partners are actively advancing their projects through exploration and drill campaigns, with 15,000 to 16,000 m of drilling planned in addition to the programs at Russell and Moore Lake. SYH could receive up to $34M in cash/share payments if these option agreements are fulfilled.

- Upcoming catalysts include positive uranium junior sentiment, drilling at Russell Lake and Moore, partner exploration programs, and potential new option agreements advancing SYH’s prospect generator business.

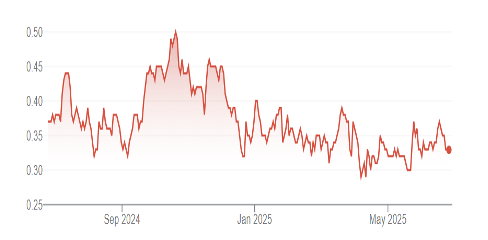

Price and Volume (1-year)

Portfolio Summary

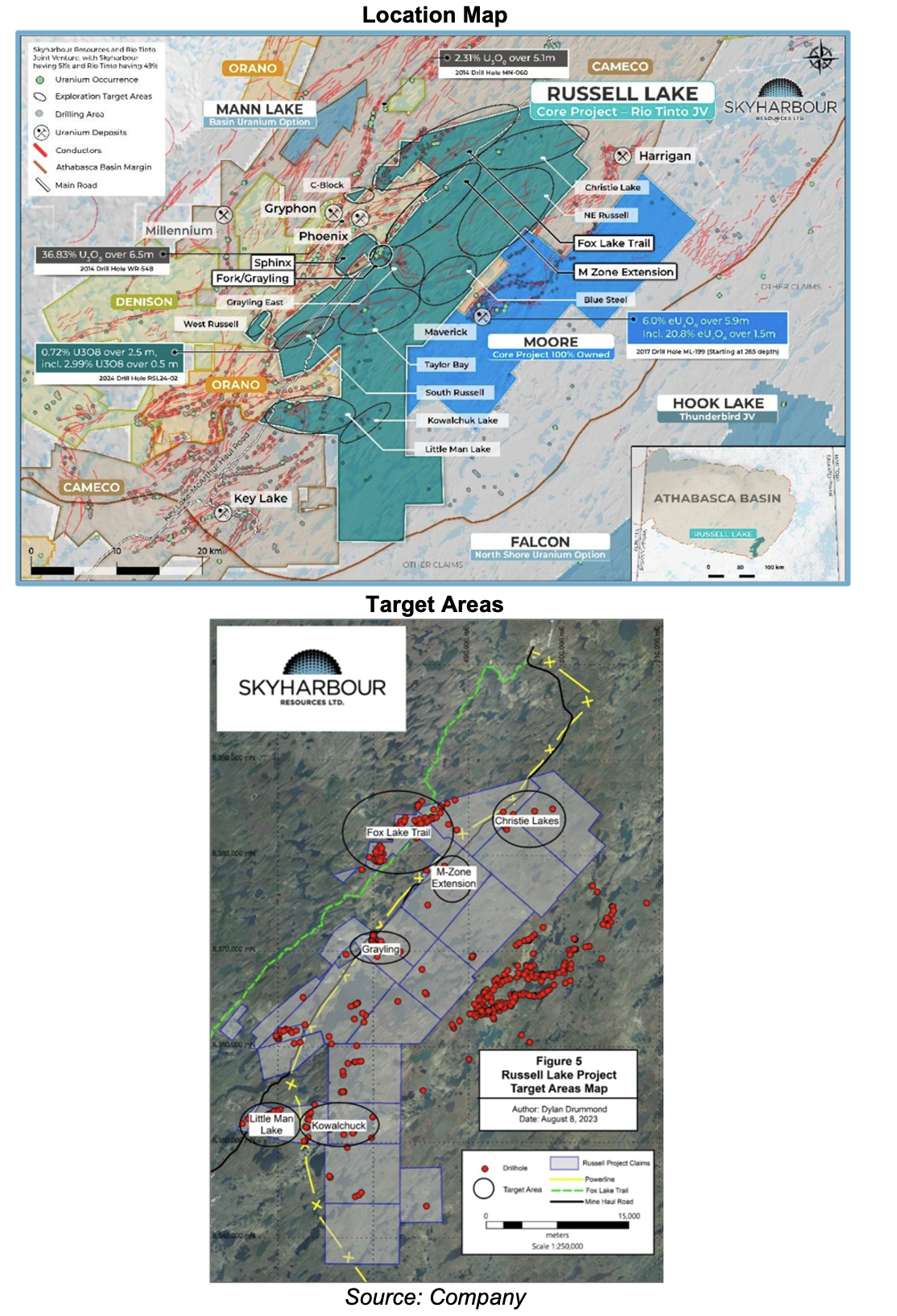

36 properties, covering 614,353 hectares, in the Athabasca basin. The Athabasca basin hosts some of the world’s richest uranium deposits and mines

Nine projects with JV/ option agreements. Partners could commit up to $36M for exploration, and $34M in cash/share payments to SYH

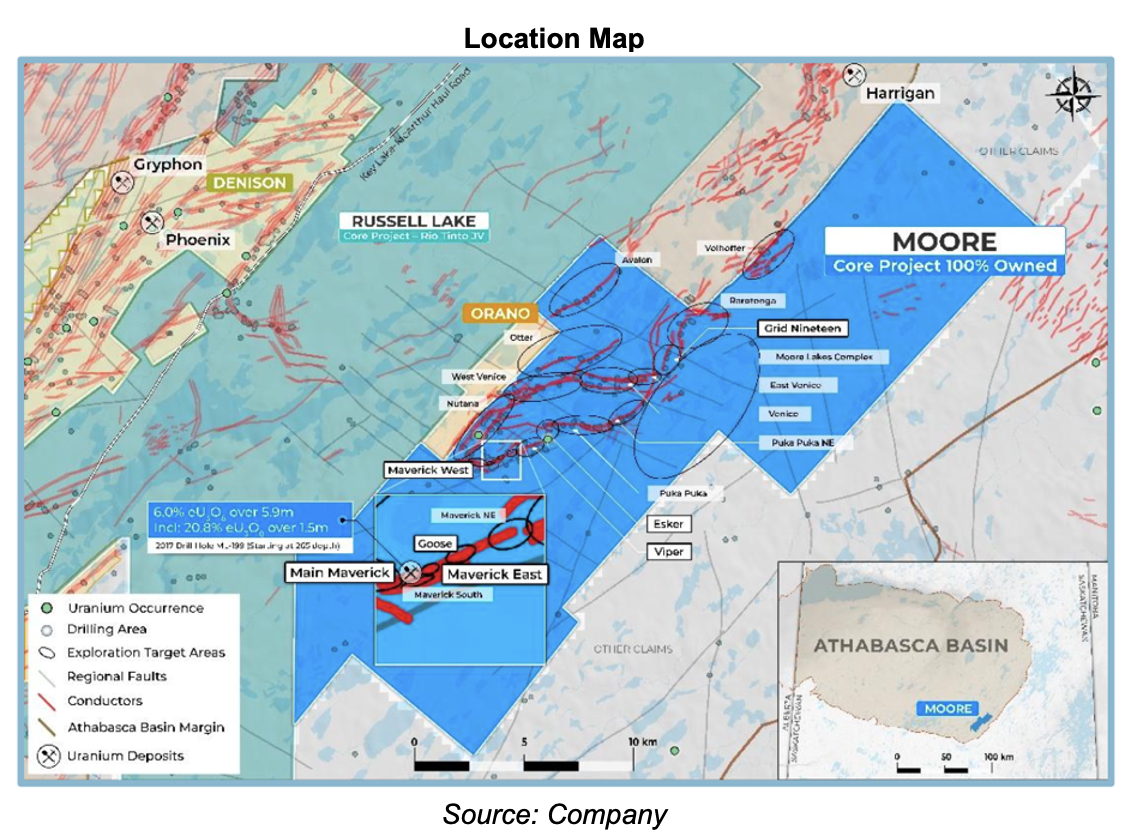

Moore Lake Uranium Project (100% interest)

Late last year, SYH completed a nine-hole drill program (totaling 2,759 m), including four at the Main Maverick zone, and five at the Maverick East zone.

