Updates on Financials, Technology, Energy, and Special Situations Companies Under Coverage

Builders Capital Mortgage Corp./TSXV:BCF

PR Title: Announces anticipated first closing of bond offering

Analyst Opinion: Positive - Management anticipates closing the first tranche of a previously announced $50M bond financing in early October. A private company owned by the CEO plans to acquire $7M worth of bonds, which is great to see, as it demonstrates management's commitment and positive near-term outlook. We believe this financing reflects the company's strong pipeline of mortgages. In Q2-2024, BCF recorded its highest-ever Q2 revenue, and we expect record revenue in 2024.

Sekur Private Data Ltd./CSE:SKUR

PR Title: Announces closing of first tranche of non-brokered private placement

Analyst Opinion: Positive - Sekur has raised $0.96M of its $1.7M private placement. These funds will be used for marketing and the upcoming launch of its enterprise solutions. We believe that businesses handling sensitive and confidential information, such as those in the medical, financial, and real estate sectors, are ideal targets for Sekur. While we anticipate the company will achieve profitability in 2026, management is aiming for profitability by 2025.

FRC Top Picks

The following table shows last month’s top five performers among our Top Picks. The top performers, Millennial Potash Corp. and Kootenay Silver Inc., were up 22%. Millennial is developing an advanced stage potash project in West Africa, while Kootenay is advancing multiple silver projects in Mexico.

| Top Five Weekly Performers |

WoW Returns |

| Kootenay Silver Inc. (KTN.V) |

22.2% |

| Millennial Potash Corp. (MLP.V) |

22.2% |

| Rio2 Limited (RIO.V) |

15.4% |

| Lake Resources NL (LKE.AX) |

10.8% |

| Hot Chili Limited (HHLKF) |

10.0% |

| * Past performance is not indicative of future performance (as of Sep 16, 2024) |

