Olympia's Stock Rises Ahead of Q3; Promising Updates from Kinross-Partnered Junior Gold Producer

Published: 11/12/2024

Author: FRC Analysts

In this edition, we analyze the performance of our top picks, and highlight why a Canadian financial stock emerged as the best performer last week. We also cover significant updates from a gold producer under coverage, several gold explorers, and a nickel/copper junior with a recent major discovery.

Highlights

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

Contango Ore, Inc. (CTGO)

PR Title: Announces US$12M cash distribution from the Peak Gold JV

Analyst Opinion: Positive – CTGO and its partner Kinross Gold (TSX: K) have completed processing two batches of ore, producing 100 Koz of gold (30 Koz net for CTGO). Since production began in July 2024, CTGO has received US$32M in cash distributions from the JV. Based on an average gold price of US$2,500/oz, we believe total cash costs were approximately US$1,400–US$1,500/oz. We anticipate cash costs to drop to US$1,000/oz or below as production ramps up. Manh Choh is a medium-sized/ultra-high-grade open-pit mine capable of producing 225 Koz per year (67.5 Koz for CTGO). CTGO will start reporting revenue in the upcoming Q3 financials, at which point we will start providing our 2024 and 2025 revenue and EPS estimates.

Power Metallic Mines Inc. (PNPN.V)

PR Title: Additional results from an ongoing drill program at its polymetallic Lion zone (Quebec)

Analyst Opinion: Positive – Two more holes from an ongoing 30,000 m drill program at the Lion zone have returned high grades over significant intervals, including 19.6 m at 3.82% CuEq. We project the Lion zone could host up to 1 Blbs of high-grade CuEq. Lion is one of two main mineralized areas within the Nisk project, alongside the nickel-rich Nisk Main deposit, which hosts 178 Mlbs if NiEq.

Western Exploration Inc. (WEX.V, WEXPF)

PR Title: Additional results from three holes of an ongoing drill program at Gravel Creek (Nevada)

Analyst Opinion: Positive – Drilling near the Gravel Creek resource area continues to return high-grade intercepts, including bonanza values of 22 g/t Au & 977 g/t Ag, and 50 g/t Au & 2,110 g/t Ag. Gravel Creek, featuring an underground/high-grade gold resource, is part of WEX’s Aura gold-silver project. Aura hosts three deposits (Gravel Creek, Doby George, and Wood Gulch).

Aton Resources Inc. (ANLBF, AAN.V)

PR Title: Initial results of an ongoing drill program at Abu Marawat (Egypt)

Analyst Opinion: Positive – Drill results from the initial 14 holes, located outside or along the southern margins of the maiden resource, have returned notable high-grade polymetallic intercepts, including 3.9 m grading 8.98 g/t Au, 185 g/t Ag, 0.43% Cu, and 6.12% Zn (11.16 g/t AuEq), and 3.9 m grading 10.66 g/t AuEq. Aton is advancing multiple gold projects in Egypt, with NI 43-101 compliant resources totaling 0.83 Moz AuEq across two projects.

North Peak Resources Ltd. (BTLLF, NPR.V)

PR Title: Additional drill results from the Prospect Mountain North phase two drill program (Nevada)

Analyst Opinion: Positive – Promising results; two out of four holes from a recently completed drill program returned high gold grades, including 3 m of 85.7 g/t, and 7.6 m of 0.81 g/t. NPR is awaiting the remaining assay results. Since drilling to date represents only a small portion of the property, management plans to conduct additional drilling programs to explore several untested targets before considering a maiden resource estimate.

