Spotlight on an Emerging Silver Producer and Key Updates on Copper and Silver Stocks

Published: 11/4/2024

Author: FRC Analysts

In this edition, we delve into significant developments among companies under our coverage, highlighting key insights and actionable takeaways. We also highlight our standout performers of the week, along with an introduction to Silver X Mining, a promising junior silver producer in Peru poised for significant production growth. Read on for updates from Panoro Minerals, and Equity Metals.

Key Segments

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

- Introducing a junior silver producer to our coverage: We have commenced due diligence on an emerging silver producer in Peru, with a clear plan to quadruple production. Below, we present a brief overview of its portfolio alongside our initial assessment.

Commentary on Resource Companies Under Coverage

Panoro Minerals Ltd. (PML.V, POROF)

PR Title: Extends and expands the exploration permit for its Cotabambas project (Peru)

Analyst Opinion: Positive – PML plans to conduct infill and step-out drilling, as well as test multiple under explored targets. The project’s current resource (6.7 Blbs of copper, 6 Moz of gold, 80 Moz of silver, and 54 Mlbs of molybdenum) is distributed across two targets. The company has identified 17 additional targets that remain largely untested. Cotabambas is one of the largest copper-gold deposits held by a junior in the Americas.

Equity Metals Corporation (EQMEF, EQTY.V)

PR Title: Reports final assay results from summer drilling on the Silver Queen property (B.C.)

Analyst Opinion: Positive – Drilling continues to return bonanza grades at the Camp deposit, while expanding the George Lake target. Additionally, a new sulphide-rich discovery has been identified at the Camp North target, and drilling is underway at the No. 3 Vein North target. The Silver Queen property features high-grade epithermal veins, with four of the 20 known veins hosting 85 Moz at 6.2 AgEq. We believe that drilling completed to date this year has expanded the project’s 2022 resource estimate. We will publish a detailed update shortly with our speculative estimates.

Updates on Financials, Technology, Energy, and Special Situations Companies Under Coverage

Pixie Dust Technologies./NASDAQ:PXDT

PR Title: Delisting its securities from the NASDAQ

Analyst Opinion: Negative - The company is delisting its securities from the NASDAQ this month. Management attributed this decision to ongoing reporting obligations, and the substantial costs associated with maintaining the listing. Upon delisting, the company's securities will no longer be listed on any exchange. Shares have fallen 52% since the announcement. Investors can either sell their securities now or hold onto them, treating their investment like that in a private company, with the prospect of a future liquidity event.

This announcement caught us off gaurd, especially since we expect record revenue and EBITDA in both FY2025 and FY2026. We are temporarily suspending coverage, and will resume if and when the company plans to relist on another exchange.

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks. The top performer, New Age Metals, was up 13%. NEM and its joint venture partner, Mineral Resources Ltd. (ASX: MIN), are advancing exploration at several lithium projects in Manitoba. Additionally, NAM owns an advanced-stage PGE project in Ontario.

| Top Five Weekly Performers | WoW Returns |

| New Age Metals Inc. (NAM.V) | 12.5% |

| Kidoz Inc. (KIDZ.V) | 12.0% |

| Hemostemix Inc. (HEM.V) | 11.1% |

| Fortune Minerals Limited (FT.TO) | 10.0% |

| Verde Agritech Plc. (NPK.TO) | 9.7% |

| * Past performance is not indicative of future performance (as of Nov 4, 2024) |

