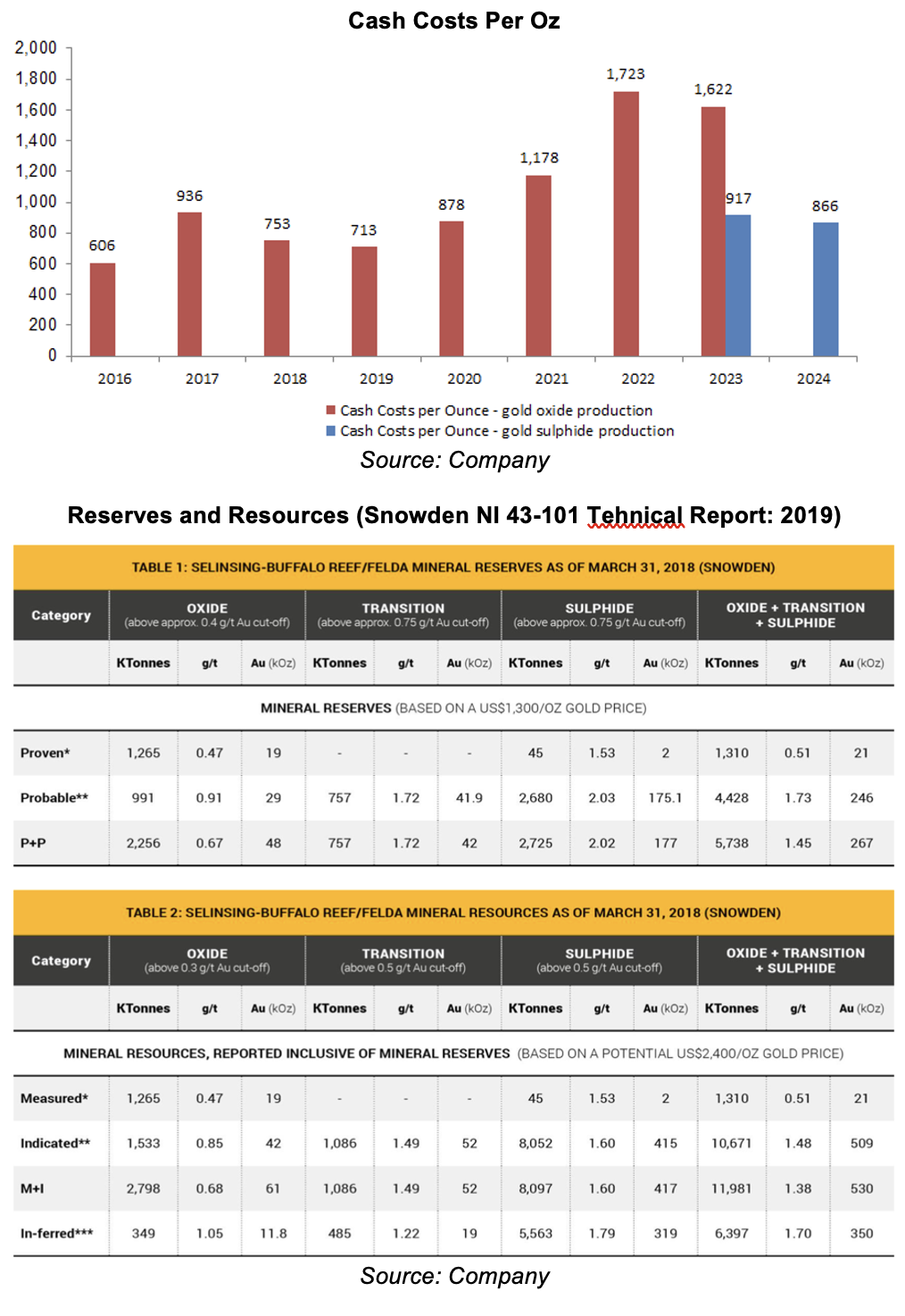

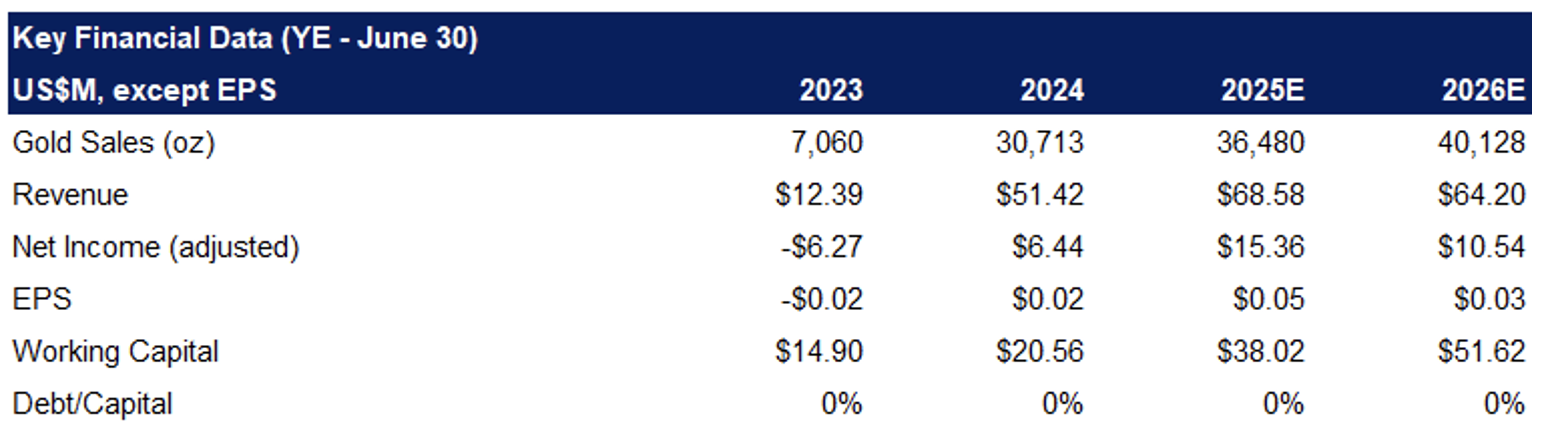

- In FY2024 (ended June 2024), MMY produced 32 Koz, up 335% YoY, beating our estimate by 7%. Cash costs declined by 6% YoY to $866/oz vs our estimate of $900/oz.

