TNR Gold Corp.

Imminent Royalty Revenue from Ganfeng’s Mariana Project

Published: 2/13/2025

Author: FRC Analysts

Sector: Basic Materials | Industry: Other Industrial Metals & Mining

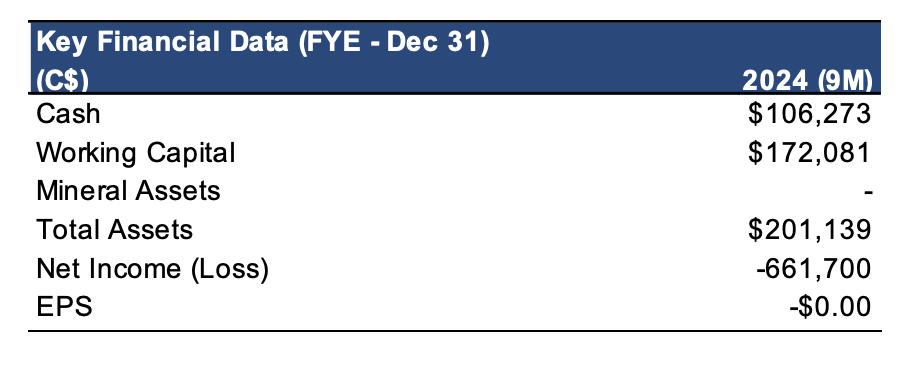

| Metrics | Value |

|---|---|

| Current Price | CAD $0.06 |

| Fair Value | CAD $0.28 |

| Risk | 5 |

| 52 Week Range | CAD $ |

| Shares O/S (M) | 190 |

| Market Cap. (M) | CAD $10 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | N/A |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

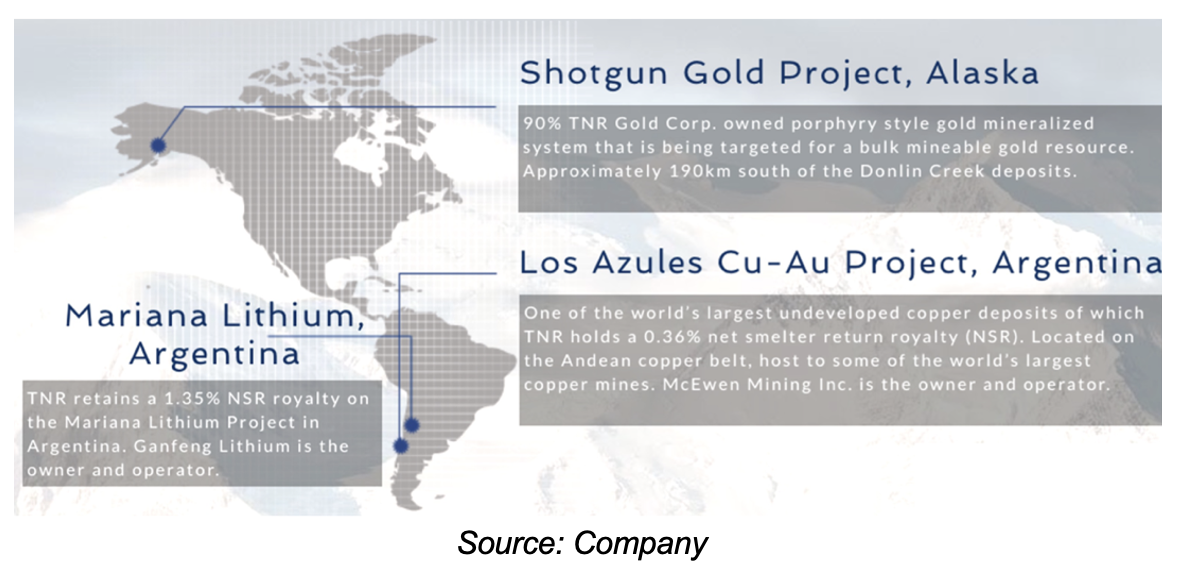

- TNR’s portfolio primarily consists of a gold project in Alaska (Shotgun), and royalties in two advanced-stage projects in Argentina, including the Mariana lithium project owned by Ganfeng Lithium (SZSE: 002460/MCAP: $12B), and the Los Azules copper-gold project owned by McEwen Copper.

