S&P 500 & Gold Reach New Highs / Insights into Our Optimism for Gold Stocks

Published: 4/1/2024

Author: N/A

Content Summary

- Last week, global equity markets were up 0.6% on average, while gold/silver were up 2.1% on average

- Explore the rationale behind our optimism for gold stocks in our latest video, "Gold Hits Record High: Five Essential Tips for Selecting Gold Stocks."

- Shares of a gold-silver junior under coverage were up 39% WoW

- Prices of mainstream cryptos were down 3% on average last week

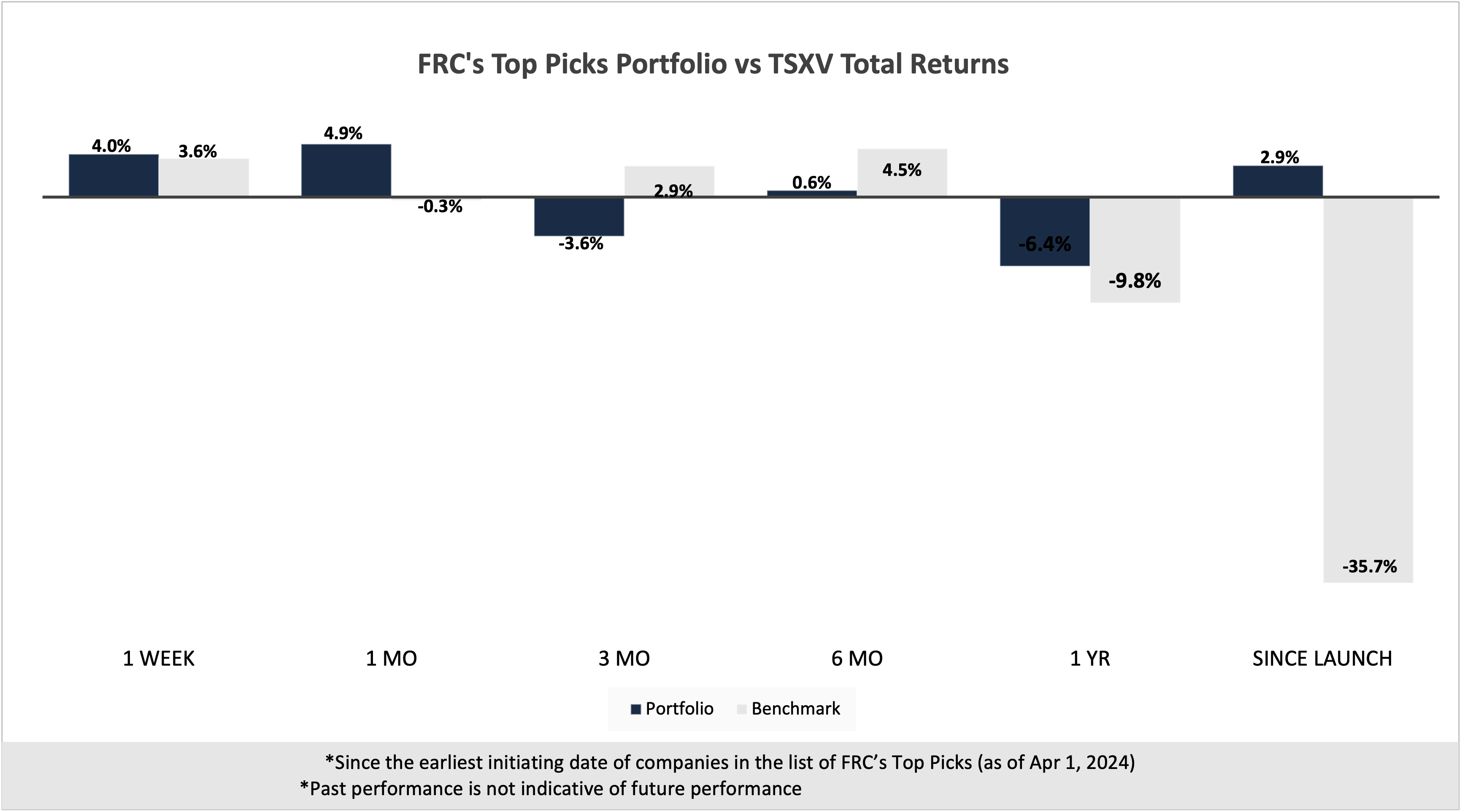

- Companies on our Top Picks list were up 4% on average last month vs -0.3% for the benchmark (TSXV)

Companies mentioned in this article:

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks, including five junior resource companies. The top performer, Golden Minerals (TSX: AUMN), was up 39%. AUMN is advancing multiple gold-silver projects in the Americas.

| Top 5 Weekly Performers | WoW Returns |

| Golden Minerals Company (AUMN.TO) | 39.0% |

| New Age Metals Inc. (NAM.V) | 33.3% |

| Southern Silver Exploration Corp. (SSV.V) | 21.9% |

| Giga Metals Corporation (GIGA.V) | 15.6% |

| Kootenay Silver Inc. (KTN.V) | 15.3% |

| * Past performance is not indicative of future performance (as of Apr 1, 2024) |

Last week, companies on our Top Picks list were up 4.0% on average vs 3.6% for the benchmark (TSXV).

| Total Return | 1 Week | 1 mo | 3 mo | 6 mo | 1 yr | Since launch |

| Mining | 8.5% | 7.3% | -4.1% | 0.3% | -10.5% | 9.5% |

| Cannabis | N/A | N/A | N/A | N/A | N/A | -23.6% |

| Tech | 8.3% | 39.3% | -4.9% | 0.0% | -22.0% | -4.3% |

| Special Situations (MIC) | 2.1% | -3.4% | 5.1% | 9.4% | 16.6% | -16.7% |

| Private Companies | N/A | N/A | N/A | N/A | 6.7% | 30.5% |

| Portfolio (Total) | 4.0% | 4.9% | -3.6% | 0.6% | -6.4% | 2.9% |

| Benchmark (Total) | 3.6% | -0.3% | 2.9% | 4.5% | -9.8% | -35.7% |

| Portfolio (Annualized) | - | - | - | - | -6.4% | 0.3% |

| Benchmark (Annualized) | - | - | - | - | -9.8% | -4.2% |

1. Since the earliest initiating date of companies on this list (as of Apr 1, 2024)

2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.

