Denarius Metals Corp.

Zancudo Production Imminent, Strengthens Balance Sheet

Published: 1/22/2025

Author: FRC Analysts

Sector: Basic Materials | Industry: Other Precious Metals & Mining

| Metrics | Value |

|---|---|

| Current Price | CAD $0.69 |

| Fair Value | CAD $1.81 |

| Risk | 5 |

| 52 Week Range | CAD $0.40-0.88 |

| Shares O/S (M) | N/A |

| Market Cap. (M) | CAD $ |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | 1.2 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

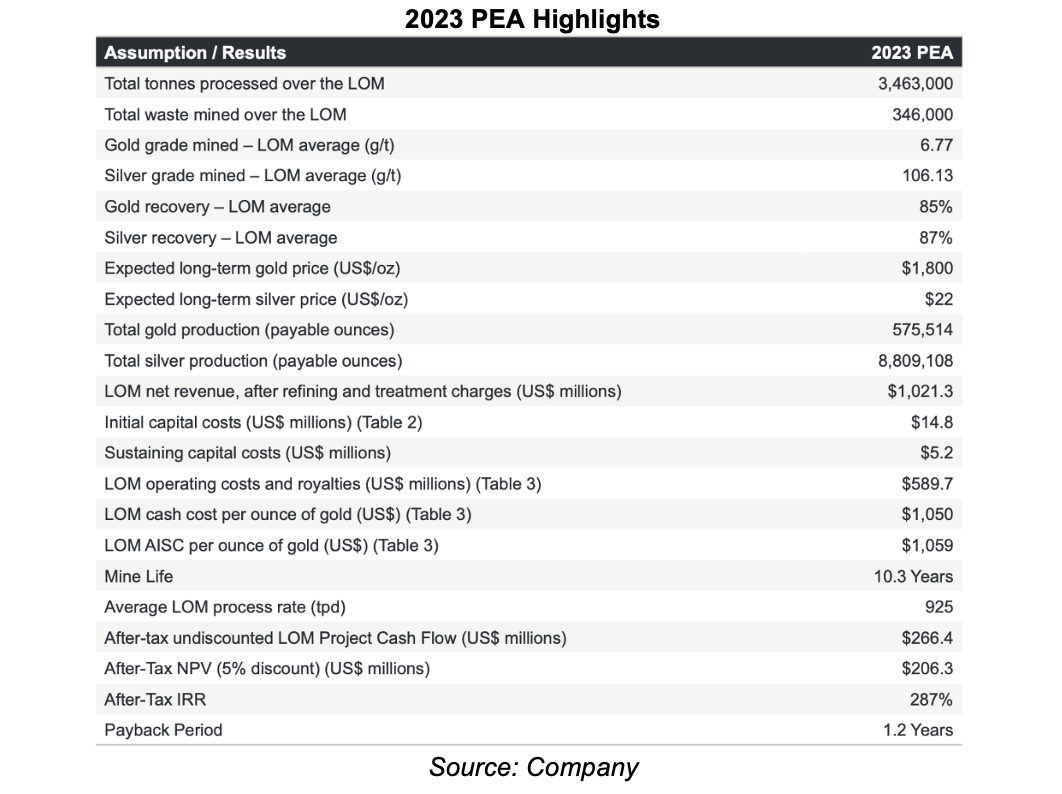

- Earlier this month, DMET announced the approval of its Environmental Impact Study (EIS) for the Zancudo gold-silver project in Colombia. The company is targeting production to begin by the end of this quarter. A 2023 Preliminary Economic Assessment (PEA) retuned an AT-NPV5% of $206M, and a very high AT-IRR of 287%, using $1,800/oz gold vs a spot price of $2,740/oz.

- The company sold a 29% stake in the Aguablanca project in Spain back to its local partners, reducing its ownership to 21%. Delays in securing a crucial water concession for dewatering, and mine preparation, hindered progress and the ability to settle acquisition payments. This sale eliminates outstanding debts, while maintaining a 21% project interest. DMET has a right of first refusal on the equity held by its partners.

