Noram Lithium Corp.

A Deep Value Play in the U.S. Lithium Sector-Valuation Report

Published: 1/22/2025

Author: FRC Analysts

Sector: Basic Materials | Industry: Other Industrial Metals & Mining

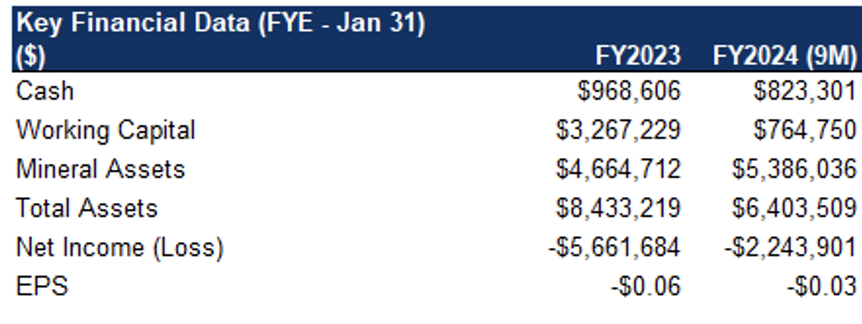

| Metrics | Value |

|---|---|

| Current Price | CAD $0.1 |

| Fair Value | CAD $1.14 |

| Risk | 5 |

| 52 Week Range | CAD $0.09-0.38 |

| Shares O/S (M) | 89 |

| Market Cap. (M) | CAD $8 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | 1.4 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

- Anticipating a rebound in lithium juniors, this report underscores the valuation gap, and highlights what the market is overlooking in NRM, a lithium junior with a highly promising project in Nevada.

- Lithium prices have dropped 22% YoY to US$10,300/tonne, down from a record high of US$78,000/tonne in 2022. This decline is attributed to a persistent supply surplus, and slower growth in global electric vehicle (EV) sales.

- Global EV sales grew by 25% in 2024, a slowdown from 35% in 2023. While the rollback of EV targets by the Trump administration may temper U.S. sales growth, consensus forecasts project a 30% increase in global EV sales in 2025, followed by a 20% rise in 2026. Notably, in China, the world’s largest EV market, sales jumped by 40% in 2024.

- We believe that current lithium prices are nearing the break-even point for most large-scale development projects, raising concerns about their economic viability. We believe prices need to be at least US$15,000/tonne to incentivize developers and financiers to advance projects. We maintain a positive outlook on juniors focused on EV metals, as battery and EV manufacturers and miners continue to seek stable, long-term supply sources. Last month, Lithium Chile (TSXV: LITH) received a bid from a large, Asian diversified enterprise to acquire its lithium project in Argentina for $250M.

