Austin Gold Corp.

High-Potential Gold Projects with Proven Leadership

Published: 11/8/2024

Author: FRC Analysts

Sector: Basic Materials | Industry: Gold

| Metrics | Value |

|---|---|

| Current Price | CAD $2.56 |

| Fair Value | CAD $ |

| Risk | 5 |

| 52 Week Range | CAD $0.62 |

| Shares O/S (M) | 13 |

| Market Cap. (M) | CAD $34 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | 3.5 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

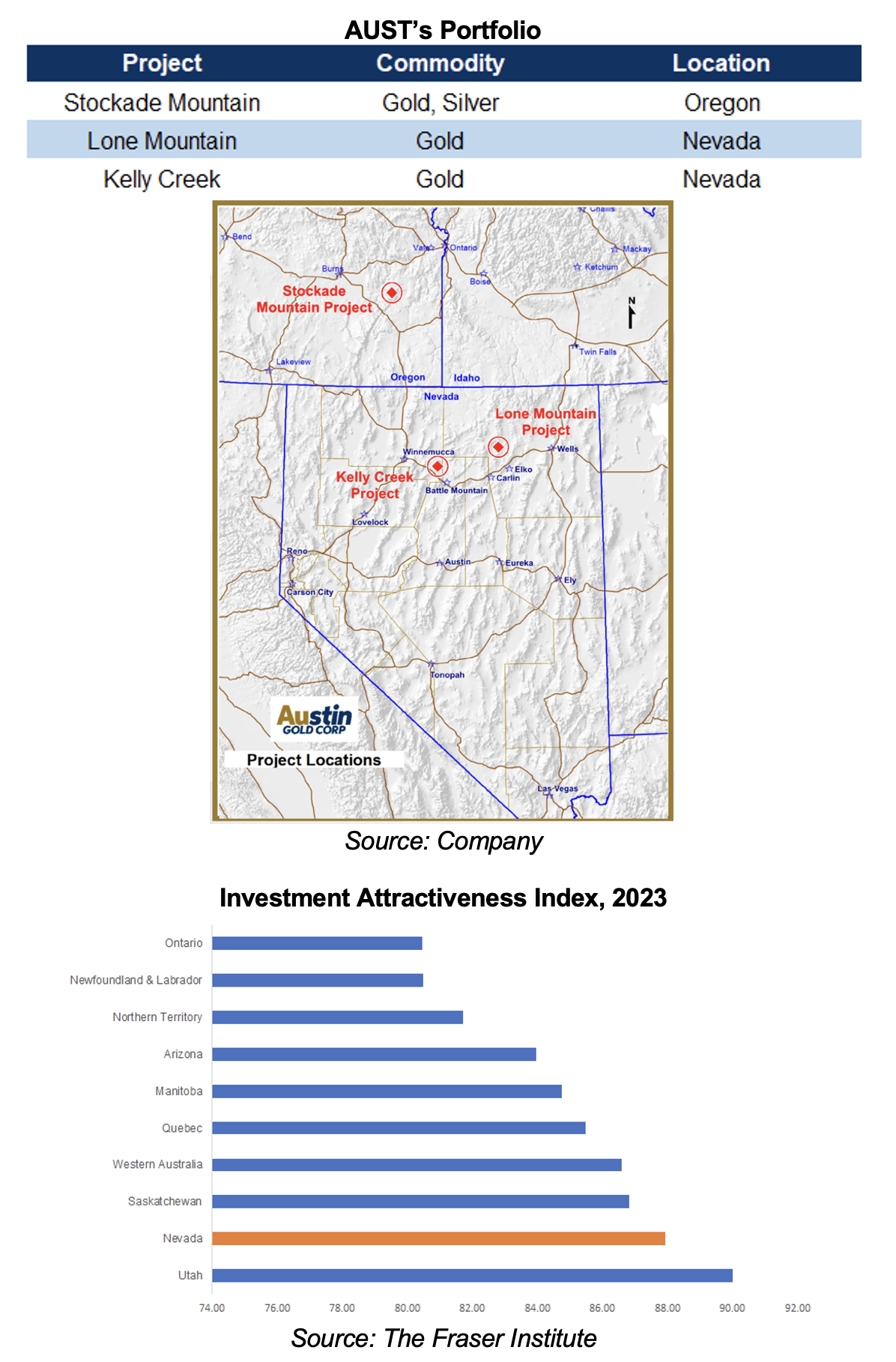

- Austin Gold has assembled three pre-resource stage gold projects in the U.S., including two in Nevada (Lone Mountain and Kelly Creek), and one in Oregon (Stockade Mountain). Nevada is one of the most attractive mining jurisdictions in the world.

