Noram Lithium Corp.

High-Grade Resources Boost Confidence

Published: 7/2/2024

Author: FRC Analysts

Sector: Basic Materials | Industry: Other Industrial Metals & Mining

| Metrics | Value |

|---|---|

| Current Price | CAD $0.27 |

| Fair Value | CAD $2.07 |

| Risk | 5 |

| 52 Week Range | CAD $0.10-0.65 |

| Shares O/S (M) | 89 |

| Market Cap. (M) | CAD $24 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | 3.0 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

- Noram has completed an updated resource estimate on its Zeus lithium project in Nevada. The property is adjacent to Albermarle’s (NYSE: ALB) Silver Peak mine, the only lithium producer in the U.S.

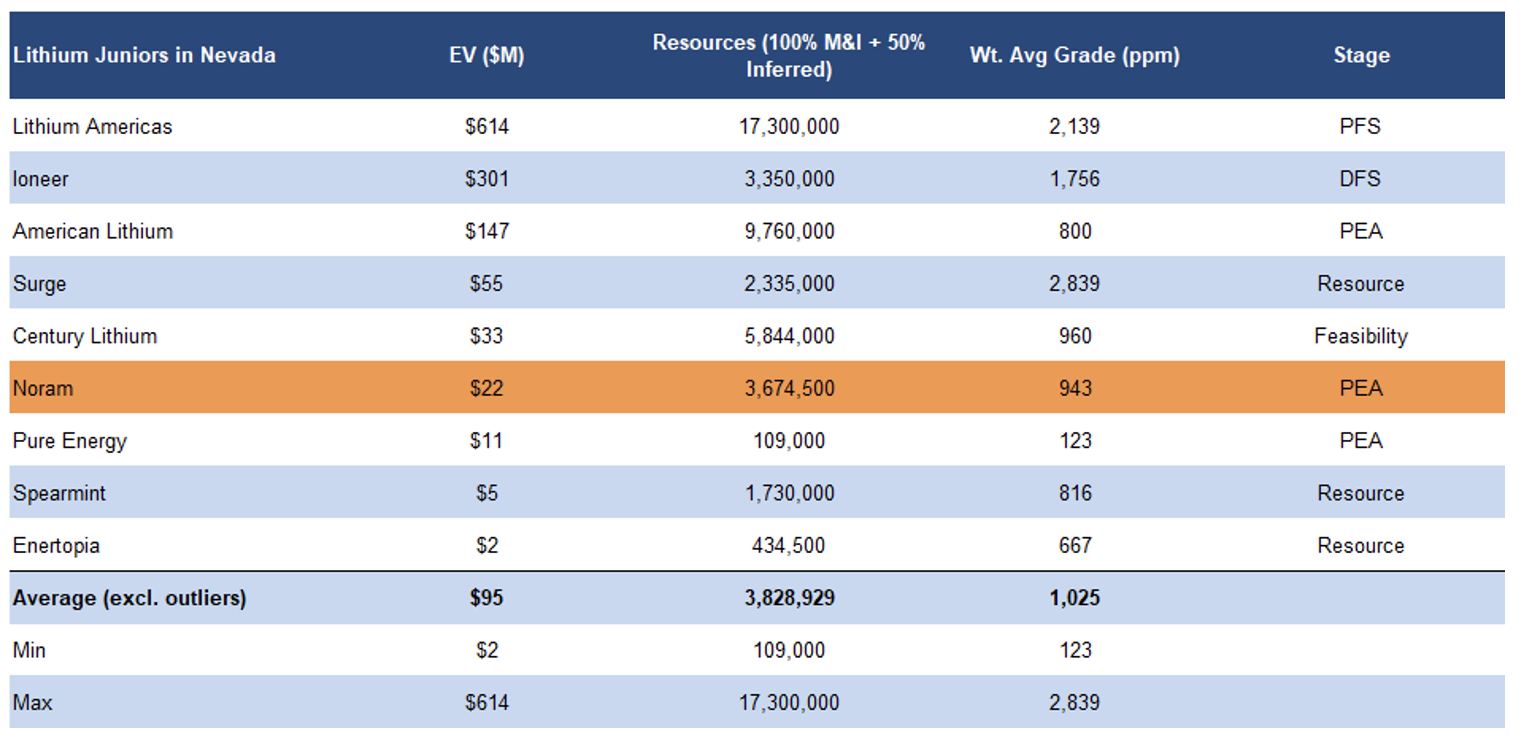

- The objective of the updated resource estimate was to improve upon previous data inputs, resulting in a more precise estimate, and delineating a high-grade portion for targeting in the initial years of operation. The revised estimate showed a 30% decrease in tonnage to 4.4 Mt LCE (lithium carbonate equivalent) at 927 ppm, mainly due to a higher cut-off grade of 525 ppm Li, up from 400 ppm previously. Despite the reduction in tonnage, we note that Zeus’ resources (both tonnage and grades) are comparable to other well-known large deposits in Nevada.

