Junior Movers & Shakers / Introducing a Promising New Junior

Published: 12/23/2024

Author: FRC Analysts

Highlights

In this edition, we analyze the performance of our top picks, including a project generator under coverage, whose shares rose 11% last week. We also highlight juniors with promising exploration results and financing. Furthermore, we present a snapshot of an early-stage, untested copper-nickel-polymetallic junior that has recently attracted a seasoned veteran with an exceptional track record in the resource sector. We will be initiating coverage on this company shortly.

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

- Introducing an early-stage polymetallic junior backed by a strong team

Commentary on Resource Companies Under Coverage

Power Metallic Mines Inc. (PNPN.V)

PR Title: Additional results from its polymetallic Lion zone (Quebec)

Analyst Opinion: Positive – An ongoing drill program continues to intersect mineralization, extending the Lion zone footprint from 550 to 600 m at depth. One hole returned high grade intercepts, including 29.5 m with grades ranging from 2.3% to 11% CuEq. We project the Lion zone could host up to 1 Blbs of high-grade CuEq. Lion is one of two main mineralized areas within the Nisk project, alongside the nickel-rich Nisk Main deposit, which hosts 178 Mlbs NiEq.

Equity Metals Corporation (EQMEF, EQTY.V)

PR Title: Initial results from a fall drill program on the Silver Queen property (B.C.)

Analyst Opinion: Positive – Drilling returned bonanza grades of up to 1,475 AgEq at the No. 3 North target, indicating potential for resource expansion. The project currently hosts resources totaling 1.04 Moz AuEq (85 Moz AgEq) at 6.2 g/t AuEq (512 g/t AgEq).

Silver Dollar Resources Inc. (SLVDF, SLV.CN)

PR Title: Identifies two new anomalies at the Ranger-Page project (Idaho)

Analyst Opinion: Positive – Geophysical surveys at the recently acquired Ranger-Page project identified two new prospects, bringing the total number of targets to nine. The drill-ready project hosts six historic mines, which have produced over 1.1 Blbs of zinc and lead, and 14.6 Moz of silver.

Doubleview Gold Corp. (DBLVF, DBG.V)

PR Title: Expands mineral claims at the Hat project (B.C.); announces a private placement of up to $1.5M

Analyst Opinion: Positive – DBG has more than tripled the Hat polymetallic project’s land package, from 5,214 to 18,114 hectares. The company is awaiting results for the remaining 15 holes of an 18-hole/10,000 m drill program, which will support an updated resource estimate. The Hat project hosts an open-pittable polymetallic porphyry deposit, with resources totaling 5 Blbs of CuEq at 0.36%, uniquely enriched with scandium and cobalt.

South Star Battery Metals Corp. (STSBF, STS.V)

PR Title: Announces a US$3.2M equity financing

Analyst Opinion: Positive – STS is ramping up production at its Santa Cruz graphite mine in Brazil. A recent PEA on the BamaStar graphite project in Alabama yielded an AT-NPV8% of US$1.6B, and an AT-IRR of 27%, based on US$1k/t graphite, in line with the current spot price. Management plans to initiate production at BamaStar in 2027.

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks. The top performer, Transition Metals (TSXV: XTM), was up 11%. XTM is a multi-commodity prospect generator, with properties spread out across Canada, including prolific mining districts in Thunder Bay, Yukon, and Saskatchewan.

| Top Five Weekly Performers | WoW Returns |

| Transition Metals Corp.(XTM.V) | 11.1% |

| New Age Metals Inc. (NAM.V) | 6.3% |

| South Star Battery Metals Corp. (STS.V) | 5.7% |

| Verde Agritech Plc. (NPK.TO) | 4.8% |

| Lake Resources NL (LKE.AX) | 3.0% |

| * Past performance is not indicative of future performance (as of Dec 23, 2024) |