- In July 2024, Argentina introduced the Large Investment Incentive Regime (RIGI) to attract foreign investment in key sectors such as mining, energy, and infrastructure. The program offers tax breaks, customs incentives, and legal stability to investors in large-scale projects, aiming to position Argentina as a more competitive destination for mining investments.

- Ganfeng is set to start commercial production at its Mariana lithium project this month. We are projecting annual royalty revenue of $1.2M for TNR at current spot lithium prices. Royalty payments for TNR could commence as early as March 2025.

- We expect a major turnaround in lithium prices this year as current levels (US$10k/t) are near the break-even point for most largescale development projects, raising concerns about their economic viability. We believe prices need to be at least US$15k/t to incentivize developers and financiers to advance projects.

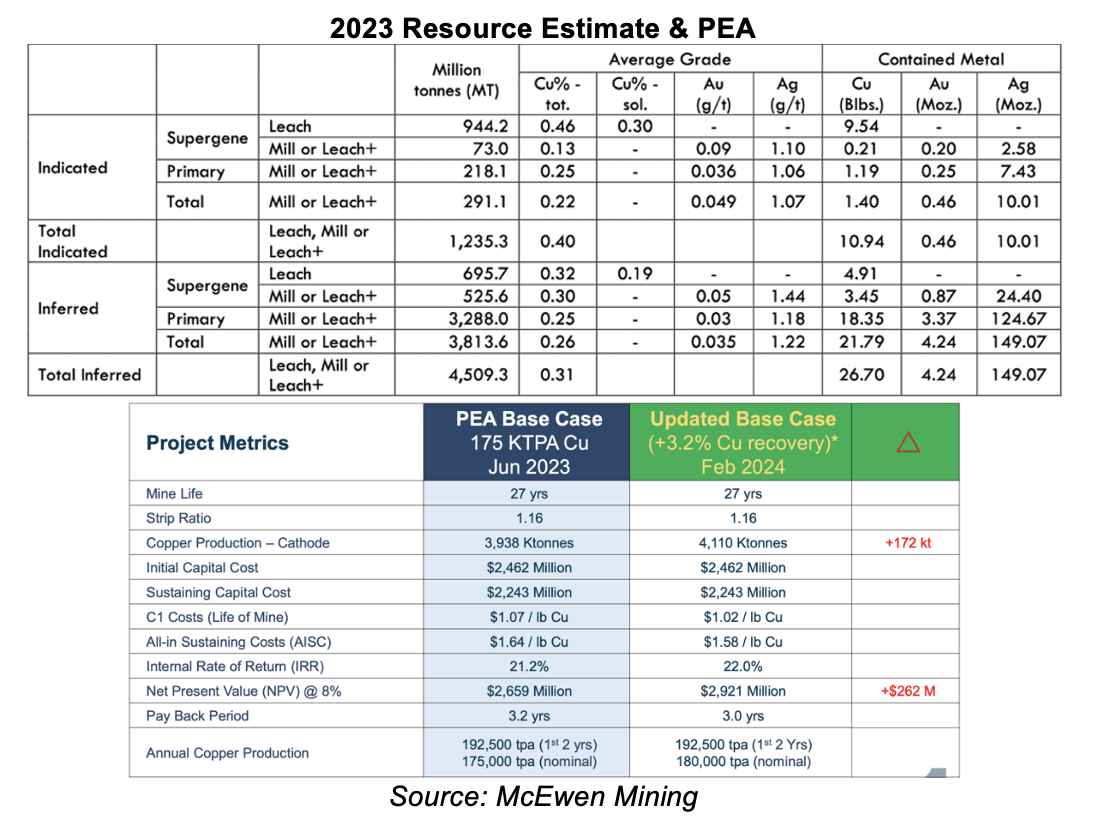

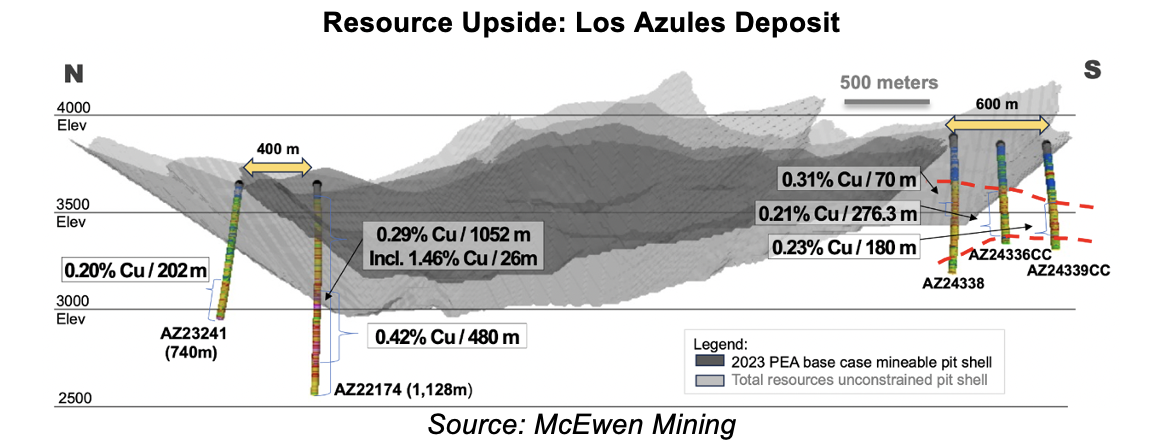