- The company will continue to operate the Aguablanca project, and will be responsible for restarting production. Importantly, the company retains the right to process materials from its other projects (Lomero and Toral) at Aguablanca’s processing plant.

- The company anticipates water concession approval in the coming months, enabling financing and a production restart later this year. Concurrent with targeting Aguablanca's production, a PEA for the Lomero project is planned for completion in the coming months.

- The company’s attributable share of the combined AT-NPV5% of Aguablanca and Zancudo is $223M. DMET’s MCAP of US$45M, and enterprise value of US$84M, indicates that the market is not only undervaluing Zancudo, but also assigning zero value to DMET’s other flagship assets.

- DMET has strengthened its financial position by reducing its interest in Aguablanca, eliminating outstanding project-related payables, securing a C$4.6M equity financing in October 2024, and amending the terms of its convertible debentures to delay the commencement of gold premium payments from 2025 to 2026.The company also has access to up to C$30M from in-the-money options and warrants.

- With gold and copper trading near record highs, we anticipate an increase in M&A activity over the next 12 months, as larger companies target juniors to grow their portfolios. Potential catalysts include the release of a PEA on Lomero, the start of production at Zancudo, and the approval of the water concession for Aguablanca.

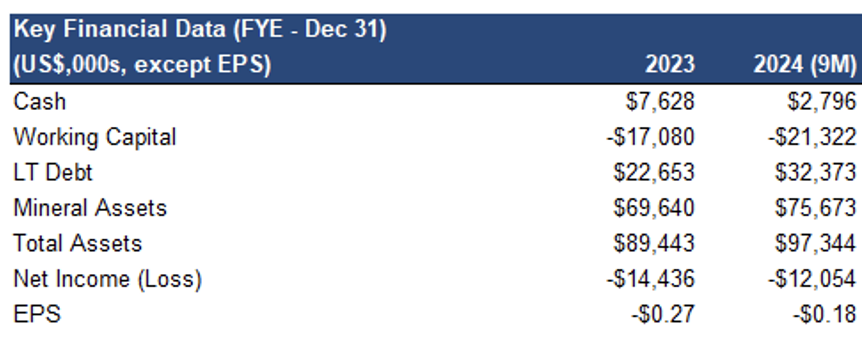

Subsequent to Q3-2023, DMET has improved its working capital deficit from $21M to $3M through the sale of its 29% interest in Aguablanca, and a C$4.6M equity financing.

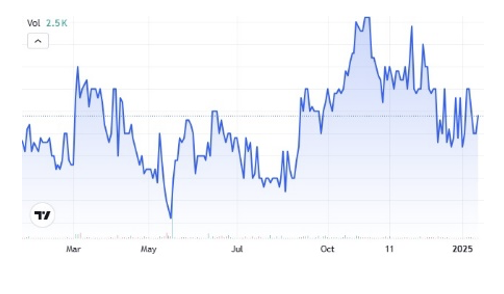

Price Performance (1-year)

Four polymetallic projects, including two near-term producers (Aguablanca and Zancudo. 3.7 Moz in AuEq or 2.2 Blbs in CuEq across four projects

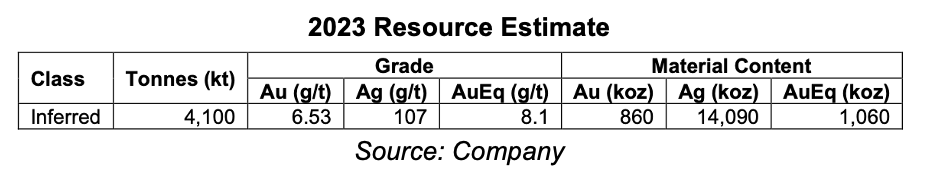

Located in the Middle Cauca gold belt, one of Colombia’s most prolific gold districts. Inferred resources totaling 1.1 Moz AuEq, at a high-grade of 8.1 g/t

Zancudo Gold-Silver Project, Colombia – 100% Interest

Following the approval of its Environmental Impact Study for the project, DMET is targeting production to begin by the end of this quarter.

