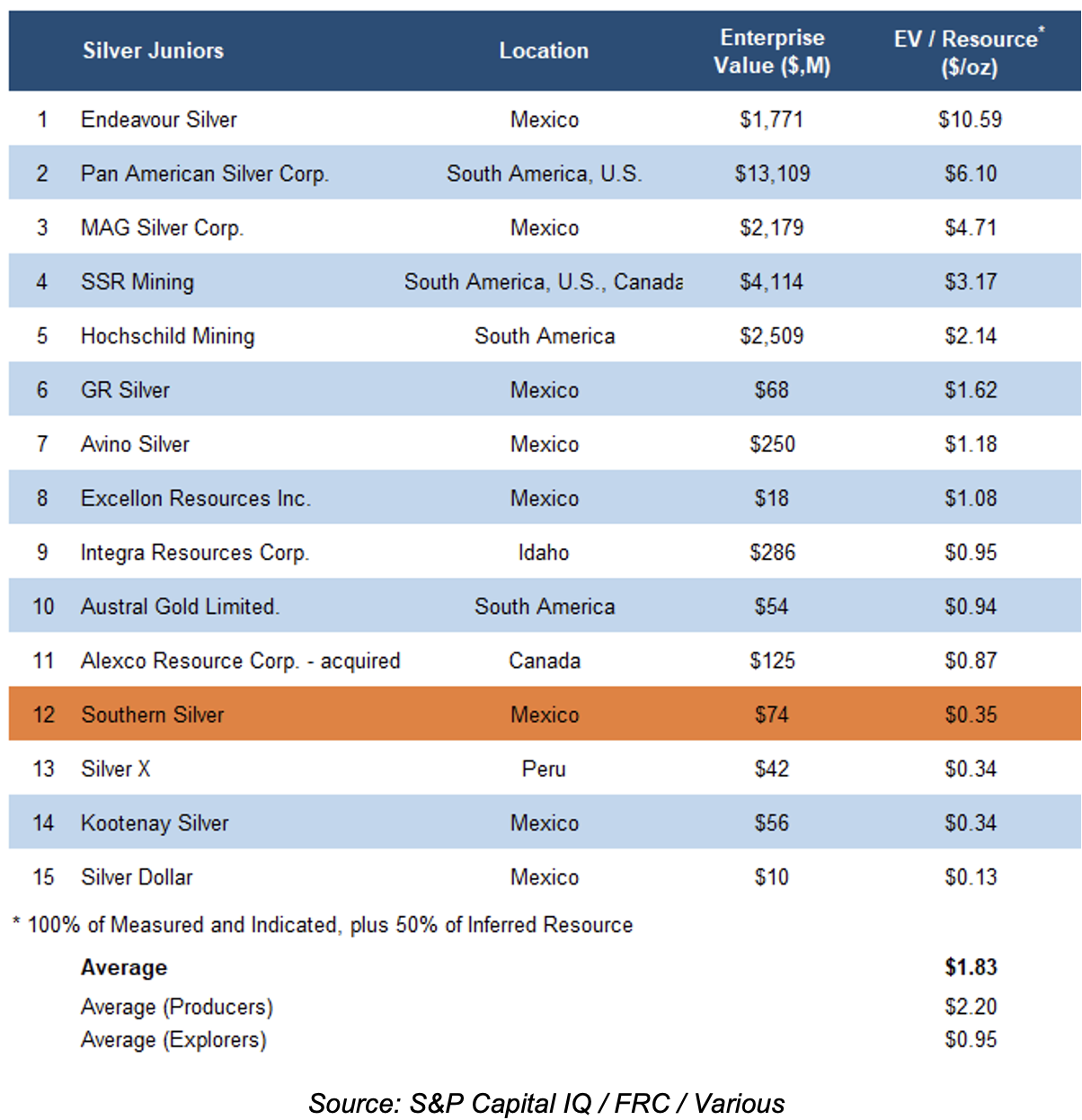

- With gold/silver trading near record highs, we anticipate increased M&A activity over the next 12 months, as larger companies target juniors to expand their portfolios. With its large, relatively high-grade silver resource at CLM, and the robust economics outlined in the PEA, we see SSV as an attractive M&A target.

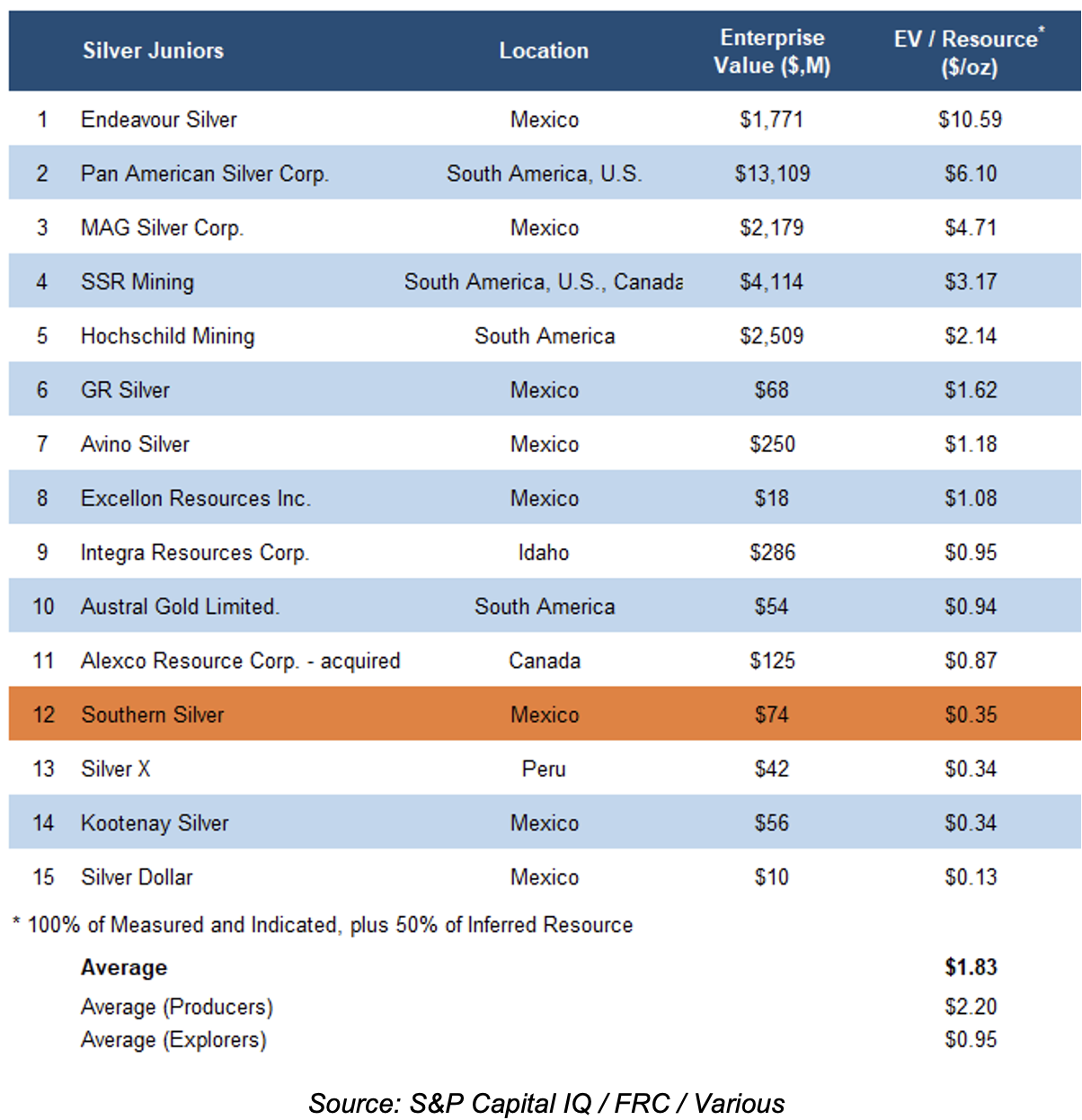

- SSV is trading at a 61% discount ($0.37/oz silver equivalent) vs the sector average of $0.95/oz, based on 100% of measured and indicated resources and 50% of inferred resources.