Our complete list of top picks (updated weekly) can be viewed here: Top Picks

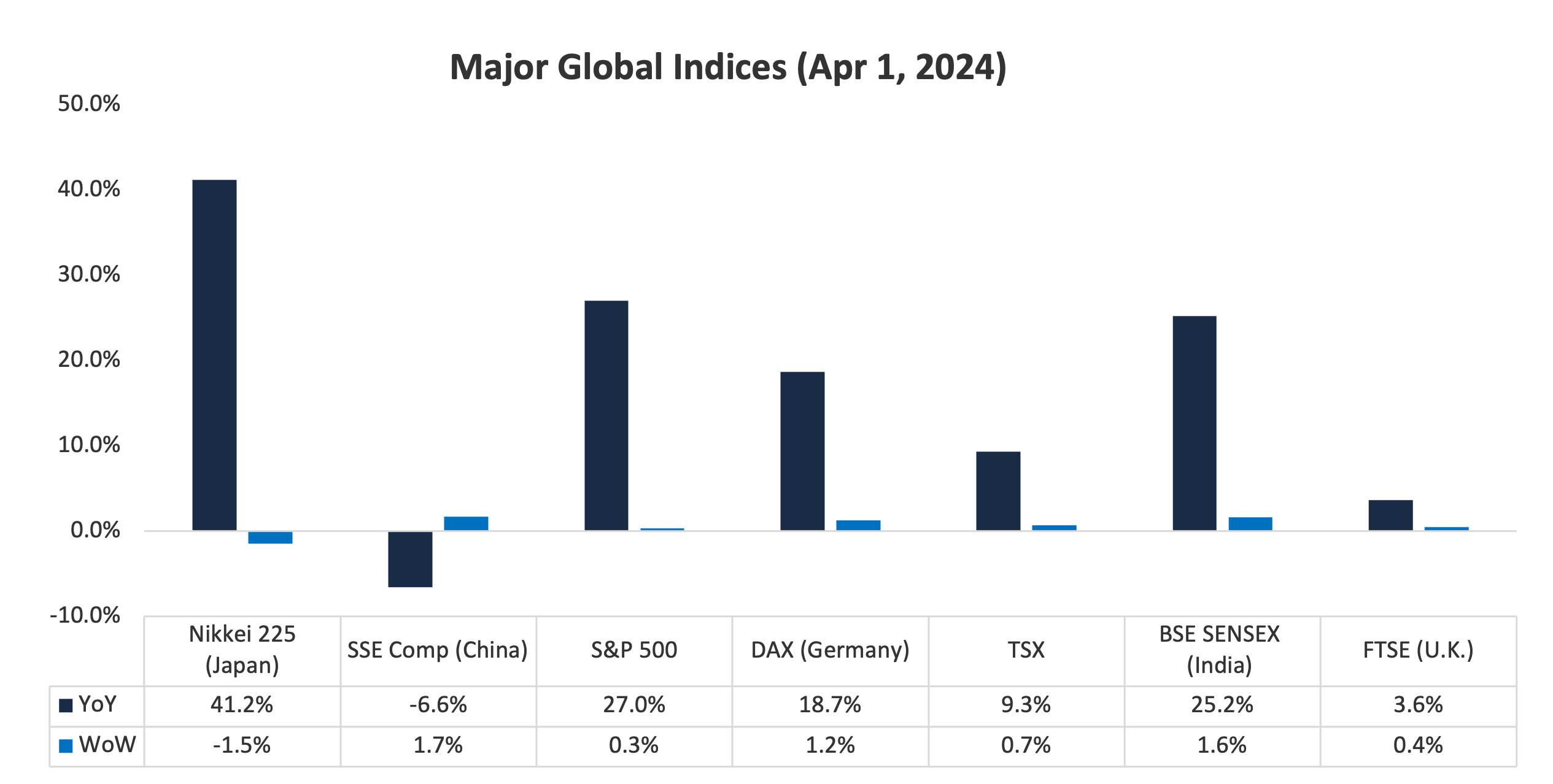

Weekly Mining Commentary

Last week, global equity markets were up 0.6% on average (up 0.9% in the previous week). Additionally, Friday's U.S. inflation data met market expectations. Equities markets, and gold/silver, have been trending higher since the Fed's last meeting where it conveyed a relatively dovish tone. We believe these developments should encourage higher investor risk tolerance, prompting increased capital allocation to small-cap stocks, which have significantly trailed the performance of large-cap stocks in the past year.