|

Source: FRC

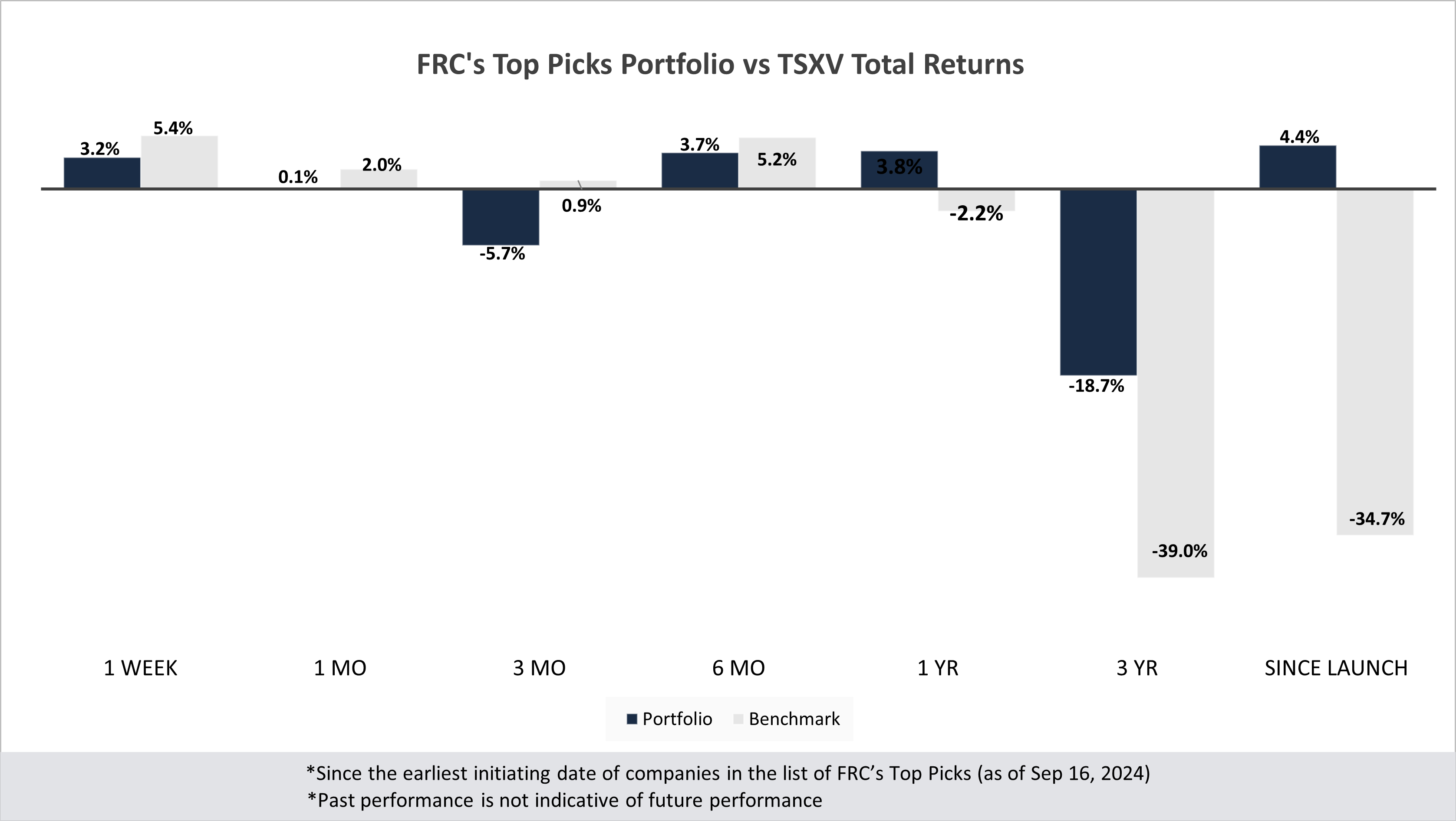

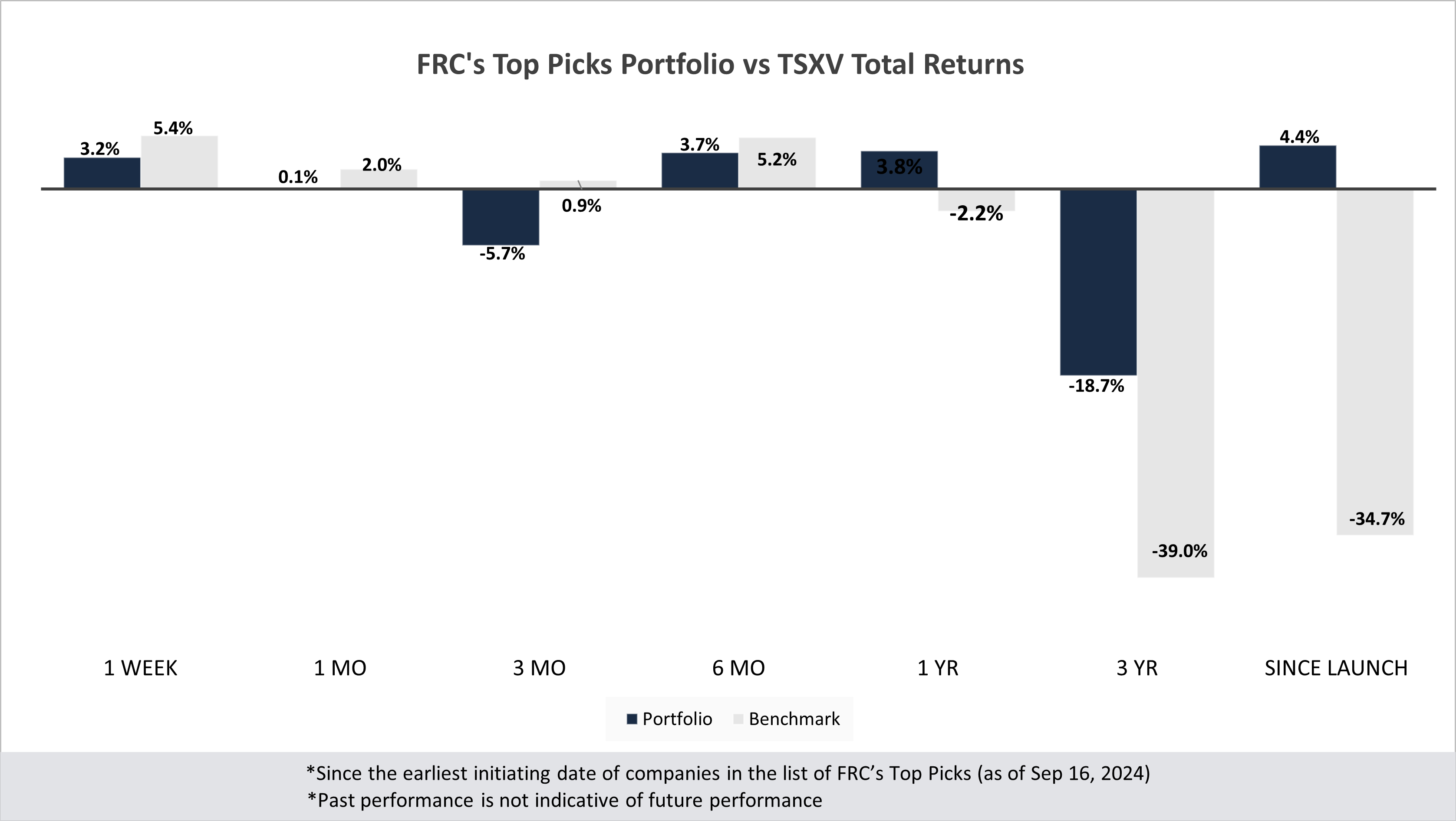

Companies on our Top Picks list were up 4% YoY on average vs -2% for the benchmark (TSXV).

Performance by Sector

| Total Return |

1 Week |

1 mo |

3 mo |

6 mo |

1 yr |

3 yr |

Since launch |

| Mining |

2.6% |

-4.1% |

-13.9% |

-0.8% |

-5.0% |

-34.9% |

-7.4% |

| Cannabis |

N/A |

N/A |

N/A |

N/A |

N/A |

-36.9% |

-23.6% |

| Tech |

-7.1% |

-23.5% |

-27.8% |

-21.2% |

-39.5% |

-37.6% |

-4.7% |

| Special Situations (MIC) |

8.2% |

21.6% |

28.3% |

37.3% |

49.1% |

-24.2% |

1.6% |

| Private Companies |

N/A |

N/A |

N/A |

N/A |

6.7% |

20.5% |

30.5% |

| Portfolio (Total) |

3.2% |

0.1% |

-5.7% |

3.7% |

3.8% |

-18.7% |

4.4% |

| Benchmark (Total) |

5.4% |

2.0% |

0.9% |

5.2% |

-2.2% |

-39.0% |

-34.7% |

| Portfolio (Annualized) |

- |

- |

- |

- |

3.8% |

-6.7% |

0.4% |

| Benchmark (Annualized) |

- |

- |

- |

- |

-2.2% |

-15.2% |

-3.9% |

| 1. Since the earliest initiating date of companies in the list of Top Picks (as of Sep 16, 2024) |