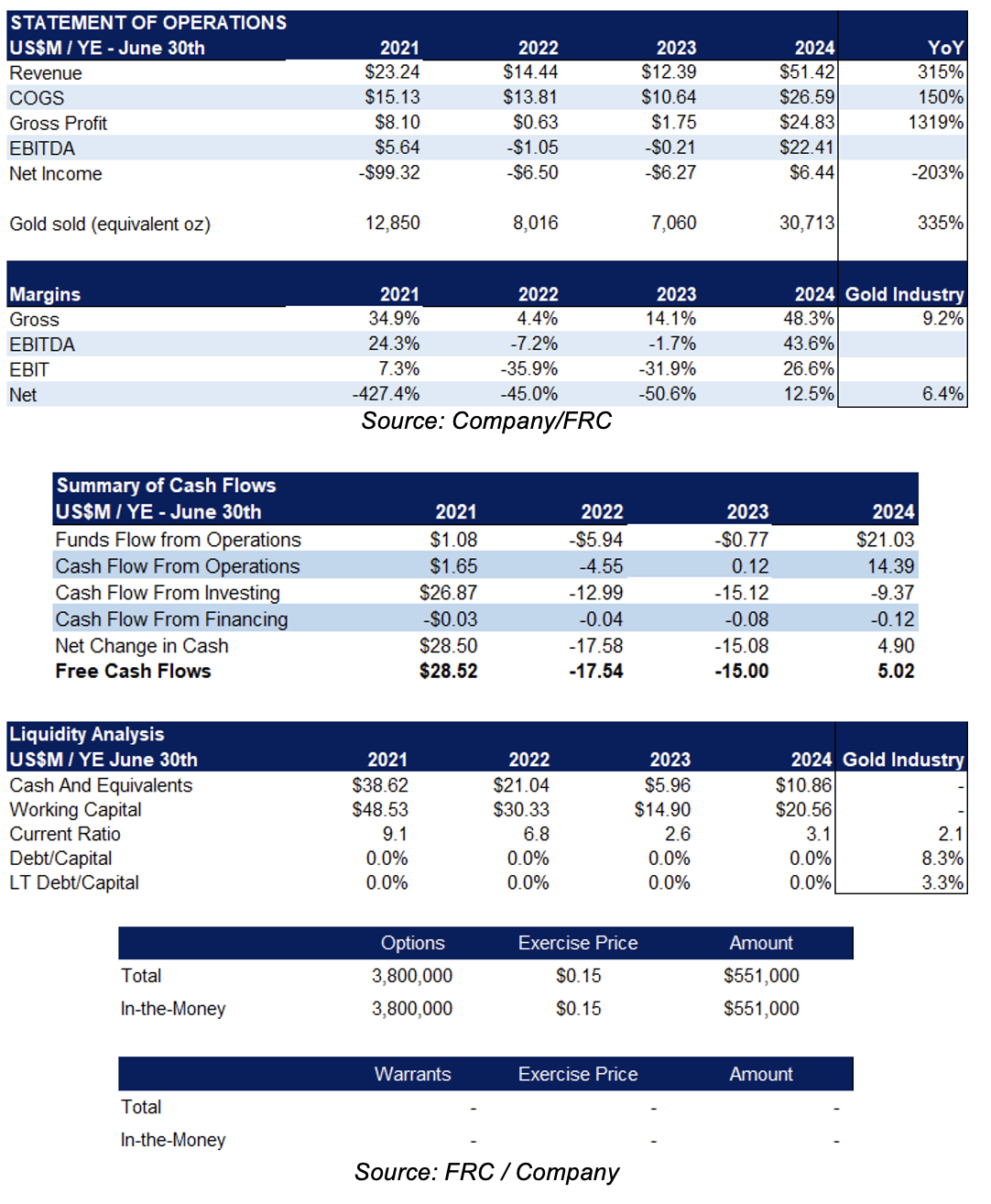

- Revenue was up 315% YoY, beating our estimate by 4%. Margins improved across the board. EBITDA, EPS, and free cash flows turned positive. We anticipate record production and EPS in FY2025.

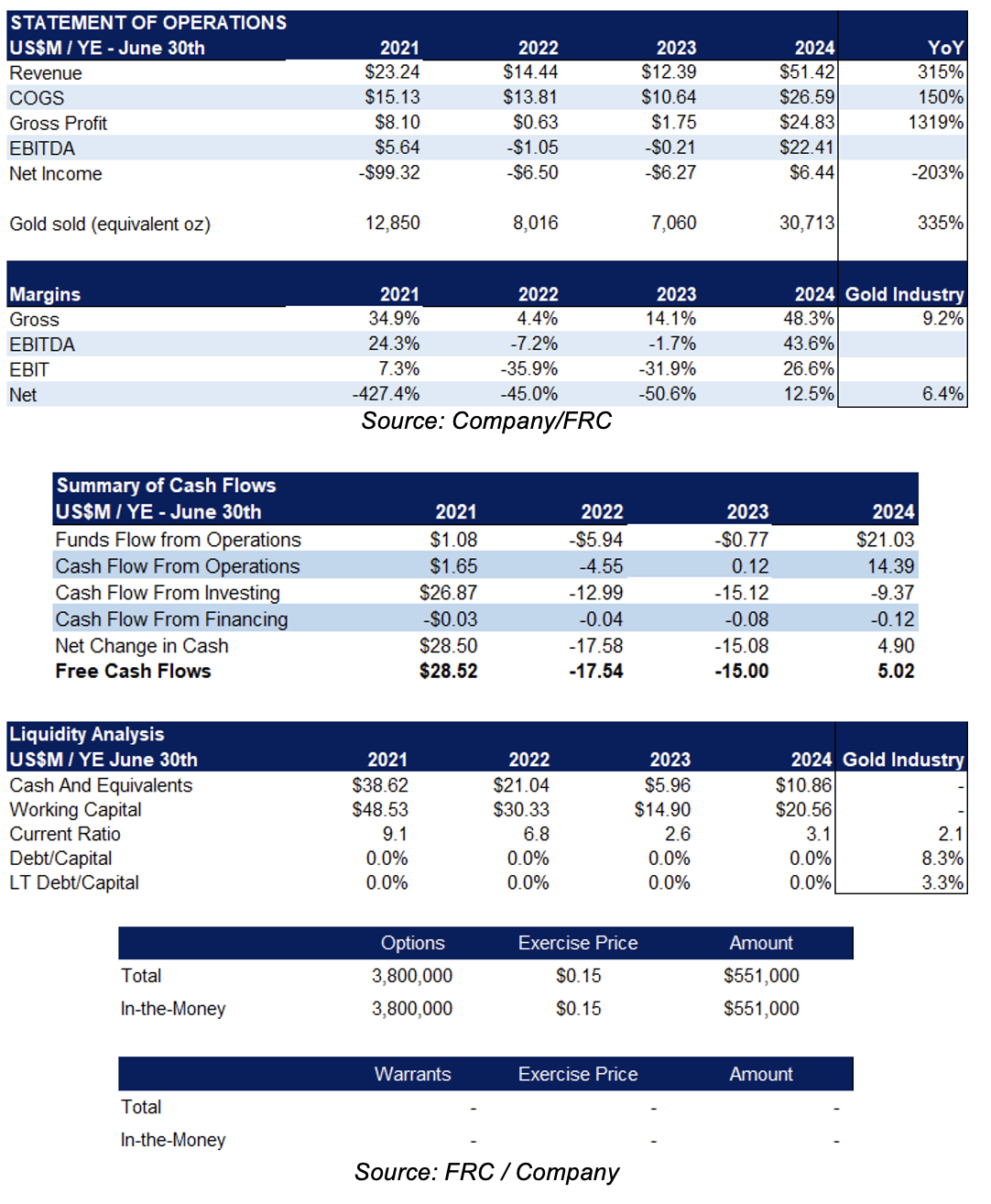

- As of June 2024, MMY had $21M in working capital, with no debt.

