Fortune Minerals Limited

Collaborating With Rio Tinto/Advancing Financing Initiatives

Published: 11/1/2023

Author: Sid Rajeev, B.Tech, CFA, MBA

Sector: Basic Materials | Industry: Other Industrial Metals & Mining

| Metrics | Value |

|---|---|

| Current Price | US $0.04 |

| Fair Value | US $0.31 |

| Risk | 5 |

| 52 Week Range | US $0.03-0.09 |

| Shares O/S (M) | 478 |

| Market Cap. (M) | US $17 |

| Current Yield (%) | n/a |

| P/E (forward) | n/a |

| P/B | 0.5 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

Highlights

Fortune’s NICO cobalt-gold-bismuth-copper project hosts the largest primary cobalt deposit in North America, and the world’s largest bismuth deposit. The U.S., EU, and Canada have identified cobalt and bismuth as critical minerals.

FT has an option to acquire a brownfield refinery site in Alberta, which can be modified into a refinery for producing cobalt sulphate, gold doré, bismuth ingots/oxides, and copper cement. We believe a major advantage of this site is its proximity to a rail line, and sources of water, natural gas, power, sulphuric acid, and reagents.

FT has attracted Rio Tinto (NYSE: RIO) to evaluate various processing methods to recover bismuth, and cobalt, from RIO’s Kennecott operations in Utah, and process at FT’s planned refinery in Alberta. Although it is premature to forecast revenue from this collaboration, we are encouraged by the partnership between FT and a major player, as well as Rio's confidence in FT's expertise in cobalt and bismuth. FT has $8.62M in debentures/loans maturing on December 31, 2023, prompting an urgent need for refinancing, and/or securing alternative financing solutions. In addition, FT has to raise funds to purchase the refinery site, and complete an updated Feasibility Study (FS). The company is in discussions with various strategic partners and government agencies. We note that securing immediate financing is vital for the company's viability.

FT is trading at just 10% of NICO’s AT-NPV7% per a FS completed in 2014, and 16% of our base-case AT-NPV estimate. Upcoming catalysts include financing, acquisition of the refinery site, updates on the collaboration with Rio Tinto, as well as positive sentiment towards EV-metal juniors.

NICO Cobalt-Gold-Bismuth-Copper Project, NWT

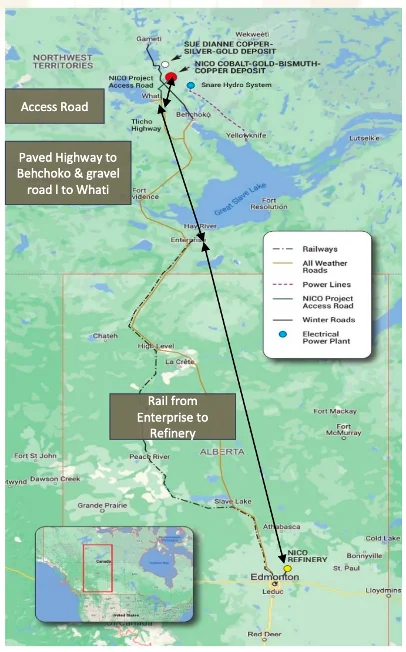

Location Map

Located 160 km northwest of Yellowknife, and 50 km north of Whati

Concentrates can be transported by truck and rail to the prospective refinery site in Alberta

The largest primary cobalt deposit in North America

1.1 Moz gold

NICO’s bismuth deposit accounts for 12% of global reserves; bismuth is used in alloys, pharmaceuticals, and chemicals

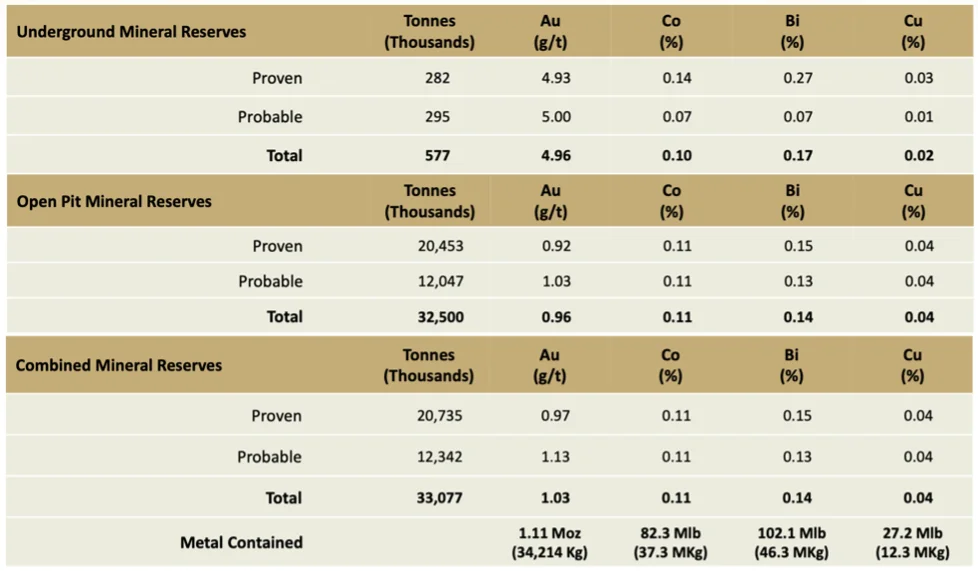

Mineral Reserves

Source: Company

Source: Company

We believe the project has resource expansion potential as the deposit remains open in multiple directions; in addition, several geophysical targets remain untested