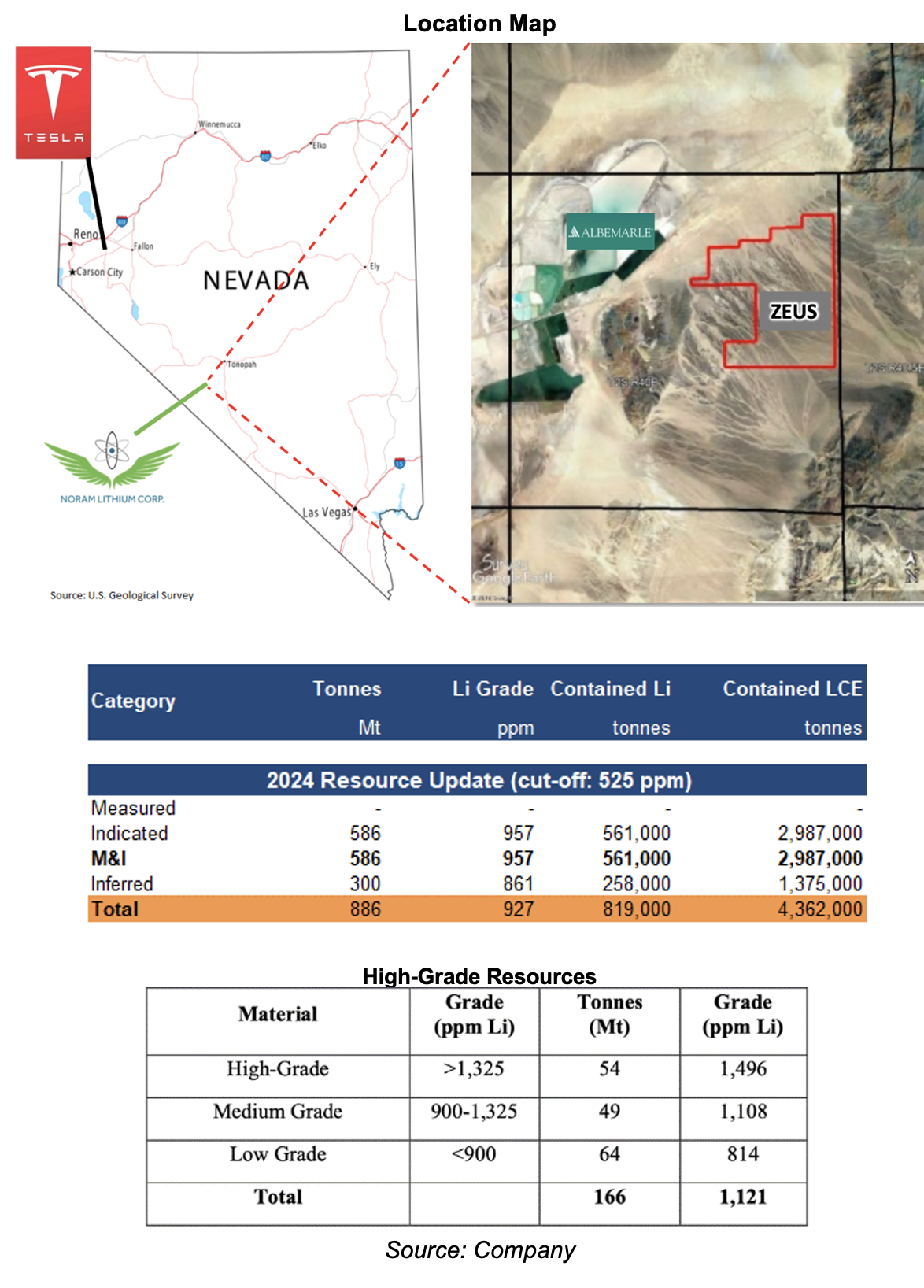

- Noram’s Zeus project is adjacent to Albemarle’s (NYSE: ALB) Silver Peak mine, the sole lithium-producing operation in the U.S.

- Zeus’ resources (both tonnage and grades), and mineralization, are comparable to other well-known large deposits in Nevada, such as Lithium America’s (TSX: LAC/MCAP: $1.07B) Thacker Pass project, and projects held by Ioneer (ASX: INR/ MCAP: $359M), American Lithium (TSXV: LI/MCAP: $142M), and Surge Battery Metals (TSXV: NILI/ MCAP: $64M). Based on the projects’ similarities and proximity, we see opportunities for M&A/consolidation in the region. General Motors (NYSE: GM) recently acquired a 38% interest in Thacker Pass for US$625M.

