Golden Minerals Company

Anticipating Positive Market Response to An Upcoming Announcement

Published: 11/18/2023

Author: Sid Rajeev, B.Tech, CFA, MBA

Sector: Basic Materials | Industry: Other Precious Metals & Mining

| Metrics | Value |

|---|---|

| Current Price | US $0.5 |

| Fair Value | US $6.97 |

| Risk | 4 |

| 52 Week Range | US $0.11-8.00 |

| Shares O/S (M) | 14 |

| Market Cap. (M) | US $7 |

| Current Yield (%) | n/a |

| P/E (forward) | n/a |

| P/B | 2.8 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

Highlights

We are expecting AUMN to commence commercial production at Velardeña (a silver-gold-lead-zinc mine in Mexico) in the coming weeks. A recently completed PEA returned an AT-NPV8% of $88M, using $1,826/oz gold, and $23/oz silver. AUMN is trading at just 4% of the AT-NPV8%.

As we expected, production at Rodeo (a gold-silver mine located 80 km west of Velardeña) ended in September 2023.

AUMN has completed a $4M equity financing to fund working capital, and initial operations at Velardeña.

Despite the completion of this financing, and the imminent production potential, AUMN is down 93% YTD. AUMN is trading at $0.03 per silver equivalent oz vs the sector average of $0.67/oz, implying a 96% discount.

In Q3, production was down 39% QoQ, but 11% higher than our estimate. Revenue was 30% higher than expected amid higher production, and gold prices. However, EPS was 18% lower than expected, due to increased cash costs from lower grades, expenses linked to winding up Rodeo operations, and higher exploration expenses.

We maintain a positive outlook on gold prices, as we anticipate the Fed will start cutting rates within the next six months, driven by rising unemployment, financial instability, and mortgage costs, declining consumer confidence, and cooling inflation.

An upcoming catalyst includes commencement of production at Velardeña. We believe the current price level offers an attractive entry point for speculative investors.

Financials

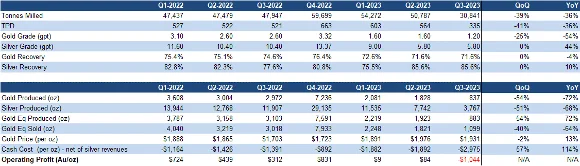

Q3 was the final quarter of production at Rodeo

As the company processed low-grade stockpiles, production declined, and cash costs increased

Q3 production was down 39% QoQ, but 11% higher than our estimate

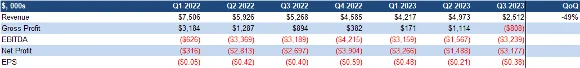

Revenue was 30% higher than our forecast amid higher production, and gold prices, but EPS was 18% lower than expected due to higher cash costs, and exploration expenses

Source: FRC / Company / S&P Capital IQ

Source: FRC / Company / S&P Capital IQ

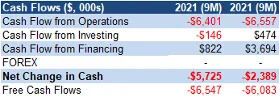

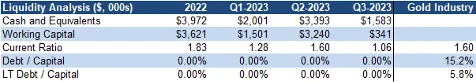

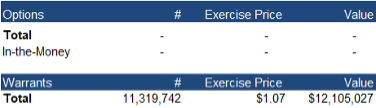

Subsequent to Q3, AUMN strengthened its balance sheet through a $4M equity financing

Project Updates

Rodeo: As expected, at the end of Q3, AUMN suspended operations upon processing all remaining economic stockpiles.

Velardeña: In Q3, AUMN generated $0.2M in revenue from processing mineralized materials extracted during test mining last year. We anticipate management will announce commercial production shortly. A recently completed PEA returned an AT-NPV8% of $88M, using $1,826/oz gold, and $23/oz silver.

Santa Maria – AUMN expects to close the previously announced sale of this project in Q4 for $2.5M, including $1.5M in cash, and $1M in royalties.

El Quevar silver property in Argentina: AUMN expects Barrick (TSX: ABX) to conduct additional geophysical studies, followed by a drill program in 2024.

Sarita Este gold property (located 1.5 hours from El Quevar): Subject to the availability of capital, management intends to resume drilling next year to support a maiden resource estimate.

Yoquivo gold-silver project (Chihuahua): Management intends to resume drilling next year, subject to the availability of capital.

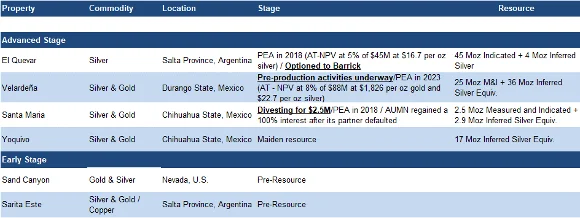

Portfolio Summary Source: FRC / Company

Source: FRC / Company

AgEq resources totaling 78 Moz M&I + 66 Moz inferred across four properties

FRC Projections Source: FRC

Source: FRC

We are introducing our 2024 forecasts based on our preliminary production estimates for Velardeña

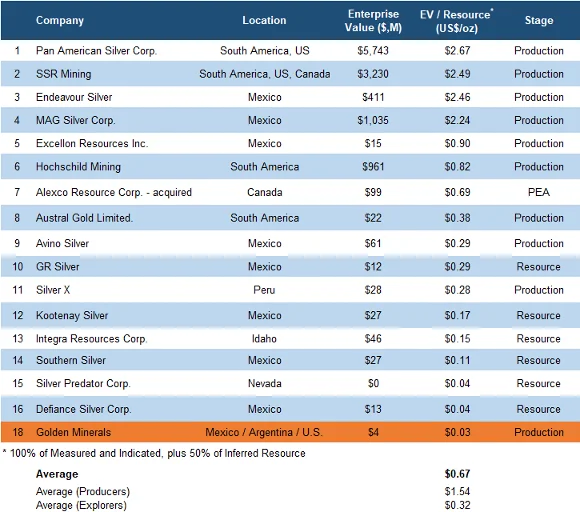

FRC Valuation Source: FRC / Various Company Websites and Technical Reports

Source: FRC / Various Company Websites and Technical Reports

AUMN is trading at $0.03 per AgEq oz (previously $0.04/oz) vs the producers’ average of $1.54 (previously $1.73/oz), and explorers’ average of $0.32/oz (previously $0.34/oz)

AUMN is the most undervalued junior on this list

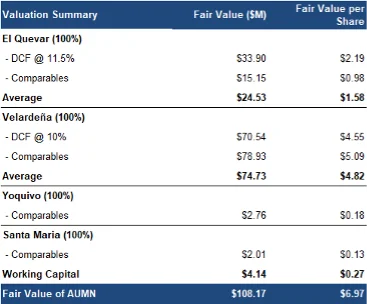

Source: FRC

Source: FRC

Our fair value decreased from $11.36 to $6.97/share, primarily due to share dilution from the recent financing

We are reiterating our BUY rating, and lowering our fair value estimate from $11.36 to $6.97/share. We believe the market is overlooking AUMN's potential to advance Velardeña to production. We believe the current price level offers an attractive entry point for speculative investors, given our anticipation of an imminent commercial production announcement.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

1. The value of the company is dependent on silver & gold prices

2. Exploration and development

3. Access to capital and potential share dilution

4. No guarantee that Velardeña will be advanced to production