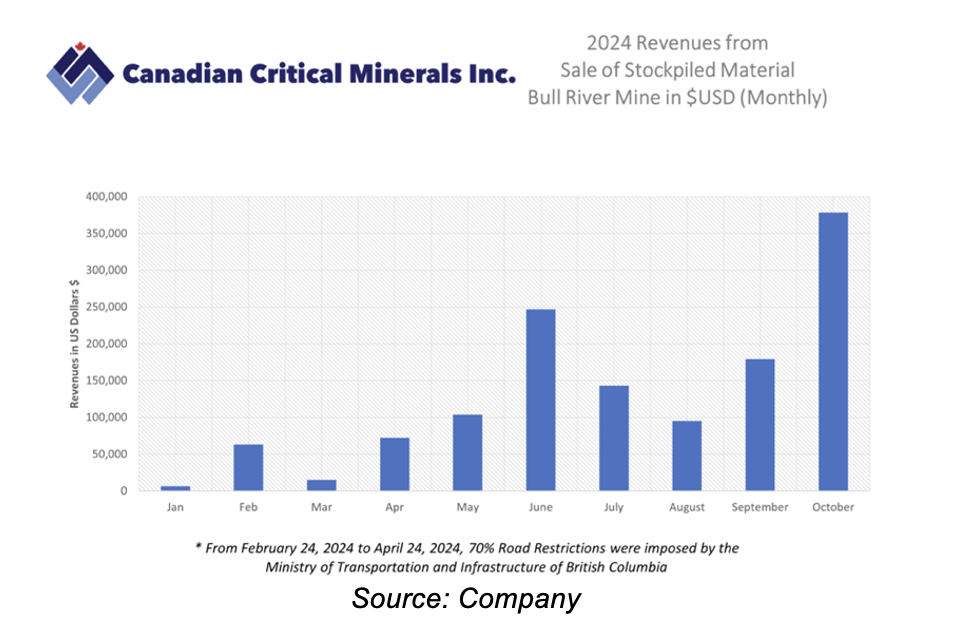

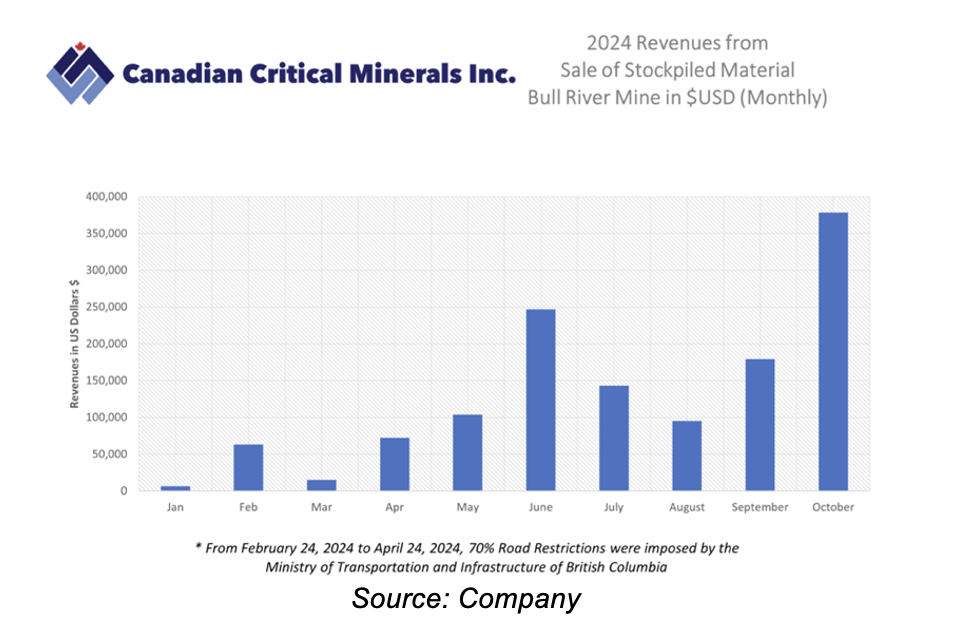

- In early 2024, the company began extracting and selling mineralized stockpiled materials, aimed at generating short-term cash flows. By December 2024, CCMI had shipped 5,825 tonnes, generating US$1.5M in revenue. Stockpile extraction will likely continue for another 12 to 15 months, potentially yielding another 10,000 tonnes, generating US$3M in revenue.

- CCMI is also in the process of applying for a tailings disposal permit, which would allow it to commence underground operations. Management plans to complete the permit application within six months, and expects approval by the end of 2025. Given the project’s low CAPEX (<US$15M), we believe the company will be able to advance to production quickly once the permit is granted

- In late 2024, XXIX Metal Corp. (TSXV:XXIX/MCAP: $30M) acquired CCMI's 30% interest in the Thierry mine project in exchange for a 10% equity stake in XXIX, valued at $3.8M at that time. XXIX owns a high-grade, open-pittable copper deposit in Quebec. This deal allows CCMI to maintain focus on its flagship Bull River mine, while retaining indirect exposure to XXIX’s projects through equity ownership.

- With gold and copper trading near record highs, we anticipate an increase in M&A activity over the next 12 months, as larger companies target juniors to grow their portfolios.

- Upcoming catalysts include permitting updates, and continued revenue generation from stockpile extraction. Copper projects are typically capital-intensive, but we believe Bull River’s low CAPEX, and swift path to production, offer a compelling opportunity for CCMI.

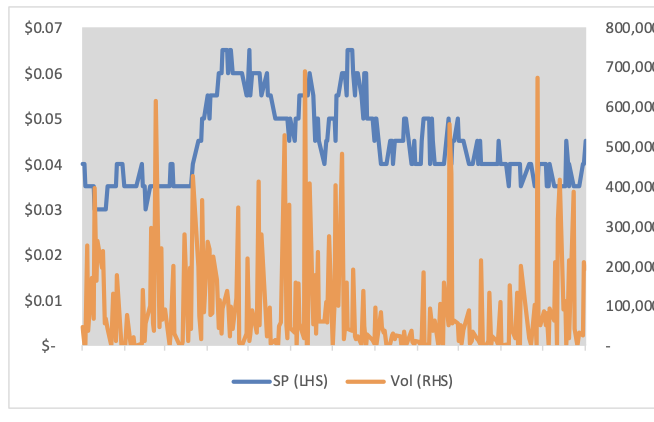

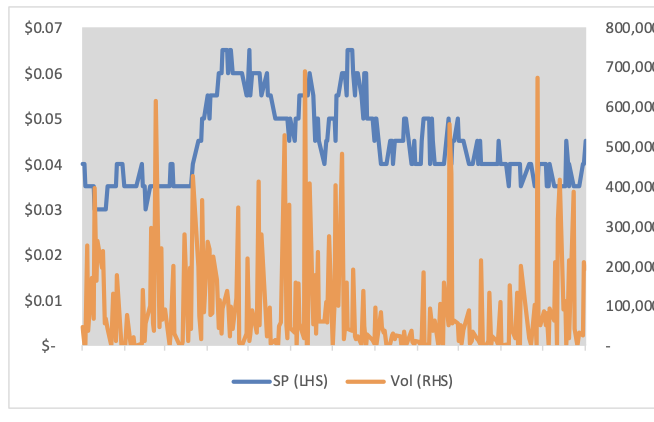

Price Performance (1-year)