- A major highlight of the new estimate is the inclusion of a high-grade component totaling 1 Mt at 1,121 ppm. This portion alone has the potential for a mine life of over 40 years. Management aims to finalize a new mine plan, prioritizing the extraction of high-grade ores, before completing an updated Preliminary Economic Assessment (PEA) this year.

- A 2021 PEA had returned an AT-NPV8% of US$1.30B, and a high AT-IRR of 31%, using US$9.5k/t LCE vs the spot price of US$13 k/t. NRM is trading at just 1% of the AT-NPV, and stands out as one of the most undervalued lithium stocks.

- Lithium prices are down 65% YoY to US$13k/t vs the five-year average of US$21k/t. That said, we maintain a positive outlook on lithium stocks as we believe lithium prices have stabilized, and battery/EV manufacturers/miners are actively seeking stable/long-term supply sources.

- Upcoming catalysts include an updated PEA later this year, and positive sentiment towards juniors focused on EV metals.

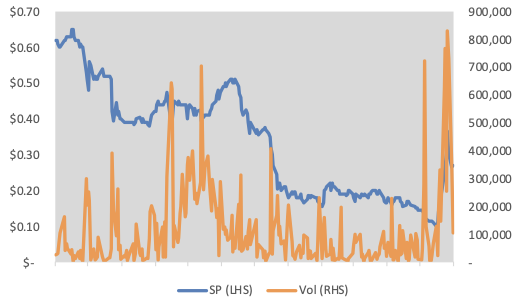

Price Performance (1-year)

*See important disclosures at the bottom of this report rating and risk definitions. All figures in C$ unless otherwise specified.

