Atrium Mortgage Investment Corporation

Strengthens Portfolio Amid Sector Headwinds

Published: 5/20/2025

Author: FRC Analysts

Sector: Financial Services | Industry: Mortgage Finance

| Metrics | Value |

|---|---|

| Current Price | CAD $11.11 |

| Fair Value | CAD $12.85 |

| Risk | 3 |

| 52 Week Range | CAD $9.97-12.00 |

| Shares O/S (M) | 48 |

| Market Cap. (M) | CAD $528 |

| Current Yield (%) | 8.9 |

| P/E (forward) | 11.2 |

| P/B | 1.0 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

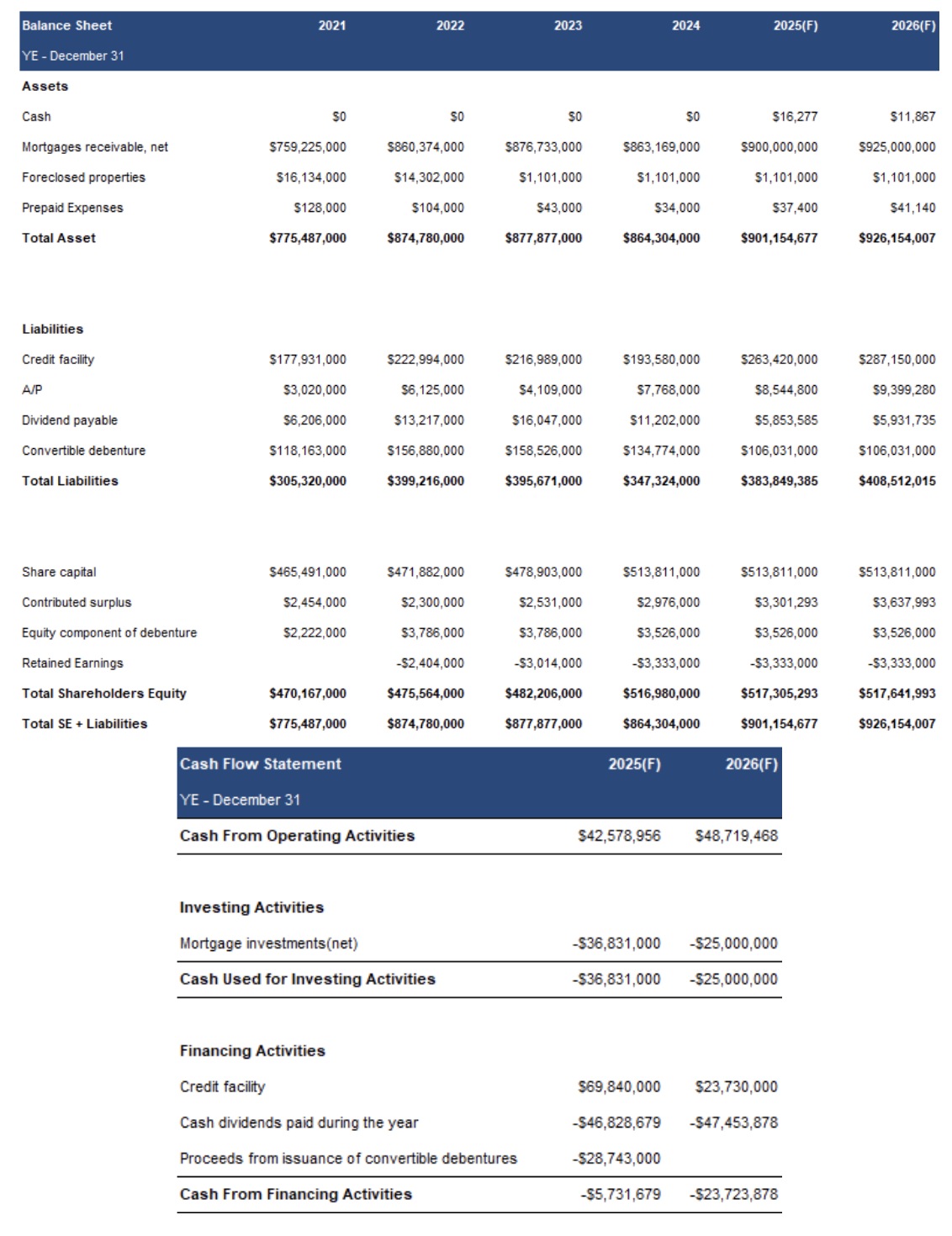

- In Q1-2025, mortgage receivables (gross) decreased 2% to $852M. Despite the dip, we maintain our view that AI can reach $900M by year-end.

- As 84% of AI’s portfolio are floating-rate mortgages, its average lending rate has declined with the Bank of Canada’s cuts.

- Q1 revenue and EPS declined 13% and 7% YoY, respectively, both missing our estimates (by 3% and 6%) due to lower lending rates. Annual regular dividends remained steady at $0.93/share, reflecting an 8.4% yield.