| |

YTD |

12M |

| CCMI |

14% |

0% |

| TSXV |

0% |

7% |

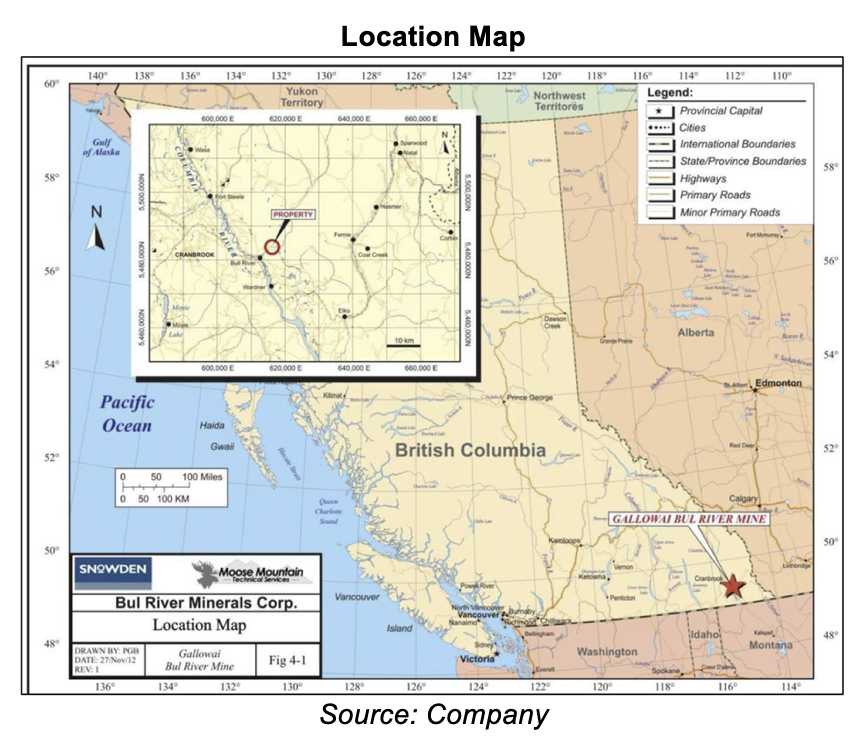

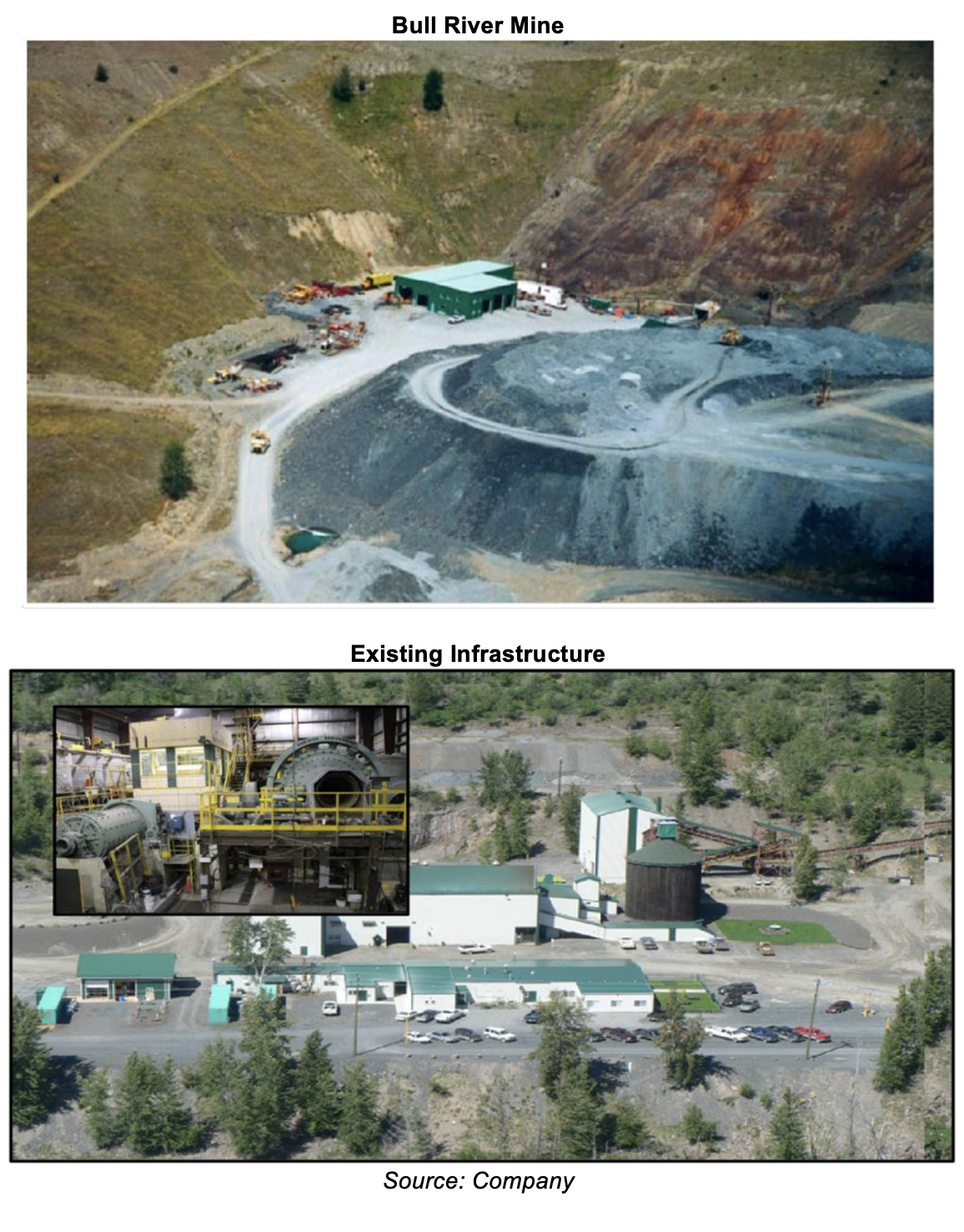

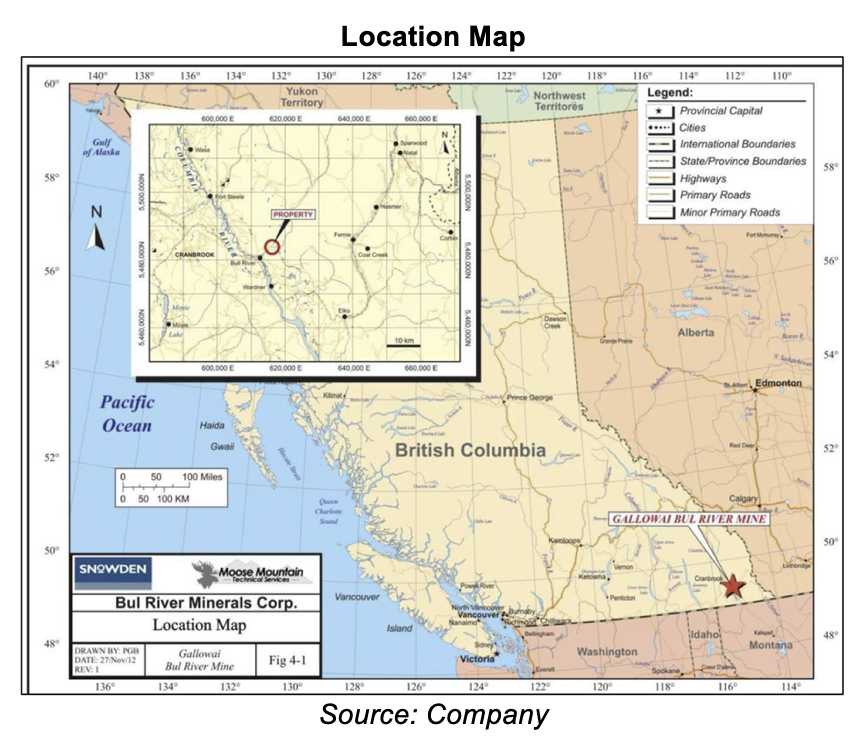

Bull River Mine (100% interest)

The property, covering 10,374 hectares, is located 50 km east of Cranbook, B.C.

10-12 hours from Vancouver. A past producer currently in care and maintenance

