Tevogen Bio Holdings Inc.

Fast Tracking a Potential Breakthrough for Treating Viral Infections and Cancer

Published: 6/17/2024

Author: FRC Analysts

Sector: Healthcare | Industry: Biotechnology

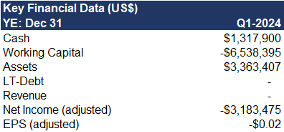

| Metrics | Value |

|---|---|

| Current Price | US $0.84 |

| Fair Value | US $4.2 |

| Risk | 5 |

| 52 Week Range | US $ |

| Shares O/S (M) | 166 |

| Market Cap. (M) | US $140 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | N/A |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

- TVGN, formed in 2020, and based out of New Jersey, is a biotech company that went public earlier this year through a reverse merger. The company has potentially developed a breakthrough technology for developing off-the-shelf/cost-effective therapeutics for viral infections, various cancers, and neurologic diseases such as multiple sclerosis.

- TVGN's patented technology harnesses the potency of cytotoxic T lymphocytes (CTLs), the body's natural defense against virus-infected and cancerous cells. We believe TVGN's approach has the potential to provide a more cost-effective and targeted treatment process compared to conventional options. The company’s CTLs are genetically unmodified and sourced from third-party donors, enabling their off-the-shelf use for prompt treatment. Extracts from a single donor could potentially treat hundreds of patients.

- In January 2023, the company completed a successful proof-of-concept trial of its flagship drug candidate for treating COVID-19 in high-risk and elderly patients. Contracting the virus can lead to rapid health decline in vulnerable groups, potentially forcing them to suspend critical treatments like cancer therapy. Therefore, early and swift treatment for COVID-19 is crucial for these patients.

- TVGN is also advancing pre-clinical studies for candidates in virology, oncology, and neurology.

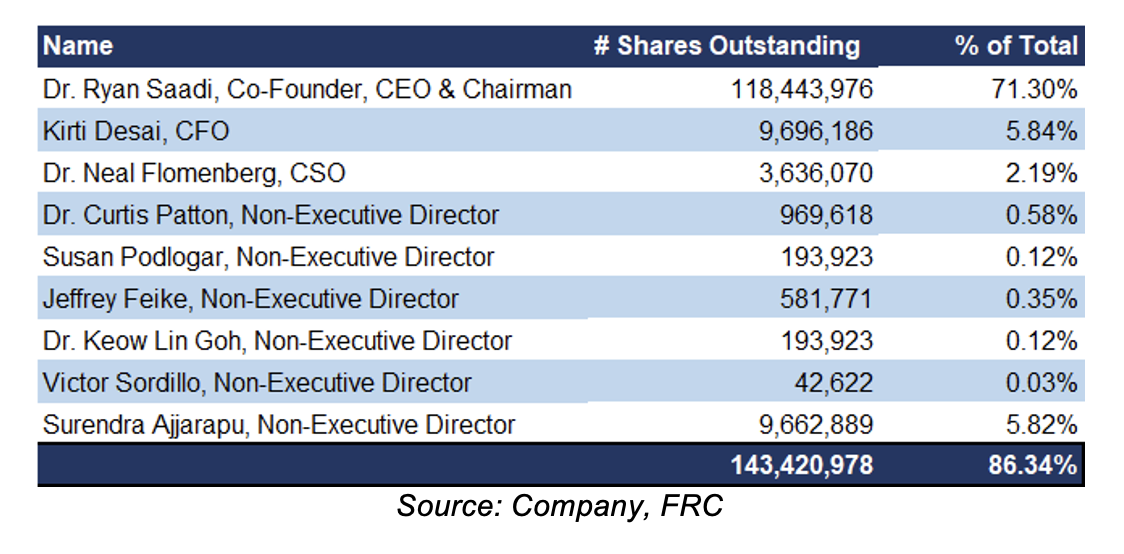

- Management and directors collectively own 86% of the outstanding shares; a tightly controlled ownership structure.

- We note that the exit strategy of most pharma/biotech companies is to get acquired by larger companies, upon completing promising clinical trials.

Risks

- Limited operating history

- In pre-revenue stage

- No guarantee that any of its drugs/therapies will be commercialized

- Potential for delays in clinical trials; unfavorable results

- Will need to pursue equity financings, implying potential for share dilution

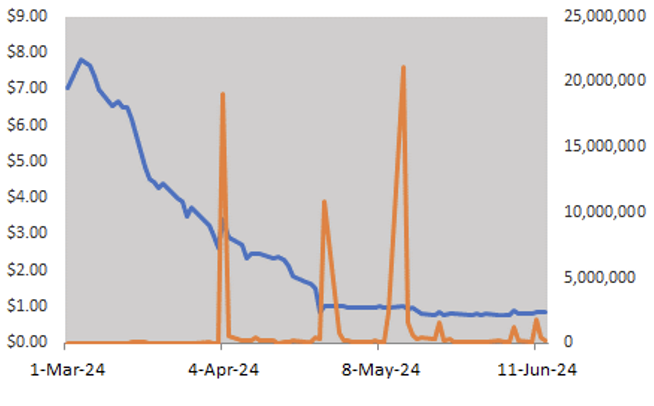

Price Performance (YTD)

*See important disclosures at the bottom of this report rating and risk definitions. All figures in C$ unless otherwise specified.

Company Overview

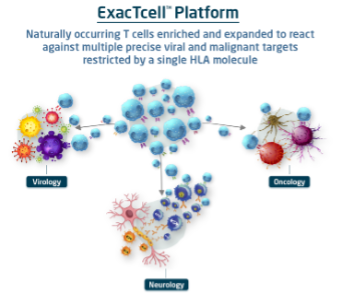

TVGN is a clinical-stage immunotherapy company powered by its proprietary ExacTcell technology platform. The company is aiming to be the first biotech company offering off-the-shelf/cost-effective cell therapies for viral infections, various cancers, and neurologic diseases. Cell therapy refers to placing new healthy cells into the body to replace or repair damaged tissues/cells.