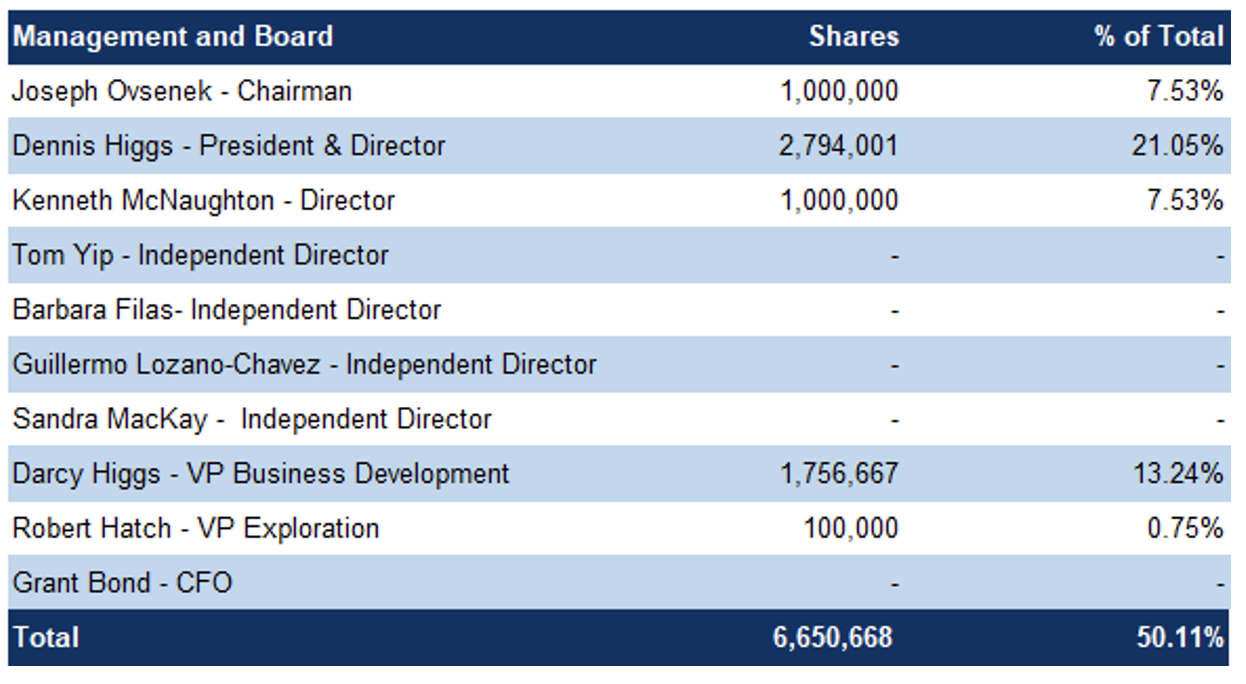

- Management and the board own 50% of AUST’s equity, and bring extensive experience in resource exploration, development, production, and M&A. Their past deals include: a) Pretium Resources, acquired by Newcrest Mining for $2.8B in 2022; b) Silver Standard Resources (now SSR Mining/NASDAQ: SSRM/MCAP: $1.2B); and c) Uranerz Energy, acquired by Energy Fuels Inc. (NYSE: UUUU) in a $320M business combination in 2015.

- At the Stockade Mountain gold-silver project, past exploration has identified a gold mineralized zone extending 5.5 km along strike, and 1.0 km in width. The project is prospective for low-sulfidation/hot spring deposits, which typically host high-grade mineralization. A recent diamond drill program targeting high-grade gold/silver mineralization at depth returned impressive results, including 1.2 m of 8.19 g/t, and 0.82 m of 9.32 g/t. Management is planning a follow-up drill program to further test potential high-grade vein targets.

