We Anticipate BHP Boosting Its Bid for BHP by Up to 11% / Potash Junior's Strong PEA

Published: 4/29/2024

Author: FRC Analysts

Key Highlights

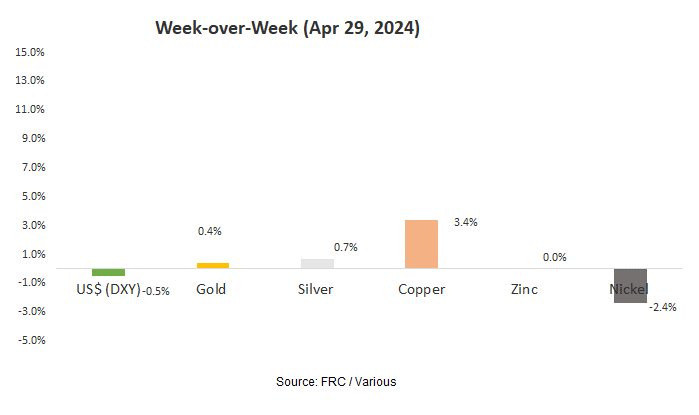

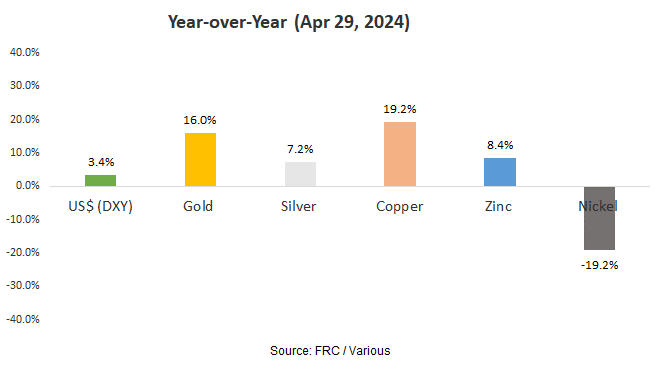

- Last week, equities and metal prices strengthened amid a weaker US$

- Anglo American (LSE: AAL) rejects BHP Group’s (ASX: BHP) US$39B offer; we believe BHP could increase its offer by up to 11%

- A potash junior under coverage has reported a robust Preliminary Economic Assessment/PEA