Connected to the BC Hydro electrical power grid. Year-round access to the site via paved, all-weather roads

Mineralization, History, and Infrastructure

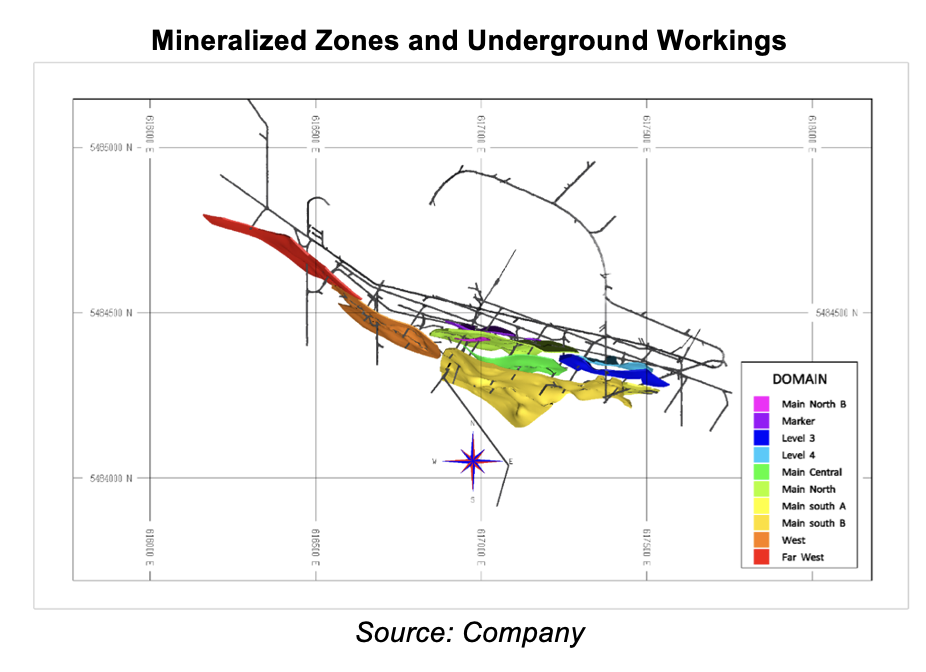

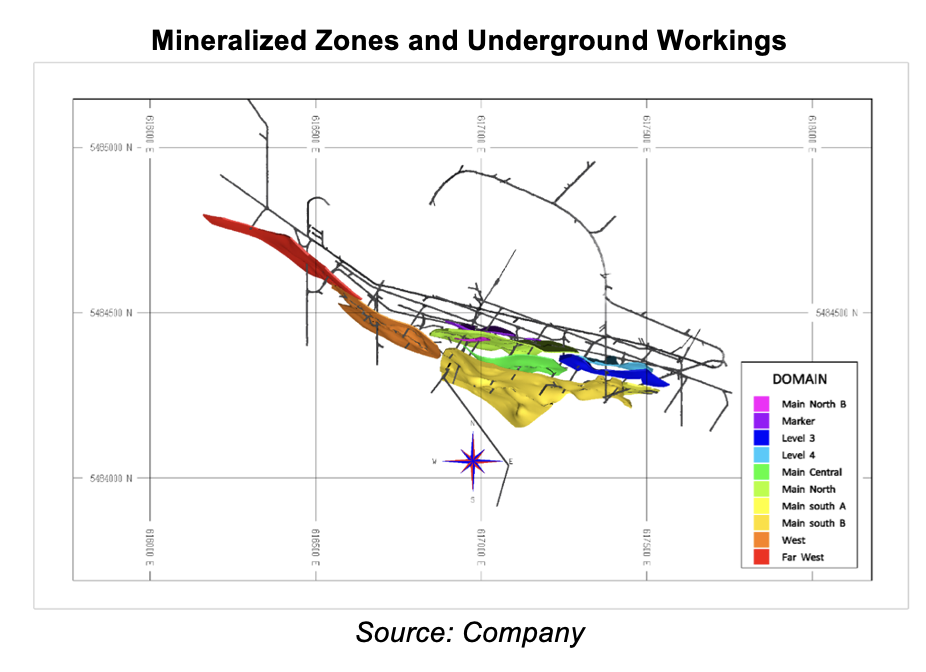

The project hosts a high-grade vein type copper-gold-silver deposit. Mineralization has been identified over 1,200 m strike, at a relatively shallow depth of 350 m, suitable for underground mining. Vein widths range between 2.5 m and 30 m.