Excellent infrastructure including access to underground mine development, national power grid, and water. A 2023 PEA retuned an AT-NPV5% of $206M, and a very high AT-IRR of 287%, using $1,800/oz gold

Low initial CAPEX. 10-year underground operations. Management is planning a drill program

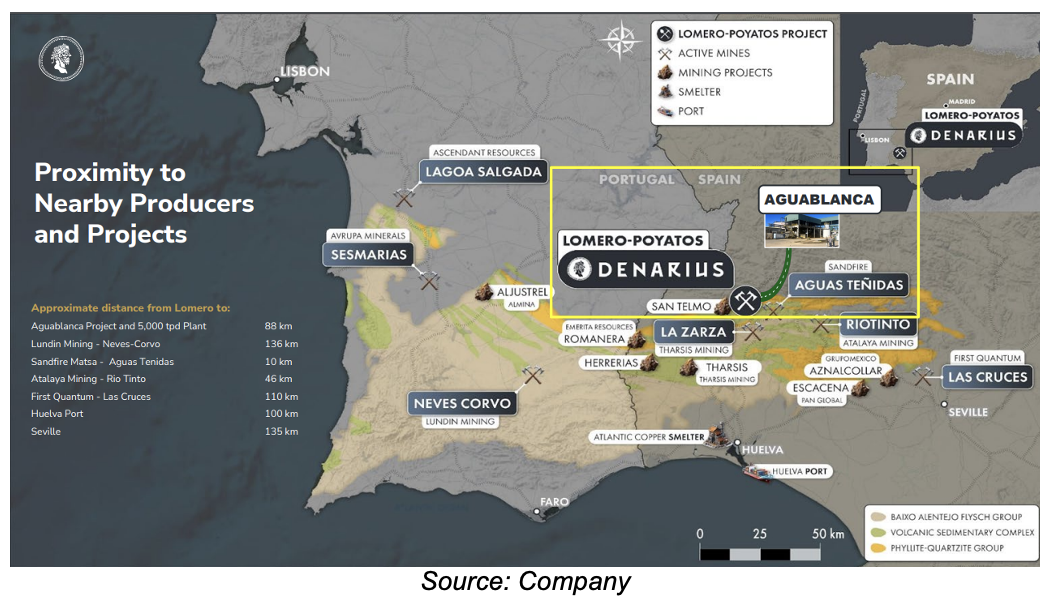

Aguablanca Polymetallic Project (21% Interest) / Lomero Project (100% owned), Spain

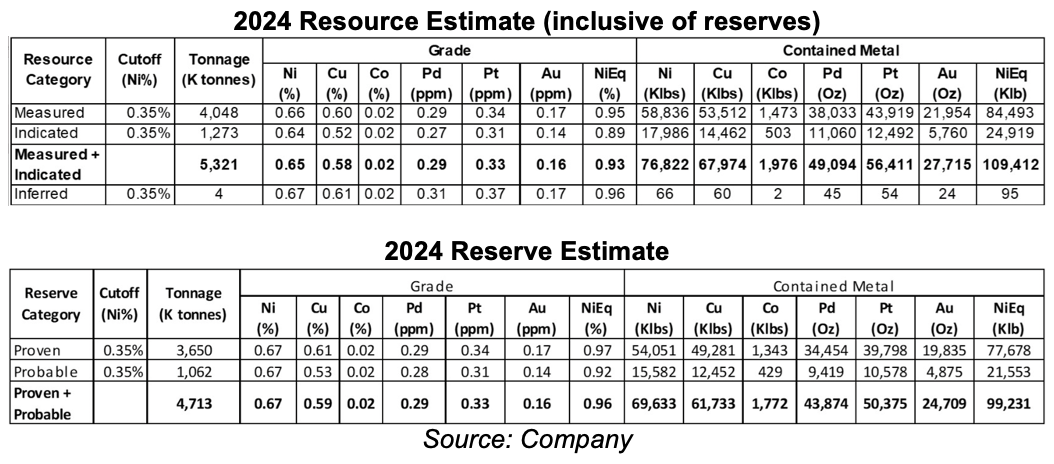

This project hosts the only known nickel-copper deposit in Spain. Located 88 km from DMET’s Lomero project