- Shares of a gold miner under coverage were up 40% WoW

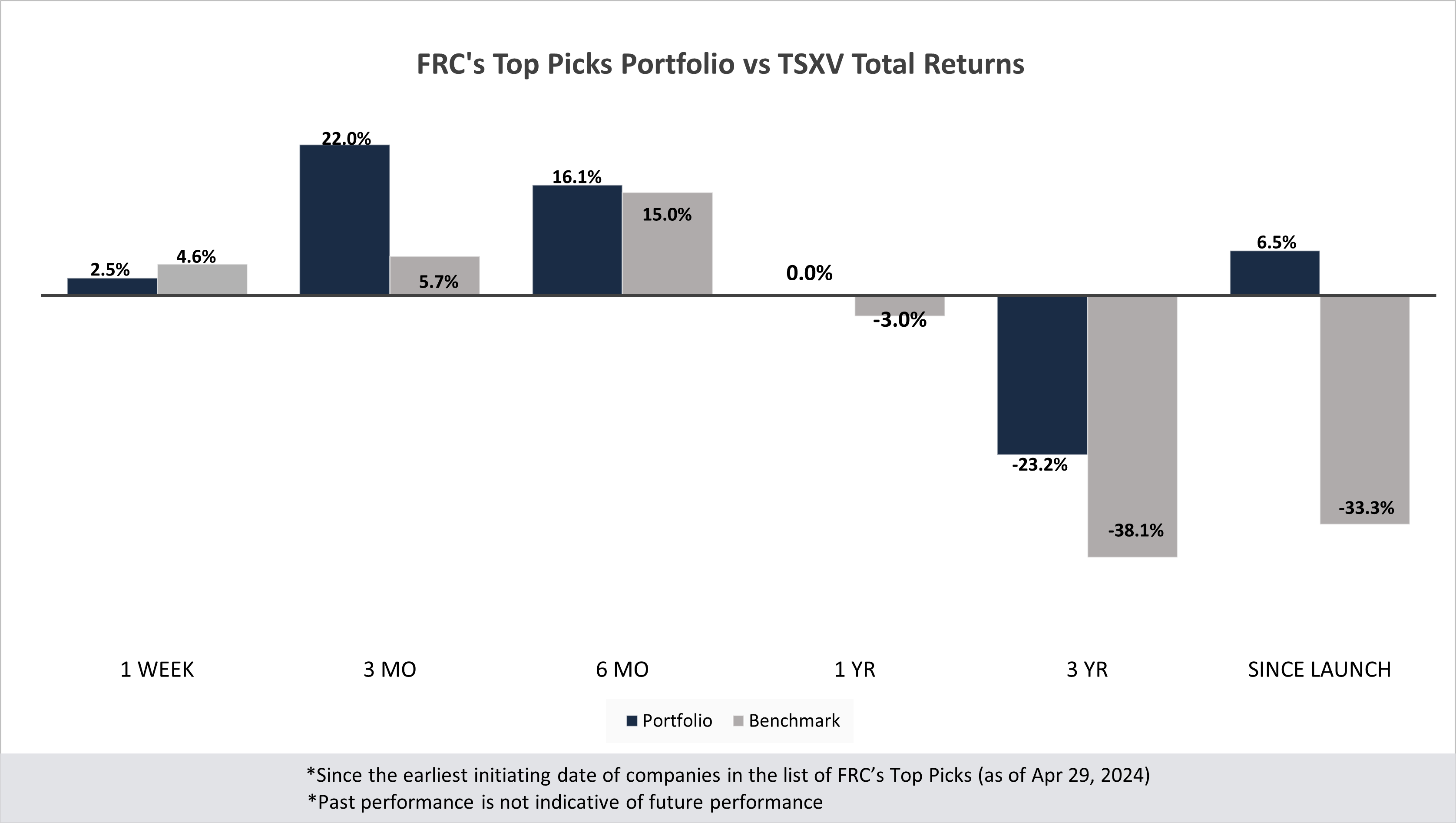

- Last month, companies on our Top Picks list were up 22% on average vs 6% for the benchmark (TSXV)

Index

- Commentary on Companies Under Coverage: Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC Top Picks: Explore the top five weekly performers among our list of top picks.

- Weekly Mining Commentary: Gain a broader perspective on global equity and metal markets, major developments, trends affecting the mining sector, along with our analysts' predictions, and metal prices forecasts.

- Weekly Crypto Commentary: Stay updated with the latest developments in the crypto markets, including detailed analysis of key parameters such as crypto prices, global market capitalization, hash rates, and valuations of publicly traded crypto companies.

Millennial Potash Corp. (MLP.V)

PR Title: Completes a positive PEA for its Banio potash project (Gabon)

Analyst Opinion: Positive - The study returned an AT-NPV10% of US$1.07B, and a high AT-IRR of 33%, using a 25-year average potash price of US$387/t. Shares are trading at just 1% of the AT-NPV. Banio hosts a large-tonnage/low-grade potash resource. Management is planning a resource update, followed by a feasibility study. We will publish an update report shortly.

Argentina Lithium & Energy Corp. (LIT.V, PNXLF)

PR Title: Announces positive lithium values from the 12th exploration well at the Rincon West project (Argentina)

Analyst Opinion: Positive – Drilling continues to return attractive lithium grades over long intervals, expanding mineralization to the east of the project area. These results will serve as inputs for a maiden resource estimate.

NV Gold Corporation (NVGLF, NVX.V)

PR Title: Reports promising surface samples, including 5,440 g/t Ag, 1.26% Cu, and 14.4 g/t Au, at the Root Spring project (Nevada)

Analyst Opinion: Positive – Promising results; surface sampling returned very high grades. Root Springs, located 21 km east of NVX’s Triple T gold project, is prospective for epithermal/mesothermal gold-silver deposits.

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks, including five junior resource companies. The top performer, Starcore International (TSX: SAM), was up 40%. SAM operates a gold mine in Mexico, and several early-stage gold projects in B.C., and Africa.

| Top 5 Weekly Performers | WoW Returns |

| Starcore International Mines Ltd. (SAM.TO) | 40.0% |

| Fortune Minerals Limited (FT.TO) | 25.0% |

| Millennial Potash Corp. (MLP.V) | 15.9% |

| Hot Chili Limited (HHLKF) | 11.9% |

| World Copper Ltd. (WCU.V) | 8.7% |

| * Past performance is not indicative of future performance (as of Apr 29, 2024) |

Source: FRC

Last month, companies on our Top Picks list were up 22% on average vs 6% for the benchmark (TSXV). Our top picks have outperformed the benchmark in five out of the six time periods listed below.