Source: FRC

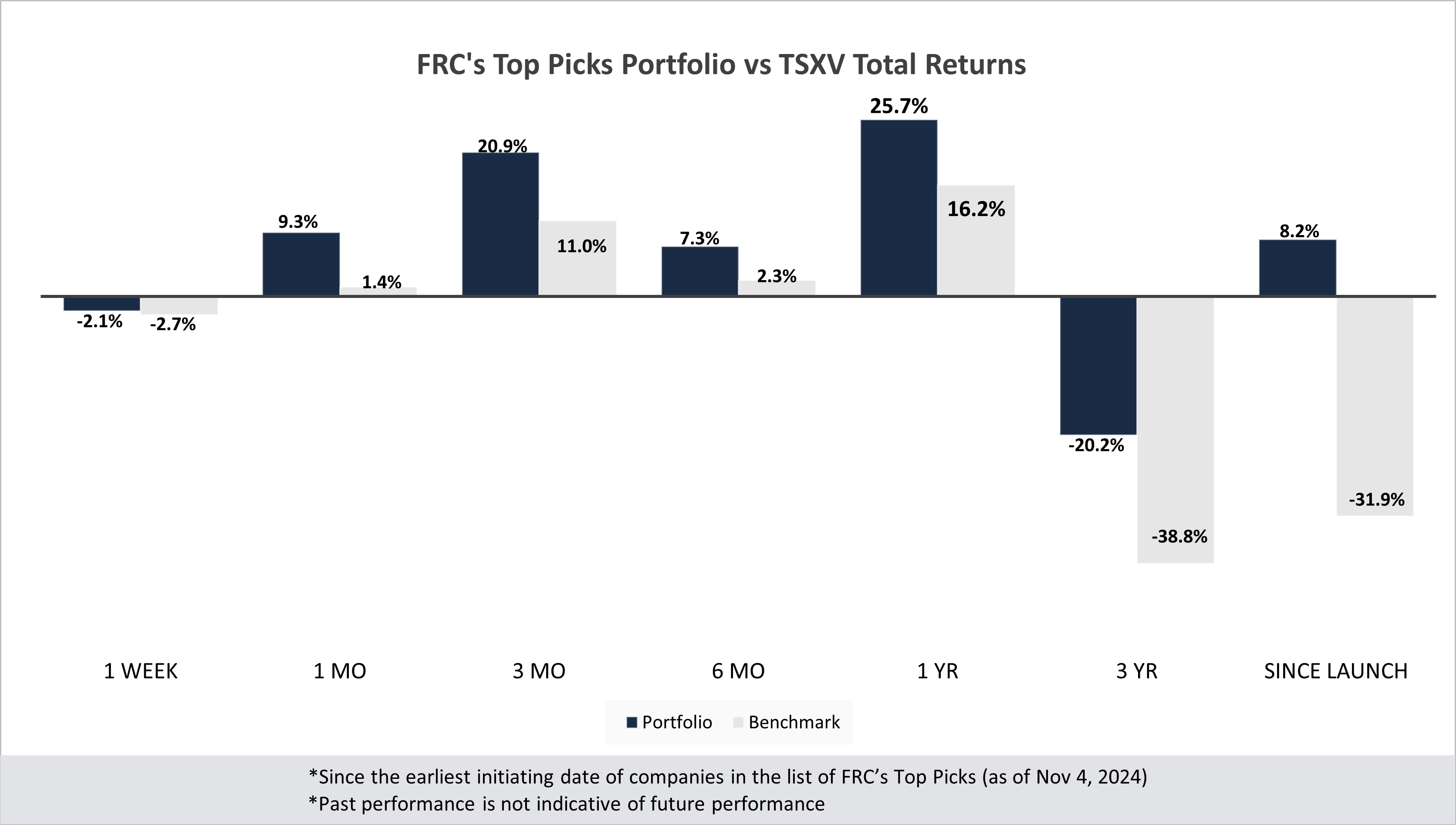

Our top picks have outperformed the benchmark (TSXV) in all seven time periods listed below.

Performance by Sector

| Total Return | 1 Week | 1 mo | 3 mo | 6 mo | 1 yr | 3 yr | Since launch |

| Mining | -2.9% | 11.0% | 20.3% | 2.1% | 23.4% | -36.3% | 1.2% |

| Cannabis | N/A | N/A | N/A | N/A | N/A | -35.3% | -23.6% |

| Tech | 12.0% | 7.7% | -12.5% | -36.4% | -22.2% | -37.5% | -4.6% |

| Special Situations (MIC) | 0.6% | 9.4% | 30.0% | 51.0% | 63.2% | -26.8% | 9.0% |