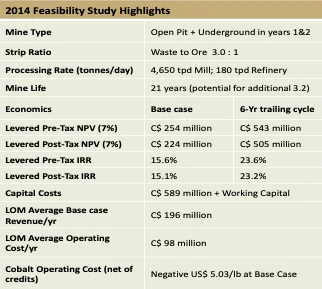

Source: Company

Source: Company

FT has an option to acquire a brownfield refinery plant in Lamont county, Alberta for $5.5M.

A 2014 FS returned an AT-NPV7% of $254M, using US$16/lb cobalt vs the current spot price of US$15/lb (three-year average spot price is US$22.5/lb); our valuation models are based on US$22.5/lb

The potential open-pit measures 1.35 km long x 0.45 km wide x 0.22 km deep

Mine optimization studies in 2020 confirmed that the project’s economics can be improved significantly through selective mining of high-grade ores in the initial years of operation

Planned Alberta Refinery Site Source: Company

Source: Company

A 77-acre land package located 30 km northeast of Edmonton, and 15 km from Sherritt’s (TSX: S) nickel-cobalt processing plant

We believe the site’s location is ideal as it is in close proximity to a rail line, and sources of water, natural gas, power, sulphuric acid, and reagents

FT is collaborating with Rio Tinto to evaluate various processing methods to recover bismuth, and cobalt, from RIO’s Kennecott operations in Utah, and process them at FT’s planned refinery in Alberta. It is premature to forecast revenue from this collaboration. Nevertheless, we note that any positive outcome from this partnership will be a bonus for FT, given that the main goal of acquiring the refinery site is to process materials from their NICO project.

Management is focused on securing financing to support its near-term initiatives, which include updating the 2014 FS, acquiring the refinery site, and advancing the permitting process.

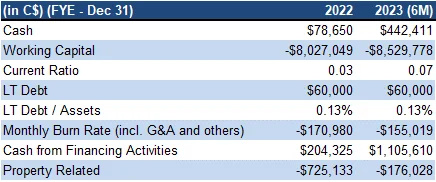

Financials

Data Source: Financial Statements

Data Source: Financial Statements

At the end of Q2-2023, FT had $8.62M in debentures/loans maturing on December 31, 2023, prompting an urgent need for refinancing, and/or securing alternative financing avenues

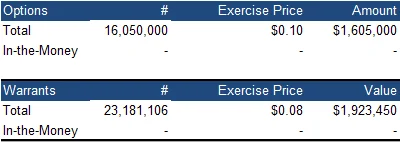

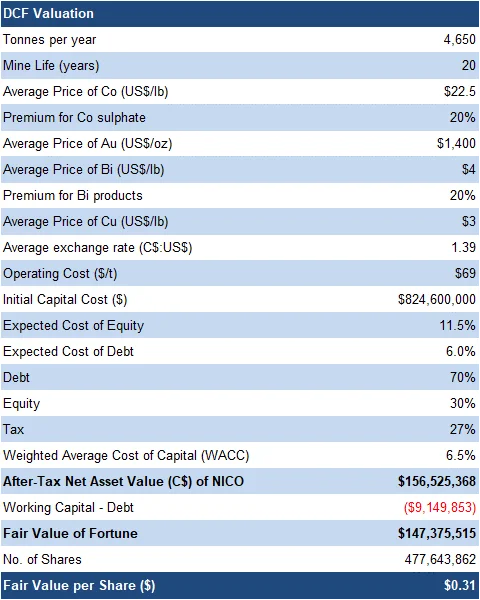

FRC Valuation

Source: FRC

Source: FRC

We are lowering our DCF valuation from $0.54 to $0.31/share, due to share dilution, and as we raised our CAPEX/OPEX estimates to account for inflation since our previous report in 2021

Our valuation remains highly sensitive to cobalt and gold prices

As there are no direct comparables for NICO, we are not using a comparables valuation model

We are reiterating our BUY rating, and revising our fair value estimate from $0.54 to $0.31/share. Securing short-term financing is crucial for the company's viability. Upcoming catalysts include financing, acquisition of the refinery site, updates on the collaboration with Rio Tinto, as well as positive sentiment towards EV-metal juniors.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

1. Commodity prices

2. Access to capital and share dilution

3. Delays in project development

4. Project financing

5. Development