| Total Return | 1 Week | 3 mo | 6 mo | 1 yr | 3 yr | Since launch |

| Mining | 4.7% | 25.1% | 16.9% | -6.4% | -46.0% | 10.7% |

| Cannabis | N/A | N/A | N/A | N/A | -44.8% | -23.6% |

| Tech | -8.3% | 133.3% | 44.7% | 31.0% | -32.8% | -3.7% |

| Special Situations (MIC) | -4.7% | 1.2% | 12.0% | 18.3% | -15.2% | -12.6% |

| Private Companies | N/A | N/A | N/A | 6.7% | 20.5% | 30.5% |

| Portfolio (Total) | 2.5% | 22.0% | 16.1% | 0.0% | -23.2% | 6.5% |

| Benchmark (Total) | 4.6% | 5.7% | 15.0% | -3.0% | -38.1% | -33.3% |

| Portfolio (Annualized) | - | - | - | 0.0% | -8.4% | 0.6% |

| Benchmark (Annualized) | - | - | - | -3.0% | -14.8% | -3.8% |

1. Since the earliest initiating date of companies in the list of Top Picks (as of Apr 29, 2024) 2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark. 3. Past performance is not indicative of future performance. 4. Our complete list of top picks (updated weekly) can be viewed here: Top Picks List