Risks

- The value of the company is highly dependent on metal prices

- Exploration and development

- Permitting

- Access to capital and potential share dilution

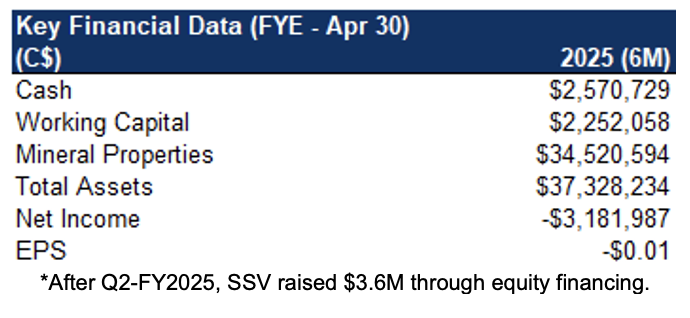

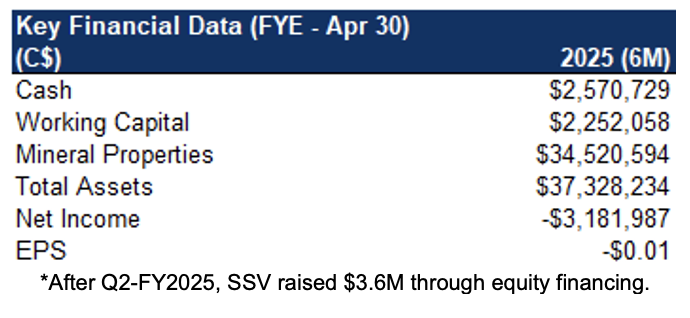

Price Performance (1-year)

| |

YTD |

12M |

| SSV |

30% |

44% |

| TSXV |

-1% |

10% |

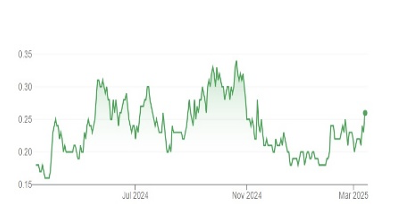

Portfolio Summary

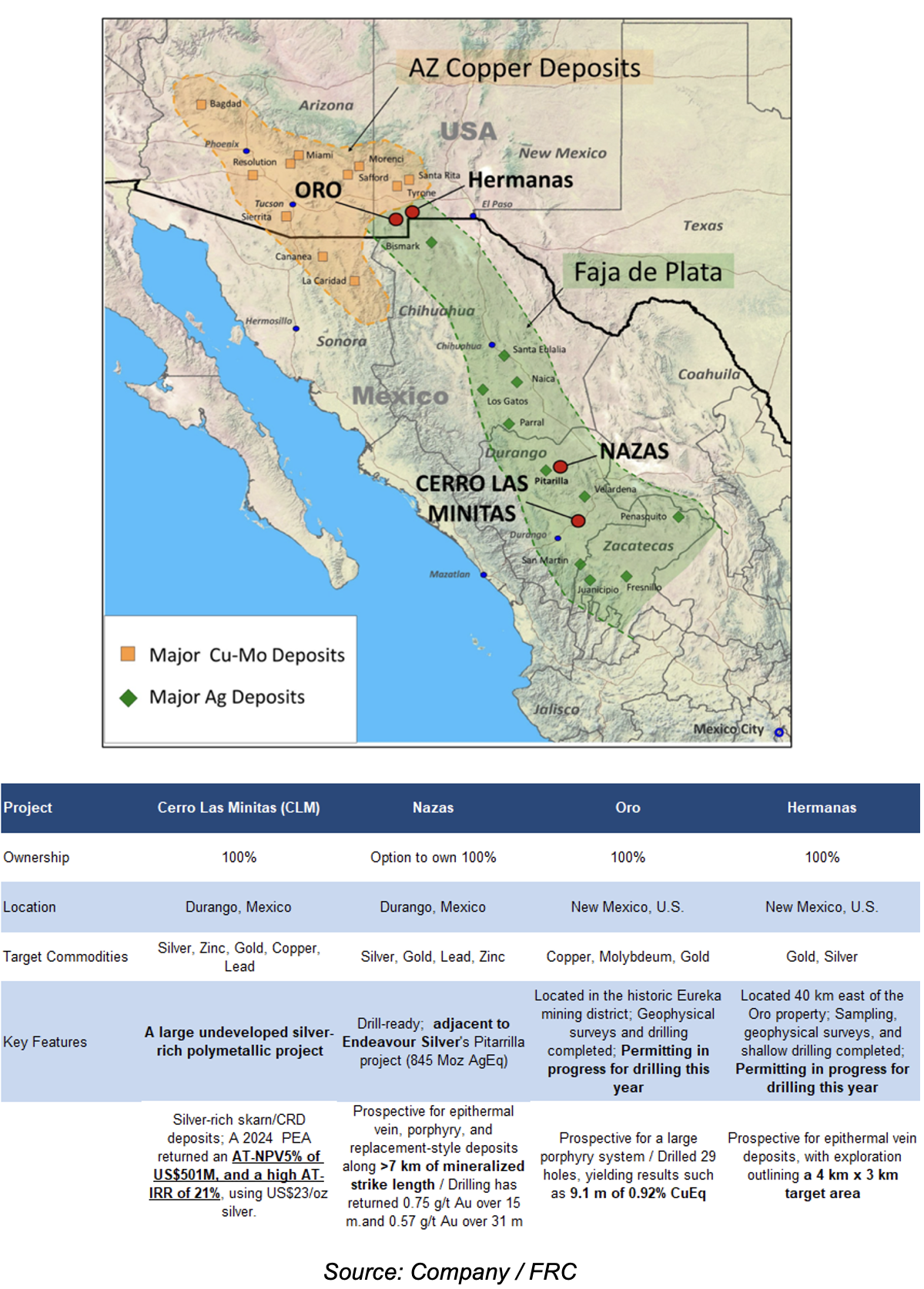

Advancing four polymetallic projects, including two in Durango, Mexico, and two in New Mexico, U.S

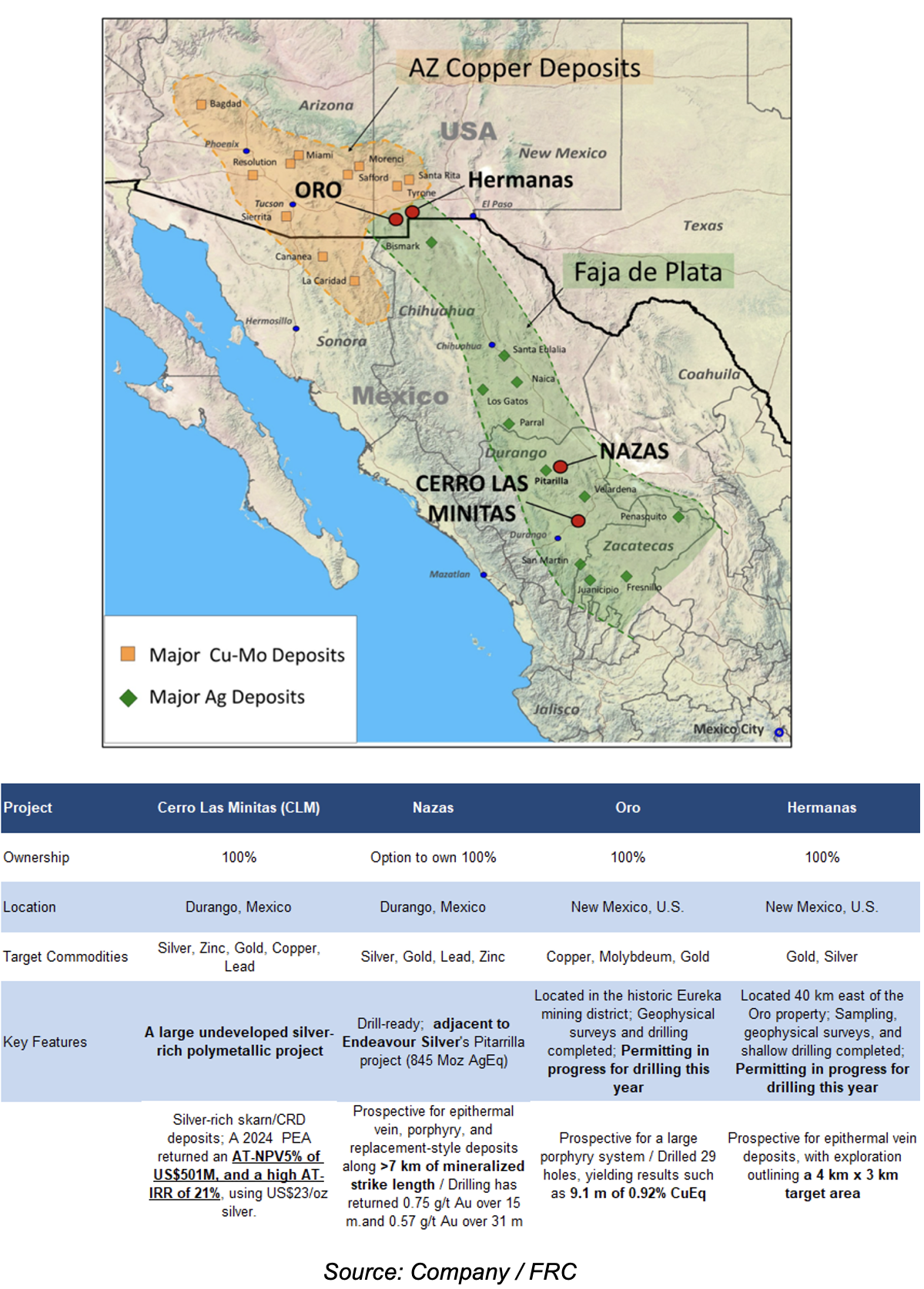

Cerro Las Minitas (100% interest)

