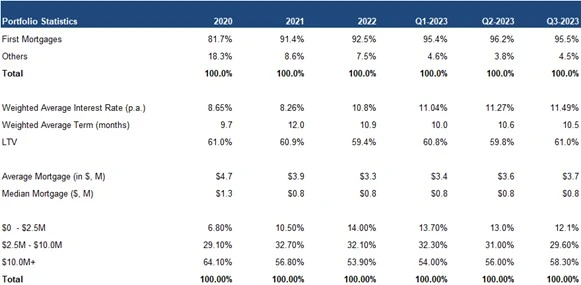

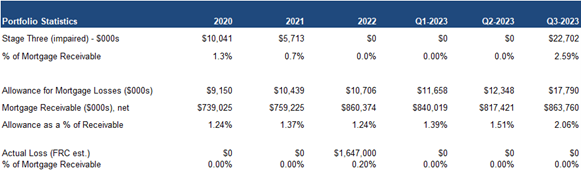

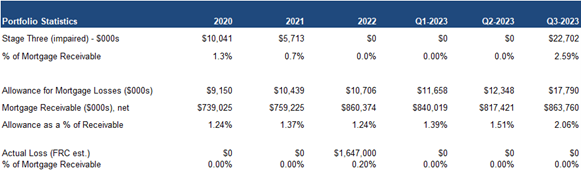

Property developers, and landlords, have been hit harder than individual homeowners due to high borrowing costs, low pre-sales, and dampened real estate activity. As a result, AI’s stage two and three mortgages (impaired) increased by 70% QoQ to $131M (15% of the portfolio). As a result of higher provisions, AI’s loan loss allowances (total reserves assigned for potential loan losses) increased to 2.1% of its portfolio, up 36% QoQ/86% YoY. In comparison, the Big Five banks increased their provisions by 150% YoY, leading to a 13% YoY increase in allowances. In the earnings call, AI’s management noted that that in the event of needing to foreclose on collateral assets, there would be ample equity remaining to enable AI to recover the vast majority of its invested capital. We find this realistic, given that AI has first priority on most of its mortgages, with a weighted average LTV of 61%.

With inflation subsiding, financial instability on the rise, mortgage costs increasing, unemployment climbing, and consumer confidence declining, we anticipate that the Bank of Canada will initiate rate cuts within the next six months. Last week, three of the Big Five slashed their mortgages rates by 20 bp on average.

Our 2023 dividend forecast of $1.16/share, reflects a yield of 11.25%. AI is the highest-yielding publicly traded MIC.

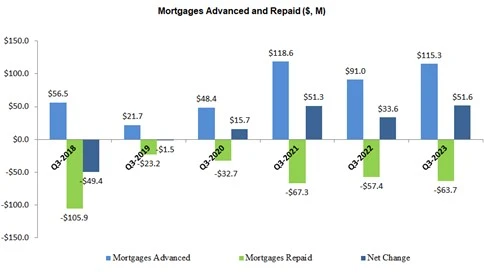

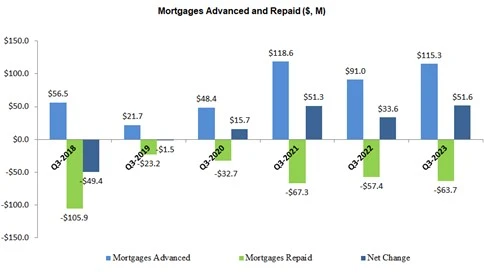

Loan advancements were up 27% YoY; repayments were up 11% YoY and Net mortgages outstanding were up 6% QoQ

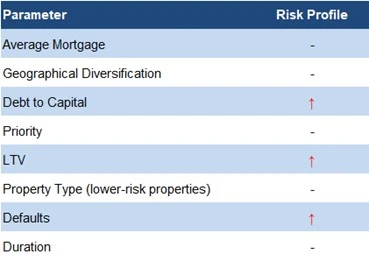

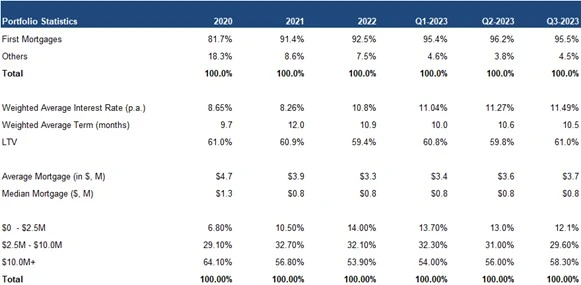

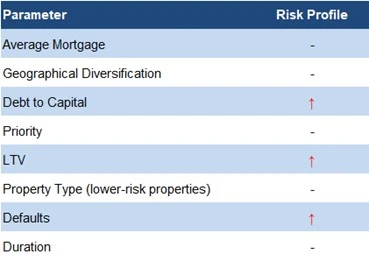

Exposure to first mortgages declined slightly, while the LTV increased, implying a moderate uptick in risk levels

