Enterprise Group, Inc.

Q3 Disappoints;Trump’s Re-election Set to Boost the Sector

Published: 11/25/2024

Author: FRC Analysts

Sector: Energy | Industry: Oil & Gas Equipment & Services

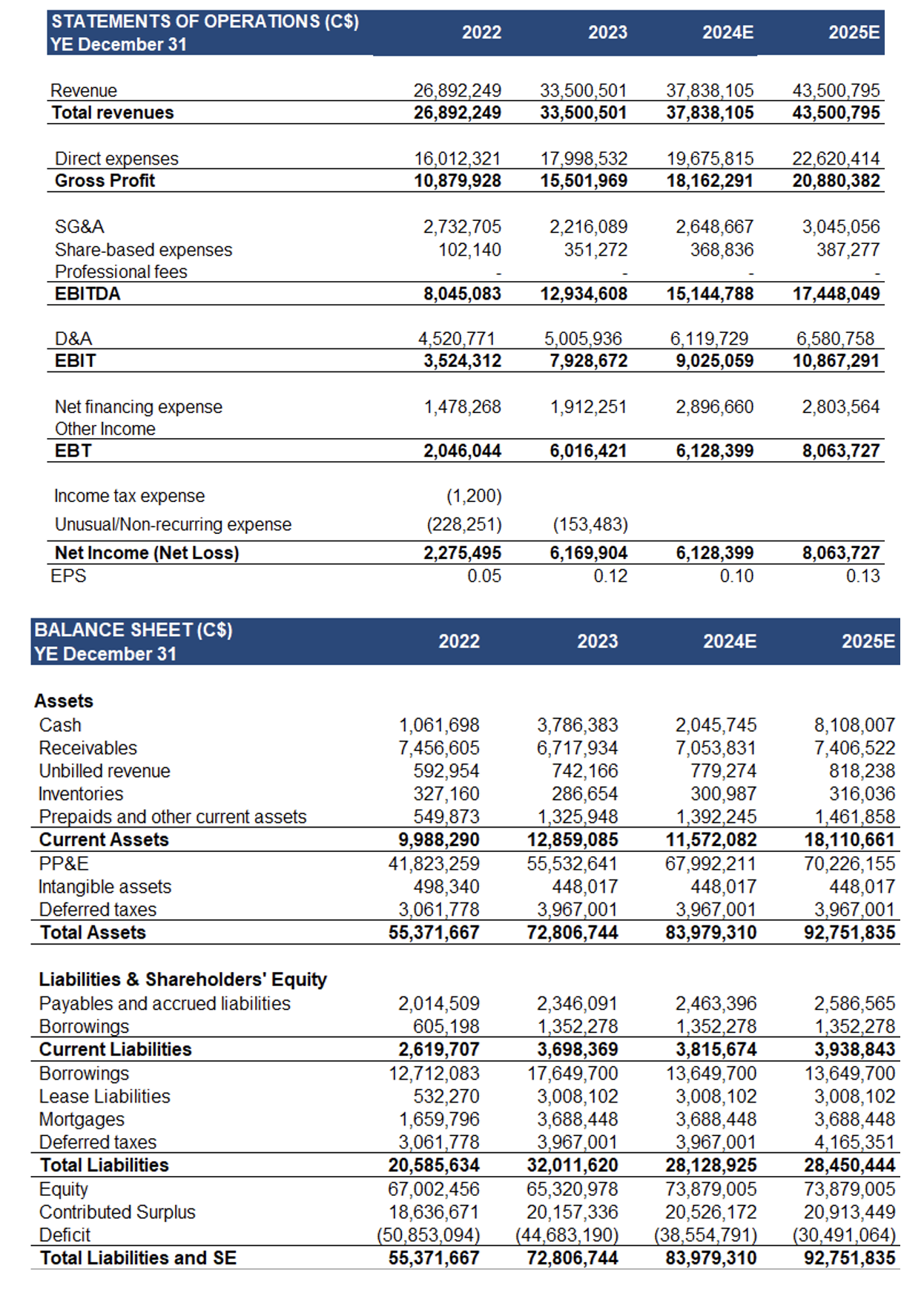

| Metrics | Value |

|---|---|

| Current Price | CAD $2.19 |

| Fair Value | CAD $2.75 |

| Risk | 3 |

| 52 Week Range | CAD $0.68-2.25 |

| Shares O/S (M) | 61 |

| Market Cap. (M) | CAD $133 |

| Current Yield (%) | N/A |

| P/E (forward) | 21.2 |

| P/B | 2.5 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

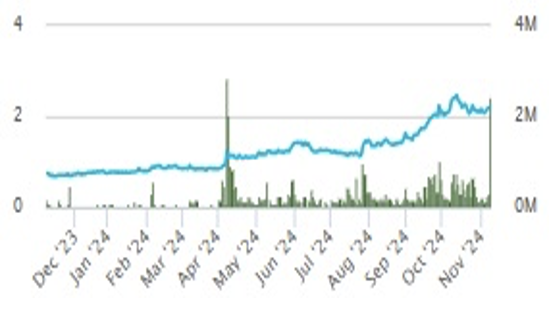

- E is up 208% YoY, making it the second-best performing stock on our list of oilfield services companies.

- Q3 revenue was down 19% YoY, missing our estimate by 23%. Lower revenue drove down gross margins, resulting in EPS turning negative. We were disappointed with the results, and the market reacted accordingly, with the shares falling 19% on announcement day.

- Although H1 revenue was up 30% YoY, driven by several new contracts with tier-one clients, Q3 revenue declined as certain clients postponed their activities due to company-specific factors or unfavorable weather conditions.

- We expect Q4 revenue to recover as clients ramp up operations following earlier delays. Note that Q1 and Q4 are historically stronger quarters due to seasonality

- In 2024 (9M), CAPEX increased 27% YoY to $12M, driven by heightened client demand necessitating new equipment purchases, indicating that management expects a strong revenue pipeline.

- In Q3, Enterprise announced a five-year exclusivity agreement with FlexEnergy Solutions, a globally recognized OEM of turbine and microturbine power generation equipment. E will offer FlexEnergy’s turbine units for temporary power needs to businesses in Western Canada. We find it highly commendable that a leading manufacturer has partnered exclusively with Enterprise, further enhancing E’s product offering.

- Per consensus estimates, growth in North American oil and gas CAPEX will ease to 2% in 2024, down from 19% in 2023, driven by slower GDP growth, and higher lending rates. However, we believe the re-election of Trump will provide a major boost for the sector, as his administration is expected to support increased oil and gas spending in the U.S. While Enterprise lacks direct exposure to the U.S., and is unlikely to see a direct benefit, we expect positive investor sentiment for the broader North American energy services sector.

Price and Volume (1-year)

