- EPS turned positive, beating our estimate by 25%, driven by higher than expected revenue and gross margins.

- In H1-2024, CAPEX increased 56% YoY to $10M, driven by heightened client demand necessitating new equipment purchases. The company is building a new facility in Fort St. John, B.C., for equipment storage and maintenance, as part of its expansion efforts in the province.

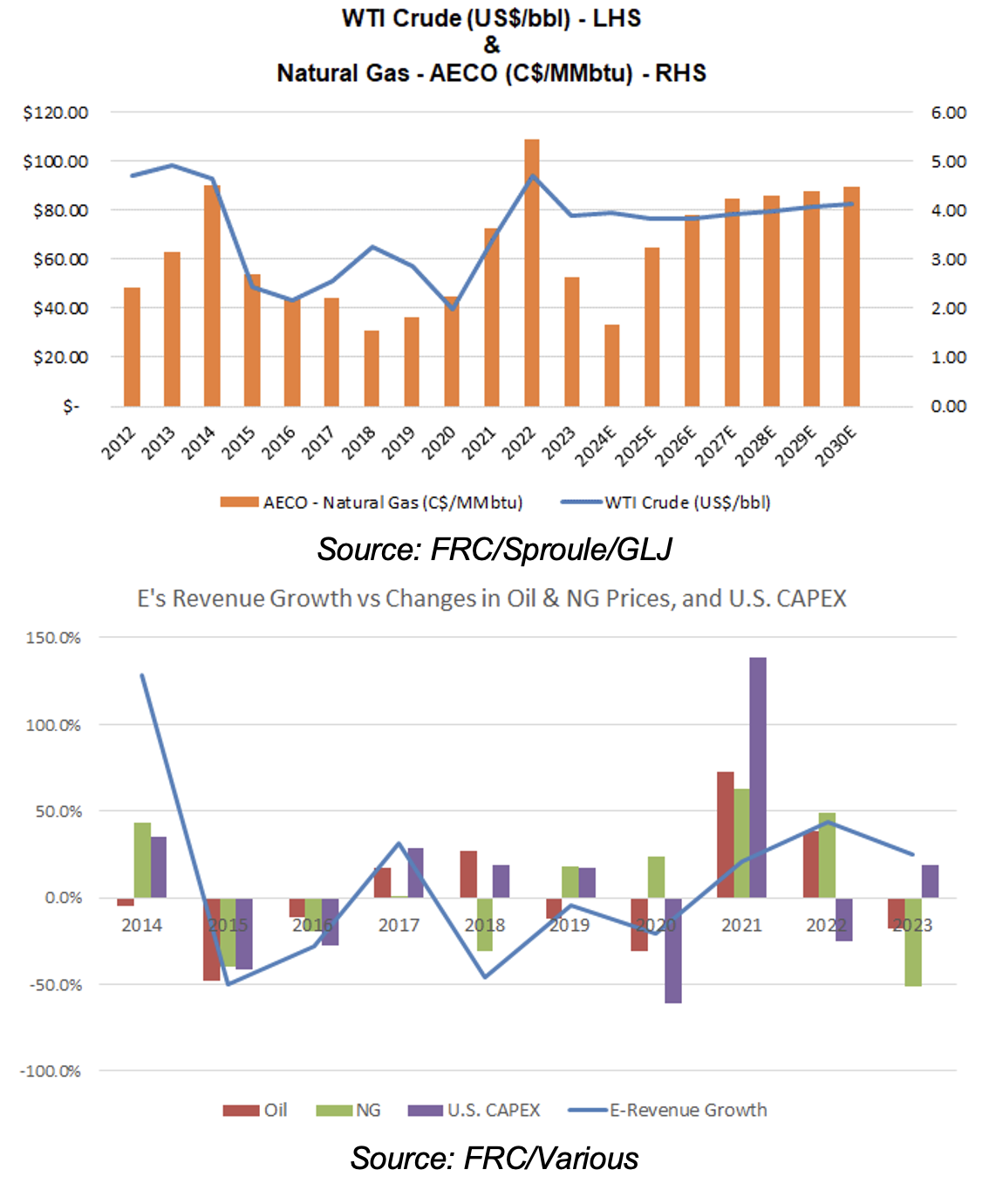

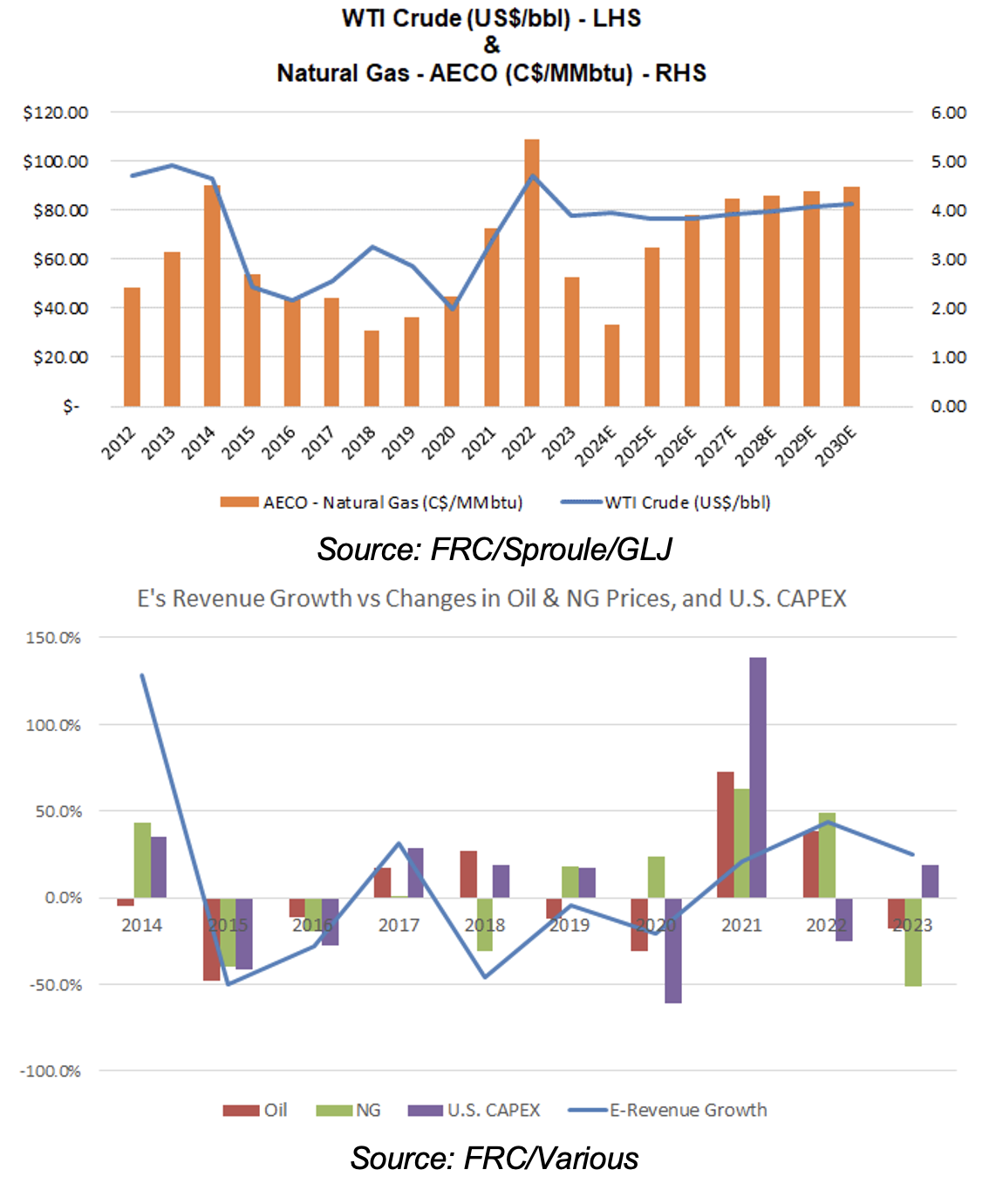

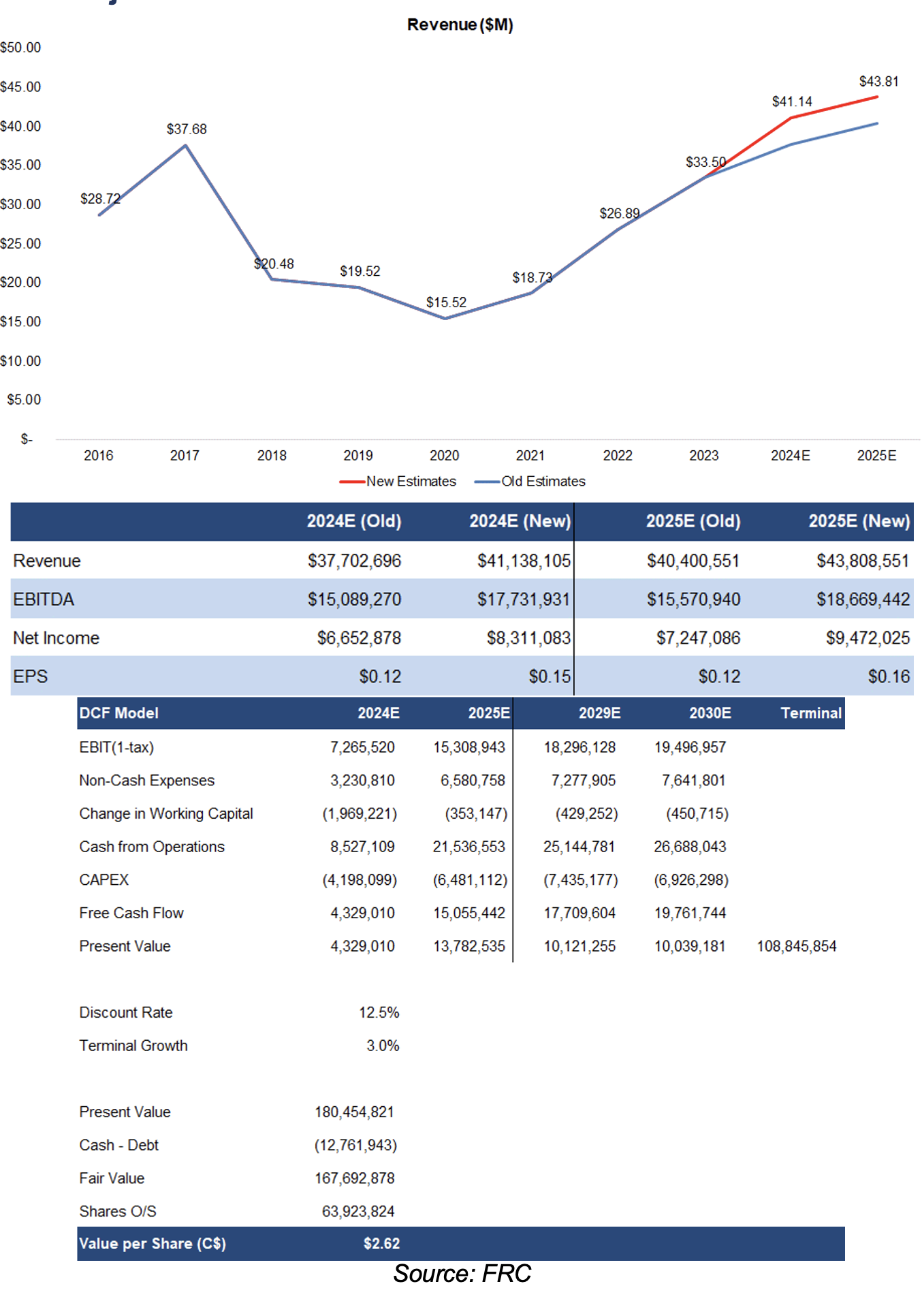

- Per consensus estimates, growth in North American oil and gas CAPEX will ease to 2.2% in 2024, down from 19% in 2023, driven by slower GDP growth, and higher lending rates. We believe the