North Peak Resources Ltd.

Significant Drilling Progress; Targeting Untested Areas Next

Published: 10/15/2024

Author: FRC Analysts

Sector: Basic Materials | Industry: Gold

| Metrics | Value |

|---|---|

| Current Price | CAD $0.85 |

| Fair Value | CAD $ |

| Risk | 5 |

| 52 Week Range | CAD $0.67-1.95 |

| Shares O/S (M) | 30 |

| Market Cap. (M) | CAD $26 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | 2.1 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

- Since our previous report in August 2023, NPR has made significant progress at its Prospect Mountain Mine Complex (Prospect MMC) project in Nevada.

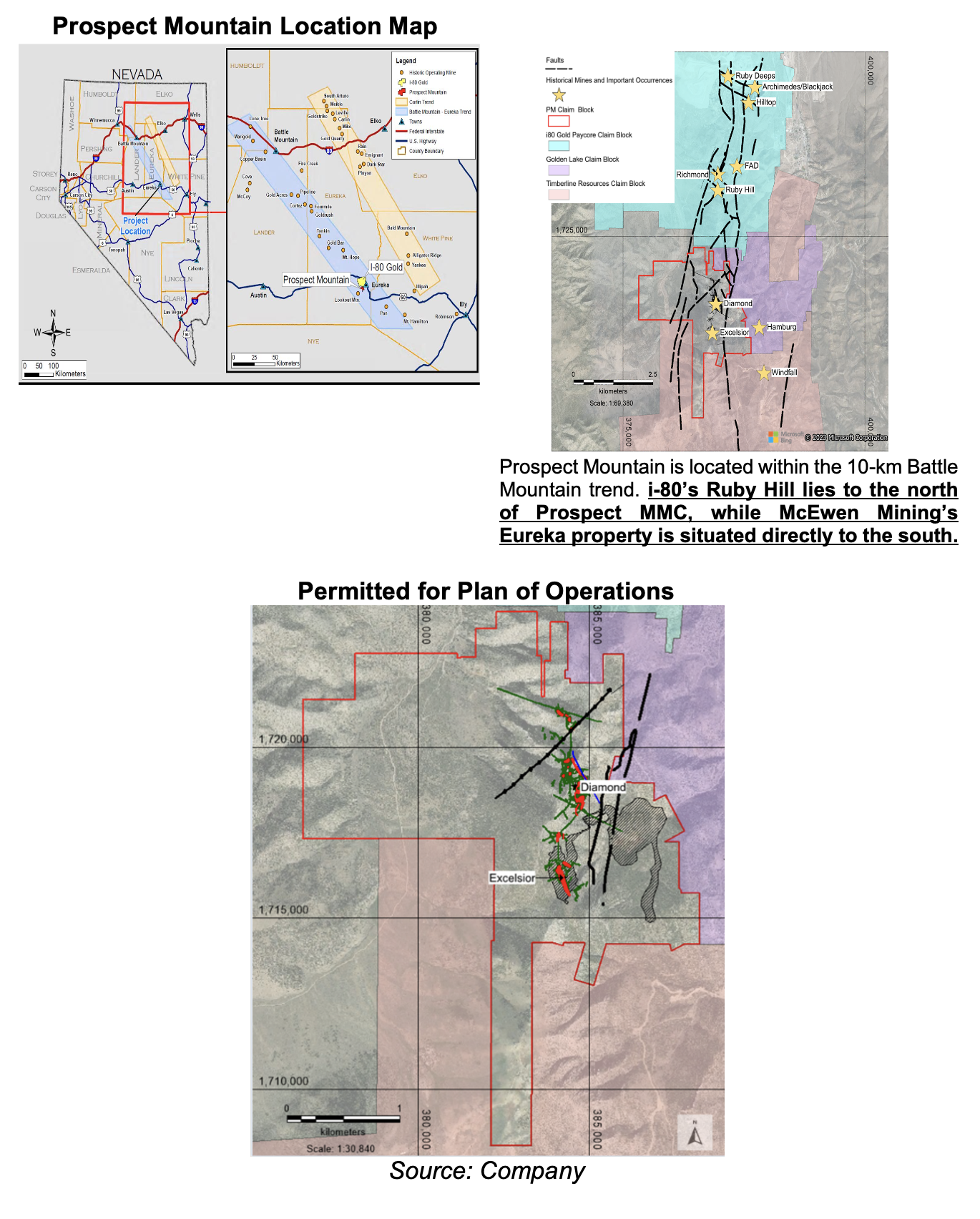

- Prospect MMC is a historic gold/silver/lead producer in the Eureka mining district. The project borders i-80 Gold’s (TSX: IAU/MCAP: $570M) Ruby Hill project, which hosts a large gold-silver resource, and McEwen Mining’s (NYSE: MUX/MCAP: $703M) Eureka property to the south.