|

|

|

| 2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark. |

|

|

|

|

| 3. Past performance is not indicative of future performance. |

|

|

|

|

|

|

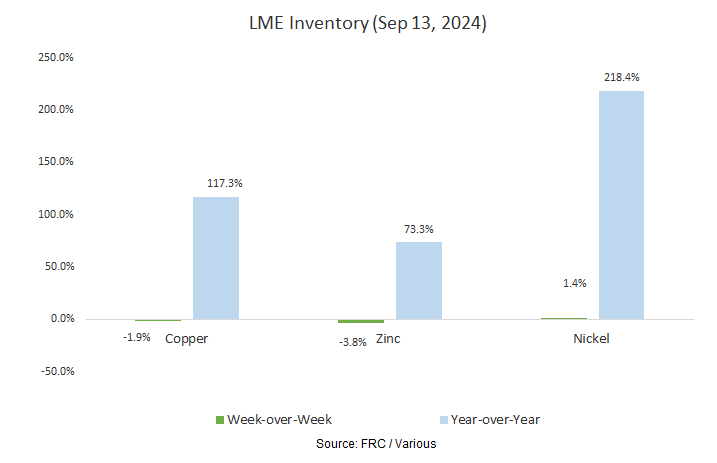

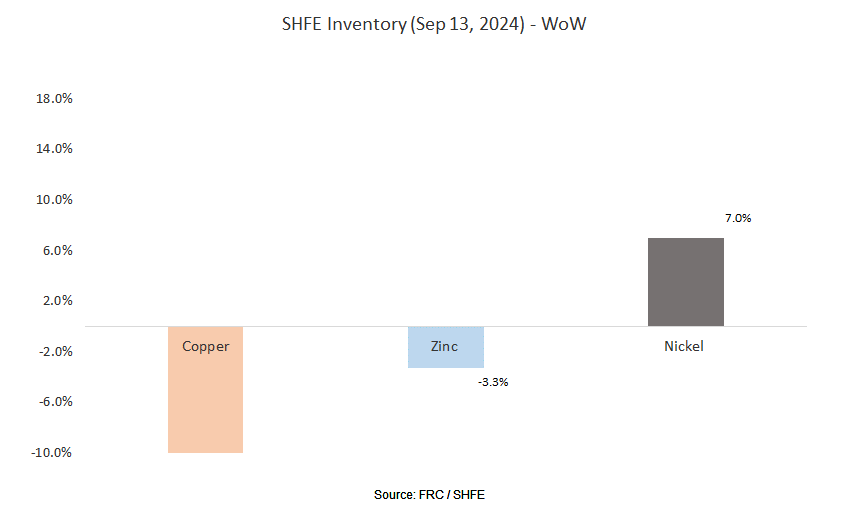

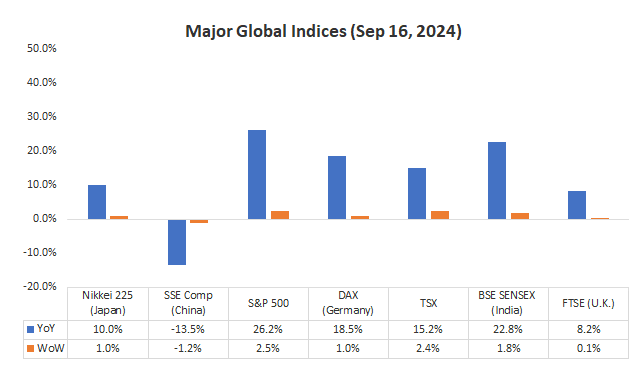

Market Updates and Insights: Mining

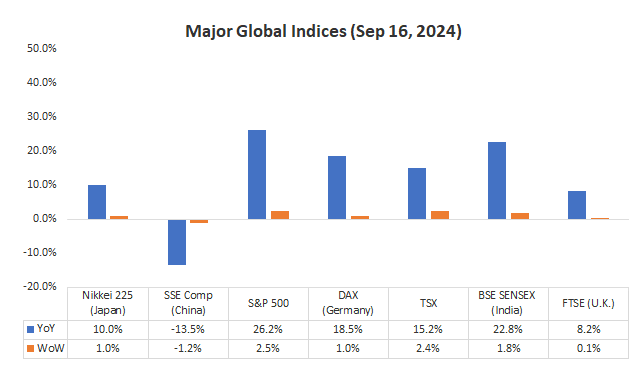

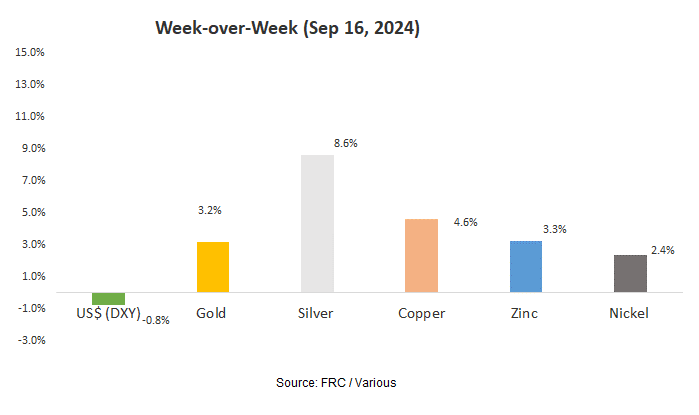

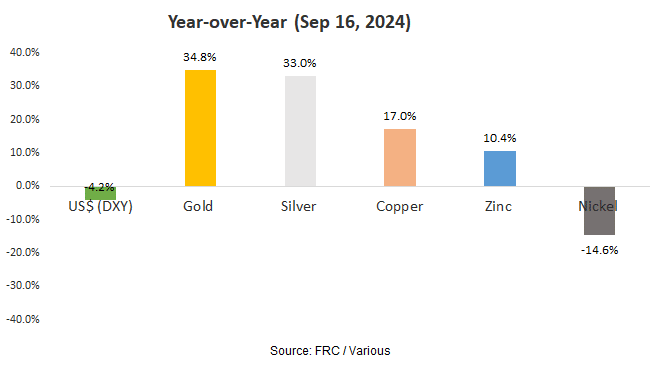

Last week, global equity markets were up 1.1% on average (down 1.9% in the previous week). The S&P 500 was up 2.5% ahead of a potential Fed rate cut. The US$ fell 1%, while gold briefly surpassed US$2,600/oz for the first time. This week, all eyes are on the meetings of the Fed, the Bank of England (BoE), and the Bank of Japan (BoJ). While the BoE and BoJ are expected to hold rates steady, the Fed is anticipated to lower rates by 25 to 50 basis points.

Source: FRC / Various

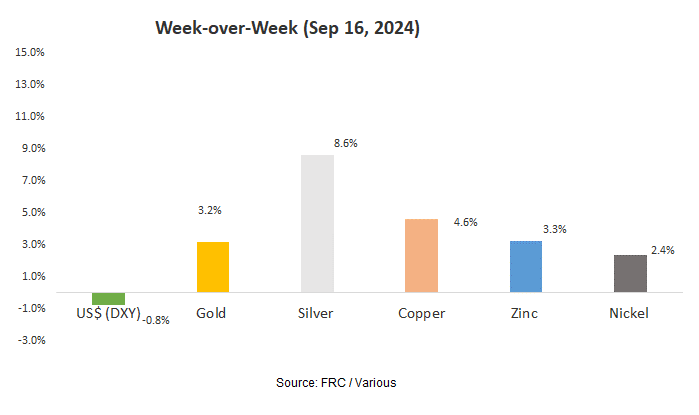

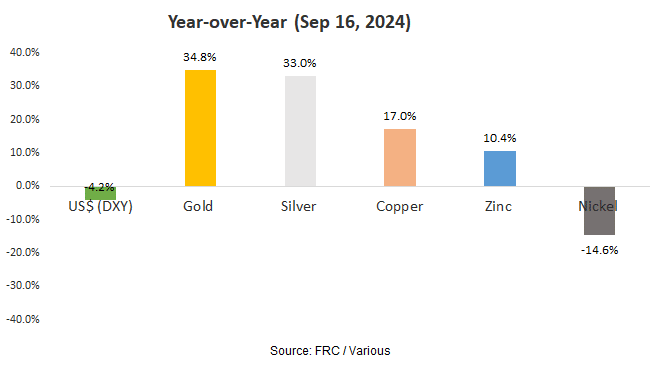

Last week, metal prices were up 4.4% on average (down 0.3% in the previous week).