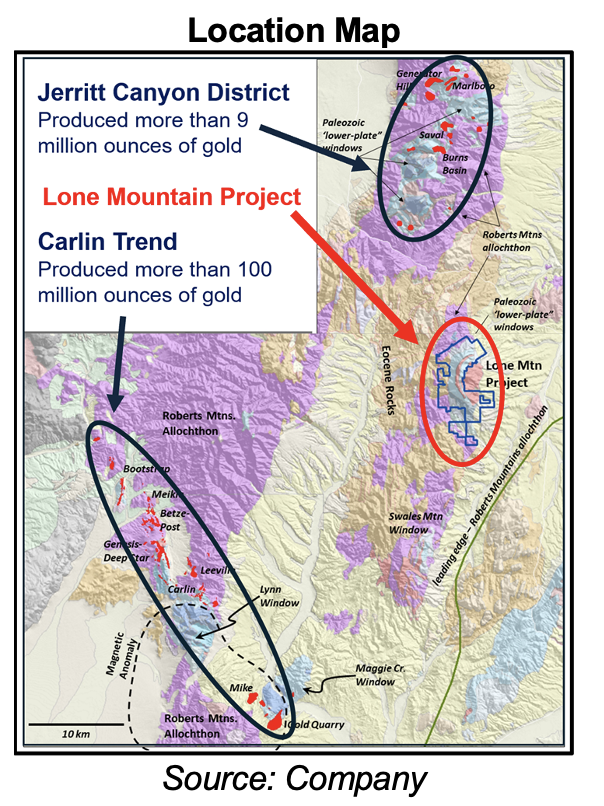

- The Lone Mountain gold project, with potential for hosting Carlin-type deposits (typically high-grade and low-OPEX), is located near the Carlin trend and Jerritt Canyon gold districts, which have collectively produced 109 Moz of gold. Management is awaiting results of a soil and sediment sampling program.

- The company is well-funded, with over $6M in working capital at the end of Q3-2024.

- We maintain a positive outlook on gold in light of further anticipated rate cuts by the Fed, and elevated geopolitical tensions. The sector has witnessed a substantial rise in M&A activity, with three material acquisitions just in the past month.

- Upcoming catalysts include sampling results from Lone Mountain, and drilling at Stockade Mountain. As AUST’s projects are still in the early stages, we are not assigning a rating or valuation, but we believe Stockade Mountain shows potential based on recent drill results, and the possibility of mineralization at depth. We highlight management's proven track record as AUST's primary strength.

Risks

- The value of the company is dependent on gold and silver prices

- Exploration and permitting

- No NI 43-101 compliant resources or economic studies

- Access to capital and potential for share dilution

- No assurance that the company will be able to advance all of its projects simultaneously

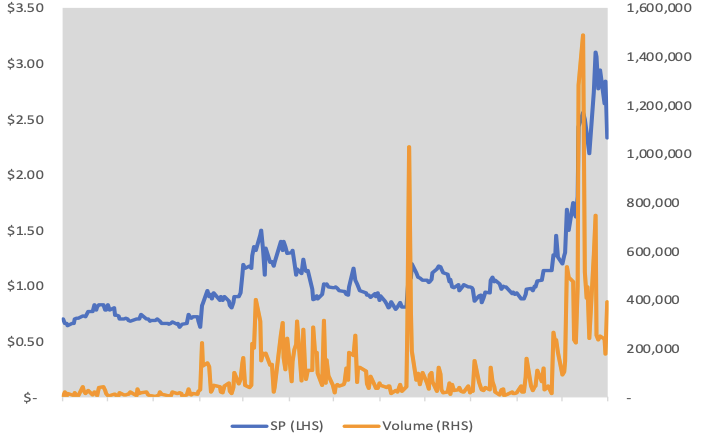

Price Performance (1-year)

Portfolio Summary

Three pre-resource stage gold projects in the U.S.. Stockade Mountain is located near an advanced-stage gold project that is currently undergoing permitting for underground mining and milling operations

Nevada is the fifth largest gold producer in the world, and is well-known for its world-class gold deposits. In 2023, Nevada was ranked the second most attractive mining jurisdiction in the world

