Dovish Tone from the Fed / Reddit’s IPO / SNB Leads Rate Cuts

Published: 3/25/2024

Author: FRC Analysts

Summary

- Last week, the S&P 500, gold, Bitcoin, and AI stocks surged amid a dovish tone from the Fed

- Shares of a gold junior under coverage were up 35% WoW

- Last week, the Swiss National Bank (SNB) became the first major central bank to cut rates

- Promising press release from a financial services company under coverage

- Companies on our Top Picks list were up 5% on average last month vs -1% for the benchmark (TSXV).

Nevis Brands Inc. (NEVI.CN)

PR Title: Reported financial results for the quarter ended November 2023

Analyst Opinion: In the quarter ended November 2023, revenue was up 44% QoQ to $396k, and gross margins were up 18 pp to 66%. However, net losses increased from $39k (EPS: -$0.002) to $77k (EPS: -$0.004), due to higher G&A expenses. Our introductory note in October 2023 did not include our revenue/EPS estimates, or a fair value estimate. Shares are up 22% since our note. Nevis owns a portfolio of THC-infused beverage brands. According to Fact.MR, the U.S. cannabis-infused beverage market will grow by 10% p.a. through 2032. In the quarter ended November 2023, revenue came from royalties received from licensees in five states. Since then, the company has expanded its distribution to encompass Nevada, California, Michigan, and Missouri, expanding its footprint to nine states. Therefore, we anticipate a significant jump in revenue this year. NEVI is trading at 1.6x revenue vs the Beverage sector average of 3.3x (Source: S&P Capital IQ).

Western Exploration Inc. (WEX.V, WEXPF)

PR Title: Announces a fully allocated $6M equity financing

Analyst Opinion: FRC Opinion: Positive – Funds will be used towards exploration and development at the Aura gold-silver project in Nevada. Agnico Eagle (NYSE: AEM, 16%) is a major shareholder.

Hannan Metals Ltd. (HANNF, HAN.V)

PR Title: Discovers a new thick style of high-grade sediment hosted copper (Peru)

Analyst Opinion: FRC Opinion: Positive – HAN has identified copper-silver mineralization along a strike length of 2.3 km, with high grades of up to 3.1% Cu. Five mineralized zones have been identified to date, with potential to host sediment-hosted deposits. Sediment-hosted deposits tend to host large tonnage/high-grades.

Max Resource Corp. (MXROF, MAX.V)

PR Title: Reports high-grade assays at AM-14, CESAR project (Colombia), including 2.2% copper, and 12.8 g/t silver, over 5.2 m

Analyst Opinion: FRC Opinion: Positive – Rock chip sampling at the AM-14 target, within the CESAR copper-silver project, returned high copper grades.

StrategX Elements Corp. (STGX.CN)

PR Title: Expands the Nagvaak critical metals and graphite discovery (Nunavut)

Analyst Opinion: FRC Opinion: Positive – Promising results; drilling at its flagship Nagvaak project returned high graphite grades of up to 34.9%, along with critical metals such as vanadium, nickel, copper, molybdenum, silver, PGE, gold, and zinc.

Skyharbour Resources Ltd. (SYH.V, SYHBF)

PR Title: Partner North Shore Uranium (TSXV: NSU) identifies elevated radioactivity fault zones and alteration at the Falcon project in Saskatchewan

Analyst Opinion: FRC Opinion: Positive – A maiden drill program intersected fault zones, and alteration associated with uranium mineralization, at two out of three targets. NSU is awaiting assay results.

Olympia Financial Group Inc. (OLY.TO)

PR Title: Seeking registration as a trust corporation Ontario

Analyst Opinion: FRC Opinion: Positive – OLY’s subsidiary, Olympia Trust Company, is licensed as a trust corporation in all Canadian provinces except ON, restricting its ability to solicit or market services in ON. Currently, it acquires customers in ON through word-of-mouth referrals. However, with pending registration in ON, OLY could potentially initiate operations within the next six to 12 months, including the establishment of offices and active marketing campaigns to attract new customers in ON. OLY has not disclosed the percentage of its existing 132k+ accounts that belong to customers in Ontario, Canada's largest market representing 40% of the population. If we assume that ON currently accounts for 10% of OLY’s customer base, we believe OLY could potentially increase its clientele by 50% after launching marketing efforts in the province. Anticipating record revenue and EPS in 2024, we deem the latest announcement justifiable for revising our long-term revenue forecasts. We intend to incorporate these revisions in our upcoming Q1-2024 update.