| Private Companies | N/A | N/A | N/A | N/A | 6.7% | 20.5% | 30.5% |

| Portfolio (Total) | -2.1% | 9.3% | 20.9% | 7.3% | 25.7% | -20.2% | 8.2% |

| Benchmark (Total) | -2.7% | 1.4% | 11.0% | 2.3% | 16.2% | -38.8% | -31.9% |

| Portfolio (Annualized) | - | - | - | - | 25.7% | -7.2% | 0.7% |

| Benchmark (Annualized) | - | - | - | - | 16.2% | -15.1% | -3.5% |

| 1. Since the earliest initiating date of companies in the list of Top Picks (as of Nov 4, 2024) | |||||||

| 2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark. | |||||||

| 3. Past performance is not indicative of future performance. | |||||||

Our complete list of top picks (updated weekly) can be viewed here.

Ramping Up Silver Production in Peru

🔹Silver X Mining Corp. (TSXV: AGX)

We have begun our due diligence on AGX. We covered the stock back in 2021/2022 and intend to relaunch our coverage in the coming weeks. Below is a brief overview of its portfolio and our initial assessment.

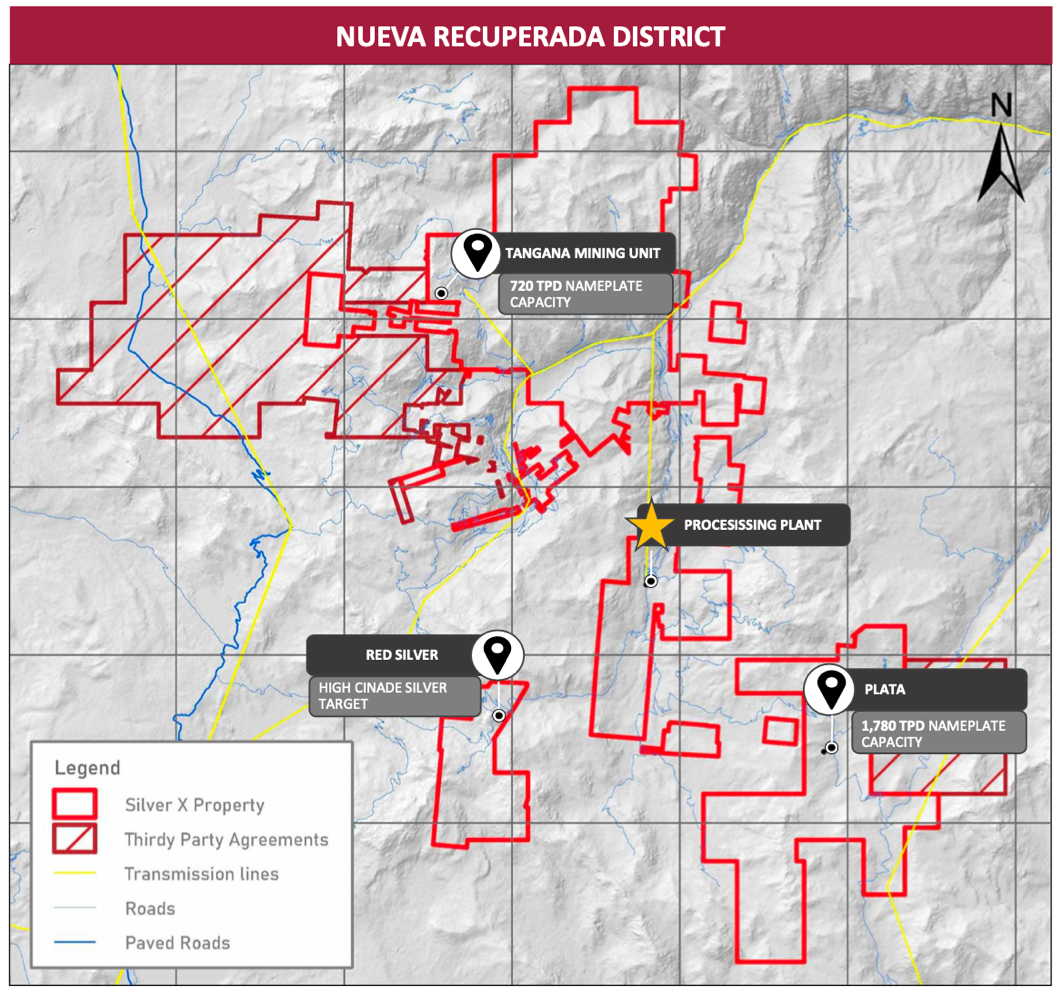

Silver X owns the district-scale Nueva Recuperada silver-polymetallic project (20,472 hectares), and the Coriorcco gold project, in Peru.

