Bitcoin Reaches New Highs on Trump Re-Election: Analyzing the Case for Holding

Published: 11/12/2024

Author: FRC Analysts

The re-election of Donald Trump has set-off unprecedented rallies across both traditional and digital assets. Bitcoin, now reaching record highs at US$88k, is leading the charge as investors gravitate toward cryptocurrencies amidst pro-crypto political shifts and bullish sentiment in equity markets. Alongside Bitcoin’s rise, the total cryptocurrency market capitalization has surpassed $3T for the first time since 2021, reflecting a heightened confidence in digital assets. With influential endorsements, softened regulatory expectations, and record inflows in stablecoin supply, Bitcoin’s historic rally is shaping up as a pivotal moment for cryptocurrencies as an alternative store of value. This analysis delves into the key drivers behind Bitcoin's latest surge, its implications for the crypto landscape, and the cautious optimism for investors navigating this dynamic market.

Key Drivers Behind Bitcoin’s Historic Surge

1. Softened Federal Oversight: Trump’s re-election has rekindled hopes for a more lenient regulatory approach towards digital assets. His administration’s stance indicates potential easing of federal oversight, which could provide a favorable framework for cryptocurrencies to flourish without the threat of heavy-handed regulations.

2. Pro-Crypto Political Landscape: Trump’s renewed embrace of digital assets aligns with a Congress that includes pro-crypto lawmakers, creating a supportive environment that recognizes the role of digital assets in the evolving economy. In a recent Bitcoin conference, Trump emphasized a commitment to positioning America as a leader in the crypto revolution.

3. Endorsement by Influential Figures: Elon Musk, a prominent Trump ally, has been vocal in his support for Bitcoin and other cryptocurrencies, amplifying the pro-crypto sentiment. Musk’s advocacy for digital assets not only validates the space but also encourages other high-net-worth individuals and institutional investors to explore cryptocurrencies as a viable asset class.

4. Expansion of Stablecoin Supply: According to recent data, stablecoin supply has grown significantly, with an additional US$5B injected into the market in the last week alone. Stablecoins, which now have a total market cap estimated at US$178B, often act as entry points for both retail and institutional investors. This increase in stablecoin supply has bolstered Bitcoin demand, as stablecoins facilitate trading and enhance liquidity in the crypto markets