Formed in 2020. Listed on the NASDAQ in 2024. Head quartered in New Jersey, with R&D offices in Philadelphia. 25+ employees

Source: Company

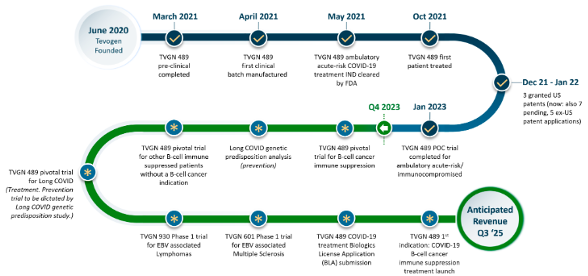

In Q1-2023, the company completed a successful proof-of-concept trial of its flagship drug candidate. Aiming to advance multiple trials targeting various indications simultaneously

Click here for additional disclaimers and information on the charts above.

Source: Company

ExacTcell: TVGN’s Proprietary T-Cell Technology Platform

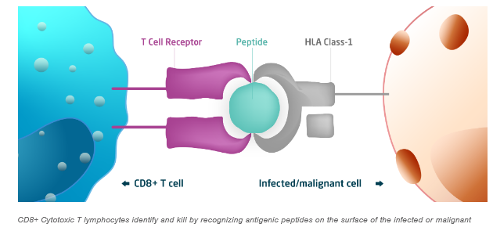

When the body is infected by a virus, its immune system deploys Cytotoxic T Lymphocytes (CTLs) to eliminate infected cells, allowing healthy cells to regenerate and facilitate healing.

Source: Company

Cytotoxic T Lymphocytes (CTLs) are also known as CD8+ T cells, or killer T cells

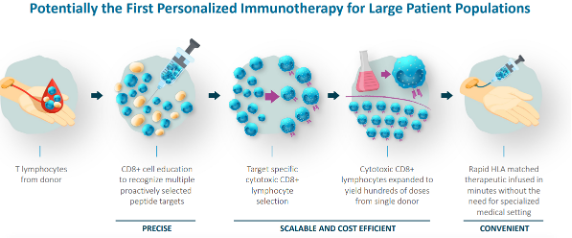

However, in patients with certain blood cancers, solid tumors, autoimmune diseases, and viral infections, killer T cells may be supressed, hindering their ability to fight back. TVGN harnesses the potency of natural CTLs while seeking to overcome their constraints. TVGN collects CTLs from healthy donors, expands them in a controlled laboratory environment, and purifies them for therapeutic use.

TVGN's concentrated CTLs, when injected in a patient’s body, target and destroy infected cells like natural CTLs.

Three granted patents, and eight pending patents, in the U.S. Extracts from a single donor could potentially treat hundreds of patients

Source: Company

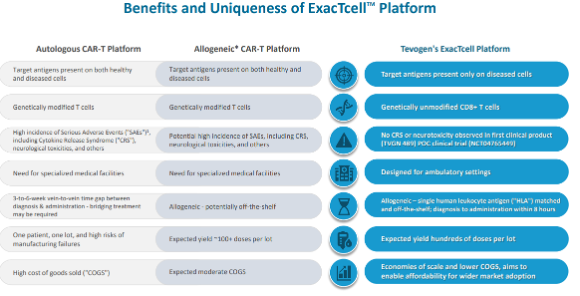

The following are a few key differentiators of TVGN's technology compared to existing treatment options.

- TVGN uses allogeneic T cells from healthy donors for a consistent and reliable supply. In contrast, most existing T cell therapies are autologous, relying on a patient's own cells. As TVGN’s CTLs are sourced from third-party donors, they can be used off-the-shelf for prompt treatment.

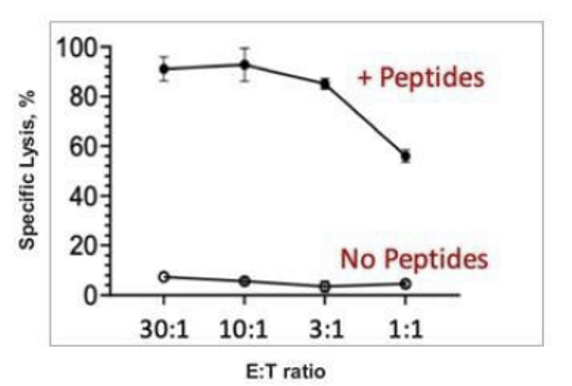

- Combating viral infections and cancer is challenging because infected cells can evade immune detection, hindering CTLs' ability to identify and eliminate them. TVGN’s concentrated CTLs are primed in the lab against specific peptide targets, enabling them to precisely identify and eliminate affected cells.

TVGN's technology has the potential for enabling off-the-shelf therapy, allowing for faster administration compared to conventional cell therapies that typically require weeks for manufacturing, and often involve pre-infusion chemotherapy

Source: Company

TVGN’s rapid treatment reduces morbidity, and treatment costs

Source: Company

TVGN's approach could be more precise and effective in eliminating cancer cells due to its utilization of a targeted group of potent CTLs

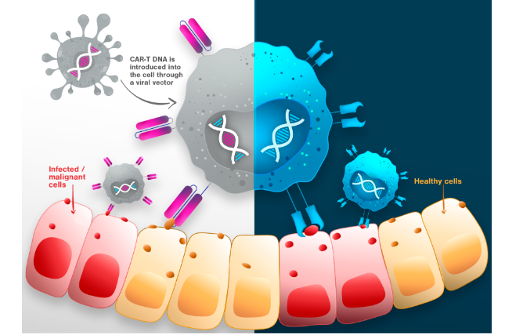

- Conventional T cell therapies often target healthy cells along with cancer cells. However, TVGN targets only infected or malignant cells, potentially reducing side effects and improving treatment safety.

- Unlike conventional T cell therapies, such as CAR-T, which requires genetic modification of T cells, TVGN offers a simpler approach, as its process uses genetically unmodified, naturally occurring T cells, potentially making manufacturing, and treatments faster/easier. Note that the FDA recently issued a warning regarding CAR-T cell therapies, highlighting concerns over the potential risk of developing secondary malignancies.

- TVGN leverages computer modeling/AI to analyze vast datasets, that identifies the most effective CTL candidates for targeted immune response.

- While conventional therapies/vaccinations target just one protein on a virus, TVGN targets multiple peptides, making it more effective against potential mutations.

