Lithium Junior Lands $250M Offer, Almost Matching Our $255M Valuation

Published: 12/30/2024

Author: FRC Analysts

Highlights

In this edition, we analyze the performance of our top picks, including a copper-gold junior, whose shares rose 21% last week. We also highlight key updates from other companies under coverage, including a lithium junior that secured a $250M offer from a large Asian entity for its project in Argentina, closely matching our US$255M valuation.

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

Commentary on Resource Companies Under Coverage

Lithium Chile Inc. (LTMCF, LITH.V)

PR Title: Executes binding letter of intent for the sale of its Arizaro project

Analyst Opinion: Positive – LITH has attracted a large, Asian diversified enterprise to acquire the Arizaro project for $250M, closely matching the $255M valuation in our most recent update report from July 2024. We are very pleased with the transaction, not only because the deal size is close to our fair value estimate, but also because we had identified Arizaro as a prime acquisition target in our recent reports. LITH’s MCAP of $169M, compared to the $250M deal, indicates shares are undervalued, with no value given to any of the company’s other assets.

DLP Resources Inc. (DLPRF, DLP)

PR Title: Intersects 256 m of 0.68% CuEq, within a 1,008 m interval of 0.37% CuEq, on the Aurora Project

Analyst Opinion: Positive – The final hole of a recent drill program at the flagship Aurora project in Peru returned attractive values over long intercepts. All nine holes intersected promising molybdenum, copper, and silver mineralization to depths exceeding 1,000 meters. Additionally, preliminary metallurgical tests confirmed good recoveries, with no significant deleterious elements. We believe the project has the potential to host over 5 Blbs of copper equivalent. Management aims to complete a maiden resource estimate in Q1-2025.

NV Gold Corporation (NVGLF, NVX.V)

PR Title: Renews exploration permits at its Surselva gold project (Switzerland)

Analyst Opinion: Positive – Surselva is prospective for orogenic gold deposits. Exploration has identified two primary targets: Medel (2km x 2km), and Surselva (7km x 7km); surface rock samples returned values of up to 17.4 g/t Au. The property is available for JV or option.

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks. The top performer, Hot Chili Limited (TSXV: HCH), was up 21%. HCH is advancing a large copper-gold project in Chile.

| Top Five Weekly Performers | WoW Returns |

| Hot Chili Limited (HHLKF) | 20.7% |

| Western Exploration Inc. (WEX.V) | 6.7% |

| Noram Lithium Corp. (NRM.V) | 5.6% |

| Giga Metals Corporation (GIGA.V) | 4.2% |

| Enterprise Group, Inc. (E.TO) | 3.3% |

| * Past performance is not indicative of future performance (as of Dec 30, 2024) |