Earlier this month, DMET decided to sell a 29% interest in Aguablanca, reducing its ownership from 50% to 21%. This decision was driven by delays in receiving approval for a water concession application, which was crucial for dewatering and preparing the underground mine for production. These delays hindered the company's ability to settle the remaining $16M payment associated with the initial 50% acquisition. As a result of the sale, the company no longer has any outstanding payments, while maintaining a 21% interest in the project.

A major advantage of the Aguablanca project is its 5,000 tpd processing plant, located approximately 88 km from the company's flagship Lomero project. Despite reducing its ownership interest, the company will maintain its role as operator of the project, and be responsible for resuming operations. The company has also preserved its ability to process material from future operations at its Lomero and Toral projects at the processing plant.

Management expects the water concession application to be approved in the next few months, allowing the company to secure the financing required to resume operations at the project later this year.

An Environmental Impact Statement/EIS, and a mining license are in place. Awaiting a water use permit to begin dewatering the open-pit for underground access

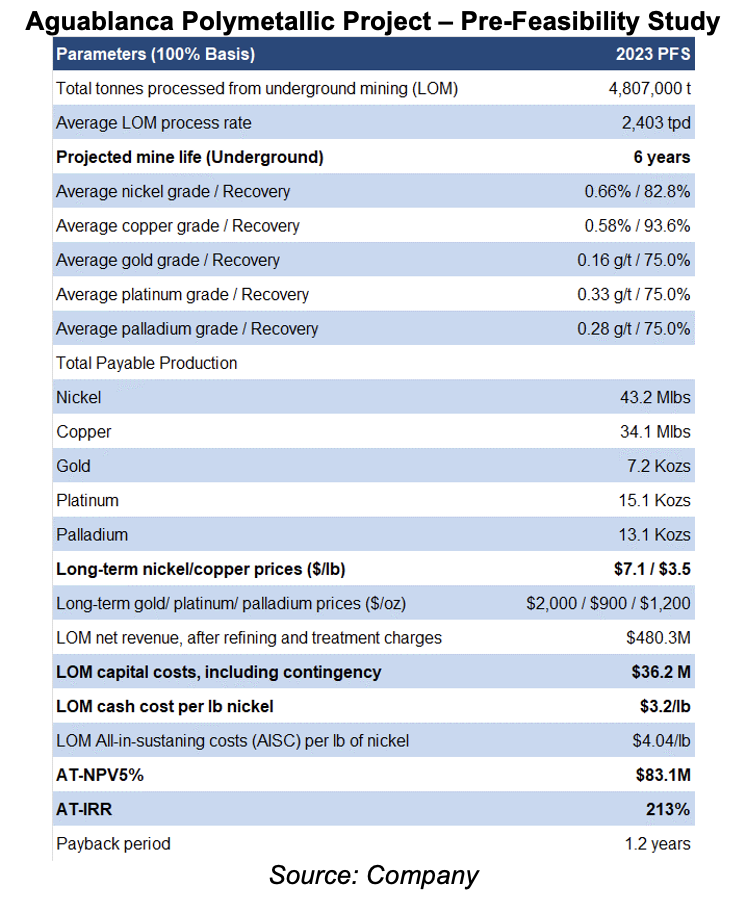

As the project has a well-maintained 5,000 tpd processing plant, a 2023 PFS estimated a low initial CAPEX of $6.1M

The study returned an AT-NPV5% of $83M, and a very high AT-IRR of 213%, using $7.3/lb Ni, and $3.5/lb Cu, vs spot prices of US$6.9/lb Ni, and $4.3/lb Cu

The PFS was predicated on the project utilizing just 50% of the processing plant’s capacity. The remaining capacity is allocated for processing materials from Lomero, thereby expediting and reducing the cost of bringing Lomero into production.