Source: FRC / Various

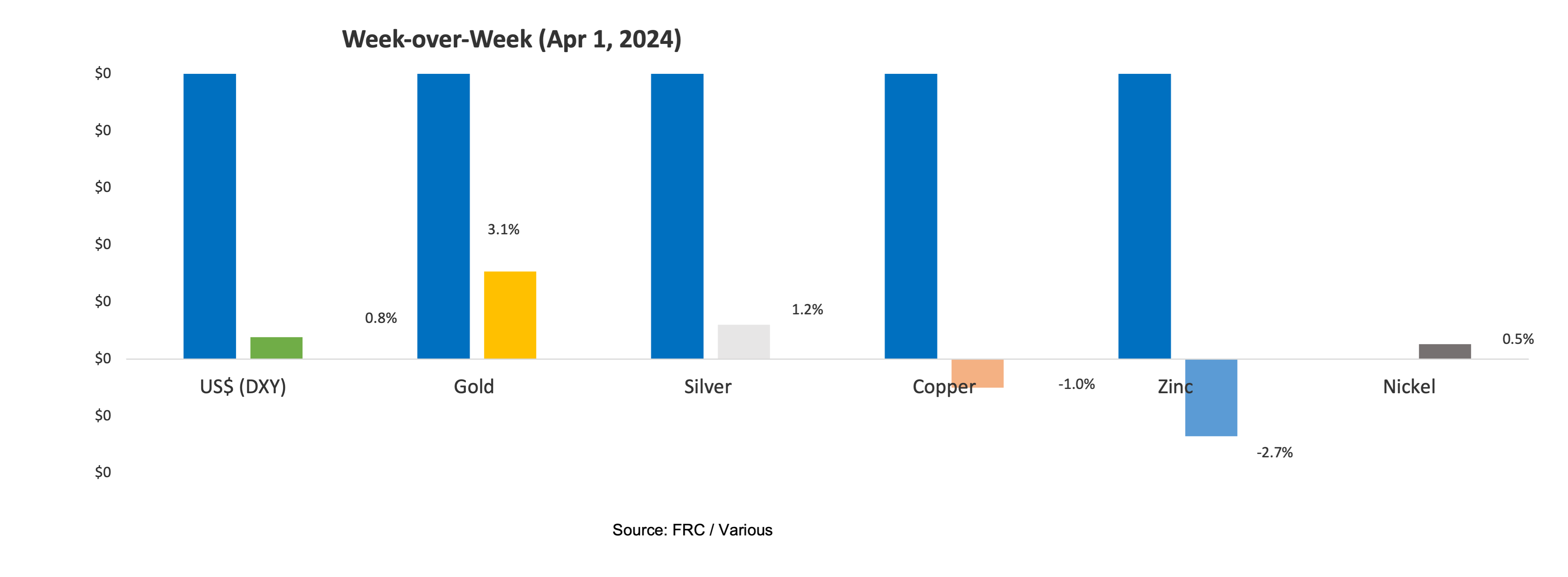

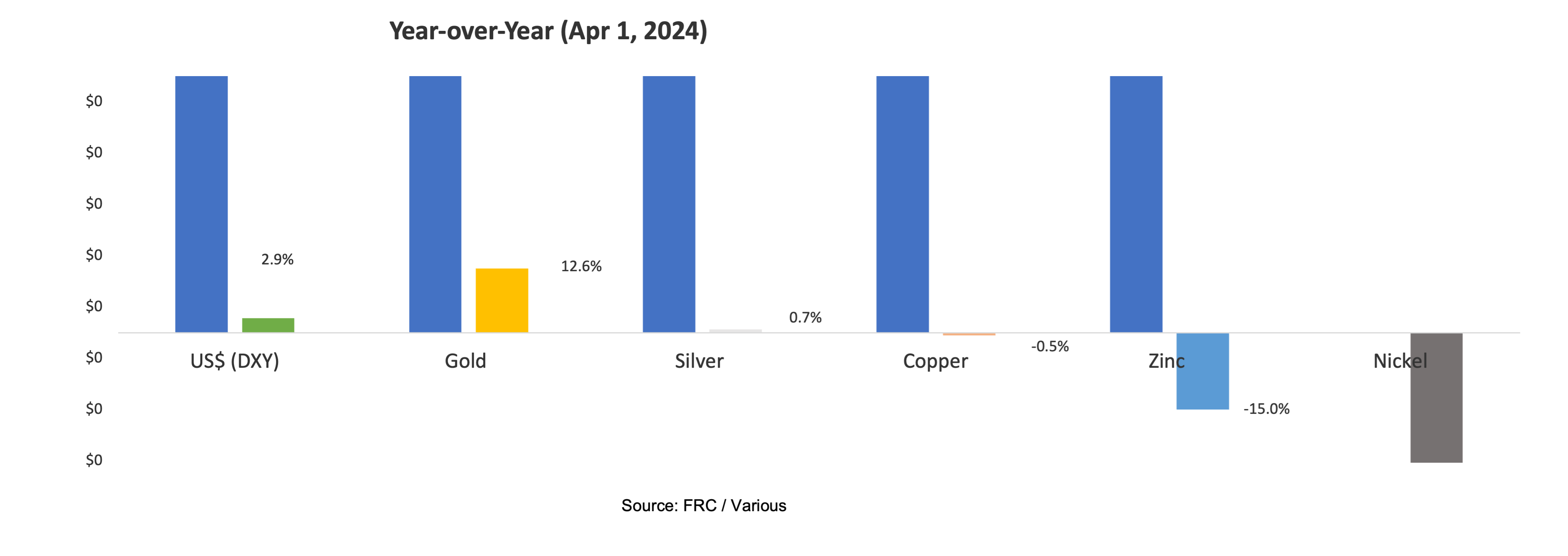

Last week, gold and silver were up 2.1% on average, while base metal prices were down 1.1% on average. Yesterday, gold surpassed US$2,250/oz for the first time. Explore the rationale behind our optimism for gold stocks in our latest video titled "Gold Hits Record High: Five Essential Tips for Selecting Gold Stocks."