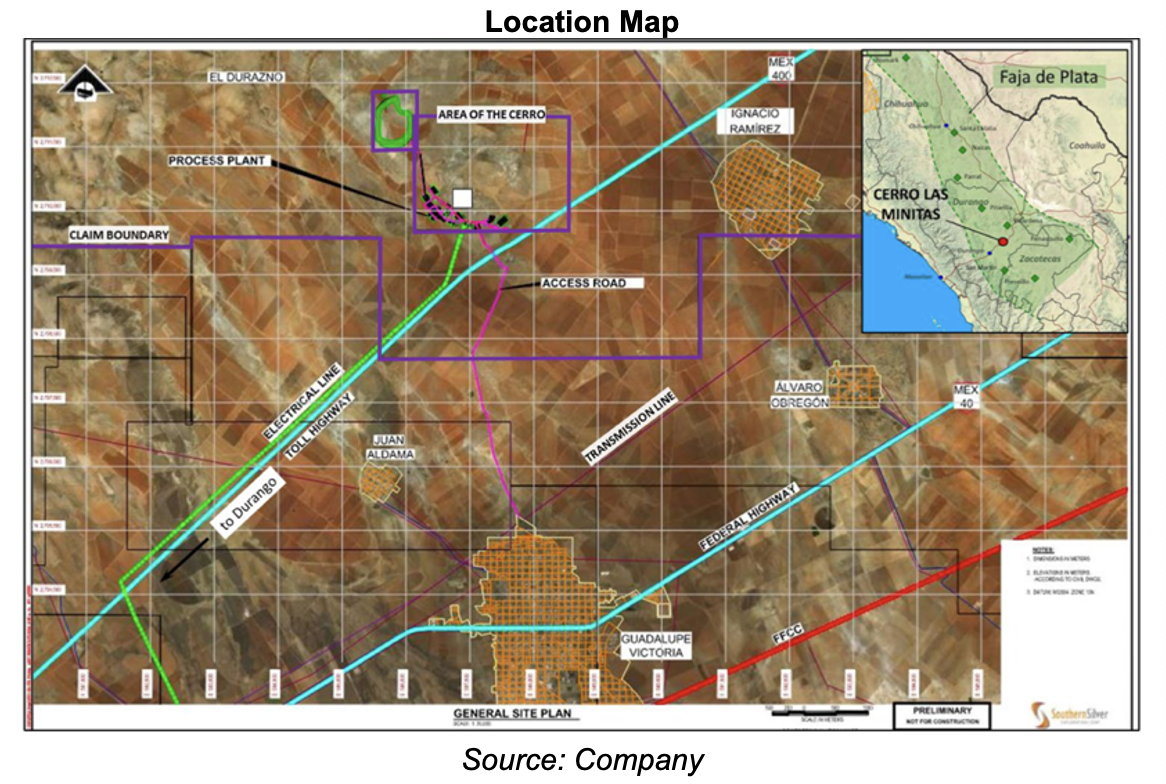

This advanced-stage project, covering 27,451 hectares, is located 70 km northeast of the city of Durango, Mexico. Since 2011, SSV has completed 214 drillholes (95,636 m).

Located in a well-established mining district near several majors. Well-developed infrastructure, including highway, railway, and grid power access

Mineralization, Resources, and PEA

The project hosts a classic silver-lead-zinc CRD/skarn system, comparable to major polymetallic deposits in Mexico.

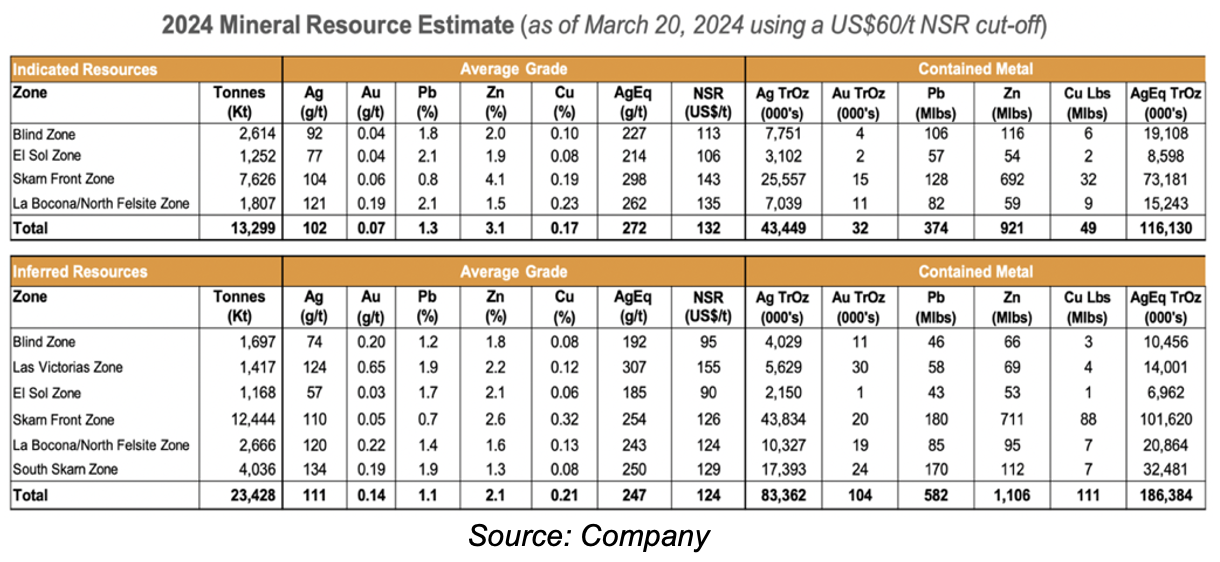

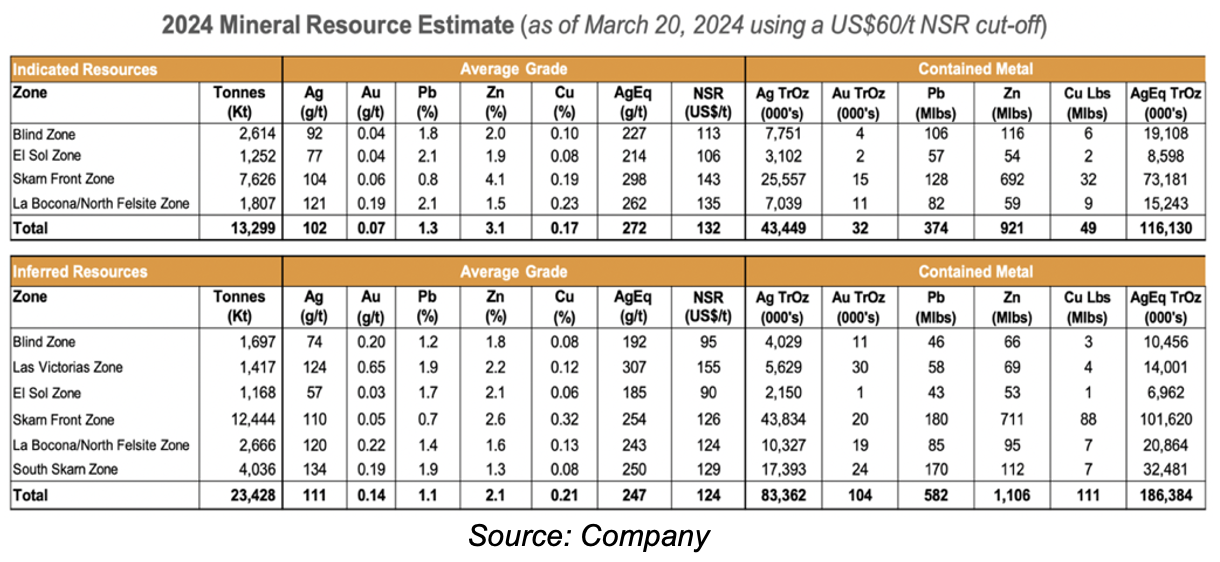

CLM hosts a large polymetallic resource, totaling 303 Moz AgEq, with relatively high-grade silver resources, and low-grade zinc, gold, copper, and lead. At spot prices, silver represents 48% of the resource, followed by zinc and lead at 40%, copper at 8%, and gold at 4%