TVGN has not disclosed its pricing, but we anticipate that it could be significantly lower than that of conventional T cell therapies ($350-$400k) due to its simpler manufacturing process

Source: Company

We project that TVGN's treatment could be priced competitively with conventional anti-viral therapies, typically ranging from $80k to $100k

TVGN’s First Clinical Drug Candidate: TVGN-489

In January 2023, TVGN completed a phase one trial of TVGN-489 for treating COVID-19 in high-risk and elderly patients.

Over 80% of deaths from COVID-19 have been in people over the age of 60. COVID-19 remains a threat for immunocompromised individuals, and high-risk elderly patients. Contracting the virus can lead to rapid health decline in these vulnerable groups, potentially forcing them to suspend critical treatments like cancer therapy. Therefore, early and swift access to treatment is crucial for these patients.

Completed a successful phase one trial in January 2023

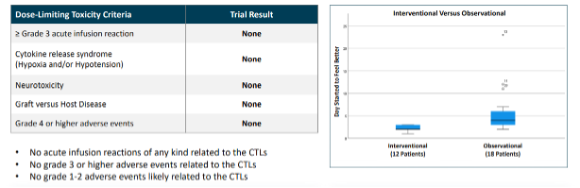

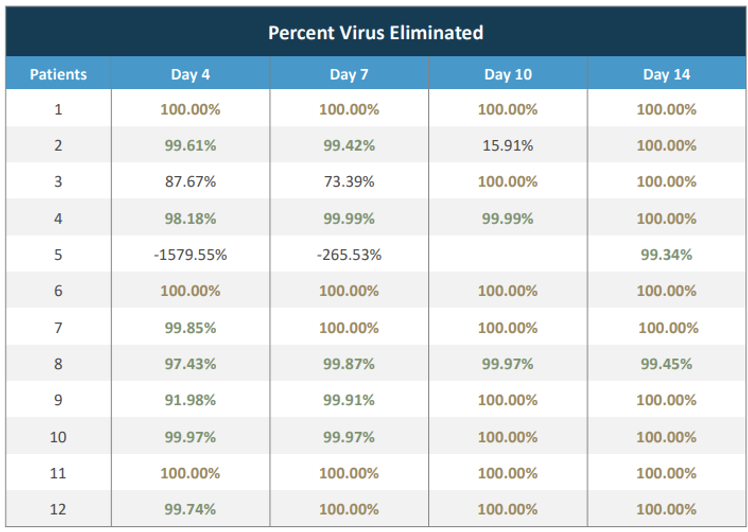

TVGN’s trial, involving 30 patients (12 received the intervention, while 18 served as controls), was conducted at Thomas Jefferson University Hospital in Philadelphia. Results indicated safety and potential effectiveness in managing acute COVID-19. None of the patients in the trial developed Long COVID during the follow-up period. Note that symptoms of Long COVID can persist for months or even years. While treatments exist to manage certain symptoms, there is currently no cure for this condition.

Key Highlights of the Phase One Trial

Source: Company

1. No dose-limiting toxicities or treatment-related material adverse events were observed among patients

2.All patients showed improvement in symptoms

3.Patients regained baseline health within 14 days post-treatment, contrasting with slower and less consistent improvement in those who received standard care

4. None of the patients developed Long COVID during the follow-up period of six months

Source: Company

Preclinical studies demonstrated that TVGN-489 exclusively targets infected cells, sparing healthy cells.

Upcoming Tests/Catalysts

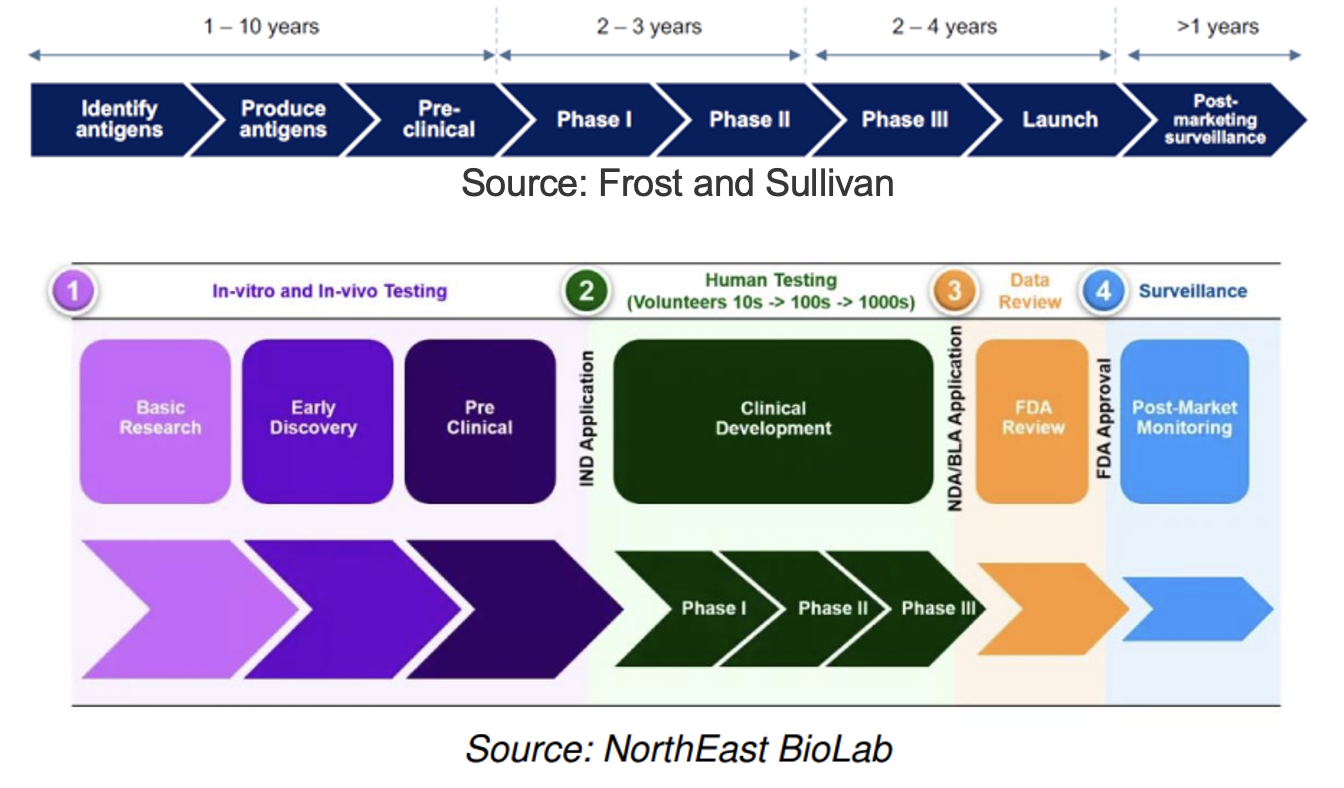

Drug Development Pathway

The typical timeframe from phase I to approval is five to 10 years, costing $200M to $1B+