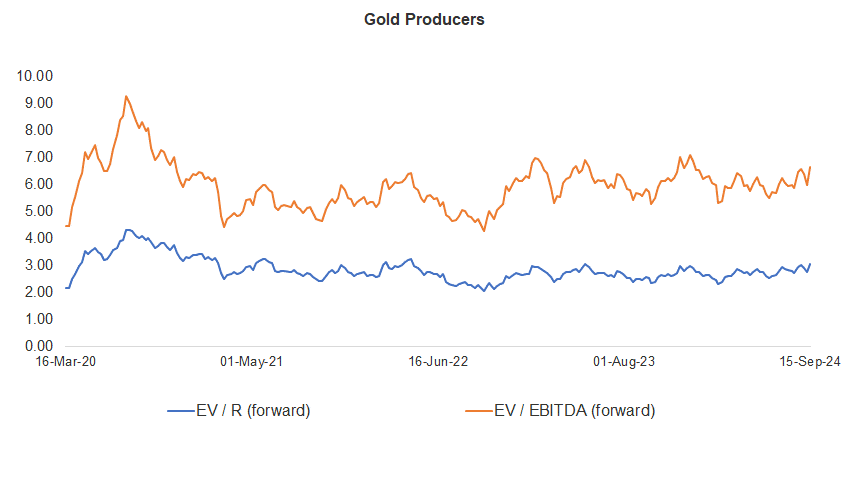

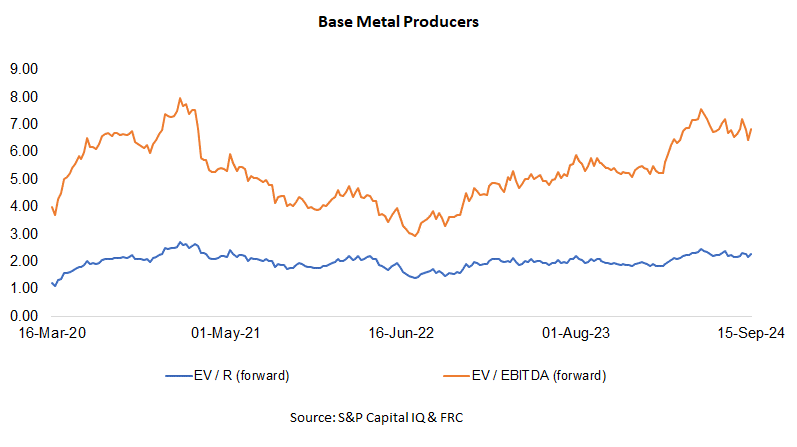

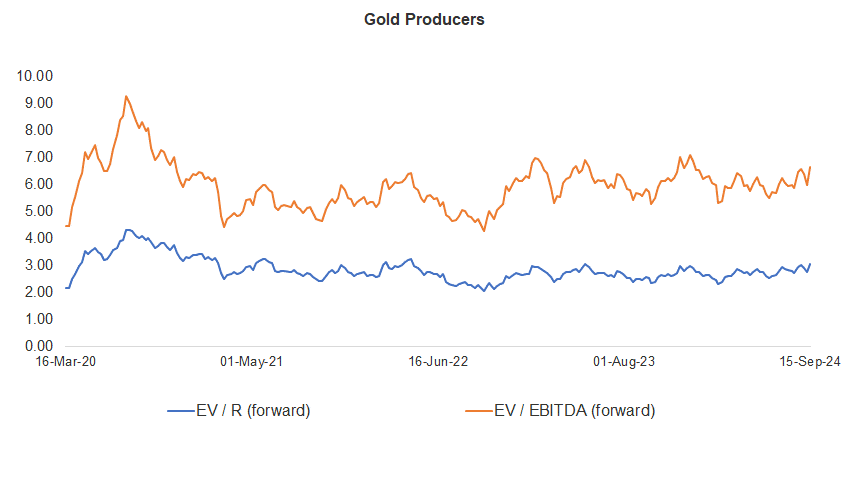

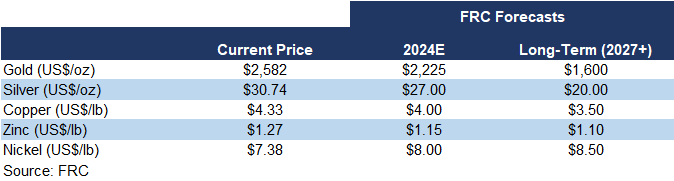

Gold producer valuations were up 11.2% last week (down 6.2% in the prior week); base metal producers were up 6.2% last week (down 5.5% in the prior week). On average, gold producer valuations are 8% lower (previously 17%) than the past three instances when gold surpassed US$2k/oz.

