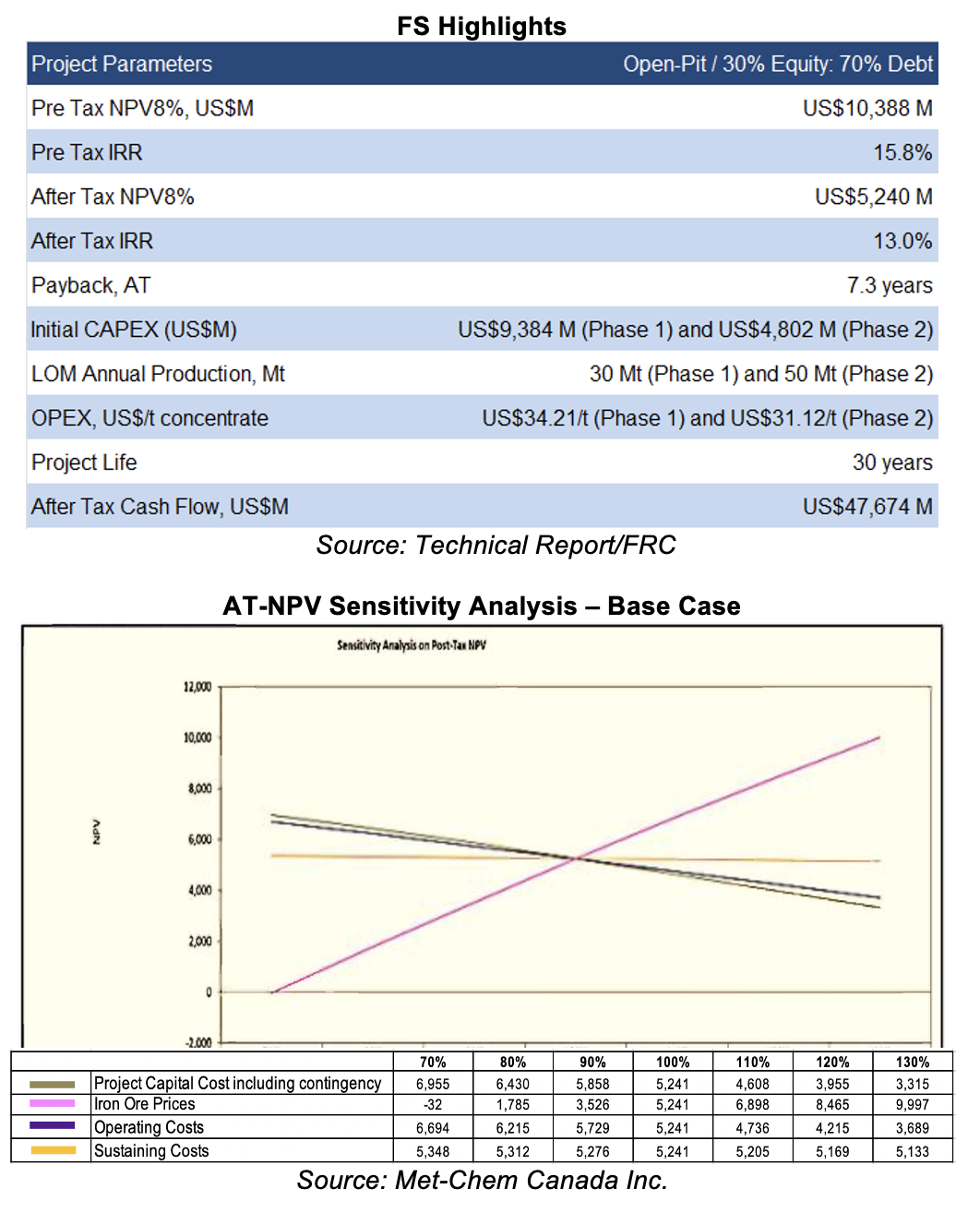

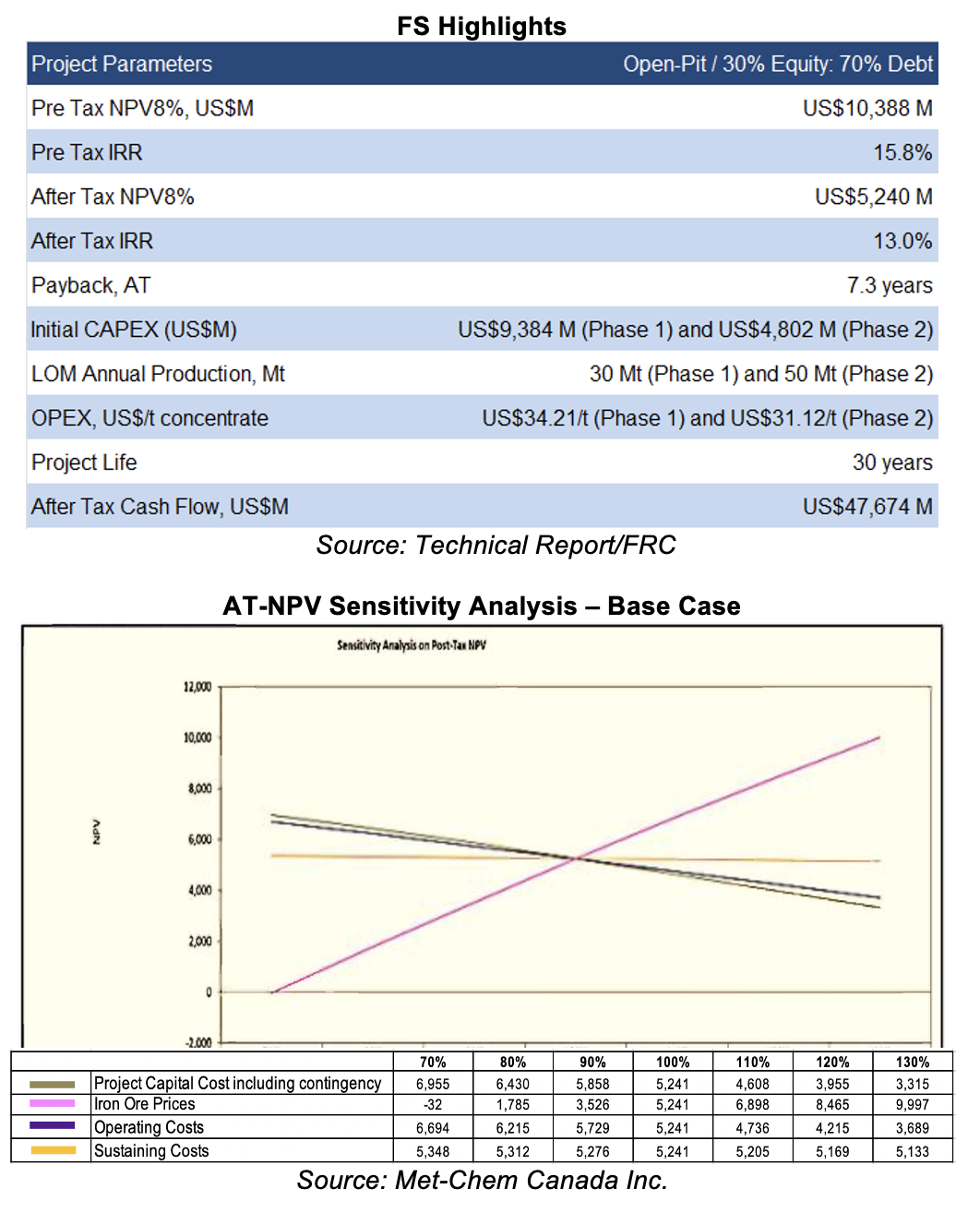

- A historic Feasibility Study (FS), conducted in 2015, returned an AT-NPV8% of US$5.24B, and an AT-IRR of 13%, based on a long-term iron ore price forecast of US$105/t (spot price: US$100/t), an initial CAPEX estimate of US$9.4B, and OPEX estimate of US$31-US$34/t. As the project is capital intensive, we believe the company’s success is highly dependent on management’s ability to attract financing.

- Management intends to complete a Preliminary Economic Assessment (PEA), and is aiming to raise funds to finance the PEA while seeking a long-term JV partner to advance the project. According to management, they will be able to complete the PEA within 10 months of securing