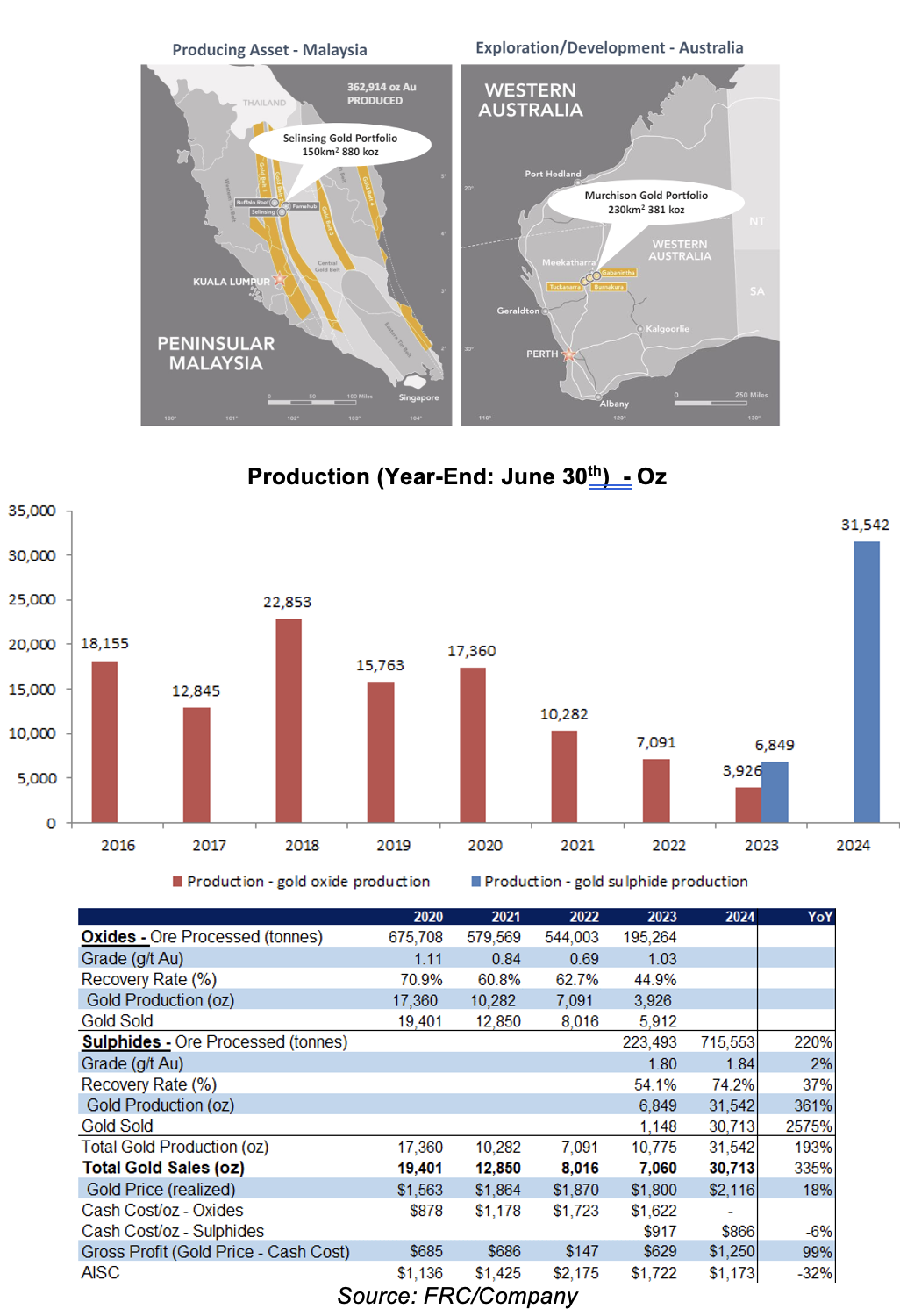

- Although MMY has not engaged in exploration at its Murchison gold project in Australia lately, management intends to start with historical resource confirmation drilling, and regional geological analysis.

- Gold is trading at record highs. We are more bullish on gold stocks than the metal itself, with gold producer valuations averaging 9% lower than the past three instances when gold surpassed $2k/oz.

- The sector has experienced multiple M&A activity this year. For example, Alamos Gold (TSX: AGI) acquired junior miner Argonaut Gold for $443M, and Westgold Resources (ASX: WGX) took over Karora Resources for $820M. We foresee larger miners continuing to grow their portfolios via M&A.

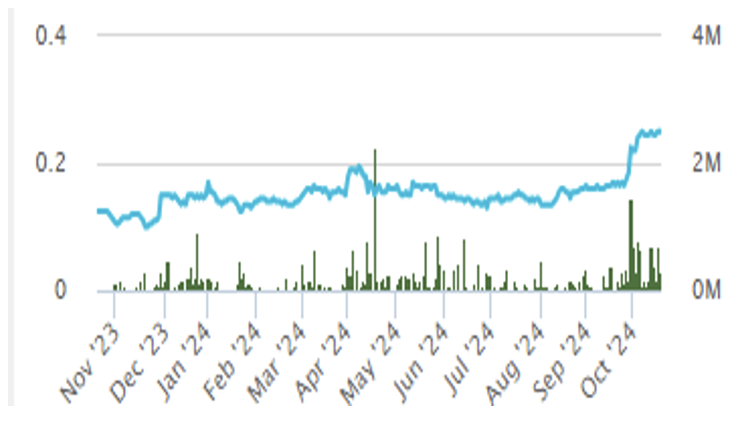

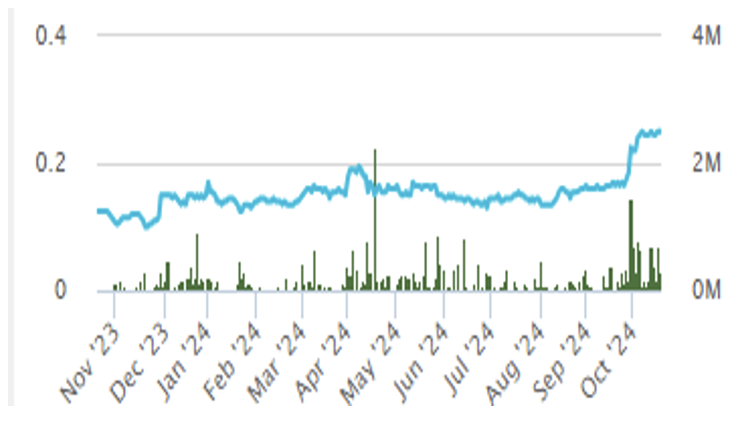

Price Performance (1-year)