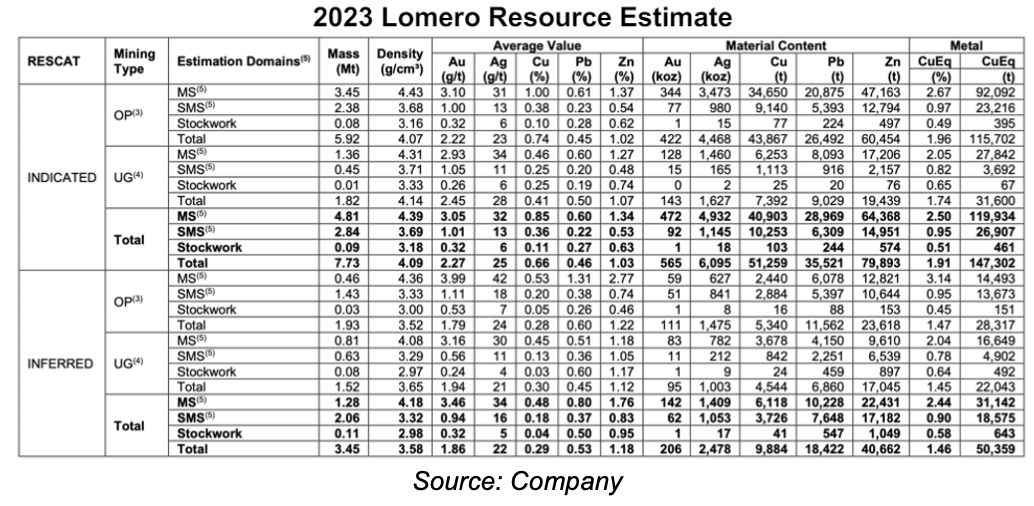

Lomero hosts a similar tonnage resource dominated by gold and copper. A PEA is expected in the coming months

Upcoming Catalysts

- Zancudo: Commence commercial production by the end of Q1-2025. DMET has secured an offtake agreement for concentrate sales.

- Lomero: Finalize a PEA in the coming months, followed by resource expansion drilling in H2-2025.

- Aguablanca: Initiate dewatering upon receiving approval for the water concession application, and prepare the underground mine for commencing production in H2-2025.

- Toral: Complete an updated resource estimate this year, followed by a PEA.