financing. The company is currently in discussions with various engineering firms to identify a suitable partner for the PEA, and is awaiting their quotes/proposals next month.

- Last year, the company sold its 28.2% interest in the Murray Brook polymetallic project to Canadian Copper Inc. (CSE: CCI/ MCAP: 14M) for $300K in cash, 2.5M shares (currently valued at $350K), and a 0.33% net smelter return (NSR). In total, MQM retains a 1% royalty on the project.

- Management and the board own 30%, aligning their interests with other investors. Upcoming catalysts include financing and option/joint venture partnerships, as well as updates on the PEA.

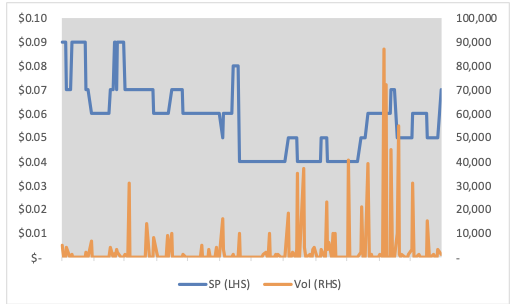

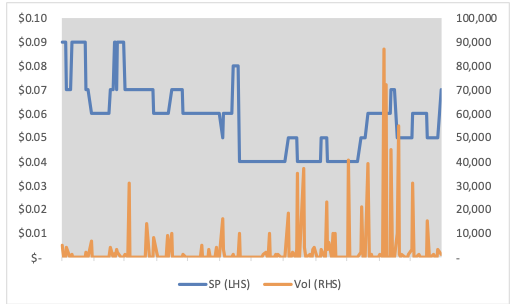

Price Performance (1-year)