| |

YTD |

12M |

| MMY |

47% |

92% |

| TSXV |

12% |

19% |

| Gold |

32% |

38% |

| GDXJ |

45% |

55% |

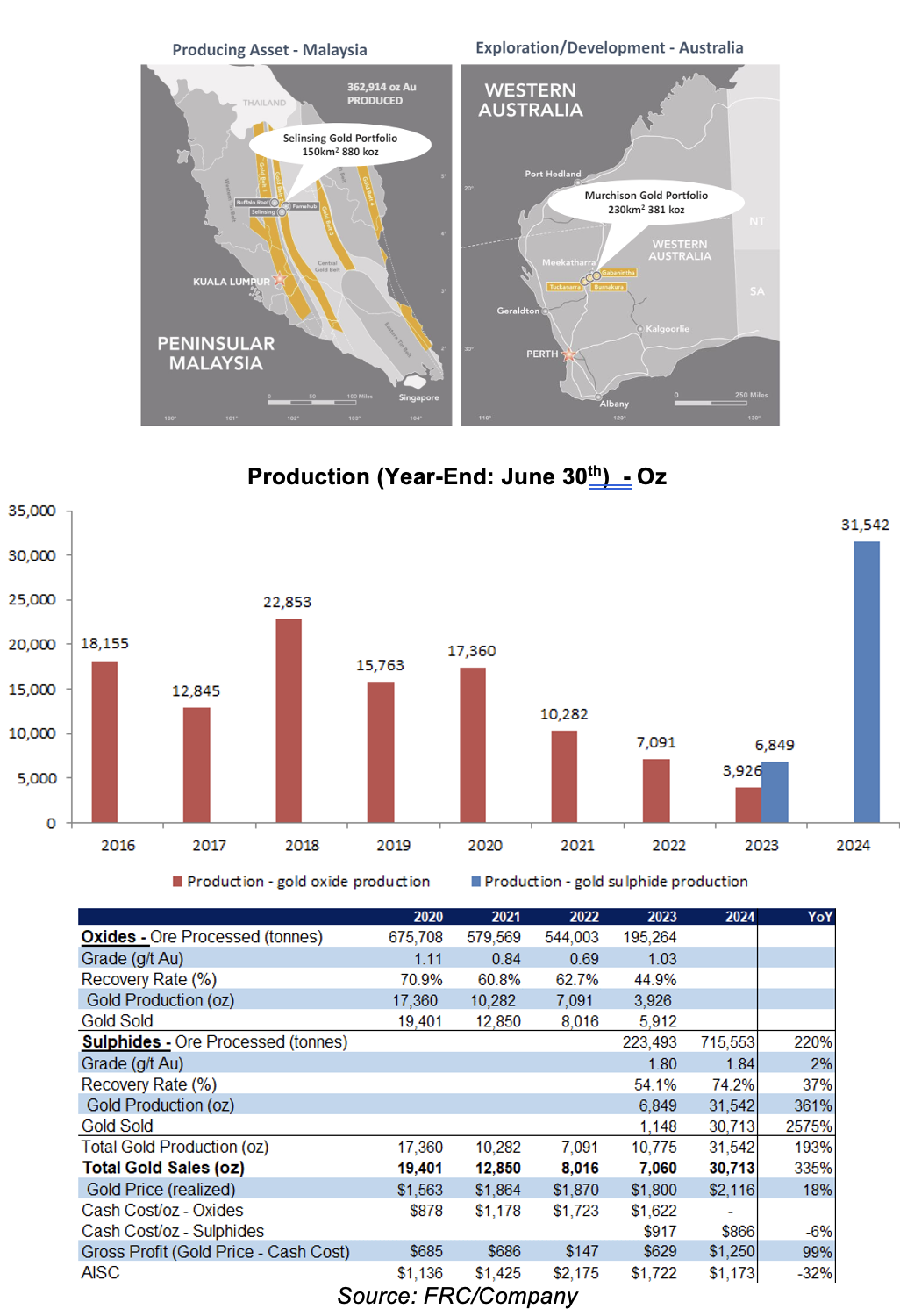

Portfolio Summary

Owns a producing gold mine in Malaysia, and exploration projects in Western Australia. Total compliant resources of over. From 2010 to 2022, MMY mined oxide and transitional materials