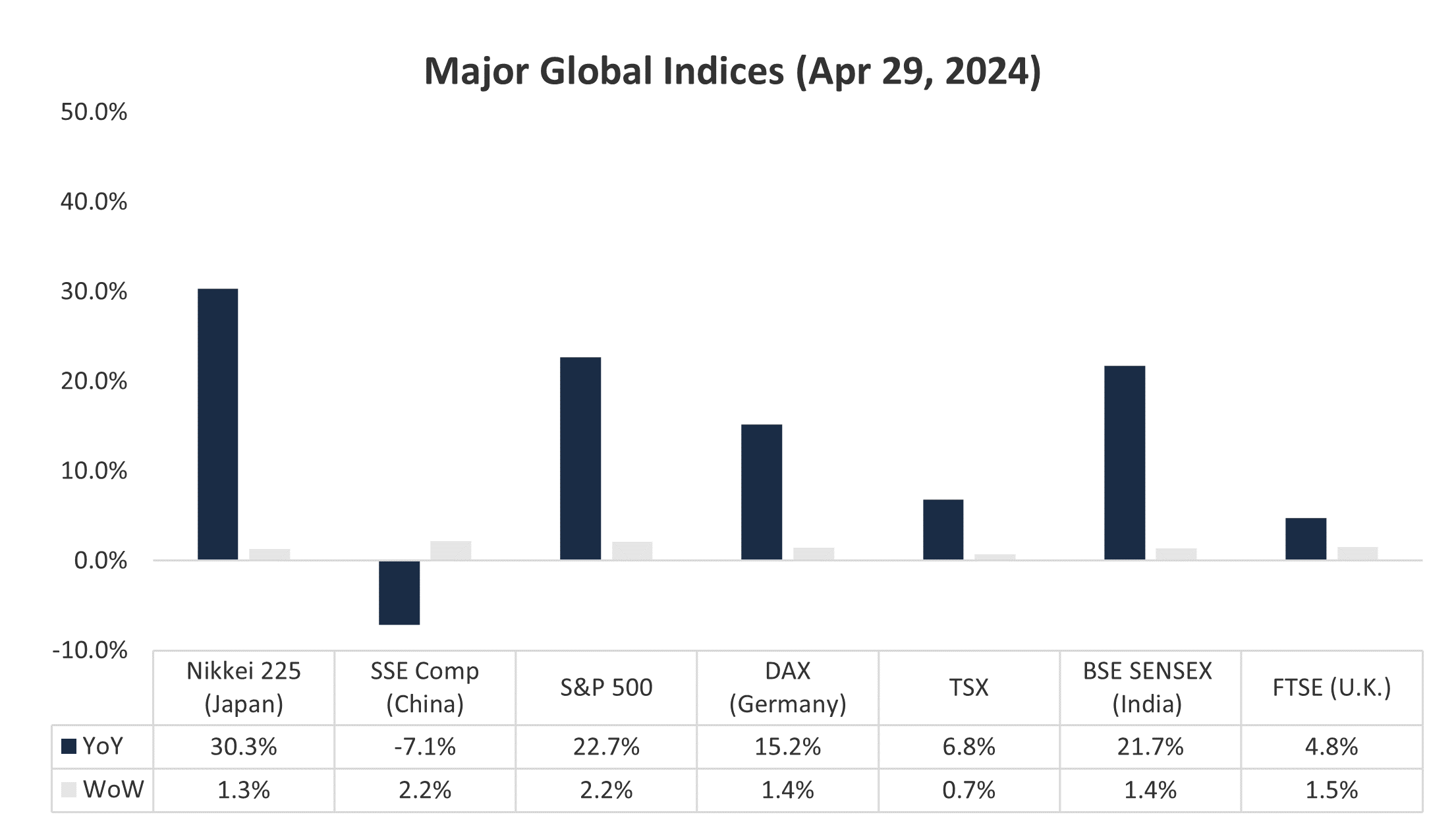

Weekly Mining Commentary

Last week, global equity markets were up 1.5% on average (down 1.0% in the previous week). Recent U.S. macroeconomic data revealed slower than anticipated GDP growth, coupled with sustained inflation. The market placed greater emphasis on the sluggish GDP growth, resulting in weakness in the US$, and strength in equities and metal prices. We anticipate the Fed cutting rates in Q4.

Source: FRC / Various

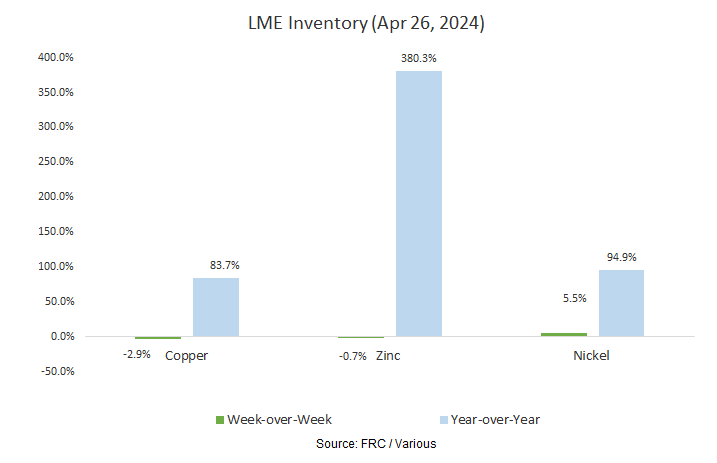

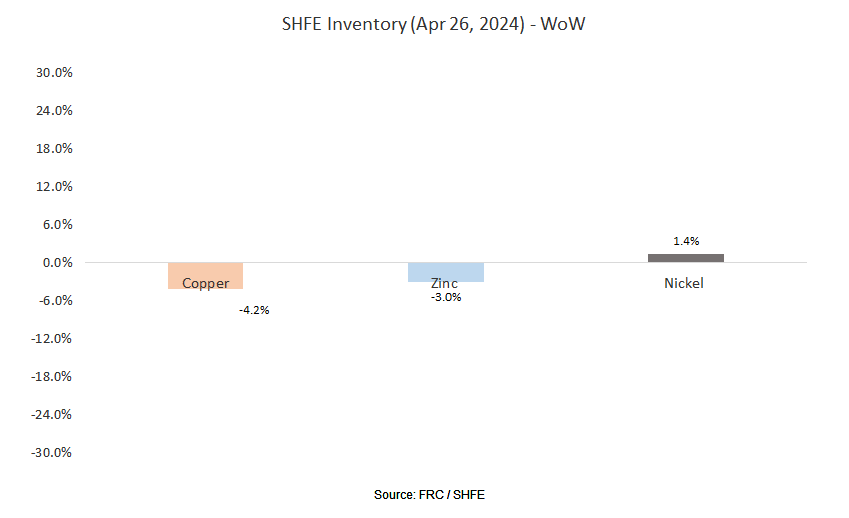

Last week, metal prices were up 0.4% on average (up 1.6% in the previous week).

