China Optimism, Junior Gold Deal, and Bitcoin Price Forecast

Published: 2/21/2024

Author: Sid Rajeev, B.Tech, CFA, MBA

Summary

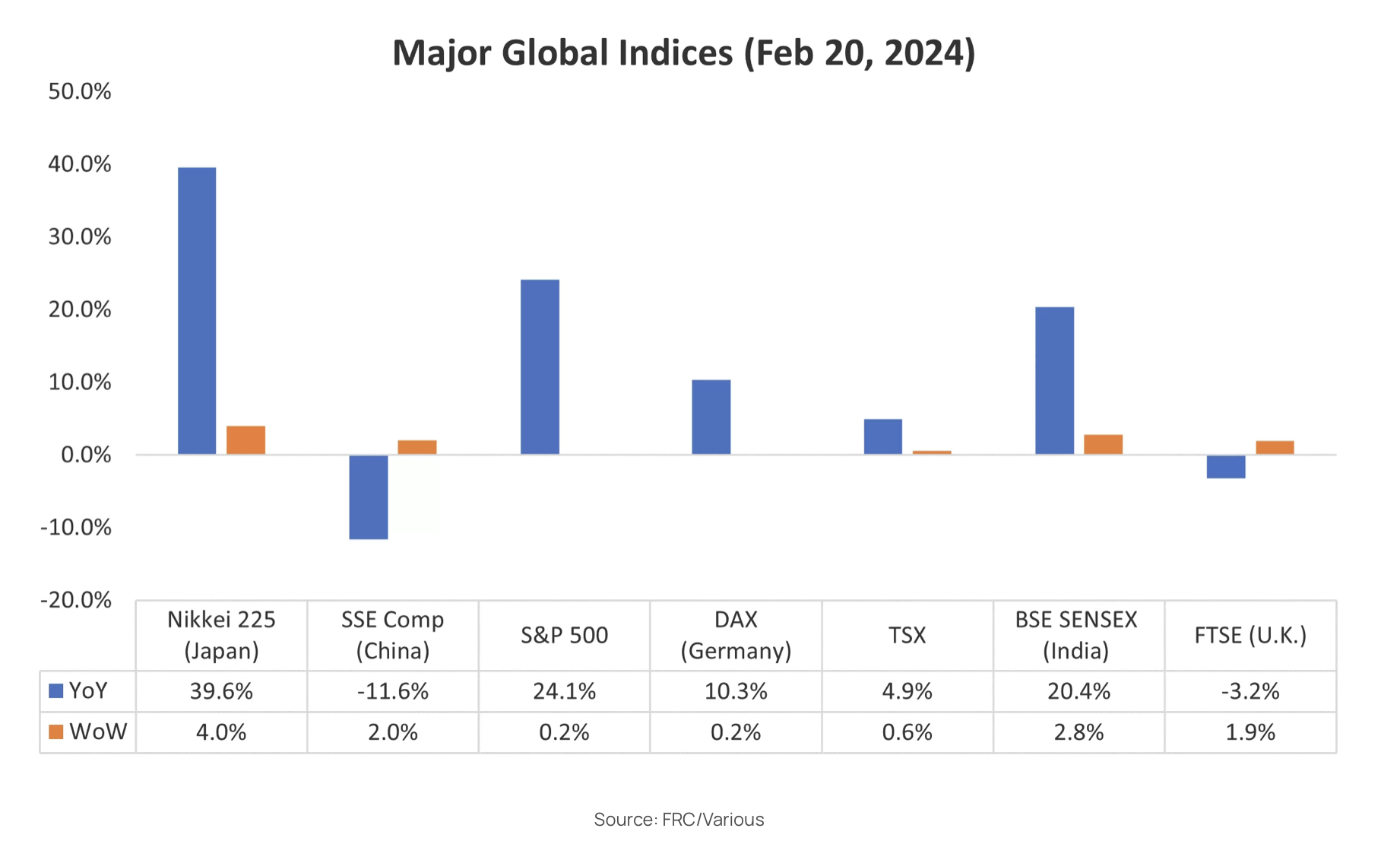

Last week, global equity markets were up 1.7% on average

Positive news from China, and mixed results from the U.S.