MMY Portfolio

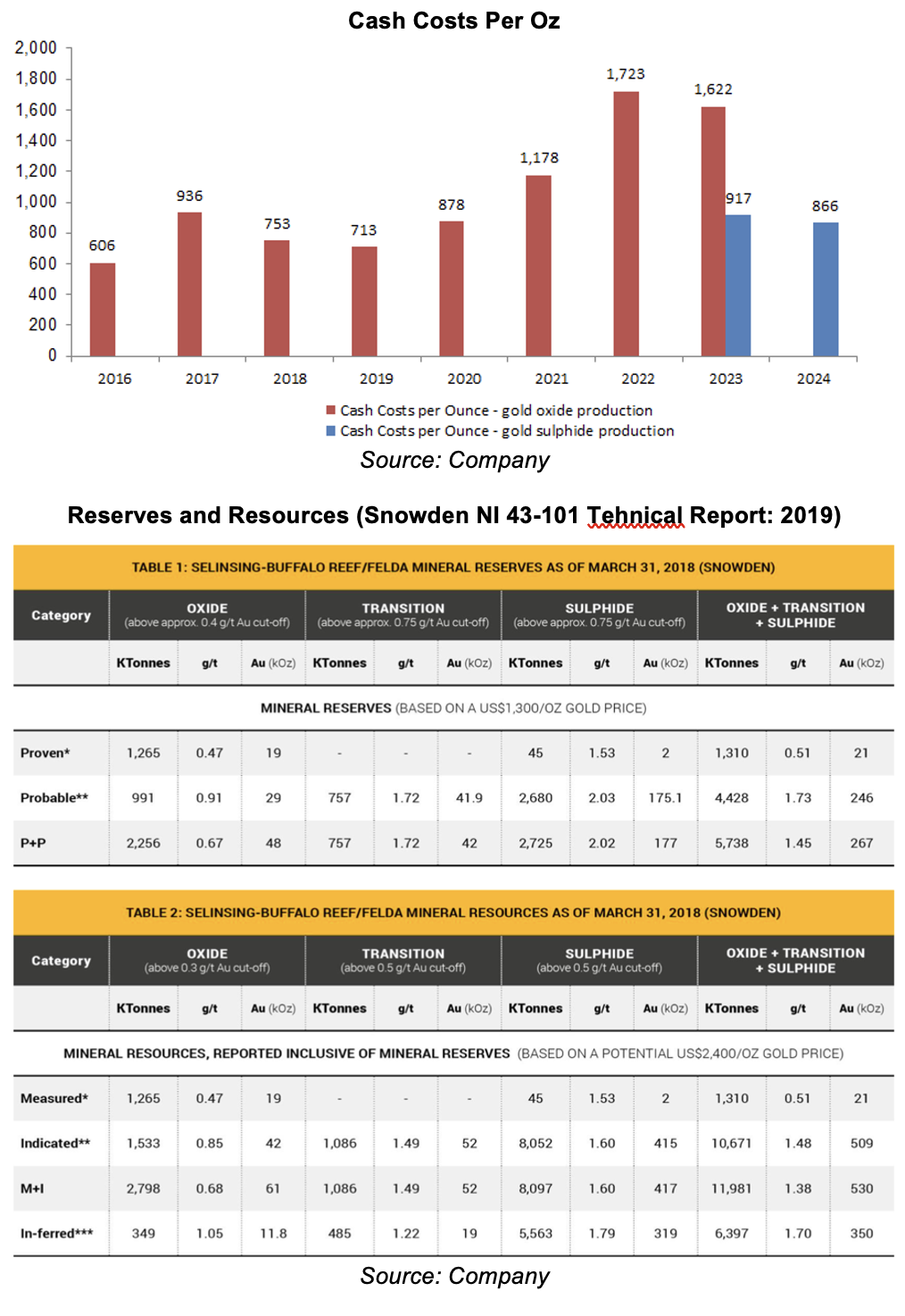

MMY has been processing sulphide materials since December 2022, with cumulative production exceeding 38 Koz by June 2024. Q4-FY2024 production was up 119% YoY to 12 Koz. In FY2024, MMY produced 32 Koz, up 335% YoY, beating our estimate by 7%

Cash costs declined 6% YoY to $866/oz vs our estimate of $900/oz

With over 700 Koz of sulfide resources remaining, we believe the mine could produce up to 14 more years, with annual production expected to rise to 40 Koz from the previous five-year average of 12.5 Koz. Grades are attractive for an open-pit mine