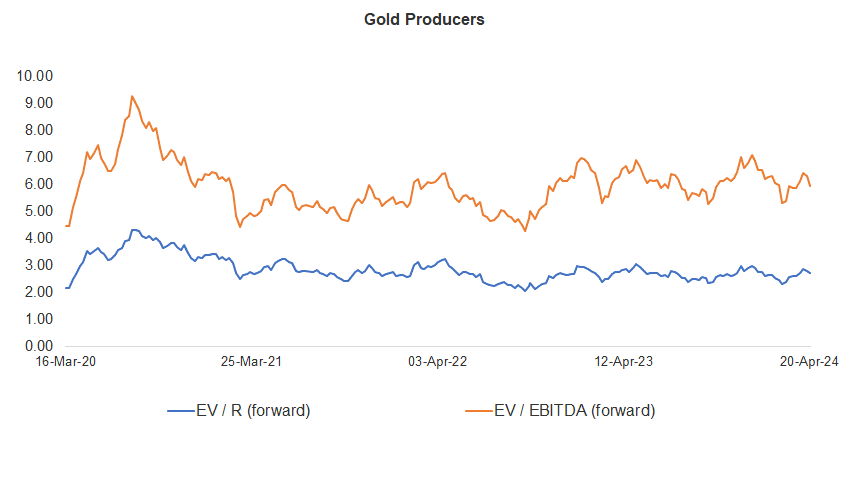

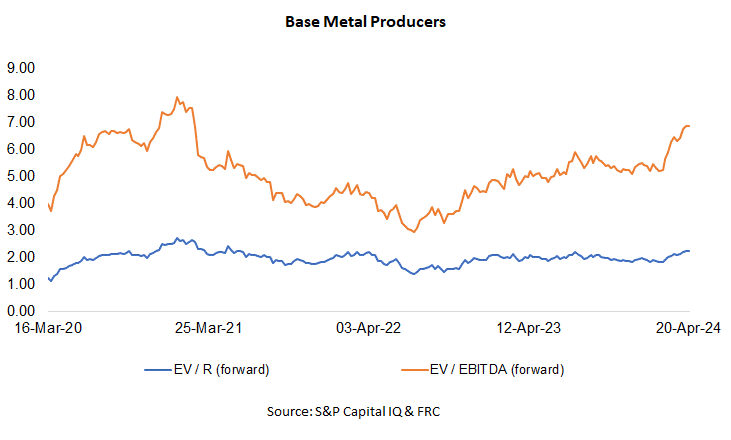

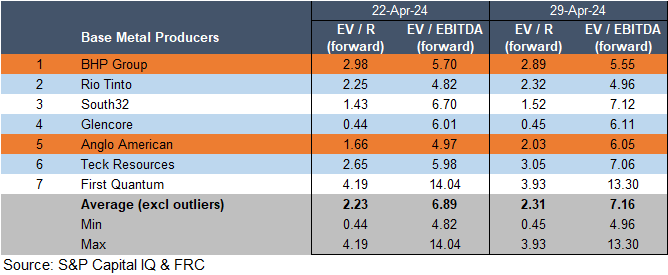

Gold producer valuations were up 0.9% last week (down 4.0% in the prior week); base metal producers were up 3.9% last week (down 0.3% in the prior week). On average, gold producer valuations are 17% lower compared to the past three instances when gold surpassed US$2k/oz.

| 15-Apr-24 | 22-Apr-24 | 29-Apr-24 | |||||

| Gold Producers | EV / R (forward) | EV / EBITDA (forward) | EV / R (forward) | EV / EBITDA (forward) | EV / R (forward) | EV / EBITDA (forward) | |

| 1 | Barrick | 3.23 | 7.04 | 3.11 | 6.60 | 3.10 | 6.58 |

| 2 | Newmont | 3.10 | 7.35 | 3.09 | 7.29 | 3.35 | 7.80 |

| 3 | Agnico Eagle | 4.40 | 8.61 | 4.52 | 8.80 | 4.53 | 8.58 |

| 4 | AngloGold | 2.25 | 5.49 | 2.18 | 5.02 | 2.15 | 4.96 |

| 5 | Kinross Gold | 2.25 | 5.29 | 2.36 | 5.49 | 2.34 | 5.36 |

| 6 | Gold Fields | 3.31 | 6.48 | 3.01 | 5.52 | 3.09 | 5.60 |

| 7 | Sibanye | 0.81 | 4.10 | 0.76 | 3.75 | 0.74 | 3.68 |

| 8 | Hecla Mining | 4.79 | 18.13 | 4.68 | 17.18 | 4.43 | 16.55 |

| 9 | B2Gold | 2.08 | 4.28 | 1.89 | 3.74 | 1.84 | 3.66 |

| 10 | Alamos | 4.76 | 9.28 | 4.79 | 8.78 | 4.92 | 9.36 |

| 11 | Harmony | 1.83 | 5.77 | 1.70 | 4.88 | 1.74 | 5.10 |

| 12 | Eldorado Gold | 2.54 | 5.55 | 2.52 | 5.28 | 2.48 | 4.93 |

| Average (excl outliers) | 2.78 | 6.29 | 2.72 | 5.92 | 2.75 | 5.96 | |

| Min | 0.81 | 4.10 | 0.76 | 3.74 | 0.74 | 3.66 | |

| Max | 4.79 | 18.13 | 4.79 | 17.18 | 4.92 | 16.55 | |

| Base Metal Producers | EV / R (forward) | EV / EBITDA (forward) | EV / R (forward) | EV / EBITDA (forward) | EV / R (forward) | EV / EBITDA (forward) | |