A material deal in the junior gold space

An oilfield services company under coverage reported robust revenue/EBITDA growth

We believe the fair value of Bitcoin (BTC) is US$43.5k, indicating 15% downside potential from the current price

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks, including three gold juniors, a copper junior, and a lithium junior. The top performer, Rio2 Limited (TSXV: RIO), was up 14%. RIO is advancing a large open-pittable gold project in Chile.

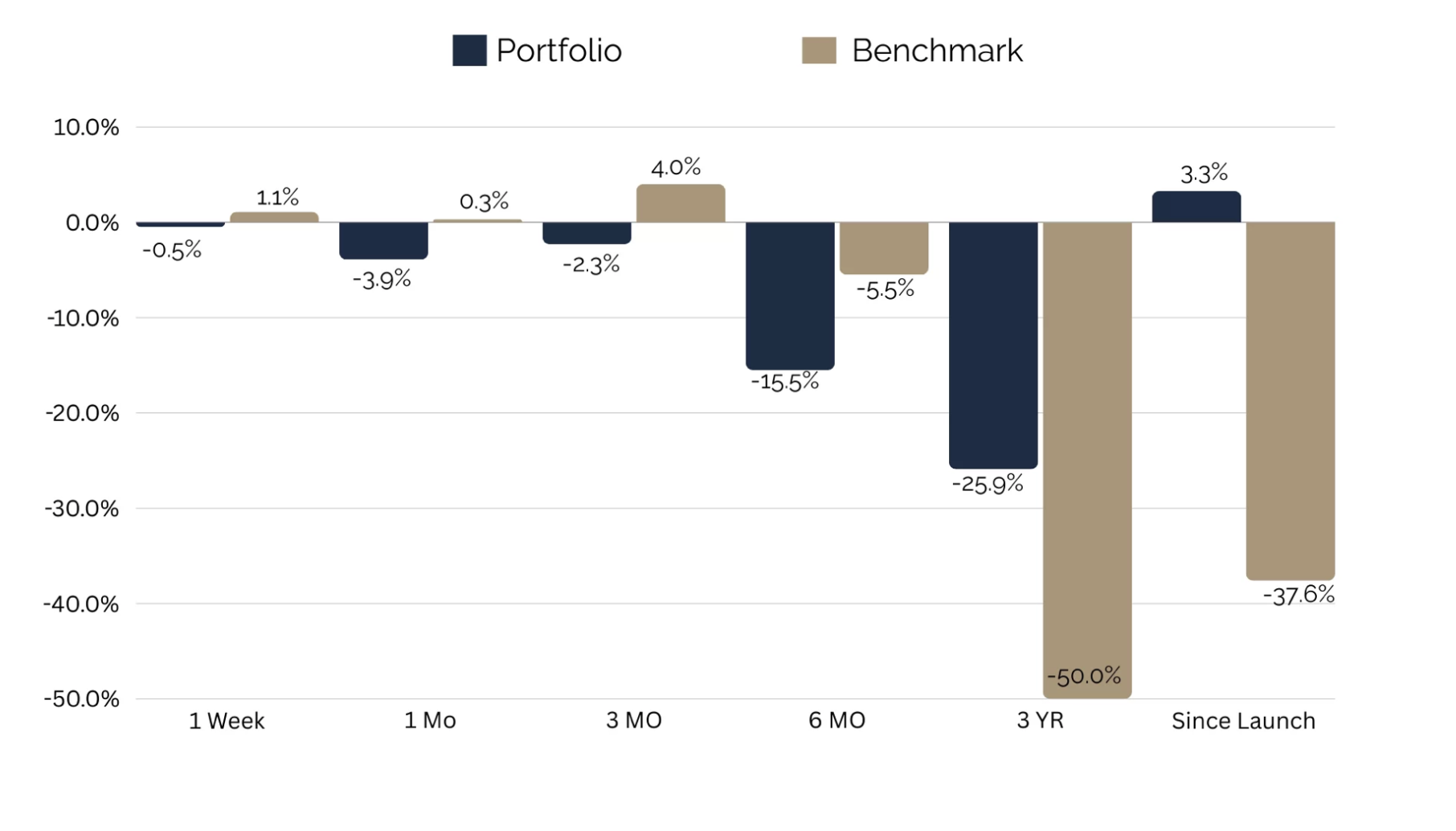

Companies on our Top Picks list are up 3% on average since we initiated coverage vs -38% for the benchmark (TSXV).

*Since the earliest initiating date of companies in the list of FRC’s Top Picks (as of February 20, 2024)

*Past performance is not indicative of future performance

1. Since the earliest initiating date of companies in the list of Top Picks (as of February 20, 2024)

2. Green (blue) indicates FRC’s picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.