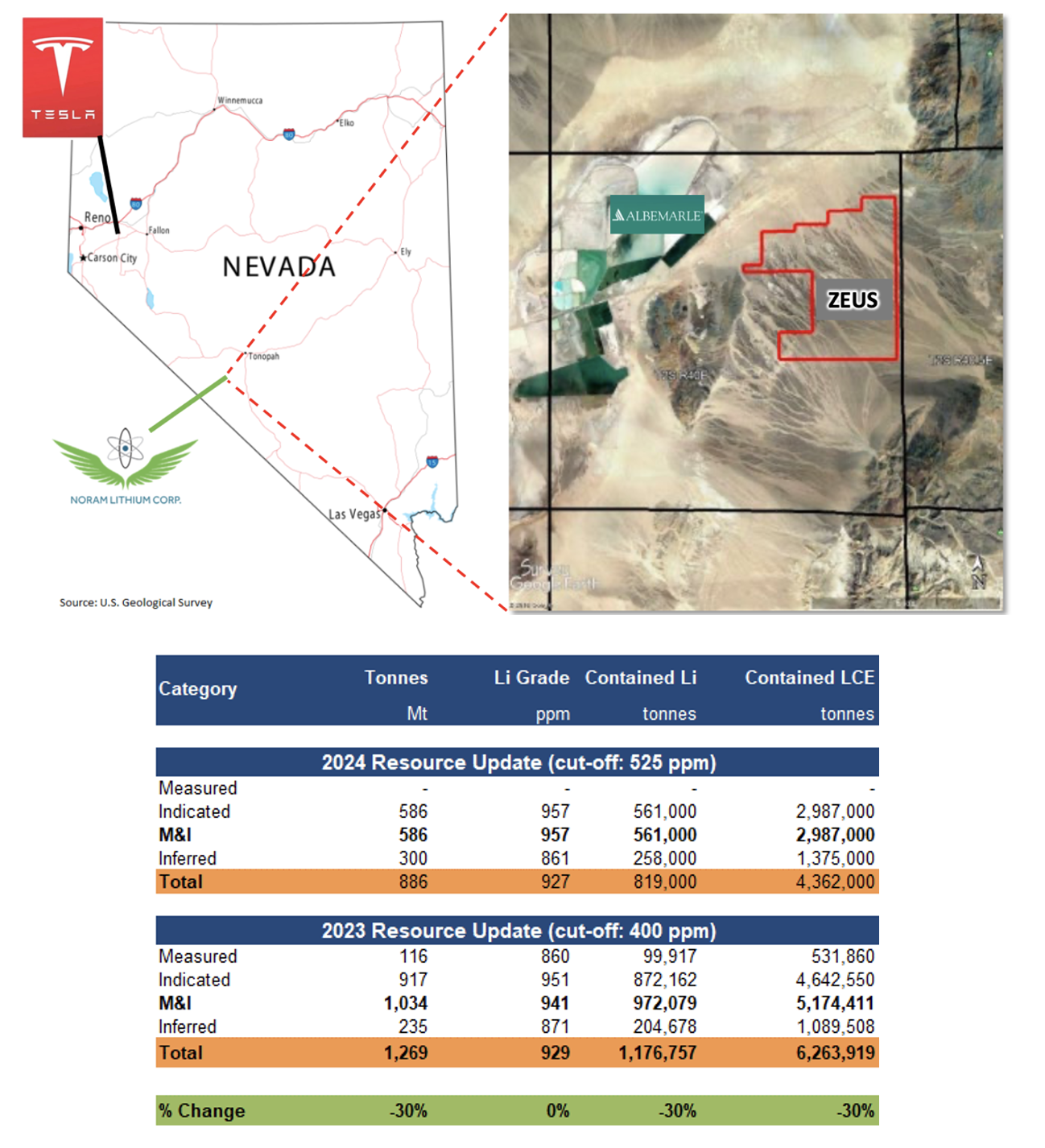

Location Map

Located 220 miles southeast of Reno, Nevada. Lies in the Clayton Valley, adjacent to Albermarle’s Silver Peak lithium brine operations. Excellent infrastructure in place, including power and paved road access

Source: Company/FRC/Various/S&P Capital IQ

Source: Company/FRC/Various/S&P Capital IQ

The updated resource estimate used a higher cut-off grade of 525 ppm Li vs 400 ppm previously

Source: Company/FRC/Various/S&P Capital IQ

Source: Company/FRC/Various/S&P Capital IQ

While tonnage decreased by 30% with no material changes in grades, confidence in the resource has significantly increased. This is attributed to the new pit-constrained approach, offering a more realistic view of economically recoverable resources compared to the previous unconstrained estimate

We note that Zeus’ resources and grade are comparable to other well-known adavanced projects in the region