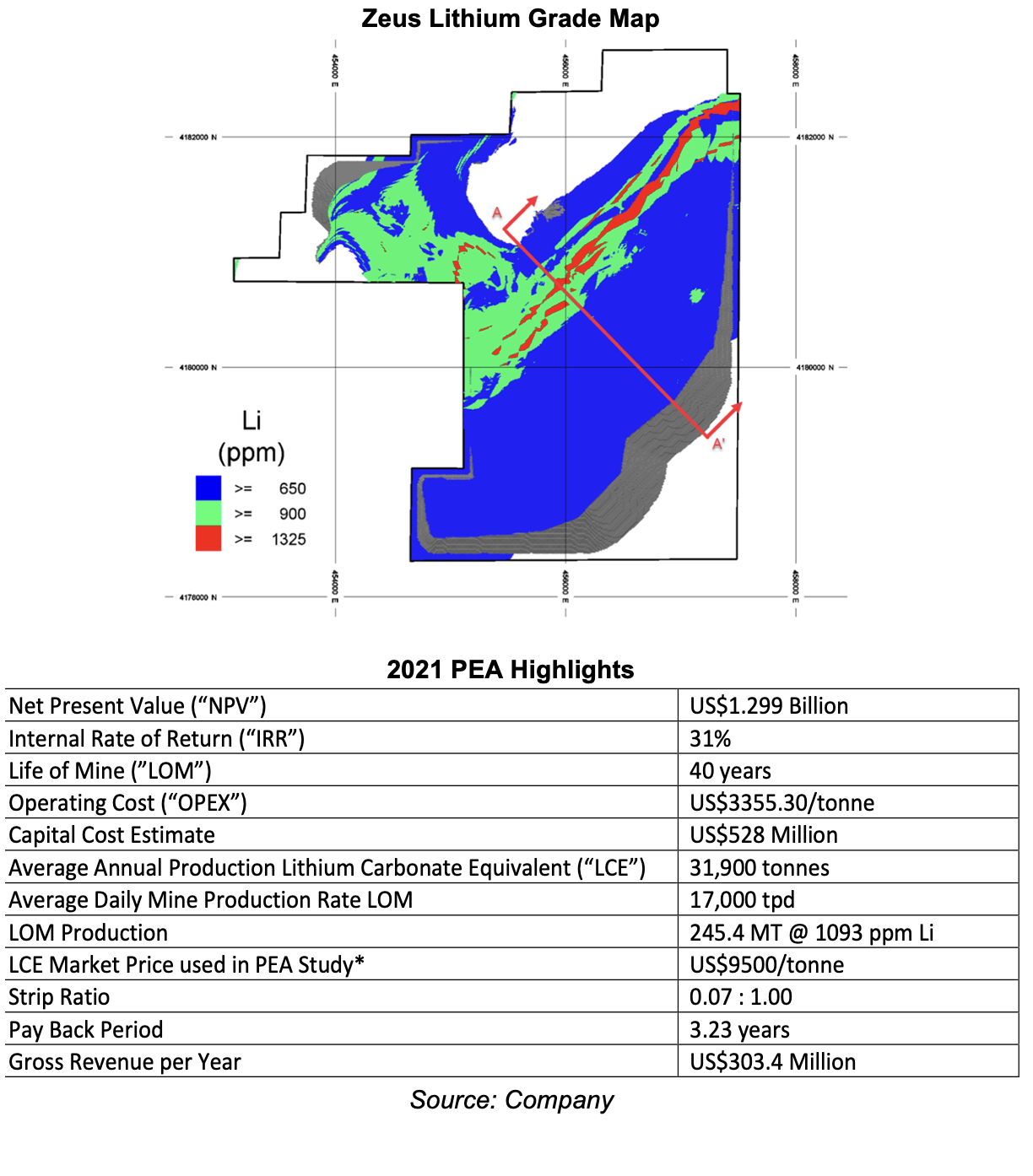

- A 2021 Preliminary Economic Assessment (PEA) on Zeus returned an AT-NPV8% of US$1.30B, and a high AT-IRR of 31%, using US$9.5k/t LCE vs a spot price of US$10k/t. NRM is trading at just 0.5% of the AT-NPV, and stands out as one of the most undervalued lithium stocks.

- Upcoming catalysts include a potential reversal of market sentiment toward lithium juniors, and prospective M&A activity in the region.

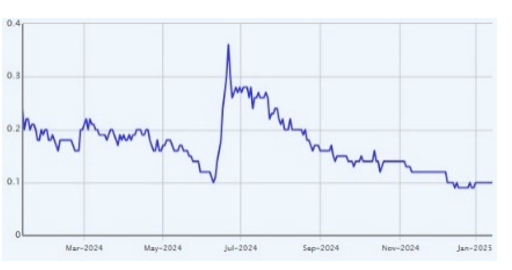

Price Performance (1-year)

Located 220 miles southeast of Reno, Nevada. Lies in the Clayton Valley, adjacent to Albemarle’s Silver Peak lithium brine operations. Excellent infrastructure in place, including power and paved road access

4.4 Mt in resources at 927 ppm. Majority of resources occur near surface, implying potential for lower OPEX. This resource has a high-grade component totaling 1 Mt at 1,121 ppm

The high-grade portion alone has the potential for a mine life of over 40 years. A 2021 PEA had returned an AT-NPV8% of US$1.30B, and a high AT-IRR of 31%, using US$9.5k/t LCE vs a spot price of US$10 k/