Weekly Mining Commentary

Last week, global equity markets were up 1.7% on average (up 1.4% in the previous week). Positive developments emerged from China, marked by robust travel spending, and a decrease in their key mortgage rate. However, reports from the U.S. presented a more mixed picture: January inflation exceeded expectations, while retail spending declined. As mentioned last week, we believe the Fed will start cutting rates in June. Considering the superior performance of the U.S. economy relative to other nations, we believe the US$ will remain strong in the coming weeks.

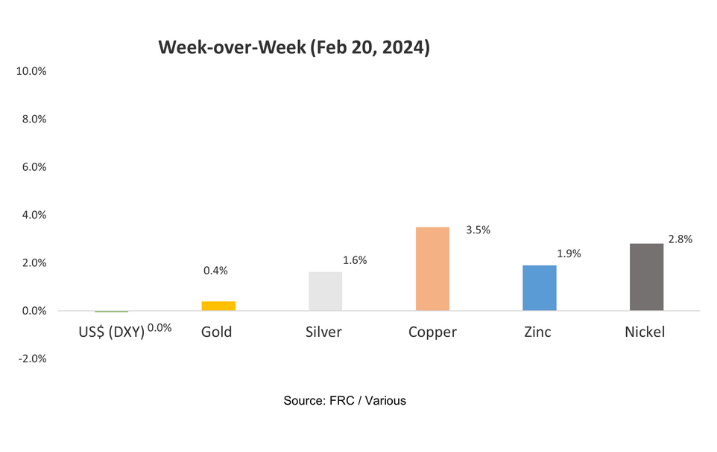

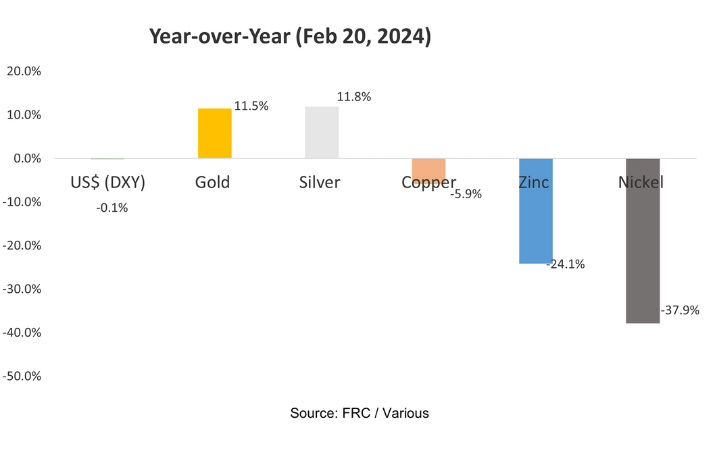

On average, metal prices were up 2% last week (down 1% in the previous week).

Gold producer valuations were down 2% last week (down 4% in the prior week); base metal producers were up 1% last week (down 2% in the prior week). On average, gold producer valuations are 21% lower compared to the past three instances when gold surpassed $2k/oz.