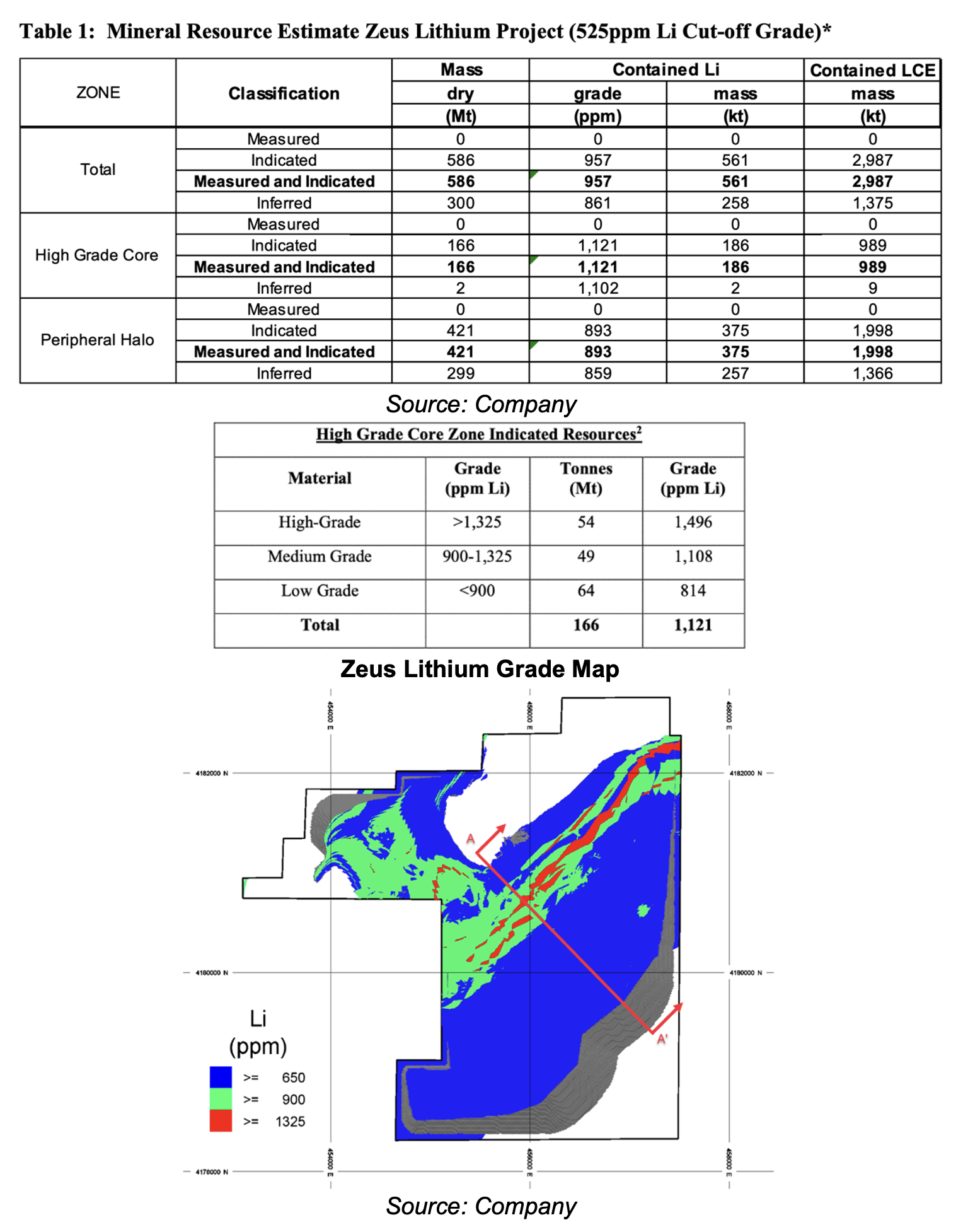

2024 Resource Estimate

A major highlight of the new estimate is the inclusion of a high-grade component totaling 1 Mt at 1,121 ppm. This portion alone has the potential for a mine life of over 40 years

Majority of its resources occur near the surface, implying potential for lower OPEX

Noram aims to finalize a new mine plan prioritizing the extraction of high-grade ores before completing an updated PEA this year. The study will focus on mining ultra high-grade materials (54 Mt at 1,496 ppm Li), supporting a projected 15-year mine life, with an annual production of 23 Ktpa of high-purity lithium carbonate.