| |

YTD |

12M |

| MQM |

0% |

-29% |

| TSXV |

0% |

11% |

Lac Otelnuk Iron Ore Project

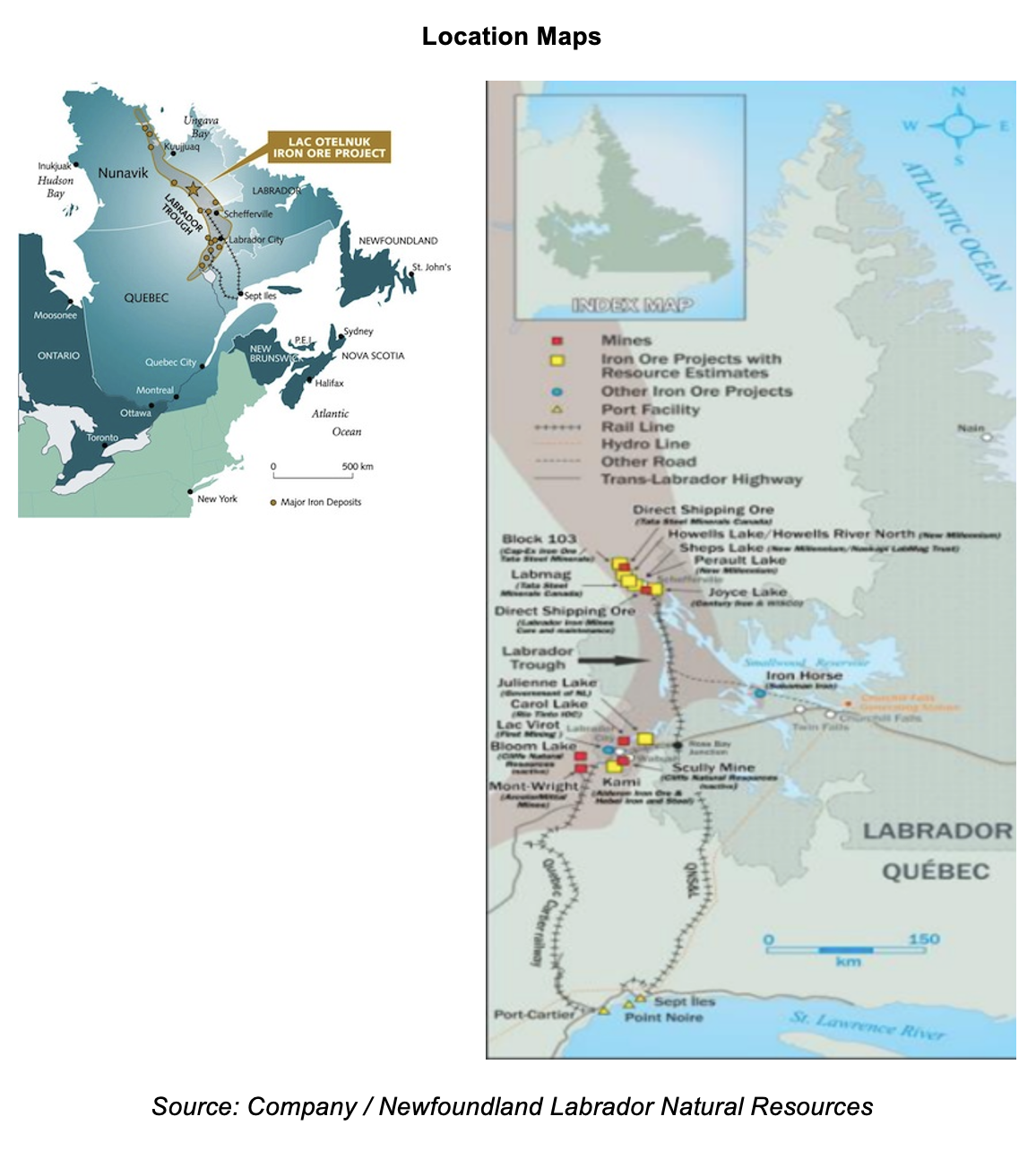

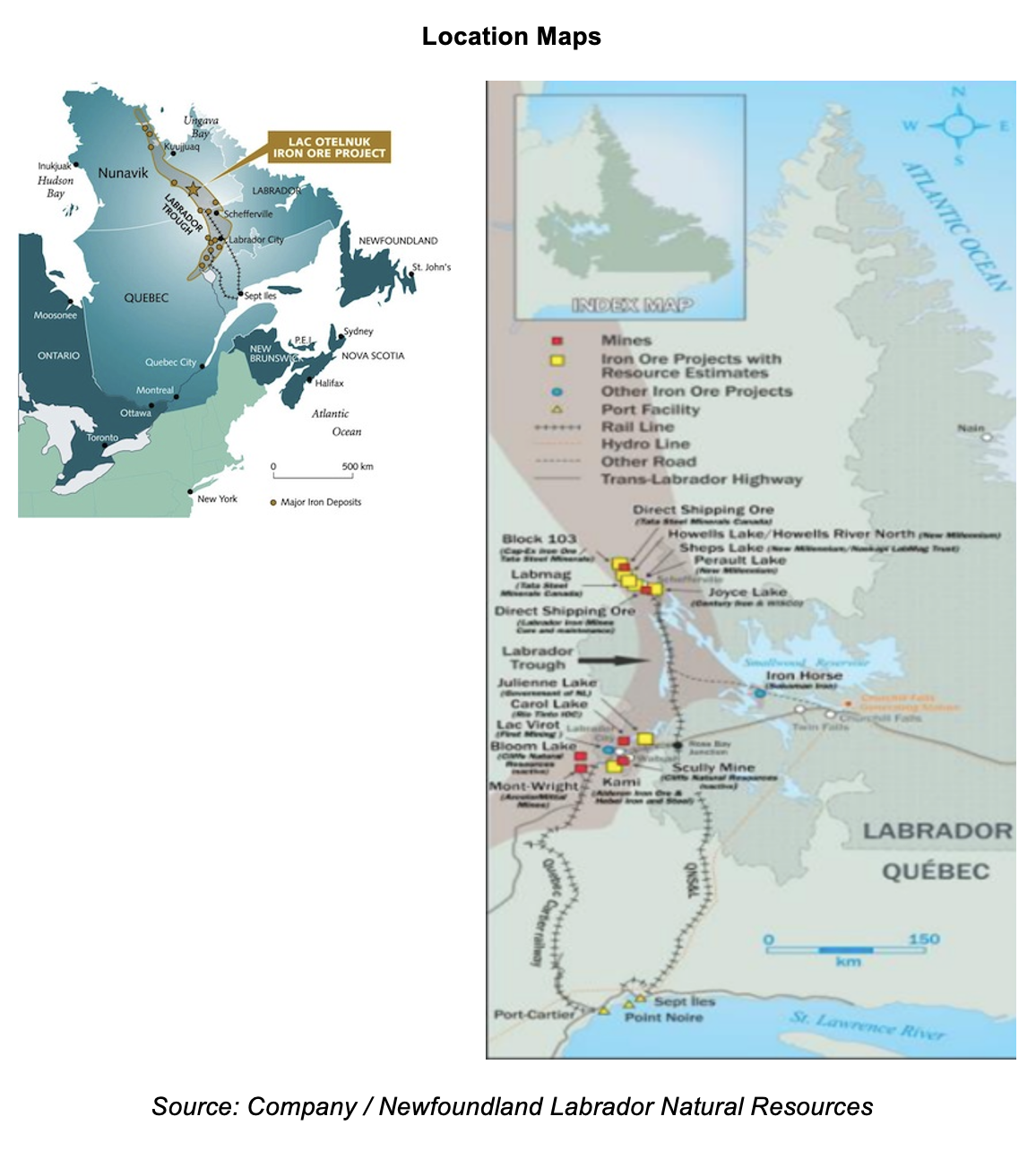

This advanced-stage project, covering 673 km2, is located in the central portion of the Labrador Trough in Nunavik, Northern Quebec. The project is located within a territory controlled by the Naskapi Nation, with whom MQM has an exploration and pre-development agreement. The company also continues to engage with other First Nations that may be impacted by the project's development.

MQM acquired the project in late 2022 for just $44K in cash; previous owners had spent approximately $150M on the project. Located 155 km northwest of Schefferville

Near active iron ore mines operated by majors, such as Rio Tinto (NYSE: RIO), Tata Steel (NSE: TATASTEEL), and ArcelorMittal (NYSE: MT). Currently, there is no road access to the property; if advanced to production, the property can be accessed through a new road and/or a rail spur

The 1,100 km long Labrador Trough is a large iron belt, accounting for 100% of Canada’s iron ore production. The region has excellent infrastructure in place, including low-cost hydroelectric power, rail, and port facilities

