Copper Junior Soars 45%, Lithium and Gold-Silver Updates

Published: 11/18/2024

Author: FRC Analysts

Highlights

In this edition, we analyze the performance of our top picks, including a copper junior under coverage, whose shares rose 45% last week. We also highlight important updates from two lithium juniors, a near-term gold-silver producer, and additional noteworthy developments.

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

Lake Resources NL (LKE)

PR Title: Announces sale of non-core assets

Analyst Opinion: Positive – LKE has secured a buyer for three of its non-core lithium assets in Argentina for A$14M. This sale will boost LKE’s cash position to A$31M. We are pleased to see LKE execute its plan to divest non-core assets, enabling the company to concentrate fully on the Kachi lithium project. Kachi hosts a large-tonnage/low-grade lithium brine resource totaling 10.6 Mt LCE at 218 mg/L.

GMV Minerals Inc. (GMV.V, GMVMF)

PR Title: Intersects two thick lithium claystone horizons at the Daisy Creek project (Nevada)

Analyst Opinion: Positive – Encouraging results; three out of four holes returned lithium intercepts of up to 49 m grading >1,000 ppm Li. We note that grades of comparable projects in Nevada typically range between 700 and 2,000 ppm. This project is in the early stages of lithium exploration.

N/A

PR Title: Acquires a 100% interest in the Toral Zn-PB-Ag project (Spain)

Analyst Opinion: Positive – As announced earlier, DMET has completed the acquisition of a 100% interest in Toral. This project hosts a large, high-grade resource totaling 3.2 Blbs of zinc+lead grading 7.2%. The company plans to complete an updated resource estimate this quarter, followed by a PEA in H1-2025. DMET is also awaiting approval of an Environmental Impact Study to begin mining operations at its Zancudo gold-silver project in Colombia.

Equity Metals Corporation (EQMEF, EQTY.V)

PR Title: Enters into an agreement to acquire the Arlington gold property (B.C.)

Analyst Opinion: Positive – EQTY can acquire the property for $780k in cash, shares, and exploration expenditures. This property, prospective for gold-copper-silver, is 60 km north of the Buckhorn mine, previously operated by Kinross (TSX: K). EQTY plans to begin soil sampling, geological mapping, prospecting, and trenching to identify potential drill targets. The company has recently finished a successful drill program at its flagship Silver Queen gold-silver-polymetallic project in B.C., with a follow-up drill program now in the works.

Skyharbour Resources Ltd. (SYH.V, SYHBF)

PR Title: Options 914W uranium project (Saskatchewan)

Analyst Opinion: Positive – SYH has optioned its early-stage 914W uranium property in the Athabasca Basin, Saskatchewan, to Mustang Energy Corp. (CSE: MEX). The optioner can acquire a 75% interest for $1.56M in cash/share payments, and exploration expenditures spread over three years. SYH’s portfolio is comprised of 29 properties covering 580k hectares. The company is actively exploring its flagship, high-grade Russell and Moore Lake projects. Option partners could commit over $41M for exploration, and over $52M in cash/share payments to SYH vs SYH's current MCAP of just $77M.

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks. The top performer, Panoro Minerals, was up 45%. Panoro is advancing multiple copper projects in Peru, including a large copper-gold deposit.

* Past performance is not indicative of future performance (as of Nov 18, 2024)

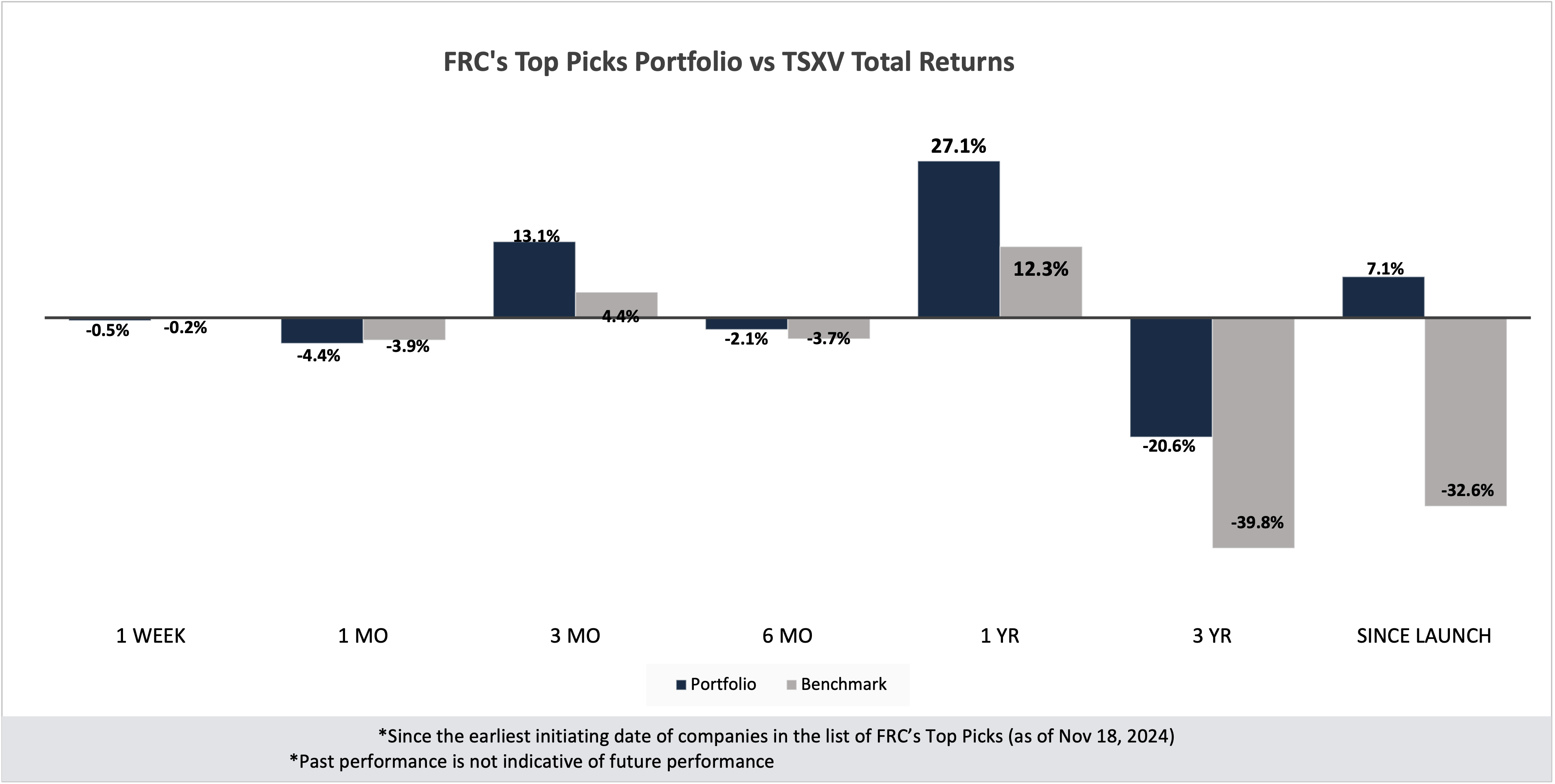

Our top picks have outperformed the benchmark (TSXV) in five out of seven time periods listed below.

Performance by Sector

1. Since the earliest initiating date of companies in the list of Top Picks (as of Nov 18, 2024)

2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.