company's expanded rental equipment fleet will help mitigate the sector-wide slowdown. We anticipate 23% revenue growth in 2024 (previously 13%) vs 25% in 2023.

- As Q2 was stronger than expected, we are raising our fair value estimate, driven by higher near-term revenue/EPS estimates.

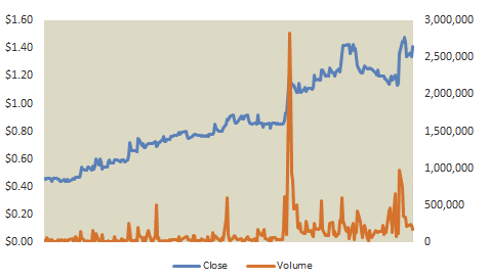

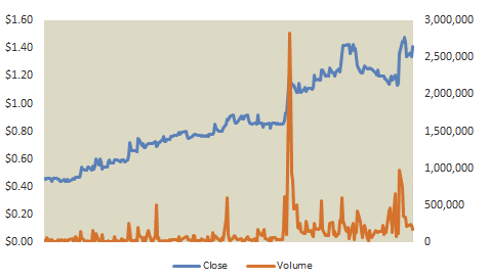

Price and Volume (1-year)

| |

YTD |

12M |

| E |

87% |

216% |

| TSX |

6% |

10% |

Enterprise vs Larger Players

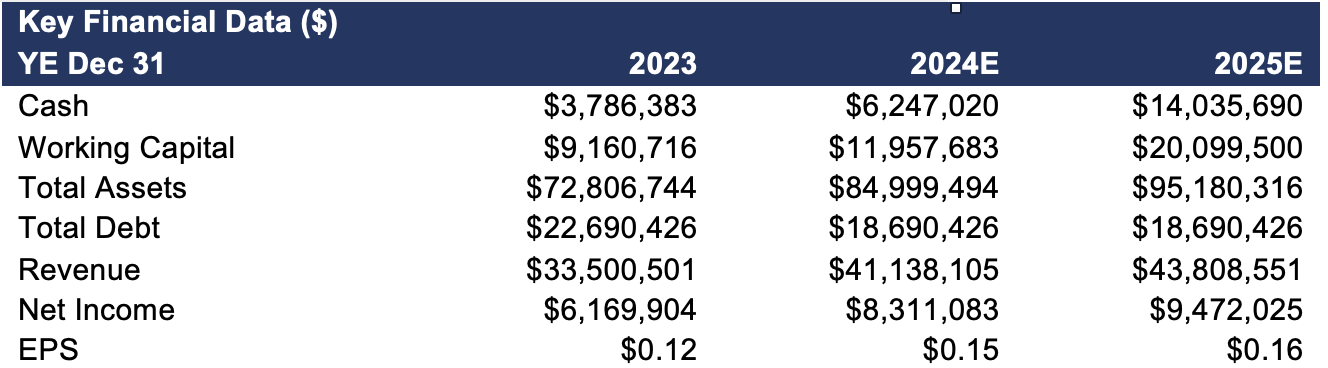

E is up 216% YoY, and is the best performing stock on our list of oilfield services companies. Gross margins are higher than the sector average, while debt/capital is lower

