Kidoz Inc.

Client Delays Impact Revenue; Sector Outlook Remains Strong

Published: 12/7/2023

Author: Sid Rajeev, B.Tech, CFA, MBA

Sector: AdTech | Industry: Advertising

| Metrics | Value |

|---|---|

| Current Price | US $0.21 |

| Fair Value | US $0.82 |

| Risk | 4 |

| 52 Week Range | US $0.14-0.44 |

| Shares O/S (M) | 131 |

| Market Cap. (M) | US $27 |

| Current Yield (%) | n/a |

| P/E (forward) | n/a |

| P/B | 4.0x |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

Highlights

In Q3, revenue dropped 20% YoY, falling 18% below our estimate due to clients delaying ad campaigns. We were disappointed with the revenue decline, especially considering the upward trend in global digital ad spending. Major digital ad platforms, YouTube (NASDAQ: GOOGL), and Meta (NASDAQ: META), reported revenue growth of 12% YoY and 24% YoY, respectively.

Another contributing factor to the decline in revenue is KIDZ's shift in sales strategy within the U.S. Instead of relying exclusively on resellers, the company expanded its sales team to prioritize direct sales; a strategy management believes will be more successful in boosting revenue, and margins.

KIDZ's ad network spans 5,000+ apps, reaching 400M kids. Prominent brands such as McDonald's (NYSE: MCD), Disney (NYSE: DIS), Lego, Kellogg's (NYSE: K), and Nintendo (TYO: 7974), advertise on KIDZ’s platform. Management has indicated that their newly launched ad platform, Prado, designed for teens and parents, is gaining significant momentum.

In Q3, gross margins improved by 2 ppt YoY, aligning with our forecast. However, EBITDA, and EPS, deteriorated due to lower revenue.

We anticipate a faster growth trajectory in global ad spending for 2024, driven by cooling inflation, and lower interest rates. We anticipate central banks will initiate rates cuts in H1-2024.

KIDZ’s forward EV/R is 1.3x vs the sector average of 3.0x, implying a 57% discount.

As Q4 usually comprises 50% of annual revenue, its results will indicate the success of KIDZ’s new direct sales strategy.

Financials

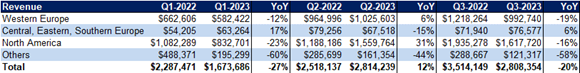

Q3 revenue was down 20% YoY, missing our forecast by 18%

Gross margins increased by 2 pp YoY, in line with our forecast

Despite a 20% YoY increase in operating expenses, they stayed in line with our forecasts

As a result of lower revenue, EBITDA, EPS, and FCF deteriorated, and fell well below our estimates

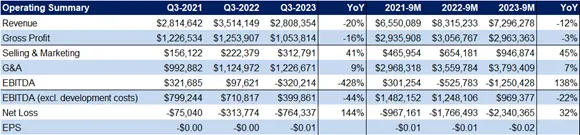

Healthy balance sheet, with negligeable debt

Source: FRC/Company

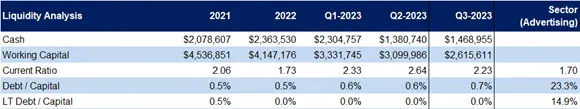

None of the outstanding options are in the money

Sector Outlook

Source: FRC / Various

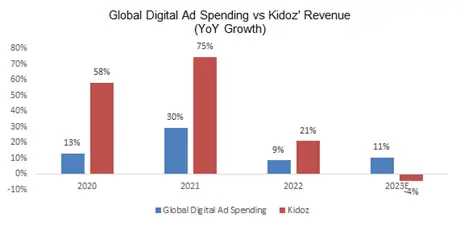

Global digital ad spending is projected to grow by 10.5% this year, up from 8.6% in 2022 (Source: eMarketer)

In 2023, KIDZ’s revenue growth lagged behind global digital ad spending, after outperforming global growth by an average of 3.3x over the past three years

FRC Projections and Valuation

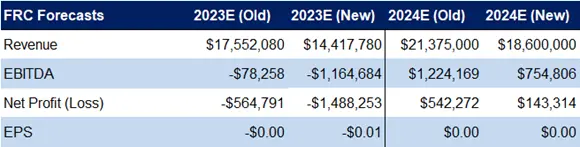

As Q3 was weaker than expected, we are lowering our near-term forecasts

Source: FRC

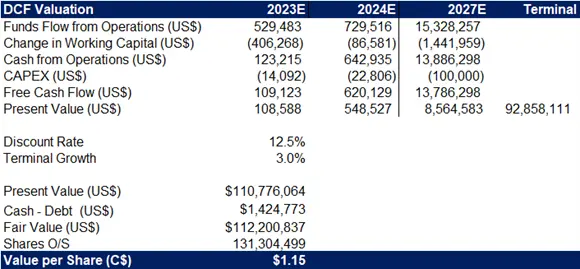

Source: FRC

As a result, our DCF valuation declined from C$1.47 to C$1.15/share

Digital AdTech Companies

Source: S&P Capital IQ / FRC

KIDZ’s forward EV/R of 1.3x (unchanged) is significantly lower than the sector average of 3.0x (previously 2.9x)

Our comparables valuation decreased from C$0.53 to C$0.48/share, driven by our lower revenue forecast

We are maintaining our BUY rating, and adjusting our fair value estimate from C$1.00 to C$0.82/ share (the average of our DCF and comparables valuations). While Q3 fell short of expectations, we remain positive on the stock, given management’s conviction in their new sales strategy, Prado’s initial success, and a robust sector outlook.

Risks

We believe the company is exposed to the following key risks:

1. Operates in a highly competitive space

2. Unfavorable changes in regulations

3. Ability to attract publishers and brands will be key to long-term growth

4. FOREX