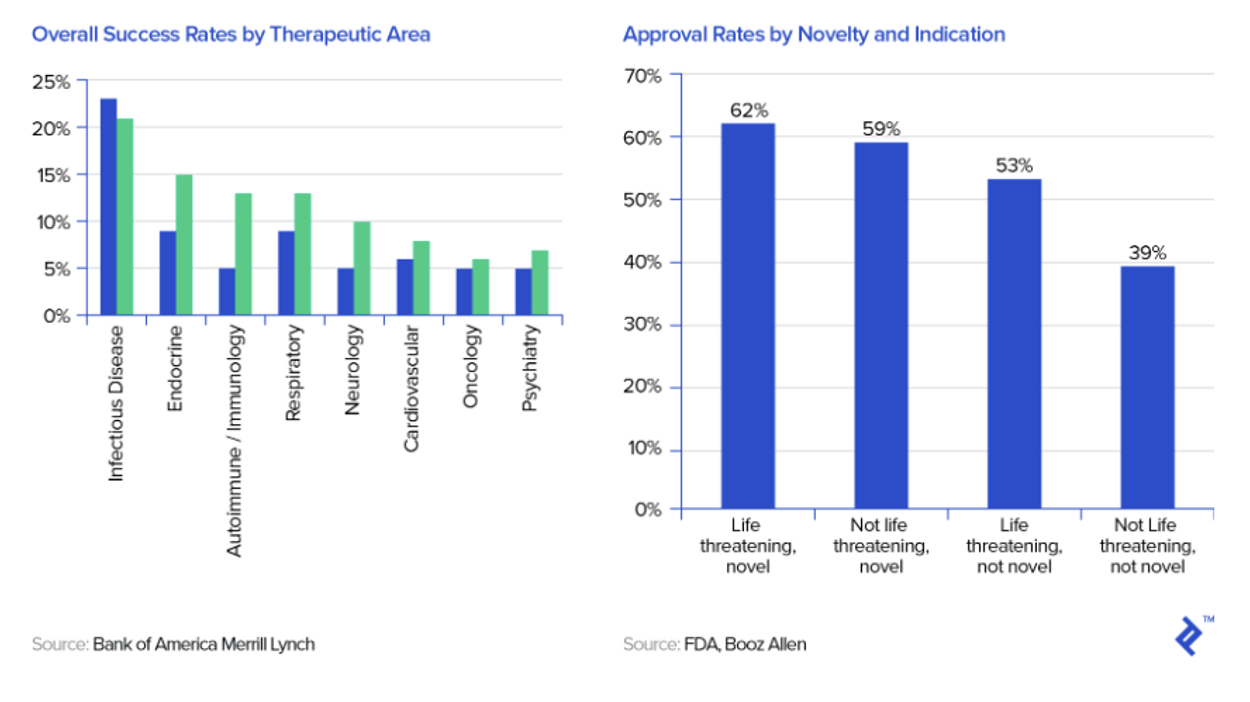

Historically, 75% of drug candidates have moved from phase I to II, 50% from II to III, 59% from III to approval, and 88% of those have received final approval (Source: National Library of Medicine), implying that 19% of candidates have advanced from phase I to approval.

Multiple upcoming catalysts. Management has yet to disclose their capital budget for 2024

