We’re Truly Passionate About Research & Results

We’ve built our reputation by covering underfollowed stocks, large caps and other unique opportunities while upholding CFA Institute Standards throughout our firm. Our professional-quality research and ‘Top Picks’ have historically performed well relative to the benchmarks.

We are a Leading Source of Equity Research for Investors

Our goal is to provide high quality, accessible equity research to a broad audience, while adhering to strong ethical standards. We aim to be the best source of equity research for all investors, not just large ones.

WE ARE PASSIONATE ABOUT

Equity Research

Our equity analysts specialize in specific industries, producing institutional quality research reports, projections, and opinions. This level of analysis was previously only available to professional and large investors. We believe all investors should have access to this level of sophisticated analysis and have made it our mission to bring our research to the masses.

Our Values

At FRC, we believe research is the key to successful investing.

For nearly 20 years, FRC has provided high-quality equity research to a wide audience.

Everything at FRC is built on trust, ensuring integrity and excellence in our research.

Empowering the world's leading investors through portals like Bloomberg, Capital IQ, Reuters, and FactSet.

Our passion is research. We ensure its thoroughness through a multi-step quality control process before publication.

Committed to simplifying smart investment decisions for our users.

How It Works

Our analysts pour through all the public information they can gather on a company and industry. The comb through this information, analyze it and put all their findings into one convenient report for you! As the company under coverage makes news, or as industry developments occur, our analysts are constantly revising their models and reports, producing updates to help you stay on top of the companies you are following.

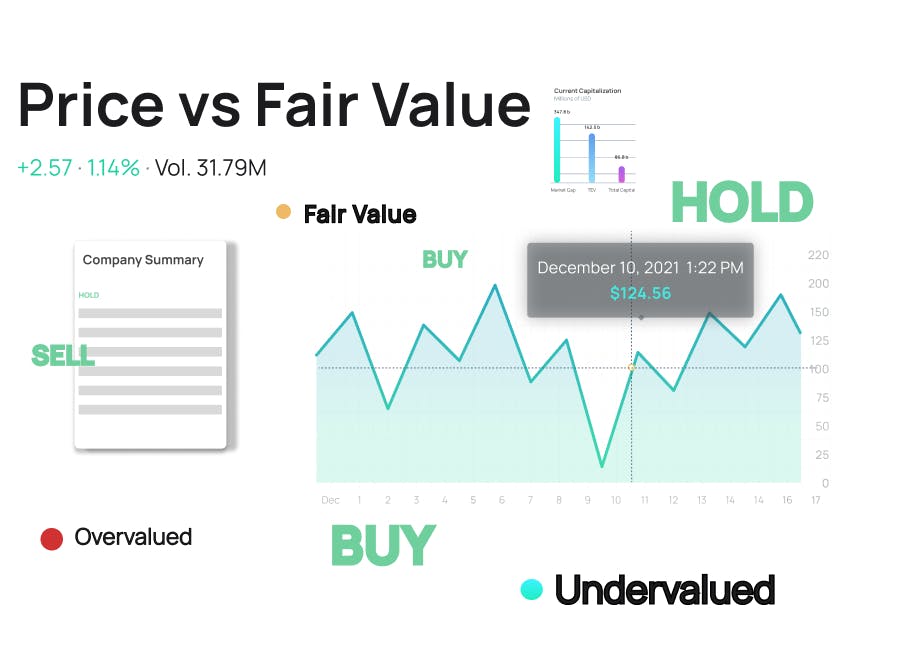

In the future, we will also be making our proprietary algorithm for valuing companies available, which gives an under, over or fairly valued opinion on every listed company! It’s the same model we use to trade our own capital!