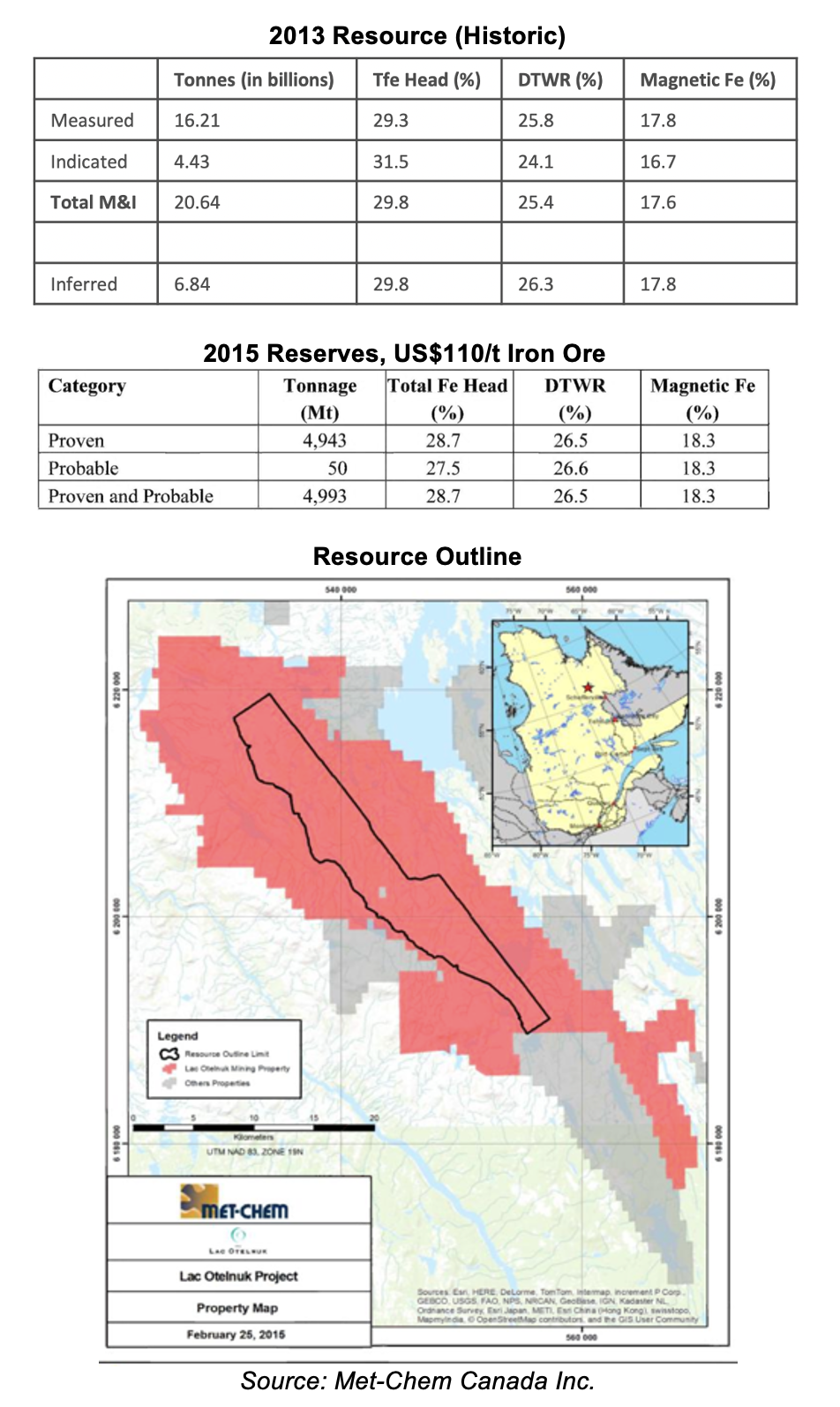

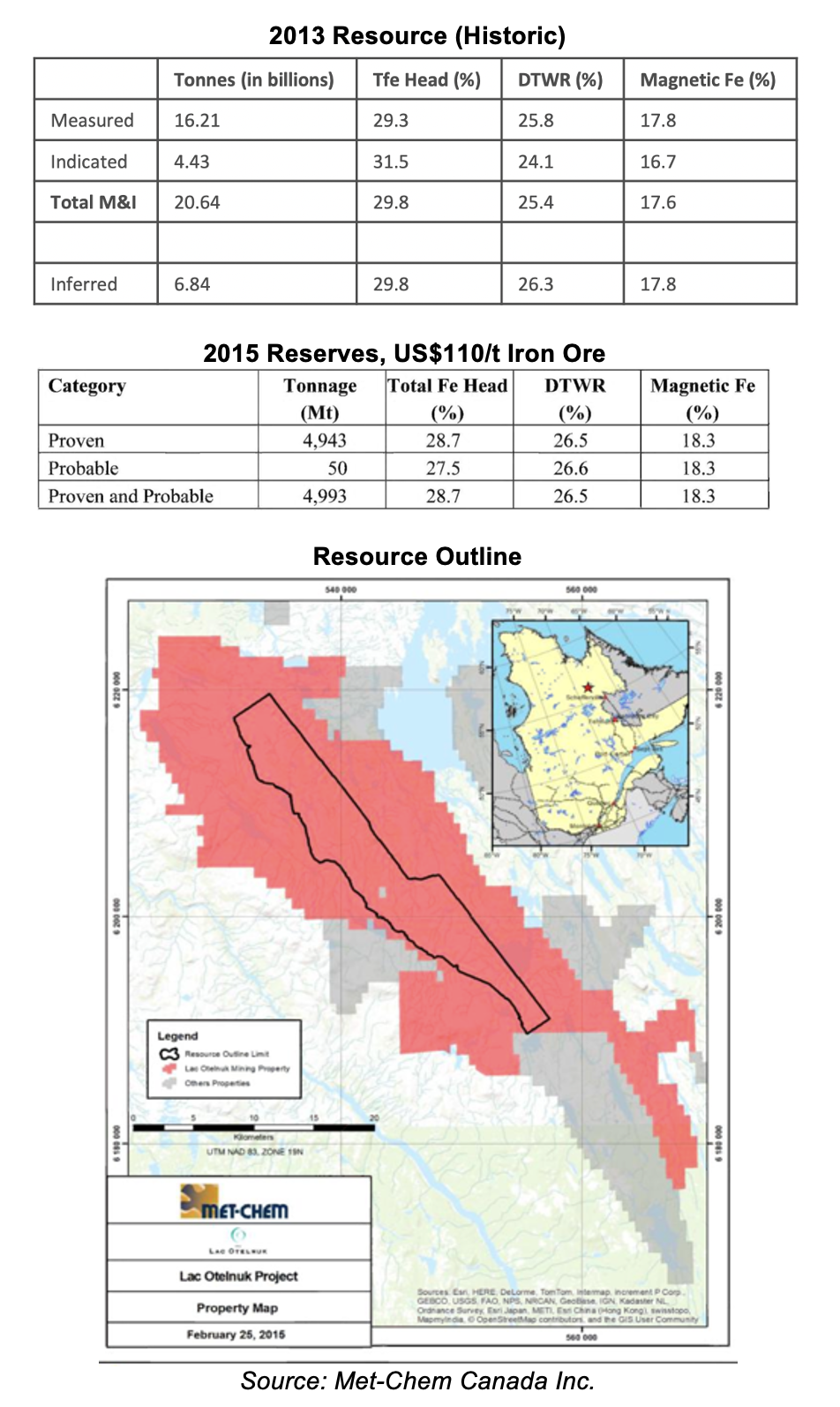

Mineralization, Resources, and FS

A large, low-grade open-pit resource. The current resource envelope covers 36 km (strike) x 4-6 km (width) x 130 m (depth). Metallurgical tests indicate that the project can produce high-grade concentrates, averaging 68% Fe (iron

The 2015 FS was based on open-pit-operations spanning 30 years.

The FS was based on just 24% of M&I resources. The study returned an AT-NPV8% of US$5.24B, AT-IRR of 13%, and a long payback period of 7.3 years, based on a long-term iron ore price forecast of US$105/t vs the spot price of US$100/t

Initial CAPEX is relatively high at US$9B, exceeding the typical range of US$2B-US$7B for iron ore projects. However, OPEX is relatively low at US$31-US$34/t, falling within the typical range of US$30-US$90/t for iron ore projects. Aiming to attract a strategic partner to advance the project