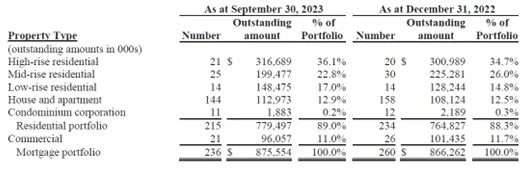

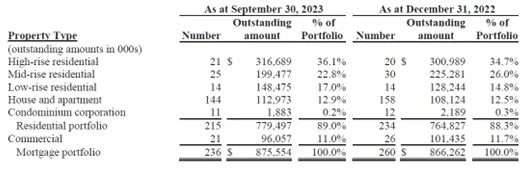

No material changes in exposure by property-type

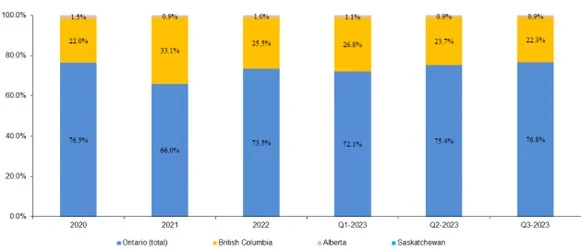

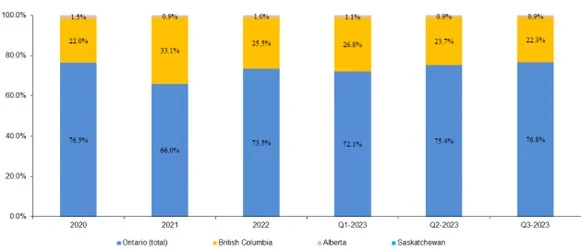

Increased exposure to ON

No realized losses

However, stage three (impaired) mortgages increased from nil at the end of Q2-2023, to $23M at the end of Q3-2023 (2.6% of portfolio)

As a result, loan loss allowances increased by 55 bps QoQ to 2.1% of the portfolio

We are doubling our total forecast for FY2023, and FY2024 loan loss provisions to $16M ($11M in 2023, and $5M in 2024)

In summary, we believe the portfolio’s risk profile has increased due to higher stage two/three mortgages

Q3 revenue was up 24% YoY, but net income was down 7% YoY, due to higher loan loss provisions

Revenue was 4% higher than our forecast, while EPS was 1% lower

Debt to capital increased by 2 pp amid increased lending, but remains within historic levels (40%-45%)

We are lowering our EPS forecasts to account for higher loan loss allowances

Our estimate for the 2024 dividend varies between $0.95 and $1.18/share, using various YoY increases in loan loss allowances

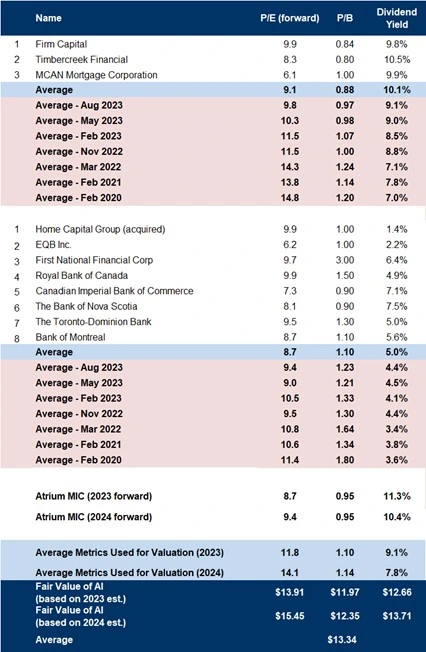

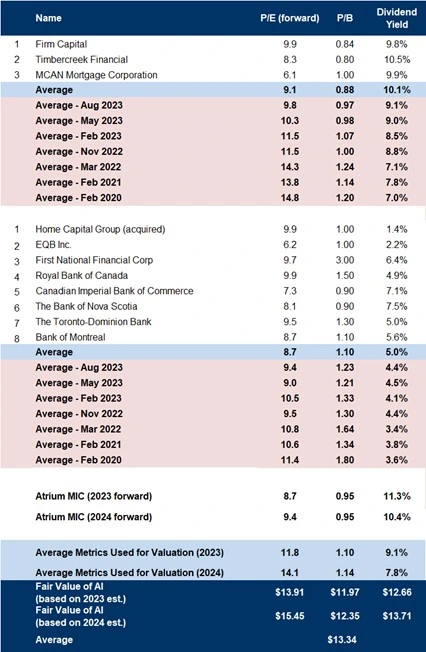

Sector multiples are down 9% since our previous report in August 2023, and 32% below pre-pandemic levels

Our fair value estimate decreased from $13.97 to $13.34/share due to lower sector multiples, and as we lowered our EPS forecasts

We are reiterating our BUY rating, and adjusting our fair value estimate from $13.97 to $13.34/share, implying a potential return of 40% (including dividends) in the next 12 months. Key risks include a softer mortgage origination market, and higher default rates. As we expect rates to start declining within the next six months, we anticipate an increase in appetite for high-yielding stocks, such as AI. We believe the current price level presents a narrow window to lock in an 11% yield.

Risks

- We believe the company is exposed to the following risks:

- Diversification – over 70% of Atrium's mortgages are secured by properties in ON

- Credit

- A downturn in the real estate sector may impact the company’s deal flow

- Timely deployment of capital is critical

- Investments in mortgages are typically affected by macroeconomic conditions, and local real estate markets

- Highly competitive sector

- Like most MICs, the company uses leverage to fund mortgages

- Default rates can rise during recession