- McEwen Copper’s Los Azules copper-gold project hosts a large, open-pittable copper deposit (38 Blbs copper + 4.7 Moz gold + 159 Moz silver). In Q4-2024, the company secured an environmental permit for construction and operation, and completed a $56M equity financing. Recent infill and resource expansion drilling has extended mineralization both along strike and at depth. An updated resource estimate, and a feasibility study (FS), are expected in the coming months. Management aims to begin construction in early 2026, and commence commercial production by 2029. We are projecting annual royalty revenue of $6.5M from this project, using conservative copper prices.

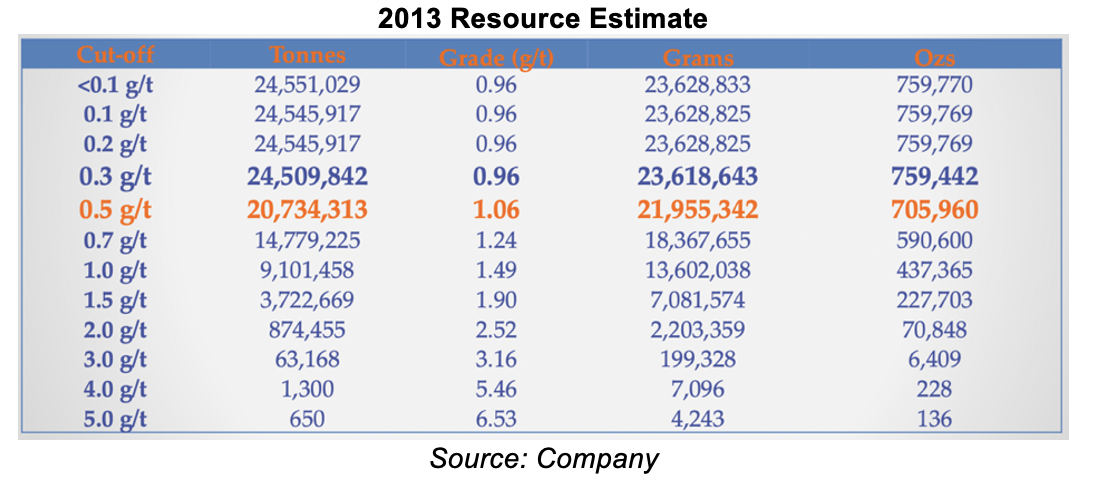

- TNR is seeking a JV partner to advance the Shotgun project to a PEA. Shotgun hosts a small to medium sized gold deposit, with inferred resources totaling 706 Koz, at a relatively high grade of 1.1 gpt.

- With gold and copper are trading near record highs, we anticipate an increase in M&A activity over the next 12 months, as larger companies target juniors to grow their portfolios.

- Upcoming catalysts include the commencement of production at Mariana, an updated resource estimate, and a FS, at Los Azules, and the possibility of a JV partner for Shotgun.