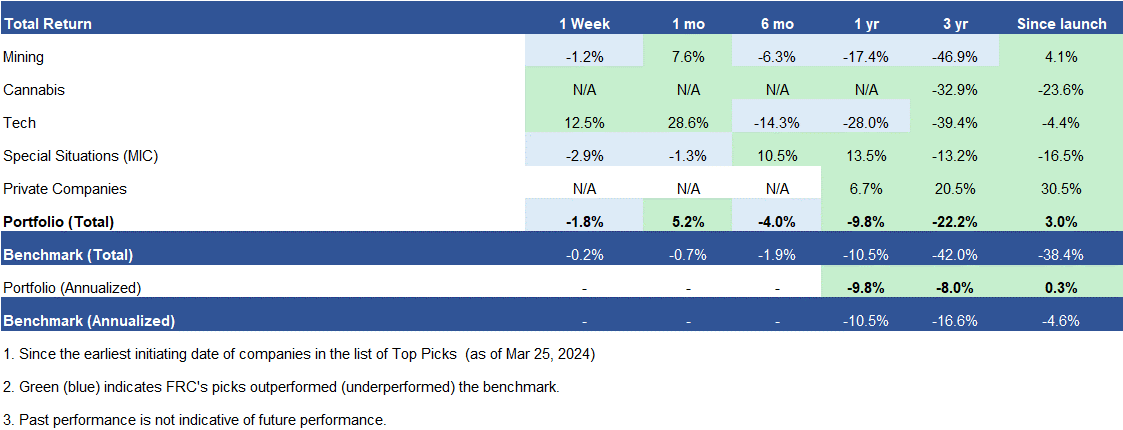

FRC Top Picks

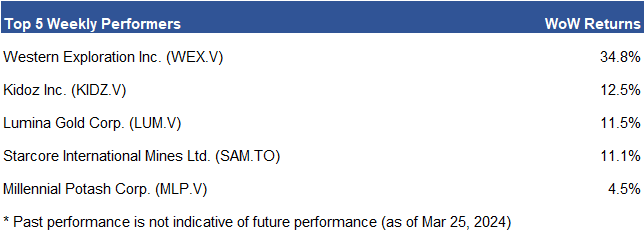

The following table shows last week’s top five performers among our Top Picks, including four junior resource companies, and an Adtech company. The top performer, Western Exploration (TSXV: WEX), was up 35%. Last week, WEX announced a fully allocated $6M equity financing.