Enterprise vs Larger Players

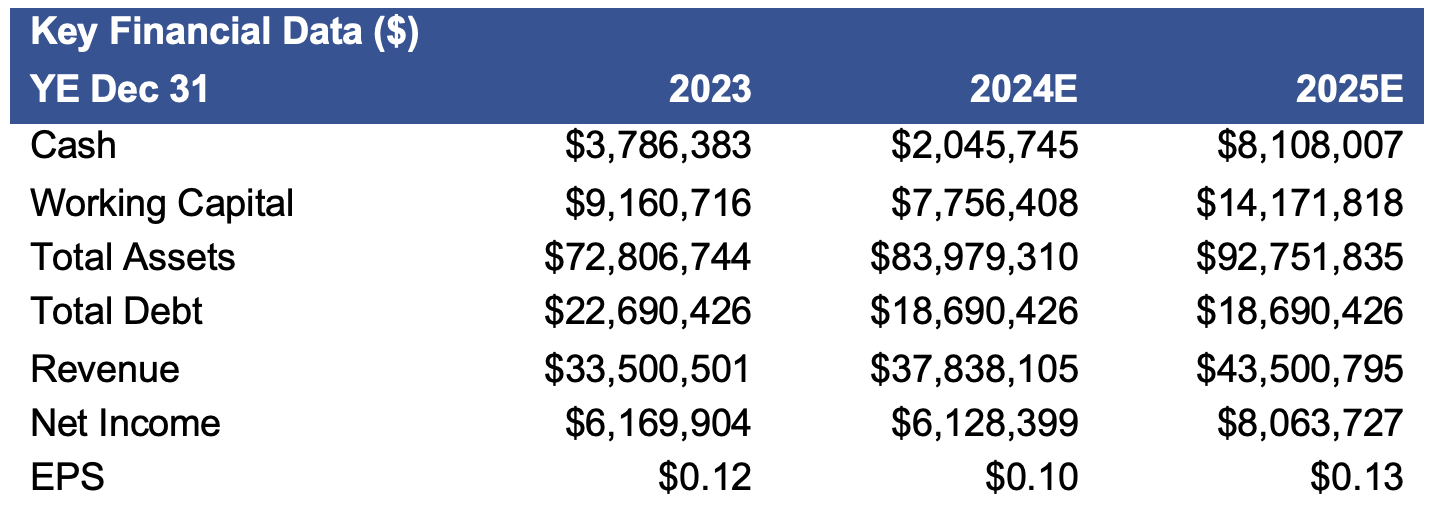

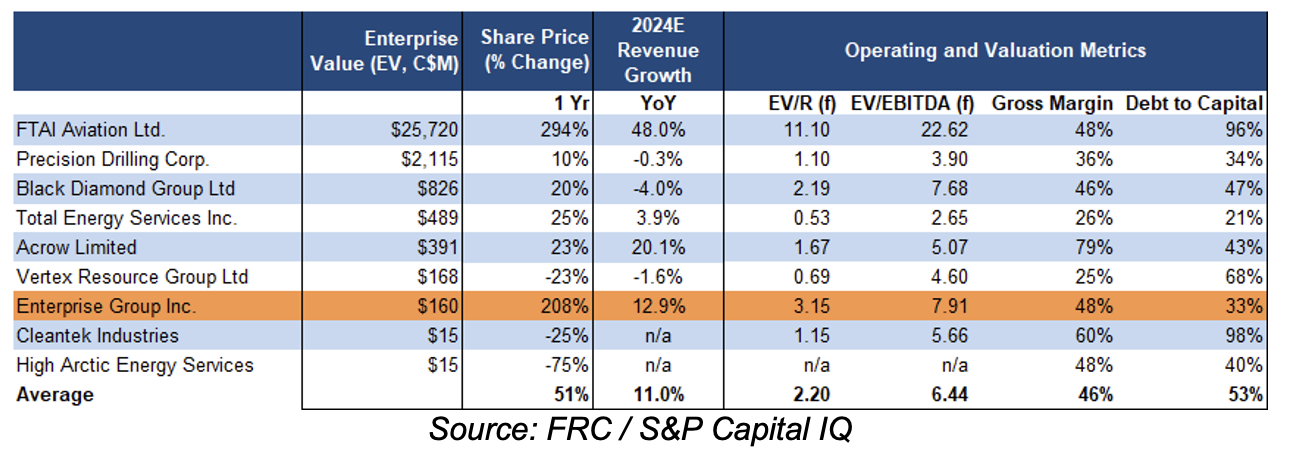

E is up 208% YoY, and is the second-best performing stock on our list of oilfield services companies. Gross margins are slightly higher than the sector average, while debt/capital is significantly lower