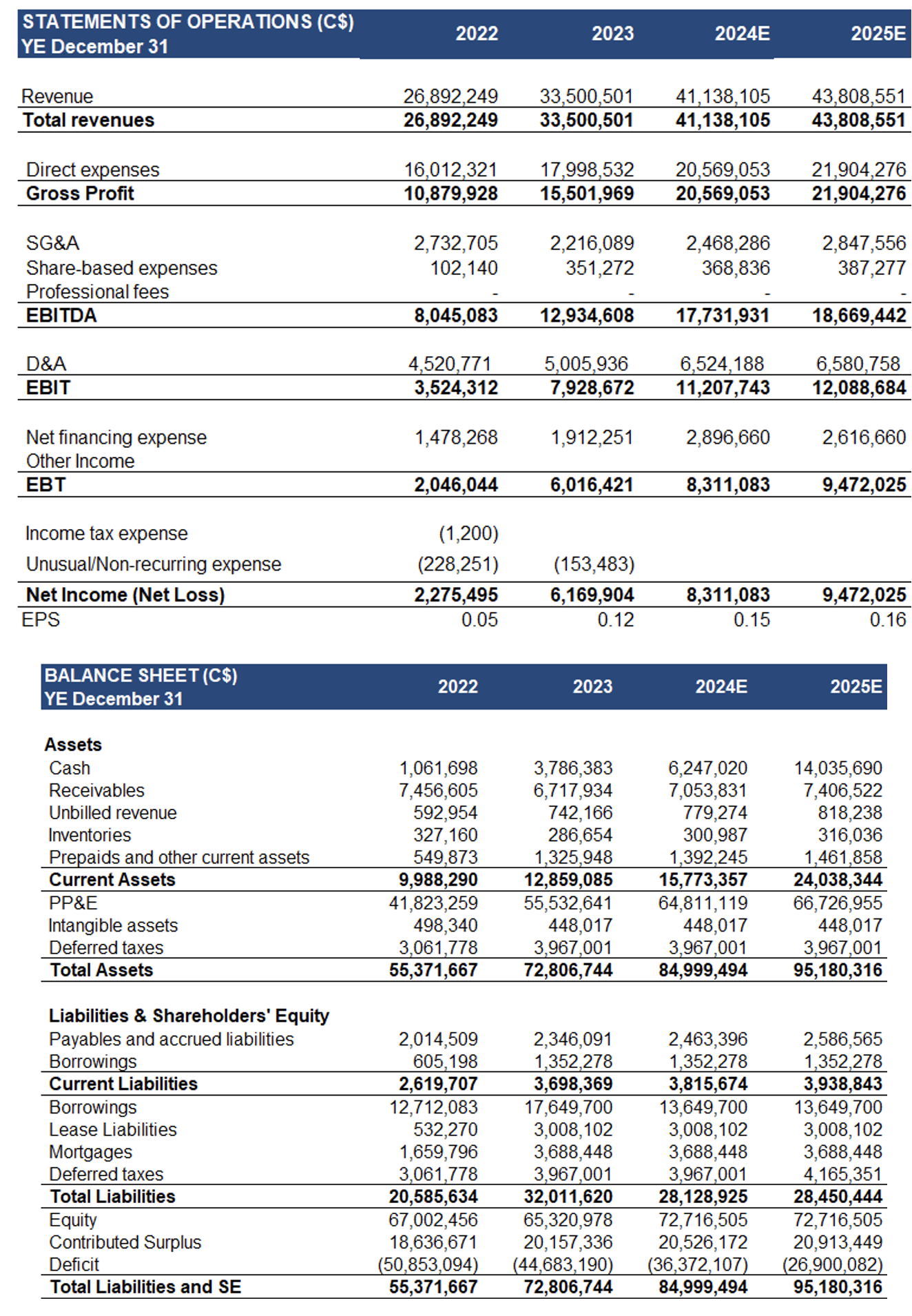

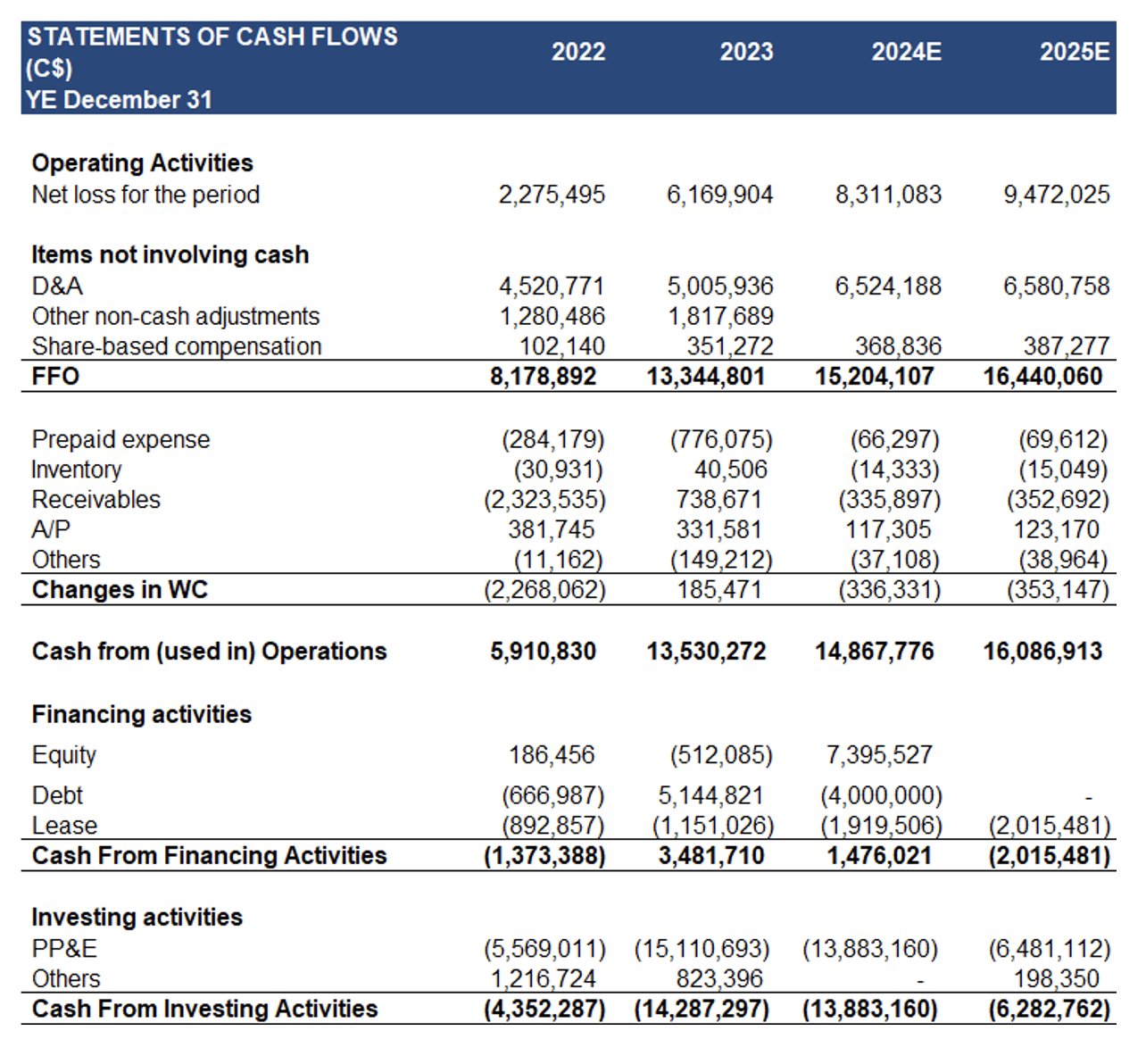

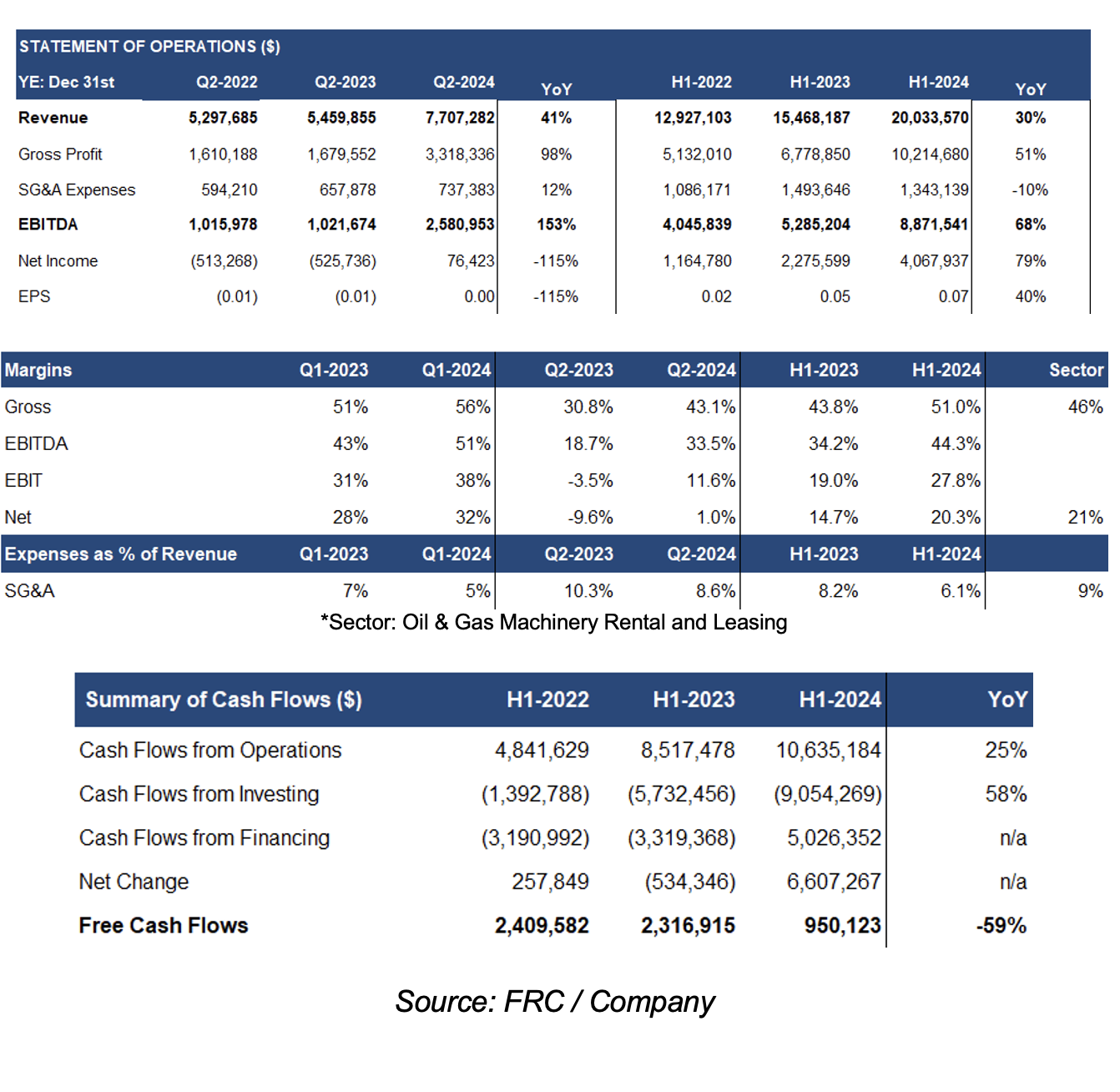

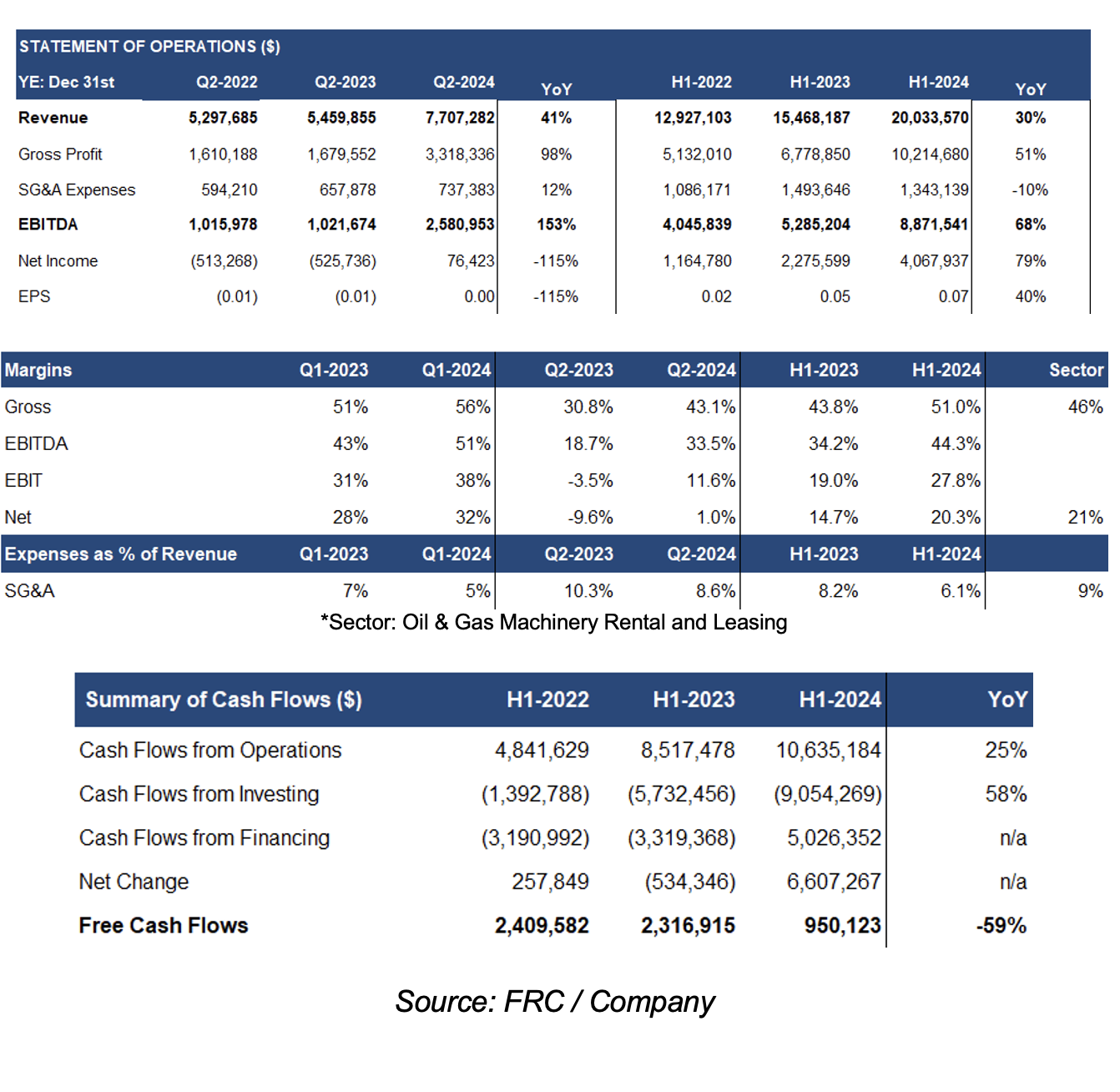

Financials

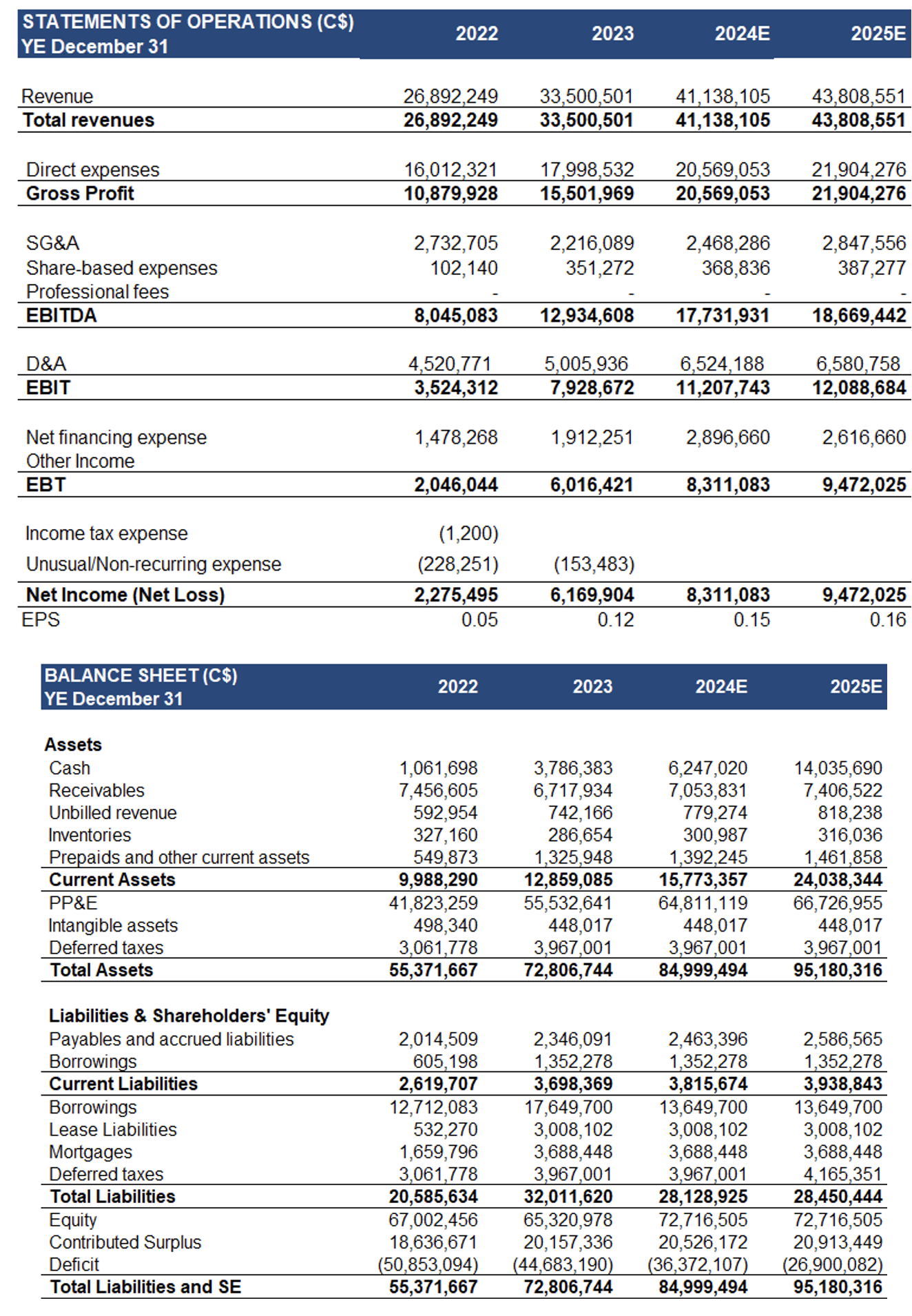