Source: S&P Capital IQ & FRC

| |

|

09-Sep-24 |

16-Sep-24 |

| |

Gold Producers |

EV / R (forward) |

EV / EBITDA (forward) |

EV / R (forward) |

EV / EBITDA (forward) |

| 1 |

Barrick |

3.22 |

6.56 |

3.46 |

7.07 |

| 2 |

Newmont |

3.56 |

7.95 |

3.78 |

8.31 |

| 3 |

Agnico Eagle |

4.89 |

8.89 |

5.27 |

9.57 |

| 4 |

AngloGold |

2.36 |

5.30 |

2.39 |

5.46 |

| 5 |

Kinross Gold |

2.46 |

5.17 |

2.83 |

5.96 |

| 6 |

Gold Fields |

2.71 |

5.37 |

2.85 |

5.60 |

| 7 |

Sibanye |

0.54 |

3.35 |

0.69 |

5.02 |

| 8 |

Hecla Mining |

4.37 |

12.68 |

5.29 |

14.54 |

| 9 |

B2Gold |

1.65 |

3.38 |

2.01 |

4.07 |

| 10 |

Alamos |

5.53 |

10.32 |

6.29 |

11.78 |

| 11 |

Harmony |

1.40 |

4.13 |

1.53 |

4.24 |

| 12 |

Eldorado Gold |

2.50 |

4.85 |

2.84 |

5.52 |

| |

Average (excl outliers) |

2.75 |

5.97 |

3.05 |

6.66 |

| |

Min |

0.54 |

3.35 |

0.69 |

4.07 |

| |

Max |

5.53 |

12.68 |

6.29 |

14.54 |

| |

|

|

|

|

|

| |

Base Metal Producers |

EV / R (forward) |

EV / EBITDA (forward) |

EV / R (forward) |

EV / EBITDA (forward) |

| 1 |

BHP Group |

2.70 |

4.93 |

2.81 |

5.20 |

| 2 |

Rio Tinto |

2.00 |

4.41 |

2.10 |

4.67 |

| 3 |

South32 |

1.38 |

4.77 |

1.45 |

5.25 |

| 4 |

Glencore |

0.36 |

5.15 |

0.36 |

5.30 |

| 5 |

Anglo American |

1.73 |

5.19 |

1.80 |

5.38 |

| 6 |

Teck Resources |

3.34 |

8.16 |

3.49 |

8.54 |

| 7 |

First Quantum |

3.58 |

12.37 |

4.01 |

13.48 |

| |

Average (excl outliers) |

2.16 |

6.43 |

2.29 |

6.83 |

| |

Min |

0.36 |

4.41 |

0.36 |

4.67 |

| |

Max |

3.58 |

12.37 |

4.01 |

13.48 |

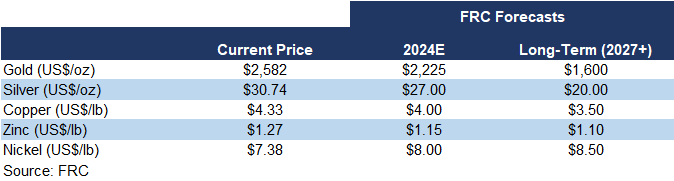

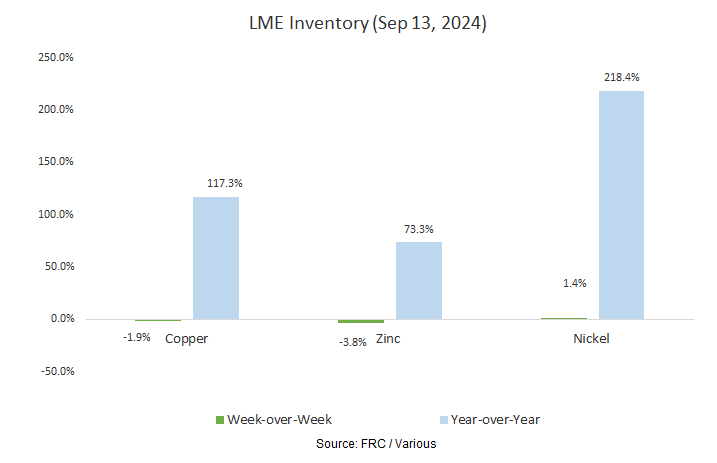

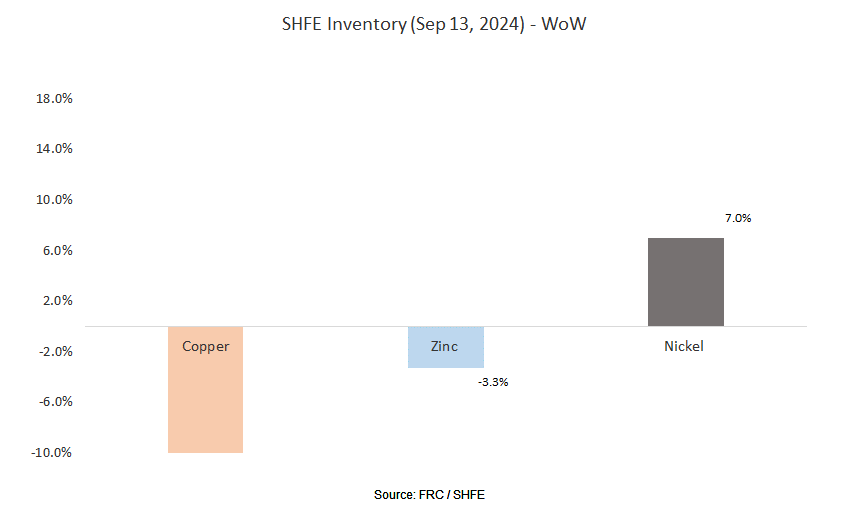

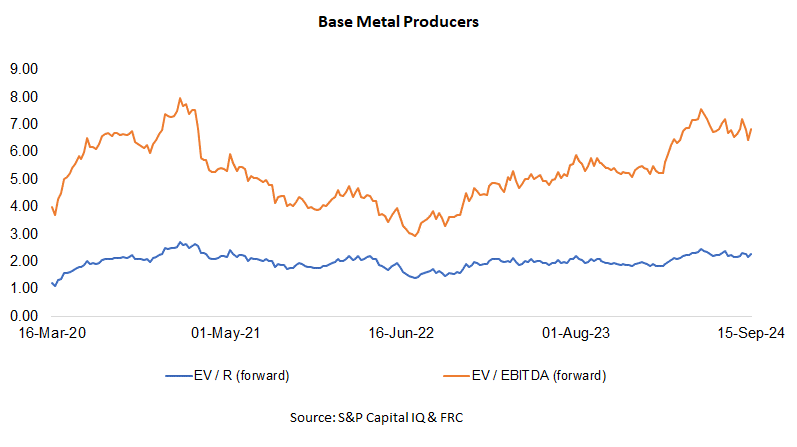

We are maintaining our metal price forecasts.

Market Updates and Insights: Cryptos

Prices of mainstream/popular cryptos were down 0.2% on average last week (down 1.1% in the previous week).

| September 16, 2024 |

|

|

| Cryptos |

WoW |

YoY |

| Bitcoin |

1% |

118% |

| Binance Coin |

0% |

148% |

| Cardano |

-7% |

32% |

| Ethereum |

0% |

44% |

| Polkadot |

-2% |

2% |

| XRP |

9% |

17% |

| Polygon |

-1% |

-28% |

| Solana |

-2% |

591% |

| Average |

0% |

116% |

| Min |

-7% |

-28% |

| Max |

9% |

591% |

| |

|

|

| Indices |

| Canadian |

WoW |

YoY |

| BTCC |

2% |

110% |

| BTCX |

2% |

116% |

| EBIT |

2% |

114% |

| FBTC |

2% |

24% |

| |

|

|

| U.S. |

WoW |

YoY |

| BITO |

2% |

28% |

| BTF |

-1% |

47% |

| IBLC |

6% |

54% |

Source: FRC/Yahoo Finance

The global MCAP of cryptos is US$2.15T, up 1% MoM, and 95%YoY.

Total Crypto Market Cap Chart

Source: CoinGecko

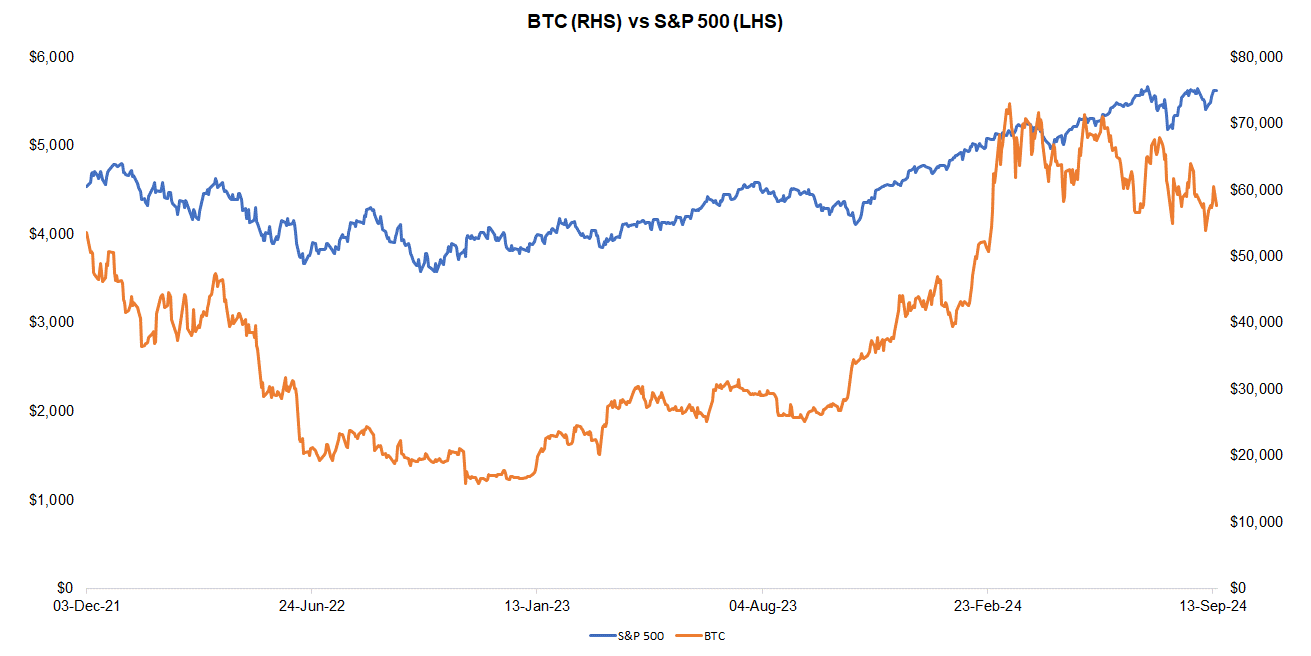

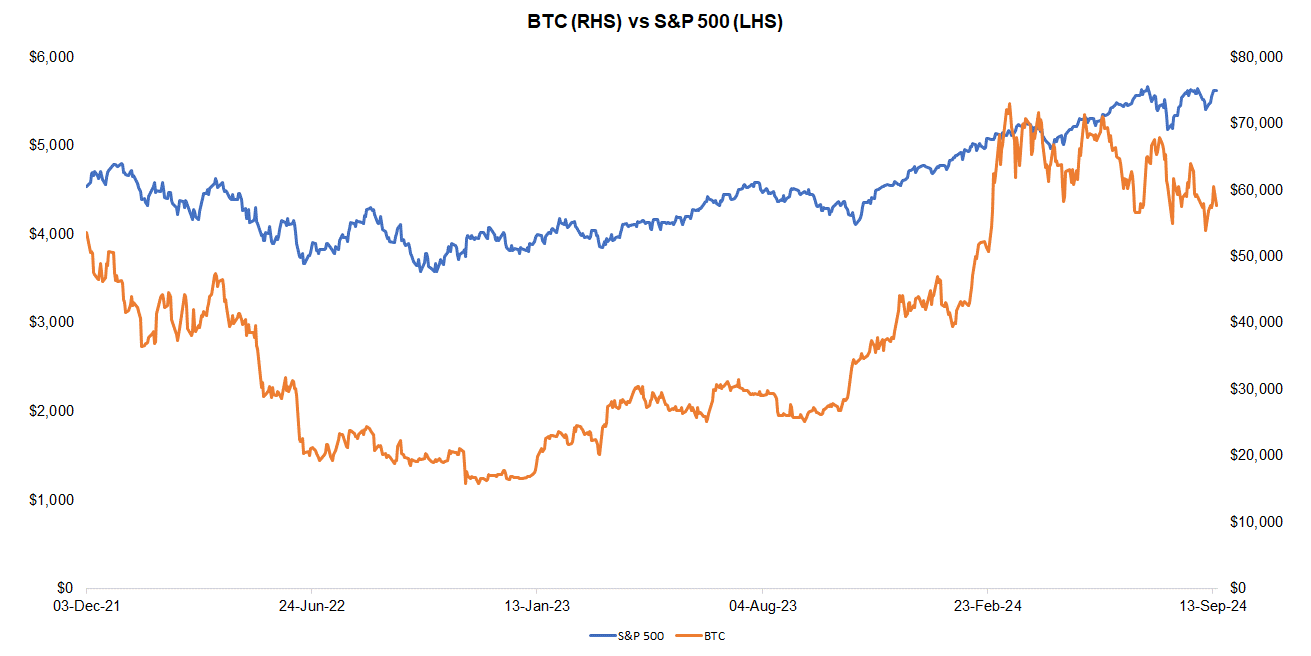

Last week, BTC was up 0.7%, while the S&P 500 was up 2.5%. The U.S. 10-year treasury yield was down 0.07 pp.