Since 1976, $250M+ has been invested in the property, including 170,000 m of drilling, revealing veins across seven levels. Mineralization remains open at depth

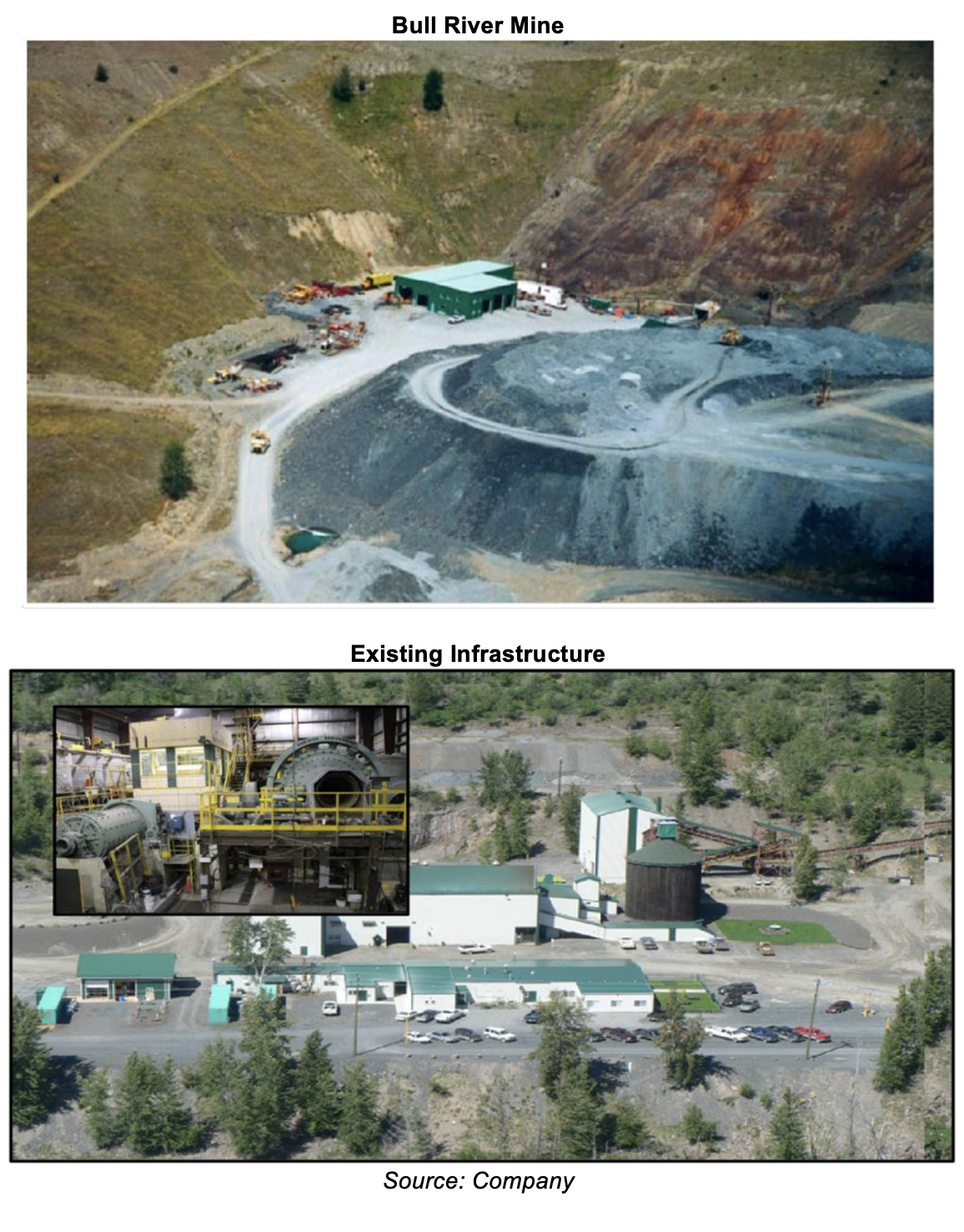

Gold was first discovered on the property in the early 1860s. The property was mined between 1971 and 1974, until the depletion of open-pit resources. During this period, production totaled 16 Mlbs of copper, 204 Koz silver, and 4 Koz gold, with a high CuEq grade of 1.8%, and a recovery rate of 93%.

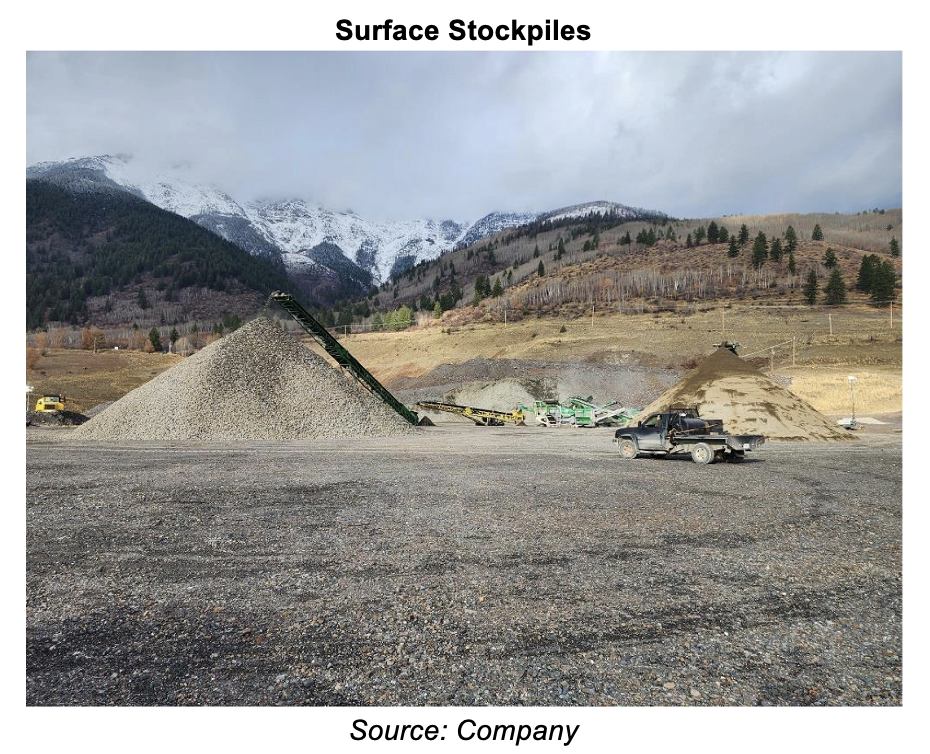

A key advantage of this project is its potential for rapid advancement to production, thanks to the existing infrastructure, which includes 22 km of underground workings, a 700 tpd mill, and a substantial surface stockpile