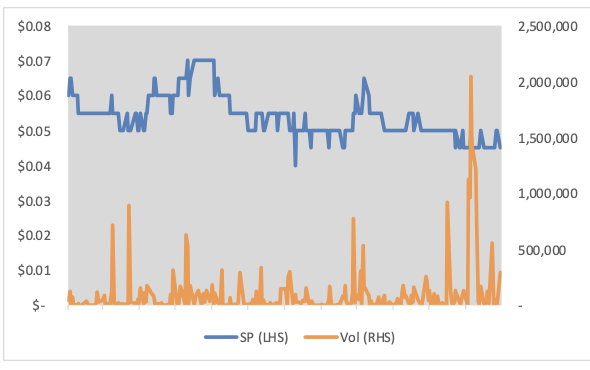

Price Performance (1-year)

Portfolio Summary

90% interest in the Shotgun gold project in Alaska. Royalties in two advanced-stage projects in Argentina, including a lithium project owned by Ganfeng Lithium, and a copper-gold project owned by McEwen Copper

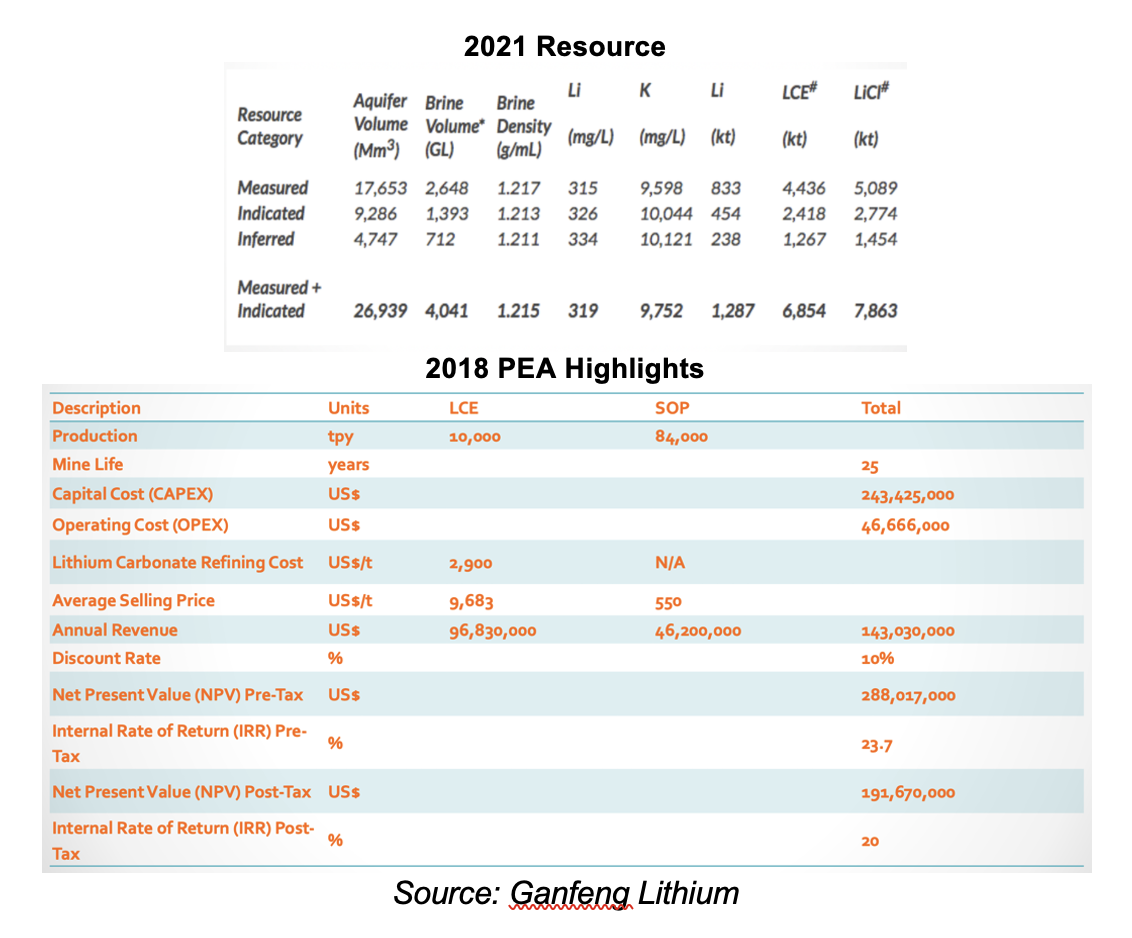

Mariana Lithium-Potassium Brine Project, Argentina (1.35% NSR)

This advanced stage lithium project is 100% owned by Ganfeng Lithium.