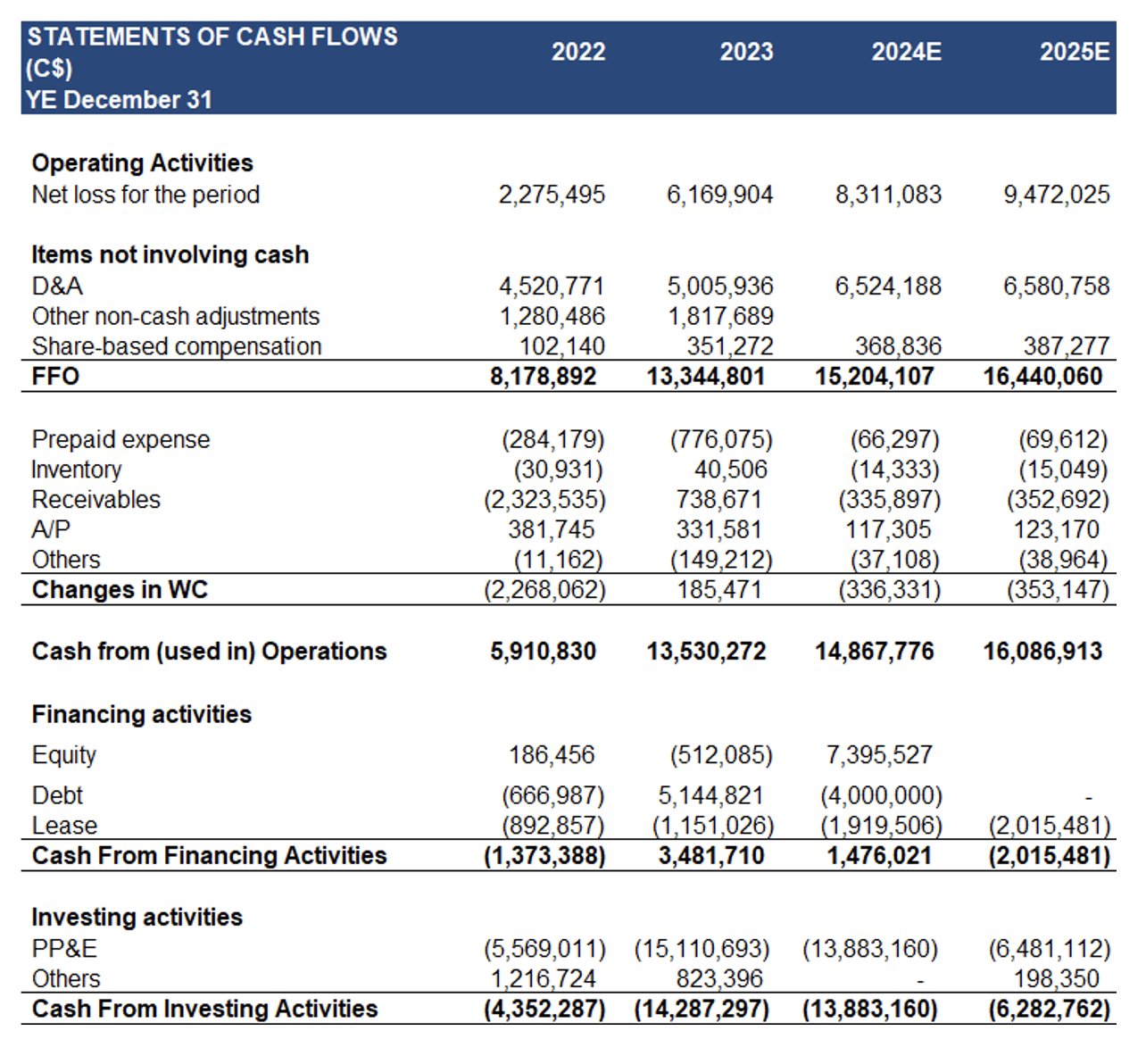

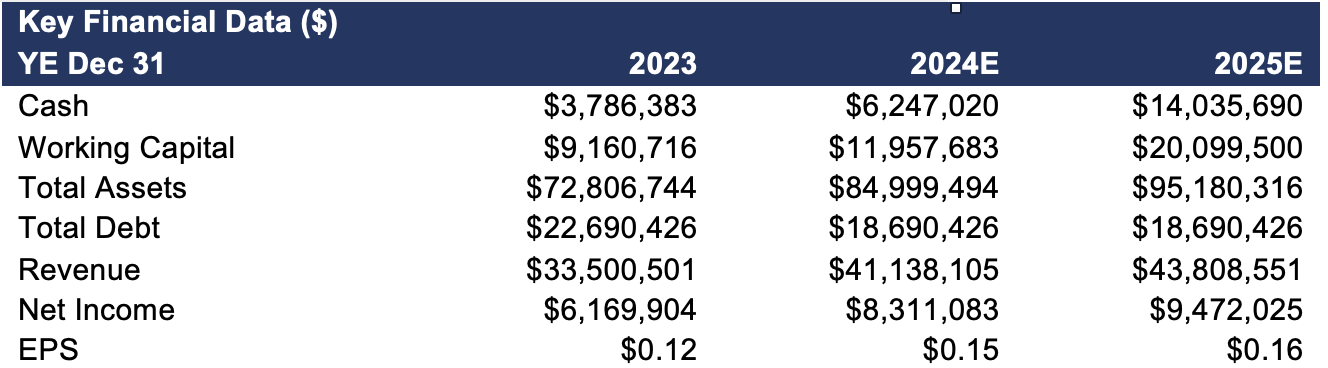

In 2024, we anticipate E’s revenue will grow by 23%, outpacing sector growth by 8 pp

Q2-2024 revenue was up 41% YoY (Q1-2024: 23% YoY), beating our estimate by 9%. Gross margins improved by 12 pp YoY, and were 3 pp higher than our estimate

G&A expenses were up 12% YoY, and 9% higher than our estimate, primarily driven by new hires supporting expansion and business growth

EPS turned positive, beating our estimate by 25%

In H1-2024, CAPEX increased 56% YoY to $10M, driven by heightened client demand necessitating new equipment purchases