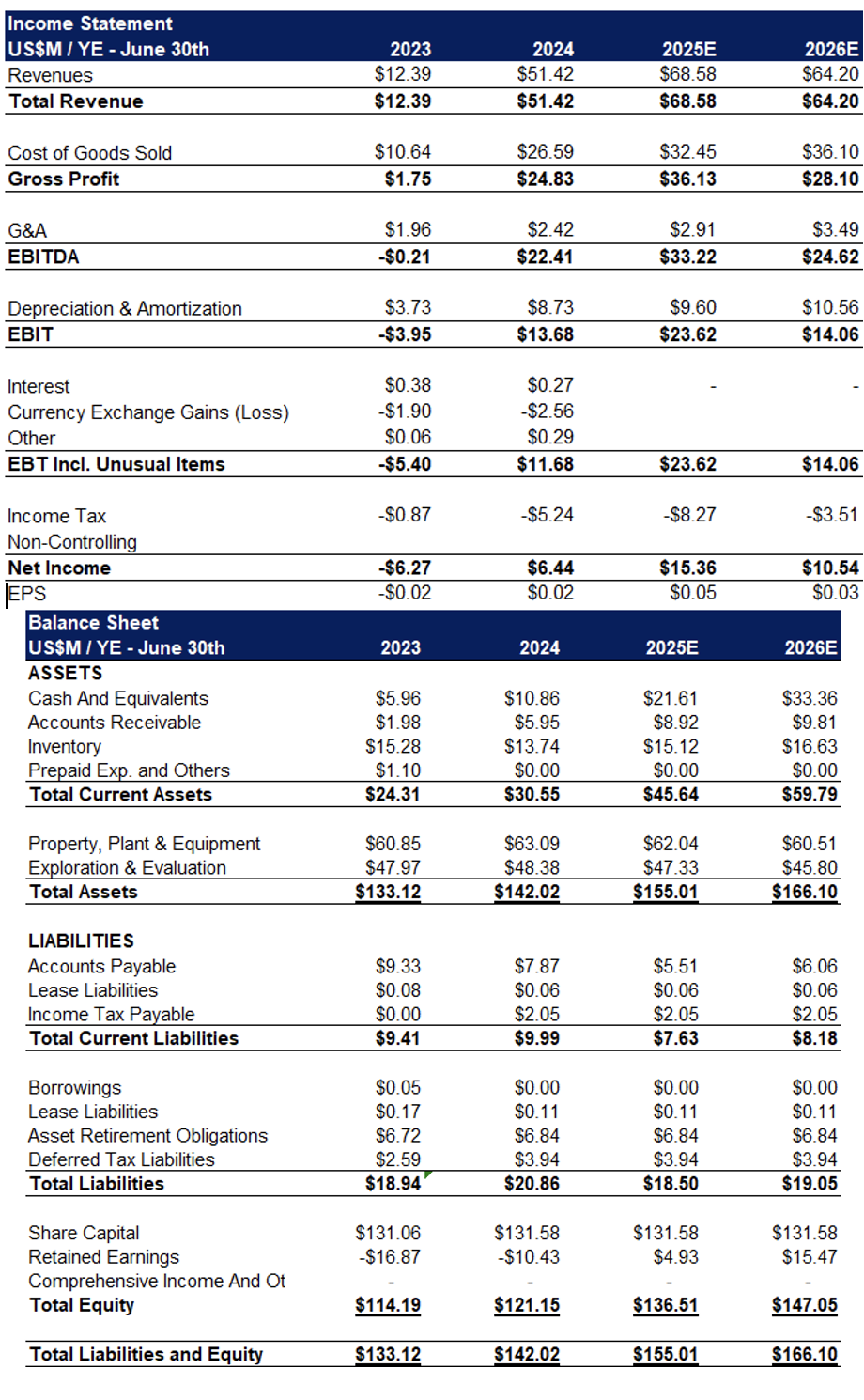

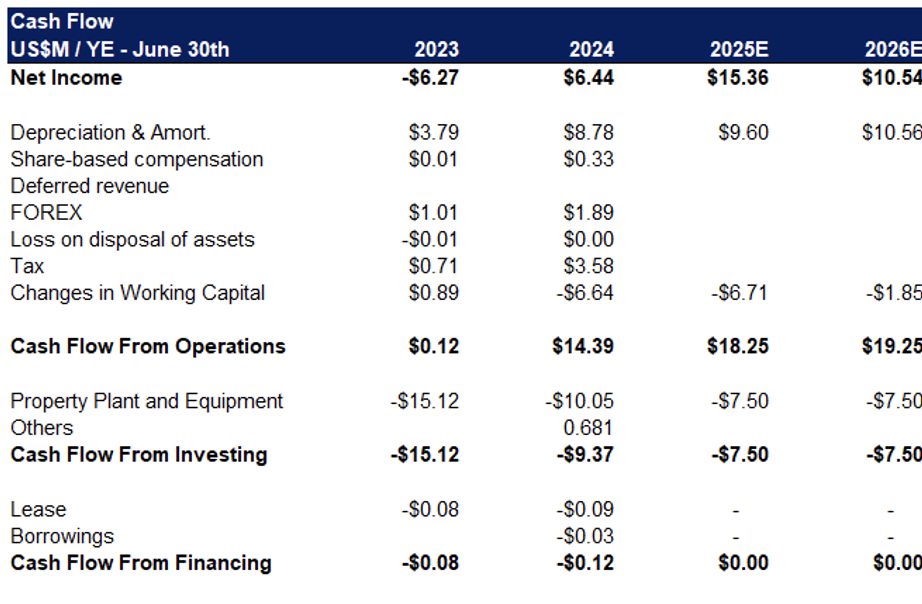

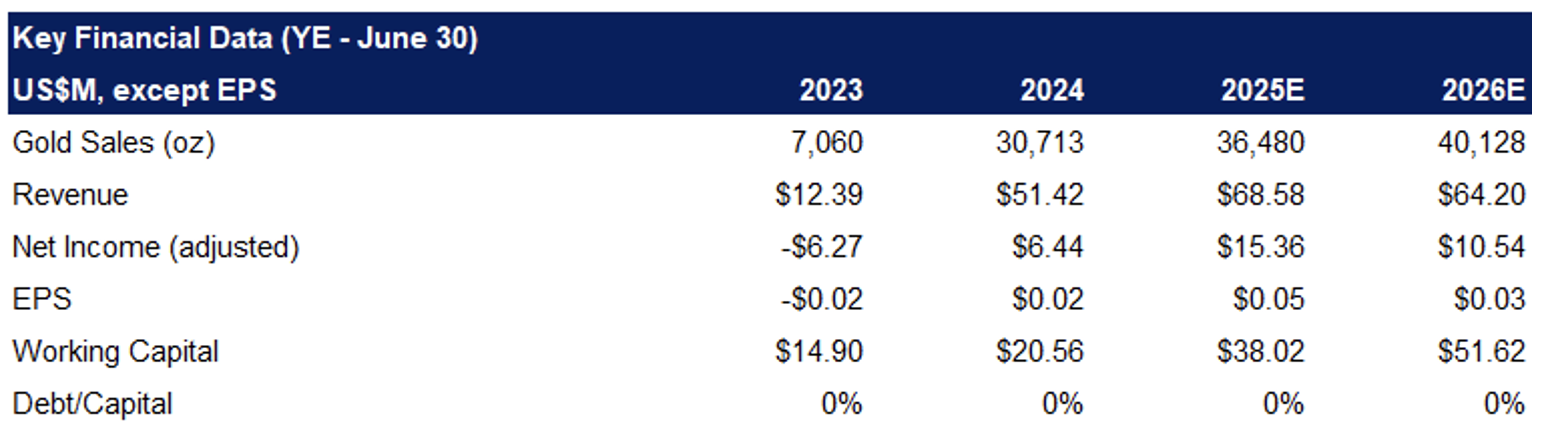

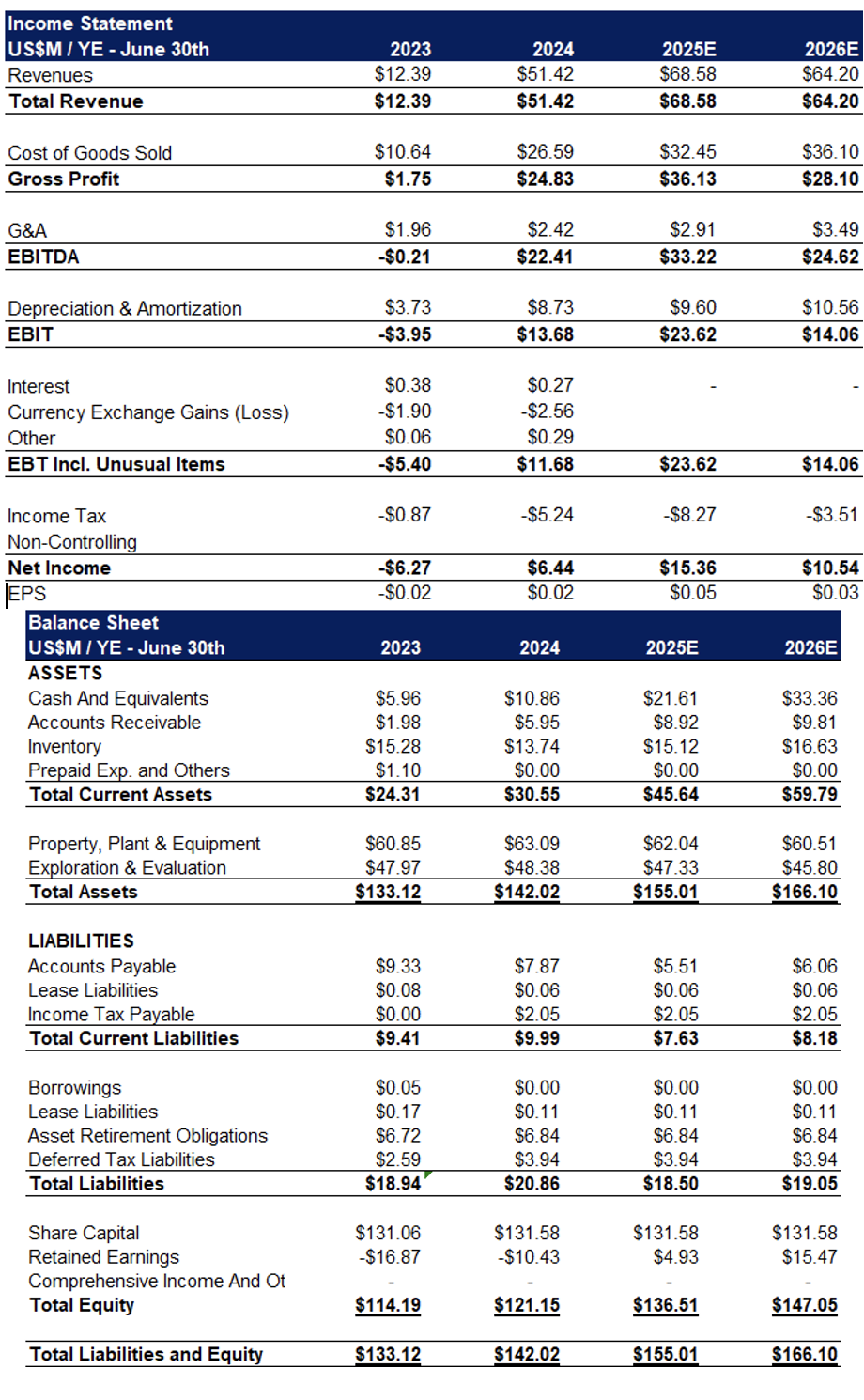

Financials (Year-End: June 30th)