Located in Salta province, Argentina. Argentina is the fourth largest lithium producer in the world. The project hosts a large lithium-potassium brine resource

A 2018 PEA based on a 10,000 tpa operation, and a 25-year mine life, returned an AT-NPV10% of US$192M, and an AT-IRR of 20%, using US$9.7k/t LCE vs the current spot price of US$10,300/t

Ganfeng anticipates producing 20,000 tpa of lithium chloride. TNR owns a 1.35% NSR in the project, of which, Ganfeng has an option to purchase 0.90% for $0.9M. We believe Ganfeng will exercise its option, thereby reducing TNR’s interest to 0.45%. We are projecting annual royalty revenue of $1.2M for TNR at current spot lithium prices.

Los Azules Copper-Gold-Silver Project, Argentina (0.36% NSR)

This advanced stage porphyry copper project is 100% owned by McEwen Copper. McEwen Copper is owned by a group led by McEwen Mining (NYSE: MUX), Stellantis (NYSE: STLA/the owner of auto brands such as Fiat, Maserati, and Chrysler), Rio Tinto (LSE: RIO/), and Rob McEwen.

Ganfeng is set to commence production this month. Located in the prolific Andes copper belt, 90 km north of Glencore’s (LSE: GLEN) El Pachon project

In December 2024, McEwen Copper received an Environmental Impact Assessment (EIA) for construction and operation.

Los Azules is one of the largest undeveloped copper projects in the world, with resources totaling 38 Blbs copper, 4.7 Moz gold, and 159 Moz silver, suitable for open-pit mining

A PEA returned an AT-NPV8% of US$2.9B, using US$3.75/lb copper vs the current spot price of US$4.59/lb

Since the 2023 PEA, the company has completed >100,000 m of drilling, extending mineralization along strike, and at depth. In addition, recent metallurgical test results returned copper recoveries of up to 76% vs 73% used in the PEA.

We note that the deposit has significant resource expansion potential as mineralization is open along strike, and at depth