Moore is located 15 km east of Denison’s (TSX: DML) Wheeler River project, and 39 km south of Cameco’s (TSX: CCO) McArthur River mine. The 4.7 km long Maverick corridor hosts numerous targets

Eight of nine holes intersected uranium mineralization, including high-grade, near-surface intercepts such as 6.4 m of 1.50% U₃O₈, with 1.5 m of 4.74% U₃O₈, from a hole located 42 m northeast of the known high-grade footprint at the Maverick East zone. We believe these results highlight the shallow, high-grade nature of the mineralization, and underscore strong potential for follow-up drilling. (Qualified Person: Serdar Donmez, P.Geo., VP of Exploration for Skyharbour)

A step-out hole intersected high-grade mineralization at shallow depths. We believe the company could complete a maiden resource estimate next year

Management is set to launch a 4,500 to 5,000 m follow-up drill program targeting the Main Maverick and Maverick East zones, along with high-priority regional targets.

Russell Lake Uranium Project (SYH 57.7%: Rio Tinto 42.3%)

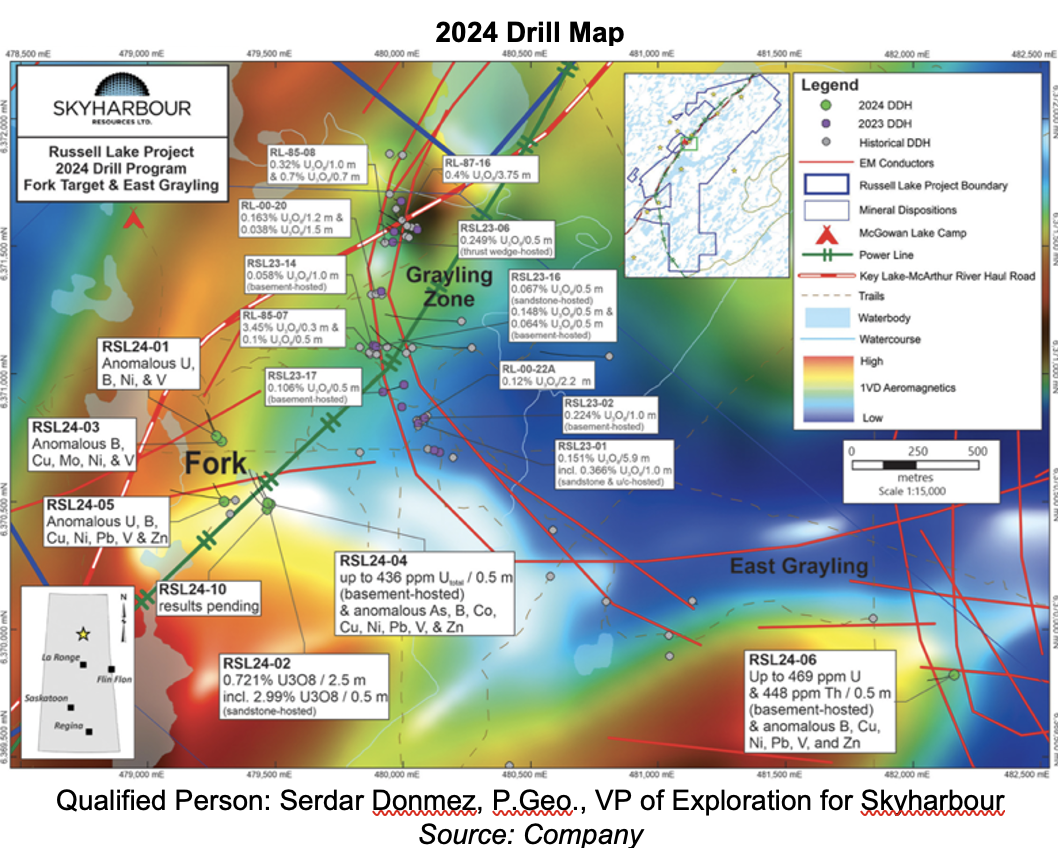

In February 2025, SYH commenced its 2025 drill program totaling 10,000 to 11,000 m (18-20 holes).

Russell Lake is strategically located between SYH’s Moore uranium project, and Denison’s Wheeler River project, and close to Cameco’s Key Lake mill, and MacArthur River mines. 35+ km of untested targets

Phase one drilling (5,000 m/ 10-12 holes) will focus on the Fork and Sphinx targets within the Grayling zone, the M-Zone Extension (MZE), and the Fox Lake zone

Last fall, SYH completed an eight-hole (4,500 m) drill program focused on expanding a high-grade zone at the Fork target and testing regional targets. One of five holes at Fork intersected high-grade mineralization, including 2.5 m grading 0.72% U₃O₈ from 338 m depth, with a higher-grade interval of 0.5 m at 2.99%. We believe this intercept marked a new discovery at the Fork target, an area with limited historical exploration. (Qualified Person: Serdar Donmez, P.Geo., VP of Exploration for Skyharbour)

Management is awaiting assay results from the 2024 fall drill program. We believe the company could complete a maiden resource estimate next year