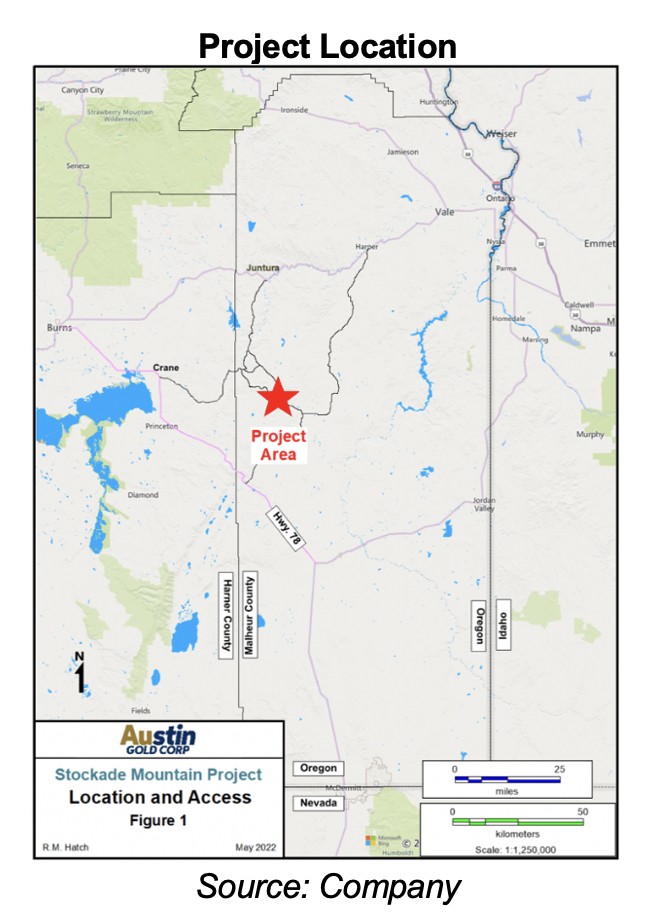

Stockade Mountain Gold-Silver Project, Oregon

This 2,748-ha property, consisting of 261 claims, is located in Malheur county, 64 km southwest of Paramount Gold’s (NYSE: PZG) advanced-stage Grassy Mountain gold project. Grassy Mountain hosts an epithermal hot spring deposit (1 Moz of gold at 1.2 g/t), and is currently undergoing permitting for underground mining and milling operations. Grassy Mountain is projected to produce 47 Koz of gold annually.

Approximately 80 km southeast of Burns, Oregon, and 145 km southwest of Boise, Idaho. The property is accessible via a paved highway, followed by gravel and dirt roads

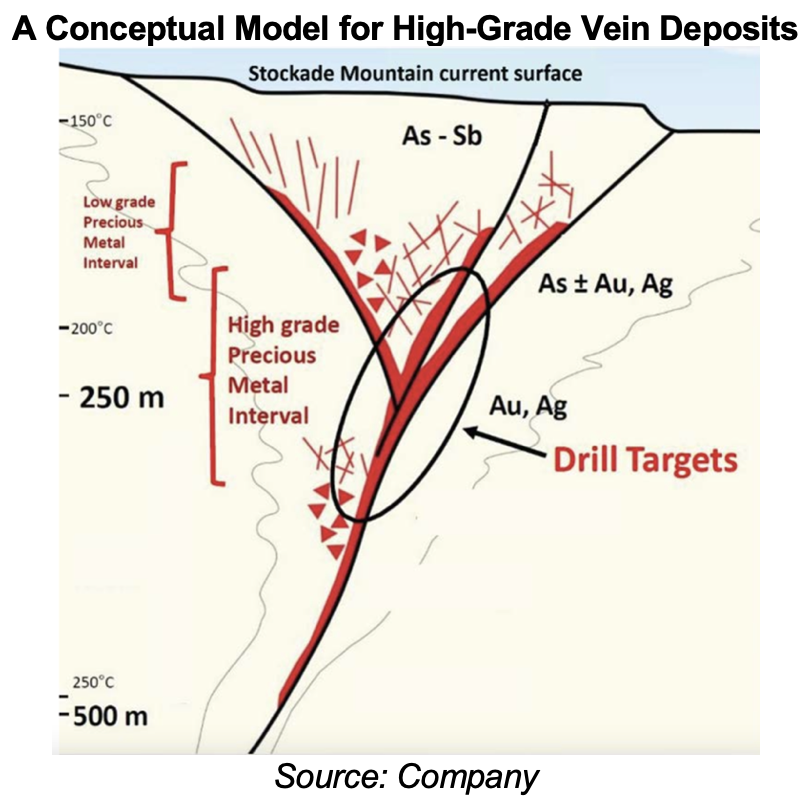

Prospective for low sulfidation/hot spring deposits, which typically host high. Past drilling focused on evaluating near-surface mineralization, and the potential for open-pit mining

History and Mineralization

Previous exploration included rock and soil sampling, geophysics, and Reverse Circulation (RC) drilling (40 holes) conducted by Phelps Dodge, BHP-Utah, Placer Dome, and Carlin Gold. Historical drilling in the 1980s and 90s intersected significant gold mineralization, extending 700 m along strike and 380 m wide within a 5.5 km by 1.0 km gold system. Notably, gold and silver values increased with depth.

Historical Drill Highlights:

- 79.2 m of 0.94 g/t from 45.7 to 125 m, including 24 m of 1.56 g/t from 58 to 82.3 m

- 4.6 m of 1.38 g/t

- 4.6 m of 1.10 g/t

- 3 m of 1.10 g/t

- 1.5 m of 1.14 g/t

The company recently conducted a diamond drill program (three holes, 743 m) to explore high-grade gold/silver mineralization at depth. All three holes returned impressive gold results, including 1.2 m of 8.19 g/t, and 0.82 m of 9.32 g/t.