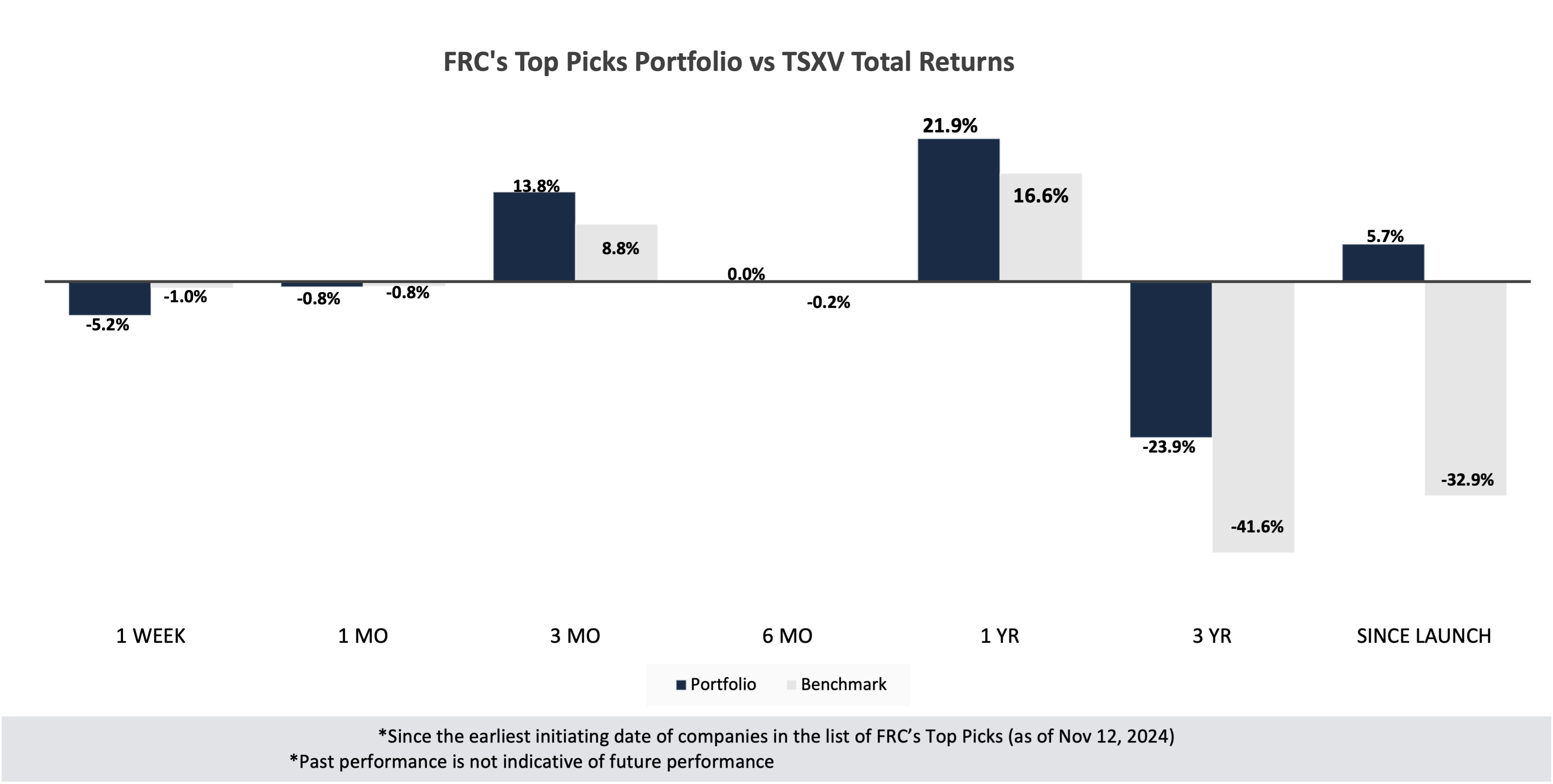

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks. The top performer, Olympia Financial Group, was up 10%. OLY is a leading Canadian custodian/administrator of alternative investments. We believe the recent share price run-up reflects anticipation of the upcoming Q3 results, expected this week. In Q2-2024, revenue was up 5% YoY, but EPS was down 1% YoY. Client assets were up 1.2% QoQ. Given the BoC’s rate cuts in the past few months, we expect OLY to report a QoQ decline in revenue for Q3.

* Past performance is not indicative of future performance (as of Nov 12, 2024)

Performance by Sector

1. Since the earliest initiating date of companies in the list of Top Picks (as of Nov 12, 2024)

2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.