In 2024, we anticipate 13% revenue growth, outpacing the sector by 2 pp

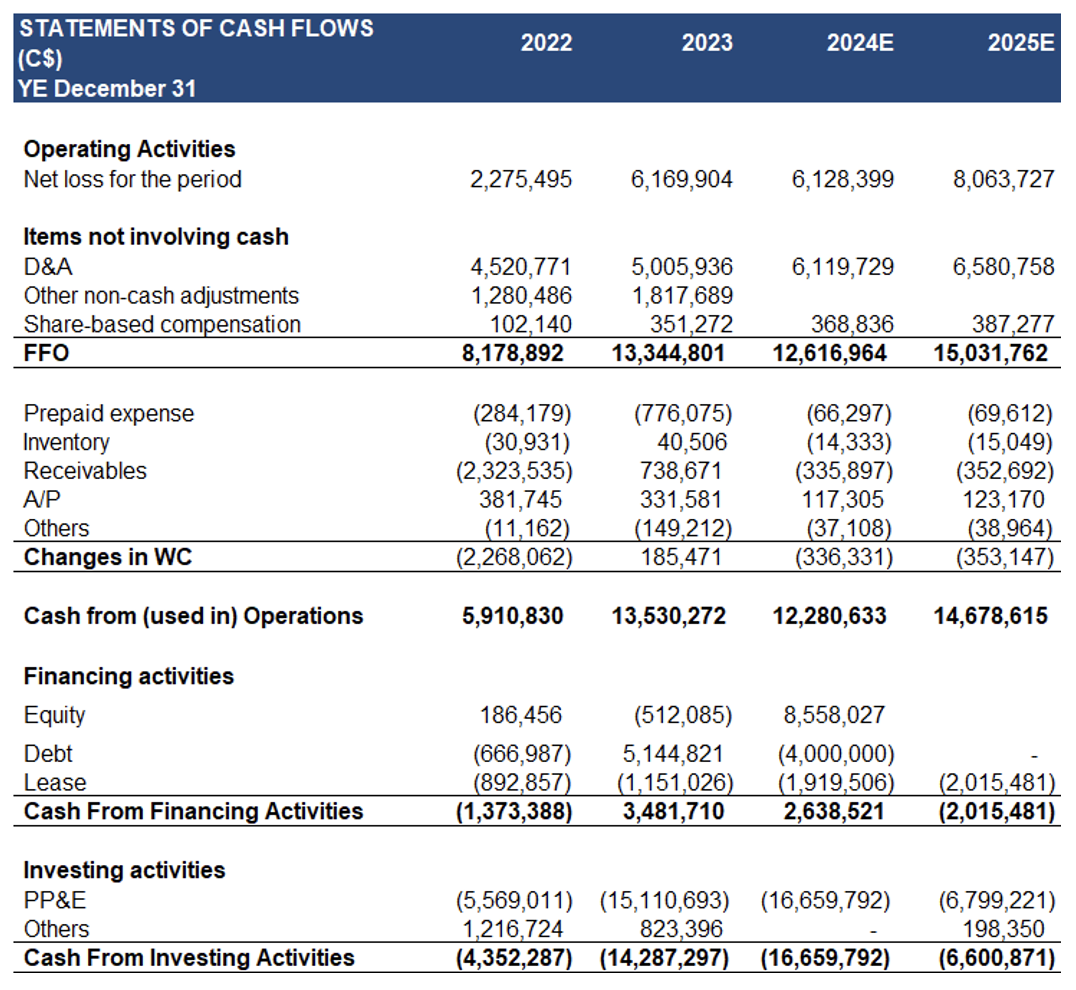

Financials

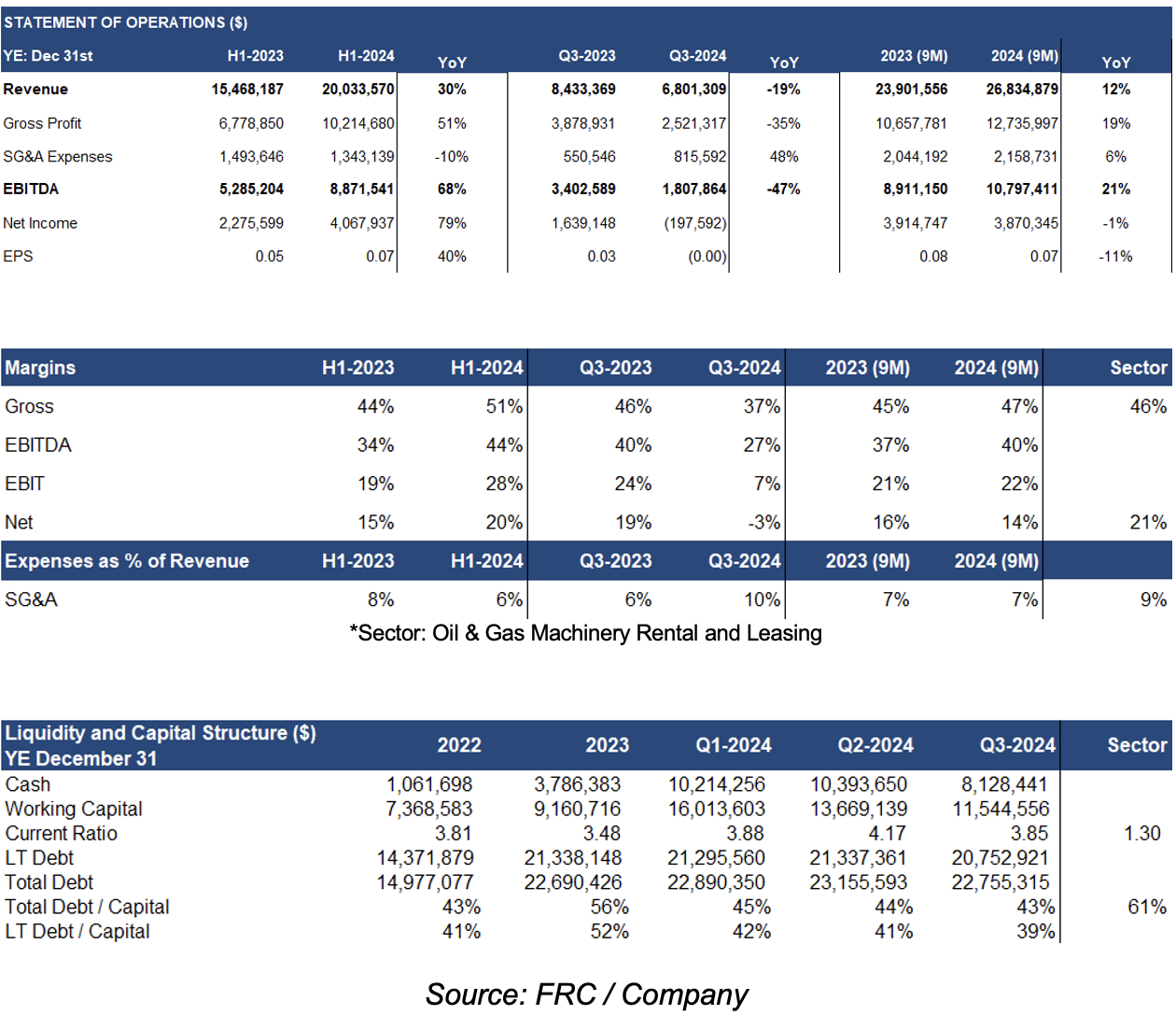

Q3-2024 revenue was down 19% YoY (H1-2024: up 30% YoY), missing our estimate by 23%. Gross margins decreased 9 pp YoY, and were 2 pp lower than our estimate, primarily due to higher transportation costs for servicing projects in remote areas