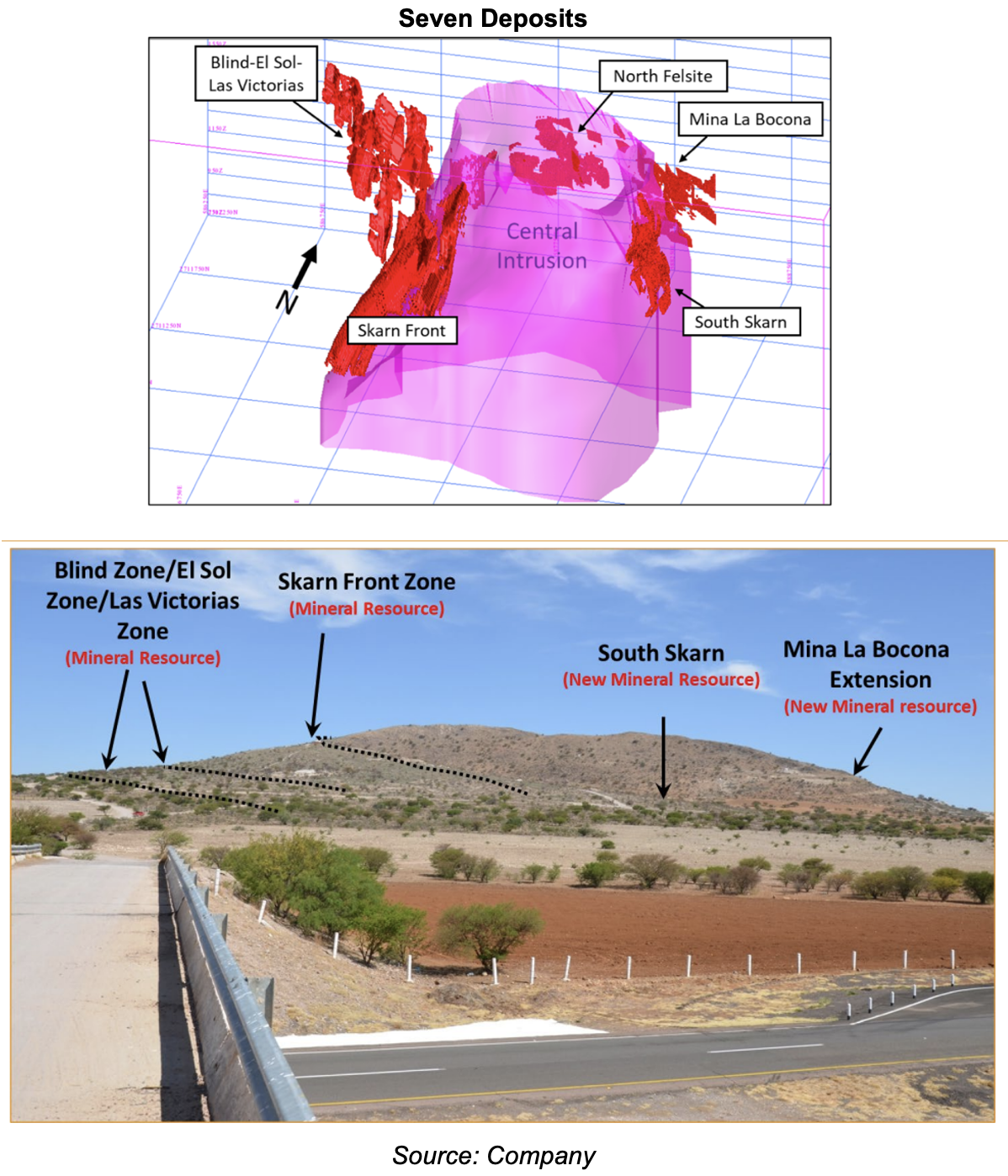

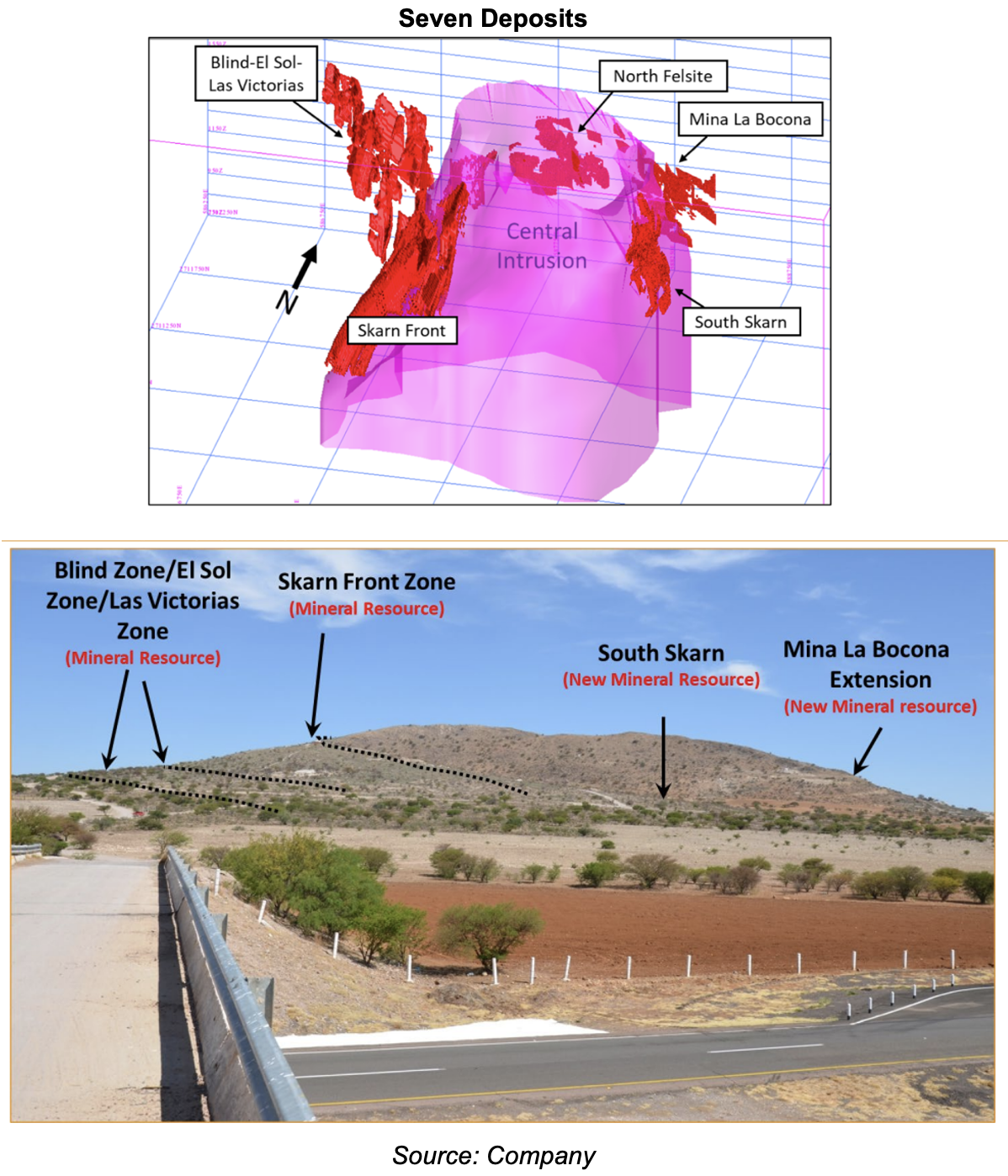

Resources are spread across seven deposits (Blind, El Sol, Las Victorias, North Felsite, Bocona, Skarn Front, and South Skarn