Top Five Performers Last Week

Source: FRC

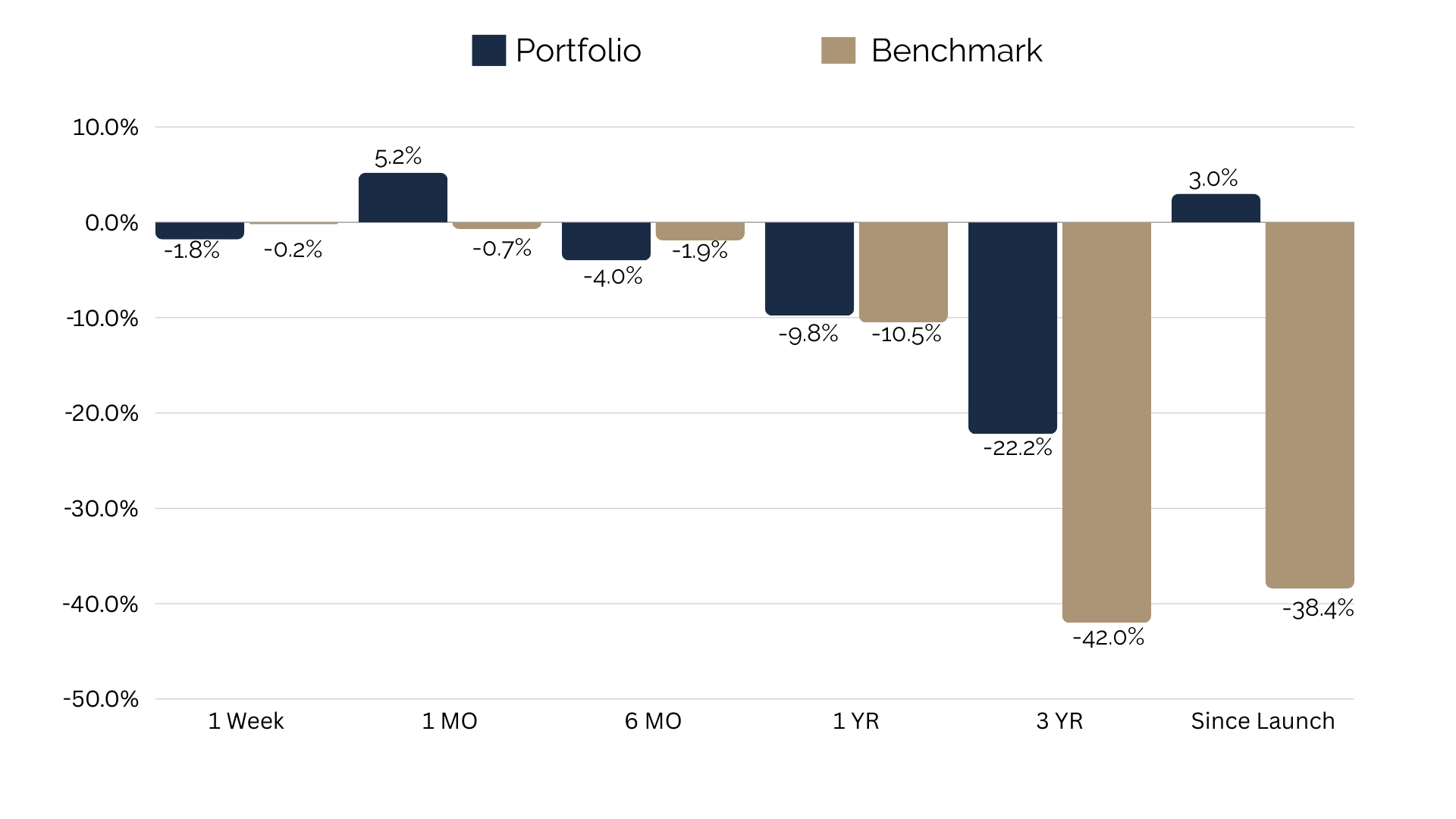

Last month, companies on our Top Picks list were up 5% on average vs -1% for the benchmark (TSXV).

Source: FRC

Weekly Mining Commentary

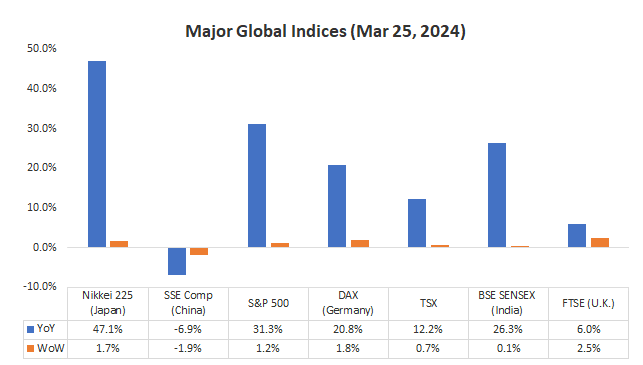

Last week, global equity markets were up 0.9% on average (up 0.8% in the previous week). The S&P 500, gold, BTC, and AI stocks surged amid a dovish tone from the Fed, suggesting three rate cuts this year, surpassing the consensus forecast of two. Last week, the Swiss National Bank (SNB) became the first major central bank to cut rates. We anticipate the Fed will start cutting rates in June. Meanwhile, Reddit (NYSE: RDDT) had a successful IPO last Thursday, raising US$750M at US$34 per share. The stock is currently trading at US$59.80. We believe these developments should encourage higher investor risk tolerance, prompting increased capital allocation to small-cap stocks, which have significantly trailed the performance of large-cap stocks in the past year.