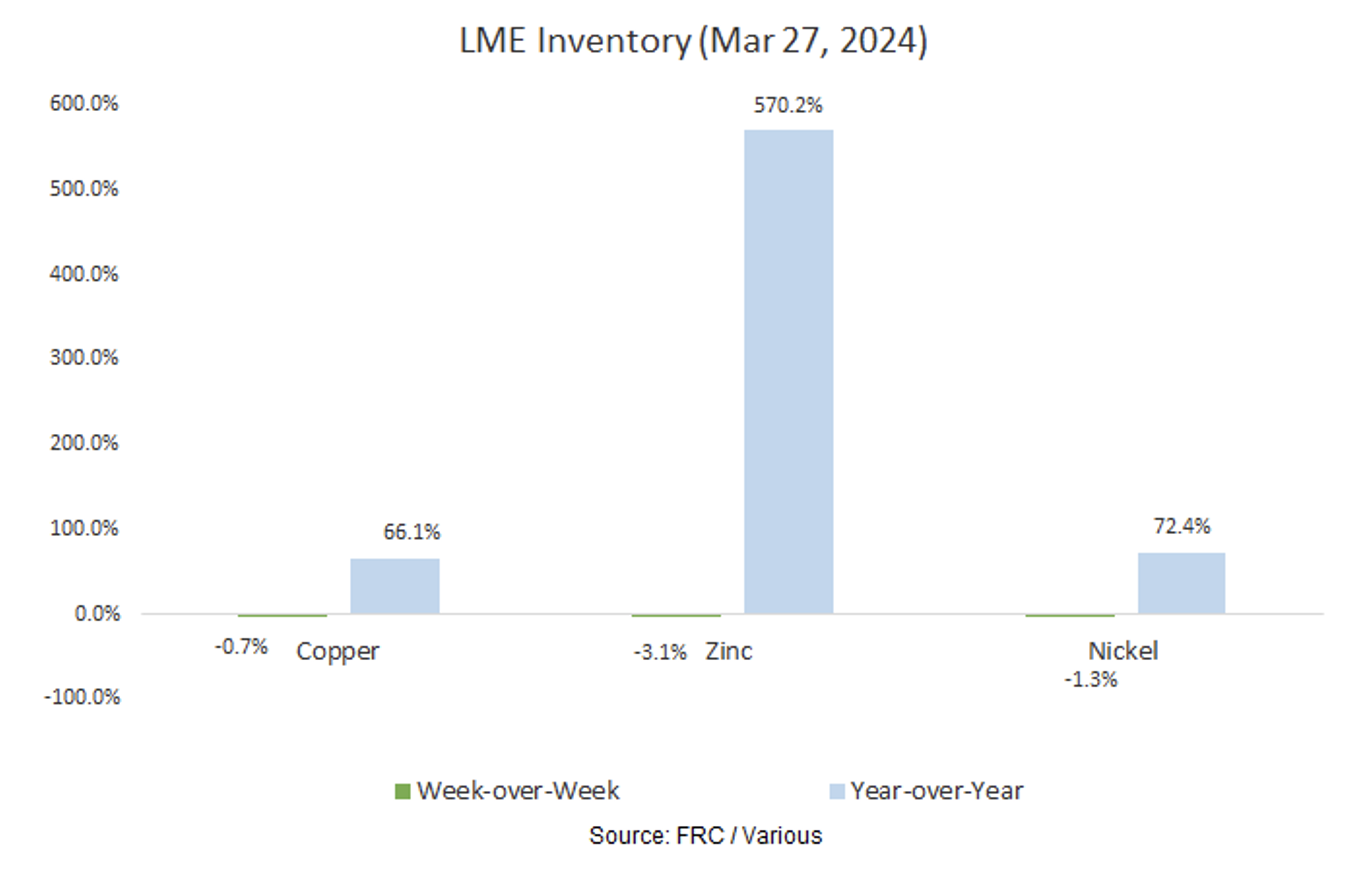

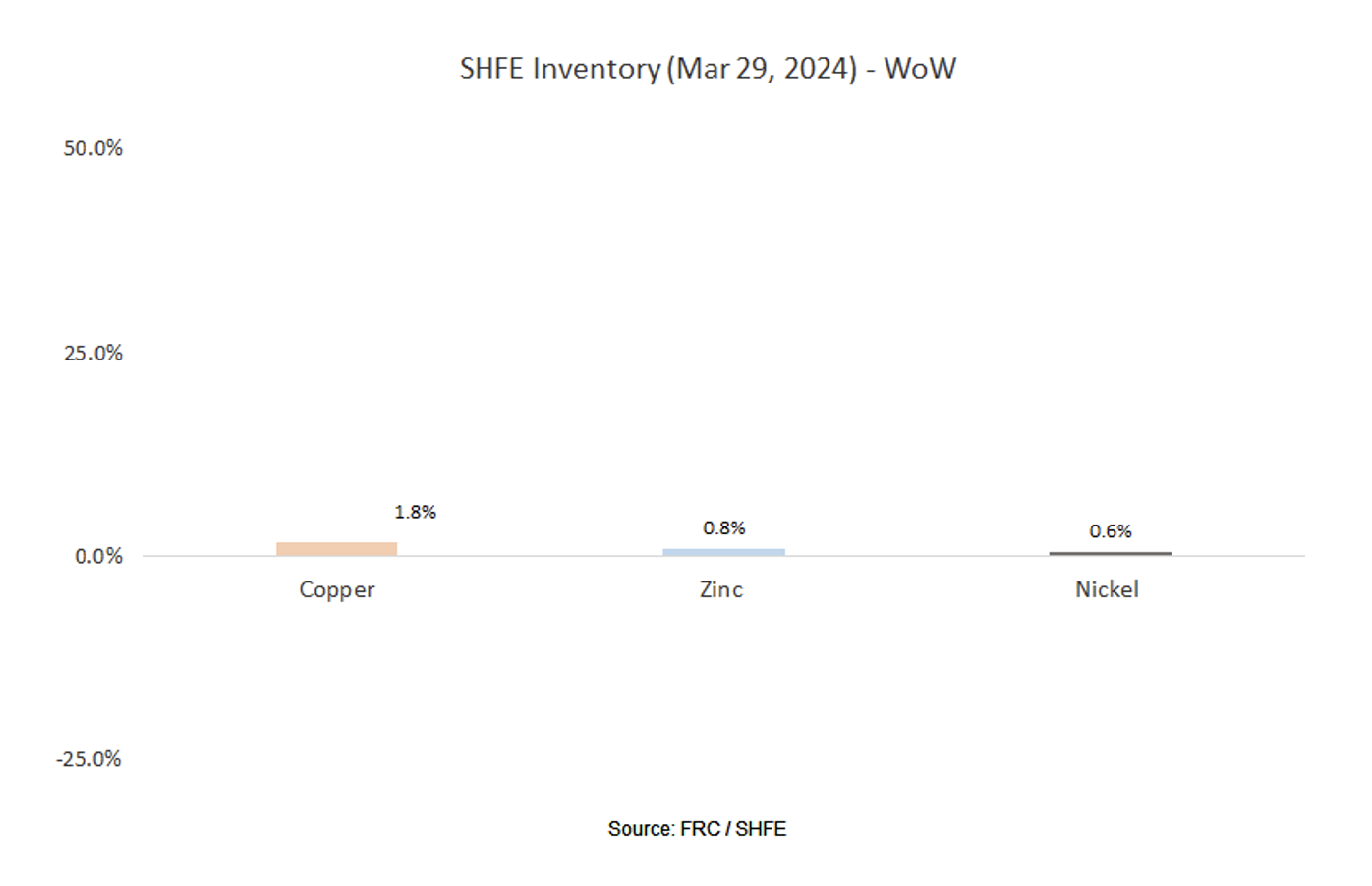

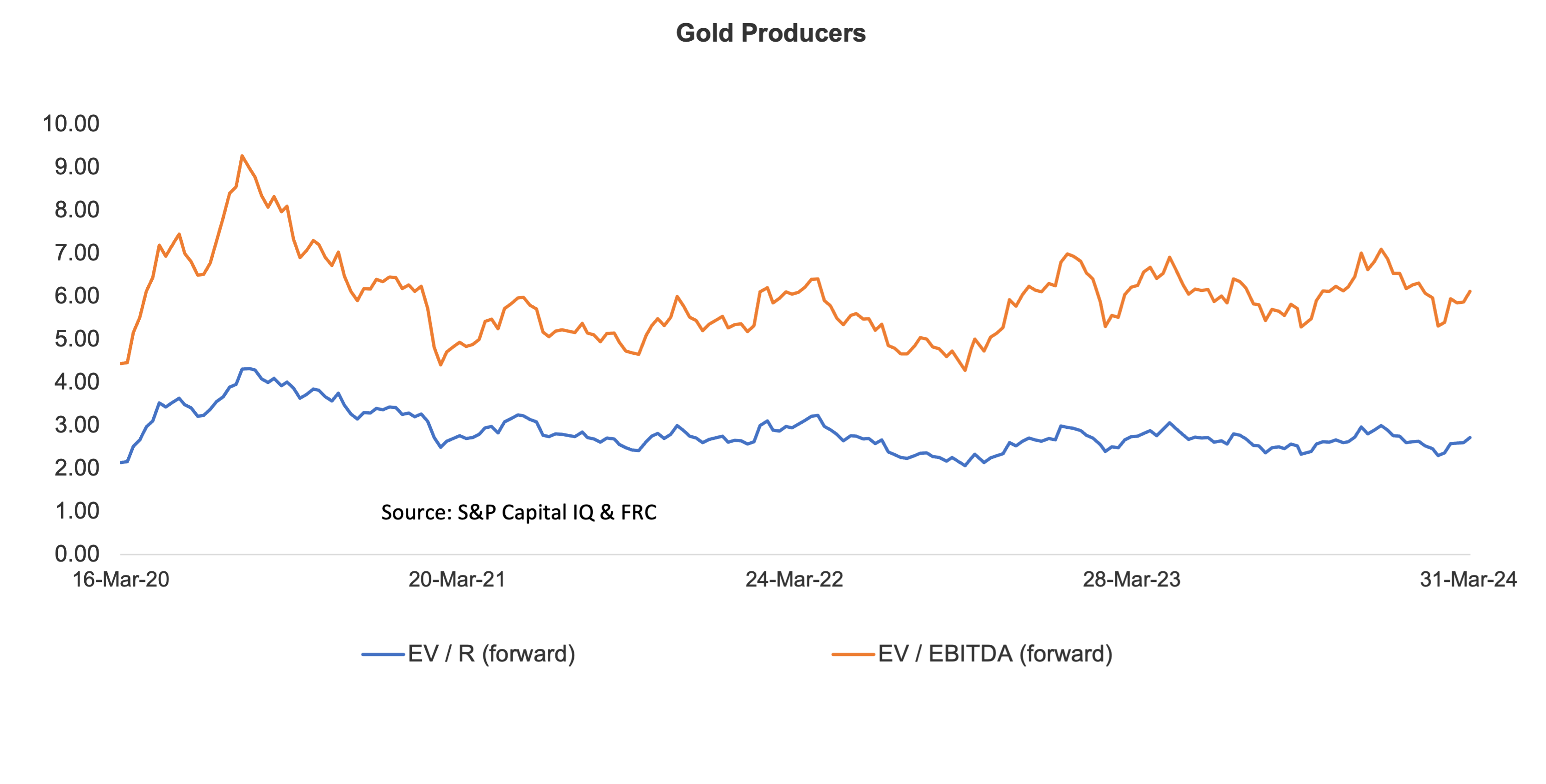

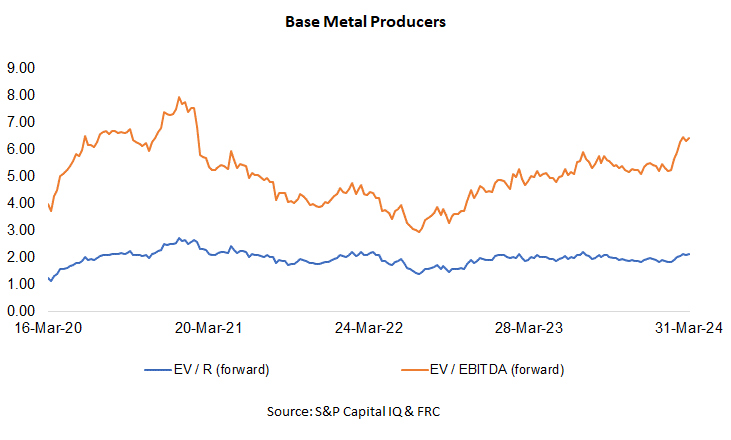

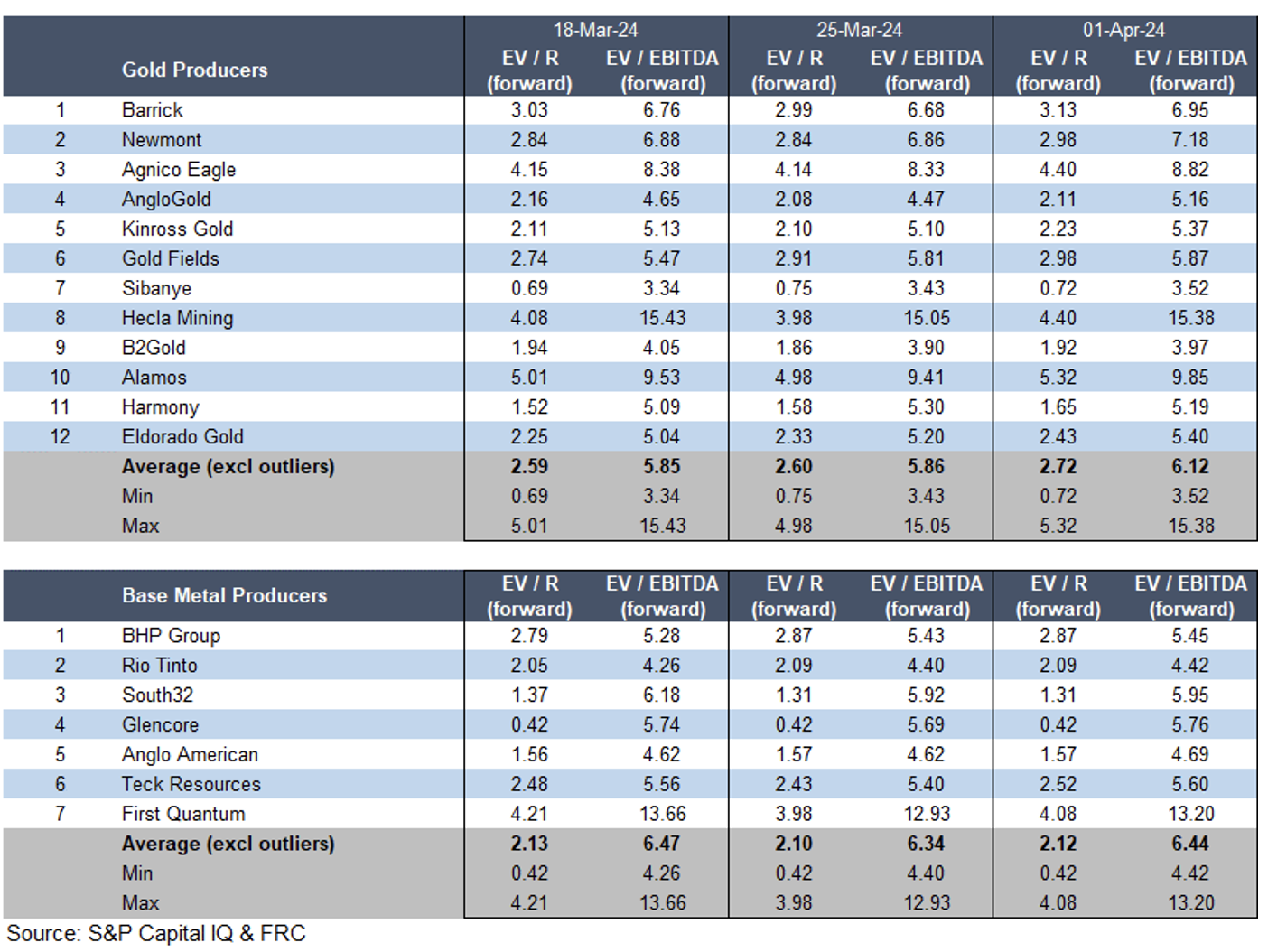

Gold producer valuations were up 4.5% last week (up 0.3% in the prior week); base metal producers were up 1.4% last week (down 2.1% in the prior week). On average, gold producer valuations are 16% lower compared to the past three instances when gold surpassed US$2k/oz.

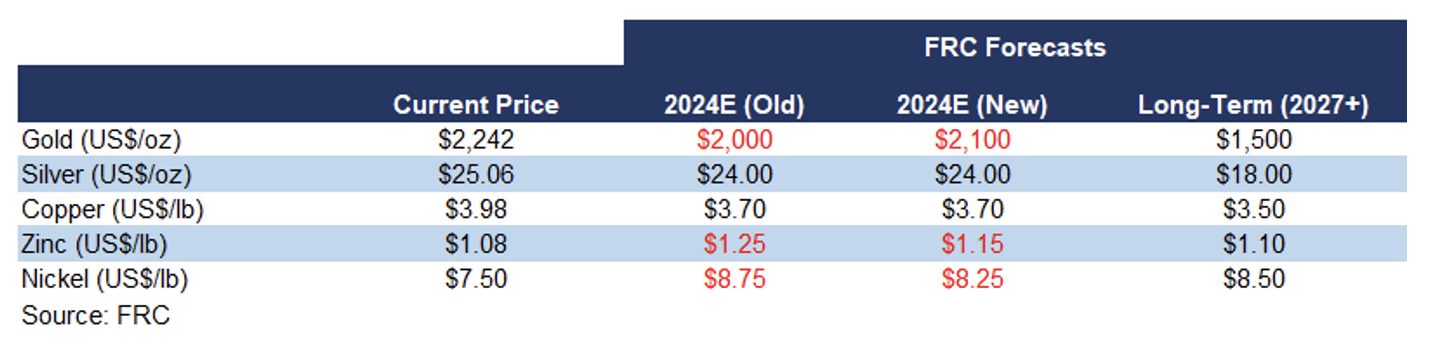

We are revising our full-year average metal price forecasts after adjusting for prices in Q1; changes are highlighted in red.

Commentary on Resource Companies Under Coverage

Max Resource Corp. / TSXV: MAX

PR Title : Reports high-grade assays at AM-14, CESAR project (Colombia) including 2.2% copper and 12.8 g/t silver over 5.2 m

FRC Opinion : Positive – Rock chip sampling at the AM-14 target, within the CESAR copper-silver project, returned high copper grades. The project is prospective for sediment-hosted deposits. Three major districts (AM, Conejo, and