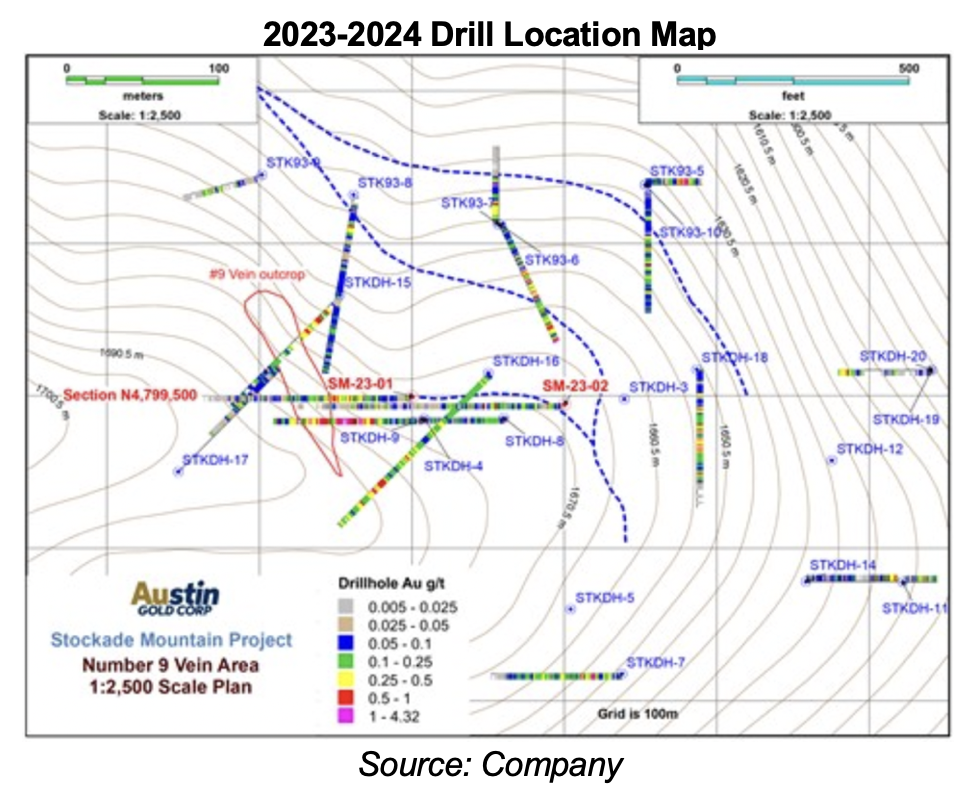

A total of 43 holes (5,971 m) have been drilled on the property across a 1.5 km² area. 2023-2024 drilling at the Number 9 vein area intersected high gold grades, including values of up to 9.32 g/t

Management is planning an RC drill program (~10 holes/4,000 m) to further test potential high-grade vein targets.

Austin is targeting high-grade vein deposits beneath the gold/silver-bearing stockwork mineralization, highlighted in the circled area. The company is planning a follow-up drill program in the coming months

While the recent drill program yielded promising results, we are unable to provide a preliminary resource estimate for the project due to limited drilling at depth

Lone Mountain Gold Project, Nevada

This 54.6 km² property, consisting of 760 claims, is located in Elko county, 32 km northeast of the Carlin gold district.

The property is prospective for Carlin-type deposits, known for their potential size and high gold grades. Although 164 holes (totaling 26,480 m) have been drilled on the property, large areas remain untested

Over the past 60 years, the property has undergone mapping, geochemical and geophysical surveys, and drilling. Austin is currently awaiting the results of a soil and sediment sampling program.

Management and Directors

Management and board own 50% of AUST’s equity. Management brings extensive sector experience, with a track record of multiple successful deals

Source: FRC/Management Information Circular

Brief biographies of the management team and board members, as provided by the company, follow:

Joseph Ovsenek – Chairman & Director

Prior to joining Austin Gold Corp., Mr. Ovsenek was President and CEO of Pretium Resources Inc. where he led the advance of the high-grade gold Brucejack Mine which has been operating profitably since 2017. Prior to Pretium he served for 15 years in senior management roles for Silver Standard Resources Inc. (now SSR Mining Inc.). Mr. Ovsenek holds a Bachelor of Applied Science degree from the University of British Columbia and a Bachelor of Laws degree from the University of Toronto.