Performance by Sector

| Total Return | 1 Week | 1 mo | 3 mo | 6 mo | 1 yr | Since launch |

| Mining | -0.6% | -12.7% | -10.4% | -13.9% | -6.4% | -9.2% |

| Cannabis | N/A | N/A | N/A | N/A | N/A | -23.6% |

| Tech | -17.2% | -17.2% | -7.7% | -22.6% | -36.8% | -4.8% |

| Special Situations (MIC) | -1.2% | -6.9% | -11.5% | 14.0% | 38.9% | 3.0% |

| Private Companies | N/A | N/A | N/A | N/A | 6.7% | 30.5% |

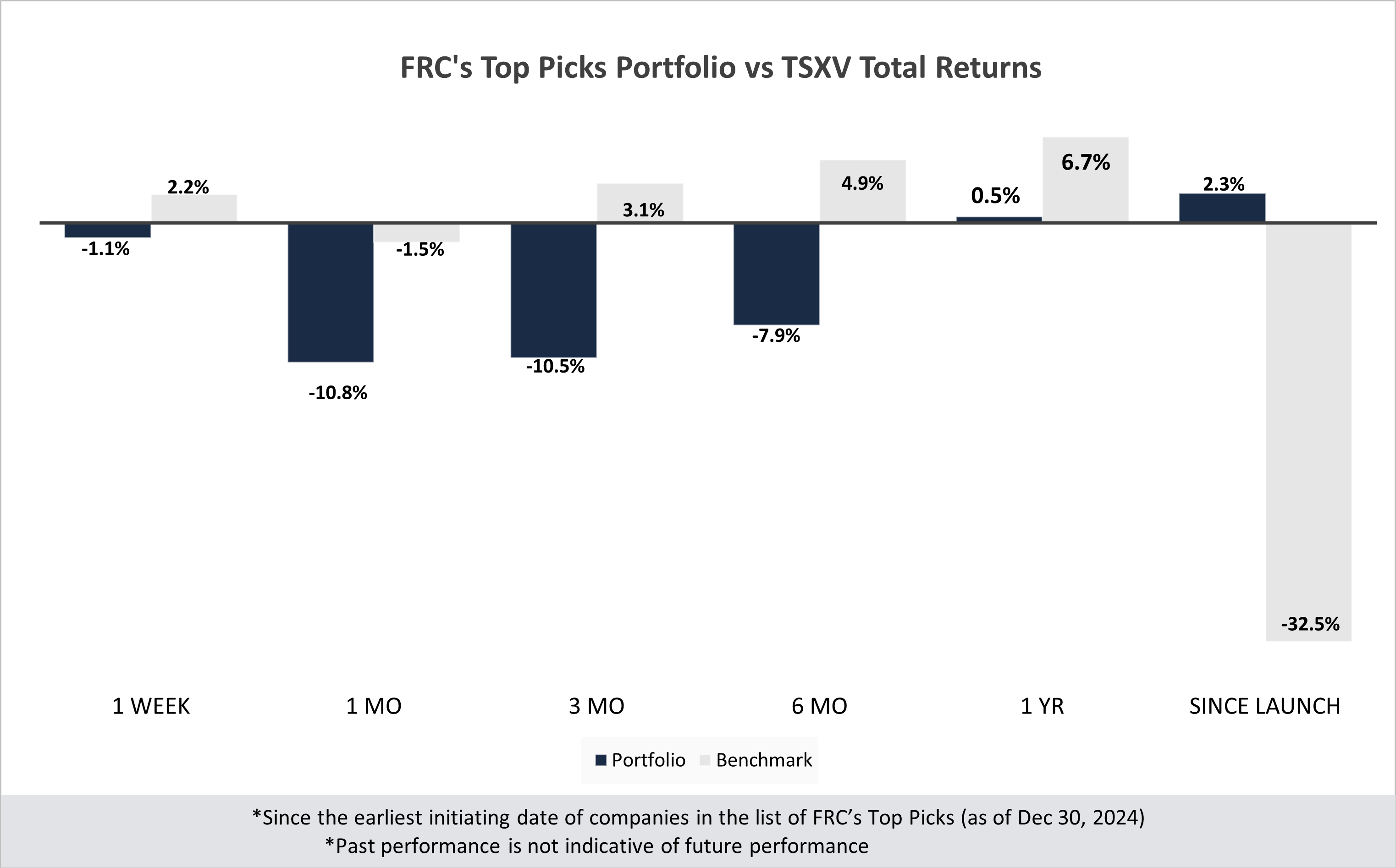

| Portfolio (Total) | -1.1% | -10.8% | -10.5% | -7.9% | 0.5% | 2.3% |

| Benchmark (Total) | 2.2% | -1.5% | 3.1% | 4.9% | 6.7% | -32.5% |

| Portfolio (Annualized) | - | - | - | - | 0.5% | 0.2% |

| Benchmark (Annualized) | - | - | - | - | 6.7% | -3.5% |

| 1. Since the earliest initiating date of companies in the list of Top Picks (as of Dec 30, 2024) | ||||||

| 2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark. | ||||||

| 3. Past performance is not indicative of future performance. | ||||||

Our complete list of top picks (updated weekly) can be viewed here.