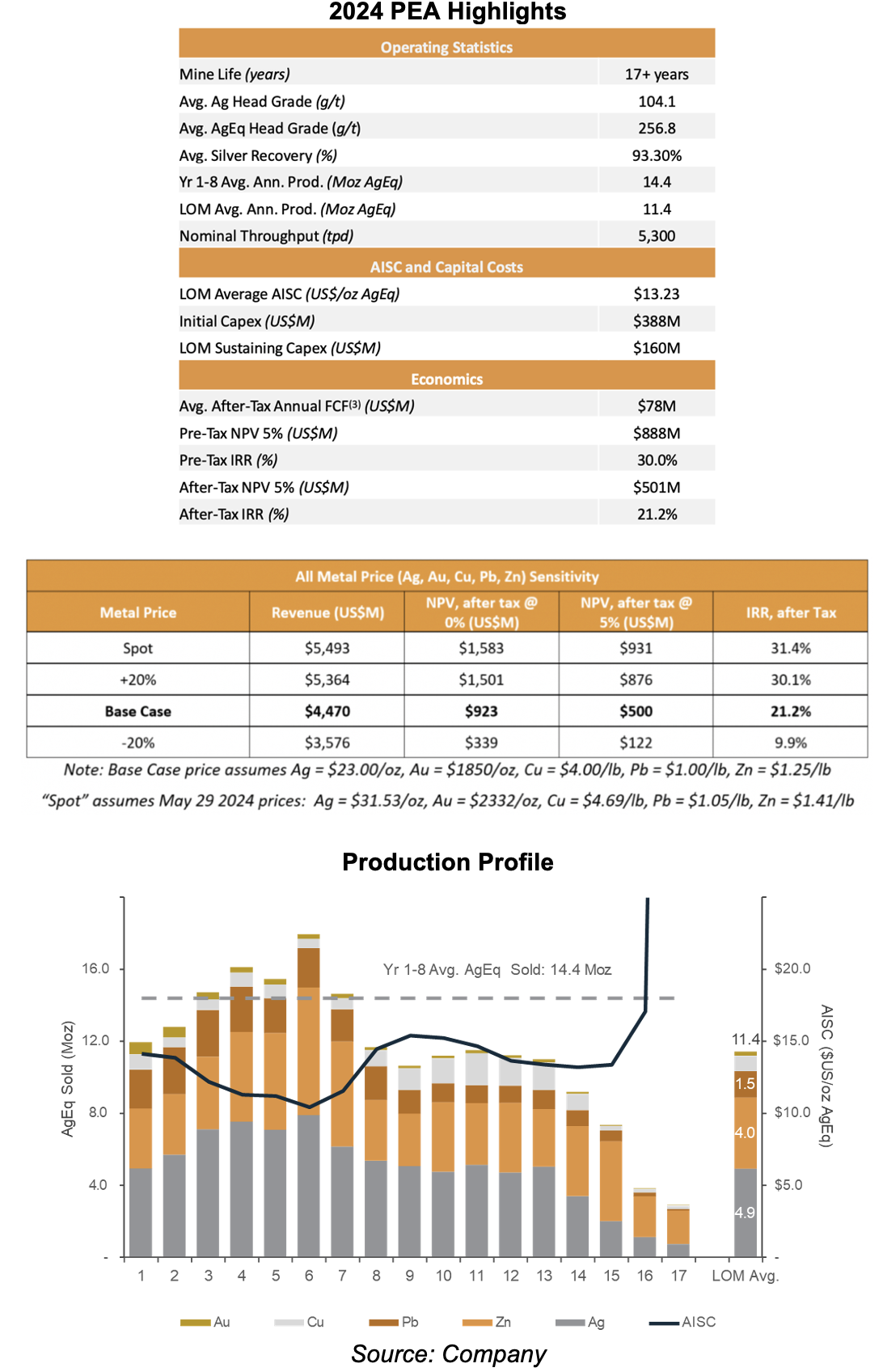

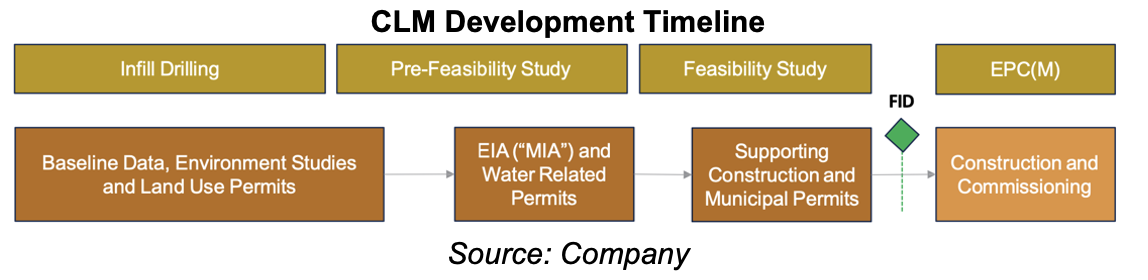

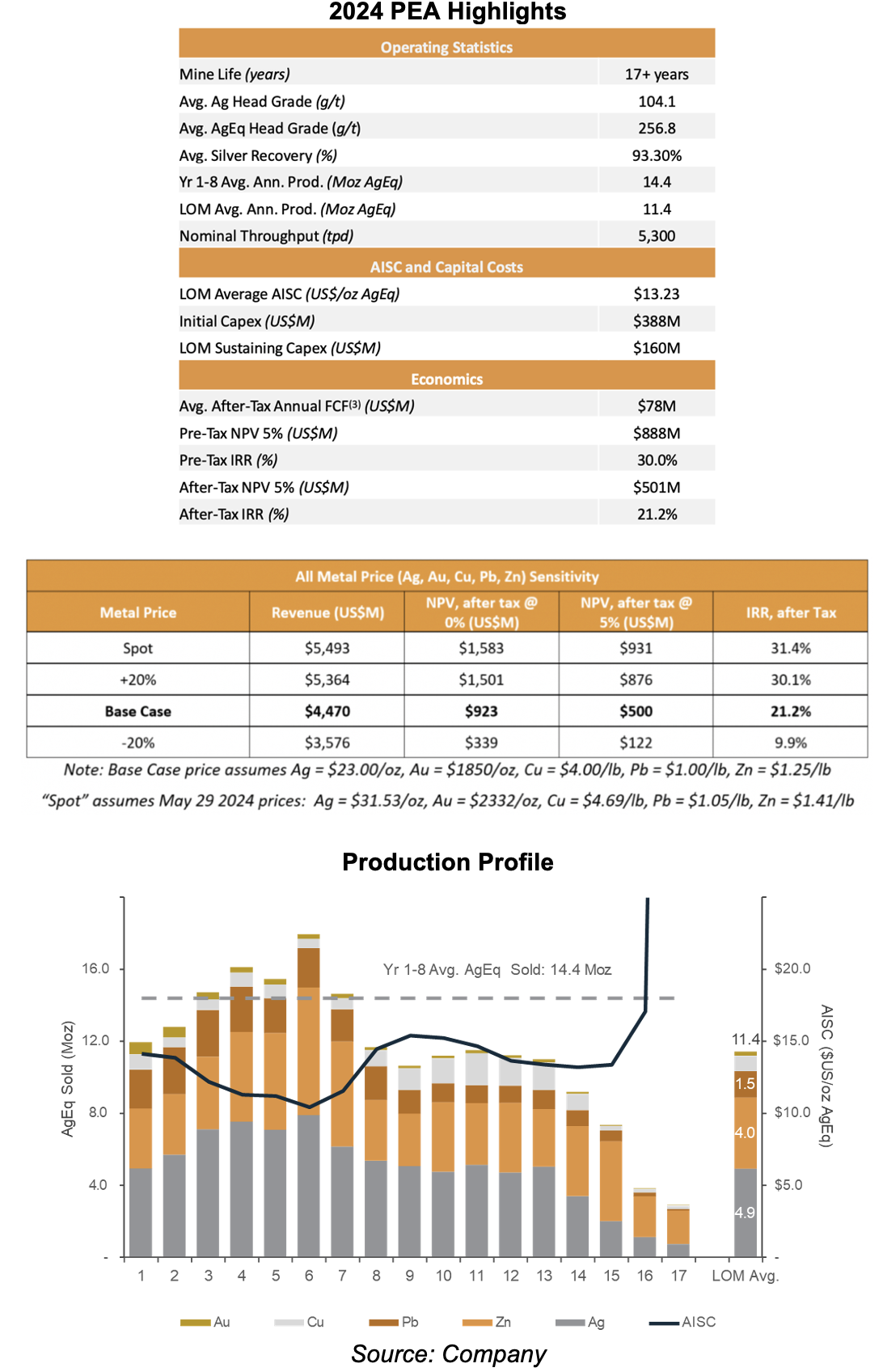

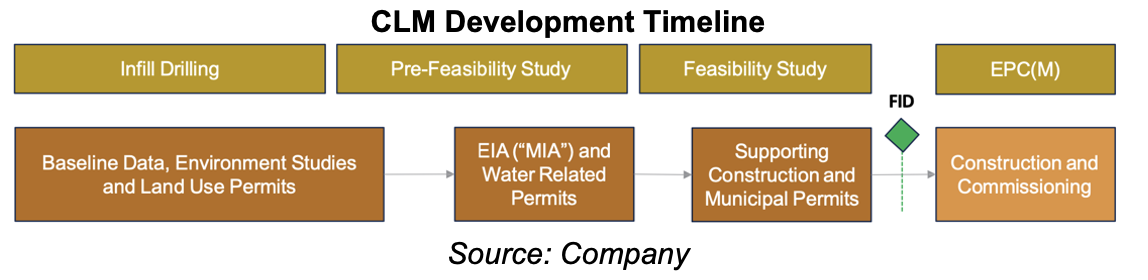

In 2024, SSV completed an updated Preliminary Economic Assessment (PEA) based on underground operations at 5,300 tpd over a 17-year mine life.

AT-NPV5% of US$501M, and an AT-IRR of 21% using US$23/oz silver vs the current spot price of US$34/oz

The AT-NPV5% increases to US$931M at US$31.53/oz Ag. Anticipated life-of-mine sales of 194 Moz AgEq over 17 years (11.4 Moz/year), at an AISC (all-in-sustaining costs) of US$13.23/oz