Updates on Other Projects

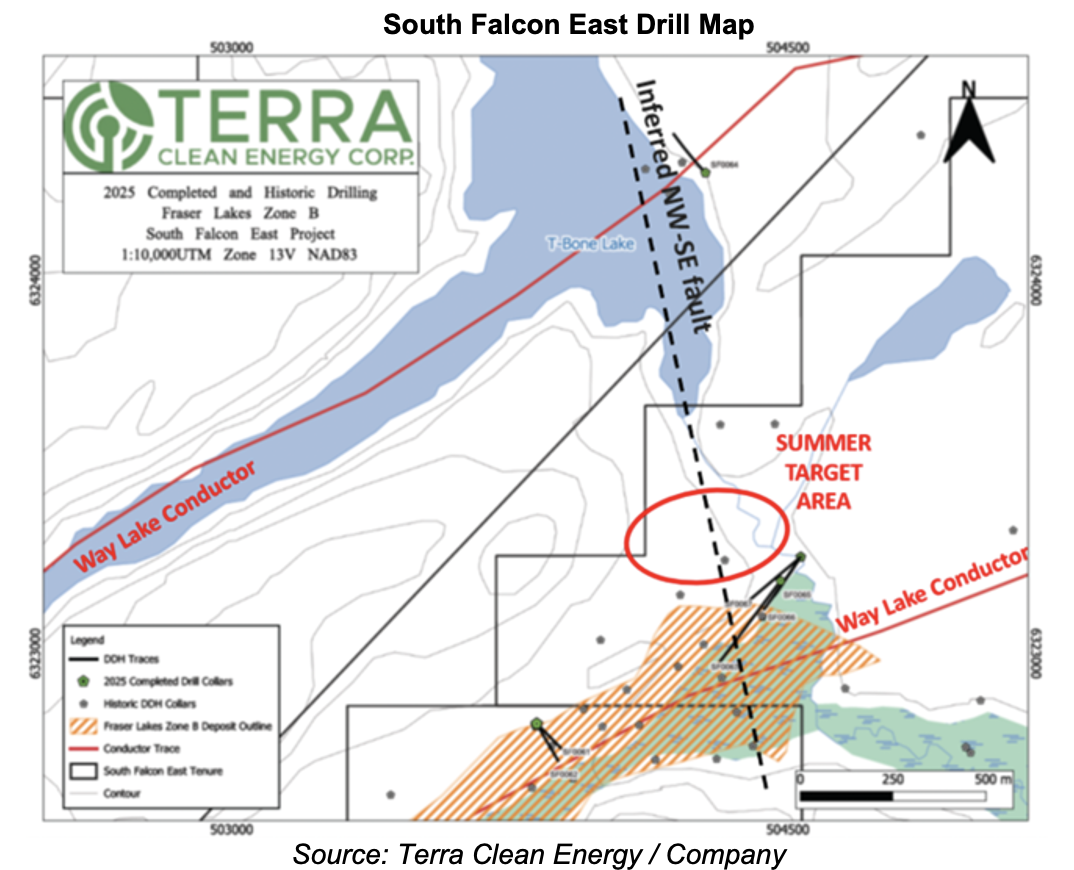

- At the South Falcon East uranium project, Terra Clean Energy (CSE: TCEC, MCAP: $5M) has completed a seven-hole program totaling 1,927 m. Six holes intersected mineralization. TCEC is preparing to begin its summer program, targeting seven to 10 holes totaling 2,500 m. (Qualified Person: Serdar Donmez, P.Geo., VP of Exploration for Skyharbour)

Follow-up drilling underway

- North Shore Uranium (TSXV: NSU, MCAP: $1M) is gearing up for a summer drill program at its Falcon uranium project, where 36 uranium targets have been identified to date.

- At the Preston uranium project, Orano Canada is undertaking a summer program comprised of 28 holes totaling 6,000 to 7,000 m. This project is strategically located in the southwestern portion of the Athabascan Basin, nearby NexGen’s (TSX: NXE) Arrow Deposit.

- At the 914W uranium project, Mustang Energy (CSE: MEC, MCAP: $14M) has commenced a rock and soil sampling program.