Performance by Sector

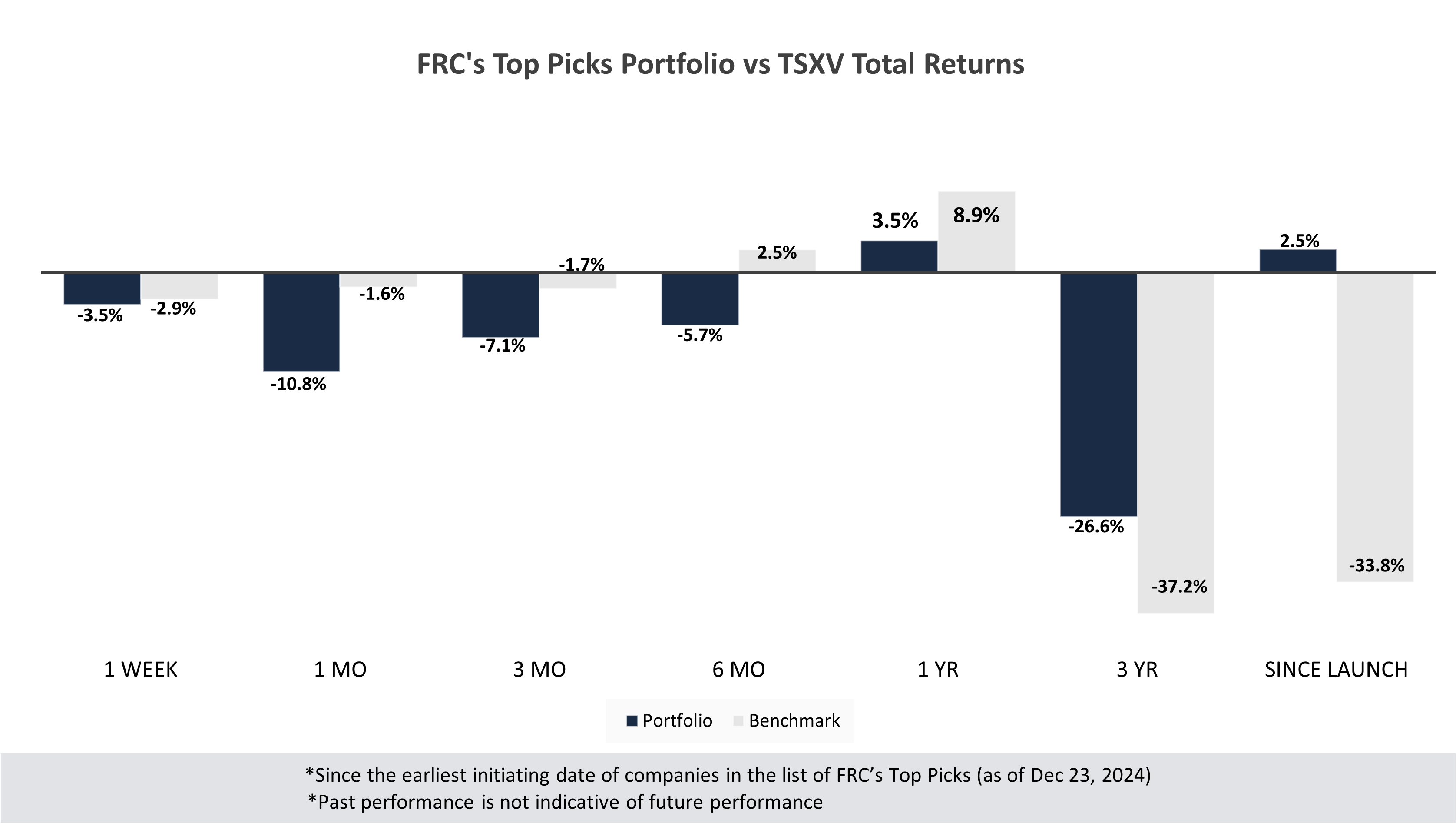

| Total Return | 1 Week | 1 mo | 3 mo | 6 mo | 1 yr | 3 yr | Since launch |

| Mining | -5.3% | -14.5% | -7.8% | -14.7% | -3.3% | -44.5% | -8.4% |

| Cannabis | N/A | N/A | N/A | N/A | N/A | -30.3% | -23.6% |

| Tech | 0.0% | 21.0% | 8.0% | -9.0% | 4.0% | -27.7% | -4.6% |

| Special Situations (MIC) | 3.7% | -5.4% | -7.8% | 32.0% | 36.4% | -47.3% | 1.9% |