The potential for higher production in the initial years is a key advantage

Exploration/Resource Expansion Plans

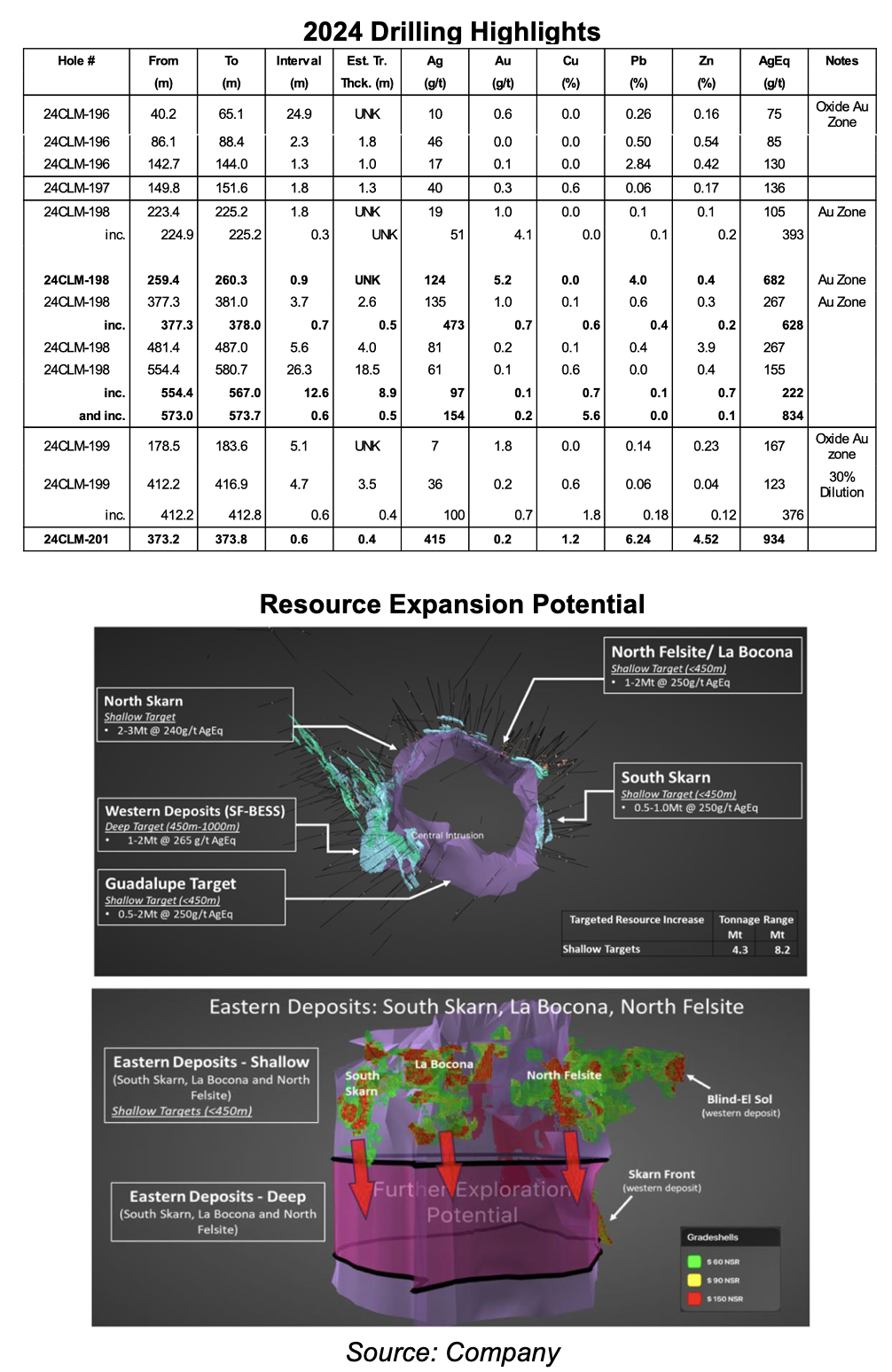

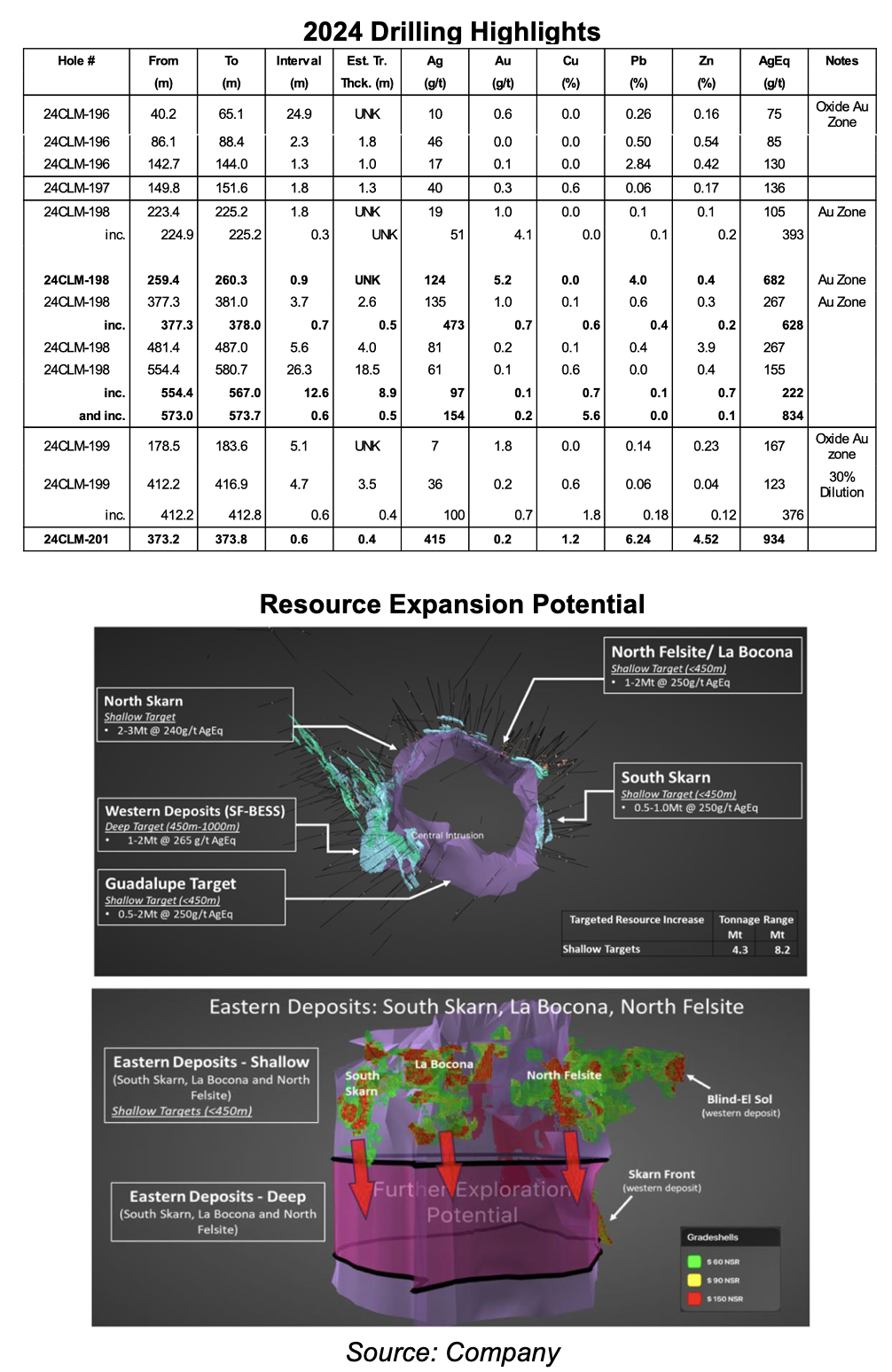

In Q4-2024, SSV drilled six holes (2,395 m) to assess shallow, high-grade mineralization at South Skarn, Mina La Bocona, and North Felsite, located on the project's eastern side.

Drilling returned thick sulphide intercepts, such as 8.9 m of 222 g/t AgEq, below the main mineralized area of the South Skarn deposit

We believe there is resource expansion potential as the deposits remain open laterally, and at depth. SSV is planning a 25,000 m drill program aimed at potentially expanding resources by 10%- 20%

Nazas (Option to earn 100% interest)

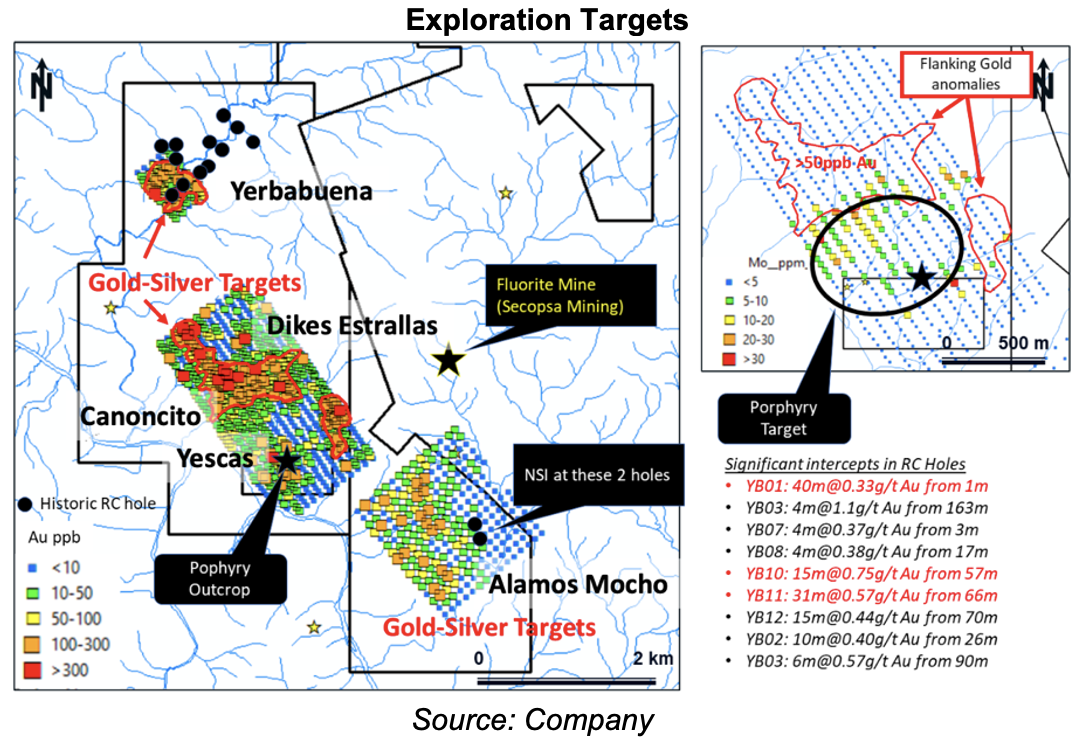

This pre-resource stage project, covering 2,189 hectares, is located 150 km south of Durango, Mexico.