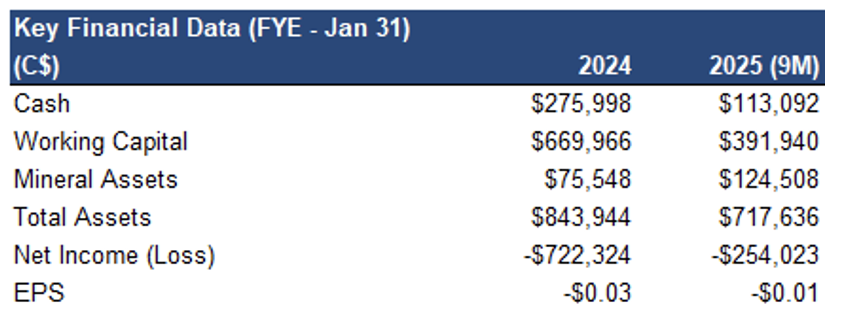

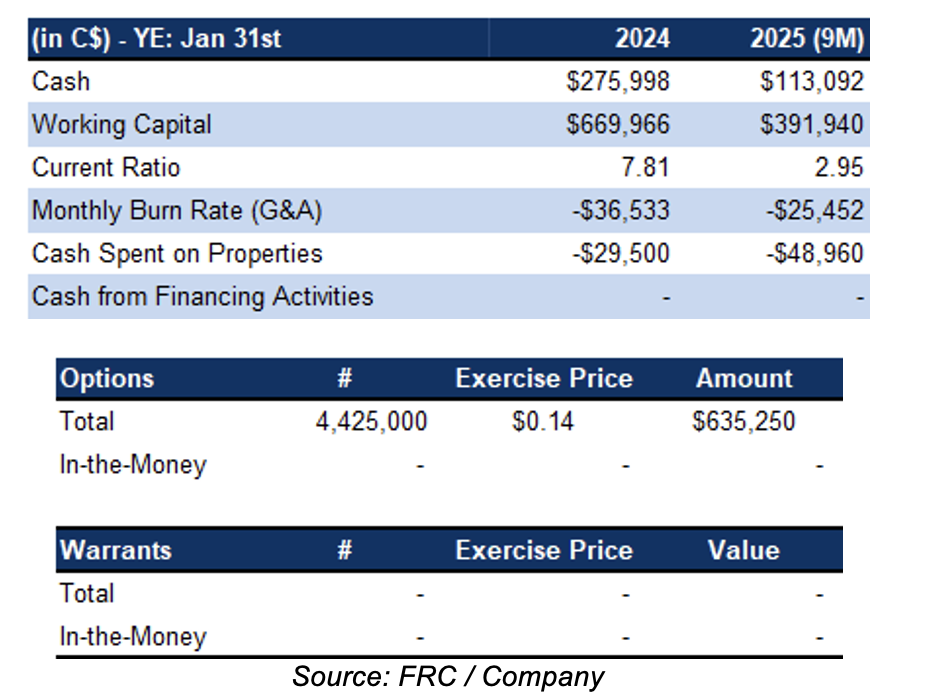

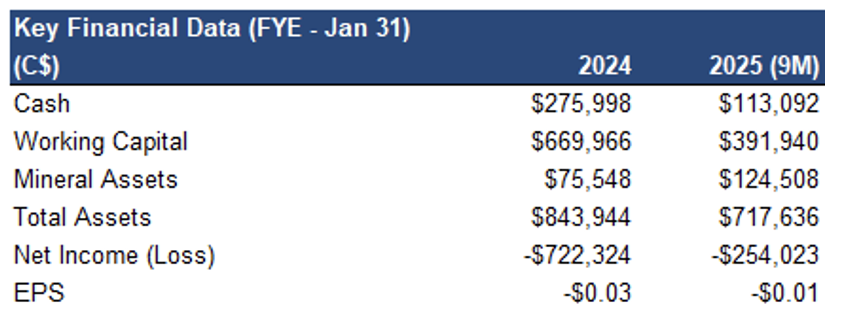

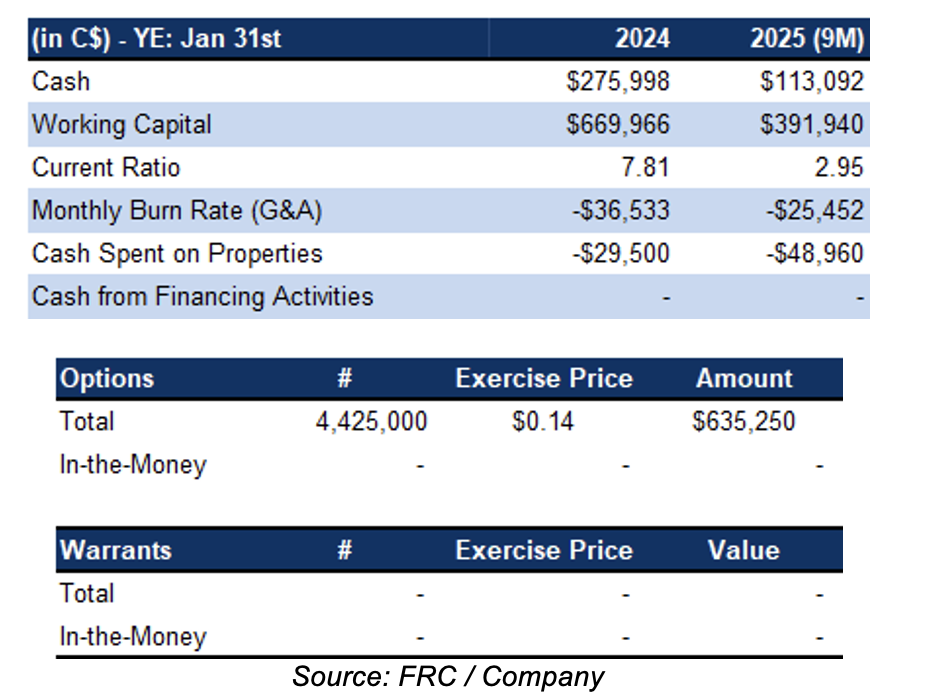

Financials

$0.4M in working capital at the end of October 2024. None of the outstaning options/warrants are in-the-money. We believe the company will pursue an equity financing in the coming months to fund the PEA