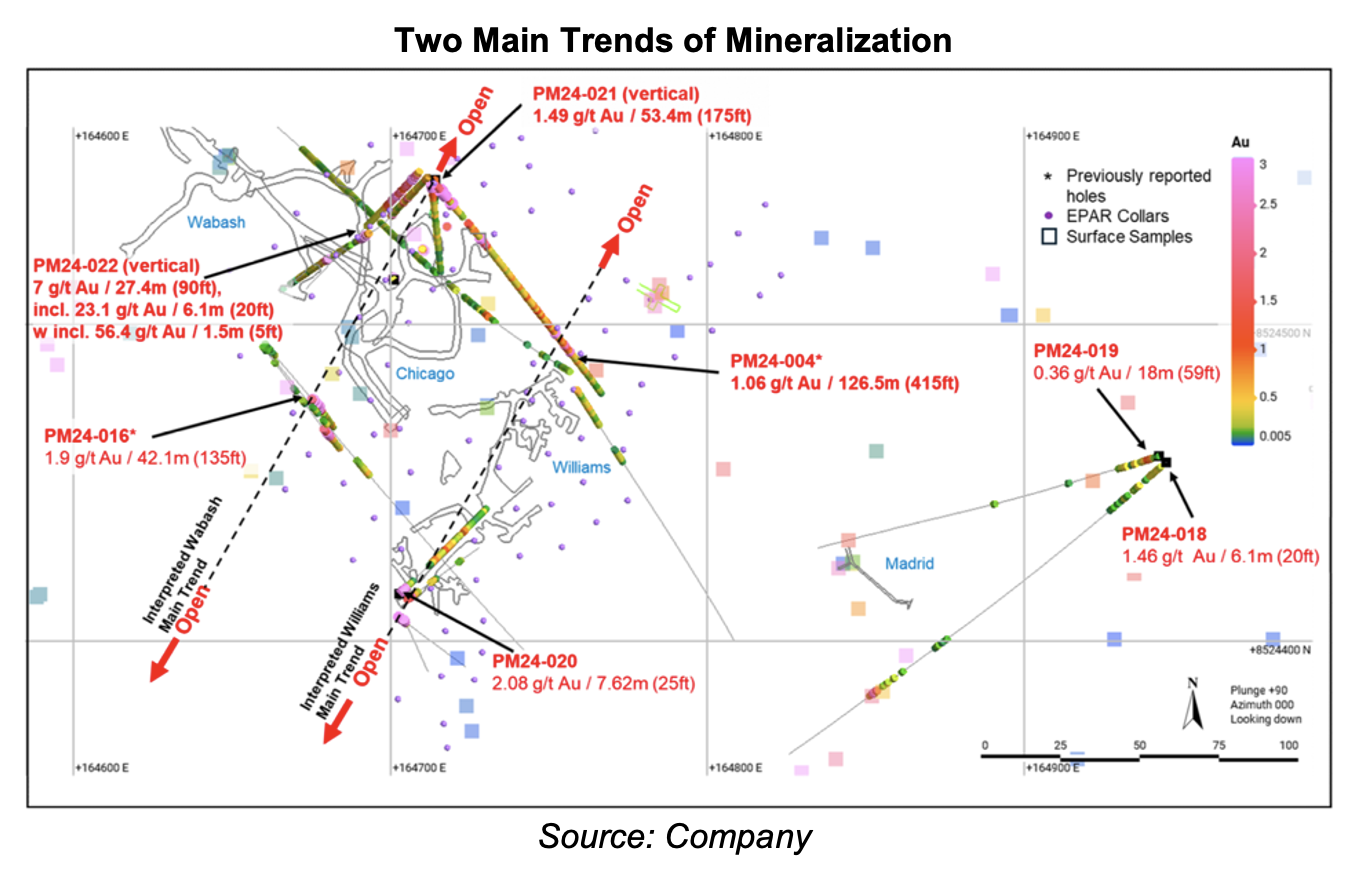

- NPR has identified multiple targets along a structural corridor extending from i-80’s Ruby Hill project. Recent drilling (28 holes, 4,352 m) delineated two zones of mineralization: Wabash and Williams. Both zones are open along strike and at depth. Drill holes returned several high-grade intercepts over long intervals, including bonanza grades of up to 56.4 g/t Au, as well as attractive long intervals from surface, such as 126.5 m of 1.06 g/t, 53.4 m of 1.49 g/t, and 27.4 m of 7.0 g/t.