Located 12 km east of Endeavour Silver's Pitarrilla silver-zinc-lead project, sharing the same geology and mineralization. Pitarrilla hosts 845 Moz AgEq, one of the largest undeveloped silver resources in the world

History and Mineralization

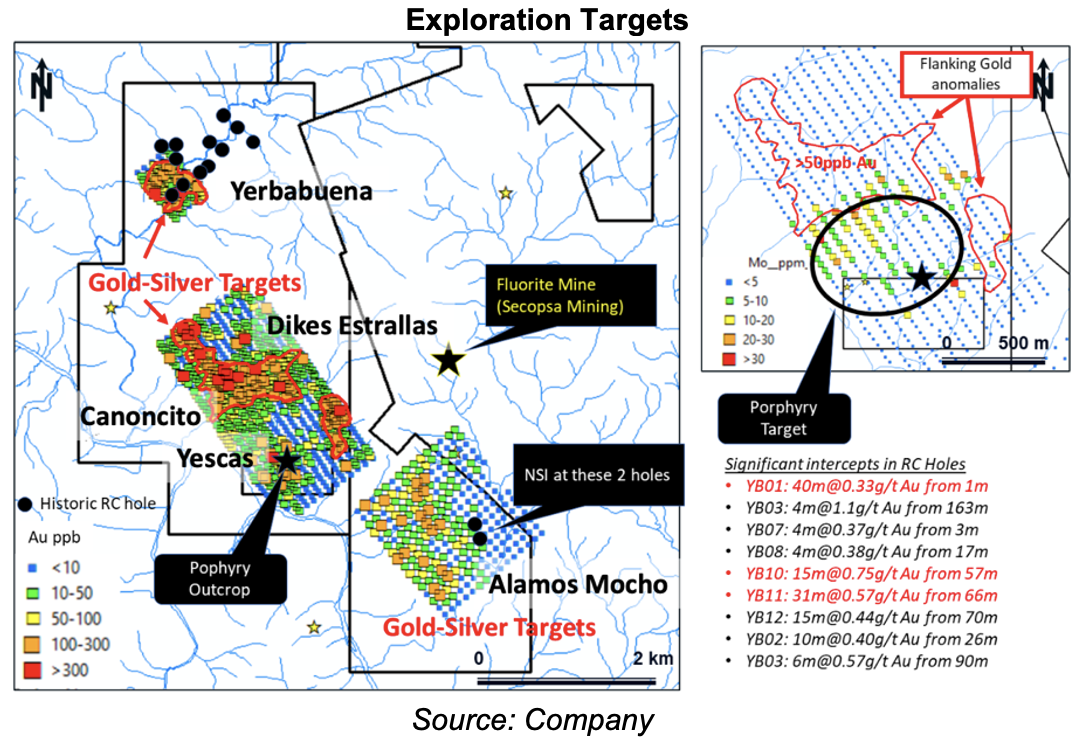

The property is prospective for epithermal vein, porphyry, and replacement-styled mineral deposits. Historic drilling (18 holes) returned multiple intercepts of anomalous gold and silver grades, including 15 m of 0.75 g/t Au, 31 m of 0.57 g/t, and 40 m of 0.33 g/t.

Seven targets identified along a >7km strike length. SSV is planning to drill test four targets (Yescas, Canonctio, Dikes Estrellas, and Alamo Mocho) this year

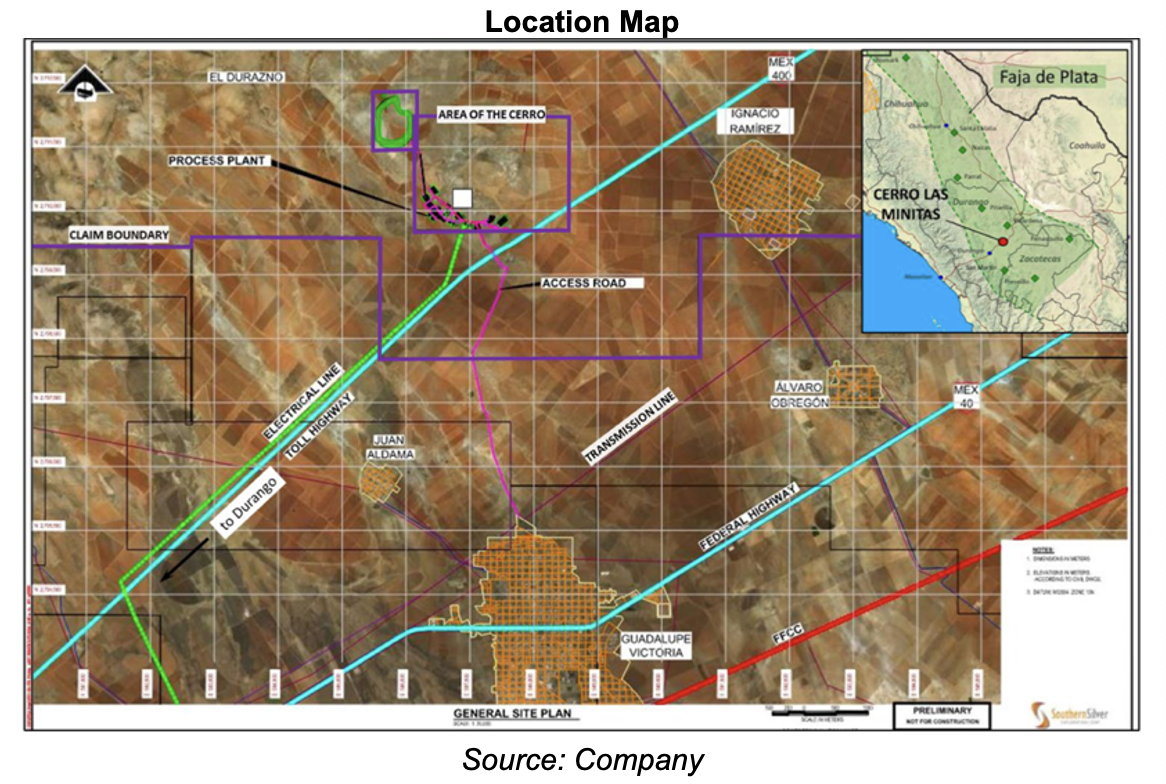

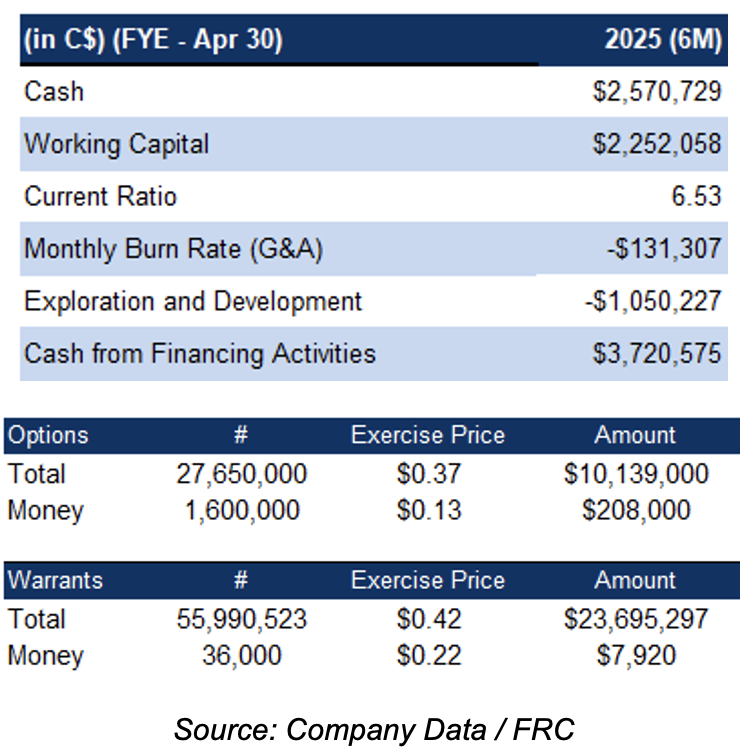

Financials

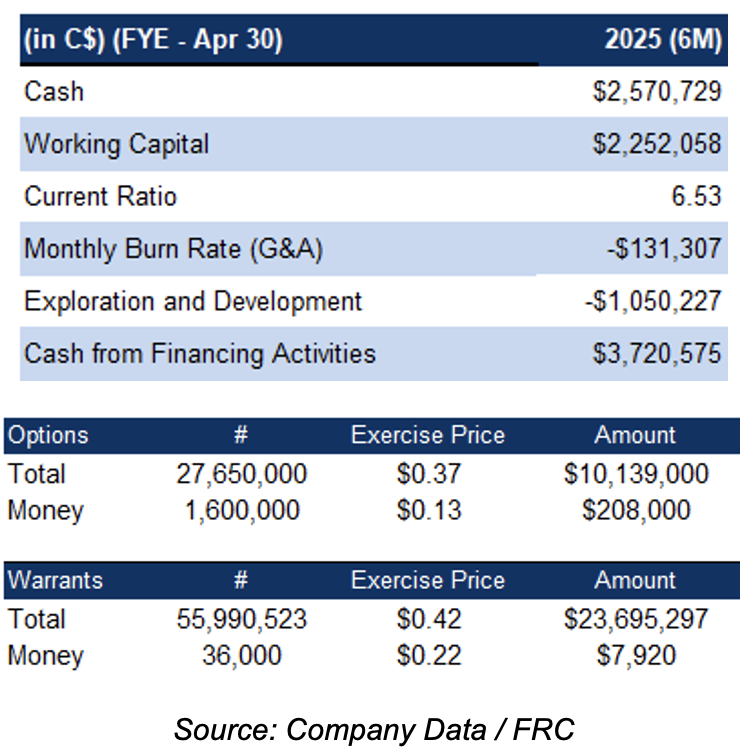

Strong balance sheet. In February 2025, SSV raised $3.6M through an equity financing