FRC Valuation and Rating

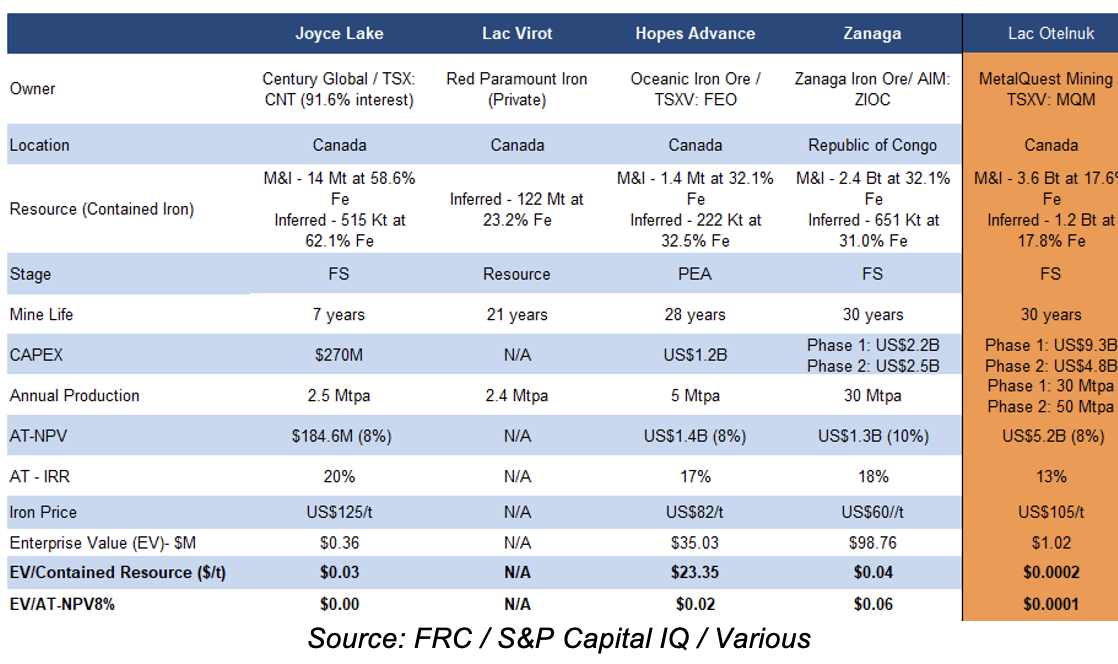

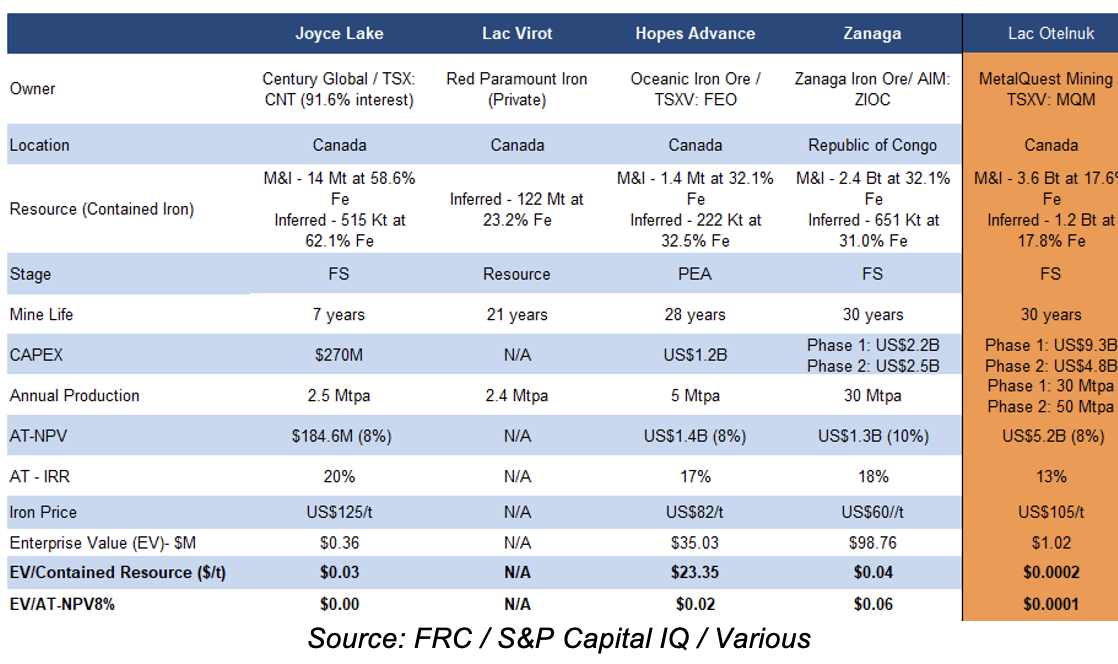

EV/Resource and EV/AT-NPV of MQM remain significantly lower than that of comparable iron ore juniors