Dennis Higgs – President & Director

During his career of over forty years, Mr. Higgs has been involved in the founding, financing, initial public listing, and building of several companies, four of which have been the subject of successful takeover bids. He was the founding Director and Executive Chairman of Uranerz Energy Corporation for ten years. Uranerz was acquired by Energy Fuels Inc. in 2015 in a $320M business combination. Mr. Higgs currently serves on the board of TSX and NYSE-listed Energy Fuels, which is now a leading U.S. producer of uranium and vanadium. Mr. Higgs holds a Bachelor of Commerce degree from the University of British Columbia.

Kenneth McNaughton – Director

Mr. McNaughton is a professional geological engineer with over 30 years of global experience developing and leading mineral exploration programs. He was previously the Chief Exploration Officer at Pretium Resources Inc. Prior to joining Pretium, he was Vice President, Exploration for Silver Standard Resources Inc. (now SSR Mining Inc.). Prior to joining Silver Standard, he was employed by Corona Corporation and its affiliate Mascot Gold Mines Ltd. Mr. McNaughton holds a Bachelor of Applied Science degree and a Master of Applied Science degree in geological engineering from the University of Windsor.

Barbara Filas – Independent Director

Ms. Filas is internationally recognized in the mining sector in the disciplines of management, environmental and social responsibility, and sustainability. She has hands-on experience at operating gold and coal mining and processing facilities; executive experience in consulting, public companies, and non-profits; and project experience on six continents. Ms. Filas is a graduate of the University of Arizona and is a licensed professional Mining Engineer. She currently serves on the Board of Energy Fuels Inc.

Guillermo Lozano-Chavez – Independent Director

Mr. Lozano is a Professional Geologist with over 40 years of experience in mineral exploration in Latin America and he manages his own geological consulting firm. Previously, he was Vice President of Exploration for First Majestic Silver Corp., the Director of Exploration for Silver Standard Resources Inc., and a consultant for several junior companies in Central and South America. Mr. Lozano holds a Master of Science degree in Geology from the University of Missouri at Columbia, and a Master of Business Administration in Finance, from the University of Texas at El Paso.

Tom Yip – Independent Director

Mr. Yip has over 30 years of financial management experience in the mining industry for exploration and development companies and producers. He was most recently CFO for Pretium Resources Inc, and previously CFO for Silver Standard Resources Inc. (now SSR Mining Inc.). He began his mining career at Echo Bay Mines Ltd. where he served as its CFO before the company merged with Kinross Gold Corporation in 2003. Mr. Yip is a Chartered Professional Accountant (CPA, CA) and holds a Bachelor of Commerce degree in Business Administration from the University of Alberta.

Sandra MacKay – Independent Director

Ms. MacKay brings over 30 years of corporate commercial legal experience to the company. Ms. MacKay is Global Vice President, Legal for Copperleaf Technologies Inc., a global supplier of AI-empowered asset investment planning software; Copperleaf was recently acquired for $1B. Previously, she was Senior Vice President, Legal of Uranerz Energy Corporation, and Vice President, Legal of Chemetics Inc. She held senior legal counsel positions with QLT Inc., and Chevron Canada Limited. She holds a Juris Doctor from the University of British Columbia and is a member of the Law Society of British Columbia.

Darcy Higgs – VP Business Development

Mr. Darcy Higgs has over forty years of experience in capital markets. He was a consultant to one of the largest private equity firms in China, including guiding its $75M investment in Pretium Resources Inc. Mr. Higgs has a Bachelor of Commerce (Finance) from the University of British Columbia.

Robert Hatch – VP Exploration

Mr. Bob Hatch is a seasoned exploration geologist with over forty-five years of experience in exploration, management, permitting, and marketing. His primary focus has been on gold and silver projects throughout the U.S., Australia, and New Zealand. Mr. Hatch started his career with twelve years at Homestake Mining Company. While at Homestake he was involved with the McLaughlin Mine discovery in California and was the first geologist to explore the Almaden Mine in Idaho for gold.

Grant Bond – CFO

Mr. Bond is a Chartered Professional Accountant (CPA, CA) with more than 12 years of financial management experience in the mining industry. He currently serves as the CFO of P2 Gold Inc. Before this, he was the Corporate Controller at Pretium Resources Inc. Mr. Bond began his career in the assurance group at PricewaterhouseCoopers LLP. He holds a Diploma in Accounting and Bachelor of Science from the University of British Columbia.

The company's advisory board includes two seasoned economic geologists, W. Perry Durning, and F. L. “Bud” Hillemeyer. According to the company, these individuals have discovered over 1 Boz of silver, and 10 Moz of gold, in their careers.