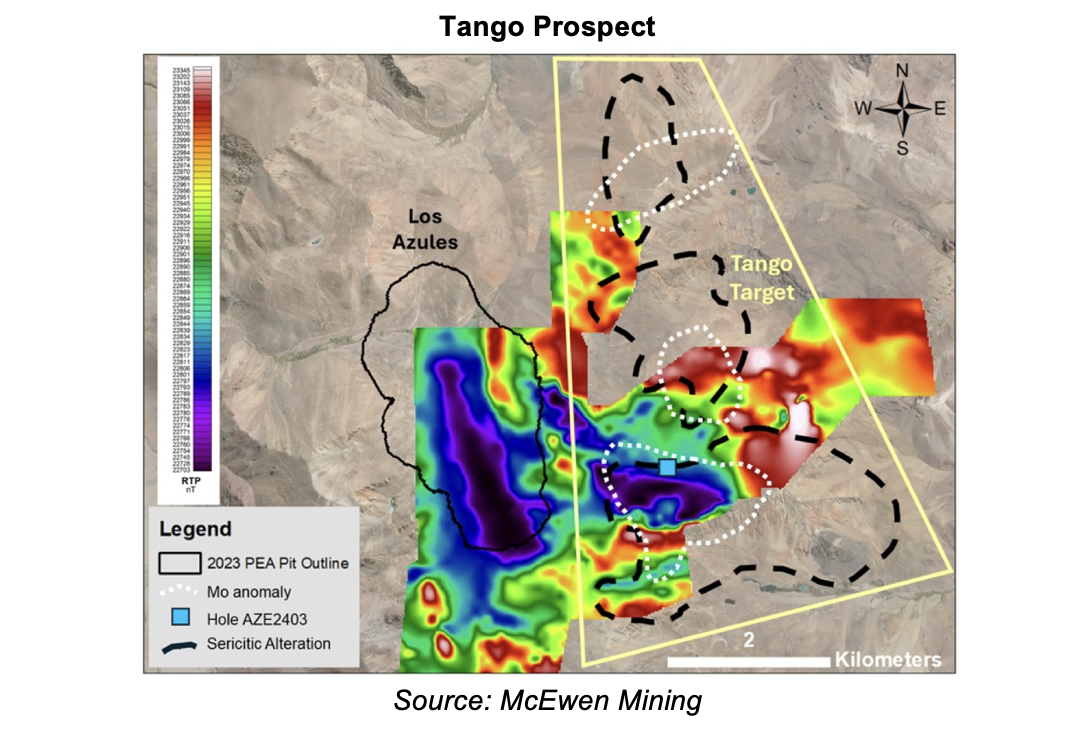

McEwen Copper has also identified multiple targets beyond the area covered by the existing resource estimate.

A potential copper system may exist 3 km to the east of the Los Azules deposit

The company is aiming to complete an updated resource estimate in Q1-2025, followed by a definitive feasibility study in Q2-2025. Management aims to begin construction in early 2026, and commence commercial production by 2029. Using our long-term average copper price forecast of US$3.5/lb, we anticipate TNR could generate $6.5M in annual royalty revenue from this project.

Shotgun Gold Project, Alaska (90% interest)

The property hosts a medium-sized/relatively high-grade/shallow deposit, with inferred resources totaling 0.71 Moz (1.06 gpt) on one of five identified targets.

Located 190 km from NovaGold and Barrick’s Donlin gold project (45 Moz in resources at 2+ gpt) – one of the largest undeveloped gold deposits in the world; Donlin has experienced delays due to strong opposition from local groups

Management is seeking an option/JV partner to advance the project to a PEA. We believe the project has resource expansion potential as the Shotgun Ridge deposit remains open along strike and at depth; in addition, four targets remain untested.