G&A expenses were up 48% YoY, and 8% higher than our estimate, driven by new hires supporting expansion and business growth. EPS turned negative ($0.03 to -$0.001) vs our forecast of $0.01. Debt/capital remained relatively flat QoQ

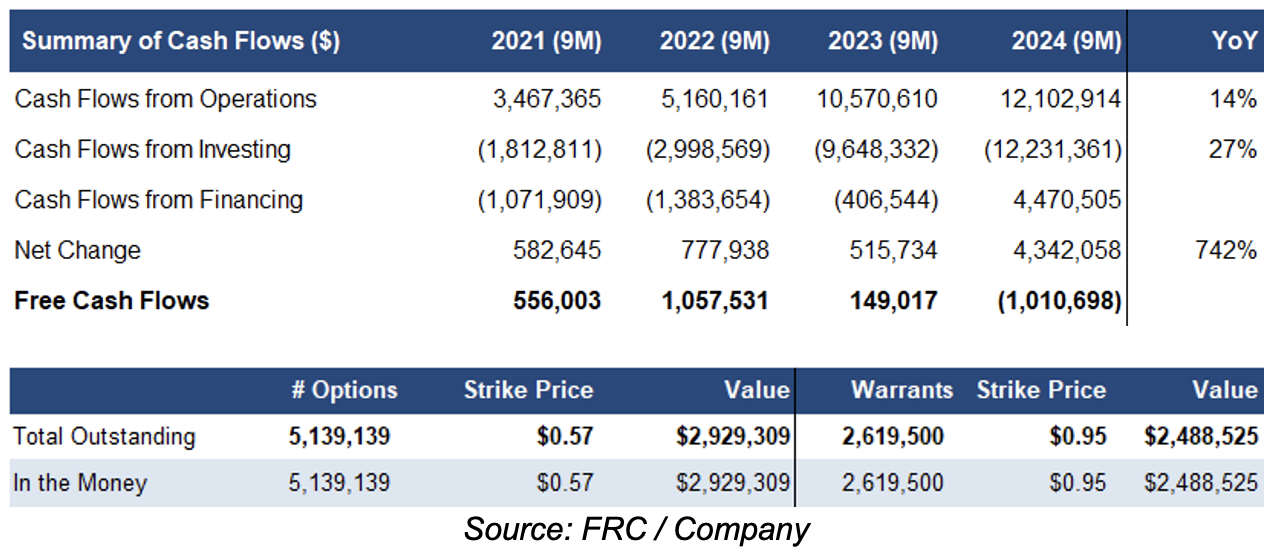

In 2024 (9M), CAPEX increased 27% YoY to $12M, driven by heightened client demand necessitating new equipment purchases. Can raise up to $5.5M from in-the-money options and warrants