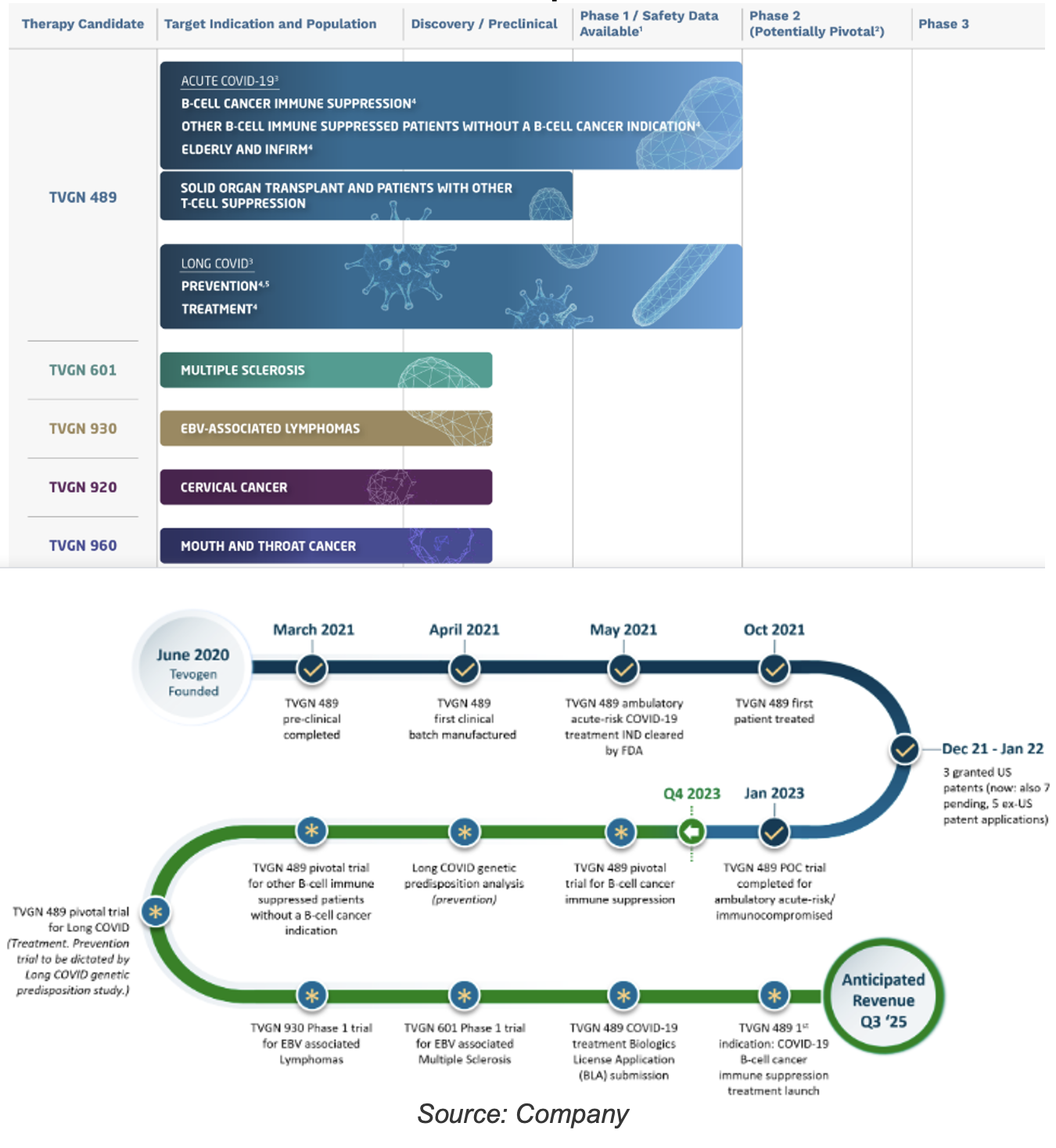

TVGN’s upcoming tests/catalysts are summarized below:

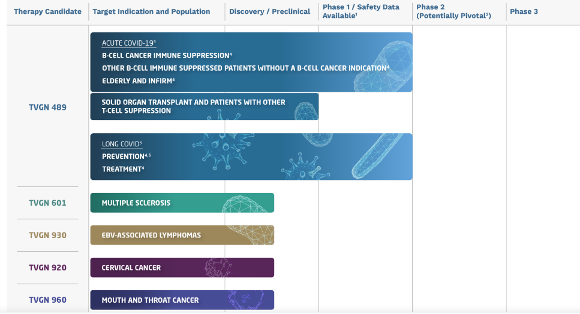

- TVGN is planning genetic studies to explore links between an individual’s genes and their risk of developing Long COVID, as part of its preclinical development efforts for treatment and prevention. Upon obtaining regulatory approvals, TVGN intends to initiate these studies in the coming months, with an anticipated completion timeline of one year.

- TVGN is also preparing for clinical trials to treat COVID-19 patients with B cell malignancies, including cancers like lymphoma.

- Advance pre-clinical studies for candidates in virology, oncology, and neurology

- Develop manufacturing capabilities by acquiring existing facilities or collaborating with third-party facilities.

- Form strategic alliances with other biopharmaceutical companies to advance one or more of its drug candidates

- Explore ways to deploy AI to select peptide candidates, and expedite product development

Product Pipeline

Advancing multiple candidates simultaneously. TVGN has spent $25M on product development to date

The company is prioritizing commercialization of its lead candidate, TVGN-489. In our discussions with management, they have not finalized a specific strategy yet, but they are actively exploring several options to expedite the process. This includes traditional clinical trials, as well as faster/cheaper alternatives like Emergency Use Authorization or compassionate use programs, which could potentially lead to commercialization in under three years. Management has indicated that they will inform the market when a go-forward strategy is finalized.