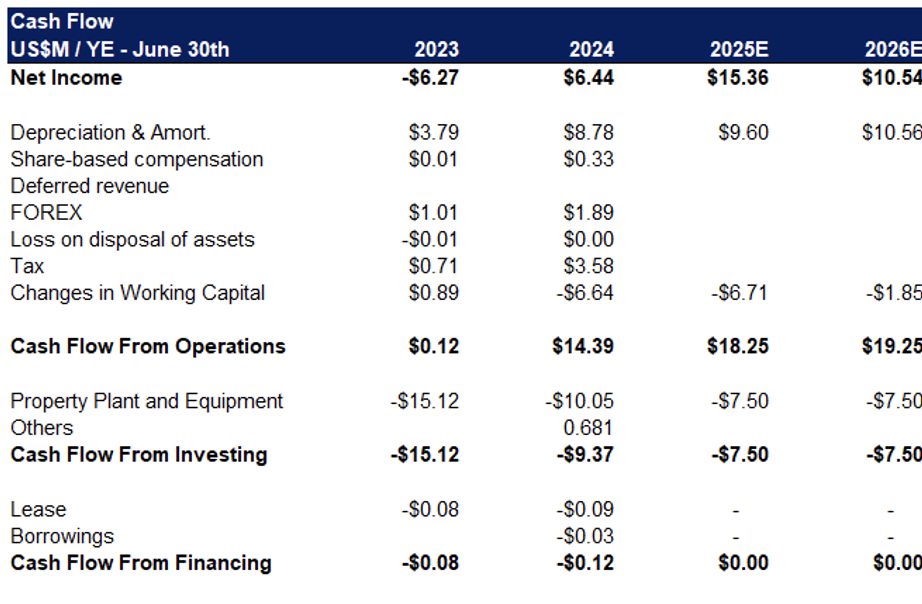

FY2024 revenue was up 315% YoY, beating our estimate by 4%. Margins improved across the board. EBITDA and EPS turned positive

FY2024 EPS of $0.02/share was exactly in line with our estimate. Free cash flow turned positive as well. Strong balance sheet, with $21M in working capital, and no debt