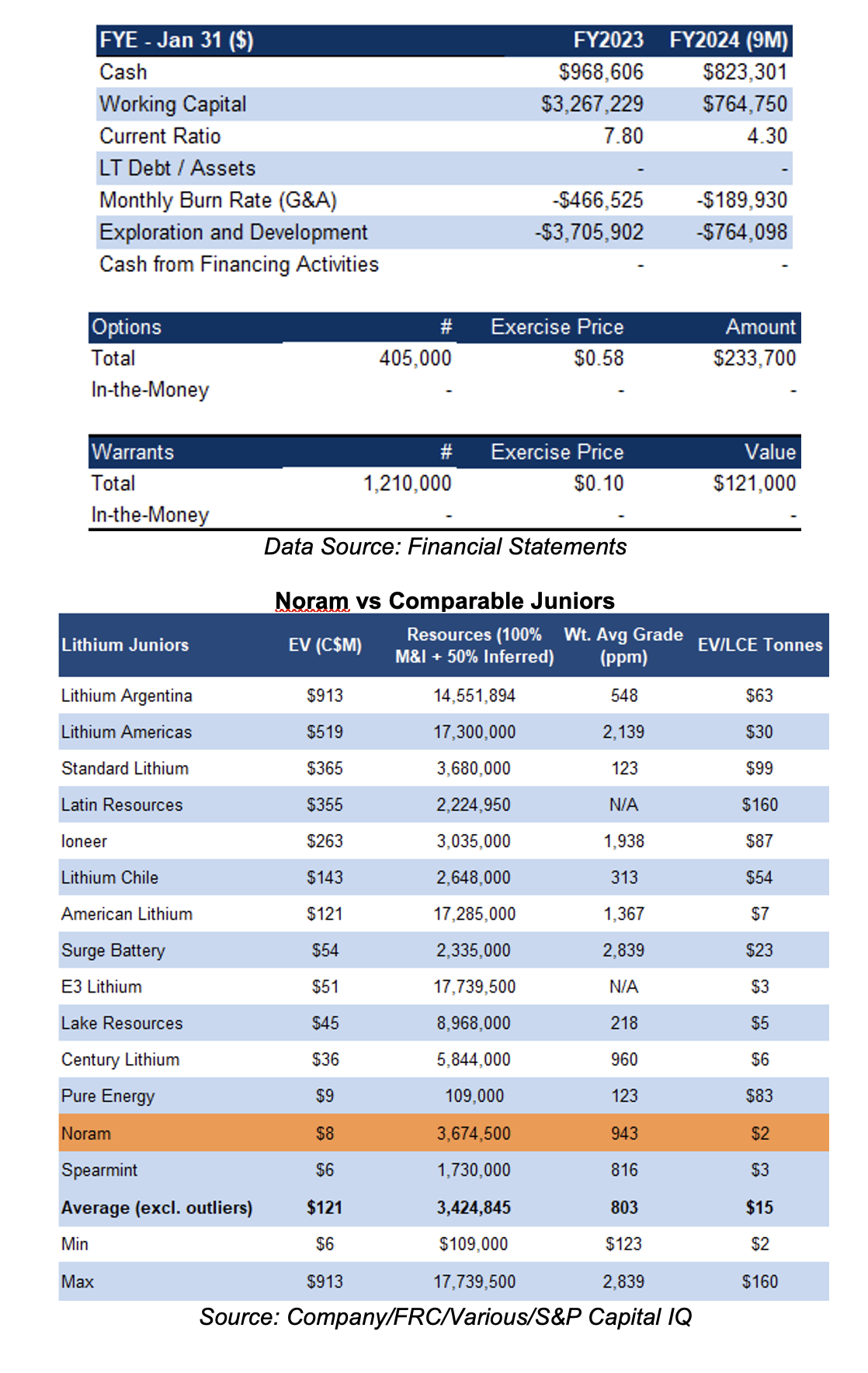

Financials

Healthy balance sheet, with no debt. We note that Zeus’ resources and grades are comparable to other well-known advanced projects

NRM is the most undervalued lithium junior on our list. NRM is trading at $2/t LCE vs the sector average of $15/t, an 85% discount. Applying $15/t to NRM’s resources, we arrived at a comparables valuation of $0.56/share