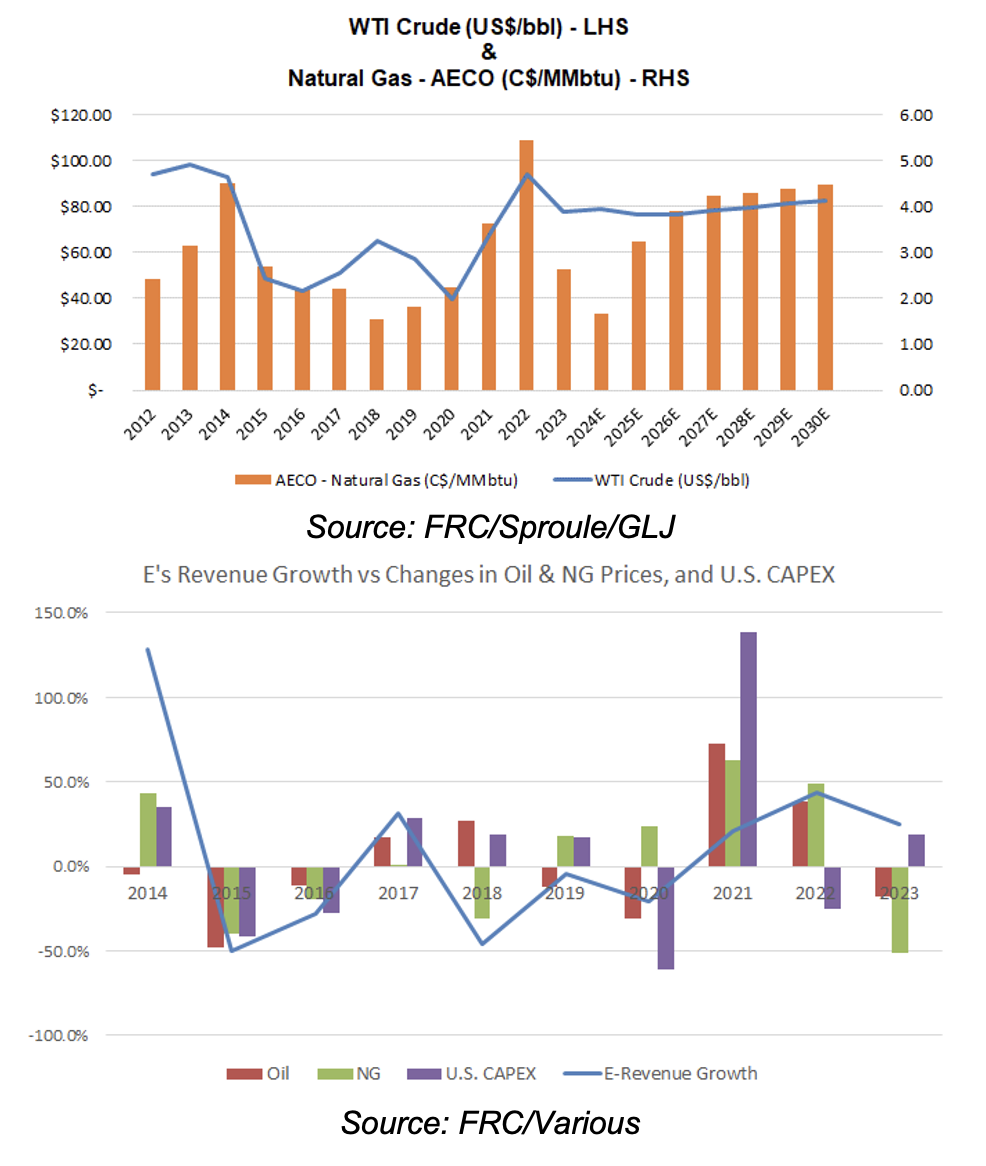

Oil & Gas Price Outlook

Consensus oil price forecasts (near and long-term) are well above historic averages, implying a positive outlook for the oilfield services sector. E's revenue generally tracks changes in oil and gas prices, and sector CAPEX spending

Historically, a 1% increase in oil and gas prices, and CAPEX spending, has led to a 2.4% increase in E's revenue. Conversely, a 1% decrease in these factors has resulted in a 1.2% decline in E’s revenue

