Steppe Gold Ltd.

Fully Funded to Triple Production

Published: 11/24/2023

Author: Sid Rajeev, B.Tech, CFA, MBA

Sector: Basic Materials | Industry: Gold

| Metrics | Value |

|---|---|

| Current Price | US $0.7 |

| Fair Value | US $2.97 |

| Risk | 4 |

| 52 Week Range | US $0.60-1.36 |

| Shares O/S (M) | 105 |

| Market Cap. (M) | US $73 |

| Current Yield (%) | n/a |

| P/E (forward) | 4.5x |

| P/B | 1.1x |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

Highlights

In Q3-2023, production from Steppe’s flagship ATO gold mine in Mongolia was up 18% QoQ, surpassing our foreast by 7%. Revenue was up 10% QoQ, and EPS (adjusted) was up 33% QoQ. Revenue and EPS exceeded our estimates by 10% and 29%, respectively.

STGO has started drawing funds from a $150M financing, from the Trade and Development Bank of Mongolia, for phase two expansion. The company is on track to increase its production from the current 25-30 Koz/year, to 100+ Koz by late 2025.

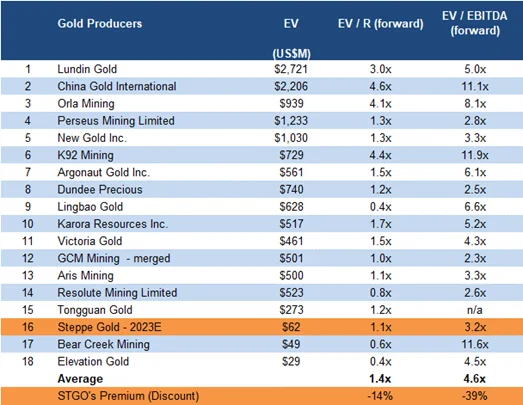

An updated Preliminary Economic Assessment (PEA) for the recently acquired Tres Cruces project (Peru) has confirmed the inputs used in a PEA completed in 2022. The latest study returned an AT-NPV5% of $159M (previously $166M). STGO is trading at 39% of the ATNPV5%; suggesting that the market is attributing zero value to the ATO mine.

We maintain a positive outlook on gold prices, as we anticipate the Fed will initiate rate cuts within the next six months, driven by rising unemployment, financial instability, mortgage costs, and consumer confidence, and cooling inflation.

STGO is trading at a 26% discount to junior gold producers.

As Q3 was stronger then expected, we are raising our 2023/2024 production, revenue, and EPS forecasts. With gold recently surpassing $2,000/oz, we anticipate a stronger Q4.

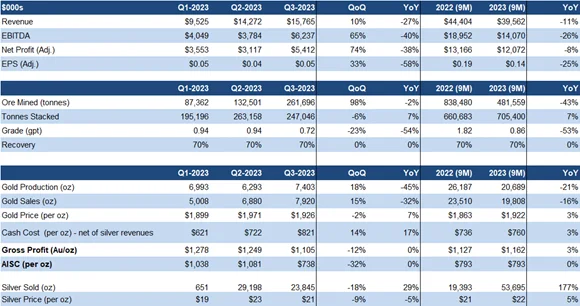

Production and Financials

Source: Company / FRC

Q3 production was up 18% QoQ, and 7% higher than our estimate, due to higher than expected throughput

Cash costs increased 14% QoQ amid lower grades, but were in line with our estimate

As a result of higher production, revenue, EBITDA, EPS, and funds from operations improved QoQ

Revenue and EPS exceeded our estimates by 10% and 29%, respectively

EBITDA margins improved as well

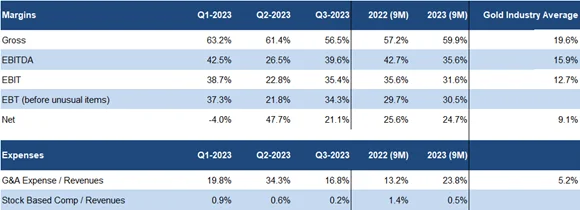

Source: Company / FRC / S&P Capital IQ

Source: Company / FRC / S&P Capital IQ

Healthy balance sheet

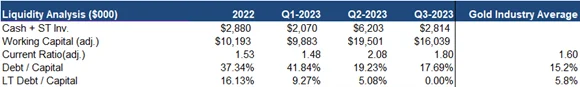

Updated PEA for Tres Cruces (Peru)

Tres Cruces is 10 km from the Lagunas Norte open-pit mine, which has produced 10+ Moz gold.

Location Map

Source: Anacortes Mining

In Q3, Steppe completed an updated PEA for the recently acquired Tres Cruces project

Excellent infrastructure in place including access to a national highway, electricity, and a deep-water port

Tres Cruces hosts a high-grade open-pittable oxide gold deposit.