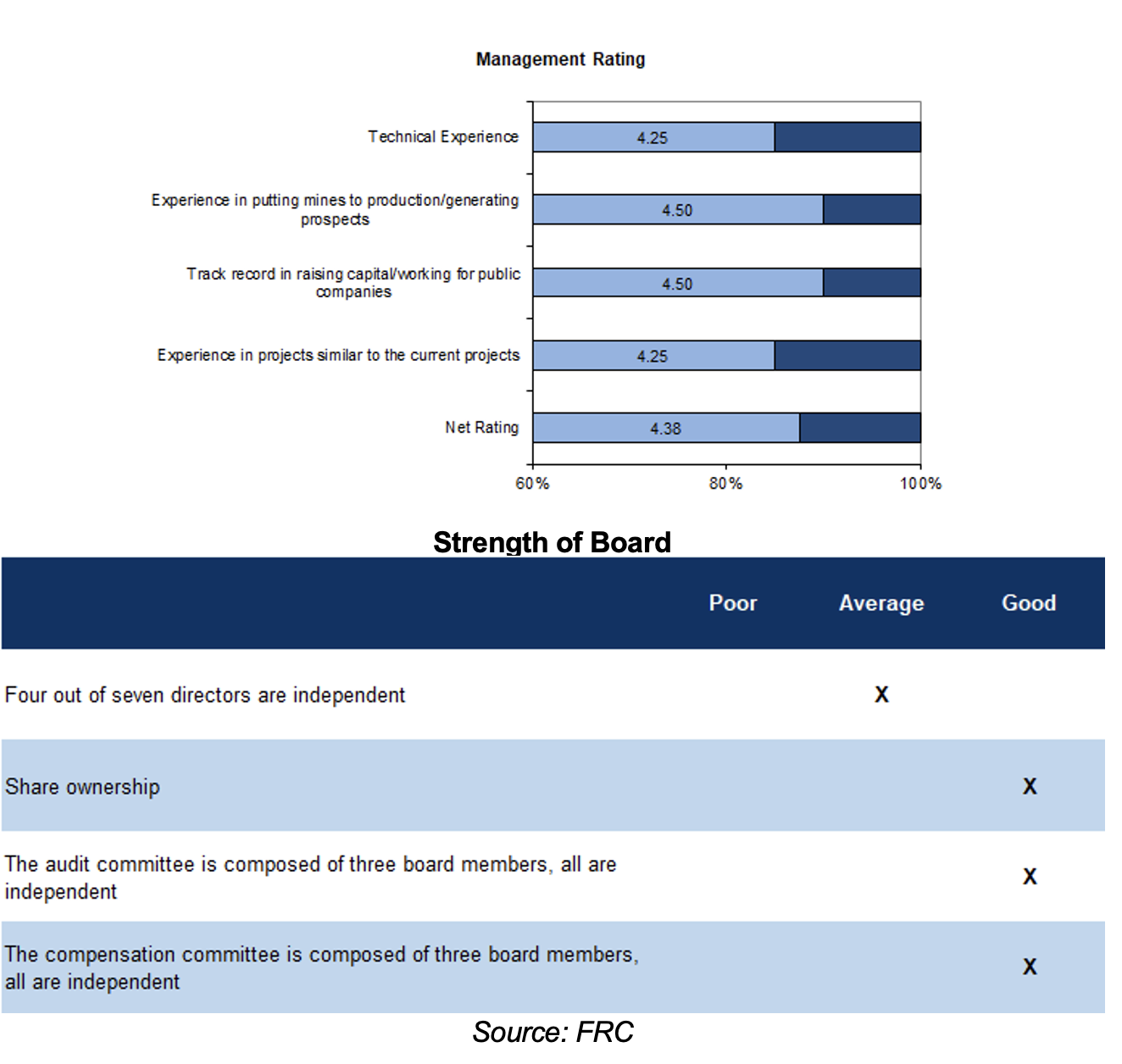

Our net rating on the company’s management team is 4.4 out of 5.0. Four out of seven directors are independent