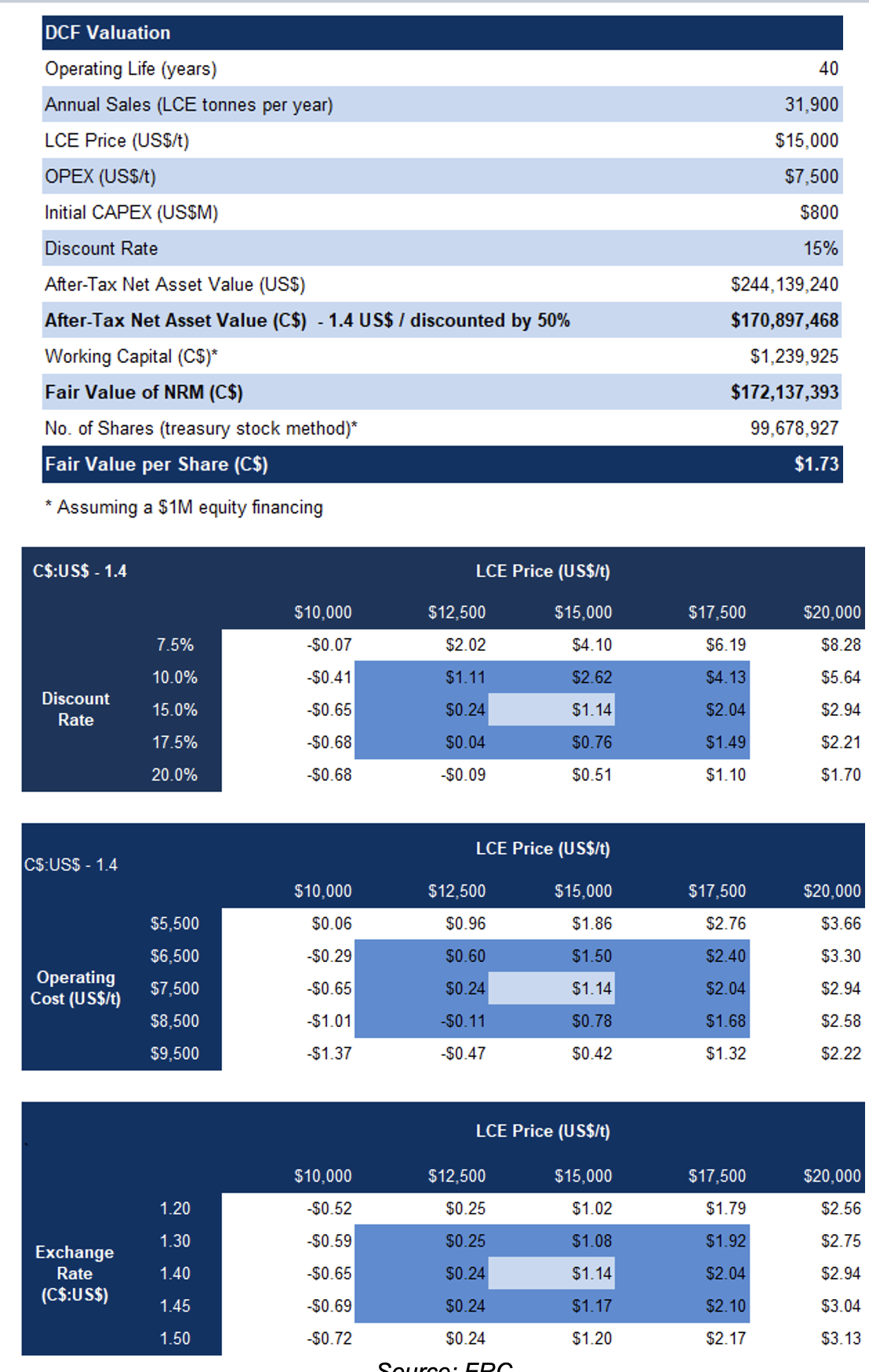

Our DCF valuation is $1.73/share. The average of our DCF and comparables valuation is $1.14/share. Our valuation is highly sensitive to lithium prices

We are assigning a BUY rating, with a fair value estimate of $1.14/share. We expect the lithium market to rebound, creating opportunities for undervalued juniors like NRM to gain investor attention. NRM is the most undervalued lithium junior on our list, trading at a steep discount to Zeus’ NPV, highlighting its strong upside potential. Located in a strategic region near major lithium projects, NRM is well-positioned for potential M&A or consolidation, further enhancing its appeal.

Risks

We are assigning a risk rating of 5

We believe the company is exposed to the following key risks (not exhaustive):

- The value of the company is dependent on lithium prices

- Access to capital and share dilution

- Development

- Weak market sentiment toward lithium juniors

- Permitting

- Large projects are capital intensive