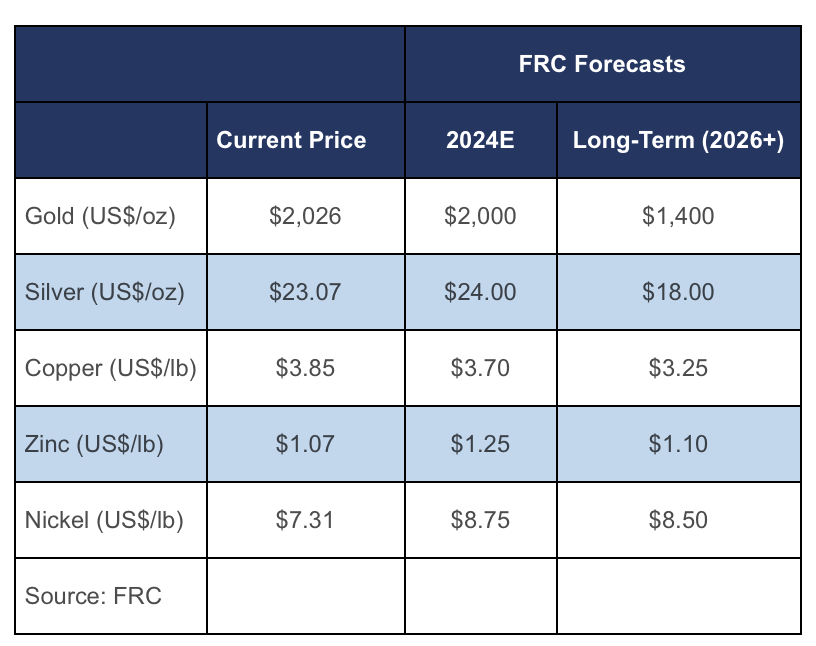

We are maintaining our metal price forecasts.

A key sector development (positive):

Last week, there was a significant deal in the junior gold space, consistent with our anticipated surge in M&A activity within the sector. Dundee Precious Metals Inc. (TSX:DPM) has decided to withdraw from its proposed takeover of Osino Resources (TSXV: OSI) for $287M, following Osino’s acceptance of a superior offer of $368M from an undisclosed miner. Osino owns an advanced stage gold project in Namibia, with resources totaling 3 Moz. We note that Osino is receiving $109/oz vs the sector average of $44/oz for gold juniors, reflecting a 148% premium.

Updates from Resource Companies Under Coverage

Tudor Gold Corp./ TSXV: TUD

PR Title: Announces an updated resource estimate

FRC Opinion Positive – TUD has completed an updated resource estimate for its 60% owned Treaty Creek project, located in the Golden Triangle, B.C. Resources increased by 10% to 34 Moz AuEq (78% gold + 22% copper/silver), solidifying the project’s status as one of the largest undeveloped gold projects globally. The weighted average grade was up 10% to 1.20 gpt AuEq. We will publish a detailed update report shortly.

Power Nickel Inc. / TSXV: PNPN

PR Title: Extends mineralization at Nisk Main (Quebec)

FRC Opinion Positive – Four out of six holes expanded mineralization along strike, and at depth. PNPN had recently delineated a medium-sized/high-grade resource totaling 178 Mlbs NiEq for the project. We believe the project has significant resource upside potential as the deposit remains open at depth. In addition, several targets remain untested.

Silver Dollar Resources Inc. / CSE: SLV

PR Title: Samples up to 4,311 g/t AgEq at its 100%-owned La Joya silver project (Mexico)

FRC Opinion Mixed – In 2023, revenue was up 25% to $34M, missing our estimate by 7%. However, gross margins were up 6 pp to 46% vs our forecast of 45%. EBITDA was up 63%, beating our estimate by 2%. We will publish a detailed update when audited financial statements are released in the coming weeks.