Broader Crypto Market Gains

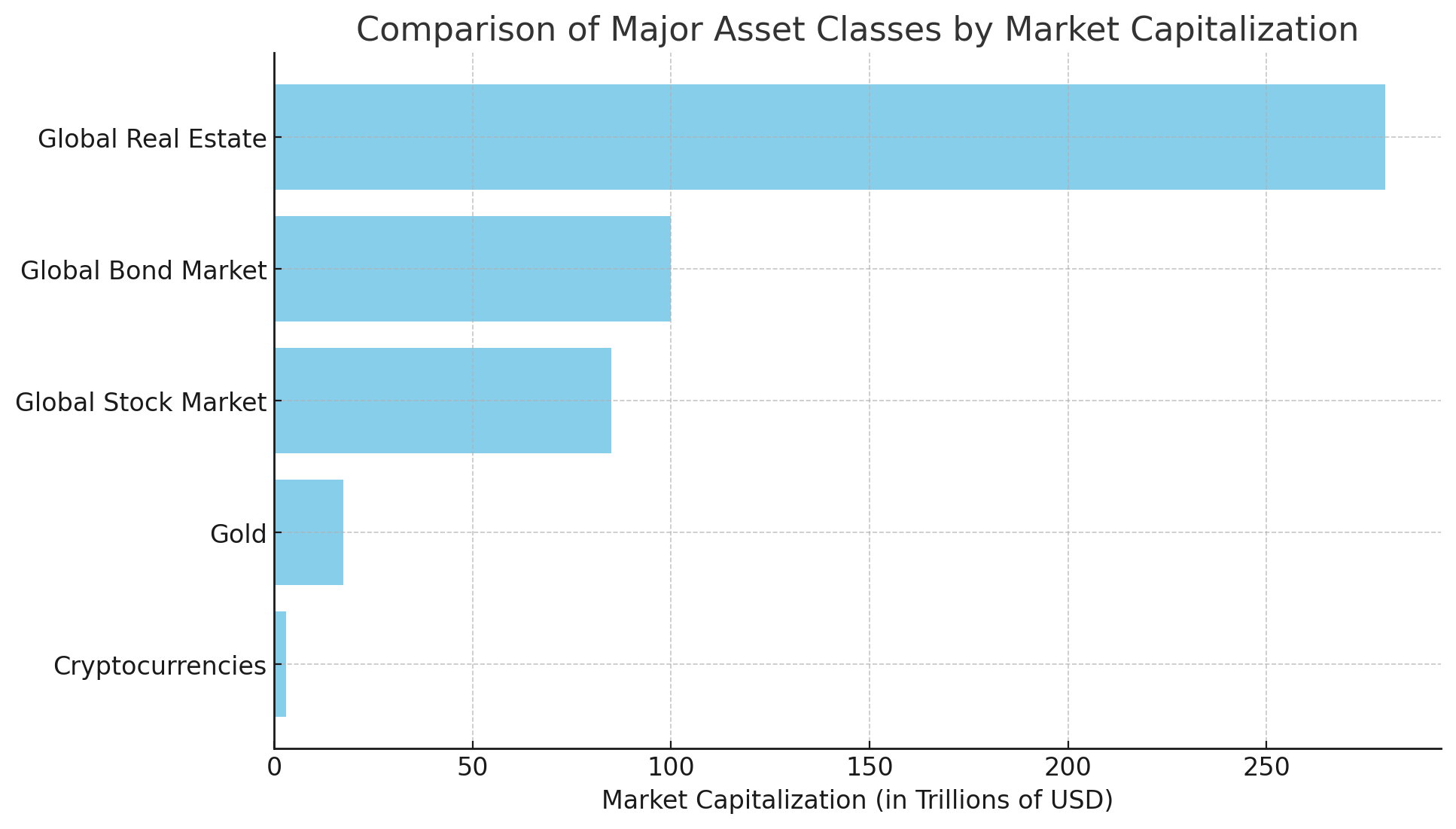

As of November 2024, the total market capitalization of cryptocurrencies stands at US$3T. To contextualize this within the broader financial landscape, here's a comparison with other major asset classes.

Source: FRC / Various

This comparison highlights that, despite its rapid growth, the cryptocurrency market is still relatively modest in size compared to more established asset classes like real estate, bonds, and equities. For context, the market capitalization of gold stands at US$17T compared to Bitcoin’s US$1.7T. We believe both Bitcoin and the broader crypto market have substantial room for expansion if they capture even a fraction of gold’s market as alternative stores of value. This comparison highlights Bitcoin’s potential role in wealth diversification and hedging, akin to how investors view gold during periods of economic uncertainty.

Benefits of Holding Bitcoin

- Decentralized Asset with Minimal Regulatory Interference: Bitcoin’s decentralized nature shields it from monetary policies or economic decisions made by individual governments, positioning it as an alternative asset that may retain value independently of traditional markets.

- Hedge Against Inflation: Bitcoin’s limited supply of 21M coins makes it attractive as a long-term inflation hedge. As inflation concerns grow, many see Bitcoin as having similar capital preservation potential to gold. As mentioned above, Bitcoin’s current market cap suggests ample room for growth should it continue to position itself as “digital gold.”

- Enhanced Transaction Efficiency: Bitcoin’s blockchain technology enables fast, borderless transactions, making it an attractive option for international transfers while bypassing intermediary fees associated with conventional financial systems.

- Portfolio Diversification: Bitcoin introduces exposure to a potentially high-growth asset that can offset traditional portfolio risks tied to stocks and bonds, offering an alternative asset class for risk-adjusted portfolio diversification.

Caution for Investors: Historical Volatility and Future Risks

Despite the current rally, investors should remain cautious, as history has demonstrated Bitcoin’s volatility. After reaching US$64k in 2021, Bitcoin’s value fell sharply to US$16k within a year. This volatility underscores the importance of strategic investment positioning and risk management for those looking to enter the crypto market.

Potential Risks to the Crypto Market

- Regulatory Uncertainty: While the current sentiment favors lenient oversight, future political dynamics could result in stricter regulation, potentially impacting liquidity and investor participation in the market.

- Market Liquidity and Volatility: The influx of capital into the crypto market can create liquidity challenges, especially if large investors exit the market abruptly, potentially causing sharp price corrections.

- Technological Vulnerabilities: As blockchain technology matures, there is always a risk of security breaches or technological failures that could undermine investor confidence and disrupt market stability.

- Emergence of New Technologies: Rapid technological advancements could introduce new cryptocurrencies or innovations that disrupt the current market, possibly rendering certain assets, including Bitcoin, obsolete if they fail to adapt to future developments.

- Environmental Impact: The energy-intensive nature of Bitcoin mining has led to growing environmental concerns. Consequently, more sustainable blockchain networks are being developed to address these issues.

Conclusion: Navigating the Market with Caution - The recent developments paint a promising picture for Bitcoin and the broader crypto market, with pro-crypto policies and influential endorsements adding momentum. However, as history has shown, the crypto market remains highly volatile. Investors should carefully consider their risk tolerance and investment horizon when evaluating Bitcoin as part of their portfolio.

With potential for substantial gains and significant risks, Bitcoin’s journey in the post-Trump re-election era underscores both the promise and perils of cryptocurrency investment. For those looking to diversify and hedge against traditional market volatility, Bitcoin presents an intriguing, albeit high-risk, opportunity that warrants close attention in the weeks and months ahead.

We currently have no active crypto companies under coverage. Recently, we have covered companies like Bitcoin Well Inc., BIGG Digital Assets, The INX Digital Company, and Banxa Holdings Inc., among others. We are planning to initiate coverage on a few exciting companies soon.