- Since the Wabash/Williams areas represent only a small portion of the property, with several targets yet to be tested, management plans to conduct additional drilling programs to explore these targets before considering a maiden resource estimate.

- We maintain a bullish outlook on gold amid heightened geopolitical tensions, and upcoming Fed rate cuts.

- NPR’s objective is to keep drilling, test all key targets, and potentially delineate a multimillion-ounce resource that would appeal to larger players considering M&A. Management and board have extensive experience in the resource sector. CEO Brian Hinchcliffe was a co-founder/CEO of Kirkland Lake Gold, which was acquired by Agnico Eagle Mines (NYSE: AEM) for $13.5B in 2022. He was also the CEO/founder of Rupert Resources (TSXV: RUP/MCAP: $886M), and an investment banker at Goldman Sachs (NYSE: GS).

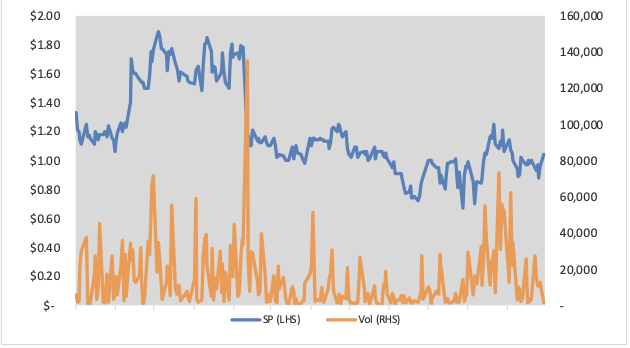

Price Performance (1-year)