Two Projects in Peru

Source: Company

The Nueva Recuperada project, situated in Peru’s premier silver district, includes the producing Tangana mine, a 720 tpd processing plant, the advanced-stage Plata mining unit (expected to be operational next year), and four exploration projects.

Source: Company

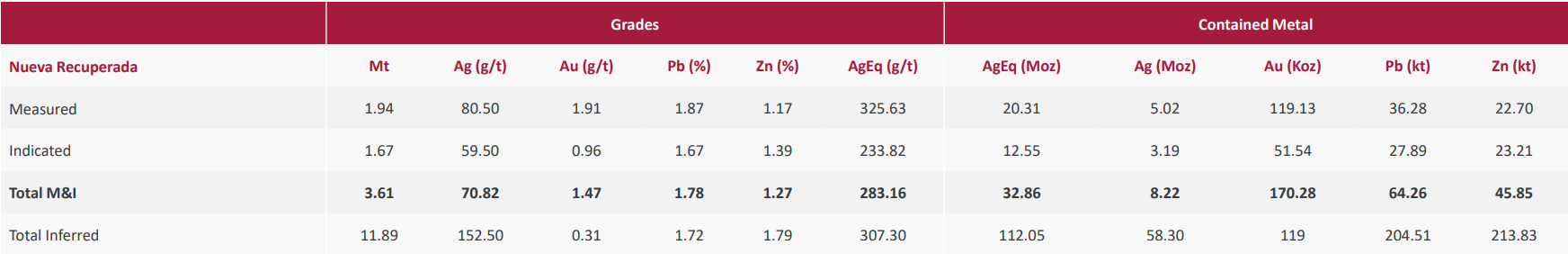

Prior exploration has delineated 200+ targets, and 500+ outcrop veins, potentially hosting medium to high-grade silver-rich polymetallic mineralization. The current resource, totaling 145 Moz AgEq, is distributed across three deposits within the producing Tangana Mining Unit (TMU). Silver is the dominant metal, accounting for 45% of the total value of the contained metals.

2023 Resource Estimate

Source: Company

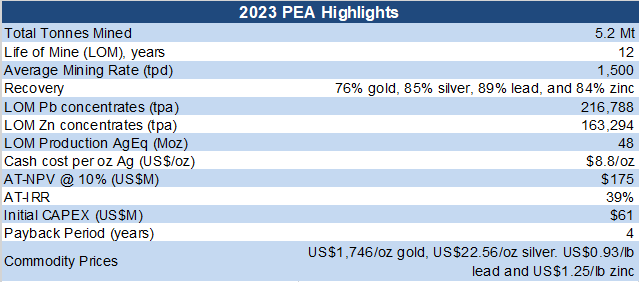

A Preliminary Economic Assessment (PEA) focused solely on the Tangana Mining Unit (TMU), based on a 12-year mine life, and average annual production of 4.2 Moz AgEq, yielded promising results. The study returned an AT-NPV10% of US$175M, and a high AT-IRR of 39%, using conservative commodity prices of US$23/oz silver, and US$1,746/oz gold, with cash costs of US$8.80/oz AgEq. We believe the study was conservative, as it utilized less than 40% of the project’s resources.