The mine features underground infrastructure down to 350 m

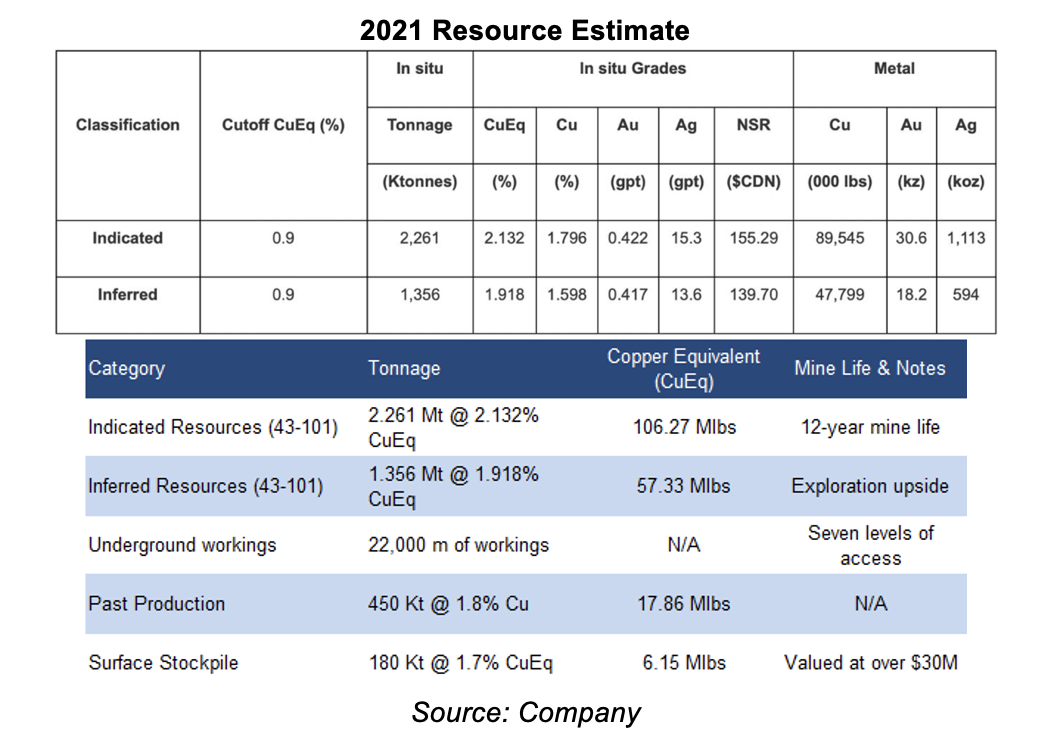

Resources and Stockpile

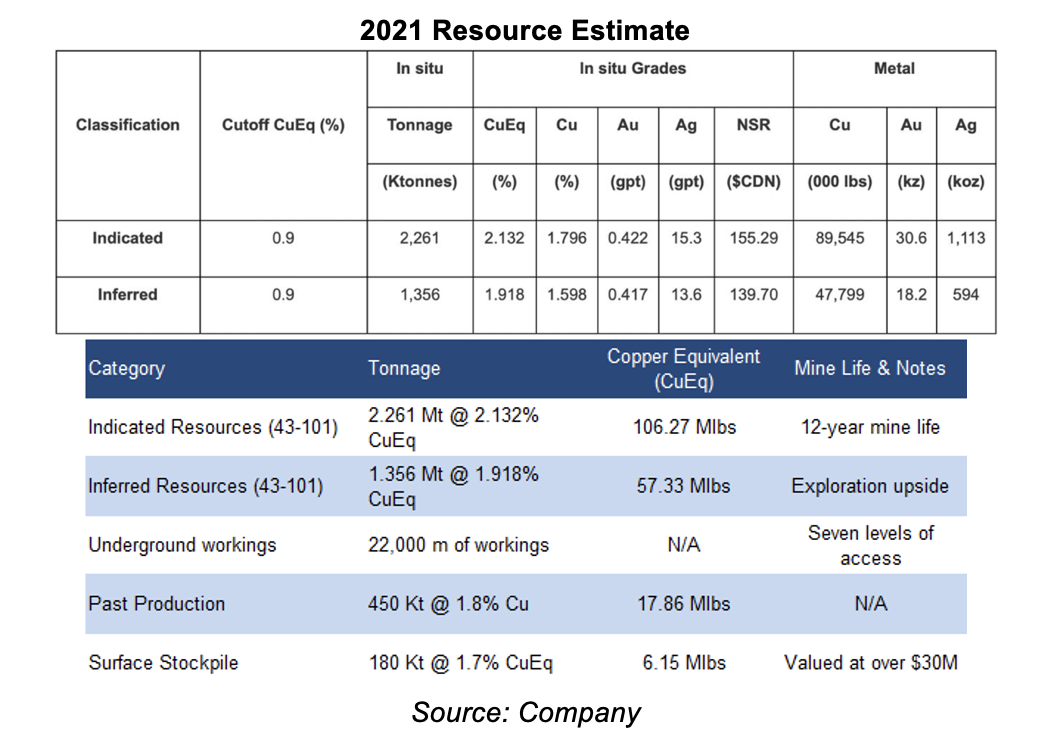

High-grade/low-tonnage underground resources totaling 164 Mlbs CuEq at 2.1%. Indicated resources alone support a 12-year mine life

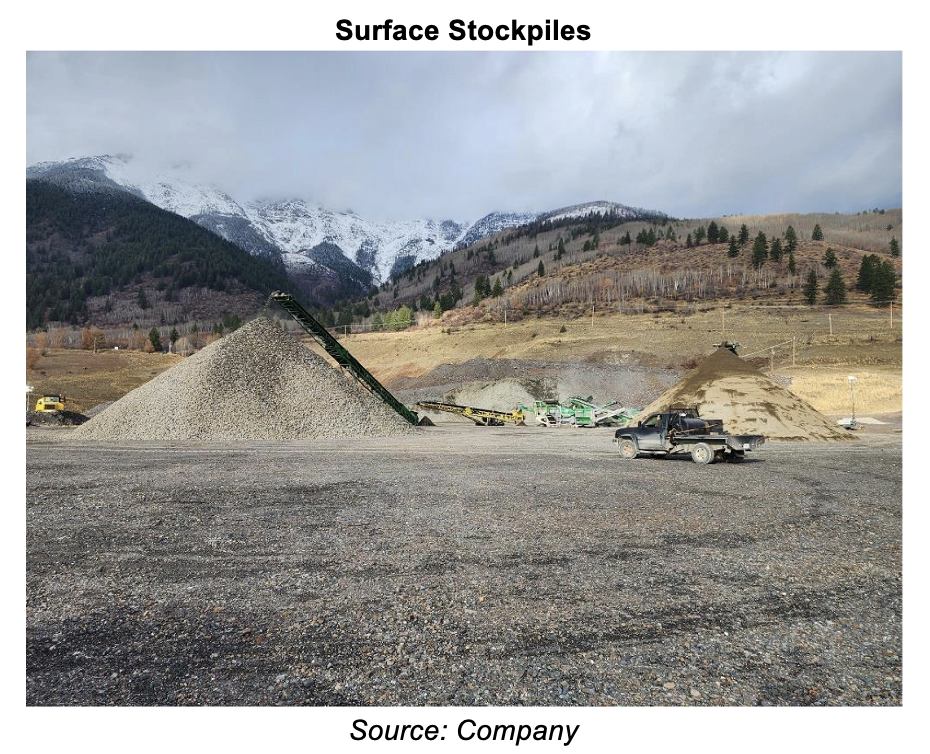

In addition to the underground resources, the project has 6.1 Mlbs in CuEq (1.7%) surface stockpiles.