Prospect Mountain Gold-Silver-Lead Mine Complex

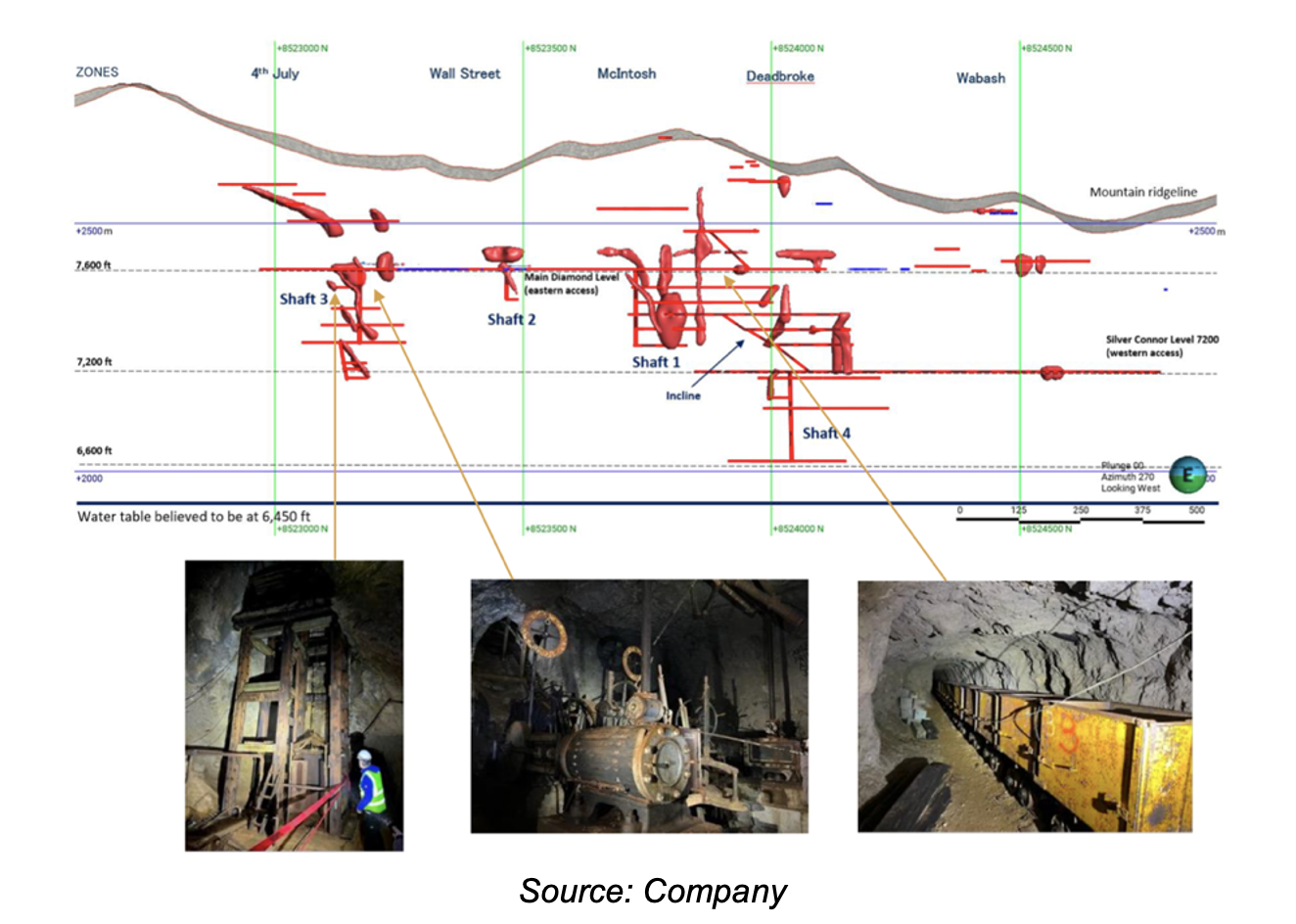

The property hosts several historic mines (Diamond, Excelsior, Silver Conner, Deadbroke, and Metamoras). Two types of mineralization (carbonate replacement mineralization and Carlin) have been identified on the property, controlled by faulting similar to mineralized structures on other parts of the Eureka camp.

Nevada is the fourth largest gold producer in the world. Located in the southern portion of the Battle Mountain-Eureka trend, known for CRD and Carlin-type deposits

Carlin-type deposits typically contain high gold grades, while CRDs are typically found in clusters. Existing infrastructure in place including access to power, water, and underground development

Fully permitted: the project has a 10-year permit for surface exploration and underground mining of up to 365 Kt/year; the project also has a permit to extract water, and to build water containment facilities

Existing Infrastructure

A historic producer (sporadic high-grade/small-scale production). Prospect MMC consists of five main areas. Four shafts and 18 kms of tunnels