URU) have been identified along a 90 km long belt. Sediment-hosted deposits typically host large-tonnage/high grades and account for approximately 25% of global copper production. Management's short-term strategy involves delineating and potentially enlarging the footprint of priority targets. We note that extensive drilling needs to be completed before completing a maiden resource estimate.

Geomega Resources Inc. / TSXV: GMA

PR Title : Provides an update on demo plant, project design change, and start of site preparation activities at Saint-Hubert facility (Quebec)

FRC Opinion : Negative – Geomega has developed a potentially eco-friendly/cost-effective process to recycle rare earth elements, and other valuable materials, from end-of-life magnets, scraps, and other feeds. The company is aiming to build a demo plant for rare earth recycling in Quebec.

However, GMA's recent studies uncovered design flaws regarding water discharge management, prompting revisions while aiming to maintain the daily throughput at 1.5 tons. We will produce an update report once a revised design is completed, and when we have more clarity on the proposed plant's cost structure and other key metrics. For conservatism, we have decided to delay demo production by two years, and increase the discount rate from 15% to 20% in our valuation models. Consequently, our fair value estimate has decreased from $1.20 to $0.78/share.

Commentary on Financials, Technology, Energy, and Special Situations Companies Under Coverage

PR Title : Announces unaudited 2023 results

FRC Opinion: Mixed – 2023 revenue was down 12% YoY to $13M, missing our estimate by 8%, primarily due to clients delaying ad campaigns, and a strategic shift in KIDZ’s sales strategy from relying exclusively on resellers to prioritizing direct sales. The latter resulted in increased gross margins. As a result, EBITDA improved from -$0.8M to -$0.7M, beating our estimate of -$1.2M. We will publish a detailed update once the audited financials are released later this month.

Weekly Crypto Commentary

Prices of mainstream/popular cryptos were down 3% on average last week (up 3% in the previous week).