Source: FRC / Various

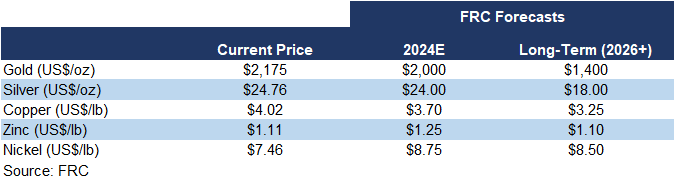

On average, metal prices were down 2% last week (up 1% in the previous week) amid a stronger US$.

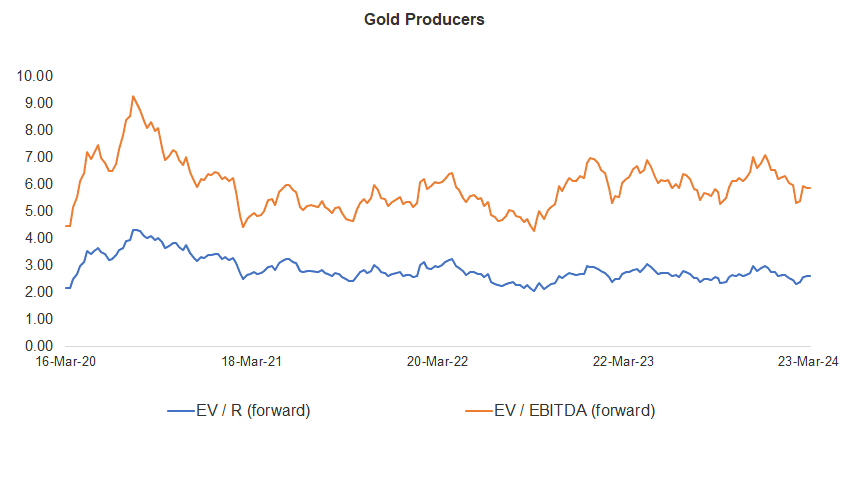

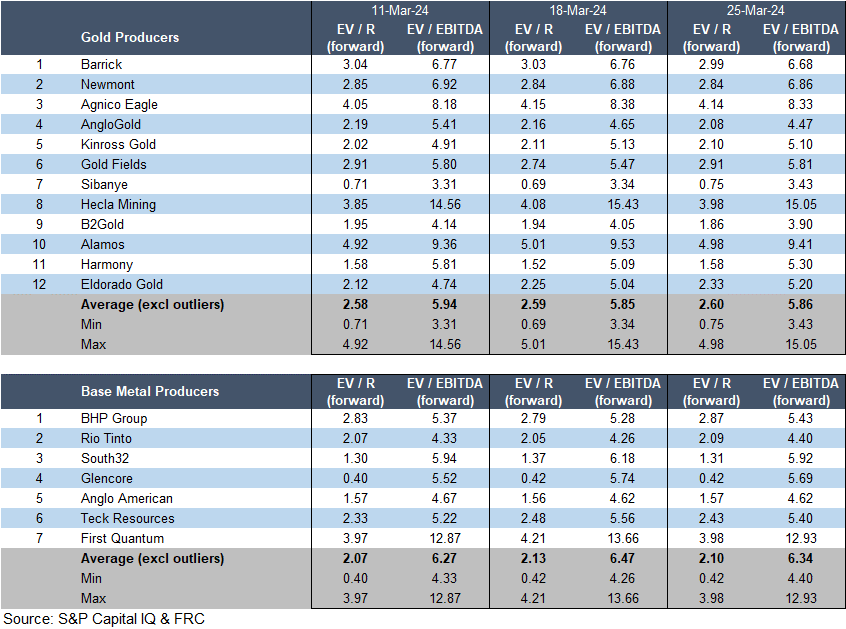

Gold producer valuations were up 0.3% last week (down 1% in the prior week); base metal producers were down 2% last week (up 3% in the prior week). On average, gold producer valuations are 20% lower compared to the past three instances when gold surpassed US$2k/oz.