| 1 | BHP Group | 2.98 | 5.69 | 2.98 | 5.70 | 2.89 | 5.55 |

| 2 | Rio Tinto | 2.26 | 4.87 | 2.25 | 4.82 | 2.32 | 4.96 |

| 3 | South32 | 1.47 | 6.82 | 1.43 | 6.70 | 1.52 | 7.12 |

| 4 | Glencore | 0.45 | 6.14 | 0.44 | 6.01 | 0.45 | 6.11 |

| 5 | Anglo American | 1.68 | 5.02 | 1.66 | 4.97 | 2.03 | 6.05 |

| 6 | Teck Resources | 2.70 | 6.05 | 2.65 | 5.98 | 3.05 | 7.06 |

| 7 | First Quantum | 4.15 | 13.64 | 4.19 | 14.04 | 3.93 | 13.30 |

| Average (excl outliers) | 2.24 | 6.89 | 2.23 | 6.89 | 2.31 | 7.16 | |

| Min | 0.45 | 4.87 | 0.44 | 4.82 | 0.45 | 4.96 | |

| Max | 4.15 | 13.64 | 4.19 | 14.04 | 3.93 | 13.30 | |

Source: S&P Capital IQ & FRC

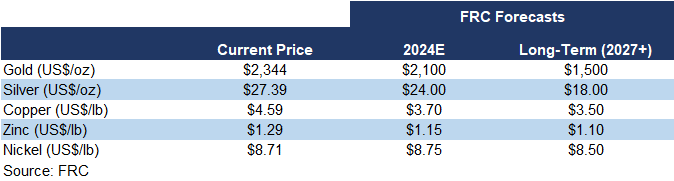

We are maintaining our metal price forecasts.

Key Developments:

-

Last Thursday, BHP Group (MCAP: US$143B) made headlines by announcing its bid to acquire Anglo American (MCAP: US$40B) for US$39B. BHP is the largest mining company in the world by MCAP, and the third largest copper producer. If completed, this deal will elevate BHP to the top spot, controlling 10% of the global copper supply. Anglo swiftly rejected BHP's offer, stating it undervalued their stock. BHP is now contemplating an improved offer. The following section outlines our assessment of the deal's valuation.

Just prior to BHP’s bid, Anglo’s shares were trading at 1.7x revenue, and 5.0x EBITDA, which were 26% lower than sector averages. Despite BHP's bid lifting Anglo's multiples by 22%, they trail sector averages by 10%. Assuming BHP is willing to align with sector multiples, we anticipate BHP could increase its offer by up to 11%, bringing its bid to US$43B.

Weekly Crypto Commentary

Prices of mainstream/popular cryptos were up 1% on average last week (up 10% in the previous week).

| April 29, 2024 | ||

| Cryptocurrencies | 1-Week | 1-Year |

| Bitcoin | -3% | 114% |

| Binance Coin | -3% | 83% |

| Cardano | -5% | 12% |

| Ethereum | 1% | 66% |

| Polkadot | 12% | 8% |

| XRP | -2% | 8% |

| Polygon | 6% | -32% |

| Solana | -13% | 473% |

| AVERAGE | -1% | 92% |

| MIN | -13% | -32% |

| MAX | 12% | 473% |

| Indices | ||

| Canadian | 1-Week | 1-Year |

| BTCC | -6% | 119% |

| BTCX | -6% | 125% |

| EBIT | -6% | 123% |

| FBTC | -5% | 34% |

| U.S. | 1-Week | 1-Year |

| BITO | -6% | 70% |

| BTF | -3% | 72% |

| IBLC | -3% | 68% |

Source: FRC/Yahoo Finance

The global MCAP of cryptos is US$2.43T, down 12% MoM, but up 93%YoY.

