Gold & Bitcoin Approaching Highs / AI Stocks Dominate Headlines / Predicting Increased Risk Appetite

Published: 3/7/2024

Author: Sid Rajeev, B.Tech, CFA, MBA

Summary

Last week, gold and Bitcoin (BTC) were up 5%, and 7%, respectively, and are currently trading near their all-time highs

Artificial Intelligence/AI stocks continued to tend higher, dominating headlines

We are predicting higher investor risk tolerance, prompting increased capital allocation to small-cap stocks

Shares of a lithium junior under coverage were up 42% WoW

Nickel has risen 10% to US$7.78/lb since our note in January, wherein we predicted an uptick in prices.

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks, including four junior resource companies, and a biotech company. The top performer, Noram Lithium (TSX: NRM), was up 42%. NRM is advancing a large high-grade lithium project in Nevada.

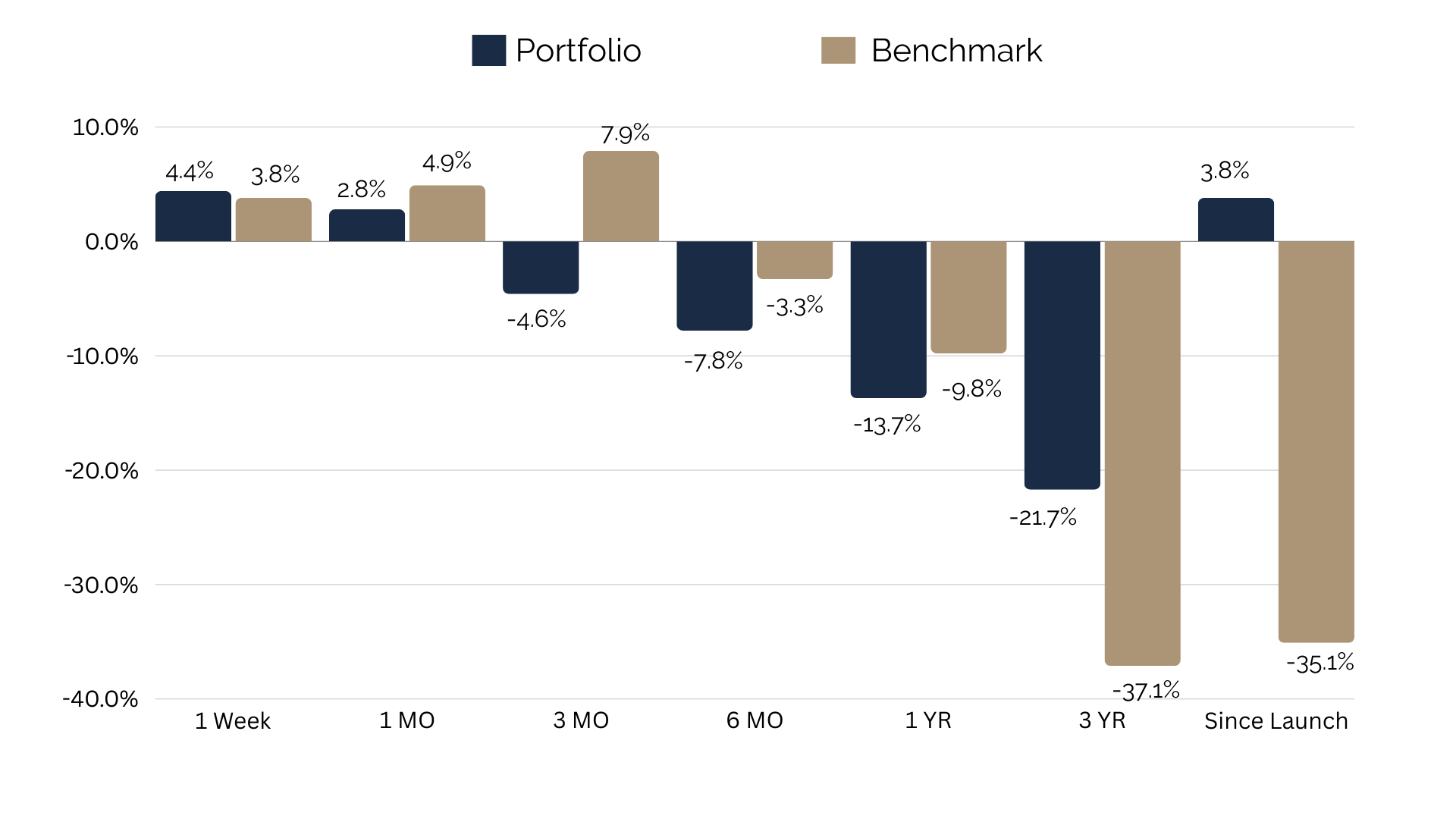

Companies on our Top Picks list are up 4% on average since we initiated coverage vs -35% for the benchmark (TSXV).

1. Since the earliest initiating date of companies in the list of Top Picks (as of March 04, 2024)

2. Green (blue) indicates FRC’s picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.

Weekly Mining Commentary

Last week, global equity markets were up 1.3% on average (up 1.2% in the previous week), driven by cooling inflation in Europe, and slower than expected U.S. GDP growth. Gold and BTC were up 5%, and 7%, respectively, and are currently trading near their all-time highs. AI stocks continued to tend higher, dominating headlines. We believe these developments should encourage higher investor risk tolerance, prompting increased capital allocation to small-cap stocks, which have significantly trailed the performance of large-cap stocks in the past year.