Source: S&P Capital IQ&FRC

We are maintaining our metal price forecasts.

Weekly Crypto Commentary

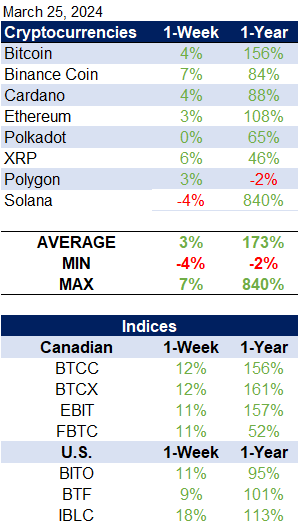

Prices of mainstream/popular cryptos were up 3% on average last week (down 8% in the previous week).

Source: FRC/Yahoo Finance

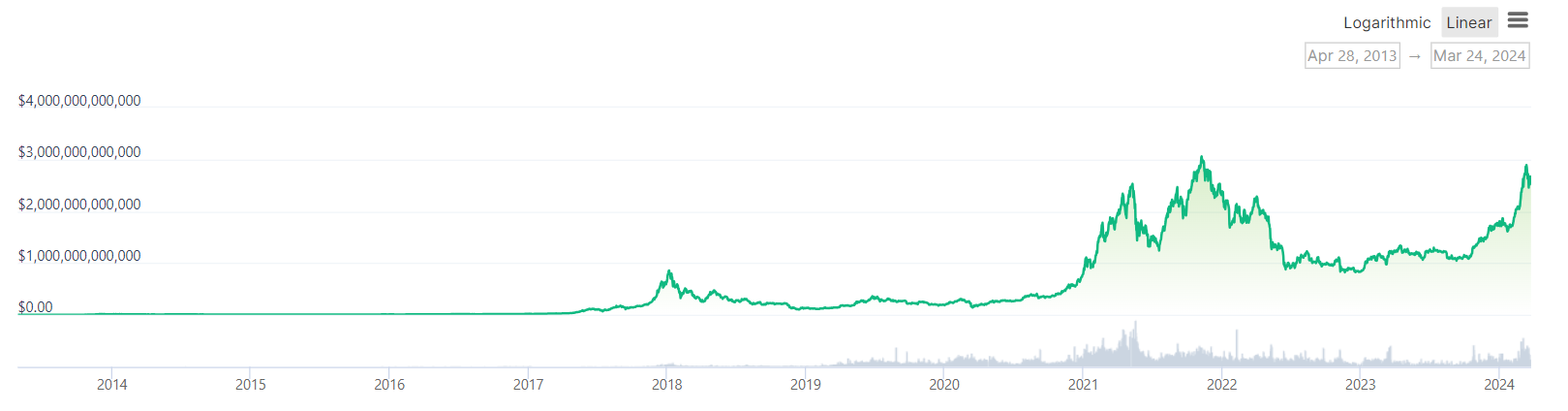

The global MCAP of cryptos is US$2.6T, up 18% MoM, and 117%YoY.