| Private Companies | N/A | N/A | N/A | N/A | 6.7% | 20.5% | 30.5% |

| Portfolio (Total) | -3.5% | -10.8% | -7.1% | -5.7% | 3.5% | -26.6% | 2.5% |

| Benchmark (Total) | -2.9% | -1.6% | -1.7% | 2.5% | 8.9% | -37.2% | -33.8% |

| Portfolio (Annualized) | - | - | - | - | 3.5% | -9.8% | 0.2% |

| Benchmark (Annualized) | - | - | - | - | 8.9% | -14.4% | -3.7% |

| 1. Since the earliest initiating date of companies in the list of Top Picks (as of Dec 23, 2024) | |||||||

| 2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark. | |||||||

| 3. Past performance is not indicative of future performance. | |||||||

Our complete list of top picks (updated weekly) can be viewed here.

Introducing Cupani Metals Corp. (CSE: CUPA/MCAP: $19M)

We have begun our due diligence on CUPA. Below is a brief overview of CUPA’s Blue Lake project, and our initial assessment.

Cupani is an early-stage exploration company operating in a relatively untapped region of Quebec, backed by a strong management team and board. The company's CEO is the largest shareholder, owning approximately 31% of the outstanding shares. Recently, Cupani attracted Douglas MacQuarrie, an industry veteran with an exceptional track record in the resource sector. He founded Asante Gold Corporation (CSE: ASE/MCAP: $535M) in 2011, which successfully transitioned from an explorer to a producer. MacQuarrie also served as the CEO of PMI Gold, which was acquired by Galiano Gold (TSX: GAU) in 2013 for $180M. He currently owns 18% of Cupani's outstanding shares, and serves as a director of the company. We believe management and board’s significant investment in the company demonstrates their strong confidence, and belief in the potential of the Blue Lake project.