FRC Projections and Valuation

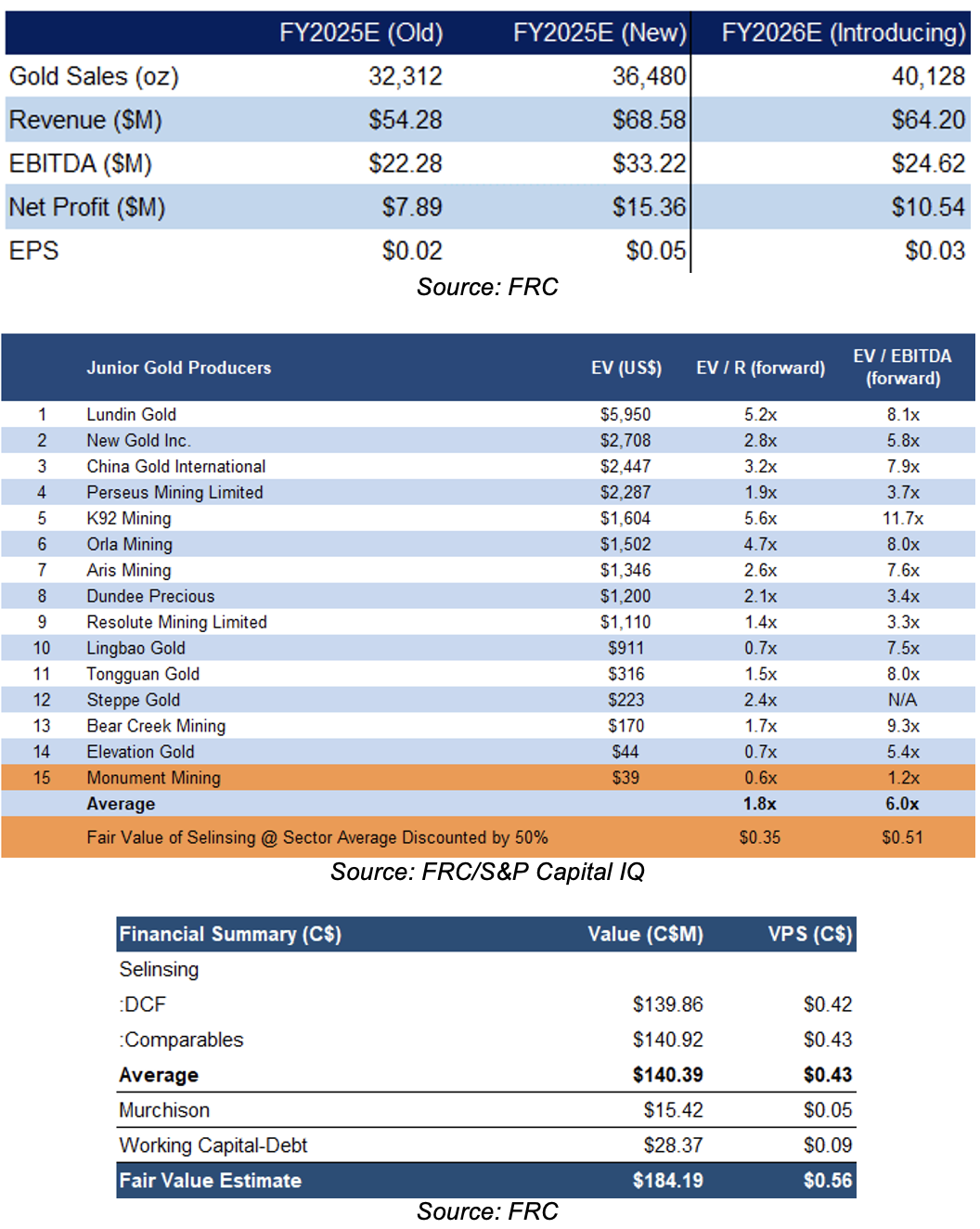

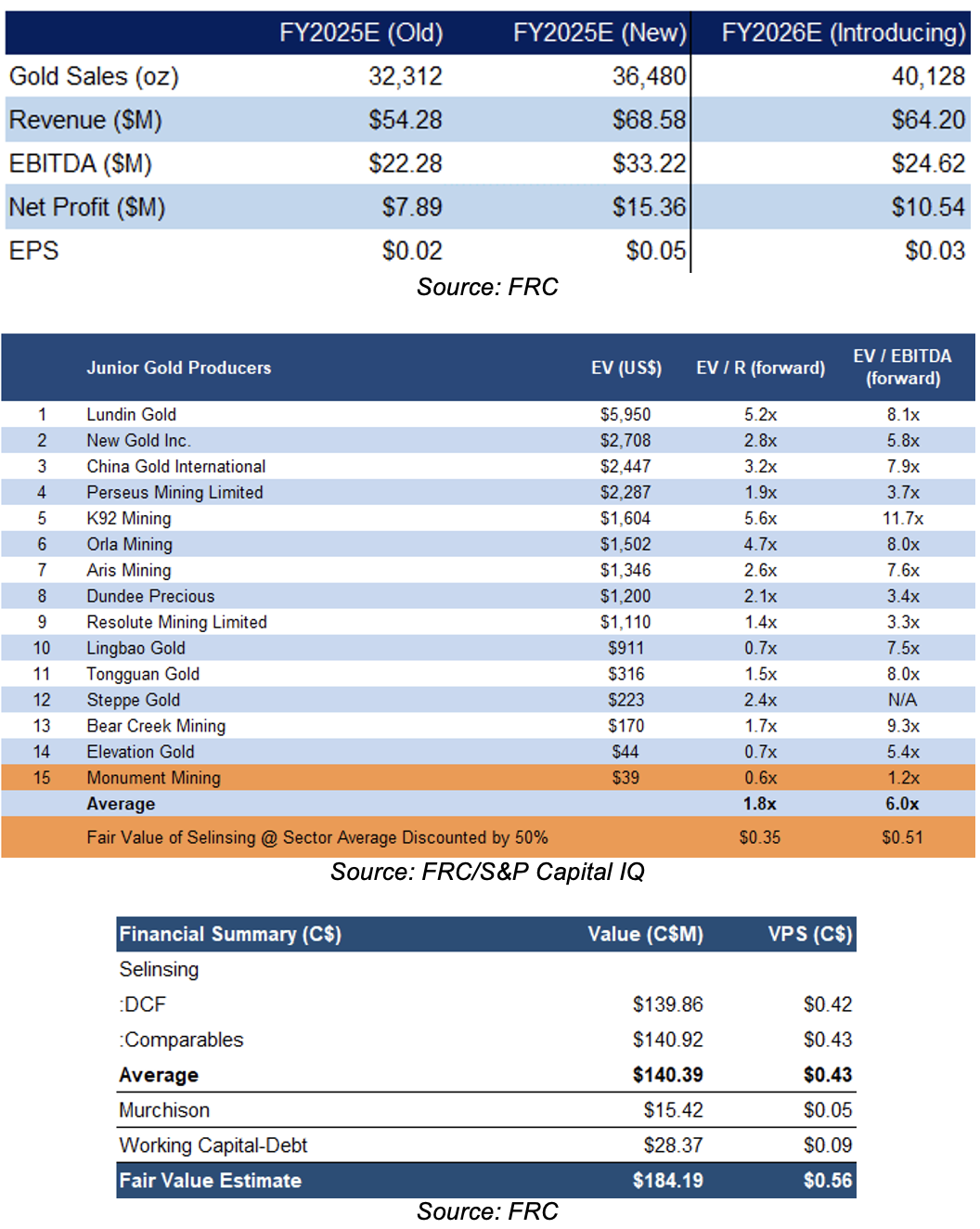

We anticipate record revenue and EPS in FY2025. Sector multiples are up 34% since our previous report in July 2024

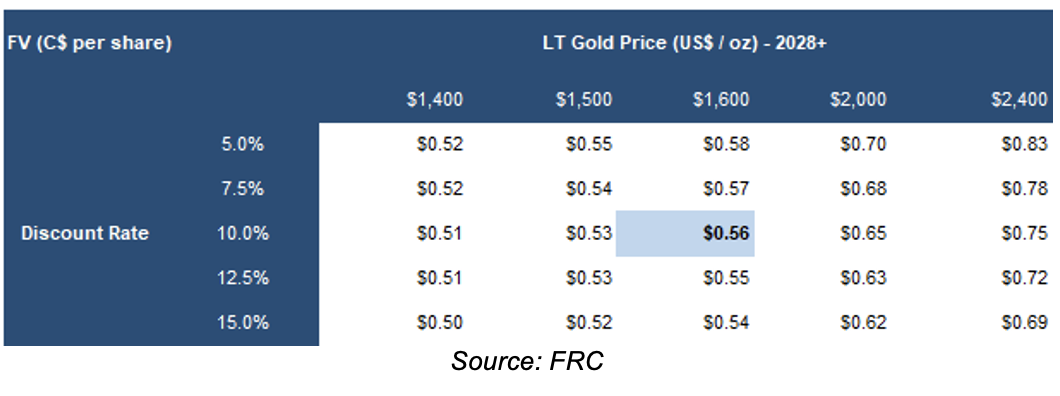

MMY is trading at a 75% discount (previously 86%) to comparable junior gold producers. Applying sector multiples, we arrived at a fair value estimate of C$0.43/share (previously C$0.36/share) on the Selinsing mine.

Our DCF valuation on Selinsing is C$0.42/share (previously C$0.37/share), driven by higher near-term production estimates

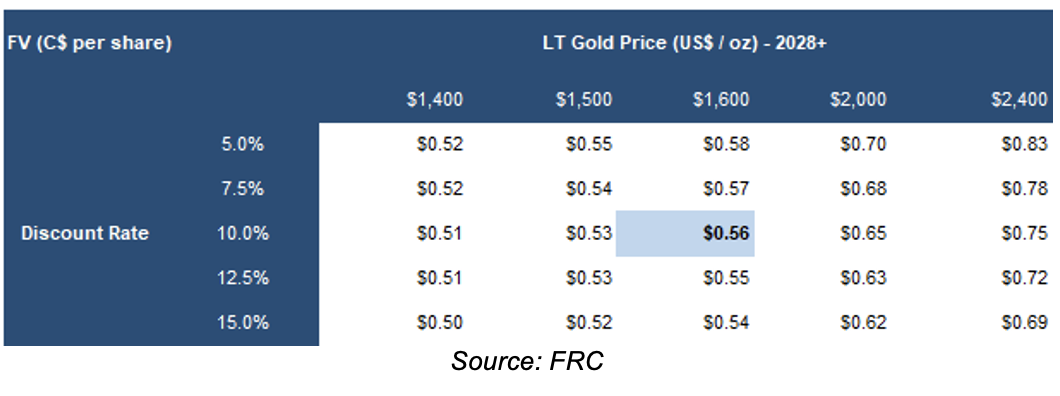

We are reiterating our BUY rating, and a fair value estimate of C$0.56/share (previously C$0.51/share). MMY remains undervalued compared to its peers. The company’s strong operational performance, robust financial position, and promising growth potential make it a compelling opportunity. With ongoing M&A activity in the sector, we believe MMY is well-positioned to benefit from increased sector valuations, and potential acquisition interest.

Using a sum-of-parts valuation model, we arrived at a fair value estimate of C$0.56/share (previously C$0.51/share

Risks

The following risks, though not exhaustive, will cause our estimates to differ from actual results:

- The value of the company is dependent on gold prices

- FOREX

- Operational

- Exploration and development

Maintaining our risk rating of 4 (Speculative

APPENDIX