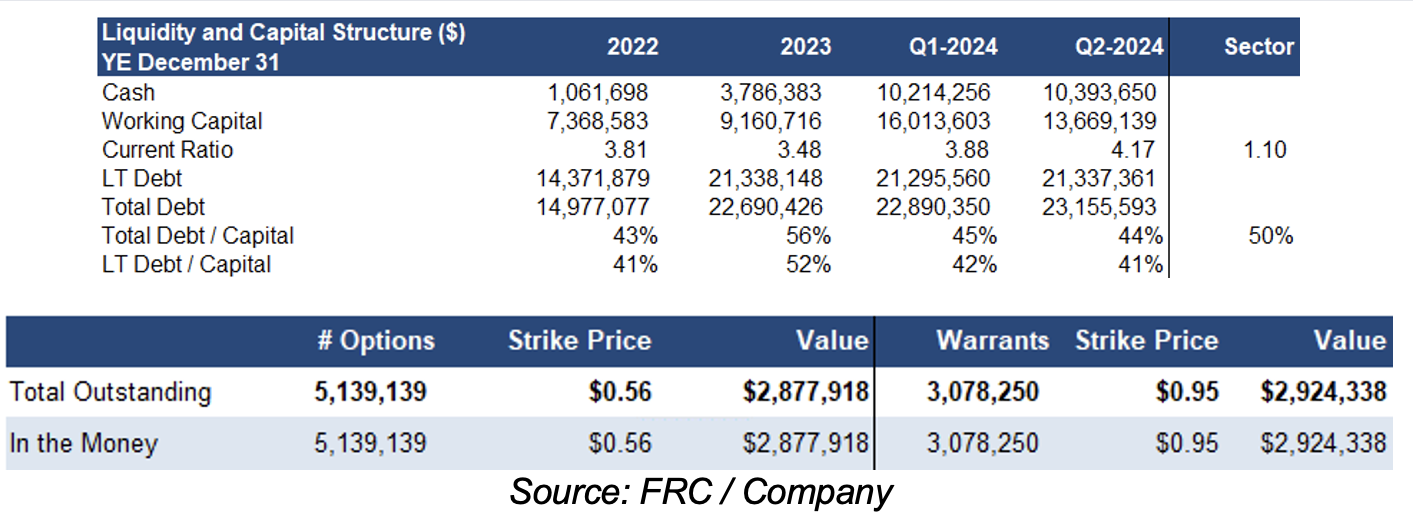

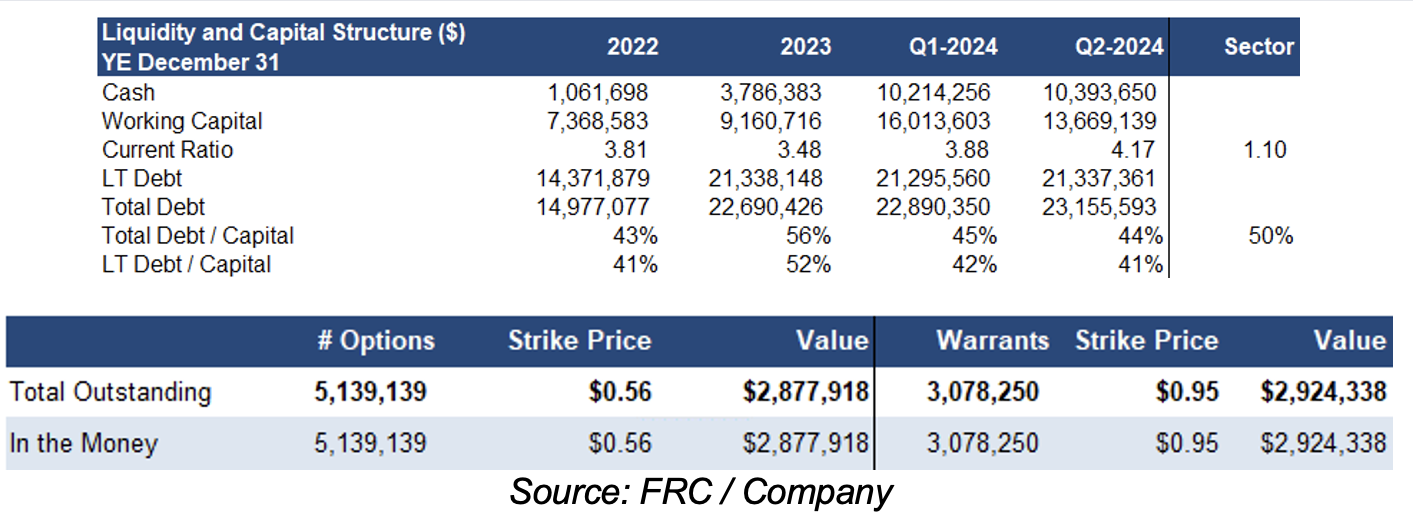

Debt/capital remained relatively flat QoQ. Can raise up to $6M from in-the-money options and

Oil & Gas Price Outlook

Consensus oil price forecasts (near and long-term) are well above historic averages, implying a positive outlook for the oilfield services sector

E's revenue generally tracks changes in oil and gas prices, and sector CAPEX spending. Historically, a 1% increase in oil and gas prices, and CAPEX spending, has led to a 2.4% increase in E's revenue

Conversely, a 1% decrease in these factors has resulted in a 1.2% decline in E’s revenue

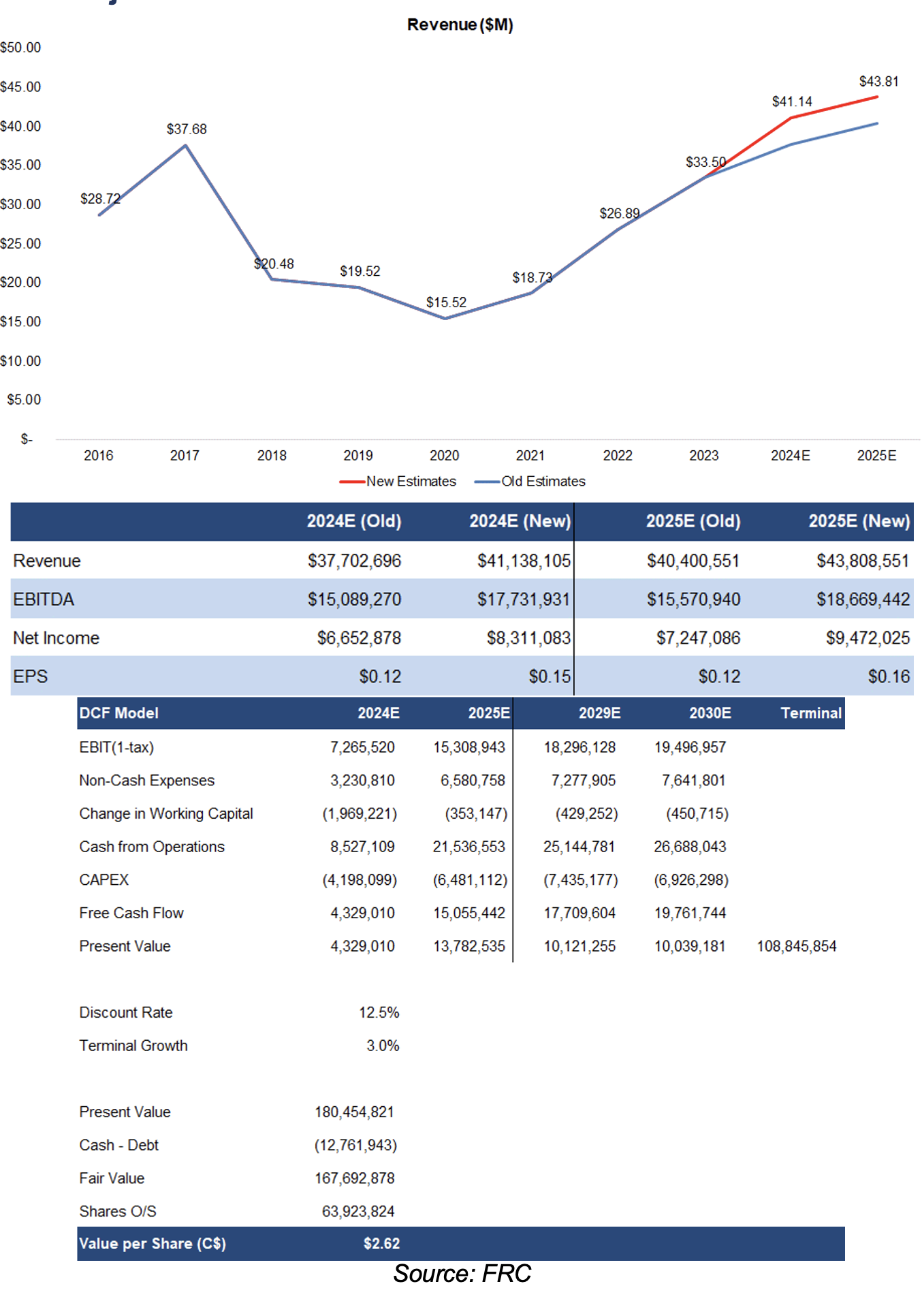

FRC Projections and Valuation

As Q2 revenue and gross margins were higher than expected, we are raising our 2024 and 2025 estimates