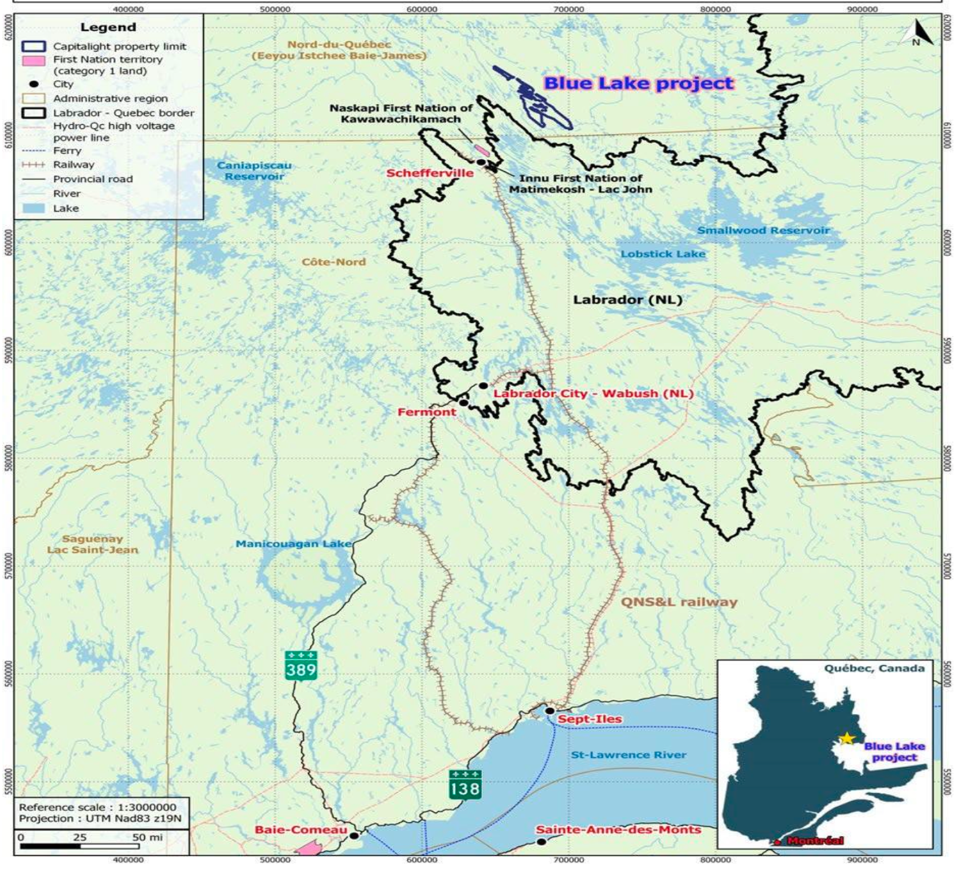

Blue Lake Project (100% owned)

The Blue Lake copper-nickel-platinum-palladium project, spanning 49,655 hectares, is located 65 km northeast of Schefferville, Quebec. Management spent the past 10 years consolidating this land package, which was previously held by various parties. The property is situated along the 1,600 km long and 160 km wide Labrador Trough, a prolific region that has produced over two billion tonnes of iron ore, and hosts numerous copper-nickel mines, deposits, and prospects.