FRC Projections and Valuation

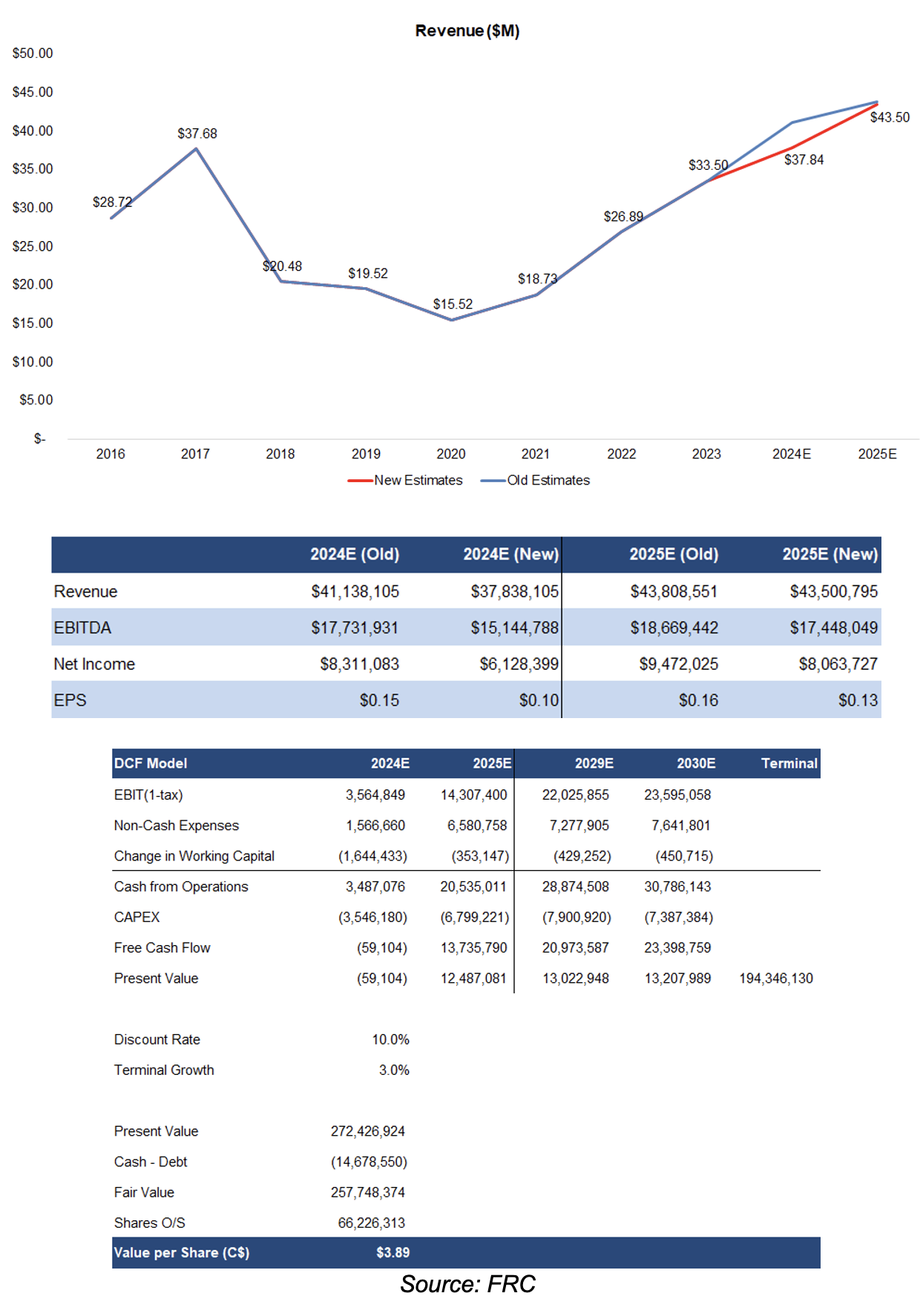

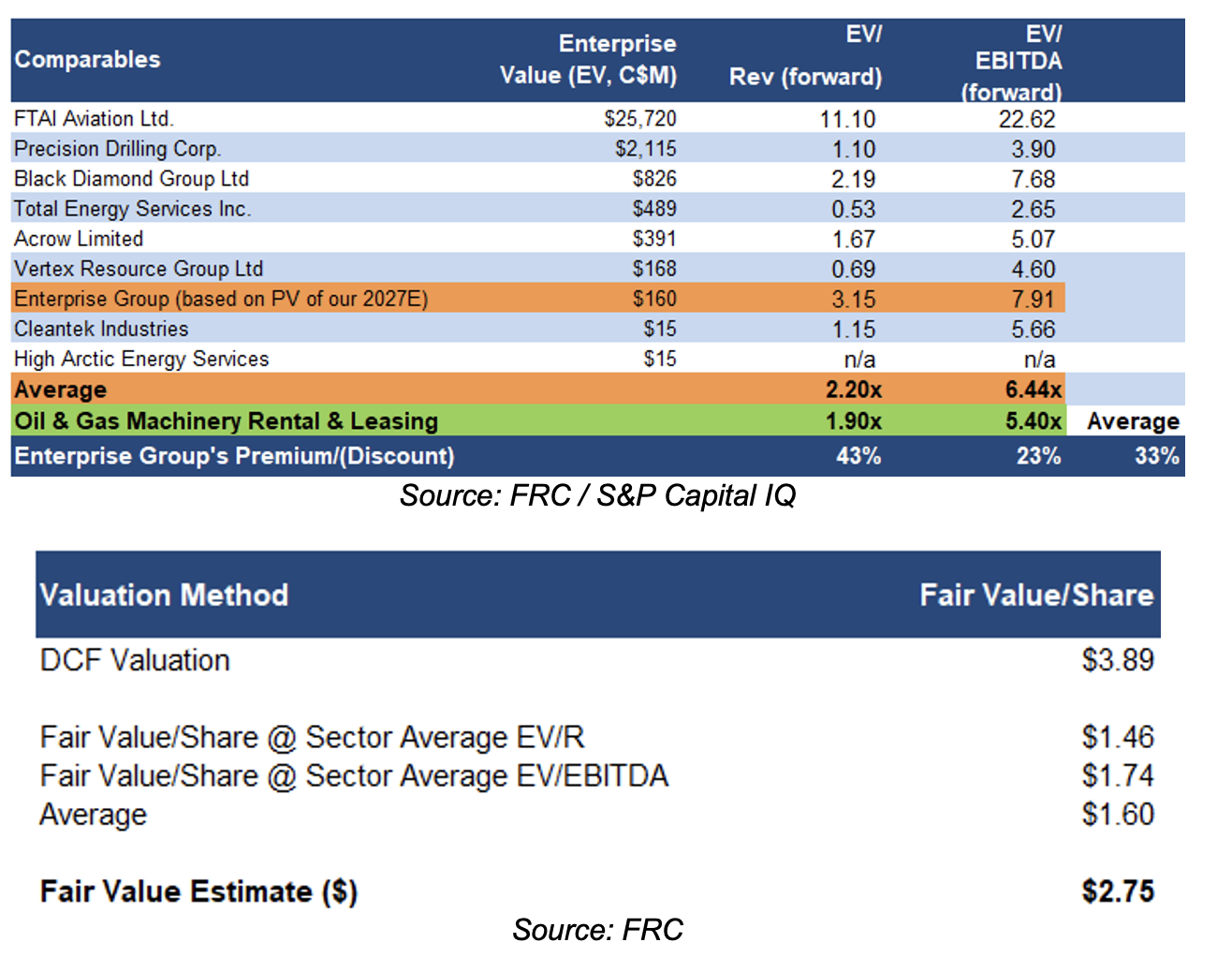

As Q3 revenue and gross margins were lower than expected, we are lowering our 2024 and 2025 estimates

However, given the multiple recent contracts with tier-one clients, we are raising our long-term revenue forecasts, while lowering our discount rate assumption (from 12.5% to 10.0%), reflecting reduced risk in retaining existing clients, consistently attracting new ones, and increased outlook for energy from the new incoming administration in the U.S.

As a result, our DCF valuation increased from $2.62 to $3.89/share

Sector multiples are up 23% since our previous report in August 2024. E’s forward EV/Revenue and EV/EBITDA are 33% (previously 22%) higher than sector averages

We believe E’s premium is justified, given its higher margins, lower debt/capital, and higher 2024 revenue growth estimate

As a result of our revised DCF valuation and updated sector multiples, our fair value estimate increased from $1.90 to $2.75/share

We are maintaining our BUY rating, and raising our fair value estimate from $1.90 to $2.75/share (the average of our DCF and comparables valuations). While Q3 results were disappointing, we anticipate a rebound in Q4 as clients resume operations following earlier delays. The re-election of Trump is unlikely to directly benefit Enterprise, however, we expect positive investor sentiment for the broader North American energy services sector. Our long-term outlook remains positive, supported by the company’s ability to retain existing clients, and consistently attract new ones.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- The oil/gas field services market is highly dependent on oil and gas prices

- Operates in a competitive space

- As the company uses leverage, a downturn in business activities can negatively impact its balance sheet

We are maintaining our risk rating of 3 (Average)

Appendix