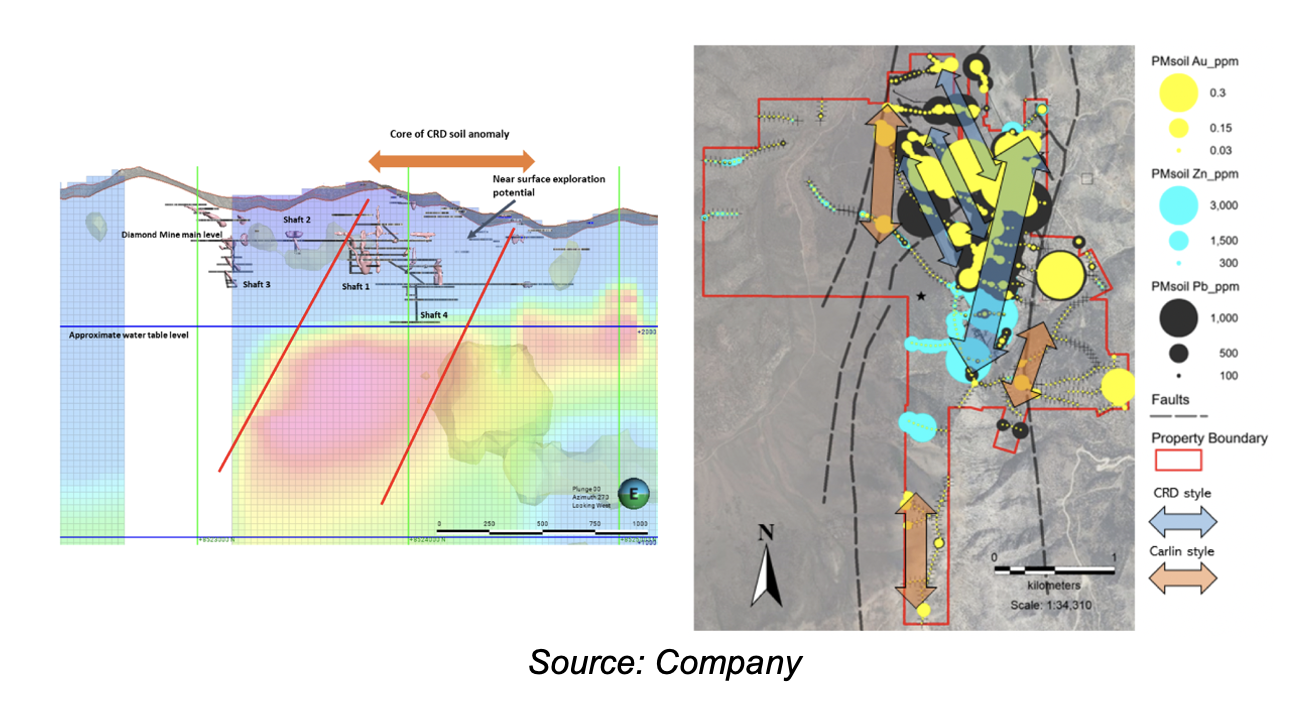

Geophysical and geochemical sampling results indicate the potential for deep-seated mineralization directly beneath historic workings, and near-surface mineralization in the northern part of the property, where only minimal historical exploration has been conducted.

Geophysical and Soil Anomalies

Geophysics identified a 2-km long conductive anomaly, directly under old stopes and mine workings. Soil sampling has identified mineralization over 3 km

NPR has completed a two-phase drill program at the Prospect Mountain North area. The first phase was initial drill testing (one hole/ 992 m) the above mentioned 2-km long geophysical anomaly, while the second phase (27 holes/ 3,360 m) was designed to confirm historic grades, and extend mineralization at the Wabash, Williams, Chicago, and Madrid mine areas.

Phase one drilling intersected at least eight zones of CRD mineralization, with attractive grades of up to 9.5% Zn, and 4.6% Pb

Phase 2 Drill Highlights:

- PM24-004: 126.5 m of 1.06 g/t Au from surface, including 12.2 m of 4.20 g/t

- PM24-021: 53.4 m of 1.49 g/t from surface, including 3.0 m of 12.8 g/t

- PM24-023: 50.3 m of 1.1 g/t from surface including 3.1 m of 4 g/t

- PM24-016: 42.1 m of 1.89 g/t, including 18.3 m of 3.92 g/t

- PM24-022: 27.4 m of 7.0 g/t from surface, including 6.1 m of 23.1 g/t

- PM24-006: 21.3 m of 2.03 g/t from near surface (1.5m)

- PM24-025: 18.3 m of 2.88 g/t from surface

- PM24-020: 7.6 m or 2.08 g/t from surface

Phase two drilling returned high gold grades over several long intervals. Drilling confirmed two near-surface trends: Williams and Wabas; both zones are open along strike, and depth

Due to the mountainous terrain of the project, only a limited number of potential targets across the property have been tested

Since the Wabash/Williams areas represent only a small portion of the property, with several targets yet to be tested, management plans to conduct additional drilling programs to explore these targets before considering a maiden resource estimate.