Source: CoinGecko

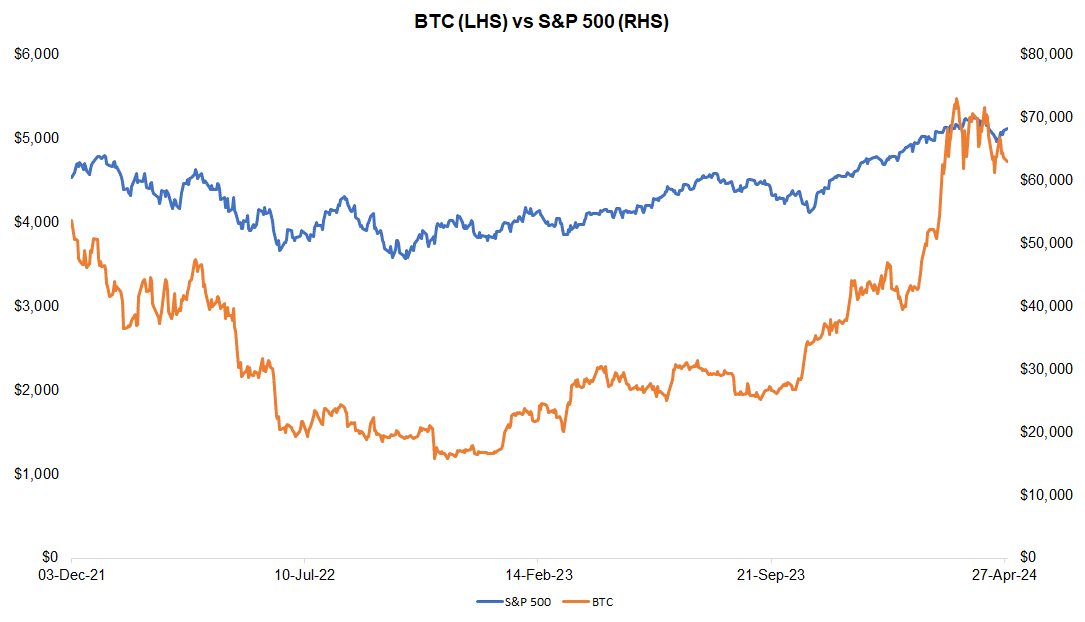

Last week, BTC was down 3%, while the S&P 500 was up 2%.

Source: FRC/ Yahoo Finance

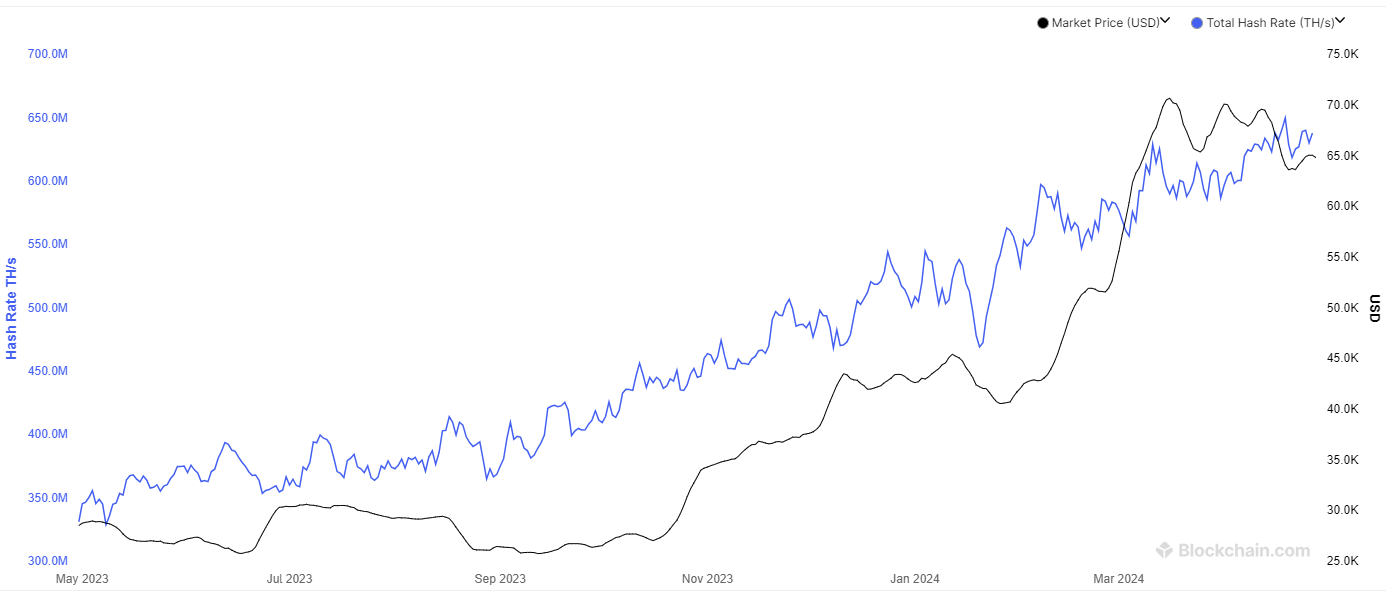

The global hash rate of BTC (defined as calculations performed per second/an indicator of network difficulty) is 638 exahashes per second (EH/s), down 1% WoW, but up 6% MoM. The decrease in hash rates is positive for miners as their efficiency rates (BTC production per EH/s) are inversely linked to global hash rates.