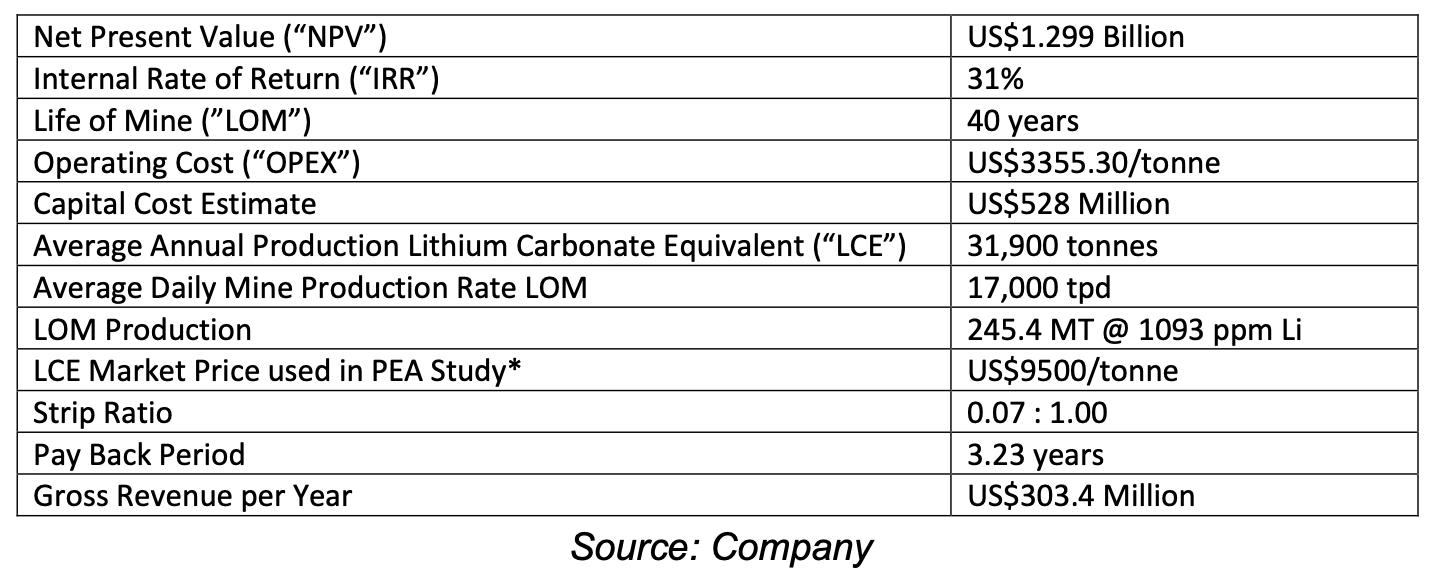

2021 PEA Highlights

Based on the high-grade mine plan, we believe the upcoming PEA should return stronger economics

The 2021 PEA had returned an AT-NPV8% of US$1.30B, and a high AT-IRR of 31%, using US$9.5k/t LCE vs the spot price of US$13 k/

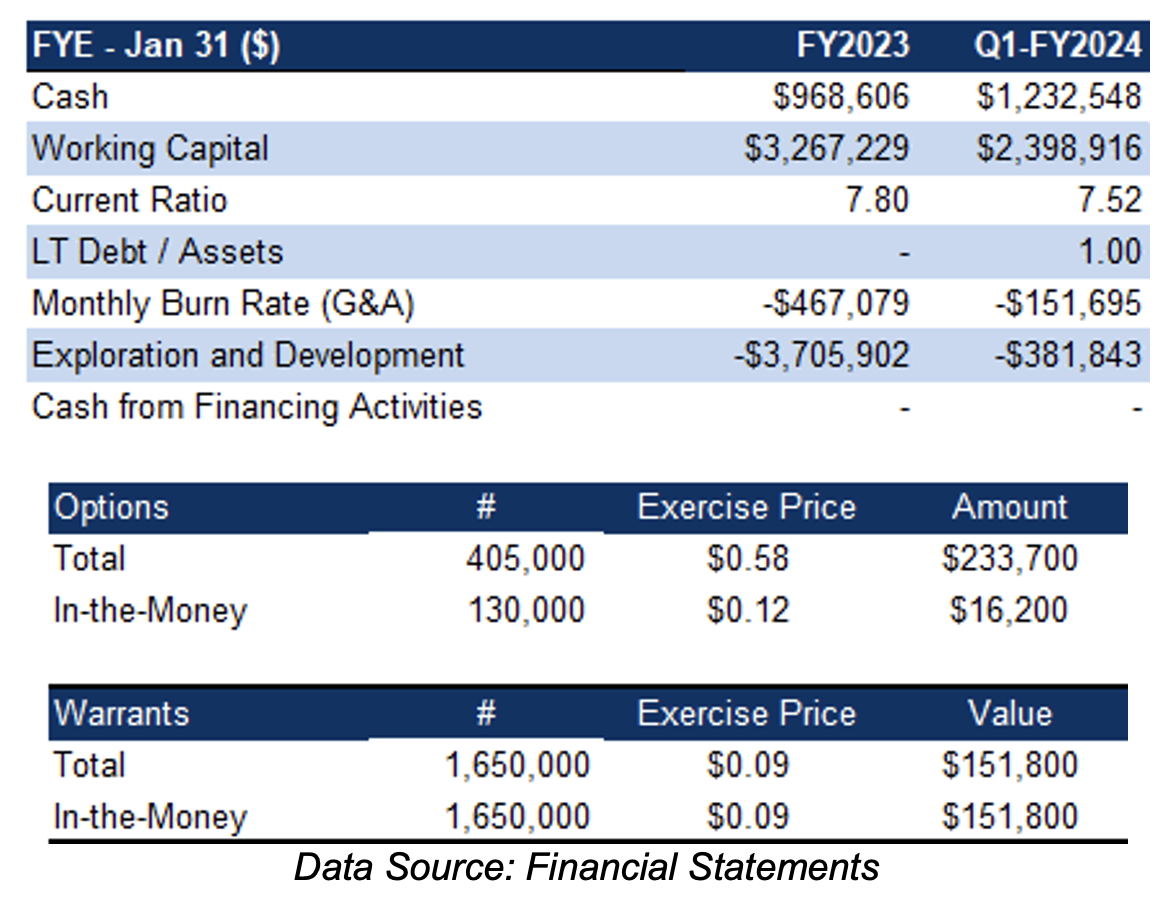

Financials

Healthy cash position, with no debt. NRM does not have to pursue any equity financings this year