Project Location

Source: Company

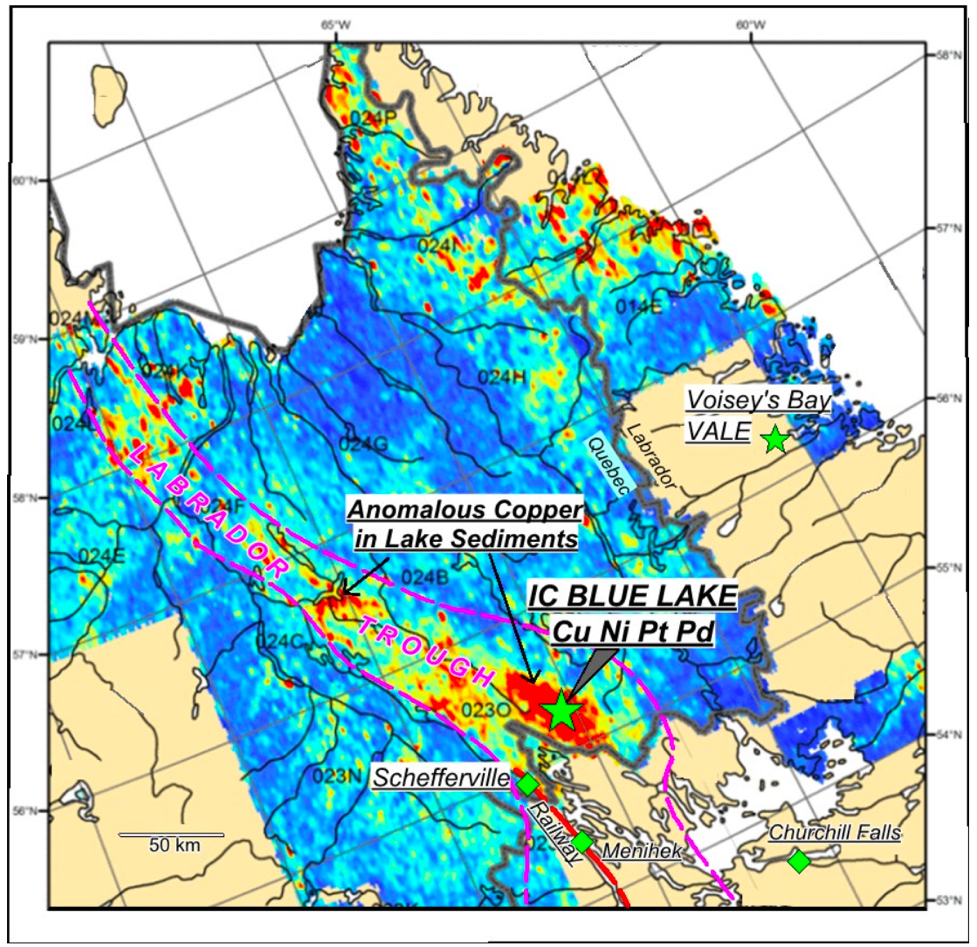

Labrador Trough and Copper Soil Anomalies

Source: Company

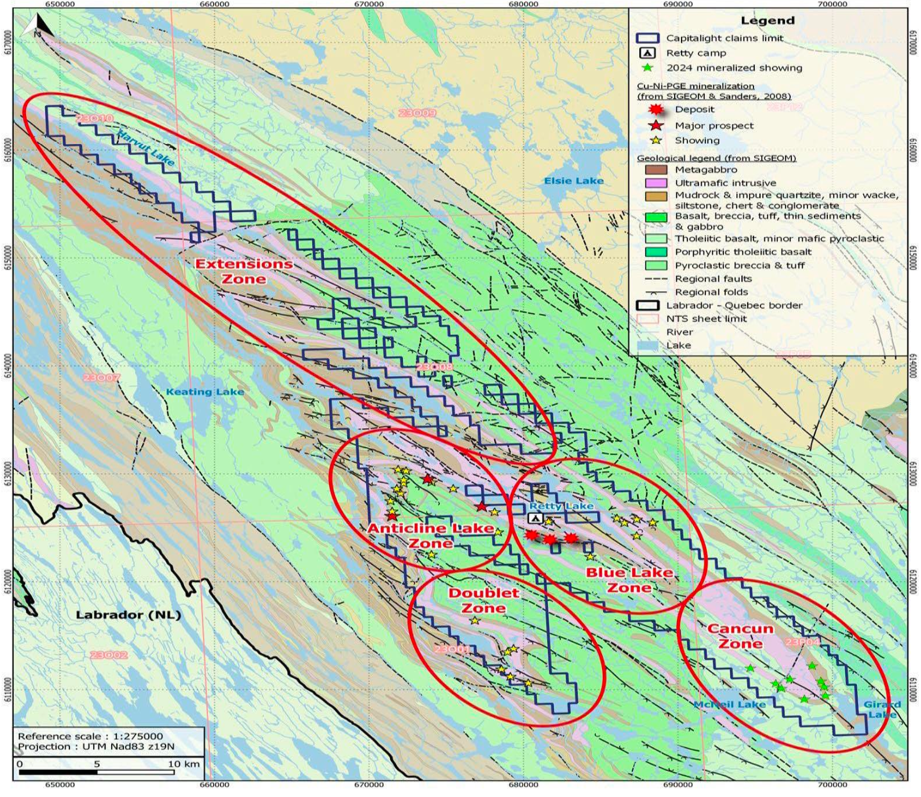

Exploration to date has identified five major zones (Blue Lake, Cancun, Anticline Lake, Doublet, and Extensions) spanning over 500 km². A significant advantage of the project is that mineralization is near surface, suggesting the potential for relatively low OPEX. Mineralization at this project is comparable to Vale's (BVMF: VALE3) operating Voisey’s Bay mine in Labrador, and Glencore's (LSE: GLEN) Raglan mine in Quebec.