Comparables Valuation

SSV is trading at $0.37/ AgEq oz vs the sector average of $0.95/oz. Applying the sector average multiple of $0.95/oz, we arrived at a fair value estimate of $0.61/share

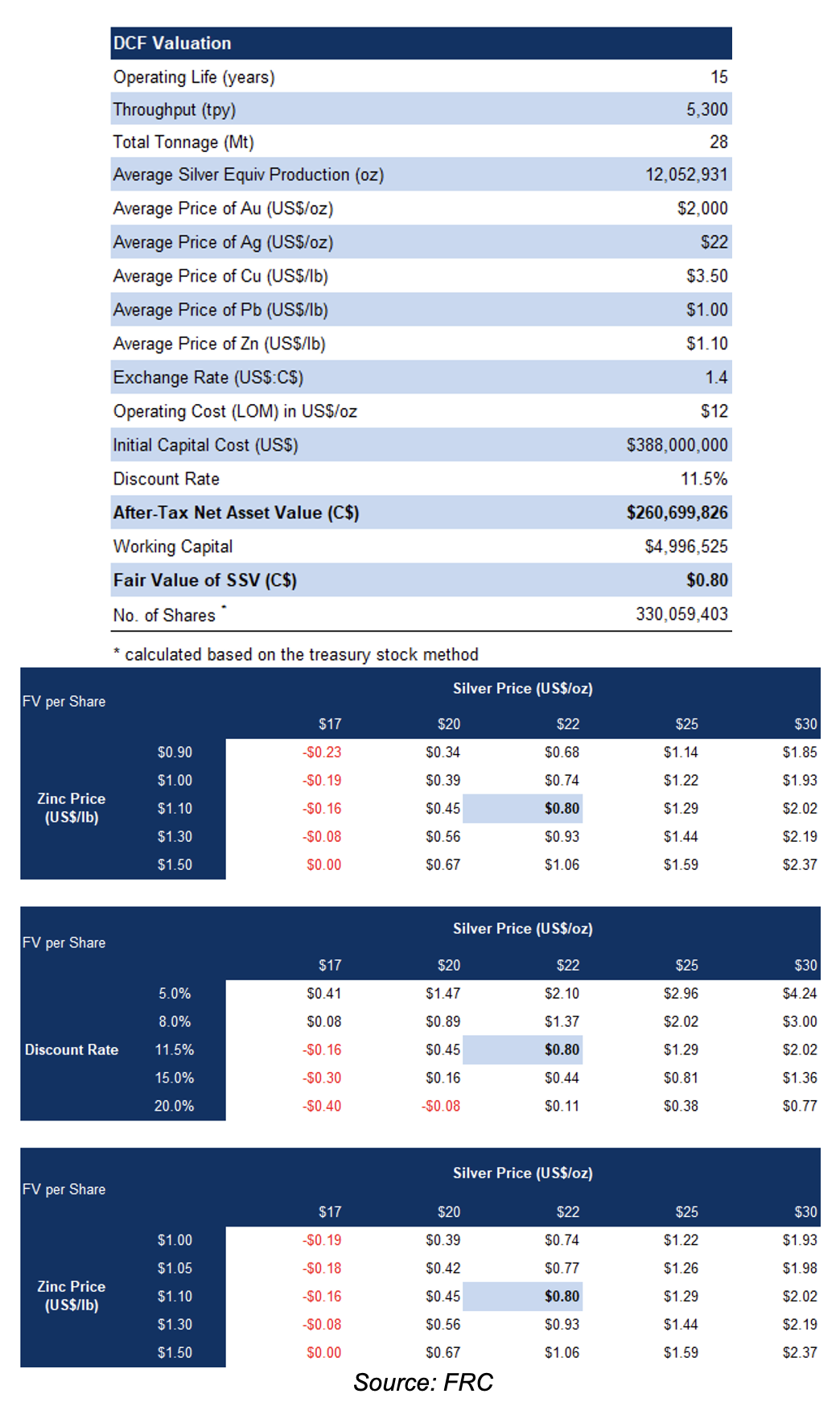

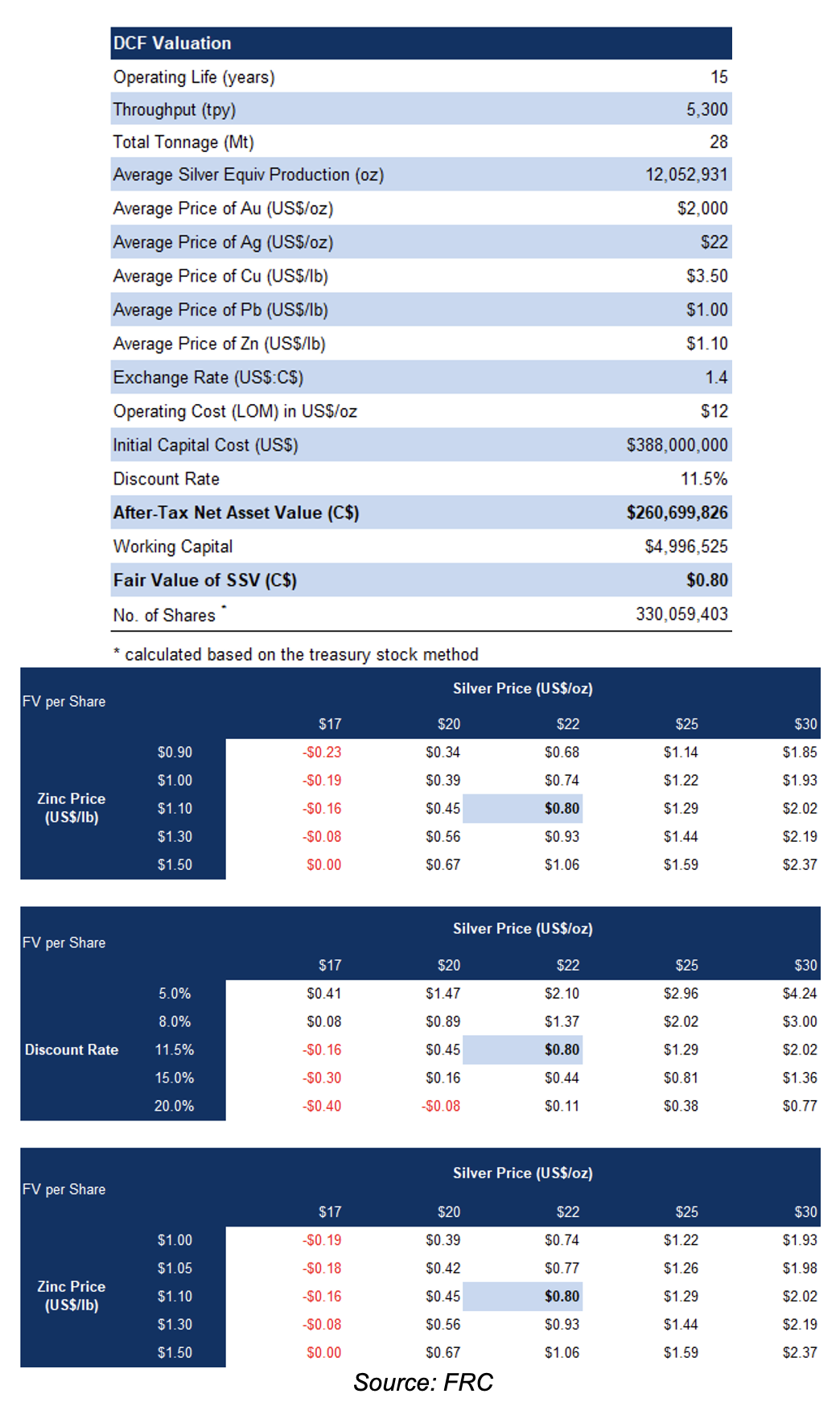

DCF Valuation

Our DCF valuation is $0.80/share. Our valuation is highly sensitive to metal prices

For conservatism, our models are based solely on the flagship CLM project, without assigning any value to SSV’s other projects

Based on our review of CLM project, we are assigning a BUY rating, with a fair value estimate of $0.71/share (the average of our DCF and comparables valuations). We believe SSV's significant silver-rich resource at CLM, coupled with a strong PEA demonstrating robust economics, positions the company as a compelling M&A target, particularly given its steep valuation discount.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- The value of the company is highly dependent on metal prices

- Exploration and development

- Permitting

- Access to capital and potential share dilution