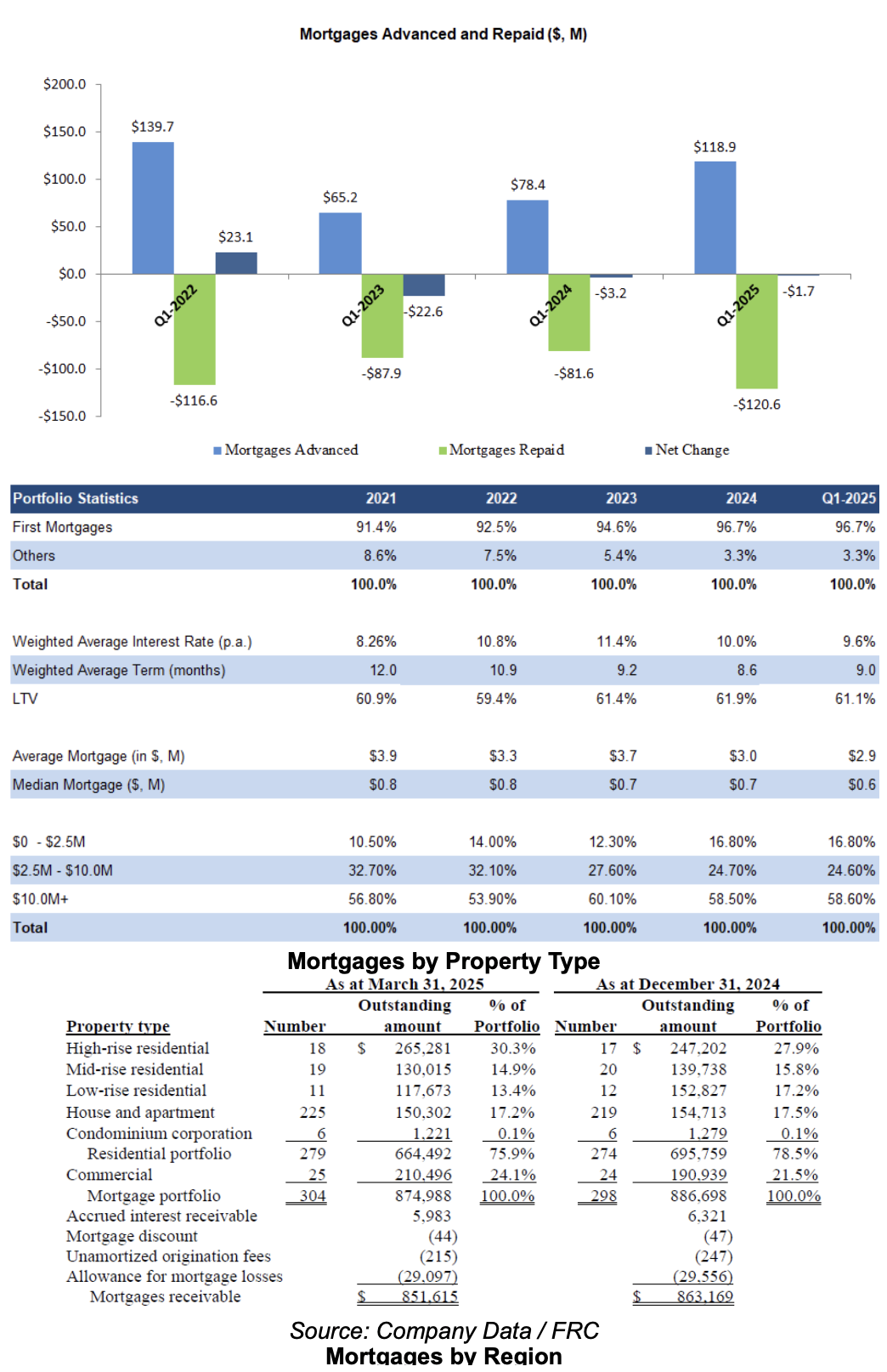

- Stage three (impaired) mortgages declined 33% QoQ to 2.2% of mortgages, the lowest level since Q2-2023, signaling a lower risk profile. Key portfolio metrics remained stable, with a high proportion of first mortgages (96.7%), and a relatively low LTV of 61%.

- Due to sluggish sector activity, particularly in development and construction projects, the company has been increasing its exposure to lower-risk property types, such as single-family residential and income-producing commercial properties, which should reduce portfolio risk, and yields.

- Since June 2024, the BoC has cut rates seven times (225 bp), with the potential for one or two more cuts this year, due to slowing GDP growth, high unemployment, and cooling inflation. Although mortgage delinquencies remain a concern for lenders, we believe the risk is easing amid falling mortgage rates. We anticipate a rebound in pre-sales, and reduced financing costs for developers, and increased transaction volumes for real estate lenders this year.

- While Trump’s tariff threats have increased uncertainty amid escalating trade tensions, geopolitical risks, and the potential for a global GDP slowdown, the recent trade deal with the U.K., and temporary agreement with China have partially restored investor confidence. We believe Trump is likely to reverse or soften most of his administration’s new measures, given their potential negative impact on U.S. consumers and businesses. Should this occur, we would revert to a bullish stance on MICs, as declining rate environments have historically boosted MIC/financial stocks.

- AI remains well-positioned to navigate economic uncertainties, given its strengthened portfolio, featuring more first mortgages, fewer stage-three mortgages, and an enhanced focus on relatively low-risk properties.

Price and Volume (1-year)

Portfolio Update

Loan advancements were up 52% YoY; repayments were up 48% YoY. Over 80% of mortgage advancements were toward new originations, demonstrating AI’s strength in attracting new deals rather than relying primarily on renewals. Net mortgages outstanding were down 2% to $852M

Net mortgages outstanding were down 2% to $852M. We believe transaction volumes will continue growing this year, driven by lower interest rates. No material changes in key portfolio metrics

Lending rates decreased following BoC rate cuts. Continued to increase exposure to revenue generating commercial properties while scaling back on residential development projects, implying a lower risk profile

Continued to increase exposure to ON while reducing exposure to B.C., due to higher B.C. repayments, and more attractive opportunities in ON

APPENDIX