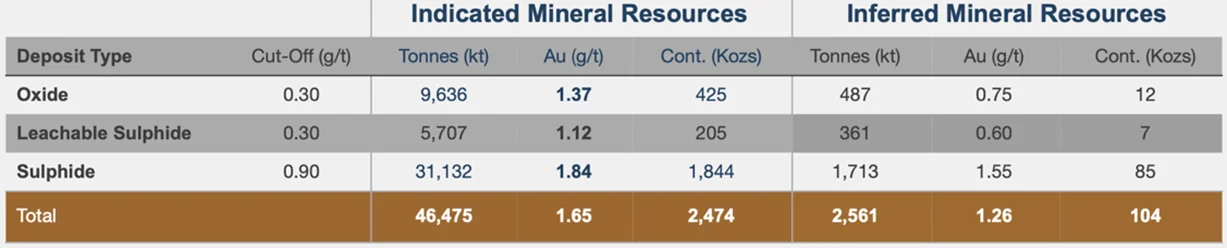

Resource

Source: Anacortes Mining

Indicated resources account for 96% of total resources, implying high confidence

We note that open-pittable oxide resources tend to be low grade (<0.8 gpt) vs 1.3 gpt at Tres Cruces

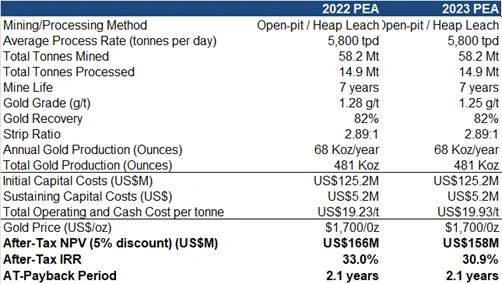

2022 PEA vs 2023 PEA Comparison

Although both sulfide and oxide material exist, the 2023 PEA considered oxide and transition mineralization only, accounting for just 25% of total resources

No changes in forecasts for CAPEX, annual gold production (68 Koz/year conventional heap leach operation), grades, and recovery

However, cash costs were increased by 4%

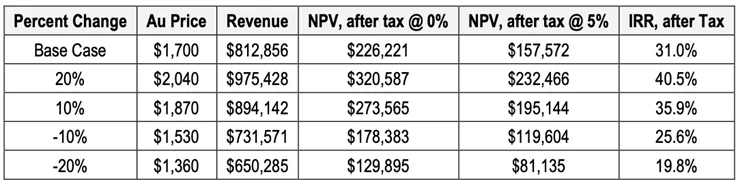

Sensitivity Analysis

Source: Company

AT-NPV5% of $158M (previously $166M), and a high AT-IRR of 31% (previously 33%), using $1,700/oz gold

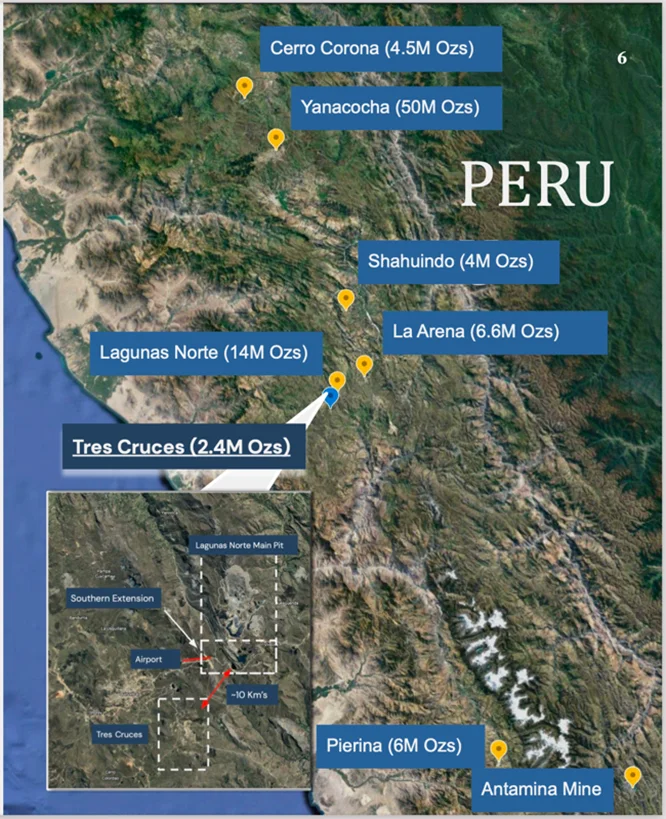

FRC Projections and Valuation

Source: FRC

As Q3 production was higher than expected, we are raising our near-term EPS forecasts

Source: FRC

Sector multiples are up 11% since our previous report in August 2023

STGO is trading at a 26% discount to junior gold producers

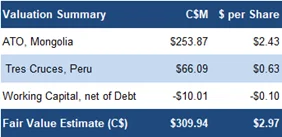

Due to higher production forecasts, we are raising our fair value estimate from $2.93 to $2.97/share

We are reiterating our BUY rating, and adjusting our fair value estimate from C$2.93 to C$2.97/share. We believe the market is underestimating Steppe's fully funded plan to triple its production within the next two years. As the company unveils advancements in its expansion efforts, we believe the market will begin to recognize its inherent potential. With gold recently surpassing $2,000/oz, we anticipate a stronger Q4.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

1. The value of the company is dependent on gold prices

2. Like most producers, the company has debt

3. Geopolitical

4. Exploration and development

5. FOREX

6. Ability to ramp up production