Multiple catalysts. Advancing all four projects simultaneously

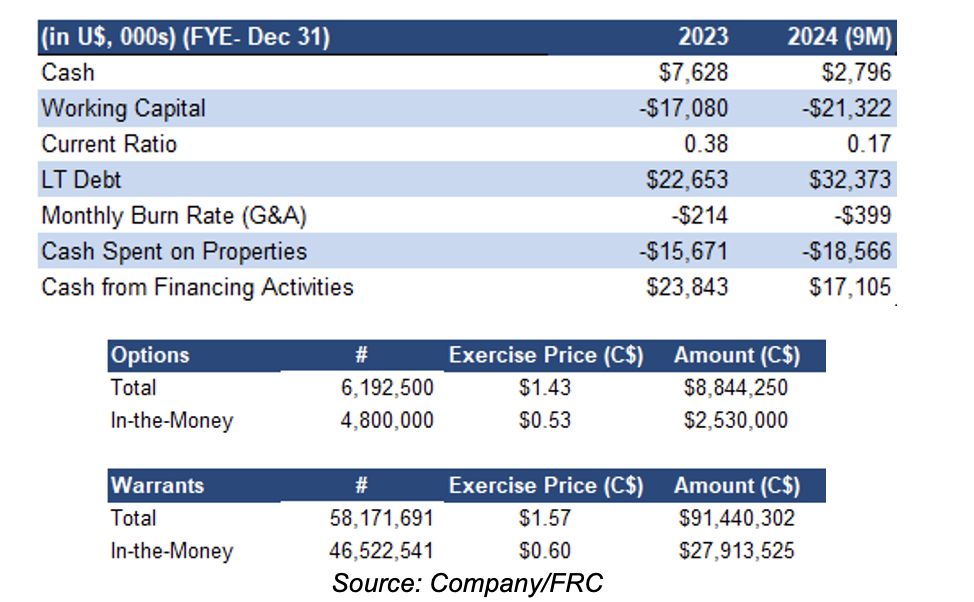

Financials

Subsequent to Q3-2023, DMET has improved its working capital deficit from $21M to $3M through the sale of its 29% interest in Aguablanca, and a C$4.6M equity financing