Total Crypto Market Cap Chart

Source: CoinGecko

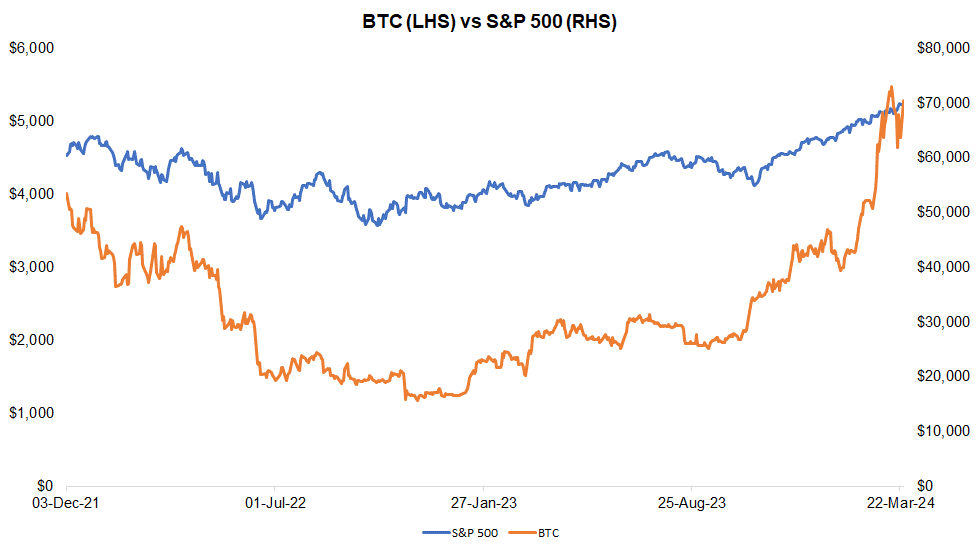

BTC was up 4% last week, while the S&P 500 was up 1%.

Source: FRC/Yahoo Finance

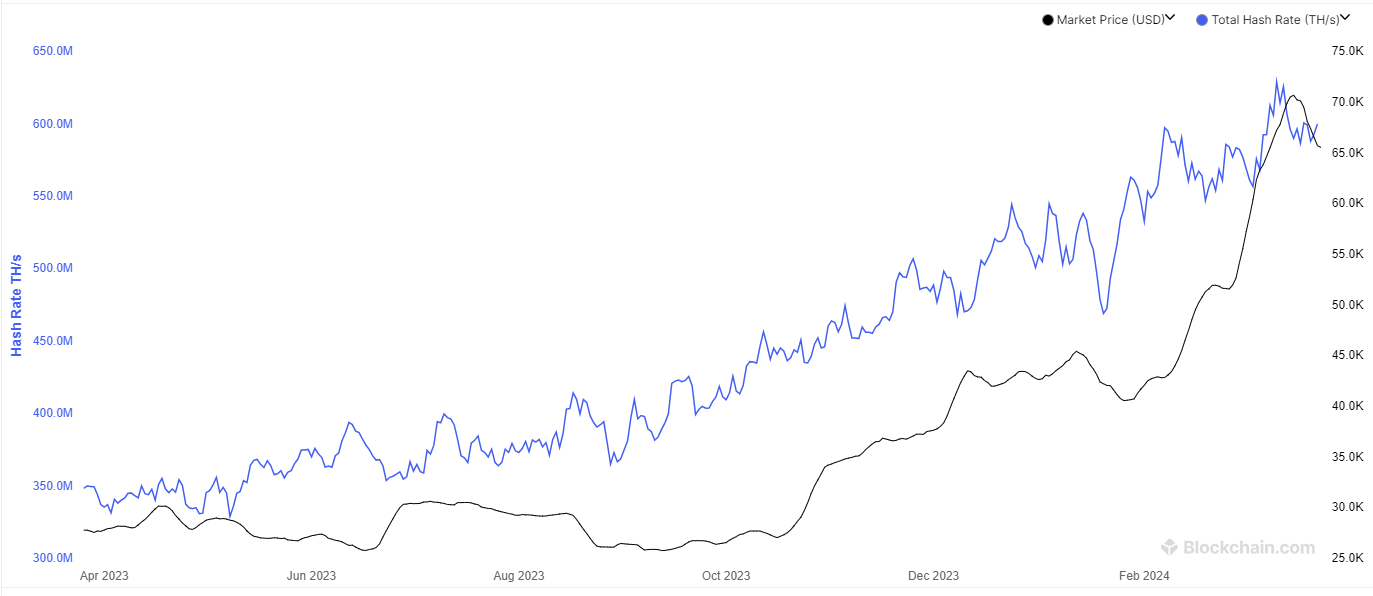

The global hash rate of BTC (defined as calculations performed per second/an indicator of network difficulty) is 600 exahashes per second (EH/s), up 2% WoW, and 2% MoM. The increase in hash rates is negative for miners as their efficiency rates (BTC production per EH/s) are inversely linked to global hash rates.