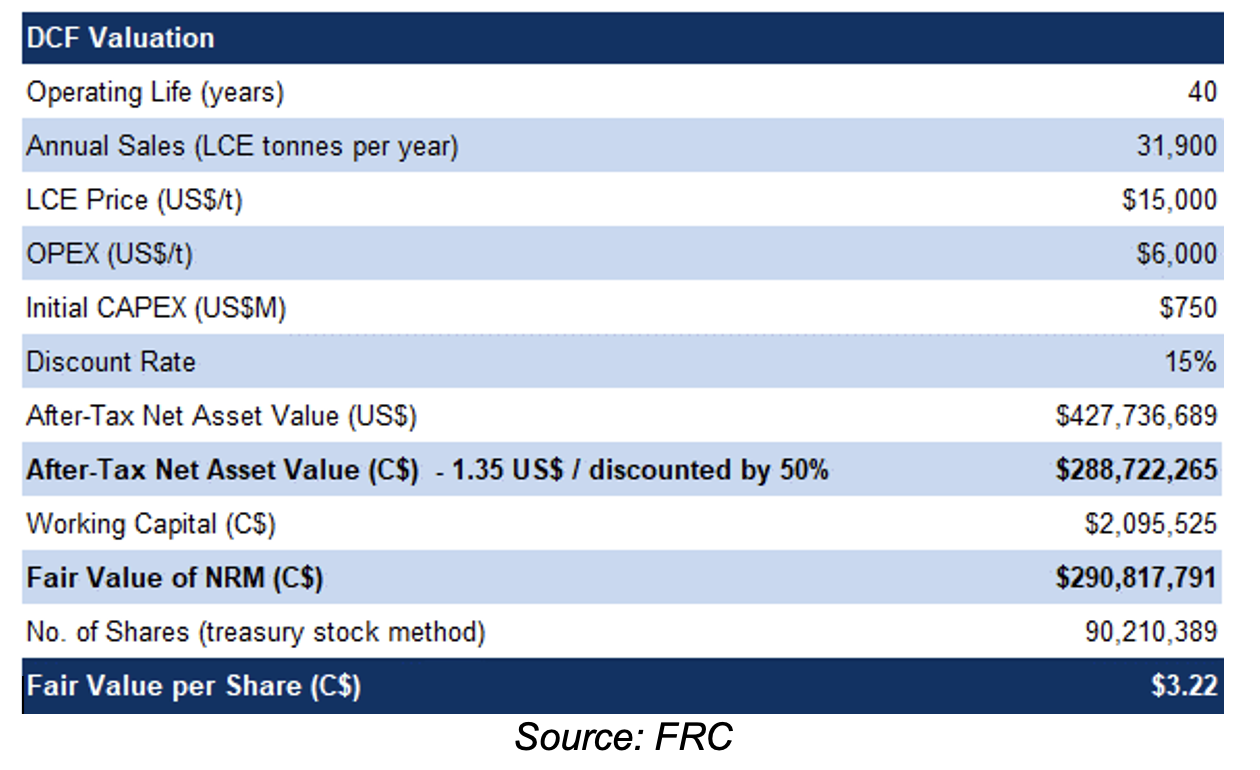

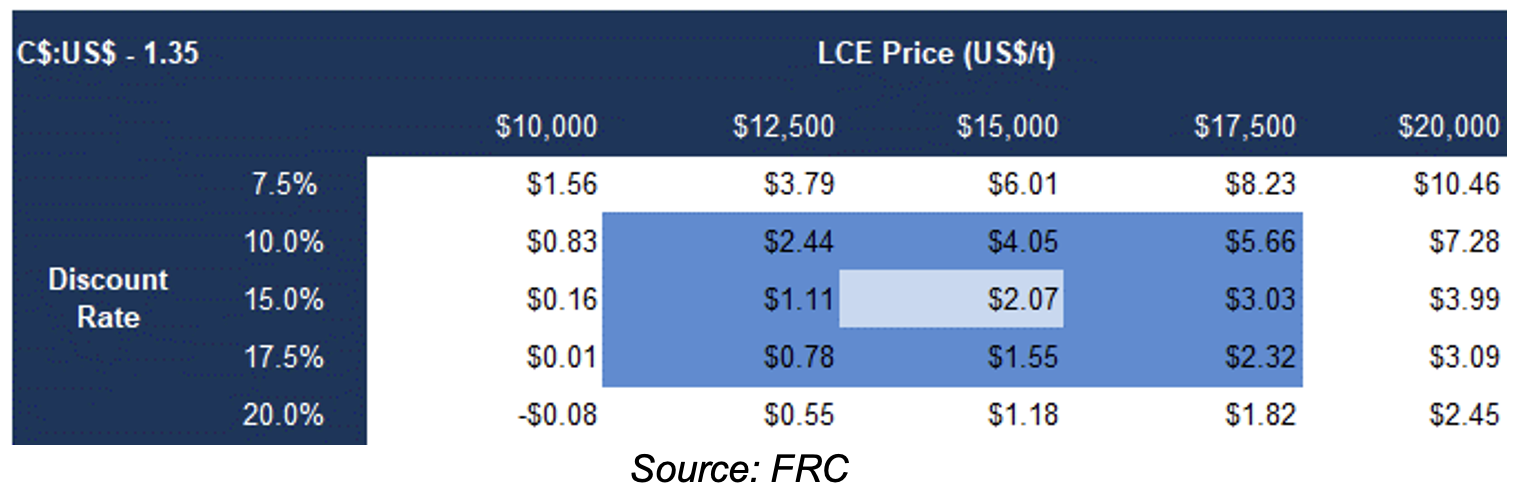

FRC DCF Valuation

Our DCF valuation increased from $2.93 to $3.22/share, driven by the new high-grade resource