| April 1, 2024 | ||

| Cryptocurrencies | 1-Week | 1-Year |

| Bitcoin | -1% | 142% |

| Binance Coin | 0% | 84% |

| Cardano | -5% | 57% |

| Ethereum | -1% | 90% |

| Polkadot | -7% | 45% |

| XRP | -1% | 19% |

| Polygon | -11% | -15% |

| Solana | 0% | 812% |

| AVERAGE | -3% | 154% |

| MIN | -11% | -15% |

| MAX | 0% | 812% |

| Indices | ||

| Canadian | 1-Week | 1-Year |

| BTCC | 3% | 139% |

| BTCX | 3% | 147% |

| EBIT | 3% | 143% |

| FBTC | 3% | 48% |

| U.S. | 1-Week | 1-Year |

| BITO | 0% | 82% |

| BTF | 2% | 86% |

| IBLC | -4% | 88% |

Source: FRC/Yahoo Finance

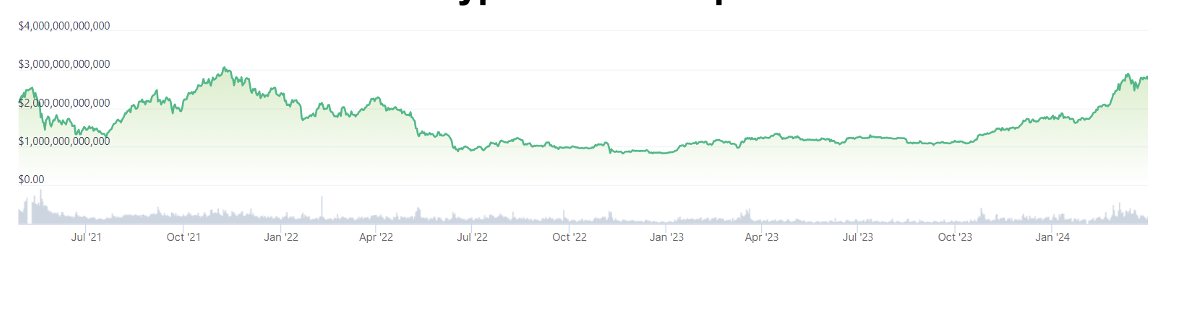

The global MCAP of cryptos is US$2.8T, up 15% MoM, and 127%YoY.

Total Crypto Market Cap Chart

Source: CoinGecko

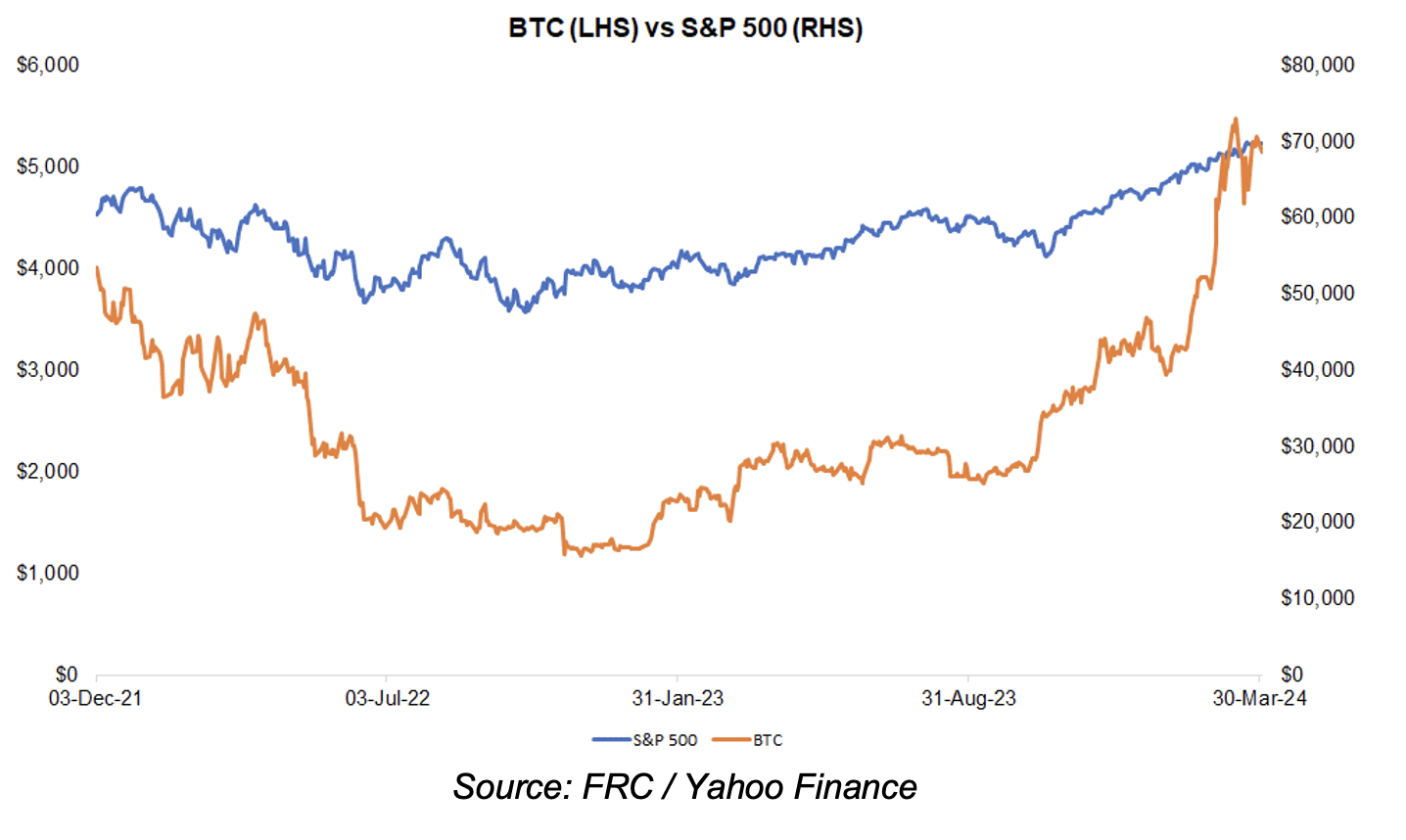

BTC was down 0.5% last week, while the S&P 500 was up 0.3%.