Can raise up to C$30M from in-the-money options and warrants

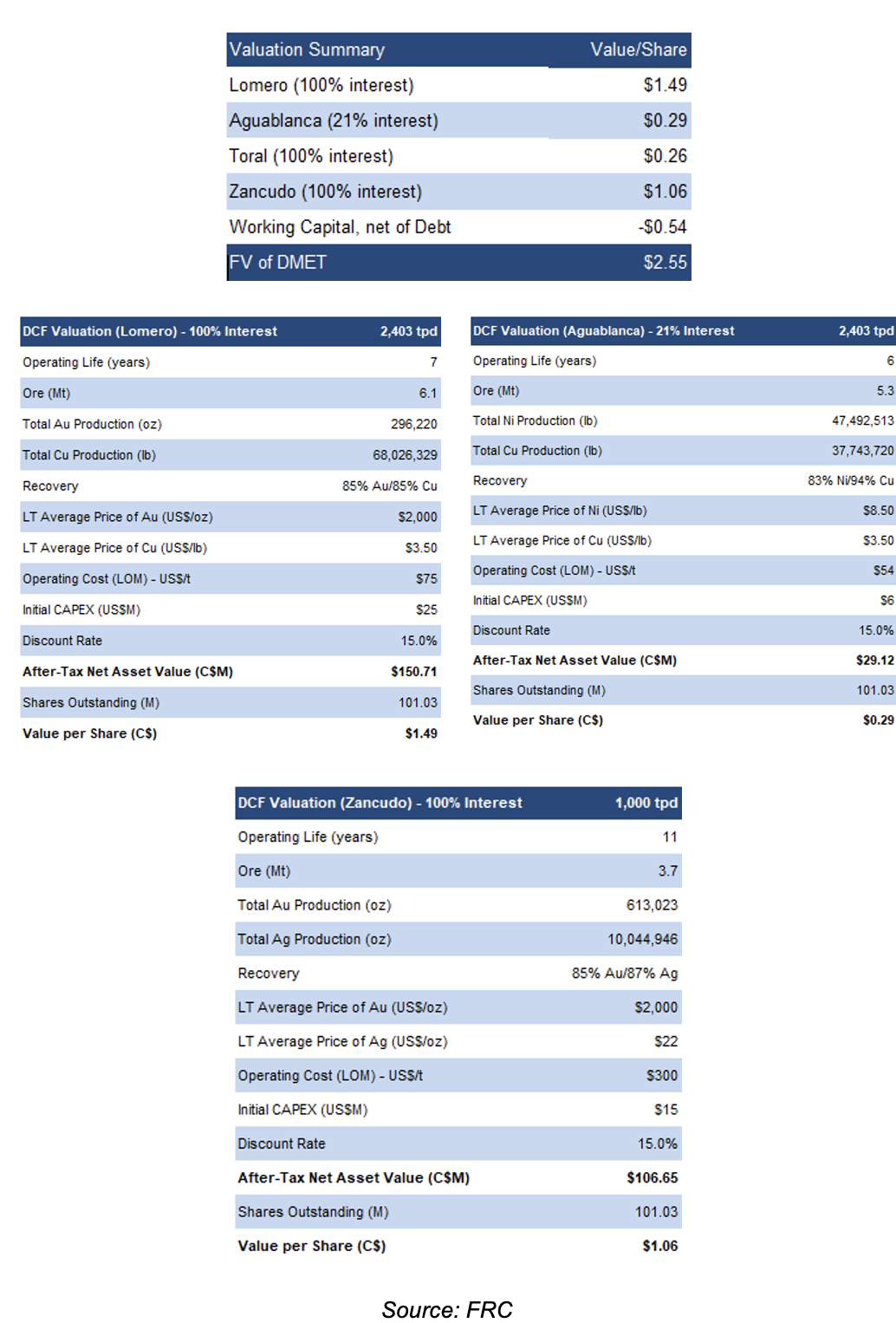

FRC Valuation

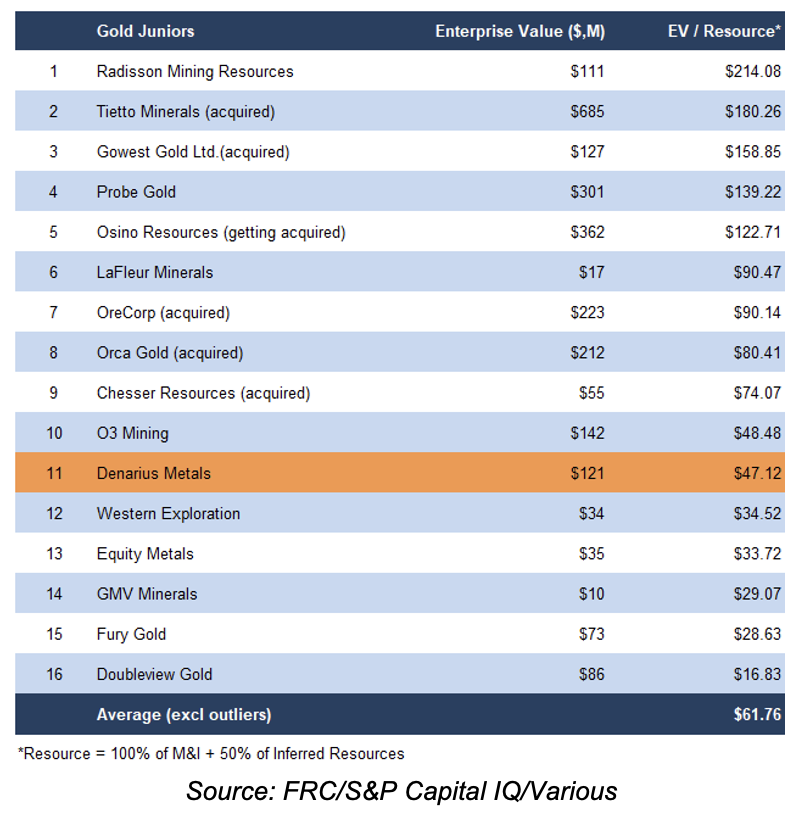

DMET is trading at $47/oz vs the sector average of $62/oz (previously $49/oz). Our comparables valuation increased from C$0.86 to C$1.06/share due to higher sector valuations

Our DCF valuation (Net Asset Value) increased from C$2.43/share to C$2.55/share, primarily driven by Zancudo advancing closer to production