Mineralized Zones

Source: Company

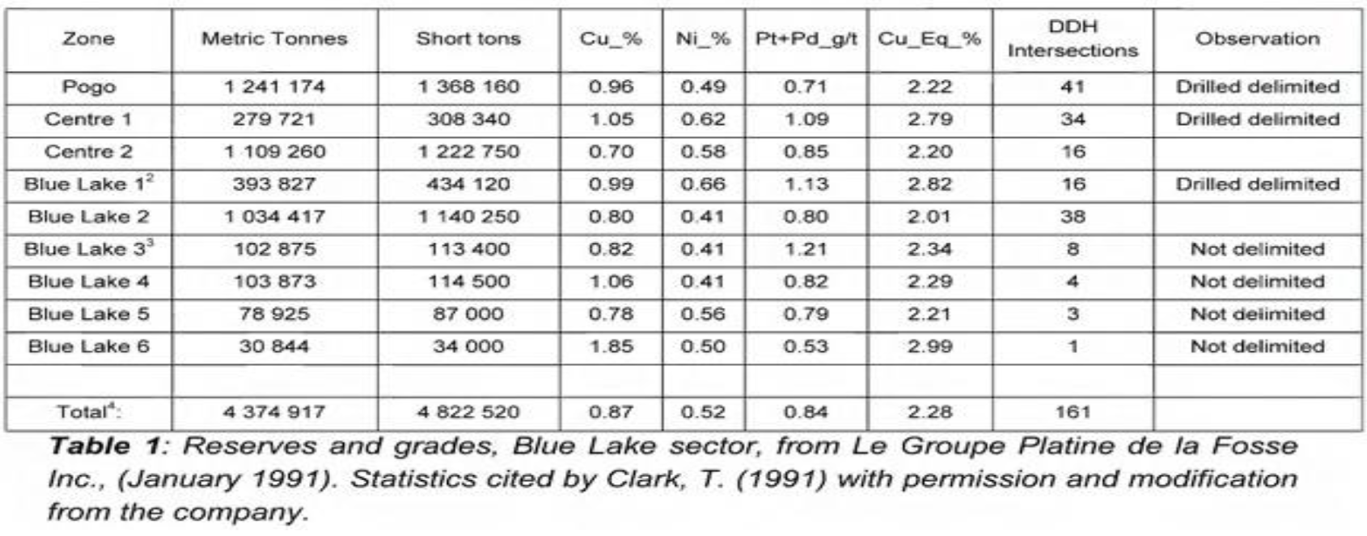

The Blue Lake zone hosts several deposits with historical, relatively high-grade resources totaling 4.83 Mt at 0.85% Cu, 0.52% Ni, 0.84 g/t Pt+Pd.

Historic Resources: Blue Lake Zone

Source: Company

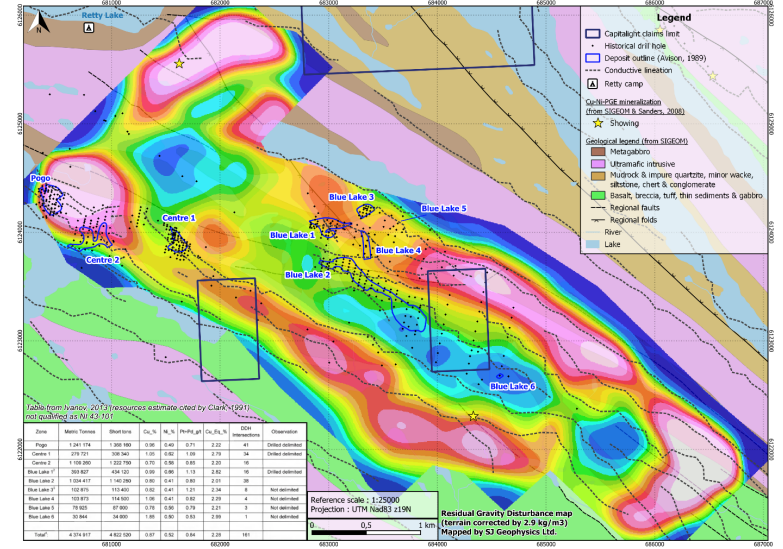

Recent gravity surveys have delineated multiple priority targets within the Blue Lake zone, located outside the boundaries of the historical resources. The company intends to test these targets. In addition, recent prospecting, sampling, and field surveys conducted at the Anticline Lake and Cancun zones have also yielded promising results.

2024 Gravimetric Survey Results

Source: Company

Management is currently reviewing historical data and drill holes, with plans to conduct follow-up exploration before generating drill targets. The company aims to confirm historical and delineate new resources for other targets within the Blue Lake zone, while also testing the Anticline Lake and Cancun zones in the near term. Given the size of the anomalies and the potential dimensions of each identified priority target, we believe the company has potential to discover resources several times larger than the historical estimate.

In summary, we believe that genuine early-stage, untested projects with strong management teams are scarce in the current environment, and Cupani is a standout example. We plan to initiate coverage with a detailed report and a valuation in the coming weeks.