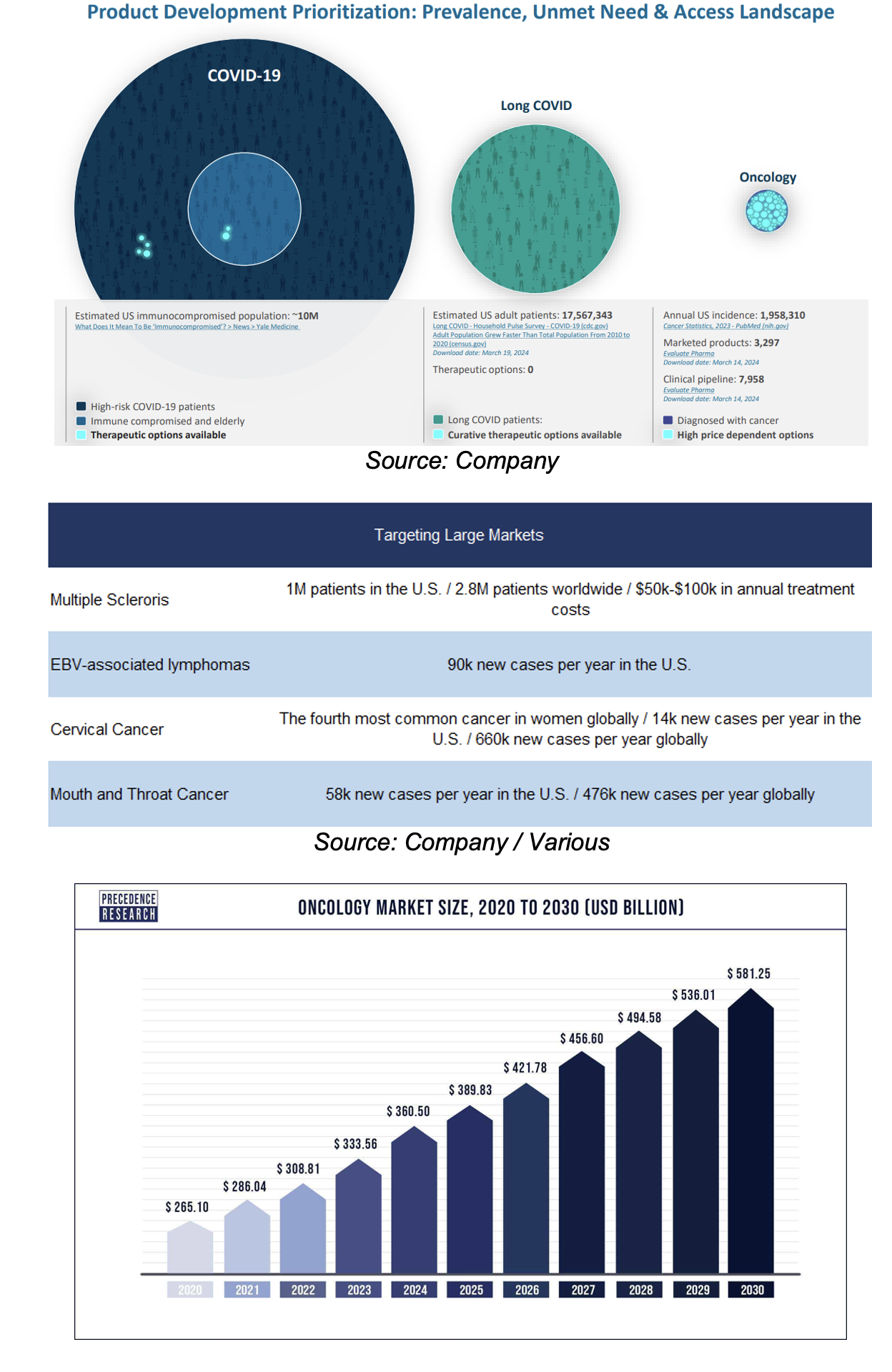

Target Markets

TVGN is targeting large markets

With 10M immuno-compromised patients in the U.S., we believe capturing just 0.1% of this market could yield $1B in revenue, based on a treatment price of $100k

It is estimated that the global oncology market will grow from $286B in 2021, to $581B by 2030, implying a CAGR of 8%

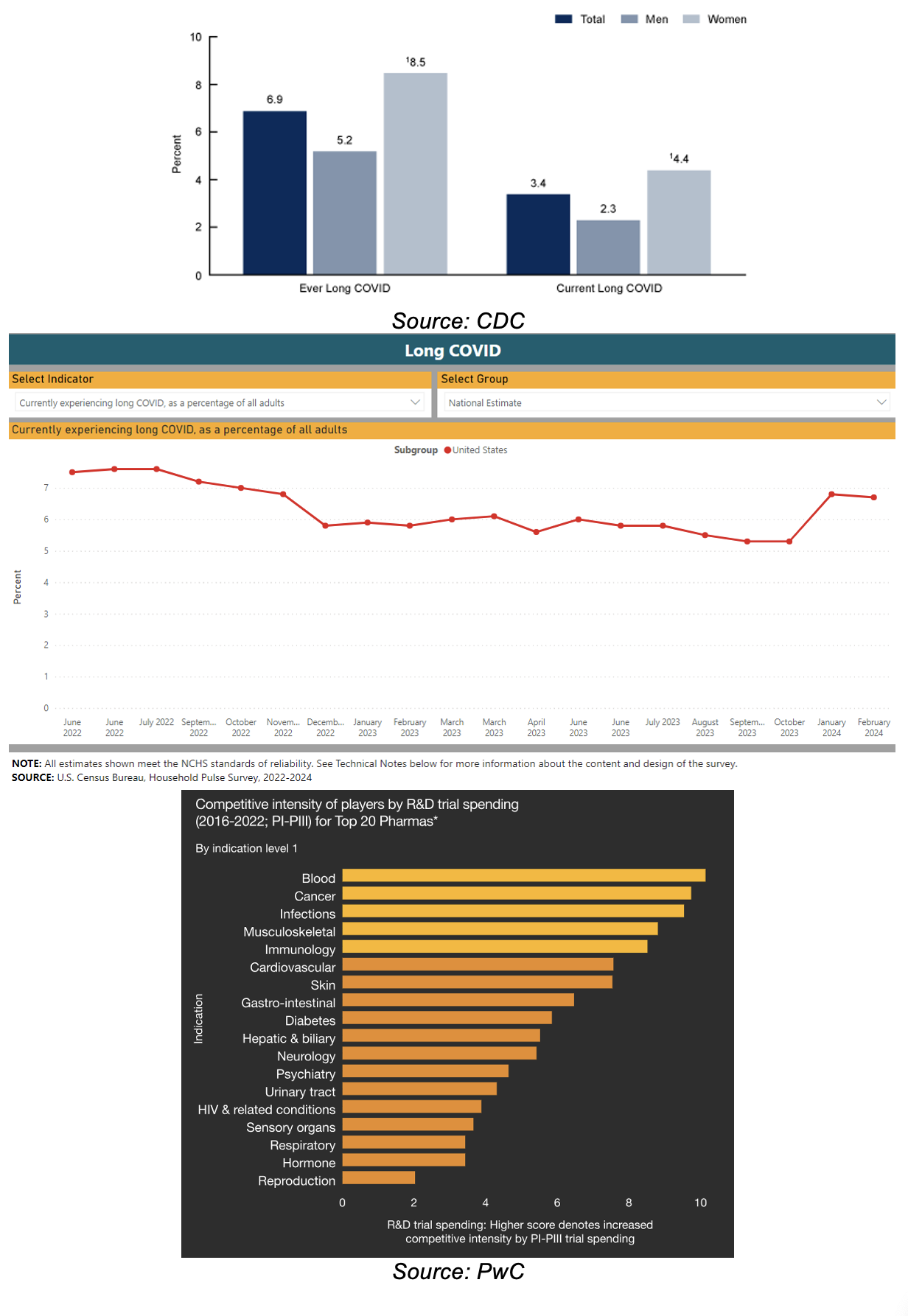

At the end of 2023, 17.6M, or 6.8% of American adults were experiencing long Covid symptoms

TVGN’s primary target market are among the top three areas for R&D spending by big pharmas

Source: Toptal

TVGN’s target markets (infectious/life-threatening diseases) have relatively high approval rates