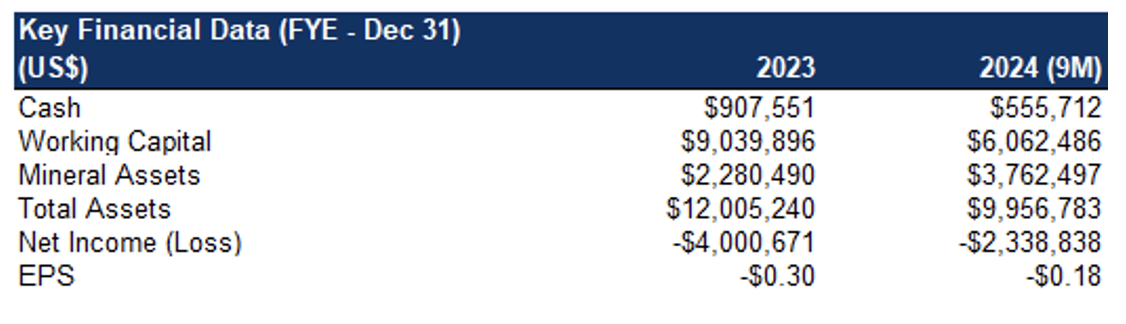

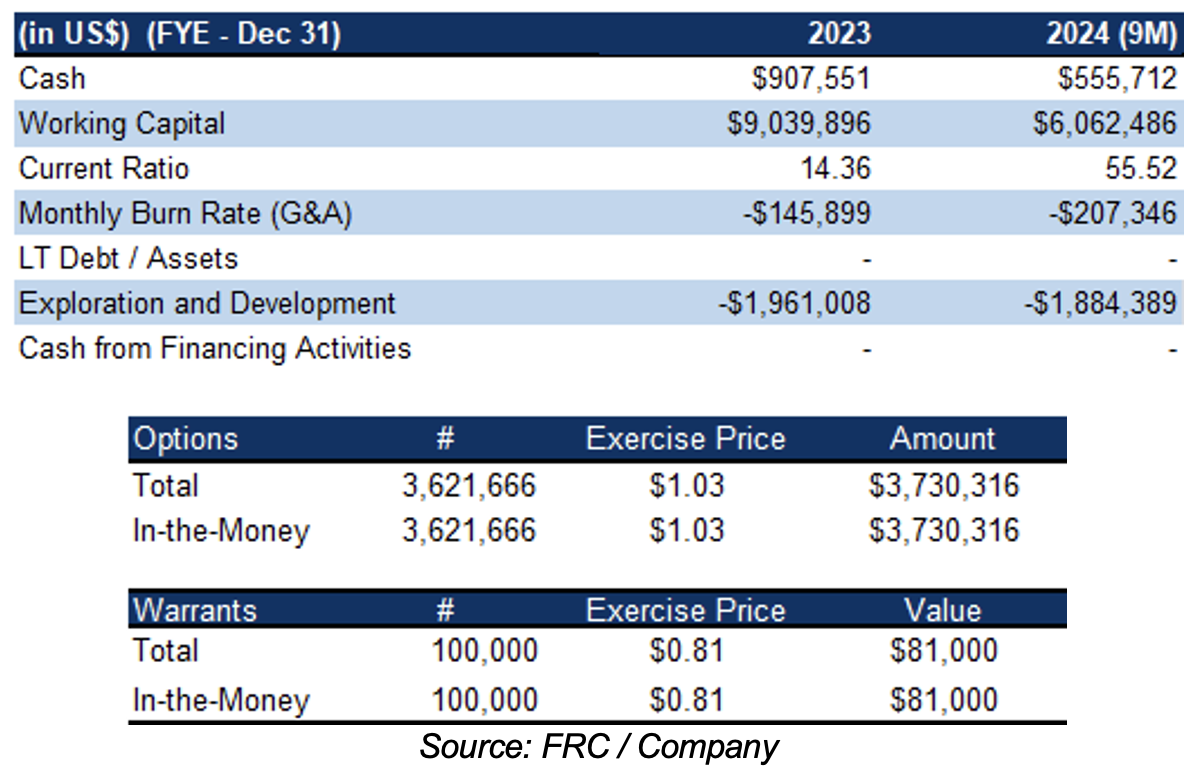

Financials

Strong balance sheet. In-the-money options and warrants can bring in $3.8M

Valuation

As the company’s projects are in the early stages, we are not assigning a rating or valuation to AUST at this time. However, we believe Stockade Mountain shows significant potential, particularly in light of recent drill results, and the possibility of mineralization at depth. The property remains largely untested, and is still in the early phases of exploration. We highlight management's proven track record as AUST's primary strength, with future drilling programs serving as key catalysts. The company has a tight capital structure, with only 13M shares outstanding, meaning any small positive developments could lead to substantial swings in the share price.

Risks

We are assigning a risk rating of 5 (Highly Speculative)

We believe the company is exposed to the following key risks (not exhaustive):

- The value of the company is dependent on gold and silver prices

- No NI 43-101 compliant resources or economic studies

- Access to capital and potential for share dilution

- Permitting and exploration

- No assurance that the company will be able to advance all of its projects simultaneously