Source: FRC/ Yahoo Finance

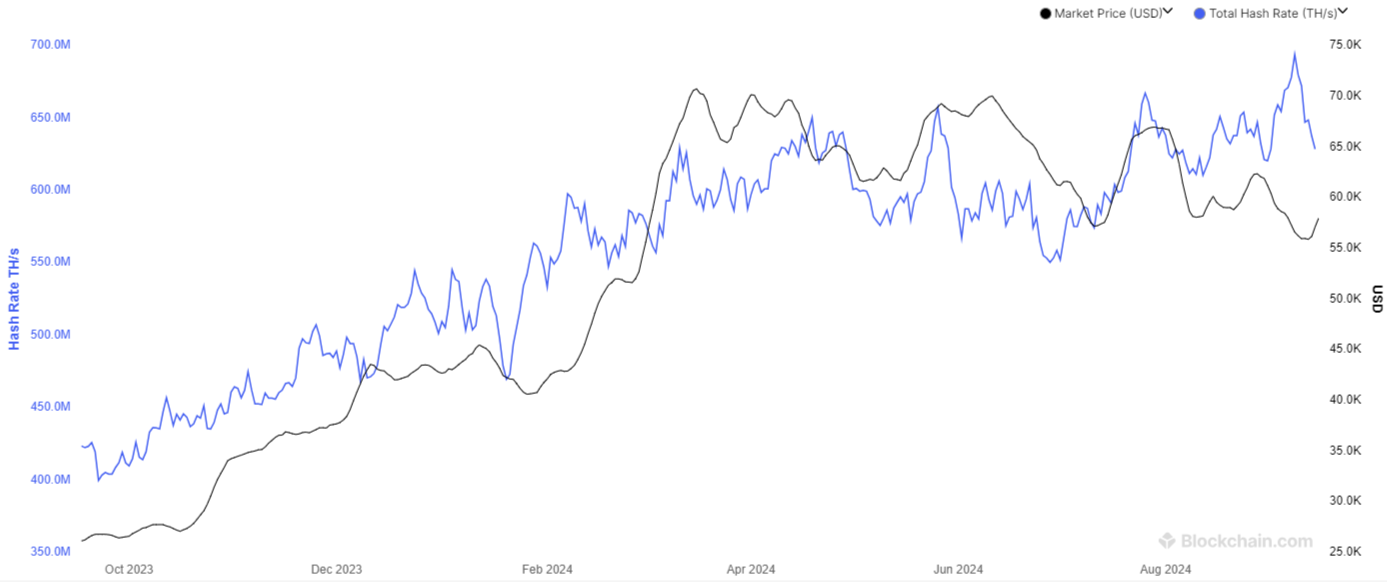

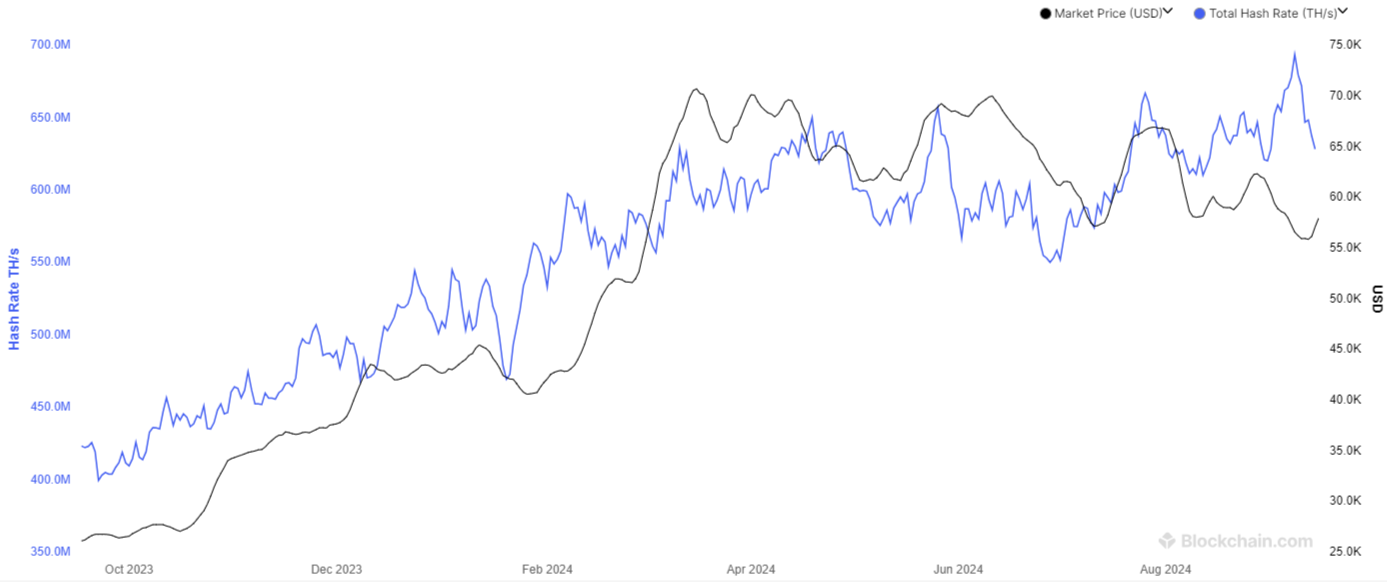

The global hash rate of BTC (defined as calculations performed per second/an indicator of network difficulty) is 629 exahashes per second (EH/s), down 7% WoW, and 1% MoM. The decrease in hash rates is positive for miners as their efficiency rates (BTC production per EH/s) are inversely linked to global hash rates.