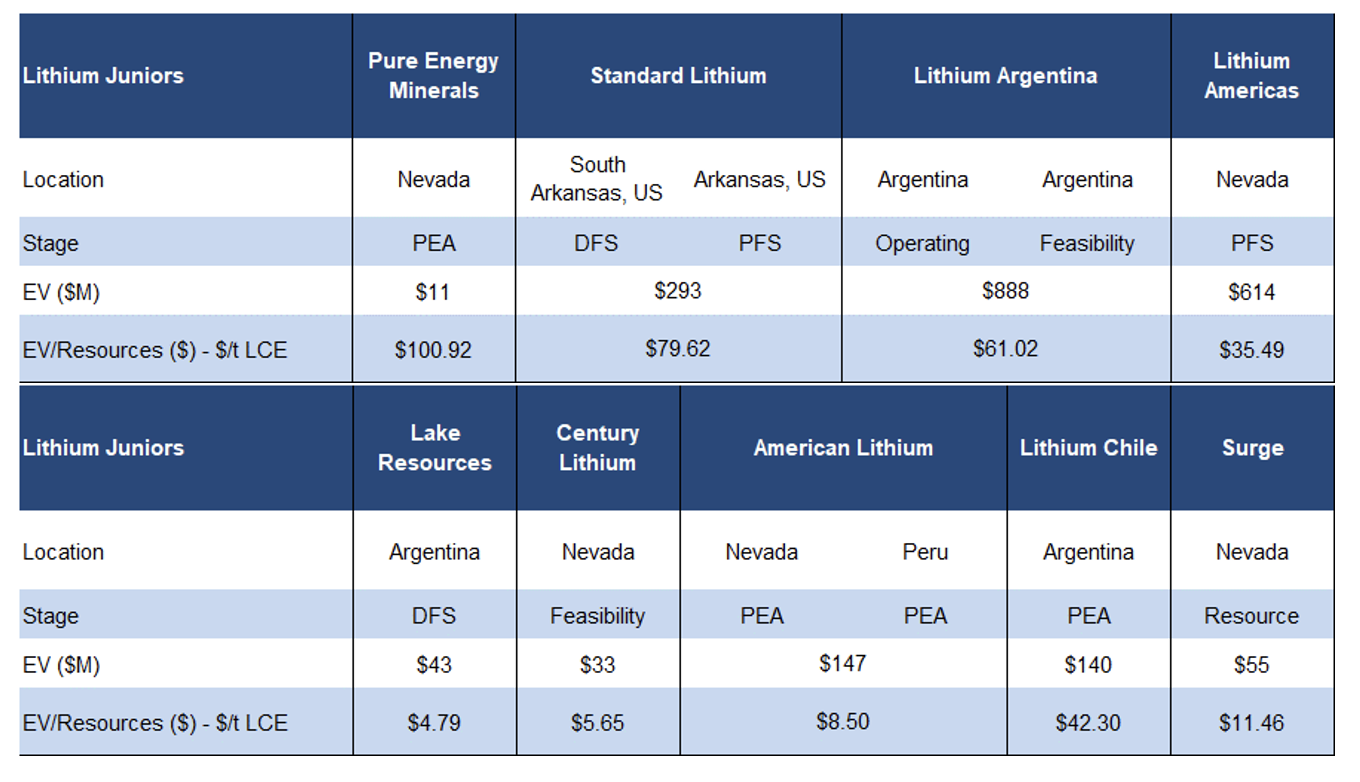

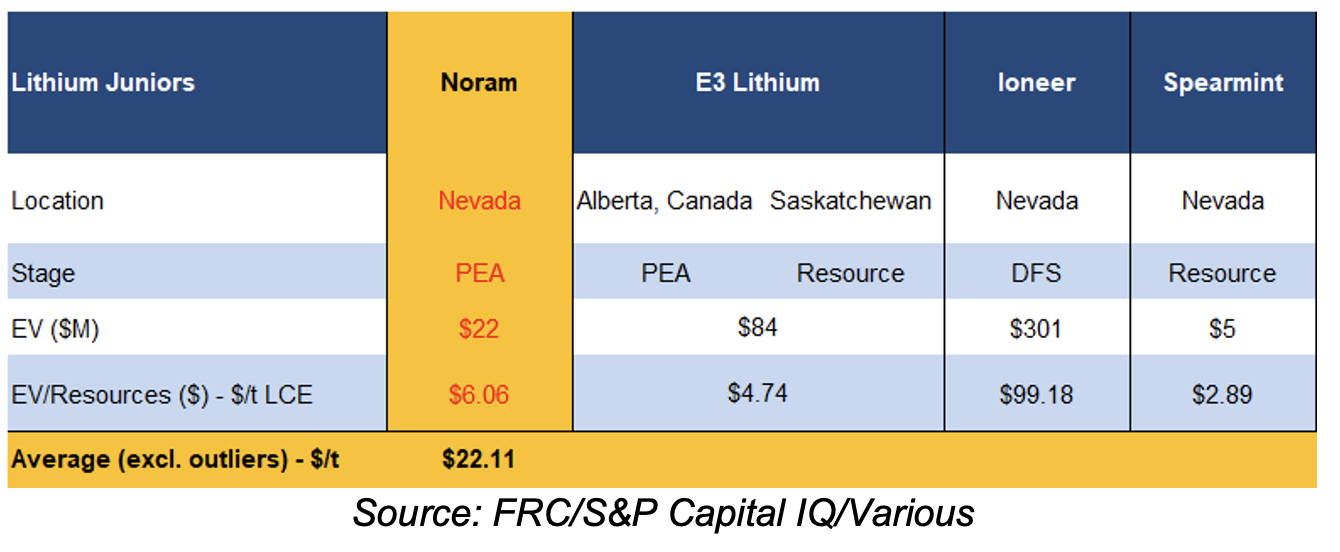

Comparables Valuation

NRM is trading at $6/t (previously $7.5/t) vs the sector average of $22/t (previously $32/t). By applying $22/t to NRM’s resources, we arrived at a revised comparables valuation of $0.92/share (previously $3.15/share

Our valuation is highly sensitive to lithium prices

We are reiterating our BUY rating, and adjusting our fair value estimate from $3.04 to $2.07/share (the average of our DCF and comparables valuations). Our valuation declined due to a steep reduction in comparable valautions. We believe the company's M&A prospects have improved significantly with the delineation of high-grade resources, which should enhance the project's economics.

Risks

Maintaining a risk rating of 5

We believe the company is exposed to the following key risks (not exhaustive):

- The value of the company is dependent on lithium prices

- Access to capital and share dilution

- Development

- Permitting

- Large projects are capital intensive