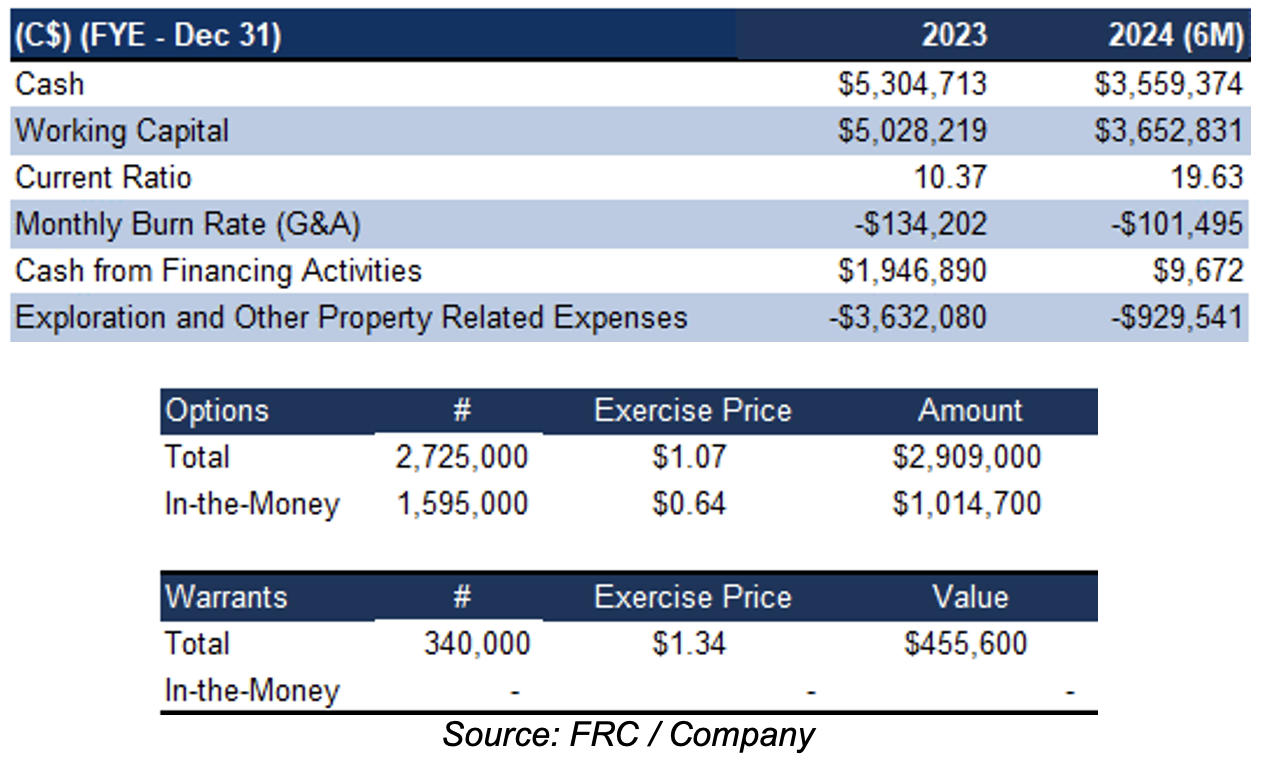

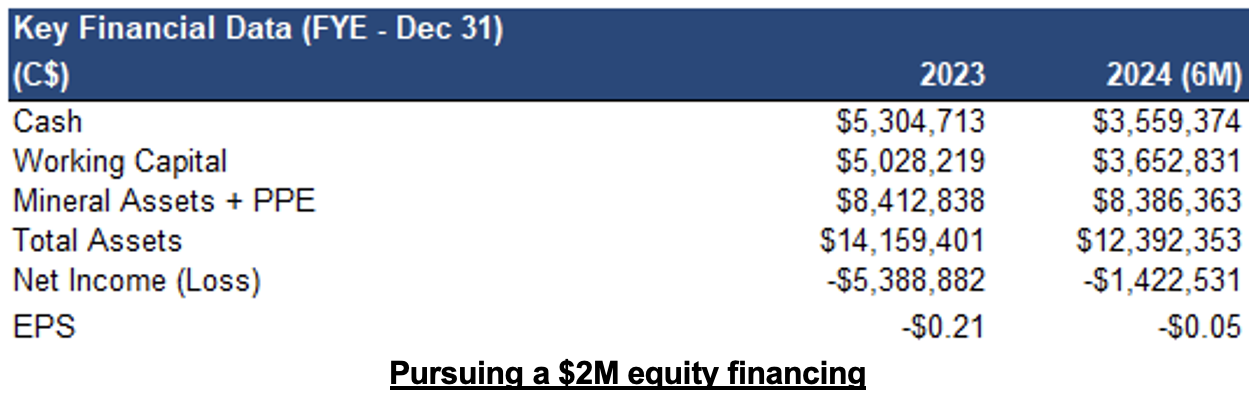

Financials

Strong balance sheet, with $3.6M in cash. Pursuing a $2.0-$2.3M equity financing. In-the-money options and warrants can bring in up to $1.5M

Valuation and Rating

Although the recent drilling program has provided us with sufficient data to calculate a rough speculative resource estimate for the Williams and Wabash areas, the property remains largely untested, and is still in the early stages of exploration. We believe that assigning a valuation to NPR based solely on the current drilling results would not accurately reflect the project’s intrinsic value. Consequently, we will continue to refrain from assigning a rating or valuation to NPR at this time.

The recent drilling has bolstered our confidence that the project has significant potential, and warrants a more comprehensive study, considering its favorable location, existing infrastructure, and historical exploration results. We underscore management's proven track record as NPR's primary strength, with further drilling programs serving as future catalysts.

Risks

We are maintaining our risk rating of 5 (Highly Speculative)

- The value of the company is dependent on gold prices

- Exploration

- Permitting and development

- No NI 43-101 compliant resource estimate

- Access to capital and potential for share dilution