Total Hash Rate (BTC)

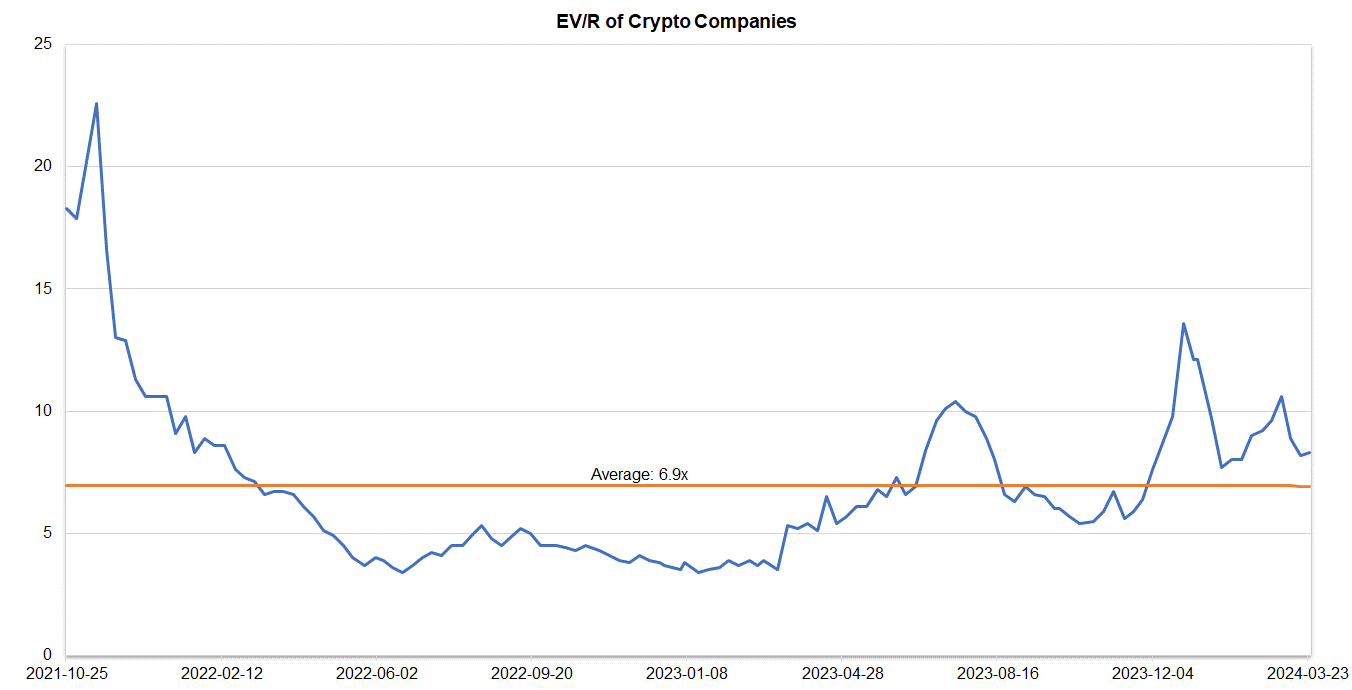

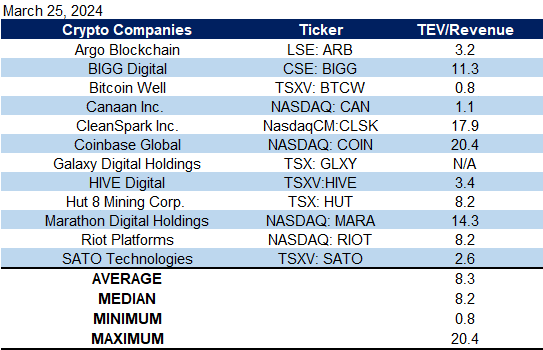

Companies operating in the crypto space are trading at an average EV/R of 8.3x (previously 8.2x).

Source: S&P Capital IQ/FRC

Source: S&P Capital IQ/FRC