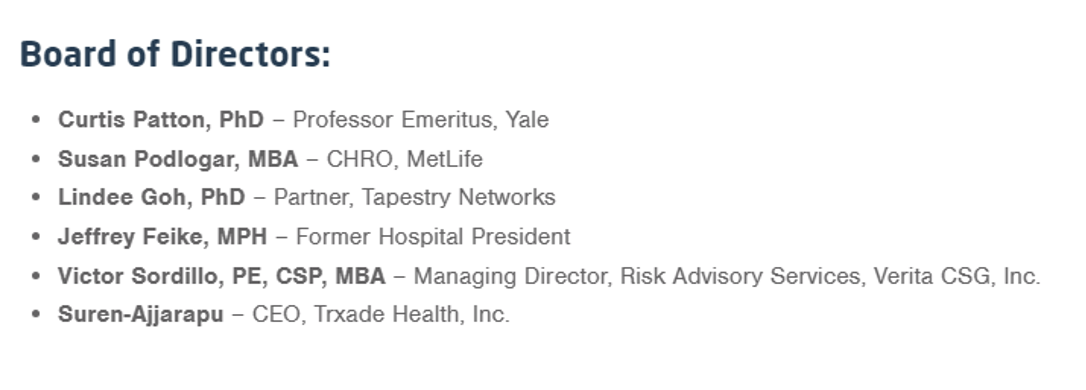

Management and Board

TVGN was founded by its CEO, Dr. Ryan Saadi, who is also the largest shareholder, owning 71% of the outstanding shares

Brief biographies of the management team, as provided by the company, follow:

Dr. Ryan Saadi – CEO and Chairperson

Dr. Saadi has been a member of the Leadership Council of the Yale School of Public Health since 2021. Prior to founding Tevogen Bio, Dr. Saadi was the Global Vice President of Evidence, Market Access, and Strategic Pricing for CSL Behring, a biopharmaceutical company that manufactures plasma-derived and recombination therapeutic products, from September 2018 to October 2019. Dr. Saadi served as Global Head, Market Access and Policy, Oncology for Janssen from 2012 to September 2018, and Worldwide Vice President, Health Policy, Reimbursement, Strategic Pricing and Market Access for Johnson & Johnson’s Cordis business from 2008 to 2012. Dr. Saadi was Global Vice President, Health Outcomes & Pricing for Genzyme, and Global Head, Health Outcomes and Market Access for Sanofi-Aventis’ oncology, bone and arthritis product portfolio.

Kirti Desai – CFO

Mr. Desai previously served as President of Star Accounting Services Inc., an accounting firm providing accounting and tax services to businesses and individuals, from January 2005 to December 2021. Mr. Desai is a certified public accountant.

Dr. Neal Flomenberg – CSO

Prior to joining Tevogen Bio, Dr. Flomenberg served as professor and Chair of the Department of Medical Oncology at Sidney Kimmel Medical College of Thomas Jefferson University from 2008 to July 2022, and Deputy Director of Thomas Jefferson University’s Sidney Kimmel Cancer Center from 2015 to July 2022. Prior to those positions, Dr. Flomenberg held a number of leadership roles in the academia, hospital, and research settings. Dr. Flomenberg’s career has focused on blood cancers, particularly those requiring bone marrow or peripheral blood stem cell transplants, and he has authored over 175 peer reviewed publications. At Jefferson, Dr. Flomenberg also maintained an active medical practice and was continually listed in Philadelphia Magazine’s “Top Doctors in Philadelphia” for more than 15 years prior to joining Tevogen Bio.

Sadiq Khan – CCO

Previously, Mr. Khan held several roles at the New Jersey Institute of Technology from 2014 to March 2022. Mr. Khan served as Senior Director and then Executive Director of Operations & Business Planning at BioCentriq, a for-profit cell and gene therapy contract development and manufacturing organization owned by New Jersey Innovation Institute, which was itself a non-profit subsidiary of NJIT, from September 2018 to March 2022. While at BioCentriq, Mr. Khan was part of the leadership team that prepared BioCentriq for its spin-off from NJII. Mr. Khan held several roles at NJII from 2014 to February 2020, including Director of Business Development, Biopharma Innovation beginning in 2018, where he worked to facilitate academic, government, and industry collaboration in the biopharmaceutical field. From 2008 to March 2018, Mr. Khan also acted as Founder and Chief Strategist for Pharmique Health LLC, where he advised corporations on strategic commercial planning and other matters. Mr. Khan has also held various roles at Hoechst Marion Roussel, Aventis, and Sanofi-Aventis

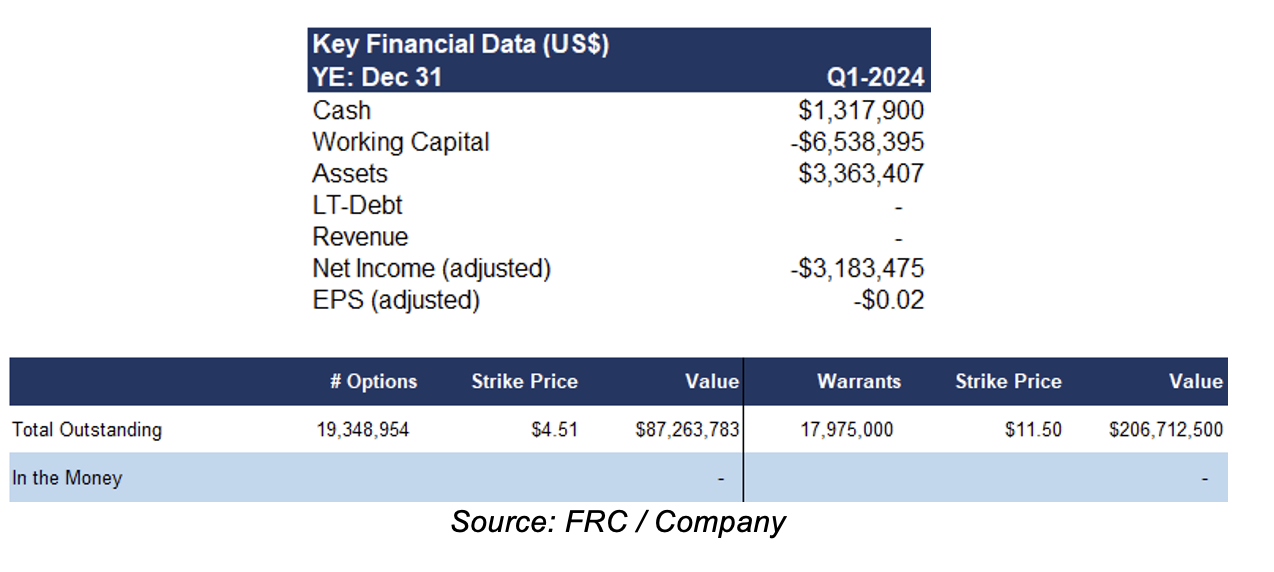

Financials

In pre-revenue stage. Current monthly burn rate : $750k-$1M. Subsequent to Q1-2024, TVGN secured a $36M line of credit, and $14M in equity financing, from an existing investor, with interest paid in shares

FRC Projections and Valuation

In 2023, the 10 largest biopharma M&A deals totaled $116B globally, up from $65B in 2022, and $53B in 2021 (Source: Fierce Pharma). The following table lists several established oncology drugs, and their annual revenue.