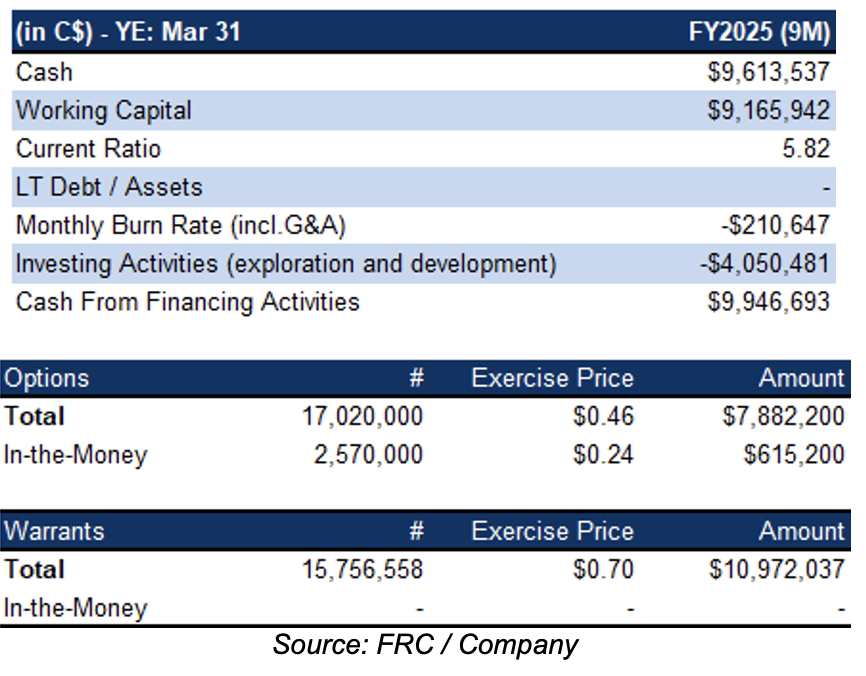

Financials

Strong balance sheet. In-the-money options can bring in $0.62M

FRC Projections and Valuation

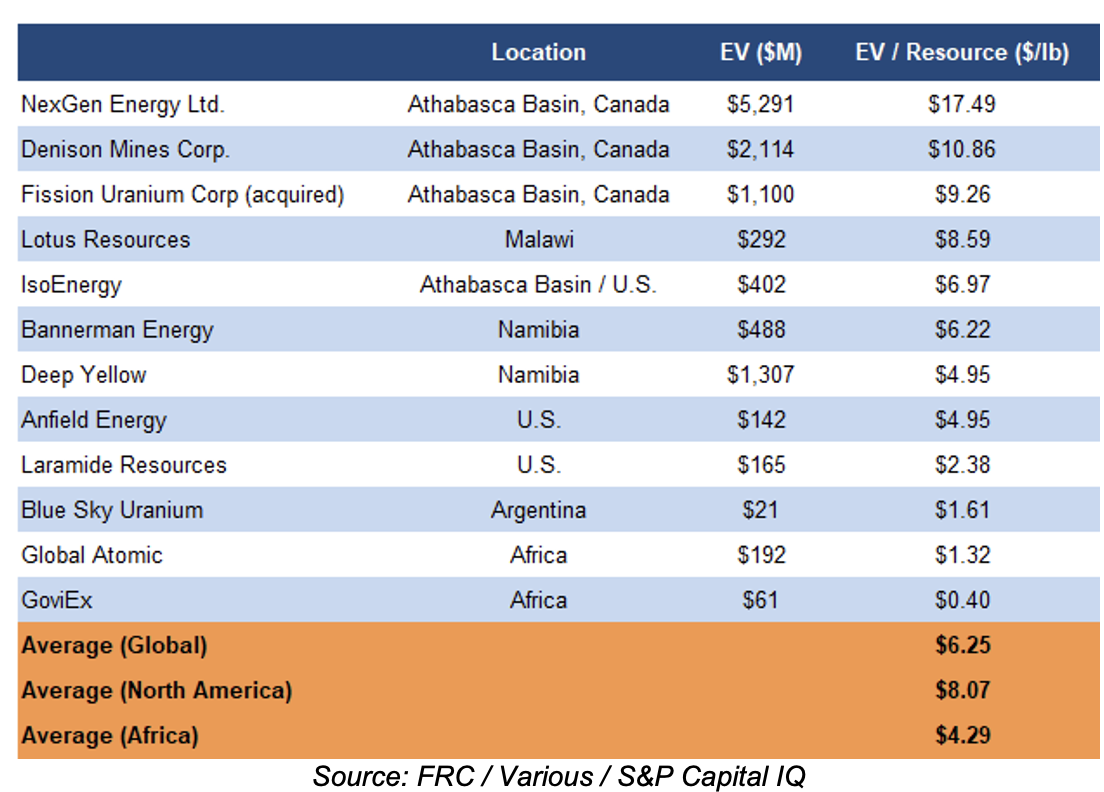

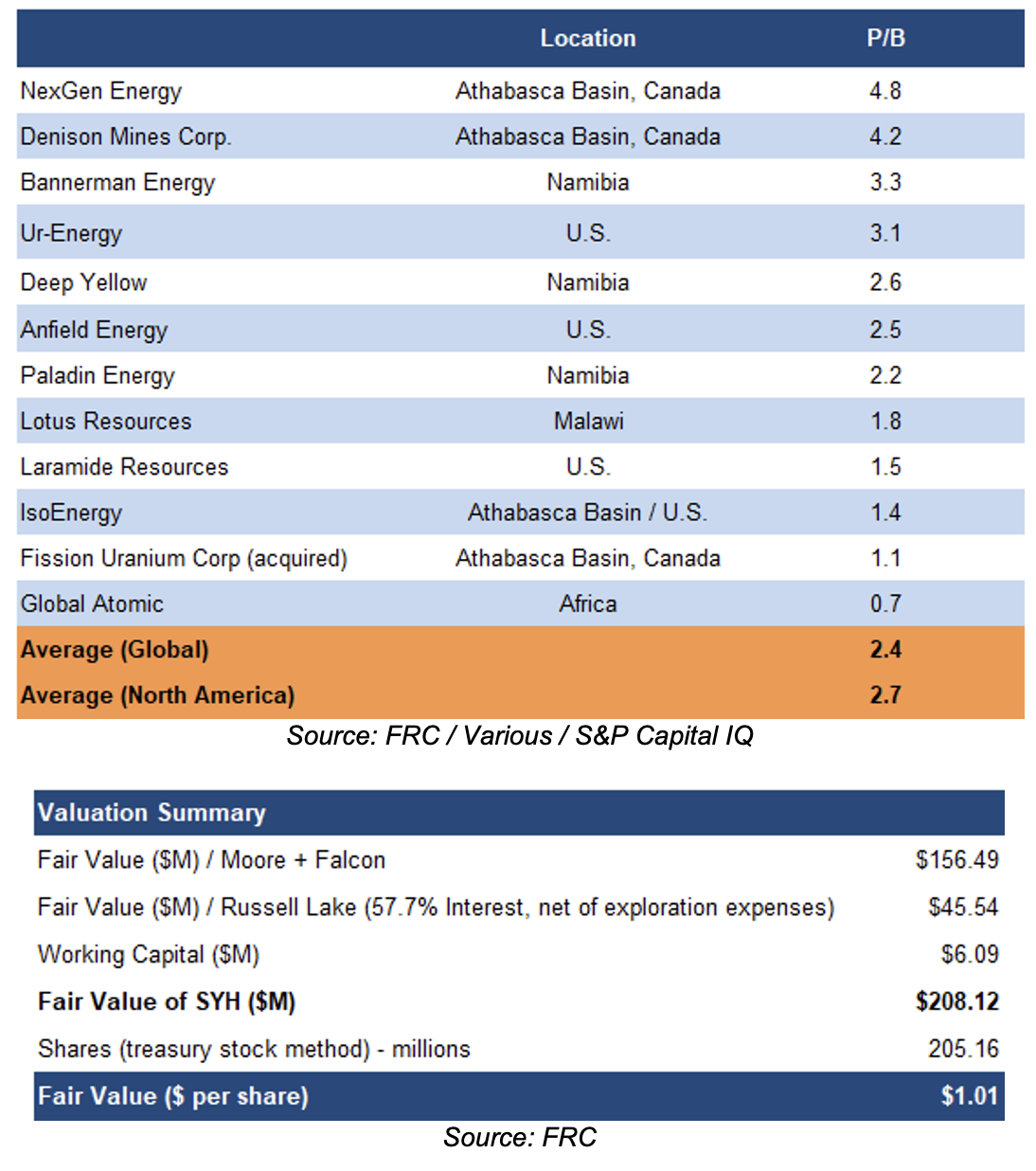

North American uranium juniors are trading at $8.07/lb (previously $8.12/lb North American uranium juniors are trading at 2.4x book value (previously 2.5x)

Applying sector multiples to SYH’s flagship assets, we arrived at a revised fair value estimate of $1.01/share (previously $1.02/share). Our valuation decreased due to lower sector multiples

We are reiterating our BUY rating, while adjusting our fair value estimate from $1.02 to $1.01/share. Uranium sector sentiment is improving, driven by rising prices, strong institutional investment, and commitments from major tech players securing nuclear power for future growth. We believe SYH is well-positioned to capitalize on this momentum with its largest-ever drill campaign and promising exploration results at Russell Lake and Moore.

Risks

We believe the company is exposed to the following key risks:

- The value of the company is dependent on uranium prices

- Exploration and development

- None of its flagship projects have a NI 43-101 compliant resource estimate

- Access to capital and share dilution

- No guarantee that option partners will follow through with their proposed programs