Our Top Picks Rally / A Helium Junior in the Limelight

Published: 1/6/2025

Author: FRC Analysts

In this edition, we analyze the performance of our top picks, including an oilfield services company, whose shares rose 27% last week. We also highlight the latest addition to our coverage: a leading helium junior with a relatively substantial MCAP among the fewer than 20 publicly listed helium juniors globally.

Highlights

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

Pulsar Helium Inc. (PLSR.V, PSRHF)

PR Title: Announces drilling has commenced at the Jetstream #1 appraisal well, Topaz project, Minnesota

Analyst Opinion: Positive – Management plans to deepen the Jetstream #1 well by another 500 m to test the full height of the reservoir, and initiate a step-out drilling program to expand the current resource envelope. The company is also pursuing a US$7.5M equity financing. Despite having a small initial resource estimate, PLSR ranks second in MCAP among the helium juniors we track, driven by its unusually high grades, and resource expansion potential. Upcoming catalysts include drilling, geophysics

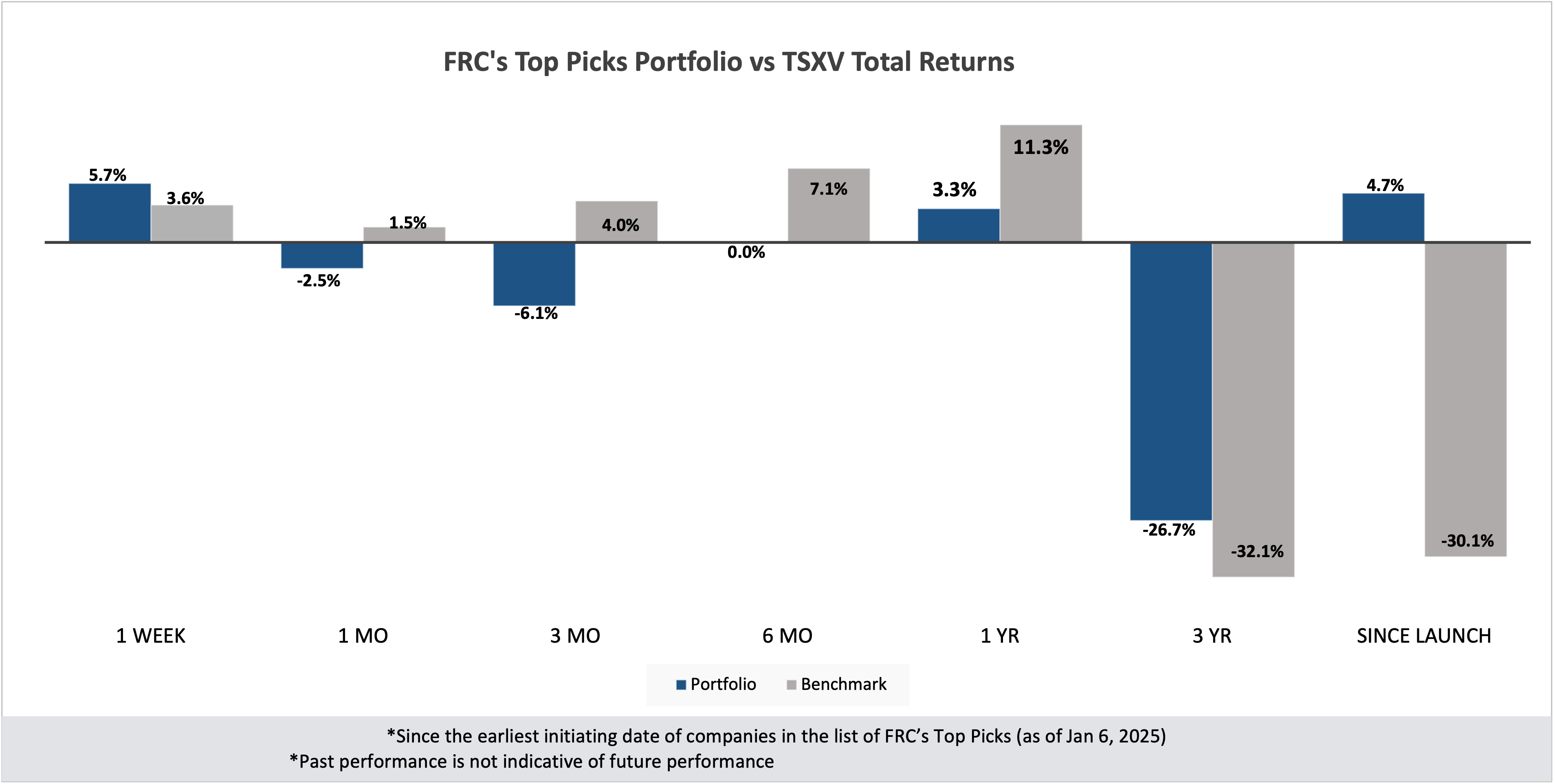

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks. The top performer, Enterprise Group, Inc. (E.TO), was up 27%. E is up 202% YoY, making it the second-best performing stock on our list of oilfield services companies.

* Past performance is not indicative of future performance (as of Jan 6, 2025)

Performance by Sector

1. Since the earliest initiating date of companies in the list of Top Picks (as of Jan 6, 2025)

2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.