Source: FRC / Company

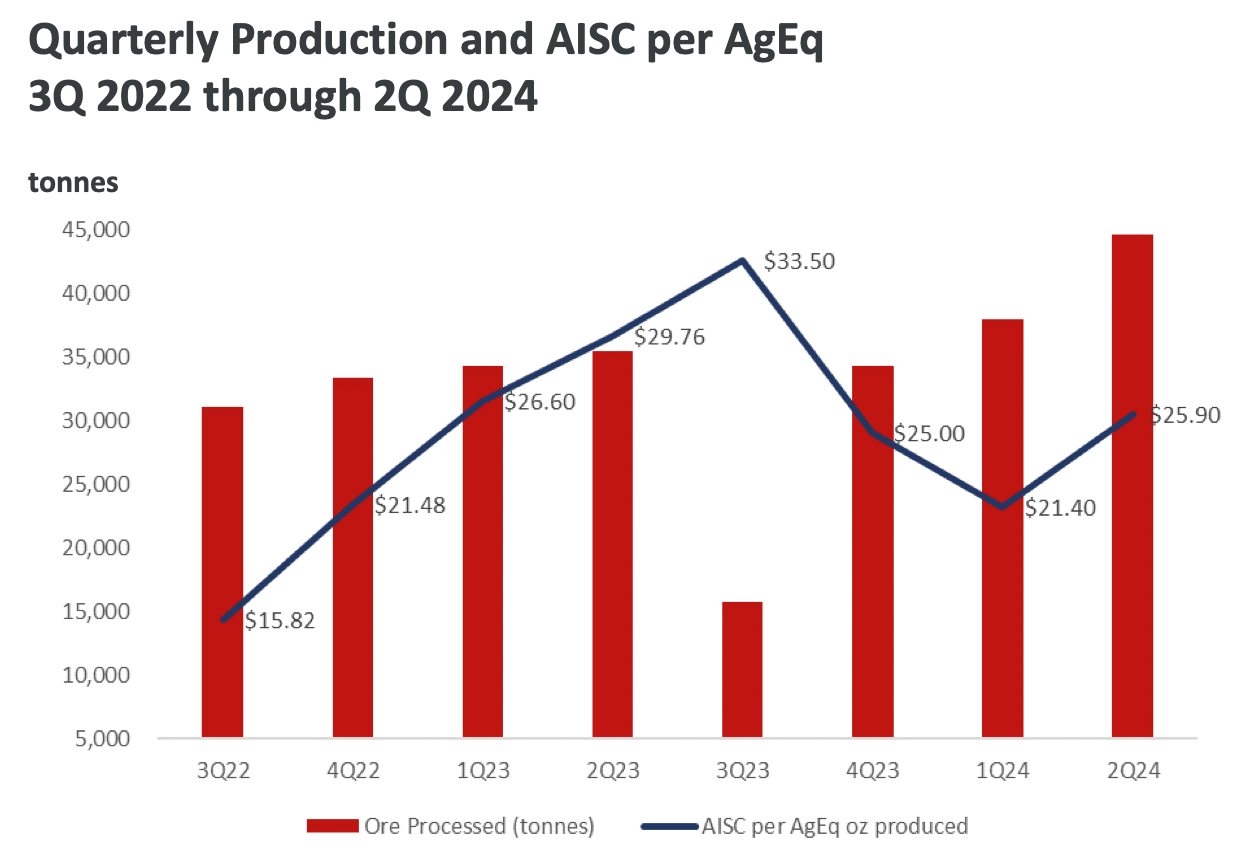

The company began commercial production in January 2023. In Q2-2024, AGX produced 284 Koz AgEq (up 14% YoY), generating US$6.2M in revenue (up 34% YoY). EBITDA turned positive, and cash costs decreased from US$21 to US$19/oz AgEq.

Source: Company

Source: Company

The company’s vision is to expand annual production to over 6 Moz of AgEq within the next few years. Management aims to commence production at the Plata mining unit in 2025. Immediate objectives involve finalizing an updated resource estimate, followed by an updated PEA for a combined 2,500 tpd operation integrating both the Plata and Tangana units.

At the end of Q2-2024, the company had US$11M in debt and payables, net of current assets. Management and institutions own 25% of the equity, and the company is currently pursuing a $5M equity financing.

We believe AGX appears undervalued based on the following three key metrics.

- AGX is trading at $1.25/oz vs the junior silver producers’ average of $2.1/oz, a 65% discount.

- AGX is trading at 1.9x revenue vs the sector average of 2.6x, a 26% discount.

- Given that the last PEA returned an AT-NPV10% of US$175M, AGX is currently trading at only 28% of this AT-NPV.

As noted before, we plan to initiate coverage with a detailed report in the weeks ahead.