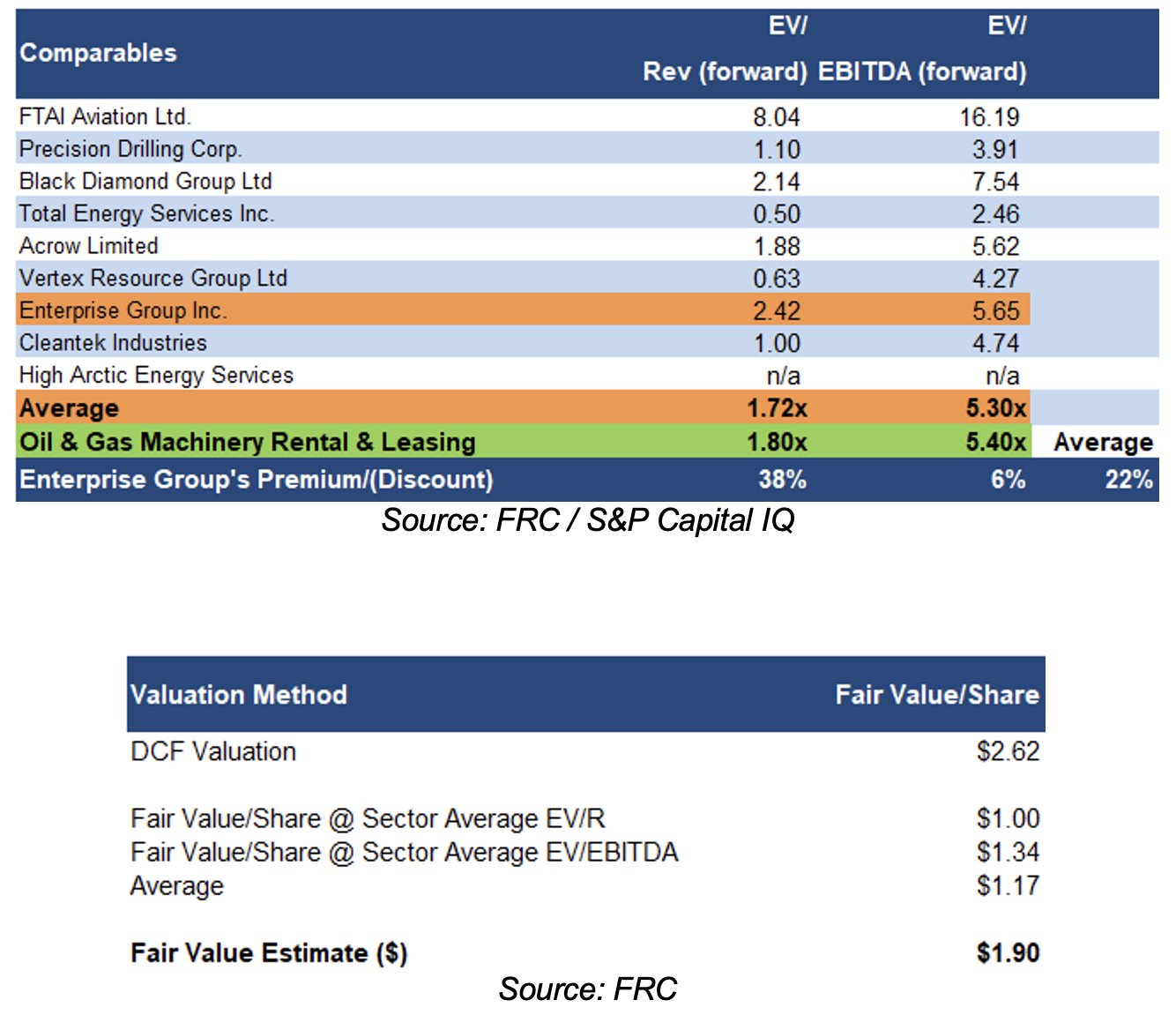

As a result, our DCF valuation increased from $2.44 to $2.62/share

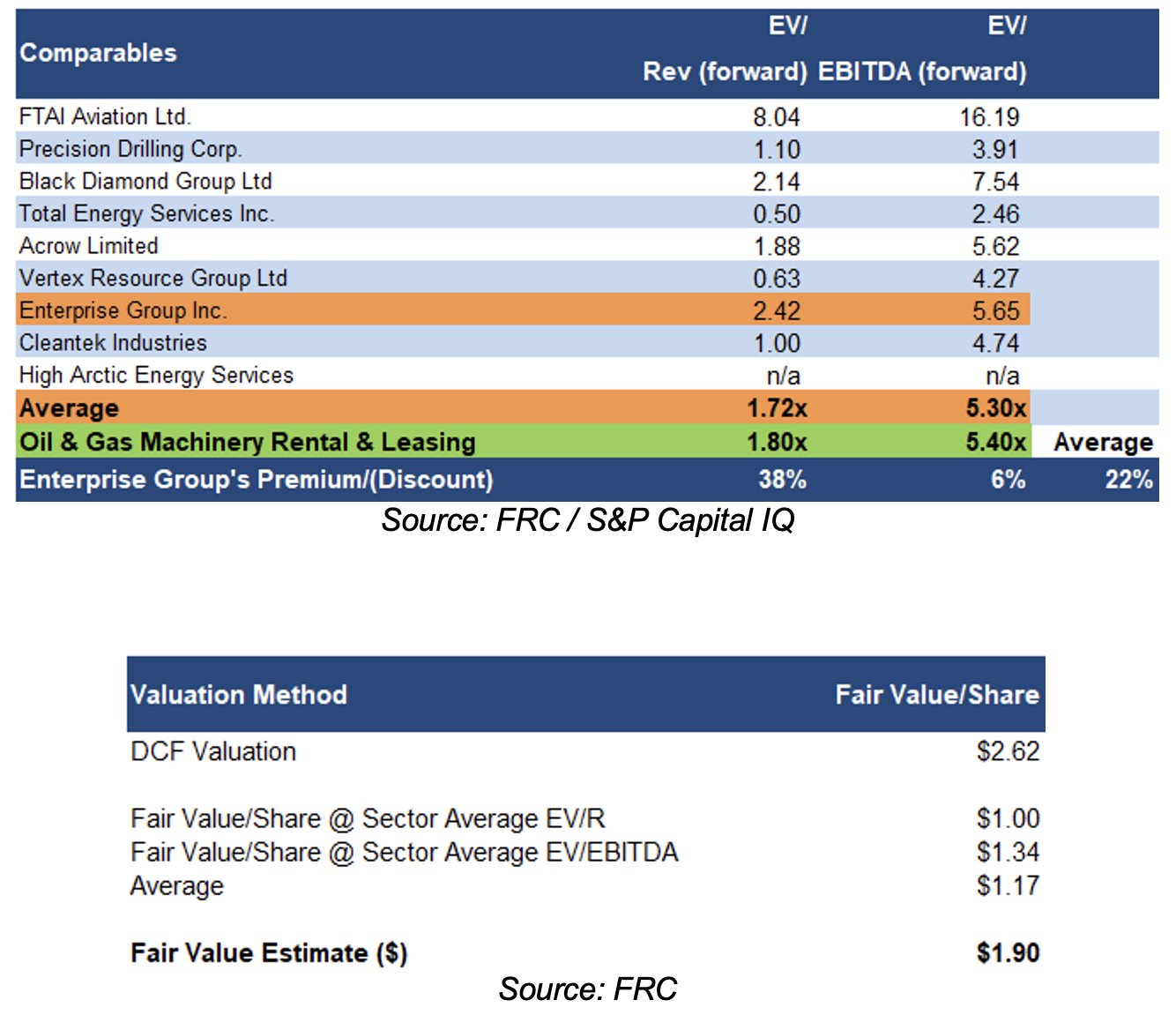

Sector multiples are up 6% since our previous report in May 2024. E’s forward EV/Revenue and EV/EBITDA are 22% (previously 21%) higher than sector average

We believe E’s premium is justified, given its higher margins, lower debt/capital, and higher 2024 revenue growth estimate

As a result of our revised DCF valuation and updated sector multiples, our fair value estimate increased from $1.62 to $1.90/share

We are maintaining our BUY rating, and raising our fair value estimate from $1.62 to $1.90/share (the average of our DCF and comparables valuations). Upcoming catalyst includes revenue growth stemming from the deployment of newly acquired equipment.

Risks

We are maintaining our risk rating of 3 (Average)

We believe the company is exposed to the following key risks (not exhaustive):

- The oil/gas field services market is highly dependent on oil and gas prices

- Operates in a competitive space

- As the company uses leverage, a downturn in business activities can negatively impact its balance sheet

Appendix