Total Hash Rate (BTC)

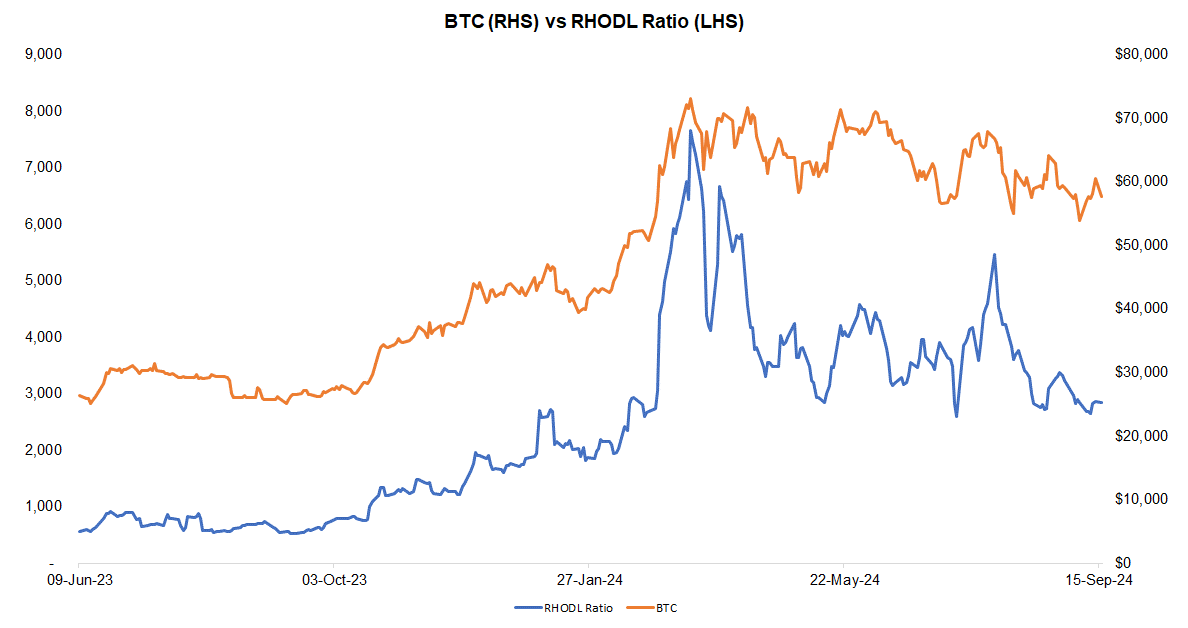

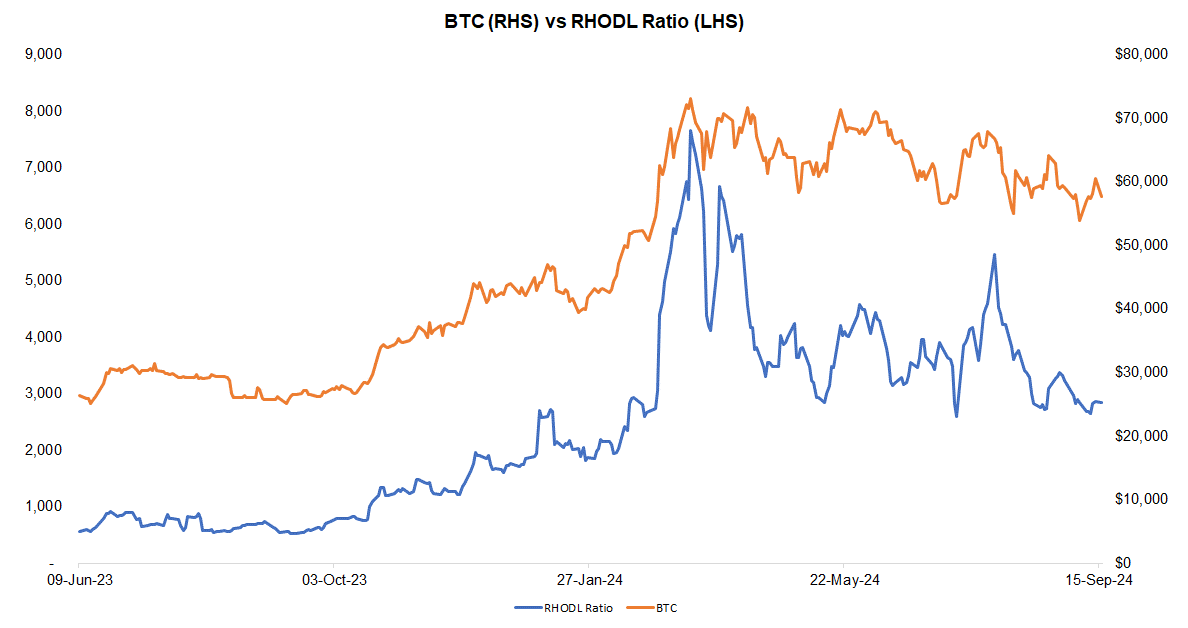

The Realized HODL ratio (RHODL), which gauges the activity of short-term holders relative to long-term holders, was down 0.2% WoW, but up 421% YoY. We interpret the decrease in RHODL as a sign of weakening demand.

Source: FRC/ Various

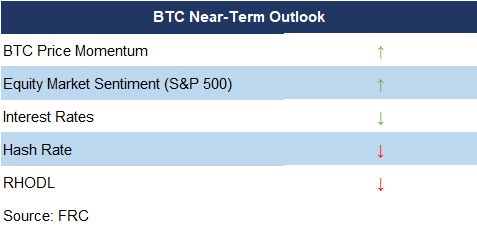

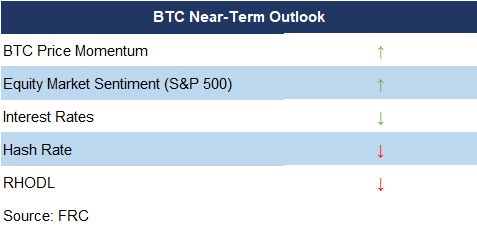

The table below summarizes the changes in key statistically significant factors influencing BTC prices, including the factors mentioned above. With three positive signals and two negative (compared to three negative and two positive in the previous week), our near-term outlook for BTC prices has turned from bearish to bullish. Although our model anticipated weakness, BTC prices were up marginally last week despite a broader decline in crypto markets.

* “↑” and “↓” indicate whether a parameter has increased or decreased

* “↑” and “↓” indicate whether a parameter has increased or decreased

* Red (green) denotes a negative (positive) signal for BTC prices; black implies neutral.