Established oncology (cancer) drug manufacturers can earn annual revenue ranging from hundreds of millions to billions of dollars

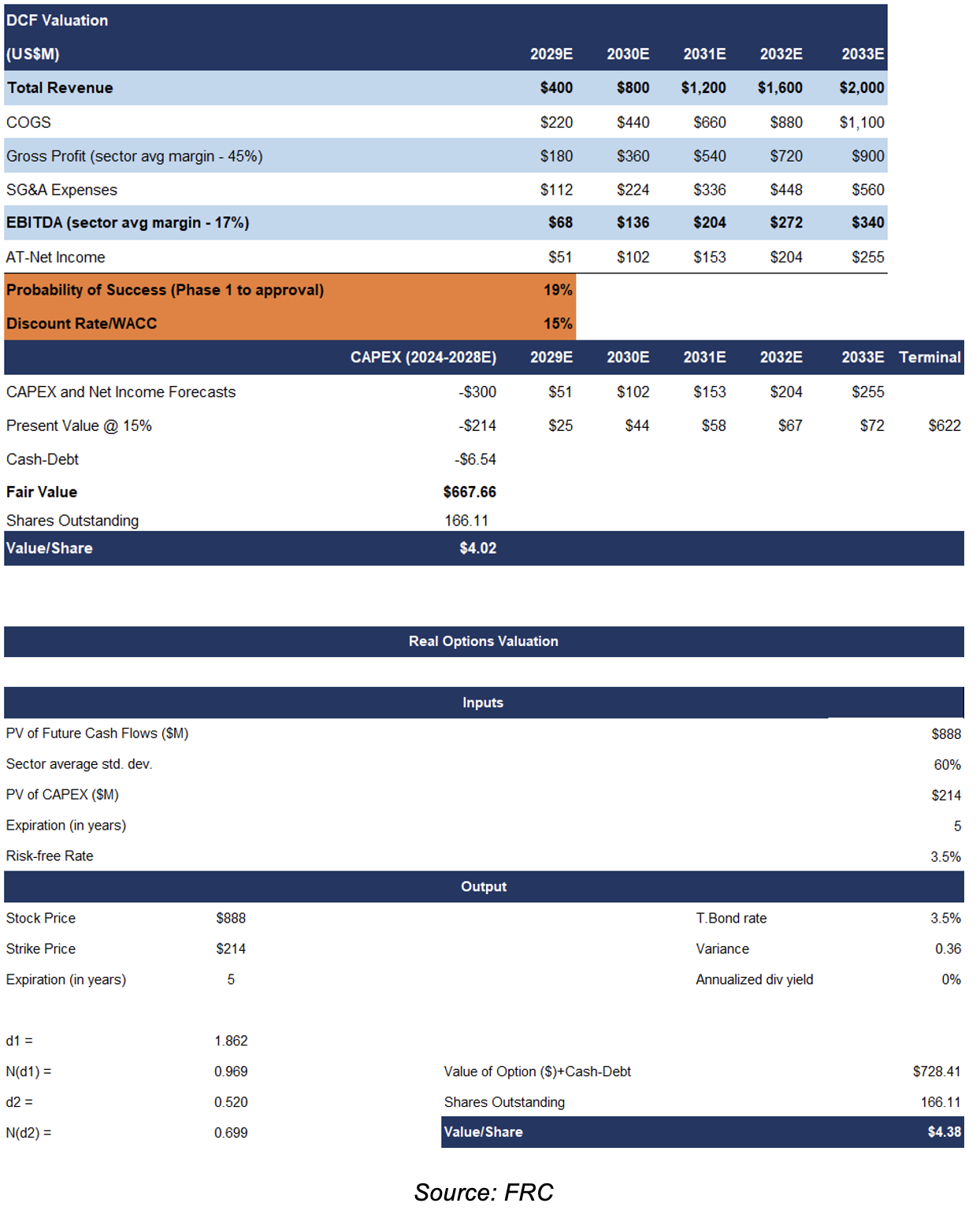

We arrived at a DCF valuation of $4.02/share on TVGN. Modelling $300M in CAPEX for advancing TVGN’s therapy towards commercialization

Our real options valuation is $4.38/share

We believe the real options valuation model is a good technique to value development-stage biotech companies, as the model takes into account management’s ability to pursue / abandon / delay drug development

Key assumptions:

- Despite the potential for expedited commercialization through Emergency Use Authorization or compassionate use programs, for conservative valuation purposes, we anticipate the company will advance product development through traditional clinical trials.

- Our models are based on the assumption that TVGN’s therapy will capture 0.2% of the immunocompromised market, implying $2B in annual revenue by 2033.

- We are applying a probability of success of 19%, which is in line with the sector average success rate.

- We are using a relatively high discount rate of 15%; we typically use 10%-15% for valuing pre-revenue companies

We are initiating coverage with a BUY rating, and a fair value estimate of $4.20 per share (the average of our DCF and real options valuations). The exit strategy of most pharma/biotech companies is to get acquired by larger companies, upon completing promising clinical trials. A key upcoming catalyst includes TVGN's inclusion in the Russell 3000 index next month.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- Limited operating history

- In pre-revenue stage

- No guarantee that any of its drugs will be commercialized

- Potential for delays in clinical trials; unfavorable results

- Will need to pursue equity financings, implying potential for share dilution

As with all R&D stage biotech companies, we are assigning a risk rating of 5 (Highly Speculative)