The tables presented here summarize our valuation on each project

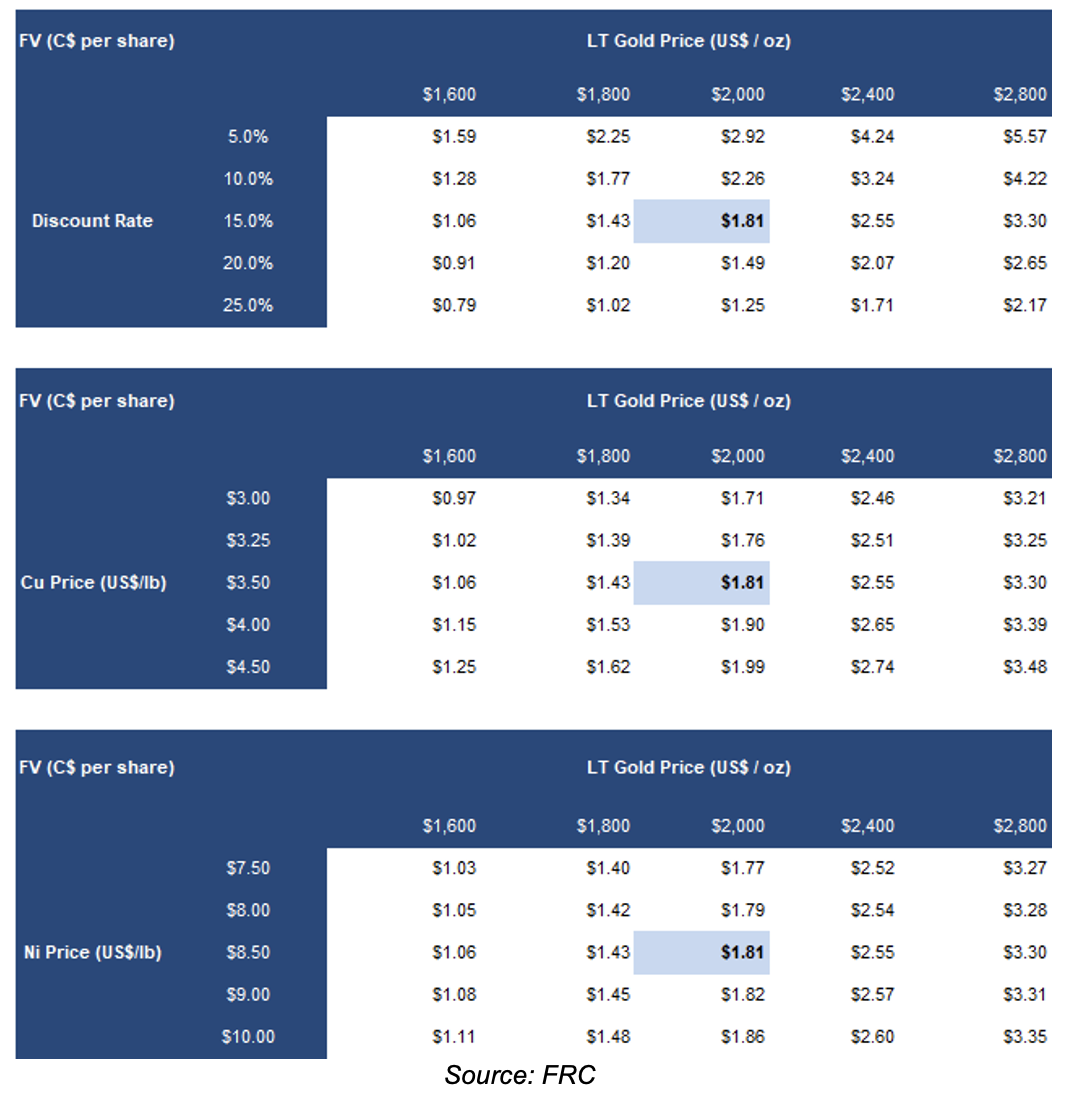

Our valuation is highly sensitive to metal prices

We are reiterating our BUY rating, and adjusting our fair value estimate from C$1.65/share to C$1.81/share (the average of our DCF and comparables valuations). Upcoming catalysts, including the release of the Lomero PEA, Zancudo production commencement, and Aguablanca water concession approval, could significantly boost DMET's stock price. As these milestones are achieved, we believe the market is likely to recognize the intrinsic value of the company's assets.

Risks

We are maintaining our risk rating of 5 (Highly Speculative)

Commodity prices

Exploration, development, and permitting

FOREX

No guarantee that the company will be able to advance all of its projects simultaneously

Access to capital and potential for share dilution