Unusually high grades (1.7% CuEq) for stockpiles

Development Strategy

In early 2024, the company received a permit authorizing screening, crushing, and sorting activities, enabling the extraction of stockpiles to generate near-term cash flows. The company secured an agreement with New Gold Inc.’s (TSX: NGD) New Afton mill, located 650 km from the Bull River mine, to supply pre-concentrated copper ore from its surface stockpile over two years.

Started extracting materials from stockpiles in early 2024. As of December 2024, CCMI had shipped 5,825 tonnes of mineralized material to New Afton, generating US$1.5M in revenue

Stockpile extraction will likely continue for another 12 to 15 months, potentially yielding another 10,000 tonnes, generating US$3M in revenue

The project hosts 180 Kt of mineralized stockpile, with approximately 15 Kt expected to be sold under the two-year agreement with NGD. While generating near-term cash flows from stockpile extraction, the company is advancing plans to process the remaining stockpile (165 Kt), and resume underground mining. This requires obtaining permits for tailings disposal, and underground mining. The following steps summarize management’s strategy:

- Apply for a tailings disposal permit by mid-2025, with approval expected by late 2025 or early 2026.

- Procure mill equipment, and start processing the remaining stockpile in H2-2026.

- At a processing rate of 700 tpd, the stockpile should support operations for approximately eight months.

- Apply for an underground mining permit in 2026, with production targeted for 2027. We believe this process will likely be straightforward, as the tailings permit will address many key environmental and operational aspects, and the mine has a history of operations.

As the project’s CAPEX is low (<US$15M), we believe the company will not have any difficulties in raising capital and advancing the project to production, once the permit is approved.

Our discussions with management indicated that key aspects of the permitting process include a detailed design for dry stack tailings, and an updated effluent discharge plan. As there are First Nations communities near the project, the company will have to gain support from them, if and when the project is advanced to production. Management has indicated that they are in discussions with First Nations communities in the region.

Advancing plans to process the remaining stockpile, and resume underground mining

Management and Directors

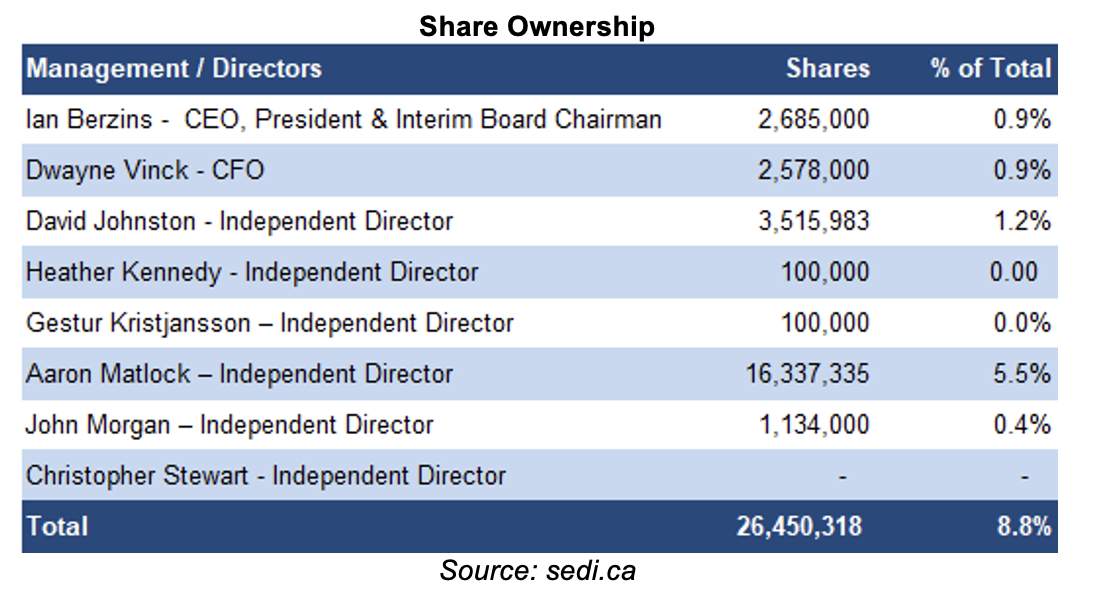

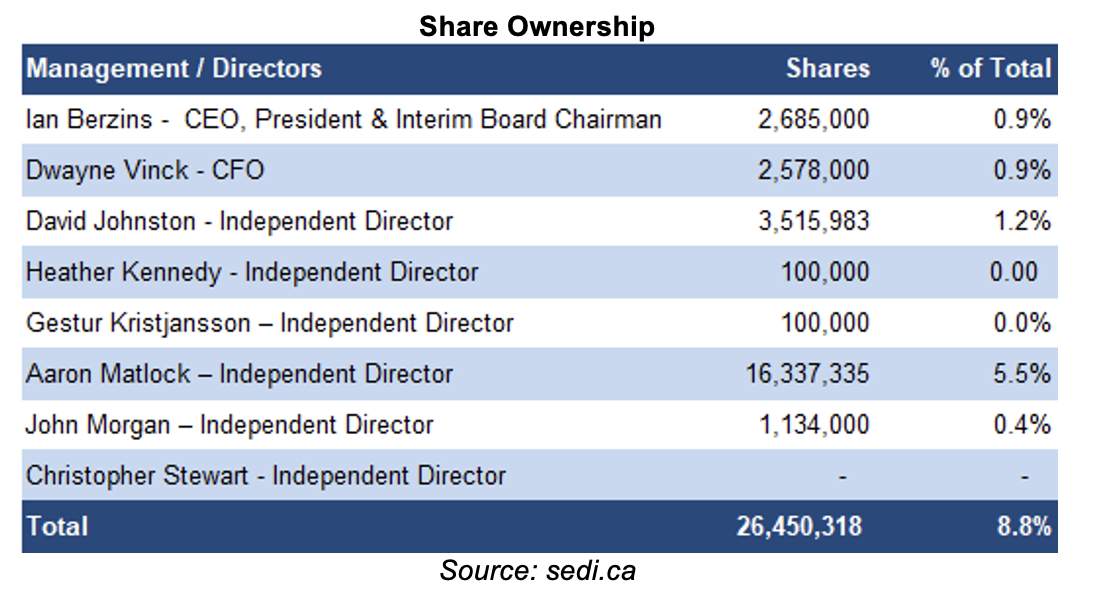

Management and board own 9% of the outstanding shares. Six out of seven directors are independent