Total Hash Rate (BTC)

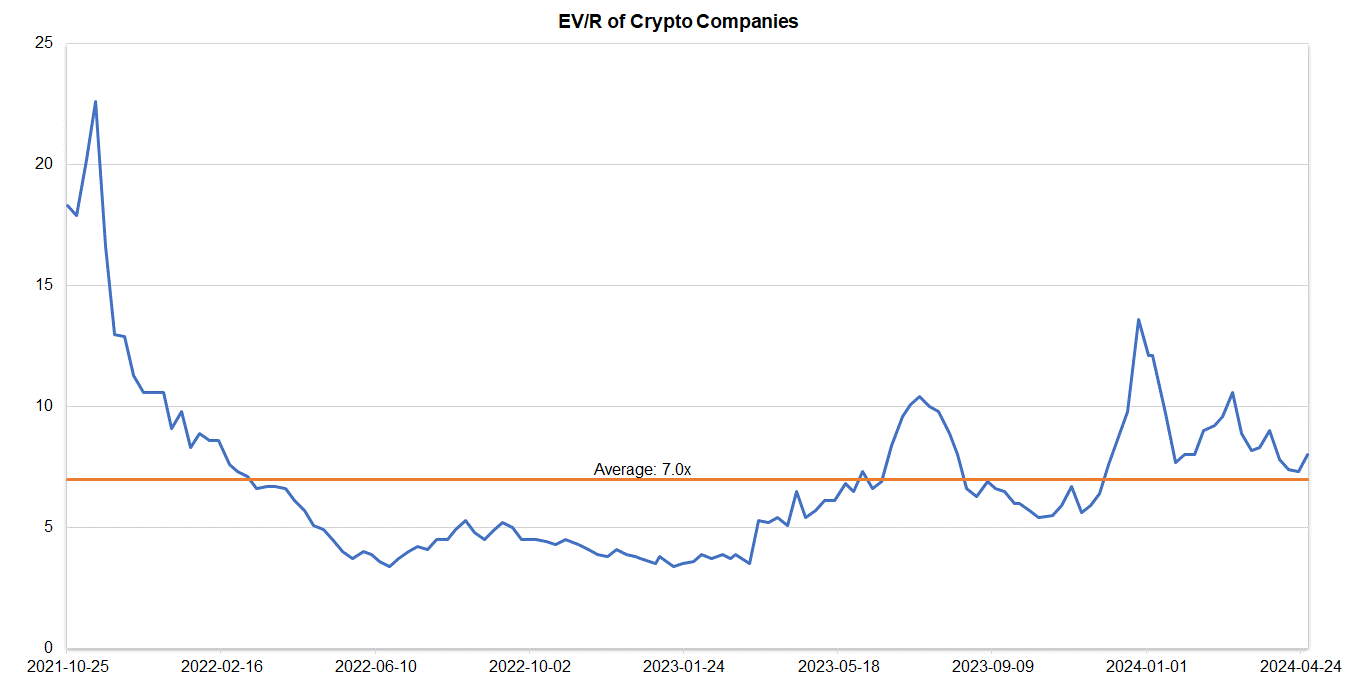

Companies operating in the crypto space are trading at an average EV/R of 8.0x (previously 7.3x).

Source: S&P Capital IQ/FRC

| April 29, 2024 | ||

| Crypto Companies | Ticker | TEV/Revenue |

| Argo Blockchain | LSE: ARB | 2.8 |

| BIGG Digital | CSE: BIGG | 9.3 |

| Bitcoin Well | TSXV: BTCW | 0.7 |

| Canaan Inc. | NASDAQ: CAN | 0.5 |

| CleanSpark Inc. | NasdaqCM:CLSK | 20.1 |

| Coinbase Global | NASDAQ: COIN | 19.1 |

| Galaxy Digital Holdings | TSX: GLXY | N/A |

| HIVE Digital | TSXV:HIVE | 3.5 |

| Hut 8 Mining Corp. | TSX: HUT | 8.2 |

| Marathon Digital Holdings | NASDAQ: MARA | 13.3 |

| Riot Platforms | NASDAQ: RIOT | 8.7 |

| SATO Technologies | TSXV: SATO | 2.2 |

| AVERAGE | 8.0 | |

| MEDIAN | 8.2 | |

| MINIMUM | 0.5 | |

| MAXIMUM | 20.1 |

Source: S&P Capital IQ/FRC