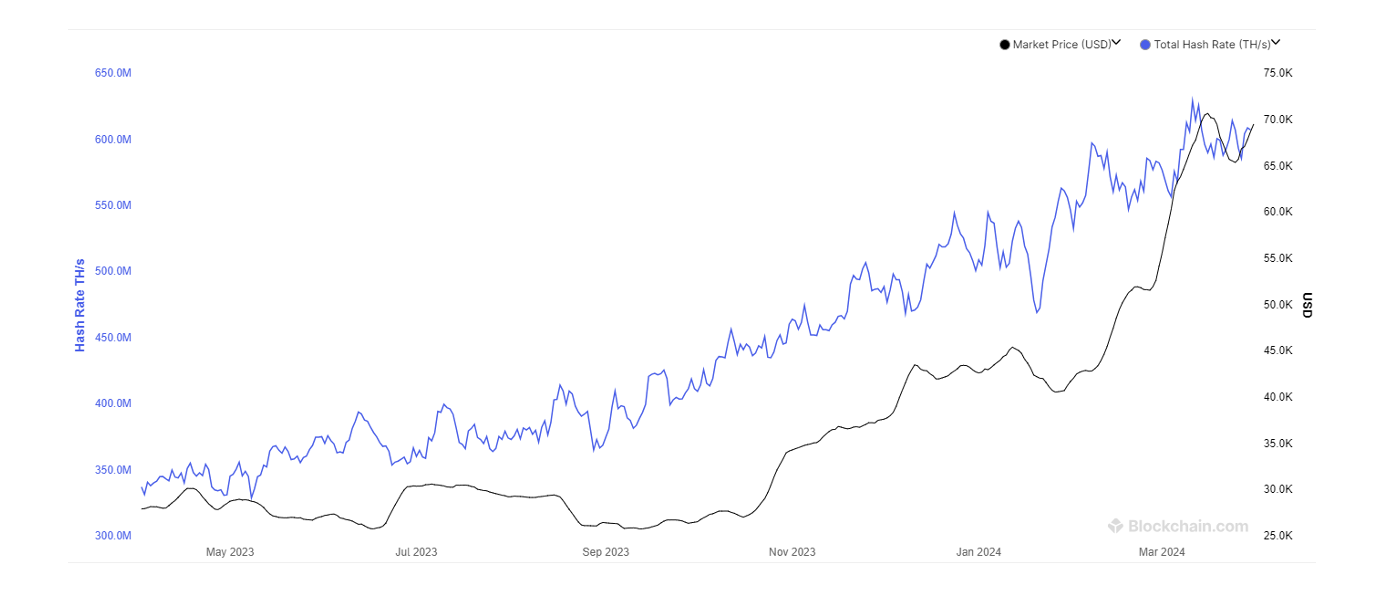

The global hash rate of BTC (defined as calculations performed per second/an indicator of network difficulty) is 607 exahashes per second (EH/s), up 1% WoW, and 5% MoM. The increase in hash rates is negative for miners as their efficiency rates (BTC production per EH/s) are inversely linked to global hash rates.

Total Hash Rate (BTC)

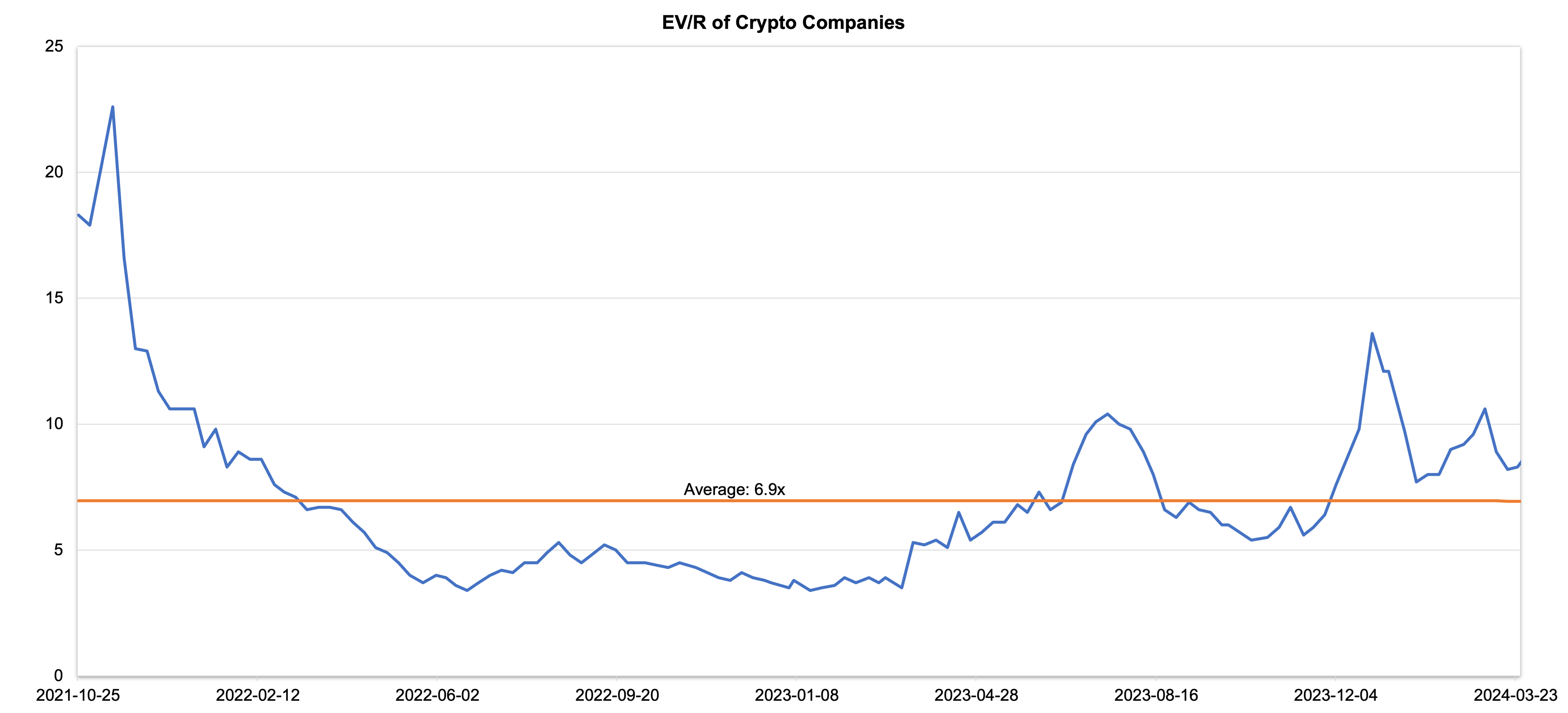

Companies operating in the crypto space are trading at an average EV/R of 9.0x (previously 8.3x).

Source: S&P Capital IQ/FRC

| April 1, 2024 | ||

| Crypto Companies | Ticker | TEV/Revenue |

| Argo Blockchain | LSE: ARB | 3.6 |

| BIGG Digital | CSE: BIGG | 11.0 |

| Bitcoin Well | TSXV: BTCW | 0.8 |

| Canaan Inc. | NASDAQ: CAN | 1.2 |

| CleanSpark Inc. | NasdaqCM:CLSK | 22.1 |

| Coinbase Global | NASDAQ: COIN | 21.2 |

| Galaxy Digital Holdings | TSX: GLXY | N/A |

| HIVE Digital | TSXV:HIVE | 3.8 |

| Hut 8 Mining Corp. | TSX: HUT | 8.2 |

| Marathon Digital Holdings | NASDAQ: MARA | 15.5 |

| Riot Platforms | NASDAQ: RIOT | 9.0 |

| SATO Technologies | TSXV: SATO | 2.5 |

| AVERAGE | 9.0 | |

| MEDIAN | 8.2 | |

| MINIMUM | 0.8 | |

| MAXIMUM | 22.1 |

Source: S&P Capital IQ/FRC