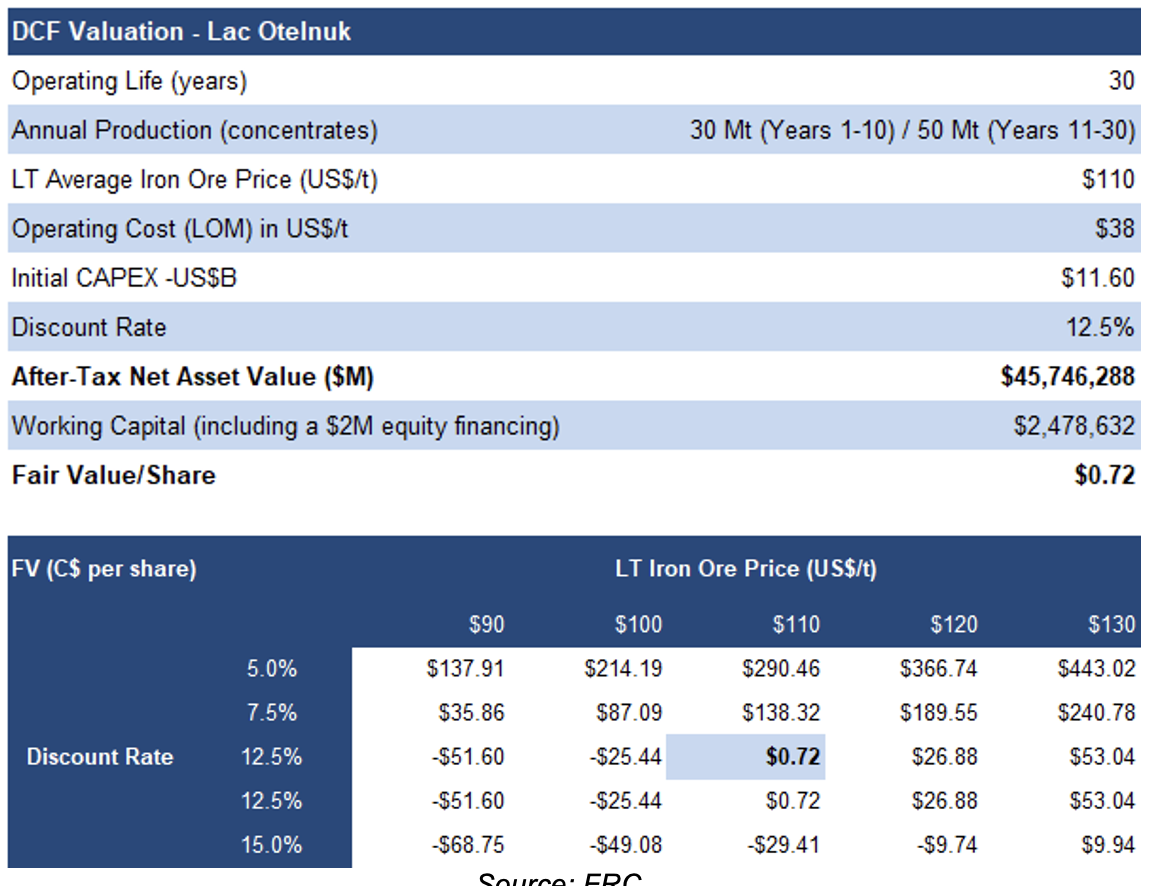

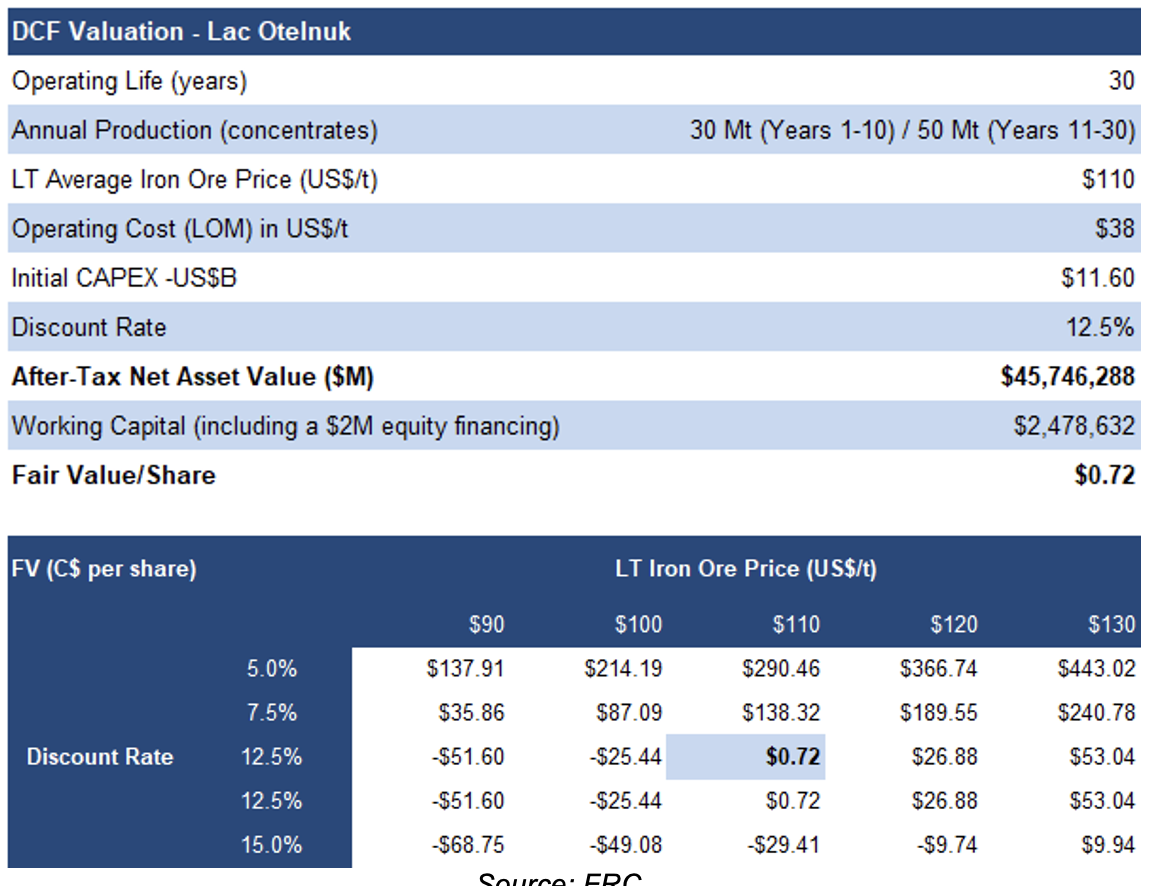

Our DCF valuation declined from $0.95 to $0.72/share primarily due to potential share dilution from the upcoming equity financing

We are reiterating our BUY rating, and adjusting our fair value estimate from $0.95 to $0.72/share. We believe Lac Otelnuk presents a significant long-term opportunity in the iron ore sector, but its success hinges on securing substantial financing, and a strategic partner to navigate the capital-intensive development path.

Risks

Maintaining our risk rating of 5 (Highly Speculative)

We believe the company is exposed to the following key risks (not exhaustive):

- The value of the company is dependent on commodity prices

- Exploration and development

- Permitting

- Iron ore projects are typically large/high-CAPEX

- Local support from first nations communities is critical for project development

- Access to capital and potential for share dilution