As Shotgun is much smaller, we anticipate a smoother permitting process

Financials

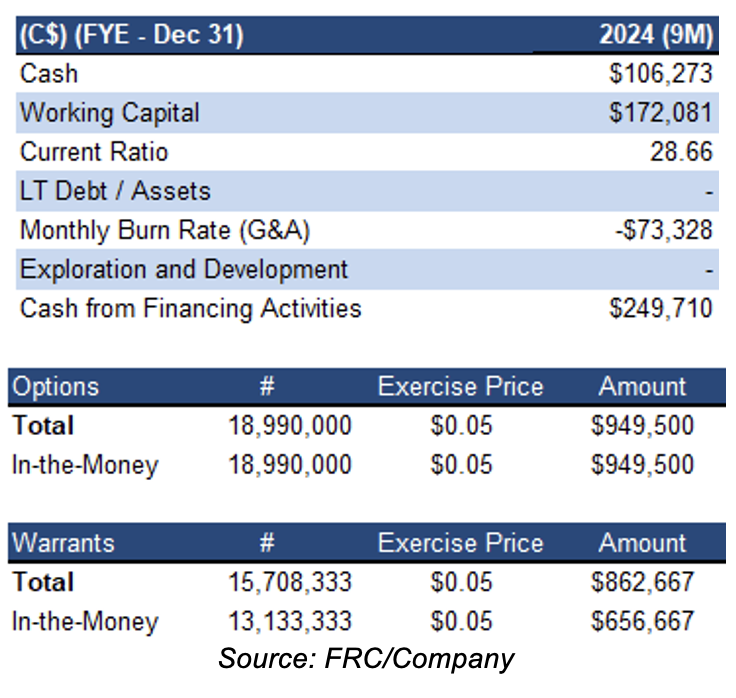

At the end of Q3-2024, TNR had $172k in working capital, with no debt

Can raise up to $1.61M from in-the-money options and warrants

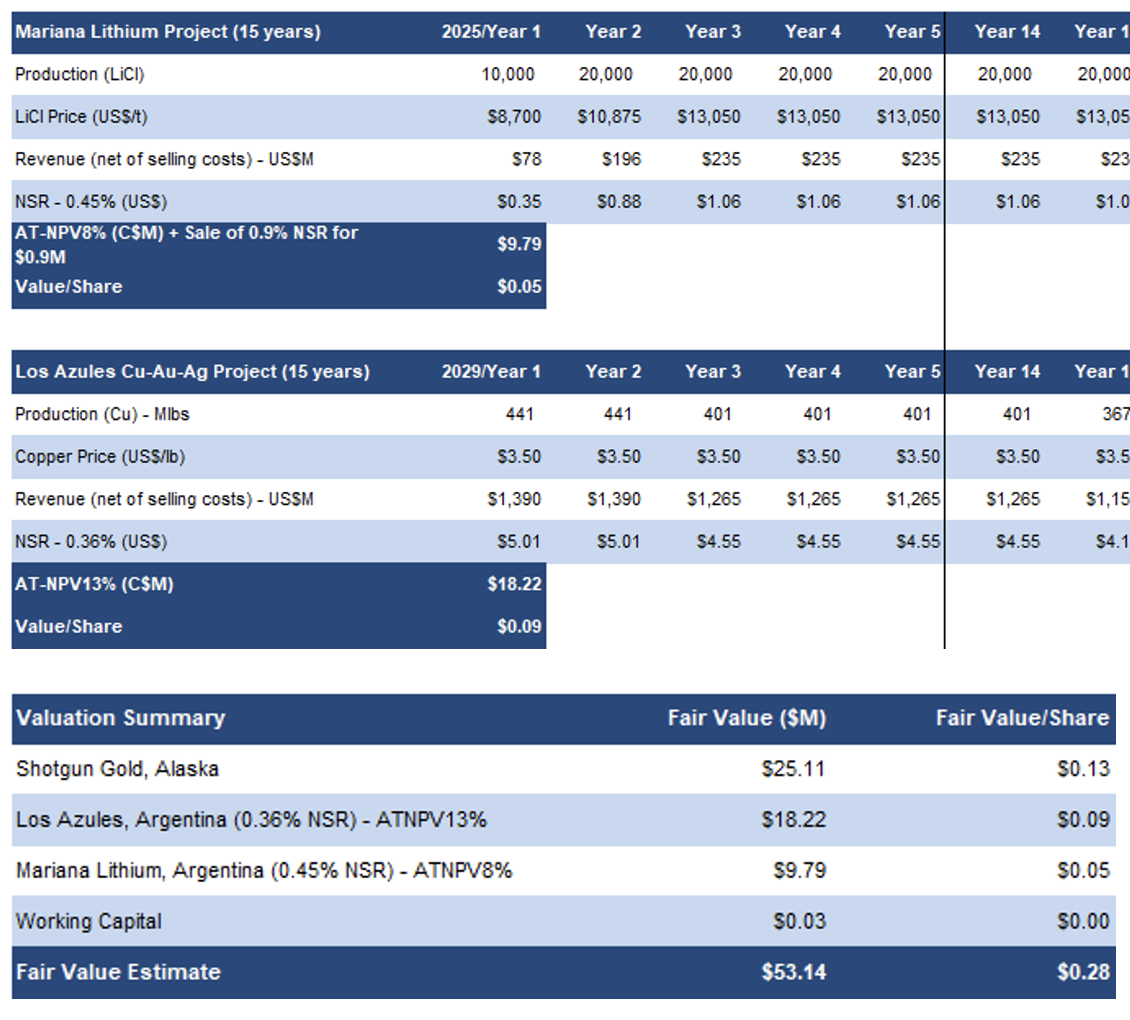

FRC Valuation and Rating

Based on an average EV/Resource of $53/oz (previously $41/oz) for gold juniors, we arrived at a fair value estimate of $0.13/share (previously $0.10/share) on the Shotgun project

Our AT-NPV estimate on Mariana royalties is up 4%, driven by the time value of money as the project nears production

Using a sum-of-parts model, we arrived at a fair value estimate of $0.28/share on TNR (previously $0.24/share)

We are reiterating our BUY rating, and adjusting our fair value estimate from $0.24 to $0.28/share. We believe TNR's share price of $0.055 indicates that the market is not only undervaluing the Shotgun project, but also completely overlooking TNR's royalty interests. TNR is poised to benefit from near-term royalty revenue from Mariana as it begins production, offering immediate cash flow potential.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- Commodity prices

- Potential for delays in attracting a partner for Shotgun

- Exploration and development

- No assurance that its partners will advance their projects within expected timelines

- Access to capital and share dilution