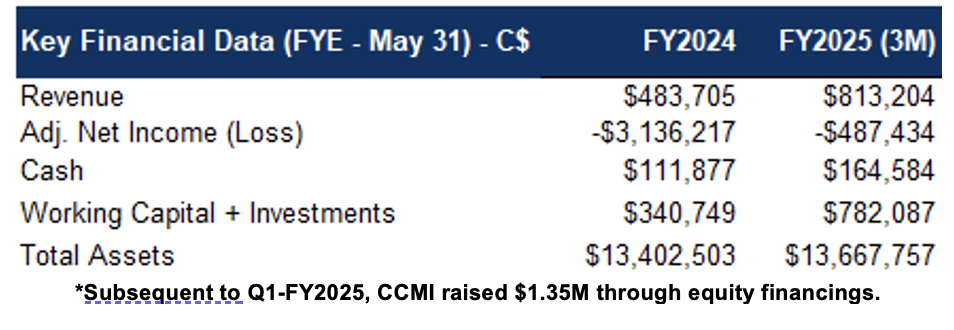

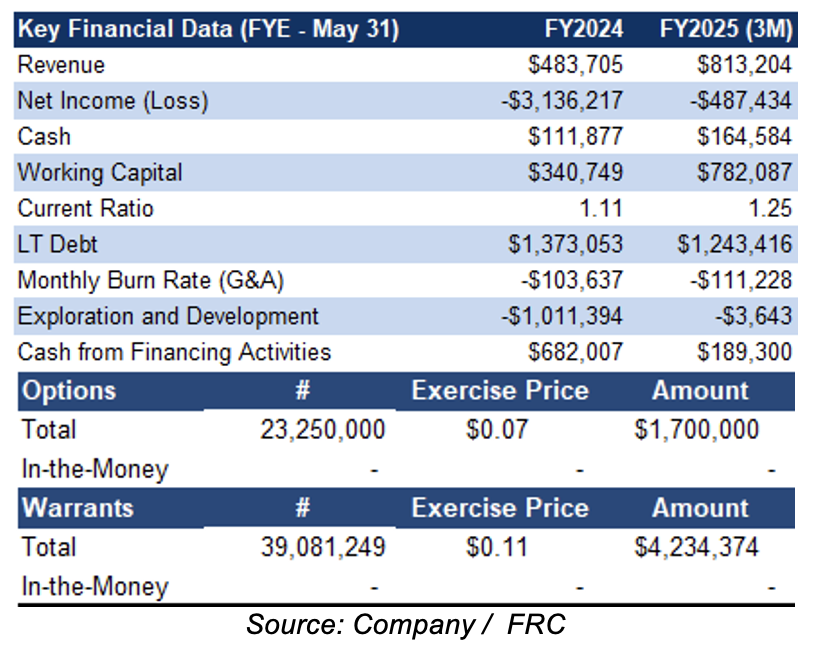

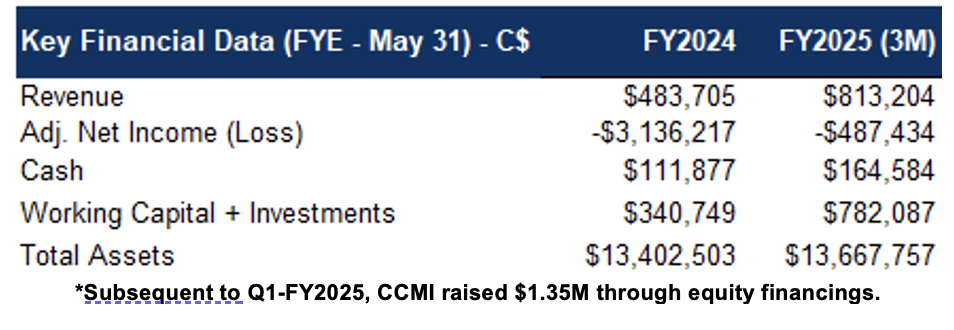

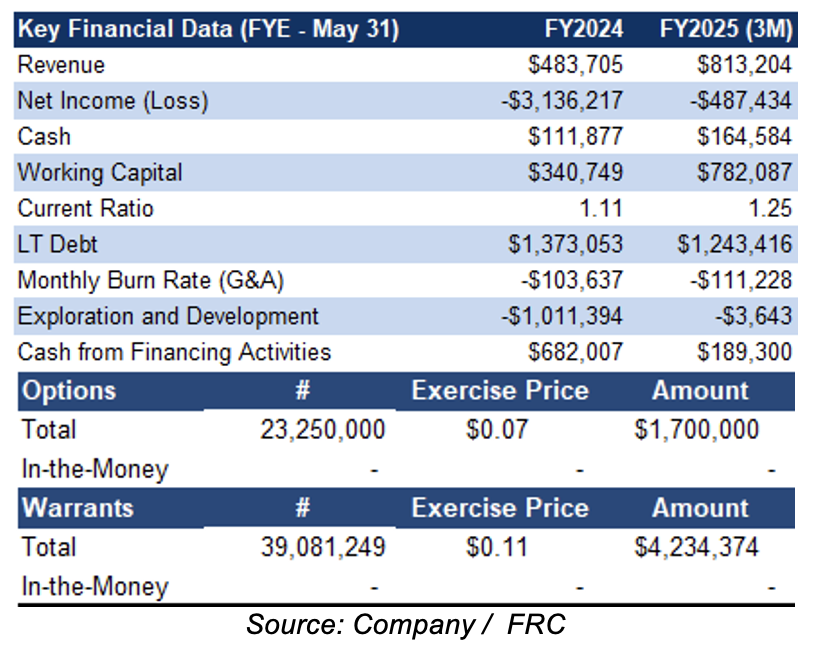

Financials

Subsequent to Q1-FY2025, CCMI raised $1.35M through equity financings

FRC Valuation and Rating

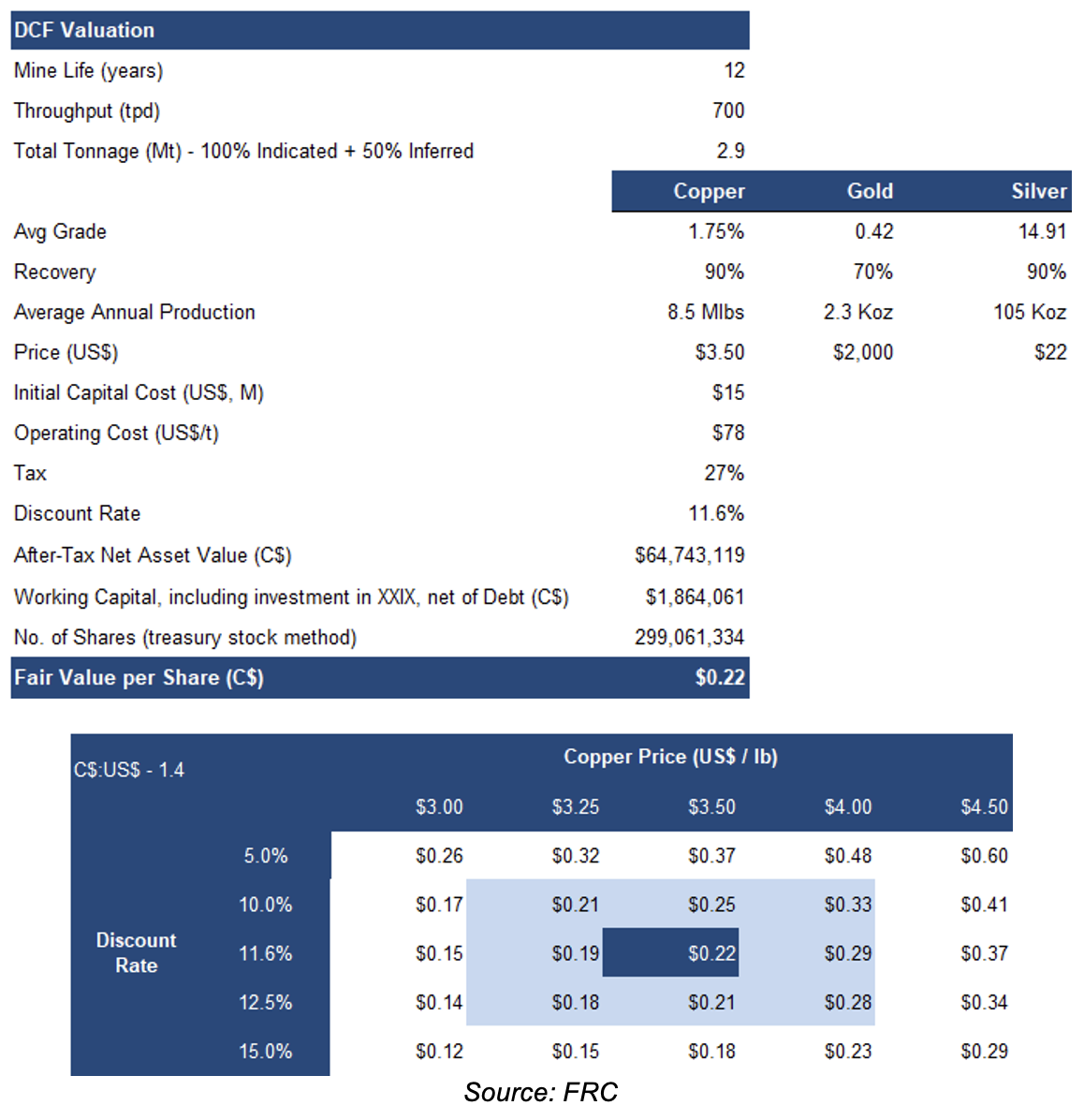

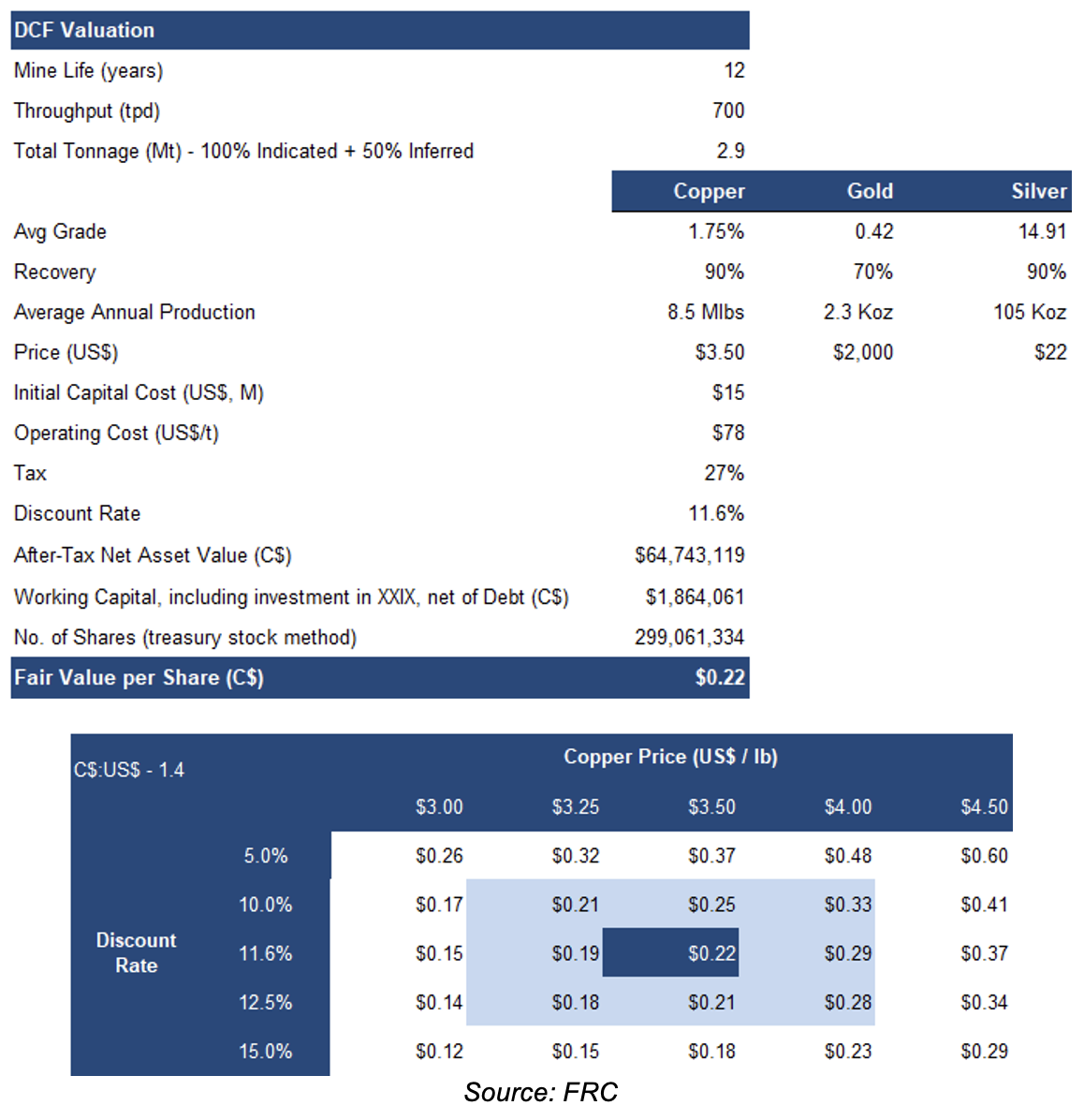

Our DCF model returned a fair value estimate of $0.22/share. Our valuation is highly sensitive to copper prices

We are resuming coverage with a BUY rating, and a fair value estimate of $0.22/share. 2025 could be a pivotal year for CCMI, as permitting stands as the company’s primary hurdle. The company has delineated a resource capable of supporting 10+ years of operations, with a low CAPEX requirement, thanks to pre-existing infrastructure. We believe that any positive progress in the permitting process will lead to a significant boost in the share price. Our valuation is conservative, as it does not account for any upside from the company’s exposure to XXIX Metal.

Risks

We are assigning a risk rating of 5 (Highly Speculative)

We believe the company is exposed to the following key risks:

- The value of the company is dependent on commodity prices

- Permitting

- Financing and potential for share dilution

- Exploration and development