Source: FRC

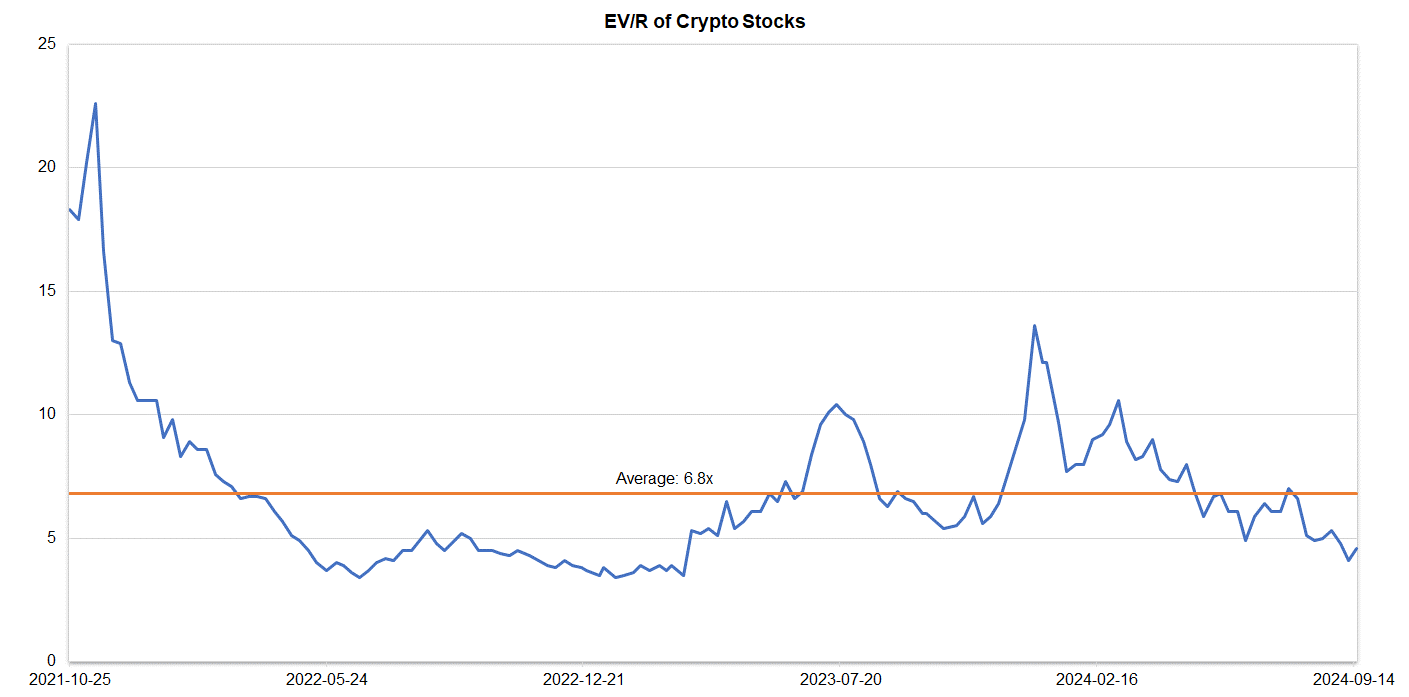

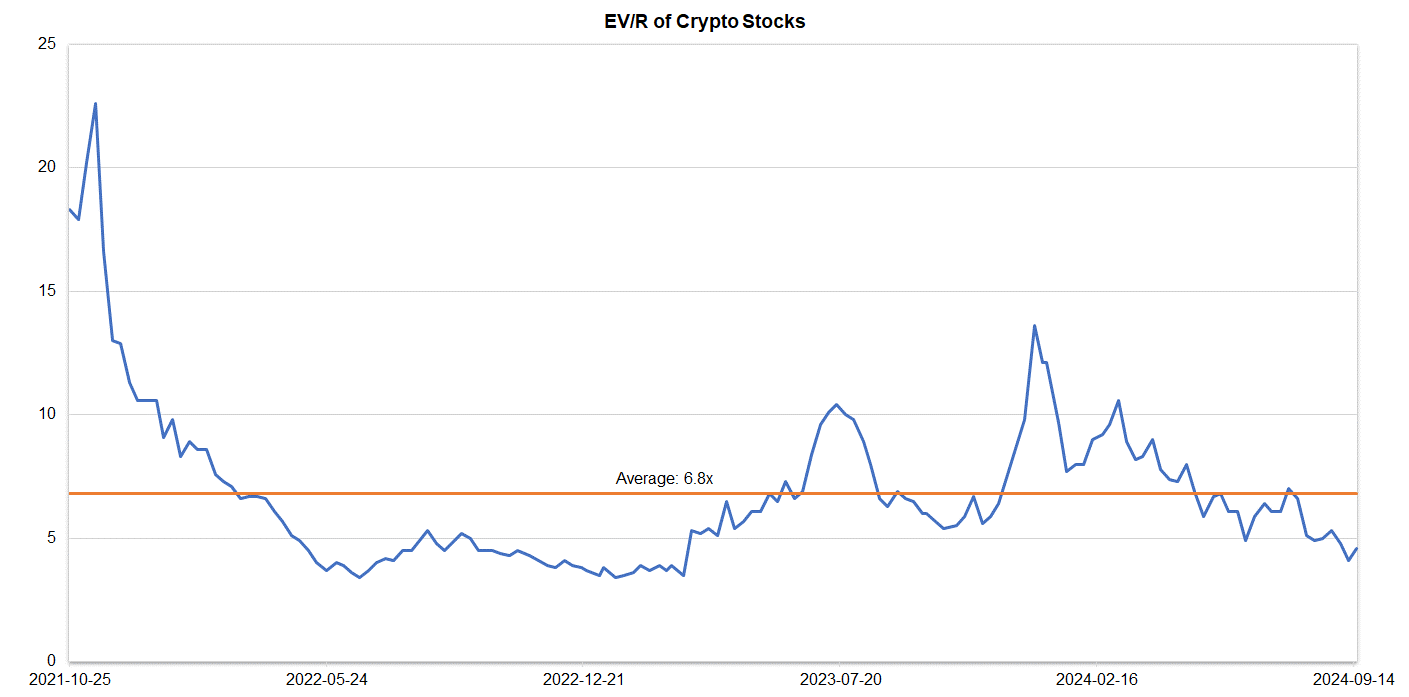

Companies operating in the crypto space are trading at an average EV/R of 4.6x (previously 4.1x).

Source: S&P Capital IQ/FRC

| September 16, 2024 |

|

| Crypto Stocks |

EV/Revenue |

| Argo Blockchain |

2.1 |

| BIGG Digital |

4.3 |

| Bitcoin Well |

0.7 |

| Canaan Inc. |

1.4 |

| CleanSpark Inc. |

6.6 |

| Coinbase Global |

8.4 |

| Galaxy Digital Holdings |

N/A |

| HIVE Digital |

2.9 |

| Hut 8 Mining Corp. |

8.2 |

| Marathon Digital Holdings |

8.6 |

| Riot Platforms |

5.6 |

| SATO Technologies |

1.4 |

| |

|

| Average |

4.6 |

| Median |

4.3 |

| Min |

0.7 |

| Max |

8.6 |

Source: S&P Capital IQ/FRC

Market Updates and Insights: Artificial Intelligence/AI

Major AI indices are up 1% WoW on average (down 4% in the previous week), and 14% YoY.

| September 16, 2024 |

|

|

| AI Indices |

WoW |

YoY |

| First Trust Nasdaq AI and Robotics ETF |

3% |

0% |

| Global X Robotics & AI ETF |

4% |

20% |

| Global X AI & Technology ETF |

4% |

26% |

| iShares Robotics and AI Multisector ETF |

1% |

-3% |

| Roundhill Generative AI & Technology ETF |

-5% |

27% |

| Average |

1% |

14% |

| Min |

-5% |

-3% |

| Max |

4% |

27% |

Source: FRC/Various

The following table highlights some of the most popular large-cap AI stocks. Shares of these companies are up 2% WoW on average (down 3% in the previous week), and 80% YoY. Their average P/E is 33x (previously 30x) vs the NASDAQ-100 Index’s average of 31x (previously 30x).

| AI Stocks |

WoW |

YoY |

P/E |

| Arista Networks |

10% |

93% |

46.7 |

| Dell Technologies |

-9% |

67% |

21.0 |

| Microsoft Corporation |

6% |

31% |

36.5 |

| NVIDIA Corp |

-8% |

165% |

55.8 |

| Micron Technology |

0% |

23% |

n/a |

| Palantir Technologies |

4% |

135% |

n/a |

| Qualcomm |

4% |

48% |

21.4 |

| Super Micro Computer (SMCI) |

10% |

84% |

22.8 |

| Taiwan Semiconductor Manufacturing |

4% |

75% |

26.6 |

| Average |

2% |

80% |

33.0 |

| Median |

4% |

75% |

26.6 |

| Min |

-9% |

23% |

21.0 |

| Max |

10% |

165% |

55.8 |

Source: FRC/Various

Key Developments:

- Apple (NASDAQ: AAPL) is set to launch the iPhone 16 on September 20th. The new model will feature new AI capabilities like enhanced computational photography, more advanced Siri features, and personalized app suggestions. Apple's management is highly optimistic about these new features driving strong sales for the iPhone 16.